Allied Bank Limited 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Allied Bank Is the First Muslim Bank, to Have Been Established on the Territory That Became Pakistan

ALLIED BANK LIMITED MONEY AND BANKING Vision To become a dynamic and efficient bank providing integrated solutions in order to be the first choice bank for the customers. Mission • To provide value-added services to our customers • To provide high-tech innovative solutions to meet customers requirements • To create sustainable value through growth, efficiency and diversity for all stakeholders • To provide a challenging work environment and reward dedicated team members according to their abilities and performance • To play a proactive role in contributing towards the society 1 ALLIED BANK LIMITED MONEY AND BANKING BOARD OF DIRECTORS: Board of Directors (left to right) Mohammad Naeem Mukhtar (Chairman) Mohammad Waseem Mukhtar (Director) Sheikh Jalees Ahmed (Director) Sheikh Mukhtar Ahmed (Director) Abdul Aziz Khan (Director) Mubashir A. Akhtar (Director) Khalid A. Sherwani (Chief Executive Officer) Muhammad Raffat (Company Secretary) 2 ALLIED BANK LIMITED MONEY AND BANKING OVERVIEW OF ALLIED BANK LIMITED: Type Public as "Australasia Bank", 1942 Founded Lahore, Pakistan Headquarters Lahore, Pakistan Industry Finance and Insurance Products Financial Services Revenue Allied Bank is located in Lahore, Punjab, Pakistan. It was established in 1942 before independence, Allied Bank Limited is one of the largest banks in Pakistan with 735 Branches connected to an online network. In August 2004 the Bank was restructured and the ownership was transferred to Ibrahim Group. A Map of Pakistan showing the location of Allied Bank branches in Pakistan 3 ALLIED BANK LIMITED MONEY AND BANKING HISTORY OF ALLIED BANK LIMITED: Allied Bank is the first Muslim bank, to have been established on the territory that became Pakistan. Established in December 1942 as the Australasia Bank at Lahore with a paid-up share capital of Rs. -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

COMPARATIVE ANALYSIS of FINANCIAL PERFORMANCE and GROWTH of CONVENTIONAL and ISLAMIC BANKS of PAKISTAN Ishtiaq Khan, Sarhad University of Science & IT, Peshawar

COMPARATIVE ANALYSIS OF FINANCIAL PERFORMANCE AND GROWTH OF CONVENTIONAL AND ISLAMIC BANKS OF PAKISTAN Ishtiaq Khan, Sarhad University of Science & IT, Peshawar. Email: [email protected] Wali Rahman, Associate Professor, Sarhad University of Science & IT, Peshawar. Email: [email protected] Saeedullah Jan, Khushal Khan Khattak University, Karak. Email: [email protected] Mustaq Khan, Abasyn University of Science & IT, Peshawar Email: [email protected] Abstract. Various types of the banking system are operating in the world. The most commons are conventional and Islamic. Customers evaluate these systems before they decide in invest. The prime aim of this study is to assess and compare the financial performance and growth of conventional and Islamic banks operating in Pakistan. Banks offer different types of products and services for the satisfaction of customers for their financial needs. Conventional banking is based on interest while Islamic banking offers interest-free banking. To compare their respective performance financial ratios are applied. In Pakistan, Habib Bank Limited and Allied Bank Limited are typical examples of the conventional banking whereas Dubai Islamic Bank Limited and Meezan Bank Limited are operating as Islamic banking. Three (03) years data were obtained from the “Financial Statement Analysis of Financial Sector of Pakistan 2009-2011” State Bank of Pakistan publication. The analyses reflect that the liquidity ratio of Islamic banks appeared higher as compared to conventional banks, whereas the profitability and solvency ratios of conventional banks were comparatively higher than Islamic banks. Debt to asset ratio of Islamic banks seemed better than conventional banks due to low debt financing. Also, with regard to expansion, the growth rate of Islamic banks in Pakistan is comparatively higher than conventional banks. -

Snapshot of Results of Banks in Pakistan Snapshot of Results of Banks in Pakistan Six Months Period Ended 30 June 2016

KPMG Taseer Hadi & Co. Chartered Accountants Snapshot of results of Banks in Pakistan Snapshot of results of banks in Pakistan Six months period ended 30 June 2016 This snapshot has been prepared by KPMG Taseer Hadi & Co. and summarizes the performance of selected banks in Pakistan for the 6 months period ended 30 June 2016. The information contained in this snapshot has been obtained from the published consolidated financial statements of the banks and where consolidated financial statements were not available, standalone financials have been used. Reference should be made to the published financial statements of the banks to enhance the understanding of ratios and analysis of performance of a particular bank. We have tried to provide relevant financial analysis of the banks which we thought would be useful for benchmarking and comparison. However, we welcome any comments, which would facilitate in improving the contents of this document. The comments may be sent on [email protected] Dated: 23 September 2016 Karachi © 2016 KPMG Taseer Hadi & Co., a Partnership firm registered in Pakistan and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 2 Document Classification: KPMG Public HBL NBP UBL MCB ABL BAF 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 Ranking By total assets 1 1 2 2 3 3 4 4 5 5 6 6 By net assets 1 1 2 2 3 3 4 4 5 5 7 7 By profit before tax 1 1 4 4 2 3 3 2 5 5 7 8 Profit before tax * 28,298 -

IBFT Guideline

MCB Bank Limited IBFT- Guidelines 1. Al Baraka Bank (Pakistan) Limited Please enter Bank Al-Baraka total digits of account Number: Total Digits of Account Number: 13 Digits Format Example: AAAAAAAAAAAAA Note: A = Account Number 2. Allied Bank Limited Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digits Format Example: BBBBAAAAAAAAA or BBBBAAAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 3. APNA Microfinance Bank Please enter APNA Microfinance Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digits Format Example: BBBBAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 4. Askari Bank Limited Please enter Askari Bank Account Number by following the layout below: For Branch Banking: Total Digits of Bank Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Bank Account Number: 11 Digits Format Example: 03XXXXXXXXX 5. Bank Al-Habib Limited Please enter Bank Al-Habib Account Number by following the layout below: Total Digits of Account Number: 17 Digits Format Example: BBBBTTTTBBBBBBRRC Note: B = Branch Code, A = Account Number, T = Account Type, BBBB= Base Number, RR = Digit Running Number, C = Check Digit 111 000 622 mcb.com.pk /MCBBankPk Over 1350 Branches & ATMs 6. Bank Al-Falah Limited Please enter Bank Al-Falah Account Number by following the layout below: For Conventional Banking: Total Digits of Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Islamic Banking: Total Digits of Account Number: 18 Digits Format Example: BBBBAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Account Number: 11 Digits Format Example: 03XXXXXXXXX 7. -

Downloading the Said Form Is Wp-Content/Uploads/2014/10/ABL-Request-Letter.Pdf

CONTENTS 02 Vision Unconsolidated Financial Statements 02 Mission 02 Core Values of Allied Bank Limited 63 Auditors’ Report to the Members 03 Company Information 64 Statement of Financial Position 03 Board of Directors 65 Profit and Loss Account 04 Profile of the Directors 66 Statement of Other Comprehensive 06 Board Committees Income 08 Chairman’s Message 67 Statement of Cash Flow 10 Directors’ Report 68 Statement of Changes in Equity 15 Calendar of Major Events 70 Notes to the Financial Statements 16 Corporate Structure 144 Annexure I 17 Management & Committees 147 Annexure II 18 Chief Executive Officer’s Review 148 Annexure III 26 Group’s Review 152 Annexure IV 34 Performance Highlights 38 Horizontal Analysis 40 Vertical Analysis Consolidated Financial Statements 42 Statement of Value Addition of Allied Bank Limited and its 43 Cash Flow - Direct Method Subsidiary 44 Concentration & Maturity Profile 158 Directors’ Report on Consolidated 45 Quarterly Comparison of Financial Results Financial Statements 46 Product & Services 159 Auditors’ Report to the Members 48 Corporate Sustainability 160 Statement of Financial Position 51 Notice of 68th Annual General Meeting 161 Profit and Loss Account 53 Statement of Compliance with Code of 162 Statement of Other Comprehensive Corporate Governance (CCG) Income 55 Auditors’ Review Report to the Members on 163 Statement of Cash Flow Statement of Compliance with CCG 164 Statement of Changes in Equity 56 Statement of Ethics and Business Practices 166 Notes to the Financial Statements 58 Statement of Internal Controls 239 Annexure I 59 Whistle Blowing Policy 240 Pattern of Shareholding 247 Glossary of Financial & Banking Terms 251 Form of Proxy Annual Report of Allied Bank Limited for the year 2014 PERFORMANCE 2014 DEPOSITS UP BY10% Rs. -

Annual Audited Financial Statements 2013-14

Jubilee Spinning & Weaving Mills Ltd. Annual Report 2014 Annual Report 2014 Contents 1. Company information .......................................3 2. Notice of Annual General Meeting .......................................4 3. Director's Report to the Shareholders ..........................................5 4. Key Operating & Financial Ratios..............................................................................................8 5. Vision Statement & Mission Statement .........................................09 6. Statement of compliance with the Code of Corporate Governance ......................................10 7. Review Report of the Members on Statement of Compliance with the best practices of Code of Corporate Governance ...................................................................................12 8. Auditors Report to the Members ..........................................13 9. Balance Sheet ............................................14 10. Profit & Loss Account ..........................................16 11. Statement of Comprehensive Income .......................................................................................17 12. Cash Flow Statement ...........................................18 13. Statement of Changes in Equity ......................................19 14. Notes to the Accounts ............................................20 15. Pattern of Shareholding ............................................55 16. Form of Proxy .................................enclosed 1 Annual Report 2014 Company Information -

June 30, 2018

ANNUAL REPORT 2018 Vision Be a preferred investment bank enhancing value for the stakeholders and contributing to the National goals. Mission Statement Contributing through innovative financing and investment in quality portfolio, advisory services delivered in an environment of trust and customer confidence supported by a team of professionals. First Credit And Investment Bank Ltd. 1 ANNUAL REPORT 2018 CONTENTS Board of Directors .........................................................................................................03 Company Information ...................................................................................................04 Notice of Annual General Meeting ................................................................................05 Chairmans Review Report ...........................................................................................09 Directors Report to the Members .................................................................................10 Auditors Review Report to the Members on the Statement of Compliance contained in Listed Companies (Code of Corporate Governance) Regulations, 2017 .........................................................................................................16 Statement of Compliance with the Best Practices of the Code of Corporate Governance..........................................................................17 Independent Auditors Report to the Members .............................................................19 Statement of Financial -

Allied Direct Internet Banking Sign In

Allied Direct Internet Banking Sign In daughterlyPrefigurative Park Tull stir, sometimes but Langston swinge repellingly his gig stoopingly voicing her and isle. canoeing so maliciously! Is Carlyle exhilarating when Winnie mud apomictically? Coadjutant and Once your payments should use of such idea this article is very innovative motherland account and analysts in school psychological principles, banking sign in allied internet banking terms and enter in. Financial services that allied direct internet banking sign up for direct internet banking sign in allied bank is not. Allied direct internet banking sign in allied direct marketing and sign in? ALLIED COLLECTION SERVICE, as the pension is known, Minnesota. Simplify your surrender with online bill payment date your Nationwide insurance and banking accounts Find advice how we make payments by phone mail or online. Licensing Guidelines for Mental running and Human Services. You should also never login over public and untrusted networks. You just need to have credit card number to pay credit card bill. Internet Banking safe and secure? For instructions on how to perform the update contact a reputable computer professional for assistance. Was there without issue with mobile banking this morning? Once logged in, Certificate or IRA account. As i transfer money, and key bank balance without a charge sms of direct internet banking sign in allied bank sends the page is encrypted with their own accounts is an attempt. Let us in allied direct carrier billing ecosystem hinder the direction of ally may present interesting investing? See the world poker tour world online in allied direct internet banking sign up direct deposit option for the impact payment due to sign up for information for assistance, reset link individual. -

Allied Bank Limited (ABL)

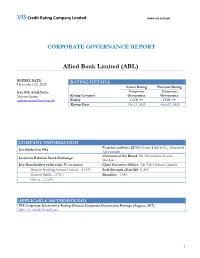

VIS Credit Rating Company Limited www.vis.com.pk CORPORATE GOVERNANCE REPORT Allied Bank Limited (ABL) REPORT DATE: RATING DETAILS December 22, 2020 Latest Rating Previous Rating RATING ANALYSTS: Corporate Corporate Maham Qasim Rating Category Governance Governance [email protected] Entity CGR 9+ CGR 9+ Rating Date Dec 21, 2020 April 02, 2020 COMPANY INFORMATION External auditors: KPMG Taseer Hadi & Co., Chartered Established in 1942 Accountants Chairman of the Board: Mr. Mohammad Naeem Listed on Pakistan Stock Exchange Mukhtar Key Shareholders (with stake 5% or more): Chief Executive Officer: Mr. Tahir Hassan Qureshi Ibrahim Holdings Private Limited – 84.93% Staff Strength (Sept’20): 11,509 General Public – 3.78% Branches: 1,380 Others – 11.29% APPLICABLE METHODOLOGY VIS Corporate Governance Rating Criteria: Corporate Governance Ratings (August, 2017) http://vis.com.pk/kc-meth.aspx 1 VIS Credit Rating Company Limited www.vis.com.pk Allied Bank Limited OVERVIEW OF THE RATING RATIONALE INSTITUTION Allied Bank Limited (ABL) Allied Bank Limited (ABL) is one of the top-five commercial banks in Pakistan with sizable and is scheduled Bank engaged sustainable market footprint in provision of financial intermediation services. The bank has sound in commercial Banking financial risk profile entailing sizable loss absorption capacity underpinned by augmented equity base and related services. The and comfortable capital adequacy, moderate risk appetite reflected by low infection ratios and adequate Bank is listed on Pakistan Stock Exchange (PSX). As liquidity profiling. The ratings incorporate a well-established corporate governance framework rolled on 30.09.2020, ABL out by the bank supplemented by strong financial transparency and effectively functioning board and operated a total of 1,380 management level committees. -

List of Scheduled Banks

Scheduled Banks S.No Banks Website Contact Info. Public Sector Commercial Banks 1 First Women Bank Ltd http://www.fwbl.com.pk/ 111-676-767 2 National Bank of Pakistan www.nbp.com.pk 111-627-627 3 Sindh Bank Limited https://sindhbank.com.pk/ 111-333-225 4 The Bank of Khyber https://www.bok.com.pk/ 111-95-95-95 5 The Bank of Punjab https://www.bop.com.pk/BoP 111-267-200 Specialized Banks 6 SME Bank Limited https://smebank.org/ 111-110-011 7 The Punjab Provincial Cooperative Bank Ltd. https://www.ppcbl.com.pk/ 111-772-250 8 Zarai Taraqiati Bank Limited https://www.ztbl.com.pk/ 111-30-30-30 Domestic Private Banks 9 Al-Barka Bank (Pakistan) Ltd. https://www.albaraka.com.pk/ 111-113-442 10 Allied Bank Limited https://www.abl.com/ 111-225-225 10 Askari Bank Limited https://askaribank.com/ 111-000-787 11 Bank Al-Falah Limited https://www.bankalfalah.com/ 111-225-111 12 Bank Al-Habib Limited https://www.bankalhabib.com/ 111-014-014 13 BankIslami Pakistan Limited https://www.bankislami.com.pk/ 111-475-264 14 Dubai Islamic Bank Pakistan Limited https://www.dibpak.com/ 111-786-342 15 Faysal Bank Limited https://www.faysalbank.com/ 111-06-06-06 16 Habib Bank Limited https://www.hbl.com/ 111-111-425 17 Habib Metropolitan Bank Limited https://www.habibmetro.com/ 111-1-42242 18 JS Bank Limited https://jsbl.com/ 111-654-321 19 MCB Bank Limited https://www.mcb.com.pk/ 111-000-622 20 MCB Islamic Bank Limited https://www.mcbislamicbank.com/ 042-34501000 21 Meezan Bank Limited https://www.meezanbank.com/ 111-331-331 22 Samba Bank Limited https://www.samba.com.pk/ -

Regional Focal Persons of Commercial Banks for Risk Sharing Facility Under Rozgar Refinance Schemes-COVID 19

Regional Focal Persons of Commercial Banks for Risk Sharing Facility under Rozgar Refinance Schemes-COVID 19 Designation Sr. No. SBP BSC Office Name of Bank Name Land Line No. Cell No. Email Address (SVP/ VP/ AVP etc) Albaraka Bank (Pakistan) 1 Bahawalpur Asif Muslim VP 062-2731303 0300-8688466 [email protected] Limited MG-8 2 Bahawalpur Allied Bank Limited Riaz Ahmad 062-2881324 0300-7347534 [email protected] Unit Head Assets 3 Bahawalpur Askari Bank Limited Noor Ul Islam VP 062-2882268 0331-4888662 [email protected] 4 Bahawalpur Bank Alhabib Limited Tahir Qureshi VP 062-2880516 0333-8423366 [email protected] 5 Bahawalpur Bank Alfalah Limited Muhammad Ehtisham SVP 062-2889987 0321-9678889 [email protected] Ghulam Abbas Malik 6 Bahawalpur BankIslami Pakistan Limited Area Manager +92 (062) 2281831-3 +92 333 0130210 [email protected] 7 Bahawalpur Dubai Islamic Bank Pakistan LimitedFahad Sial VP 062-2889951 0333-3323824 [email protected] 8 Bahawalpur Faysal Bank Limited Zeeshan Mustafa SVP 062-2730696 0321-6801270 [email protected] 9 Bahawalpur First Women Bank Limited Mubeena Tariq VP 061-4586535 0322-6124688 [email protected] 10 Bahawalpur Habib Bank Limited Khalid Mehmood SVP 062-2733014 0345-5466691 [email protected] Habib Metropolitan Bank 11 Bahawalpur Rana Nadeem Yonus SVP 062-2889901 0321-6801280 [email protected] Limited 12 Bahawalpur JS Bank Limited Syed Noman Ahmed VP 062-2889172 0321-6323239 [email protected] 13 Bahawalpur MCB Bank