The Bank of East Asia, Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Bank of East Asia, Limited 東亞銀 行 有限公司 (Incorporated in Hong Kong with Limited Liability in 1918) (Stock Code: 23)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. The Bank of East Asia, Limited 東亞銀 行 有限公司 (Incorporated in Hong Kong with limited liability in 1918) (Stock Code: 23) ANNOUNCEMENT OF 2020 FINAL RESULTS SUMMARY OF RESULTS The Board of Directors of the Bank is pleased to announce the audited results (Note 1(a)) of the Group for the year ended 31st December, 2020. This financial report, which has been reviewed by the Bank’s Audit Committee, is prepared on a basis consistent with the accounting policies and methods adopted in the 2020 annual accounts. Consolidated Income Statement For the year ended 31st December, 2020 2020 2019 Restated Notes HK$ Mn HK$ Mn Interest income 4 21,107 28,575 Interest income calculated using the effective interest method 21,718 28,143 Other interest (expense)/income (611) 432 Interest expense 5 (9,557) (14,009) Net interest income 11,550 14,566 Fee and commission income 6 3,714 3,821 Fee and commission expense (792) (946) Net fee and commission income 2,922 2,875 Net trading profit 7 984 807 Net result on financial instruments at FVTPL 8 198 213 Net result on financial assets measured at FVOCI 9 153 84 Net loss on sale of investments measured at amortised cost (14) (1) Net hedging profit 10 62 12 -

Elliott's Perspectives on Bank of East Asia, Limited ("BEA")

Elliott’s perspectives on Bank of East Asia, Limited ("BEA") 4 February 2016 Additional information General Considerations This presentation is for general informational purposes only and does not (i) purport to be complete; or (ii) constitute an agreement, offer, a solicitation of an offer, or any advice or recommendation to enter into or conclude any transaction (whether on any terms shown herein or otherwise). This presentation may not be relied upon by any person for any purpose and should not be construed as investment, financial, legal, tax or other advice. Elliott Associates, L.P., Elliott International, L.P. and each of their respective affiliates (together, “Elliott”) expressly disclaim any obligation to verify or update the data, information or opinions contained in this presentation. Cautionary Statement Regarding Forward-Looking Statements The information herein contains “forward-looking statements”. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could”, “would” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe Elliott’s objectives, plans or goals are forward-looking. Any forward-looking statements are based on Elliott’s current intent, belief, expectations, estimates and projections regarding BEA and projections regarding the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially. -

Jiaqi Qu 60 Crittenden Blvd

Jiaqi Qu 60 Crittenden Blvd. Apt. 932, Rochester, NY, 14620, US +1 585 2988873 | [email protected] EDUCATION University of Rochester Rochester, US PhD in Finance 2019 – 2024 (expected) London School of Economics and Political Science London, UK Msc in Finance and Economics with Distinction 2018 – 2019 The University of Sydney Sydney, Australia Bachelor of Commerce (Honours) in Finance 2014 – 2017 Sub-major: Economics with First Class Honours RESEARCH “Pricing Convertible Bonds --Value of Stochastic Interest Rate Modelling” Master Dissertation Abstract: This study looks at the value of stochastic interest rate modelling in pricing convertible bonds. We use least square Monte Carlo simulation (LSM) by Longstaff and Schwartz (2001) with a focus on plain vanilla convertible bonds. The results show that there exist pricing differences between constant interest rate model and stochastic interest rate models. The results are statistically and economically significant for convertible bonds that have long maturity or out of the money. Results are also significant when the current interest rate deviate a lot from its long-term mean. For other situations, however, the pricing differences are only statistically significant but economically minor. “How does customer credit quality affect supplier firms’ bank loan contract terms?” Honours Thesis, Supervisor: Associate Prof. Eliza Wu, deputy head of discipline research Abstract: This study investigates whether customer firms’ credit quality impact on supplier firms’ bank loan contract terms. -

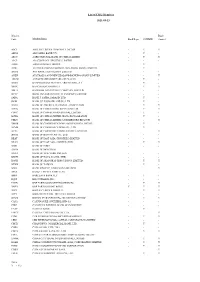

List of CMU Members 2021-08-18

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

Banking and Credit Card Services

Bill Payment Payee List – Banking and Credit Card Services Merchant Category Merchant Name Bill Account Description Bill Type Bill Type Description Banking and Credit AEON Credit Service Credit Card Number or Agreement Number 01 AEON Credit Card Card Services AEON Credit Service Credit Card Number or Agreement Number 02 Hire Purchase & Instalment American Express Cards Card Account Number Australia and New Zealand Banking Group Account Number 01 Credit Card Limited Hong Kong Branch Australia and New Zealand Banking Group Account Number 02 MoneyLine of Credit and Revolving Loan Limited Hong Kong Branch Australia and New Zealand Banking Group Account Number 03 Other Payment Limited Hong Kong Branch Bank of America, N.A.-HK Branch Credit Card Number Bank of Communications (Hong Kong Credit Card Number Branch) BOC Credit Card Card Number CCB (Asia) UnionPay Dual Currency Credit Credit Card Number Card CCB (Asia) VISA/MasterCard Credit Card Credit Card Number or Personal Loan 01 Credit Card or Loan Products Account Number CCB (Asia) VISA/MasterCard Credit Card Credit Card Number or Personal Loan 02 Revolving Cash Facility or Loan Products Account Number CCB (Asia) VISA/MasterCard Credit Card Credit Card Number or Personal Loan 03 Personal Installment Loan or Loan Products Account Number China CITIC Bank International Limited Account Number China Construction Bank (Asia) Banking 9-digit Settlement Account for Mutual Services Funds Subscription China Merchants Bank AIO 16 Digit All In One Card Number Chong Hing Bank Account Number 01 Credit Card -

The Bank of East Asia Branch Location

The Bank of East Asia Bank Branch Address 1. 133 Wai Yip Street G/F, 133 Wai Yip Street, Kwun Tong 2. Aberdeen 162-164 Aberdeen Main Road, Aberdeen 3. Admiralty Shop 2003-2006, 2/F, United Centre, 95 Queensway, Admiralty, Hong Kong. 4. BEA Harbour View Centre Shop 1, G/F, Bank of East Asia Harbour View Centre, 56 Gloucester Road, Wanchai 5. Bonham Road Shop 1-3, G/F, Ka Fu Building, 19-27 Bonham Road 6. Castle Peak Road Shop 1A, G/F & UG/F, One Madison, 305 Castle Peak Road, Cheung Sha Wan 7. Causeway Bay G/F, Ying Kong Mansion, 2-6 Yee Wo Street, Causeway Bay 8. Causeway Bay The Sharp (This branch was closed after 28 Mar 2021) 9. Chai Wan 345 Chai Wan Road, Chai Wan 10. Cheung Sha Wan Plaza Shop 117 - 119, 1/F, Cheung Sha Wan Plaza, 833 Cheung Sha Wan Road, Cheung Sha Wan 11. East Point City Shop 217B, Level 2, East Point City, 8 Chung Wa Road, Tseung Kwan O 12. Fanling (This branch was closed after August 21, 2021) 13. Festival Walk (This branch was closed after October 10, 2020) 14. Happy Valley 5-7 Sing Woo Road, Happy Valley 15. Hennessy Road G/F, Eastern Commercial Centre, 395-399 Hennessy Road, Wanchai 16. Hoi Yuen Road Unit 1, G/F, Hewlett Centre, 54 Hoi Yuen Road, Kwun Tong 17. Hong Kong Baptist G02, G/F, Jockey Club Academic Community University Centre, 9 Baptist University Road, Kowloon Tong 18. iSQUARE Shop UG01, iSQUARE, 63 Nathan Road, Tsim Sha Tsui Bank Branch Address 19. -

The Bank of East Asia, Limited, Macau Branch

The Bank of East Asia, Limited, Macau Branch Ref. Position Department No. of Vacancy Target Corporate Banking Department / 1 Officer Trainee Branch Distribution & Services 3 Local Students Department Corporate Banking Department / 2 Manager Trainee Branch Distribution & Services 3 Local Students Department 職位申請可透過以下電郵: E‐mail: [email protected] BEA Induction: The Bank of East Asia, Limited, Macau Branch 東亞銀行有限公司澳門分行 Incorporated in 1918, The Bank of East Asia, Limited (“BEA”) is Hong Kong’s largest independent local bank, with total consolidated assets of HK$8,652 billion (US$1,111 billion) as of 31st December, 2019. BEA is listed on The Stock Exchange of Hong Kong, and is a constituent stock of the Hang Seng Index. BEA offers customers a comprehensive range of commercial banking, personal banking, wealth management, and investment services through an extensive network of more than 200 outlets covering Hong Kong and the rest of Greater China, Southeast Asia, the United Kingdom, and Induction about MT: BEA Macau Branch was established in 2001. Currently, we have a branch and 4 sub‐branches in Macau that provide a broad range of products and services to meet the diverse needs of both corporate and personal customers. To cope with the business expansion in Macau, we are pleased to launch the Management Trainee (“MT”) Programme and invite applications from qualified candidates for the MT Programme. BEA Macau Branch offers a promising career path to outstanding university graduates. Our 24‐ month MT Programme aims to nurture potential and young executives and to develop future management staff of our Branch. MTs, who complete the MT Programme as per the training schedule, are able to “fast‐track” to manager in two years, a process that usually takes four years. -

Criteria Caixa Corp Buys 4% of the Bank of East Asia in Accordance with "La Caixa’S" International Expansion Strategy

Criteria Caixa Corp buys 4% of The Bank of East Asia in accordance with "la Caixa’s" international expansion strategy The Bank of East Asia (BEA) is the fifth largest bank in Hong Kong with total consolidated assets of €32.42Bn, over 200 branches and 8,900 employees. "la Caixa" has assets totalling €232.30Bn, 10.3 million customers, 5,246 branches and 23,707 employees. Criteria Caixa Corp is 100% controlled by "la Caixa" and it will be soon listed on the Stock Market. Barcelona, 20 September 2007 . "la Caixa” has bought a 4% stake in The Bank of East Asia (BEA), Hong Kong’s fifth largest bank in terms of consolidated assets and the largest local independent bank, for €265Mn. This move is part of the "la Caixa’s” international expansion strategy and was carried out by Criteria Caixa Corp, its financial arm. "la Caixa” is chaired by Isidro Fainé and managed by Juan María Nin. The Bank of East Asia, chaired by Dr. David K.P. Li, has total consolidated assets of €32.42Bn (as at 30 June 2007), over 200 branches and 8,900 employees. The bank is listed on the Stock Exchange of Hong Kong and is one of the constituent stocks of the Hang Seng Index. BEA, which has a long-term A- credit rating from Standard & Poor’s and an A2 rating from Moody’s, was named the best foreign retail bank in China in 2006 by the specialist journal The Asian Banker. This is Criteria Caixa Corp first step in the Asian financial sector, complementing "la Caixa’s” opening of a representative office in Beijing last year. -

The Bank of East Asia, Limited Tailored Resolution Plan Public Section Summary of Resolution Plan

The Bank of East Asia, Limited Tailored Resolution Plan Public Section Summary of Resolution Plan 1. Introduction Section 165(d) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 requires systemically important financial institutions that conduct business in the United States to file resolution plans with U.S. regulators. Section 165(d) has been implemented through regulations of the Board of Governors of the Federal Reserve System (the “FRB”) and the Federal Deposit Insurance Corporation (the “FDIC”) that require a foreign-based covered company to provide detailed information about its entities and activities in the United States, including the process by which those entities and activities would be resolved in the event of the company’s material distress or failure (the “Regulations”).1 Pursuant to the Regulations, The Bank of East Asia, Limited (“BEA”) has developed a tailored resolution plan (the “Plan”). The Regulations direct that the Plan focus on BEA’s U.S. nonbanking operations. The following discussion provides interested members of the public with an overview of the key elements of BEA’s Plan. 2. BEA and its U.S. Operations BEA BEA, the covered company for purposes of this resolution plan, was incorporated in 1918 under the laws of the Hong Kong Special Administrative Region of the People’s Republic of China. BEA is a publicly traded corporation listed on The Stock Exchange of Hong Kong and is one of the constituents stocks of the Hang Seng Index. Headquartered in Hong Kong, BEA operates an extensive international network covering Hong Kong and the rest of Greater China, Southeast Asia, the United Kingdom, and the United States. -

The Bank of East Asia (“BEA”)

NEWS RELEASE AFFIN Holdings Berhad and The Bank of East Asia, Limited Sign a Memorandum of Understanding to Establish a Strategic Partnership Kuala Lumpur, 26th August, 2010 – AFFIN Holdings Berhad (“AHB”) and The Bank of East Asia, Limited (“BEA”), Hong Kong, have today signed a memorandum of understanding (“MoU”) to formally establish a strategic partnership. Under the MoU, the two financial institutions will jointly develop their business potential in Mainland China, Hong Kong, Malaysia, and other key markets where they both operate. This strategic partnership signifies the beginning of of long-term collaboration between AHB and BEA and the MoU outlines the framework for the mutually beneficial co-development of businesses between AHB and BEA. Commenting on today’s signing ceremony, Yang Berbahagia Gen ( R ) Tan Sri Dato’ Seri Mohd Zahidi bin Haji Zainuddin, Chairman of AHB said “This strategic partnership will enhance AHB’s ability to support its customers with businesses or intending to have business presence in Mainland China and Hong Kong by leveraging on BEA’s strong presence and extensive branch network there”. “We are confident that this strategic alliance will place both AHB and BEA in a better position in many important Asian markets, and enable us to tap an even wider range of business opportunities. Furthermore, our alliance is just the starting point from which we intend to explore co-operation in other areas that will bring benefits to both AHB and BEA”. “The partnership will create a unique growth opportunity for both AHB and BEA and will also provide a strong foundation for advancing AHB’s strategy to be one of the Malaysia’s premier consumer and business focused banking group”. -

Hong Kong Banking Report 2019

The future of banking Hong Kong Banking Report 2019 kpmg.com/cn 2 | Hong Kong Banking Report 2019 Contents Introduction 4 Overview 6 Future business models 13 What will it take to win in the age of digital banking? 14 Customer experience at the core of banks’ winning strategy 17 Wealth management partnerships take centre stage in China 20 Moving towards a connected enterprise 24 A digital future 28 Harnessing the full power of AI also requires smart governance and controls 29 Open APIs offer new opportunities for banks, but first they must focus on 32 working effectively with third parties Blockchain: no longer a buzzword in Hong Kong 34 The age of the ‘data culture’ is here 36 © 2019 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Hong Kong Banking Report 2019 | 3 Smart risk management 38 Regtech is fast becoming an indispensable part of the banking industry 39 Information sharing the key to enhancing financial crime compliance 42 Consumer trust is at the core of managing cyber and emerging technology risk 44 Viewing conduct risk through a forward-looking lens is the way of the future 46 The future market 48 A shifting regulatory focus towards conduct and data 49 Tax developments will drive banking opportunities in Hong Kong, but potential 52 challenges lie ahead The future of banking in China 54 Creating a seamless banking experience in the Greater Bay Area 56 Financial highlights 59 About KPMG 90 Contact us 91 © 2019 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. -

The Bank of East Asia, Limited

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. The Bank of East Asia, Limited 東亞銀行有限公司 (Incorporated in Hong Kong with limited liability in 1918) (Stock Code: 23) LEGAL PROCEEDINGS On 18th July, 2016, the Bank was served with a sealed copy of an unfair prejudice petition presented by Elliott International, L.P. (“Elliott”), The Liverpool Limited Partnership (“Liverpool”) and certain other entities affiliated with Elliott and Liverpool (together, the “Petitioners”) to the Court of First Instance of the High Court of the Hong Kong Special Administrative Region (the “Court”) on 18th July, 2016 pursuant to Section 724 of the Companies Ordinance (Cap. 622) (the “Petition”). The Bank and the Relevant Directors are named as respondents in the Petition. In the Petition, the Petitioners seek the following relief against the Bank and the Relevant Directors: (1) a declaration that certain resolutions of the Board in September 2014, February 2015 and March 2015 approving and affirming the SMBC Subscription and the entering into of the SMBC Subscription Agreement and SMBC Investment Agreement with SMBC, details of which are set out in the announcements by the Bank dated 5th September, 2014 and 18th March, 2015, were passed for an improper