FOR IMMEDIATE RELEASE May 26, 2021 CONTACT

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unsung Heroine Awards Breakfast

COOK COUNTY BOARD PRESIDENT TONI PRECKWINKLE AND THE COOK COUNTY COMMISSION ON WOMEN’S ISSUES PRESENT The 24 thAnnual Peggy A. Montes Unsung Heroine Awards Breakfast VIRTUAL EVENT THURSDAY, MARCH 4TH, 2021 9:30 AM - 10:30 AM WWW.COOKCOUNTYIL.GOV/CCCWI 1 24th Annual Peggy A. Montes Unsung Heroine Awards Breakfast Thursday, March 4, 2021 9:30 a.m. – 10:30 a.m. PROGRAM Welcome Érika Maldonado, Anchor, Univision Chicago Mistress of Ceremonies Remarks Audra Wilson, Chairperson Cook County Commission on Women’s Issues Toni Preckwinkle, President Cook County Board of Commissioners Presentation of Awards Érika Maldonado Recitation of Poetry Kara Jackson National Youth Poet Laureate (2019– 2020) Closing Érika Maldonado 1 The Cook County Commission on Women’s Issues COMMISSIONERS Audra Wilson Chairperson Vera Davis Dorian K. Carter Dr. Frances G. Carroll Echelle Mohn Kelley Nichols-Brown Susette Lunceford Michelle Garcia Iris Millan Marjorie A. Manchen Neha Gill Hon. Ginger Rugai Danielle Parisi Ruffatto Trina Janes Michelle Kohler Rebecca Darr Claudia E. Ayala Nancy Mott Dr. Aparna Sen-Yeldandi Andrea A. Raila 2 Cook County’s Unsung Heroines As an annual event in observance of Women’s History Month, the Commission on Women’s Issues honors one woman from each of the seventeen County districts, and an eighteenth honoree, selected by the four at-large members of the Cook County Women’s Commission. All eighteen women are recognized for their vital contributions to their respective communities. This award honors women’s achievements within the larger fabric of history and commemorates the powerful impact women have had on the development of our social, cultural, economic, and political institutions. -

Report and Opinion

Report and Opinion Concerning the Impact of the Proposed Obama Presidential Center on the Cultural Landscape of Jackson Park, Chicago, Illinois Including the Project’s Compatibility with Basic Policies of the Lakefront Plan of Chicago and the Purposes of the Lake Michigan and Chicago Lakefront Protection Ordinance By: Malcolm D. Cairns, FASLA Ball State University Muncie, Indiana May 15, 2018 Assessing the Effect of the Proposed Obama Presidential Center on the Historic Landscape of Jackson Park Prepared by: Malcolm Cairns, FASLA; Historic Landscape Consultant For: The Barack Obama Foundation Date: May 15, 2018 Statement of purpose and charge: To develop the historic landscape analysis that places the proposal to locate the Obama Presidential Center in Chicago’s Jackson Park in its proper historic context. This investigation was undertaken at the request of Richard F. Friedman of the law firm of Neal & Leroy, LLC, on behalf of the Barack Obama Foundation. The assignment was to investigate the proposed Obama Presidential Center master plan and to assess the effect of the project on the historic cultural landscape of Jackson Park, Chicago, a park listed on the National Register of Historic Places. This investigation has necessitated a thorough review of the cultural landscape history of Jackson Park, the original South Park, of which Jackson Park was an integral part, and of the history of the Chicago Park and Boulevard system. Critical in this landscape research were previous studies which resulted in statements of historic landscape significance and historic integrity, studies which listed historic landscape character-defining elements, and other documentation which provided both large and small scale listings of historic landscape form, structure, detail, and design intent which contribute to the historic character of the Park. -

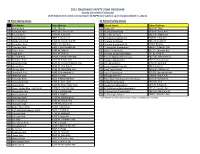

2021 CHILDREN's SAFETY ZONE PROGRAM Zones Currently Enforced

2021 CHILDREN'S SAFETY ZONE PROGRAM Zones Currently Enforced ($35 tickets for vehicles traveling 6-10 MPH over posted speed begins March 1, 2021) 38 Park Safety Zones 22 School Safety Zones Park Name Park Address School Name School Address 1 Abbott Park 49 E. 95th St. 1 Bogan HS 3939 W. 79th 2 Ashmore Park 4807 W Gunnison St 2 Burley Elementary 1630 W. Barry Ave. 3 Beverly Park 2460 W. 102nd St 3 Burr Elementary 1621 W. Wabansia 4 Calumet Park 9801 S. Avenue G 4 Charles Prosser School 2148 N. Long Ave 5 Challenger Park 1100 W. Irving Park Rd 5 Chicago Ag School 3857 W 111th St 6 Columbus Park 500 S. Central Ave 6 Chicago Vocational HS 2100 E 87th St. 7 Douglass Park 1401 S. Sacramento Dr. 7 Christopher Elementary 5042 S. Artesian Ave 8 Foster Park 1440 W. 84th St 8 Dulles Elementary 6311 S. Calumet Ave. 9 Gage Park 2411 W. 55th St 9 Frances Xavier Elementary 751 N. State St 10 Garfield Park 100 N. Central Park Ave. 10 Frazier Magnet Elementary 4027 W. Grenshaw St. 11 Gompers Park 4222 W. Foster Ave 11 Harvard Elementary 7525 S. Harvard Ave 12 Hiawatha Park 8029 W. Forest Preserve Ave. 12 ICCI Elementary 6435 W. Belmont 13 Horan Park 3035 W. Van Buren 13 Jones College Prep HS 700 S State St 14 Horner Park 2741 W. Montrose Ave 14 Lane Tech School 2501 W. Addison St 15 Humboldt Park 1440 N. Humboldt Dr 15 Lorca Elementary 3231 N. Springfield Ave 16 Jefferson Park 4822 N. -

This Month's Secretary Is Kelsey Beccue

It is the mission of the Urbana Park District to: Improve the quality of life of its citizens through a responsive, efficient, and creative park and recreation system, Pursue excellence in a variety of programs, parks, and special facilities that contribute to the attractiveness of neighborhoods, conservation of the environment, and the overall health of the community. NOTICE AND AGENDA OF MEETING URBANA PARK DISTRICT ADVISORY COMMITTEE (UPDAC) TUESDAY, AUGUST 24, 2021 7:00 PM LARGE PAVILION IN CRYSTAL LAKE PARK 206 W. PARK STREET URBANA, IL 61801 I. Call to Order – Welcome New Members and Introductions II. Public Comment Any member of the public may make a brief statement at this time within the public participation rules of the Board. III. Approval of the Minutes of the June 22, 2021 Meeting IV. New Business A. UPDAC Year‐in‐Review B. Upcoming Programs and Projects Upcoming meetings: V. Reports September 28, 2021 A. UPDAC Chair October 26, 2021 B. Board Representative November 16, 2021 *third C. Director’s Report Tuesday due to Thanksgiving D. Capital Projects Report VI. UPDAC Member Comments and Open Discussion VII. Adjourn ***This month’s secretary is Kelsey Beccue*** Note: The Meeting Agenda and Supporting Materials are on the UPD website at http://www.urbanaparks.org/documents/index.html; choose the “Public Meetings” category and search for the meeting information you wish to download. UPDAC Agenda – August 24, 2021 1 URBANA PARK DISTRICT ADVISORY COMMITTEE (UPDAC) MINUTES TUESDAY, JUNE 22, 2021 7:00 PM‐8:30 PM ONLINE VIA ZOOM URBANA, ILLINOIS 61802 The meeting of the Urbana Park District Advisory Committee (UPDAC) was held Tuesday, June 22, 2021 remotely via Zoom at 7:00 pm. -

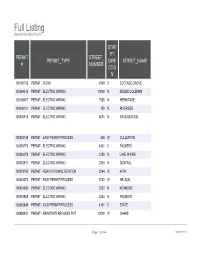

Full Listing Based on Building Permits

Full Listing Based on Building Permits STRE ET PERMIT STREET_ PERMIT_TYPE DIRE STREET_NAME # NUMBER CTIO N 100190752 PERMIT - SIGNS 6349 S COTTAGE GROVE 100296510 PERMIT - ELECTRIC WIRING 10000 N BESSIE COLEMAN 100108067 PERMIT - ELECTRIC WIRING 7535 N HERMITAGE 100696131 PERMIT - ELECTRIC WIRING 150 N RIVERSIDE 100830913 PERMIT - ELECTRIC WIRING 4001 N RAVENSWOOD 100832738 PERMIT - EASY PERMIT PROCESS 248 W CULLERTON 100858773 PERMIT - ELECTRIC WIRING 4301 S PACKERS 100886078 PERMIT - ELECTRIC WIRING 3150 N LAKE SHORE 100833917 PERMIT - ELECTRIC WIRING 2350 N CENTRAL 100878195 PERMIT - RENOVATION/ALTERATION 2544 W 46TH 100834372 PERMIT - EASY PERMIT PROCESS 5123 W NELSON 100834900 PERMIT - ELECTRIC WIRING 2233 N KENMORE 100834888 PERMIT - ELECTRIC WIRING 2324 N FREMONT 100835849 PERMIT - EASY PERMIT PROCESS 4131 S STATE 100858937 PERMIT - REINSTATE REVOKED PMT 10000 W OHARE Page 1 of 846 09/27/2021 Full Listing Based on Building Permits WORK_DESCRIPTION INSTALL BUILDING SIGN LOW VOLTAGE ADD CIRCUITS FOR COMPUTERS. LOW VOLTAGE CABLING FOR 18TH & 25TH FLOOR BUILD OUTS. ATT IL01735G NR UPGRADE - 850: SWAP (3) EXIST LTE RRUS12 W/ (3) PROPOSED RRUS4478-B5 W/ 2ND FIBER IN P4. ONLY CONNECT 2 PORTS OF RADIO TO ANTENNA, OTHER 2 PORTS TO BE CAPPED OFF.ADD (1) 12 PAIR FIBER TRUNK TO EXISTING FC12 BOX ON SHELTER WALL.SELF RET - P45G NR UPGRADE - 850: ADD (3) 25A BREAKERS, (1) 20A BREAKER, (1) 6630, AND UPPER/LOWER SFPS. INSTALL 800'LF X 6'HIGH FENCE ALONG PROPERTY LINE OF VACANT LOT TIME AND MATERIAL. DEMO ELECTRIC AS NEEDED FOR NEW TENANT IMPROVEMENTS. FURNISH AND INSTALL 3 DIGITAL LINE VOLTAGE HONEYWELL THERMOSTATS FOR HEAT/COOL WINDOW UNITSFOR DIANE DUNNE UNIT OWNER APT 34E INSTALL CAT 5/6 CABLE FOR KIOSKS AND FRONT COUNTER NEW FRONT PORCH TO REPLACE EXISTING IN PLACE ON AN EXISTING 2 STORY 2 UNIT MULTIFAMILY RESIDENCE. -

Mahomet, Illinois, a Unit of the Champaign County Forest Preserve District, in Mahomet, Illinois Doris K

Museum of the Grand Prairie (formerly Early American Museum), Mahomet, Illinois, a unit of the Champaign County Forest Preserve District, in Mahomet, Illinois Doris K. Wylie Hoskins Archive for Cultural Diversity Finding Aid (includes Scope and Content Note) for visitor use Compiled by interns Rebecca Vaughn and Katherine Hicks Call to schedule an appointment to visit the Doris Hoskins Archive (217-586-2612) Museum website: http://www.museumofthegrandprairie.org/index.html Scope and Content Note Biographical Note Mrs. Doris Baker (Wylie) Hoskins, was born October 18, 1911 in Champaign, Illinois, and passed away in September, 2004, in Champaign, Illinois. She served for many years with the Committee on African American History in Champaign County of the former Early American Museum (now Museum of the Grand Prairie), serving as the group's archivist. She was also active in the Champaign County Section of the National Council of Negro Women. Her collection of historical material was transferred to Cheryl Kennedy upon her passing. The Hoskins Archive is now made publicly accessible by the staff of the Museum of the Grand Prairie, Champaign County Forest Preserve District, and inquiries should be made to Cheryl Kennedy, Museum Director, [email protected] (cited in eBlackCU.net Doris K. Wylie Hoskins Archive description). Hoskins Archive Summary The Doris K. Wylie Hoskins Archive for Cultural Diversity contains a wide body of materials featuring African American history in Champaign County and East Central Illinois. The date range for the archives contents extends from 1861 to 2010. The ―bulk dates‖ or dates that the majority of the file contents fall under, range from 1930 to 2000. -

2021 Schedule

2021 Schedule Date Day Park Title Rating CC Park Address Park Phone Underwriter 6-Jul Tue Oakdale Park Sonic The Hedgehog PG Yes 965 W. 95th St. (312) 747-6569 7-Jul Wed Humboldt Park Tom & Jerry PG Yes 1440 N. Sacramento (312) 742-7549 8-Jul Thu Mary Bartelme Park 10 Things I Hate About You PG-13 Yes 115 S. Sangamon St. (312) 746-5962 Mary Bartelme Park Advisory Council 8-Jul Thu Pasteur Park Trolls World Tour PG Yes 5825 S. Kostner Ave (773) 284-0530 9-Jul Fri Amundsen Park The Greatest Showman PG Yes 6200 W. Bloomingdale Ave. (312) 746-5003 9-Jul Fri Jesse Owens Park Jumanji: The Next Level PG-13 Yes 8800 S. Clyde (312) 747-6709 10-Jul Sat Douglass Park The High Note PG-13 Yes 1401 S. Sacramento Dr. (773) 762-2842 10-Jul Sat Paschen Park Imagine That PG Yes 1932 W. Lunt Ave. (773) 262-5871 13-Jul Tue Augusta Park Dolittle PG Yes 4433 W. Augusta Blvd. (312) 742-7544 13-Jul Tue Beverly Park Wizard of Oz G Yes 2460 W. 102nd St. (312) 747-6024 14-Jul Wed Lorraine Hansberry Park The Croods: A New Age PG Yes 5635 S. Indiana Ave. (312) 256-1248 14-Jul Wed Olympia Park The Croods: A New Age PG Yes 6566 N. Avondale Ave. (773) 631-6861 15-Jul Thu Gompers Park Spider-Man: Into the Spider-Verse PG Yes 4222 W. Foster Ave. (773) 685-3270 15-Jul Thu Vittum Park Aladdin (2019) PG Yes 5010 W. -

The Greater Homan Square Strategic Development Plan

TABLE OF CONTENTS 1. Introduction 2. Homan Square Today 3. Moving Forward 4. Expanding the Community Development Vision 5. Opportunities to Support 6. Acknowledgements 1 Executive Summary . Inspire potential investment in specific projects within the larger With long standing roots in Chicago’s North Lawndale community, the Plan. Foundation for Homan Square (FHS) has a demonstrated track record in Potential redevelopment opportunities surround the Campus footprint. the production and long-term stewardship of quality affordable housing The area, once populated with greater commercial and residential and community facilities. Homan Square Campus is a campus community density, now struggles with the challenges presented by vacant lots, in comprised of DRW College Prep, Nichols Tower commercial facility, a abandoned buildings and underutilized sites that negatively impact community center and residential housing units developed, owned and otherwise strong city blocks. These sites now present infill or managed by the Foundation for Homan Square. redevelopment opportunities that can leverage existing community The success of Homan Square lies in its ability to concentrate local assets on and around the Homan Square Campus. organizations and businesses addressing community needs within the As FHS sets sights on this new community-building effort, focus areas same Campus as the families that utilize their services, creating a sense prioritizing development opportunities around the Campus footprint are of place. Organizations range from health care and recreation, to family identified in the Plan to guide the work. Dependent upon the specific support services and education, to arts programming and workforce opportunity, preliminary projects may require the involvement of development. Yet, despite the success of the Campus, continued multiple private and/or nonprofit entities, developers, service providers, investment is needed to support new development and investment in the and other partnerships. -

The Black Freedom Movement and Community Planning in Urban Parks in Cleveland, Ohio, 1945-1977

THE BLACK FREEDOM MOVEMENT AND COMMUNITY PLANNING IN URBAN PARKS IN CLEVELAND, OHIO, 1945-1977 BY STEPHANIE L. SEAWELL DISSERTATION Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in History in the Graduate College of the University of Illinois at Urbana Champaign, 2014 Urbana, Illinois Doctoral Committee: Associate Professor Clarence Lang, Chair Professor Jim Barrett Professor Adrian Burgos Associate Professor Sundiata Cha-Jua Associate Professor Kathy Oberdeck ii Abstract African American residents of Cleveland, Ohio made significant contributions to their city’s public recreation landscape during the Civil Rights and Black Power Movements. Public parks were important urban spaces—serving as central gathering spots for surrounding neighborhoods and unifying symbols of community identity. When access to these spaces was denied or limited along lines of race, gender, sexuality, or class, parks became tangible locations of exclusion, physical manifestations of the often invisible but understood fault lines of power that fractured, and continues to fracture, urban landscapes. In Cleveland, black activists challenged these fault lines through organizing protests, developing alternative community-run recreation spaces, and demanding more parks and playgrounds in their neighborhoods. This dissertation considers five recreation spaces in Cleveland—a neighborhood park, a swimming pool, a cultural garden, a playground, and a community-run recreation center—in order to make three important interventions into the scholarship on black urban Midwest communities and postwar African American freedom struggles. First, this dissertation takes up spatial analysis of black activism for improved public recreation opportunities, and argues this activism was an important, if often understudied, component of broader Black Freedom Movement campaigns in the urban north. -

North Lawndale Welcomes Youth-Led Douglass 18 By: Ashmar Mandou

Sheriff’s Office Offers Free Assistance to Tenants, Housing Providers as Eviction Moratorium Expires As the moratorium on services and financial help. locate existing government filing eviction cases has Launched late last year, rental assistance. The CRC been lifted, Cook County CRC team members work is currently operating Sheriff Thomas J. Dart is directly with the public to virtually and can be reached reminding housing providers help individuals navigate at via phone at (773) 405- and tenants grappling with social services, housing, 5116, or via email at ccso. eviction that they can access employment, medical and resourcecenter@ccsheriff. the Office’s Community mental health services, org or online at www. The availability of the efforts the Office is taking that began in March Resource Center for among others. The CRC cookcountysheriff.org/crc/ Community Resource to address the resumption of 2020. With significant assistance in accessing also can help individuals home Center is just one of several evictions after a moratorium Pase a la página 4 V. 81 No. 30 P.O. BOX 50599, CICERO, IL 60804 (708) 656-6400 FAX (708) 656-2433 ESTABLISHED 1940 Thursday, August 5, 2021 Noticiero Bilingüe WWW.LAWNDALENEWS.COM news North Lawndale Welcomes Youth-Led Douglass 18 By: Ashmar Mandou It’s time to tee-off! Residents in the North Lawndale community will welcome a new youth- designed, conservation- themed miniature golf course, Douglass 18, which opens to the public on Saturday, Aug. 7th. “We are excited about the opening of the Douglass 18 golf course,” said Sheila McNary, executive member of the North Lawndale Community Coordinating Council. -

2021-2025 Capital Improvement Plan.Pdf

2021CAPITAL IMPROVEMENT PLAN Capital Improvement Plan The Capital Improvement Plan (CIP) is the District’s comprehensive multi-year plan for land acquisition and park development, new building construction, building and facility management, park site improvements, and investment in technology and major equipment. The CIP outlines the projects that are expected to take place over the next five years. Capital projects typically have costs of over $10,000, have a life expectancy of at least 5 years, and may result in the creation of a capital asset. Capital Improvements The Capital Improvement Plan is a dynamic and evolving guide for spending over a five-year period. The CIP outlines spending priorities and expected schedules and is formed to allow for adjustment over the five-year period. The CIP allows for flexibility, for instance, if actual project expenses are above (or below) a projected budget in the CIP, as new outside funding is granted for specific projects or programs, or as new district priorities develop. The CIP is published annually to reflect the growth of the Plan each year. CAPITAL IMPROVEMENT PLAN IMPROVEMENT CAPITAL Capital Improvement Plan Process Throughout the year, the Park District compiles requests for capital improvements from numerous sources. External requests generally come from annual budget hearings, letters, emails, website inquiries, legislators, advisory councils, board meetings, community groups, city agencies, new laws, unfunded mandates, and other similar sources. Internal requests are typically derived from park inspections, facility assessments, the work order system, framework plans, policy initiatives, strategic objectives, and needs identified by recreation, culture, service, planning, construction, and maintenance departments. -

Planning to Begin for Frederick Douglass Park on the Tuckahoe Talbot County Council Names Committee to Oversee Project

FOR IMMEDIATE RELEASE January 26, 2019 Contact: Cassandra M. Vanhooser Talbot County Economic Development and Tourism (410) 770-8000 [email protected] Planning to Begin for Frederick Douglass Park on the Tuckahoe Talbot County Council Names Committee to Oversee Project The Talbot County Department of Parks and Recreation has been awarded a $50,000 grant from the Maryland Heritage Areas Authority to develop both a master plan and an interpretive plan for the Frederick Douglass Park on the Tuckahoe. The official groundbreaking for the County-owned park was held on February 14, 2018, which was the 200th birthday of native son Frederick Augustus Washington Bailey, who later changed his name to Frederick Douglass. It covers 107 acres on the Tuckahoe Creek just south of the town of Queen Anne in the northeast corner of Talbot County. A 66.96-acre parcel was purchased in 2006 with $1.8 million from Maryland Department of Natural Resources Program Open Space. The Council is appreciative of the family of George C. and Naomi H. Moore for their generous donation of another 40.2 acres of wetlands adjacent to this parcel in 2011, bringing the total to 107.16 acres. The MHAA grant will allow Talbot County to engage members of the community and develop a plan for developing the infrastructure for a recreational park. In addition, it will identify places to tell the story of Frederick Douglass and to give more information about the Tuckahoe watershed and landscape. In his first book, The Narrative of the Life of Frederick Douglass, the author himself writes, “I was born in Tuckahoe, near Hillsborough, and about twelve miles from Easton, in Talbot County, Maryland.” The Frederick Douglass Park on the Tuckahoe is located just upstream from the farm where, many believe Douglass was born in 1818.