Gtbank Sept 2020 Financial Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

D1106- XS0497792241- Guaranty Trust Bank- Final Terms 26 Apr

Final Terms dated 26 April 2010 Series Number : D1106 Tranche : 3 ISIN: XS0497792241 Common Code: 049779224 Morgan Stanley B.V. Issue of 18,709,450 Certificates (“Tranche 3”) to be consolidated with 60,000,000 Certificates (“Tranche 1”) and 40,000,000 Certificates (“Tranche 2”) and form a single series of 118,709,450 Certificates linked to the Shares of Guaranty Trust Bank Plc Guaranteed by Morgan Stanley under the Program for the Issuance of Certificates and Warrants PART A – CONTRACTUAL TERMS THE SECURITIES AND THE GUARANTEE IN RESPECT THEREOF HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OR WITH ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES, AND THE SECURITIES MAY INCLUDE BEARER SECURITIES THAT ARE SUBJECT TO U.S. TAX LAW REQUIREMENTS. NEITHER THE ISSUER NOR THE GUARANTOR IS REGISTERED, OR WILL REGISTER, UNDER THE INVESTMENT COMPANY ACT. INTERESTS IN THIS SECURITY MAY ONLY BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED (1) IN ACCORDANCE WITH RULE 144A UNDER THE SECURITIES ACT ( RULE 144A ) TO A PERSON WHO TAKES DELIVERY IN THE FORM OF AN INTEREST IN A RESTRICTED GLOBAL SECURITY THAT THE HOLDER AND ANY PERSON ACTING ON ITS BEHALF REASONABLY BELIEVE IS A QUALIFIED INSTITUTIONAL BUYER (A QIB ) WITHIN THE MEANING OF RULE 144A THAT IS ALSO A QUALIFIED PURCHASER (A QP ) AS DEFINED IN SECTION 2(a)(51) OF THE INVESTMENT COMPANY ACT AND THE RULES THEREUNDER PURCHASING FOR ITS OWN ACCOUNT OR FOR THE ACCOUNT OF ONE OR MORE QIBS EACH OF WHICH IS A QP WHOM THE HOLDER HAS INFORMED, IN EACH CASE, THAT SUCH OFFER, SALE, PLEDGE OR OTHER TRANSFER IS BEING MADE IN RELIANCE ON RULE 144A, AND IN A NOMINAL AMOUNT OR PURCHASE PRICE FOR EACH ACCOUNT OF NOT LESS THAN U.S.$100,000 OR (2) TO A PERSON THAT IS NOT A U.S. -

Ghana Fixed Income Market Summary of Status Report

GHANA FIXED INCOME MARKET SUMMARY OF STATUS REPORT JUNE 2019 1 MEMBERSHIP GFIM as at the end of June 2019 has 41 registered members categorized as follows: LICENSED DEALING MEMBERS PRIMARY DEALER BANKS 1. African Alliance Securities Limited 1. Access Bank Ghana Limited 2. Black Star Brokerage Limited 2. ARB Apex Bank 3. Bullion Securities Limited 3. Barclays Bank Ghana Limited 4. Cal Brokers Limited 4. Cal Bank Ghana Limited 5. CDH Securities Limited 5. Consolidated Bank Ghana Limited 6. Databank Brokerage Limited 6. Ecobank Ghana Limited 7. EDC Stockbrokers Limited 7. Fidelity Bank Ghana Limited 8. Gold Coast Brokerage Limited 8. GCB Bank Limited 9. Republic Securities Ghana Limited 9. Guaranty Trust Bank Ghana Limited 10. IC Securities Limited 10. Societe Generale Ghana Limited 11. Liberty Securities Limited 11. Stanbic Bank Limited 12. NTHC Ltd 12. Standard Chartered Bank Limited 13. Prudential Stockbrokers Limited 13. Universal Merchant Bank 14. SBG Securities Ghana Limited 15. SIC Financial Services Limited 16. Strategic African Securities Limited 17. UMB Stock Brokers Ltd NON - PRIMARY DEALER BANKS 1. Agricultural Development Bank 2. Bank of Africa Ghana Ltd 3. First Atlantic Bank Ghana Ltd 4. First National Bank Limited 5. FBN Bank Ghana Ltd 6. National Investment Bank 7. Prudential Bank Limited 8. Republic Bank Ghana Limited 9. Sahel Sahara Bank Ghana Limited 10. UBA Ghana Limited 11. Zenith Bank Ghana Ltd 2 SUMMARY OF SECURITIES Benchmark Securities: 9 3yr Government bond- 1 5yr Government bond- 5 7yr Government bond- 1 10yr Government bond- 1 15yr Government bond- 1 Non-Benchmark Securities: 20 3yr Government bond-10 5yr Government bond- 5 6yr Government bond- 1 7yr Government bond- 3 10yr Government bond-1 Treasury Notes: 34 1yr Government note- 16 2yr Government note- 18 Treasury Bills: 64 364 day bill- 13 182 day bill- 25 91 day bill- 12 Ghana Cocoa Bill- 14 Local US dollar 3-year bond-1 Eurobond-9 Corporate Bonds AFB Ghana Plc 18 Bayport Financial Services (Ghana) 9 Edendale Properties 2 Izwe Loans Ghana 6 PBC Ghana Limited 1 E.S.L.A. -

Guaranty Trust Bank (Ghana) Limited Annual Report and Financial Statements

GUARANTY TRUST BANK (GHANA) LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2020 GUARANTY TRUST BANK (GHANA) LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS CONTENTS P a g e Corporate Information 1 Report of the Directors 2 - 5 Report of the Audit Committee 6 Corporate Governance 7 - 21 Independent Auditor’s Report 22 – 25 Financial Statements: Statement of Comprehensive Income 26 Statement of Financial Position 27 Statement of Changes in Equity 28 Statement of Cash Flows 29 Notes to the Financial Statements 30 - 117 Appendices 118 Guaranty Trust Bank (Ghana) Limited Annual Report and Financial Statements for the year ended 31 December 2020 . CORPORATE INFORMATION Board of Directors Kwasi M. Tagbor (Chairman) Olusegun Agbaje (Vice Chairman) Thomas Attah John (Managing Director) Mobolaji Jubril Lawal Rasheed Ibrahim Maidie Elizabeth Arkutu Irene Baaba Hagan Ademola Odeyemi (Resigned on 8th May 2020) Secretary Iris Richter-Addo 25A Castle Road, Ambassadorial Area, Ridge PMB CT 416, Cantonments Accra, Ghana Auditor KPMG Chartered Accountants 13 Yiyiwe Drive, Abelenkpe P. O. Box GP 242 Accra, Ghana Registered Office Guaranty Trust Bank (Ghana) Limited 25A Castle Road, Ambassadorial Area, Ridge PMB CT 416, Cantonments Accra, Ghana Correspondent banks CitiBank London CitiBank New York Ghana International Bank J.P. Morgan Chase Bank Guaranty Trust Bank London Bank of Beirut Standard Chartered Bank UK Guaranty Trust Bank Plc Solicitors Lithur Brew and Company No. 110B, 1st Kade Close, Kanda Estates P. O. Box CT 3865, Cantonments Accra, Ghana 1 Guaranty Trust Bank (Ghana) Limited Annual Report and Financial Statements for the year ended 31 December 2020 . -

Case Study of Guaranty Trust Bank Plc

International Journal of Academic Research in Accounting, Finance and Management Sciences Vol. 4, No.2, April 2014, pp. 51–61 E-ISSN: 2225-8329, P-ISSN: 2308-0337 © 2014 HRMARS www.hrmars.com Strategic Management, an Organisational Risk Management Framework: Case Study of Guaranty Trust Bank Plc Olajide Solomon FADUN School of Management & Business Studies (SMBS), Lagos State Polytechnic, Lagos Nigeria, E-mail: [email protected] Abstract Well formulated and implemented strategies are critical to firms’ performance. Strategic management is beneficial to a business as it operates in a dynamic and uncertain business environment. The study views strategic management as organisational risk management framework that promotes identification and evaluation of organisational risks and opportunities to enhance a firm’s performance. The study examines components of strategic management process, using Guaranty Trust Bank Plc (GTBank) as case study. It highlights background of study; undertakes internal analysis - SWOT; considers external environment, using PESTLE analytical tool; highlights strategic analysis and choice; appraises long-term objectives, generic and grand strategies; explains short-term objectives; and explores strategic control and continuous improvement. The findings indicate that GTBank has built its strategy around its brand image and its major competitors have not been able to displace her in the banking sector. This suggests that strategic management is beneficial to a firm, as it operates in a dynamic and uncertain business environment. The implication for practice is that effective strategic management - evaluation, formulation and implementation of organisational objectives - is critical for survival and relevance of a firm in the global business environment. Key words Strategic management, Strategic analysis, Grand strategies, Generic strategies DOI: 10.6007/IJARAFMS/v4-i2/775 URL: http://dx.doi.org/10.6007/IJARAFMS/v4-i2/775 1. -

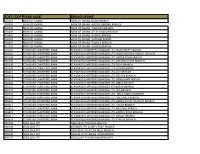

Sort Code Bank Name Branch Name

SORT CODE BANK NAME BRANCH NAME 010101 BANK OF GHANA BANK OF GHANA ACCRA BRANCH 010303 BANK OF GHANA BANK OF GHANA -AGONA SWEDRU BRANCH 010401 BANK OF GHANA BANK OF GHANA -TAKORADI BRANCH 010402 BANK OF GHANA BANK OF GHANA -SEFWI BOAKO BRANCH 010601 BANK OF GHANA BANK OF GHANA -KUMASI BRANCH 010701 BANK OF GHANA BANK OF GHANA -SUNYANI BRANCH 010801 BANK OF GHANA BANK OF GHANA -TAMALE BRANCH 011101 BANK OF GHANA BANK OF GHANA - HOHOE BRANCH 020101 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-HIGH STREET BRANCH 020102 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- INDEPENDENCE AVENUE BRANCH 020104 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LIBERIA ROAD BRANCH 020105 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OPEIBEA HOUSE BRANCH 020106 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-TEMA BRANCH 020108 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LEGON BRANCH 020112 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OSU BRANCH 020118 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-SPINTEX BRANCH 020121 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-DANSOMAN BRANCH 020126 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-ABEKA BRANCH 020127 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH)-ACHIMOTA BRANCH 020129 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- NIA BRANCH 020132 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- TEMA HABOUR BRANCH 020133 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- WESTHILLS BRANCH 020436 -

Organizational Culture and Inter-Group Behaviour in Guaranty Trust Bank in Nigeria

ISSN (Online): 2455-3662 EPRA International Journal of Multidisciplinary Research (IJMR) - Peer Reviewed Journal Volume: 6 | Issue: 9 | September 2020 || Journal DOI: 10.36713/epra2013 || SJIF Impact Factor: 7.032 ||ISI Value: 1.188 ORGANIZATIONAL CULTURE AND INTER-GROUP BEHAVIOUR IN GUARANTY TRUST BANK IN NIGERIA Worluchem Ayodele B. Chima Onuoha Department of management Department of Management University of Port Harcourt Business University of Port Harcourt Best C. Eke Department of management University of Port Harcourt Article DOI: https://doi.org/10.36713/epra5287 ABSTRACT The study empirically investigates organizational culture and inter-group behaviour in Guaranty trust bank in Nigeria. Primary data was used for the study and the data for analysis was gotten through questionnaire. The questionnaire was issued to the staff of Guarantee Trust Bank in Rivers State. The data was analyzed with the use of Chi-square in other to measure the discrepancies existing between the observed and expected frequency and to proof the level of significance in testing stated hypotheses. From the result of the study, it was discovered that organizational culture has significant influence on inter-group behaviour. Therefore, the study recommends that Guarantee Trust Bank should encourage new entrants to get internalize first with the bank’s culture to know whether they can cope with them or not. Additionally, organizations should provide adequate motivational factors like housing allowance, car loan, holiday allowance, health allowance, etc. INTRODUCTION their job and thus develop quality awareness. An organization refers to a collection of people, Organizational culture has influenced on inter-group who are involved in pursuing defined objectives. -

Global Economic Prospects | January 2016

162 CHAPTER 2.6 GLOBAL ECONOMIC PROSPECTS | JANUARY 2016 BOX 2.6.1 Regional integration and spillovers: Sub-Saharan Africa Over the past decade, regional integration in Sub-Saharan Africa (SSA) has expanded. Though still low, intraregional trade represents a growing share of the region’s trade. Cross-border financing flows within Sub-Saharan Africa have increased rapidly. Nevertheless, shocks to growth in the two largest economies – Nigeria and South Africa – appear to have no measurable effects on other countries in the region. Introduction from the traditional advanced country markets. The export exposure of SSA countries to advanced-economies has SSA is an open region, with diversified trade partners and halved over the decade ending 2014. The fall in the share sources of finance (Figure 2.6.1.1). Much of Sub-Saharan of the region’s exports to the United States, to about 1 African trade takes place with countries outside the region. percent of GDP in 2014 from its peak of 8 percent in Advanced economies remain the largest destinations of 2005, was particularly pronounced (Figure 2.6.1.2). This Sub-Saharan Africa’s exports. However, China and other reflected in part a sharp decline in Nigeria’s oil exports as developing countries in Asia are increasingly prominent. U.S. oil shale production expanded. More broadly, the Intraregional trade and financial linkages within the region anemic recovery in Euro Area countries and other have expanded in recent years and look set to expand faster advanced economies following the global financial crisis in the years ahead. underpinned the decline in the share of SSA’s exports to advanced economies. -

A Case Study of Guaranty Trust Bank, Kigali, Rwanda

[Kwizera et. al., Vol.7 (Iss.12): December 2019] ISSN- 2350-0530(O), ISSN- 2394-3629(P) Index Copernicus Value (ICV 2018): 86.20 DOI: https://doi.org/10.29121/granthaalayah.v7.i12.2019.303 Science INFORMATION TECHNOLOGY USAGE AND CUSTOMER ACCEPTANCE IN THE BANKING SECTOR: A CASE STUDY OF GUARANTY TRUST BANK, KIGALI, RWANDA John Kwizera 1, Prof. Raymond Wafula Ongus 2 1 MIS/0067/13, Mount Kenya University, Kigali Campus, P.O Box 5826, Kigali, Rwanda 2 Mount Kenya University- Kigali Campus, P.O Box 5826, Kigali, Rwanda Abstract The study was inspired by the arising issues of concern related to why customer accounts were inactive. The study examined effect of Information technology usage on customer acceptance at GT Bank, Kigali Rwanda. The research design was a case study, with target population of 20,335 customers who used either ATM, Internet banking or mobile banking technologies, 3 e-banking staff and 5 GT Bank branch managers. The data analysis tool used was Statistical Package for Social Sciences (SPSS) version 16.0. Findings revealed that Mobile banking and ATM were mostly used more than Internet banking, depending on features of use and security. ATM features were more accepted compared to Internet banking and Mobile banking features. Multiple regression analysis found R the coefficient of correlation to be 0.927 signifying a very strong positive correlation between information technology usage and customer acceptance. The coefficient of determination R2 = 0.859 indicated that 85.9% of the variability in customer acceptance depended on stochastic model developed, whereas the remaining 14.10% was attributed to factors beyond the control of the study. -

First National Bank Ghana

First National Bank Online Banking Enterprise™ - Payment Cut-Off Times Direct Payment Express Payment Instant Payment Service Service Service Service Anytime during the day Monday - Friday Anytime (including Saturdays, Sundays within the allowed cut-off and Public Holidays) processing times. In accordance with the cut-off Submission times below. Payments submitted after the cut-off times below will be processed on the next business day. Monday to Friday To First National Bank: To Participating Banks n/a No cut-off time between 09h15 and 11h35 Cut-off To other banks: 09h00 - Times 18h00 Saturdays, Sundays and Public Holidays Payments to both First National Bank and to other banks will n/a only be submitted for processing on the next business day. Any payment processed to a Any payment processed to a Participating Any payment authorised Bank through the Instant Payment service and fully processed to a Participating Bank through the Express service type within the type will be cleared within 1 minute of it Participating Bank being authorised and fully processed on Clearing allowed cut-off processing through the Direct the same day. Times: Payment service type times will be cleared within 6 within the allowed cut-off hours of it being authorised and processing times will be fully processed on the same cleared on the next day. business day. Express payments are Instant payments are posted to the posted to the recipient’s recipient’s account on the same business All payments are posted account on the same day. to the recipient’s account business day. on the next business day. -

RNS Number : 5654K Guaranty Trust Bank PLC 22 April 2020

RNS Number : 5654K Guaranty Trust Bank PLC 22 April 2020 Guaranty Trust Bank Plc UNAUDITED Q1 GROUP RESULTS FOR THE PERIOD ENDED MARCH 31, 2020: DECLARES A PBT OF N58.2BILLION Lagos Nigeria - April 22, 2020 - Guaranty Trust Bank Plc ("GTBank"), (Bloomberg: GUARANTY:NL/Reuters: GUARANT.LG), provider of diversified financial services, announces its unaudited Financial Results for the period ended 31 March 2020 and declares a PBT of N58.2bn. Commenting on the financial results, the Managing Director/CEO of Guaranty Trust Bank plc, Mr. Segun Agbaje, said; "These are very difficult and uncertain times, not just for the financial services sector and the economy as a whole, but also for hundreds of millions of people around the world whose lives and livelihoods have been put at risk by the COVID-19 pandemic. At GTBank, we know that the impact of this pandemic may sustain for months to come, but we remain positive that, by staying nimble and continuing to build on the strength of our businesses, we are appropriately positioned to cope with emerging economic realities, as reflected in our first quarter result." He further stated that, "As a platform for enriching lives, our focus is on safeguarding lives and livelihoods. That is why we are working round the clock to keep all our members of staff and customers safe, supporting the government in combatting the pandemic and being there for our customers in every way that they may need our support at this time." Financial Highlights · Strong Earnings - Profit before tax of N58.2bn (31 March 2019: N57.0bn) an increase of 2.1%. -

Gtbank Corporate Credit Card Form

7.3. If you pay at least the Minimum Amount by the Due Date and choose to revolve a part or full amount of the Revolved Amount (i.e. outstanding balance minus Minimum Amount), interest will be charged on the full amount of Revolved Amount from Transaction date to Due Date and on daily outstanding balance wwwo.fg Rtbeavolnkv.ecdo .Akmoue nt due from Due Date to next Statement date at the specified Revolving Credit Interest Rate. 7.4. For the purposes of interest calculation, payments made by you will first be offset against interest, fees, charges and oldest dated transaction amounts in descending order respectively. 7.5. It you fail to pay at least the Minimum Payment as shown in the Statement by the Due Date, a late payment penalty will be levied on the outstanding Minimum Payment amount on Due Date at the Bank’s specified late payment penalty rate and will be added n the statement for the subsequent month. This is in addition to the interest payable on outstanding balance calculated as per clause 7.3 above on outstanding balance. 7.6. In case a Card Account is overdrawn beyond the Credit Limit as on any day, an overlimit fee will be charged on the maximum amount overdrawn on any particular day will be levied and added on the Statement for the subsequent month. 7.7. Payment on the Credit Account will take effect when received by the Bank and credited to the Card Account. If the payment is made by cheque it will take effect when cleared by the respective bank. -

STATUS-REPORT-APRIL-2019.Pdf

GHANA FIXED INCOME MARKET SUMMARY OF STATUS REPORT APRIL 2019 1 MEMBERSHIP GFIM as at the end of April 2019 has 38 registered members categorized as follows: LICENSED DEALING MEMBERS PRIMARY DEALER BANKS 1. African Alliance Securities Limited 1. Access Bank Ghana Limited 2. Black Star Brokerage Limited 2. ARB Apex Bank 3. Bullion Securities Limited 3. Barclays Bank Ghana Limited 4. Cal Brokers Limited 4. Cal Bank Ghana Limited 5. CDH Securities Limited 5. Consolidated Bank Ghana Limited 6. Databank Brokerage Limited 6. Ecobank Ghana Limited 7. EDC Stockbrokers Limited 7. Fidelity Bank Ghana Limited 8. Gold Coast Brokerage Limited 8. GCB Bank Limited 9. Republic Securities Ghana Limited 9. Guaranty Trust Bank Ghana Limited 10. IC Securities Limited 10. Societe Generale Ghana Limited 11. Liberty Securities Limited 11. Stanbic Bank Limited 12. NTHC Ltd 12. Standard Chartered Bank Limited 13. Prudential Stockbrokers Limited 13. Universal Merchant Bank 14. SBG Securities Ghana Limited 15. SIC Financial Services Limited 16. Strategic African Securities Limited 17. UMB Stock Brokers Ltd NON - PRIMARY DEALER BANKS 1. Agricultural Development Bank 2. Bank of Africa Ghana Ltd 3. First Atlantic Bank Ghana Ltd 4. First National Bank GH. Ltd 5. Prudential Bank Limited 6. Republic Bank Ghana Limited 7. UBA Ghana Limited 8. Zenith Bank Ghana Ltd 2 SUMMARY OF SECURITIES Benchmark Securities: 9 3yr Government bond- 1 5yr Government bond-5 7yr Government bond-1 10yr Government bond-1 15yr Government bond-1 Non-Benchmark Securities: 21 3yr Government bond-11 5yr Government bond-5 6yr Government bond-1 7yr Government bond-3 10yr Government bond-1 Treasury Notes: 36 1yr Government note- 17 2yr Government note- 19 Treasury Bills: 64 364 day bill-9 182 day bill-26 91 day bill-13 Ghana Cocoa Bill-16 Local US dollar 3-year bond-2 Eurobond-6 Corporate Bonds AFB Ghana Plc 16 Bayport Financial Services (Ghana) 9 Edendale Properties 3 Izwe Loans Ghana 6 PBC Ghana Limited 1 E.S.L.A.