LGPS Central

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stourport Ring from Alvechurch | UK Canal Boating

UK Canal Boating Telephone : 01395 443545 UK Canal Boating Email : [email protected] Escape with a canal boating holiday! Booking Office : PO Box 57, Budleigh Salterton. Devon. EX9 7ZN. England. Stourport ring from Alvechurch Cruise this route from : Alvechurch View the latest version of this pdf Stourport-ring-from-Alvechurch-Cruising-Route.html Cruising Days : 8.00 to 11.00 Cruising Time : 51.50 Total Distance : 84.00 Number of Locks : 118 Number of Tunnels : 10 Number of Aqueducts : 0 Offering an interesting mix of river, countryside and cities, this route will take you through the historic city of Worcester, along the River Severn to one of the prettiest canals in England- The Staffordshire & Worcestershire . Take a Steam train ride in the Severn valley and cruise through Birmingham to the superb 26 acre outdoor Black Country Museum, the cosmopolitan Gas Street Basin with all its cafes and bars, and Cadbury World at Bournville. Cruising Notes Novices should take 10-14 days to complete this ring, but experienced boaters can do it in 1 week, but if you want to stop off & explore you will need 10-14 nights. Day 1 Cruise from Alvechurch marina southwards towards Worcester and you will soon encounter your first tunnels, although at 613 yards and 580 yards they are some of the shorter ones. After the last tunnel you will soon reach the Tardebigge Locks. These represent the Boaters Rite of Passage, as these 30 locks, combined with the nearby 6 Stoke Locks, represent 36 locks in 4 miles, and other groups of locks will pale into insignificance in comparison. -

WOLVERHAMPTON WELCOME | 01 Welcome to the Mander Centre the Mander Centre Is the Dominant Retail Destination in the Centre of Wolverhampton

NOW SIGNED WOLVERHAMPTON WELCOME | 01 welcome to the mander centre The Mander Centre is the dominant retail destination in the centre of Wolverhampton. The revitalised centre, anchored by Debenhams, H&M and a brand new New Look, presents retailers with the opportunity to trade and capitalise on a modern retail destination. A raft of new retailers have committed to the scheme, totally 105,000 sq ft. They are One Below, Matalan, Wilko and B&M, who will open between March and November 2019. CONTENTS 01 Welcome 07 Leasing Plan Upper Mall 02 Key Facts 08 City Economy 03 Retail 09 Marketing Support 04 The Development 10 Contact 05 Catchment 06 Leasing Plan Lower Mall KEY FACTS | 02 KEY FACTS 12.5 MILLION 23,000 ANNUAL FOOTFALL UNIVERSITY STUDENTS 65 584,000 £25 MILLION COMPLIMENTARY RESIDENT CATCHMENT INVESTMENT PROGRAMME RETAILERS POPULATION 8 NEWLY CONFIGURED UNITS 94,000 PREMIER LEAGUE FOOTBALL TEAM 550 RANGING 1,850 SQ FT - 19,700 SQ FT NEW DEBENHAMS ATTRACTS 500,000 FANS ANNUALLY CAR PARK SPACES ANCHOR STORE GLA 78,000 550,000 SQ FT AVERAGE WEEKLY TOTAL RETAIL GLA SOCIAL REACH 5TH BEST RETAIL LOCATION FOR INVESTMENT AS PER £228 MILLION PROPERTY WEEK/CACI RANKINGS NON GROCERY SALES RETAIL | 03 RETAIL “We are delighted to be opening our latest city centre store in Wolverhampton. The Mander Centre is the perfect location for our family offering and our exciting new concept store. We can’t wait for the people of Wolverhampton to shop our brand new clothing and homeware ranges in our new state-of-the-art store, designed specifically for our city centre shoppers. -

Pension Fund Committee 04 December 2020 Item 5 LGPS

Pension Fund Committee 04 December 2020 Item 5 LGPS CENTRAL POOLING UPDATE Introduction 1. This report continues the series of updates requested by Committee on progress towards delivering investment pooling. It summarises the main activity since the last update presented in September. Recommendation 2. The Committee is asked to note the position as set out in the report. LGPS Central Joint Committee 3. The LGPS Central Joint Committee is a public forum for the Councils within the LGPS Central Pool (the Pool) to provide oversight of the delivery of the objectives of the Pool, the delivery of client service, the delivery against the LGPS Central business case and to deal with common investor issues. 4. The Joint Committee provides assistance, guidance and recommendations to the individual Councils in connection with specific pooling functions taking into consideration the conflicting demands and interests of the participants within the Pool. The Joint Committee does not have delegated authority to make binding decisions on behalf of the participating Councils. 5. The Joint Committee is a public meeting and Cheshire West and Chester Council act as clerk to the Joint Committee. 6. The Joint Committee usually meets twice yearly in spring and autumn. The spring 2020 meeting was cancelled due to the impact of Covid-19 at that time. The autumn 2020 meeting was held on 20 November. The meeting was held successfully via MS Teams with a live webcast available for public viewing 7. The roles of chair and vice chair rotate annually between partner funds. Given the cancellation of the spring 2020 meeting, the November meeting elected Councillor Biggins from Shropshire as Chair and Councillor Hogg as Vice Chair for the coming year. -

Now Open Now Open

NOW OPEN NOW OPEN WOLVERHAMPTON THE CENTRE OF THE CITY The redeveloped Mander Centre will provide both existing and new retailers with the opportunity to trade and capitalise on a repositioned and modernised retail destination that will dominate the retail pitch in the city. Already home to a mix of leading retail brands, the stunning new 94,000 sqft Debenhams opened its doors in October 2017, being the first city centre store following the ‘Debenhams Redesigned’ strategy. H&M, which opened in November 2016 is one of the largest in the West Midlands and the only one to feature their home range. "The re-development of the Mander Centre created the perfect opportunity for the H&M brand to expand into Wolverhampton. The inclusion of our Homeware range in the offering continues to ensure our stores remain exciting and inspiring fashion destinations for our customers." Carlos Duarte Country Manager UK & IE “Wolverhampton is one of the largest markets which does not currently have a Debenhams store. We are delighted to be finally opening in the city. This store follows a new layout and customer journey derived from our Debenhams Redesigned strategy, which includes new elements such as our new Loaf & Bloom restaurant offer.” Rob Hadfield Director of Group Property ASSET LEASING ECONOMY MARKETING THE ASSET KEY facts 17M 550 94,000 525,000 584,000 ANNUAL FOOTFALL CAR PARK SPACES NEW DEBENHAMS TOTAL RETAIL GLA RESIDENT CATCHMENT ANCHOR STORE GLA POPULATION 23,000 65 90,000 £25M UNIVERSITY STUDENTS COMPLEMENTARY SQ FT OF NEWLY CONFIGURED INVESTMENT RETAILERS STORE OPPORTUNITIES PROGRAMME ASSET LEASING ECONOMY MARKETING CATCHMENT AREA 185,000 PRIMARY CATCHMENT CANNOCK TELFORD M54 127,000 SECONDARY CATCHMENT WOLVERHAMPTON WALSALL 272,000 SUTTON COLDFIELD TERTIARY CATCHMENT WEST BROMWICH DUDLEY 584,000 BIRMINGHAM MERRY HILL TOTAL RESIDENT PRIMARY CATCHMENT SECONDARY HALESOWEN TERTIARY STOURBRIDGE ASSET LEASING ECONOMY MARKETING THE DEVELOPMENT The redevelopment programme commenced in January 2016, and concluded with the opening of the Debenhams in October 2017. -

FREE EMERGENCY CONTRACEPTION the Following Pharmacies Provide Free Emergency Contraception and Free Chlamydia / Gonorrhoea Tests

FREE EMERGENCY CONTRACEPTION The following pharmacies provide free emergency contraception and free chlamydia / gonorrhoea tests. PLEASE CALL THE PHARMACY BEFORE VISITING, TO CHECK THAT THE FREE SERVICE IS AVAILABLE City Centre Superdrug Pharmacy (Mander Centre) Central Arcade, Unit 12, Mander Centre, Wolverhampton WV1 3NN 01902 313654 Jhoots Pharmacy (Thornley Street) 34-35 Thornley Street, Wolverhampton WV1 1JP 01902 424380 Boots UK Ltd (Dudley Street) 40-41 Dudley Street, Wolverhampton WV1 3ER 01902 427145 Asda Pharmacy (Waterloo Rd) Only available on Weds, Thurs, Sunday Asda Supermarket, Molineux Way, Wolverhampton WV1 4DE 01902 778106 Tettenhall, Whitmore Reans Millstream Pharmacy (Tettenhall Road) Halfway House, 151 Tettenhall Road, Wolverhampton, WV3 9NJ 01902 423743 Upper Green Pharmacy (Tettenhall) 5 Upper Green, Tettenhall, Wolverhampton WV6 8QQ 01902 751353 Lloyds Pharmacy (Tettenhall) Lower Street Health Centre, Tettenhall, Wolverhampton WV6 9LL 01902 444565 Tettenhall Wood Pharmacy (Tettenhall Wood) 12 School Road, Tettenhall Wood, Wolverhampton WV6 8EJ 01902 747647 Whitmore Reans Pharmacy 6 Bargate Drive, Avion Centre, Whitmore Reans, Wolverhampton WV6 0QW 01902 420600 Staveley Chemist (Whitmore Reans) 212 Staveley Road, Whitmore Reans, Wolverhampton WV1 4RS 01902 421789 Penn, Pennfields, Merry Hill, Compton, Bradmore, Warstones, Castlecroft Pennfields Pharmacy (Pennfields) 248 Jeffcock Road, Penn Fields, Wolverhampton WV3 7AH 01902 341300 Boots Pharmacy Waitrose (Pennfields) PENDING. PLEASE CHECK Waitrose Store, Penn Road, -

Wolverhampton Pharmacies for Free Emergency Contraception

Wolverhampton Pharmacies for Free Emergency Contraception The following pharmacies provide free emergency contraception. City Centre Superdrug Pharmacy (Mander Centre) 65-67 Mander Square, Wolverhampton, WV1 3NN 01902 713337 LloydsPharmacy (Thornley Street) 34-35 Thornley Street, Wolverhampton WV1 1JP 01902 424380 Boots UK Ltd (Dudley St) 40-41 Dudley Street, Wolverhampton WV1 3ER 01902 427145 Asda Pharmacy (Waterloo Road) Asda Supermarket, Molineux Way, Wolverhampton WV1 4DE 01902 778106 Tettenhall, Whitmore Reans Millstream Pharmacy (Tettenhall Road) Halfway House, 151 Tettenhall Road, Wolverhampton, WV3 9NJ 01902 423743 Upper Green Pharmacy (Tettenhall) 5 Upper Green, Tettenhall, Wolverhampton WV6 8QQ 01902 751353 LloydsPharmacy (Tettenhall) Lower Street Health Ctr, Tettenhall, Wolverhampton WV6 9LL 01902 444565 Tettenhall Wood Pharmacy (Tettenhall Wood) 12 School Road, Tettenhall Wood, Wolverhampton WV6 8EJ 01902 747647 West Midlands Co-operative Chemists Ltd (Whitmore Reans) 6 Bargate Drive, Avion Centre, Whitmore Reans, Wolverhampton WV6 0QW 01902 420600 Staveley Chemist (Whitmore Reans) 212 Staveley Road, Whitmore Reans, Wolverhampton WV1 4RS 01902 421789 Penn, Pennfields, Merry Hill, Compton, Bradmore, Warstones Penn Care Pharmacy (Warstones) 48 Warstones Road, Penn, Wolverhampton WV4 4LP 01902 336591 Co-Op Pharmacy (Pennfields) 248 Jeffcock Road, Penn Fields, Wolverhampton WV3 7AH 01902 341300 Boots Pharmacy – Waitrose (Pennfields) Waitrose Store, Penn Road, Wolverhampton WV2 4NJ 01902 713974 LloydsPharmacy (Penn Manor) Penn -

Midsummer Retail Report 2019

Midsummer Retail Report 2019 IS THIS THE END OF EXECUTIVE RETAIL SHOPPING WITH REGIONAL THE MARKET MONEY THE GOLDEN AGE OF KNOWLEDGE FOOD CONTACTS SUMMARY REIMAGINED A CONSCIENCE UPDATES ONLINE RETAILING? < > EXECUTIVE SUMMARY After an unprecedented year of turmoil, the UK retail sector and the property market that it supports is having to reinvent itself. IS THIS THE END OF EXECUTIVE RETAIL SHOPPING WITH REGIONAL THE MARKET MONEY THE GOLDEN AGE OF KNOWLEDGE FOOD CONTACTS SUMMARY REIMAGINED A CONSCIENCE UPDATES ONLINE RETAILING? < > EXECUTIVE SUMMARY OUR LATEST MIDSUMMER KEY FINDINGS RETAIL REPORT LOOKS AT ● The ‘Golden Age’ of online retailing is coming to an end. ● Major retail development can no longer play the kind Online retailers will be increasingly compelled to engage of central role in regeneration that it has for the past THE CHANGES IN STRATEGIC with physical shopping environments to stay competitive. 50 years. This poses the question as to what will become the economic focal point of urban environments. DIRECTION THAT THE SECTOR ● At £1,868 per person, the UK retail ecommerce expenditure per capita is higher than in any other G20 market, with ● The Government needs to do more to support the Retail WILL HAVE TO FACE IN ORDER both online advertising expenditure and internet retail Industry which employs 10% of the UK workforce and TO REMAIN RELEVANT expenditure almost trebling since 2010. generates £400bn of sales annually. ● Environmental concerns over the impact of online shopping ● The war on plastic, the rise of veganism and growing AND VIABLE. delivery may eventually lead to the introduction of a opposition to the waste incurred by ‘fast fashion’ are ‘suburban congestion charge’. -

Well Secured, City Centre, Retail Investment

WELL SECURED, CITY CENTRE, RETAIL INVESTMENT 2a, 2b & 2c Wulfrun Square, Wolverhampton Well Secured, City Centre, Retail Investment 2A, 2B & 2C WULFRUN SQUARE, WOLVERHAMPTON INVESTMENT SUMMARY ■■ Wolverhampton is a dynamic, thriving city in the West Midlands benefitting from a primary ■■ Well configured, substantial Poundland store comprising56,464sq.ft. catchment population of over 430,000. ■■ Re-based rents. Only 26,262sq.ft. rentalised. ■■ The property occupies a strong retailing pitch within the covered Wulfrun Centre, linking Dudley ■■ Covered shopping centre location with minimal service charge Street to the Mander Centre. Strategically located opposite Primark & the newly opened Pandora and within close proximity to Argos, Marks & Spencer and River Island. ■■ £3,880,000 (Subject to Contract & Exclusive of VAT) ■■ Circa 80% of the income secured to the long established, strong covenant of Poundland Ltd ■■ Attractive 8% net initial yield for a further 12.6 years term certain. ■■ Low capital value of circa £64.50psf. ■■ Predominantly Freehold | INVESTMENT SUMMARY | LOCATION | DEMOGRAPHICS | RETAILING IN WOLVERHAMPTON | SITUATION | PROPERTY | TENURE | TENANCIES & ACCOMMODATION | TENANT COVENANTS | NET CURRENT INCOME | SERVICE CHARGE | EPC | VAT | PROPOSAL | Well Secured, City Centre, Retail Investment 2A, 2B & 2C WULFRUN SQUARE, WOLVERHAMPTON LOCATION Wolverhampton is a large, thriving commercial and administrative centre situated in the core of the West Midlands some 29km (18 miles) north-west of Birmingham, 53km (33 miles) south of Stoke-on Trent and 68km (42 miles) south-west of Derby. The city benefits from excellent road communications with easy access to the national motorway network with Junctions 9 and 10 of the M6 situated 9.6km (6 miles) to the east, Junction 2 of the M54, 6.4km (4 miles) to the north and the M5 within 16km (10 miles) to the south-east. -

Location Name Address Line One Postcode Aberdeen

Location Name Address Line One Postcode Aberdeen - Bon Accord Centre George St AB25 1HZ Aberdeen - Union Square 3-4 South Terrace AB11 5PF Basingstoke 15 Old Basing Mall RG21 7LW Bath Southgate Centre, 1 Newark St BA1 1AT Bedford Harpur Shopping Centre, 33-37, Harpur St MK40 1TN Belfast Donegal Place, 35-47 Donegall Pl BT1 5AD Birmingham - Bullring Centre The Bullring Shopping Centre, MSU10, Moor St B5 4BE Birmingham - High Street Martineau Place, 66 High St B4 7TA Birmingham - Fort Dunlop The Fort Shopping Park, 20 Fort Pkwy B24 9FP Bournemouth - Commercial Road 18-20 Commercial Rd BH2 5NL Bournemouth - Castle Point Shopping Park Castle Ln W BH8 9UB Bradford Broadway Shopping Centre, 25 Charles Street BD1 1PU Brighton North Laine Bazaar, 129 North St BN1 2BE Bristol - Broadmead The Galleries, 59 Broadmead BS1 3EA Bristol - Clifton Queen Road 66 Queens Rd BS8 1QU Bristol - Cribbs Causeway 116 The Mall, Cribbs Causeway Shopping C BS34 5UP Bromley 234 The Glades Shopping Centre BR1 1HD Cambridge Lion Yard, 28 Petty Cury CB2 3ND Canterbury 12 Gravel Walk Canterbury Whitefriars Centre CT1 2TF Cardiff - Queen Street 36 Queen Street CF10 2RG Cardiff - University Hospital 4-5 Heath Park Way, Gabalfa CF14 4XW Chelmsford High Chelmer Shopping Centre, 43 High St CM1 1DD Cheltenham 197-199 High Street and 12-15 North St GL50 1DB Chester - Foregate Street 47-55 Foregate Street CH1 1NA Chester - Broughton Shopping Park Broughton Shopping Park CH4 0DP Chichester 10-12 North St PO19 1LB Colchester Lion Walk Shopping Centre, 4-6 Lion Walk CO1 1LX Covent -

WHS HS Store List

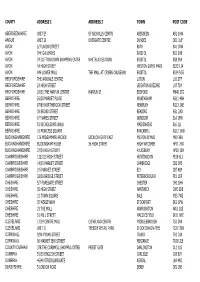

COUNTY ADDRESS 1 ADDRESS 2 TOWN POST CODE ABERDEENSHIRE UNIT E5 ST NICHOLLS CENTRE ABERDEEN AB1 1HW ANGUS UNIT 18 OVERGATE CENTRE DUNDEE DD1 1UF AVON 6/7 UNION STREET BATH BA1 1RW AVON THE GALLERIES BRISTOL BS1 3XB AVON 24 CLIFTON DOWN SHOPPING CNTRE WHITELADIES ROAD BRISTOL BS8 2NN AVON 44 HIGH STREET WESTON SUPER MARE BS23 1JA AVON 049 LOWER MALL THE MALL AT CRIBBS CAUSEWAY BRISTOL BS34 5GG BEDFORDSHIRE THE ARNDALE CENTRE LUTON LU1 2TF BEDFORDSHIRE 23 HIGH STREET LEIGHTON BUZZARD LU7 7DN BEDFORDSHIRE 29/31 THE HARPUR CENTRE HARPUR ST BEDFORD MK40 1TG BERKSHIRE 26/28 MARKET PLACE WOKINGHAM RG11 4AH BERKSHIRE 87/89 NORTHBROOK STREET NEWBURY RG13 1AE BERKSHIRE 39 BROAD STREET READING RG1 2AD BERKSHIRE 6 THAMES STREET WINDSOR SL4 1PW BERKSHIRE 51 NICHOLSON'S WALK MAIDENHEAD SL6 1LL BERKSHIRE 10 PRINCESS SQUARE BRACKNELL RG12 1XW BUCKINGHAMSHIRE 126 MIDSUMMER ARCADE SECKLOW GATE EAST MILTON KEYNES MK9 3BA BUCKINGHAMSHIRE BUCKINGHAM HOUSE 36 HIGH STREET HIGH WYCOMBE HP11 2AR BUCKINGHAMSHIRE 27/29 HIGH STREET AYLESBURY HP20 1SH CAMBRIDGESHIRE 122/123 HIGH STREET HUNTINGDON PE18 6LG CAMBRIDGESHIRE 14/15 MARKET STREET CAMBRIDGE CB2 3PE CAMBRIDGESHIRE 3-5 MARKET STREET ELY CB7 4BP CAMBRIDGESHIRE 32/36 BRIDGE STREET PETERBOROUGH PE1 1DP CHESHIRE 5/7 FOREGATE STREET CHESTER CH1 1HH CHESHIRE 35 HIGH STREET NANTWICH CW5 5DB CHESHIRE 15 TOWN SQUARE SALE M33 7WZ CHESHIRE 35 MERSEYWAY STOCKPORT SK1 1PW CHESHIRE 18 THE MALL WARRINGTON WA1 1QE CHESHIRE 51 MILL STREET MACCLESFIELD SK11 6NE CLEVELAND 17/19 CENTRE MALL CLEVELAND CENTRE MIDDLESBROUGH TS1 2NR -

Interserve AR 2006 Cover Tp

Interserve Plc Annual report and financial statements 2006 Whole-life services Extended reach, expanded markets, enhanced capabilities Contents 1 Highlights of 2006 2 Our profile and principal activities 4 Directors and advisers 6 Chairman’s statement 7 Directors’ report 7 Business review 7 Strategy 8 Operational review 18 Case studies 22 Financial review 26 Principal risks and uncertainties 28 Corporate social responsibility 38 Corporate governance 43 General information and disclosures 45 Directors’ remuneration report 54 Directors’ responsibility statement 55 Independent auditors’ report (consolidated financial statements) 56 Consolidated financial statements 56 Income statement 57 Statement of recognised income and expense 58 Balance sheet 59 Cash flow statement 60 Notes 95 Independent auditors’ report (Company financial statements) 96 Company financial statements 96 Balance sheet 97 Notes 103 Principal undertakings and trading activities 108 Shareholder information Highlights of 2006 Interserve is a services, maintenance and building group. • Revenue up 16 per cent to £1,408.5 million (2005: £1,214.5 million) • Profit before tax, exceptional items and amortisation: up 61 per cent to £58.1 million (2005: £36.0 million)a • Net cashflow from operating activities up 15 per cent to £40.1 million (2005: £34.8 million) • Earnings per share before exceptional items and amortisation: up 68 per cent to 31.7p (2005: 18.9p)b • Full-year dividend: increased by 4.8 per cent to 15.4p (2005: 14.7p) “Our trading performance emphatically demonstrated the strength of each of Interserve’s three main operating divisions, with headline earnings per share rising by 68 per cent to 31.7 pence (2005: 18.9 pence). -

Colt Smoke Curtain Projects

COLT SMOKE CURTAIN PROJECTS PROJECT LIST | SMOKEMASTER ABU DHABI World Trade Centre Mall World Trade Centre Souk AUSTRALIA Perth International Airport Multi-purpose Hall, Maylands Kimberley Residential Home, Perth RMIT University, Melbourne VIC Country Court Royal Children’s Hospital, Parkville Abu Dhabi Central Market - Phase 1 Yarra Arts Centre MCG Melbourne Cricket Ground Jupiter’s Casino, Surfers Paradise, Qld Mona Vale Hospital, Sydney, NSW 8 Chifley Square Building, Sydney, NSW Charles Perkins Centre, Sydney University, Sydney, NSW Aboriginal Health Centre, Sydney, NSW AUSTRIA Plus City, Linz / Pasching (Shopping Centre) Vienna Airport Rio Tinto, Perth Airport International Airport Red Bull Arena, Salzburg (Football Stadium) Wiener Krankenanstaltenverbund Geriatriezentrum Liesing Trend Hotel Park Royal Palace, Vienna BELGIUM Parking gare de Liege Parking ville de Mouscron Parking Nysdam La Hulpe Bureaux Administratif GSK Casino de Bruxelles Red Bull Arena, Salzburg (Football Stadium) Redecvo Flemalle Parking Police de Charleroi Brico, Zaventem Casino de Bruxelles, Brussels Grand Bazar, Antwerp United Brands, Aalst Metro Station Diamant, Antwerp Prenuptia, Genk Parking Brouwerij De Neve, Dilbeek Parking Belvue, Ledeberg Parking CIAC, Gent Parking Lievenhof, Gent Dubai Medical School Parking KUL, Leuven Parking NUBO, Zutendaal Parking Ter Clavers, Leuven Parking De Kaai, Boom Parking Romana, Tongeren Parking De Zaat, Temse Hermes Faubourg, Paris www.coltgroup.com | “People feel better in Colt conditions.” © Colt International Licensing