Extractive Sector Transparency Measures Act - Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alberta Custom Rates Survey : Crop and Pastureland Lease and Rental 2016

Alberta Custom Rates Survey Crop and Pastureland Lease and Rental 2016 Economics and Competitiveness Branch INTRODUCTION This Custom Rate Survey was conducted by Alberta Agriculture and Forestry, Economics and Competitiveness Branch, Statistics and Data Development Section. The data presented in this report was obtained by contacting producers and custom operators and thus represent actual charges. Please note that some instances may be “good neighbor rates” as opposed to commercial rates. The reader should be aware that varying lease and rental arrangements in different areas of the province could significantly affect the rates charged from year to year. The intent of the survey is to provide producers with additional information to help with their farm management decisions. The quality of data is dependent on the cooperation received by producers as well as commercial custom operators. We would like to thank all the survey participants who willingly provided the information for this report. If you are aware of anyone who is a custom operator that has not been contacted, but wish to participate in the survey, please do not hesitate to refer them to me. The assistance of Reynold Jaipaul, Roy Larsen, Guangzhi Liu, Melodie Mynzak, Marian Elson and Pamela Triska of Alberta Agriculture and Forestry is greatly appreciated. For further information, please contact: Ashan Shooshtarian Alberta Agriculture and Forestry Economics and Competitiveness Branch Statistics and Data Development Section 302, 7000 ‐113 Street Edmonton, Alberta T6H 5T6 Phone: 780‐422‐2887 Fax: 780‐427‐5220 Email: [email protected] To view the custom rates reports on Ropin the Web, please go to: http://www.agric.gov.ab.ca/app21/infopage?cat1=Statistics&cat2=Farm%20Financial Note to Users: The contents of this document may not be used or reproduced without properly accrediting Alberta Agriculture and Forestry, Economics and Competitiveness Branch, Statistics and Data Development Section. -

Brazeau County

BRAZEAU COUNTY COUNCIL MEETING April 17, 2018 VISION: Brazeau County fosters RURAL VALUES, INNOVATION, CREATIVITY, LEADERSHIP and is a place where a DIVERSE ECONOMY offers QUALITY OF LIFE for our citizens. MISSION: A spirit of community created through INNOVATION and OPPORTUNITIES GOALS 1) Brazeau County collaboration with Canadians has created economic opportunity and prosperity for our community. That we intentionally, proactively network with Canadians to bring ideas and initiative back to our citizens. 2) Brazeau County has promoted and invested in innovation offering incentives diversifying our local economy, rural values and through opportunities reducing our environmental impact. Invest in green energy programs, water and waste water upgrades, encourage, support, innovation and economic growth through complied LUB, promoting sustaining small farms, hamlet investment/redevelopment. 3) Brazeau County is strategically assigning financial and physical resources to meet ongoing service delivery to ensure the success of our greater community. Rigorous budget and restrictive surplus process, petition for government funding, balance budget with department goals and objectives. 4) Brazeau County has a land use bylaw and framework that consistently guides development and promotes growth. Promotes development of business that is consistent for all “open for business.” Attract and retain businesses because we have flexibility within our planning documents. 5) Come to Brazeau County to work, rest and play. This encompasses all families. We have the diversity to attract people for the work opportunities. We have recreation which promotes rest and play possibilities that are endless. 6) Brazeau County is responsive to its citizenship needs and our citizens are engaged in initiatives. Engage in various levels - website, Facebook, newspapers, open houses. -

County of Stettler No. 06

AAAF SPRING FORUM 2012 AGRICULTURAL FIELDMAN’S DIRECTORY –CURRENT TO April 25, 2012 SOUTH REGION M.D. of Acadia Rick Niwa (AF) Office: (403) 972-3808 Box 30, Acadia Valley Shop: (403) 972-3755 T0J 0A0 Fax: (403) 972-3833 Cell: (403) 664-7114 email [email protected] Cardston County Rod Foggin (AF) Ph: (403) 653-4977 Box 580, Cardston Stephen Bevans (AAF) Fax: (403) 653-1126 T0K 0K0 Cell: (403) 382-8236 (Rod) (403) 634-9474 email: [email protected] [email protected] Municipality of Crowsnest Pass Kim Lutz (AF) Ph: (403)-563-8658 Mail: email: [email protected] Box 600 Crowsnest Pass, AB T0K 0E0 Office: Room 1, MDM Community Center 2802 - 222 Street Bellevue, AB Cypress County Jason Storch (AF) Director Ph: (403) 526-2888 816 2nd Ave, Dunmore Christina Barrieau (AAF) Fax: (403) 526-8958 T1B 0K3 email : [email protected] [email protected] M.D. of Foothills Ron Stead (AF) Ph: (403) 603-5410 (Ron) Box 5605, High River Bree Webb (AAF) Shop: (403) 652-2423 (Bree) T1V 1M7 ext 5446 Fax : (403) 603-5414 email : [email protected] [email protected] County of Forty Mile Dave Matz (AF) Phone (403) 867-3530 Box 160, Foremost Vacant (AAF) fax (403) 867-2242 T0K 0X0 Kevin Jesske (Fieldman’s Asst.) cellular (403) 647-8080 (Dave) email [email protected] [email protected] Lethbridge County Don Bodnar (AF) Ph: (403) 328-5525 905-4th Ave. South Gary Secrist (AAF) shop: (403) 732-5333 Lethbridge T1J 4E4 Terry Mrozowich Fax: (403) 732-4328 Cell : (403) 634-0713 (Don) (403) 634-0680 (Gary) email : [email protected] [email protected] County of Newell Todd Green (AF) Office: (403) 362-2772 Box 130, Brooks Holly White (AAF/Rural Cons. -

2020 08 19 RFD Re PREDA Funding

TOWN OF PEACE RIVER Request for Decision To: Mayor & Council Date: August 19, 2020 Presenter: Christopher Parker, CAO Prepared By: R. McCuaig Topic: Proposed PREDA Membership Fee Change File No.: 64/111 Attachments: Rate Comparisons Issue Peace Regional Economic Development Alliance (PREDA) has passed a motion to make changes to their fee structure. The Town of Peace River has been invited to present a Special Resolution at the September 18, 2020 Annual General Meeting to propose an alternate fee structure. Background On July 27, 2020, Administration presented Council with PREDA’s proposed resolution and provided some suggested alternate models. Council’s decision was that PREDA consider additional funding options – instead of a singular per capita option – to be presented to the PREDA members to vote on. PREDA has since adopted a funding model of $.75 per capita. PREDA has invited the Town to propose alternate funding models via Special Resolution. Any proposed funding model must: 1. Be revenue neutral in that it must provide the budgeted funding level of the per capita model. This funding amount is currently $56,767.50. 2. Accommodate an agreed cap on contributions by the County of Grande Prairie. This cap is set at $17,000. Administration has prepared two alternate funding models which meet these requirements. Current Model The existing funding rate was based on anticipated funding from other levels of government. This funding has been reduced. The rank rating reflects the proportion of cost burden borne by that municipality. Current -

Lot 12 Block 1, Township Road 740, Rural Big Lakes County MLS® #A1089580

$209,895 - Lot 12 Block 1, Township Road 740, Rural Big Lakes County MLS® #A1089580 $209,895 0 Bedroom, 0.00 Bathroom, Land on 3.00 Acres NONE, Rural Big Lakes County, Alberta Spruce Point Estates Subdivision Lots Now Selling! Lots ranging from 3 to 10 acres with services available including natural gas, power and municipal water. Make your country living dreams come true or enjoy the recreation space. Just minutes from Spruce Point Park Marina and Campground and very close to Kinuso Alberta, these lots will appeal to anyone who wants to enjoy life near the lake and the peace and quiet of the country. All that Northern Alberta has to offer could be at your doorstep with access to year-round fishing, quadding, boating, hiking and snowmobiling. Spruce Point Estates Subdivision is just 3 hours north of Edmonton and 2 hours to Grande Prairie. Essential Information MLS® # A1089580 Price $209,895 Bathrooms 0.00 Acres 3.00 Type Land Sub-Type Residential Land Status Active Community Information Address Lot 12 Block 1, Township Road 740 Subdivision NONE City Rural Big Lakes County County Big Lakes County Province Alberta Postal Code T0G 2K0 Additional Information Date Listed April 1st, 2021 Days on Market 176 Zoning CR Listing Details Listing Office RE/MAX SLAVE LAKE REALTY Data is supplied by Pillar 9â„¢ MLS® System. Pillar 9â„¢ is the owner of the copyright in its MLS® System. Data is deemed reliable but is not guaranteed accurate by Pillar 9â„¢. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. -

Title Page.Xps

Appendix 9 "Mountain View- a land which has A Brief History of yielded all the riches the West so laden with golden visions ever Mountain View County promised." - Bodil J. Jensen During the first decade of the 21st Century, Mountain View County has become a prospering community in the heart of what has become known as Canada's economic "Western Tiger." It's remarkable that just over a century ago, the same slice of land was untamed wilderness, void of any semblance of permanent settlement. The first government surveys of the area between Calgary and fourth (Carstairs), fifth (Didsbury) and sixth (Olds) sidings. Edmonton weren't made until 1883, around the time when the Canadian Pacific Railway arrived from the east in what was Settlement in the early days was typified by ethnic and usually then the small settlement of Calgary. Just to the east of where religious groups living in close-knit communities or colonies. the busy Queen Elizabeth II highway runs today, people and Notable among them were a group of Mennonite families who goods traveled between homesteaded in the Dids- Calgary and Fort Edmonton bury area from Europe via by wagon along the original “The agenda of the municipal councils was largely Ontario around the turn of Calgary and Edmonton repetitious, and routine; deciding on the areas for road the 19th century. A large (C&E) Trail. In 1890, the C & improvement, petitioning the provincial government for number of German settlers E (Calgary and Edmonton) bridges; setting and collecting taxes; distributing the from the American Midwest Railway was chartered, and school tax when this function was taken form the local also settled around Olds; and construction began, with the school boards; enforcing the herd law and employing a a group of Norwegian pio- line reaching Mountain View pound keeper; regulating the building code; handling neers blazed a trail westward by the end of the year. -

Service List As at June 7, 2021

POINT LOMA SERVICE LIST (Updated May 7, 2021) POINT LOMA RESOURCES LTD 4000, 421-7th Ave. S.W. Calgary, Alberta T2P 4K9 Terry Meek - [email protected] MILES DAVISON LLP 900, 517 -10 Avenue S.W. Calgary, Alberta T2R OAS Attention: Terry Czechowskyj - [email protected] Counsel to Orphan Well Association BENNETT JONES LLP 4500, 855 – 2nd Street S.W. Calgary, Alberta T2P 4K7 Attention: Ken Lenz, Q.C. – [email protected] Attention: Keely Cameron – [email protected] Counsel for BDO Canada LLP, Receiver and Manager BDO Canada LLP Suite 620, 903 8th Ave SW Calgary AB T2P 0P7 Attention: Marc Kelly - [email protected] STIKEMAN ELLIOTT LLP 4300, 888 - 3rd St SW Calgary AB T2P 5C5 Attention: Jakub Maslowski - [email protected] Attention: Amanda Kousinioris - [email protected] Counsel for Enerflex Ltd. Terence Meek 1235 Varsity Estates Rd. S.W. Calgary, Alberta T3B 2W3 Email: [email protected] IRON HORSE COILED TUBING INC. 1901 Dirkson Drive N.E. Redcliff, Alberta T0J 2P0 Email: [email protected] 2 HARVEST OPERATIONS CORP. 1500, 700 – 2nd Street S.W. Calgary, Alberta T2P 2W1 Attention: Mark Tysowski - [email protected] CALNASH TRUCKING LTD. P.O. Box 726 Lac La Biche, Alberta T0A 2C0 Email: [email protected] SUMMIT SAFETY INC. c/o Charlie Wilson RR1 site 12 comp 53 Millet , Alberta T0C 1Z0 Email: [email protected] FASKEN MARTINEAU DUMOULIN LLP Suite 3400, 350 7th Ave SW Calgary AB T2P 3N9 Attention: Scott Sangster - [email protected] Counsel to Secured Creditors Richard Yurko and Kasten Resources Inc. SASKATCHEWAN REGULATOR Senior Crown Counsel Legal Services Division Ministry of Justice Attention: Leanne Lang – [email protected] SOURCE ROCK ROYALTIES LTD. -

Board Meeting Highlights February 27, 2021 (Via Zoom) This Summary Is Designed to Keep You Informed About Peace Library System (PLS) Activities and Board Decisions

Board Meeting Highlights February 27, 2021 (via Zoom) This summary is designed to keep you informed about Peace Library System (PLS) activities and Board decisions. It is distributed to member councils, library boards and the PLS Board of Directors after each Board meeting. The Board held a full Board meeting on 27 February over Zoom and Present: those in the headquarters building were able to see the new AV Carolyn Kolebaba (Chair) Northern Sunrise County equipment in action. Gena Jones Town of Beaverlodge Cindy Hockley Village of Berwyn The CEO provided an update on the pandemic response in PLS and the Lorrie Shelp Big Lakes County work experience sessions for two LIT practicum students coming up Denise Joudrey Birch Hills County soon. A discussion was had around the schools packages and some Peter Frixel Clear Hills County cancellations thereof. Updates were also provided on TAL, ALTA and Ray Skrepnek MD of Fairview TRAC (The Regional Automation Consortium). The 2020 Annual Lindsay Brown Town of Falher Report to Municipal Affairs was provided for discussion as well as the Meesha Bainton Town of Fox Creek annual reports for the service points for which PLS is the Board. Linda Waddy County of Grande Prairie Additionally, discussion was had around how PLS can support Paddle Chris Thiessen City of Grande Prairie Prairie Metis Settlement. Roxie Chapman MD of Greenview Dennis Sukeroff Town of Grimshaw Revisions were approved to the following policies: Finance Policy for Brent Anderson Town of High Level Library Service Points, Hours of Service Policy for Library Service Brian Gilroy Town of High Prairie Points, Library Use Policy for Library Service Points, Personnel Policy Camille Zavisha Village of Hines Creek for Library Service Points, Records Management Policy for Library Sandra Miller Village of Hythe Service Points, Selection Purchase Deselection Policy for Library Brad Pearson MD of Lesser Slave River Service Points, Legislative Bylaws of the PLS Board for its Library Sunni-Jeanne Walker Town of Manning Service Points. -

Current Members

Current Members Athabasca County Big Lakes County Birch Hills County City of Cold Lake County of Grande Prairie No. 1 Gift Lake Metis Settlement Lac La Biche County M.D. of Greenview M.D. of Lesser Slave River M.D. of Opportunity M.D. of Peace M.D. of Smoky River Mackenzie County Northern Sunrise County Saddle Hills County Town of Beaverlodge Town of Bonnyville Town of Fairview Town of Grande Cache Town of Grimshaw Town of High Level Town of Peace River Town of Rainbow Lake For Information Contact the Chair: Town of Sexsmith Bob Marshall Town of Slave Lake Town of Valleyview County of Grande Prairie Town of Wembley [email protected] Village of Boyle Village of Hythe Village of Rycroft Northern Alberta Development Council Advanced Technology Applications (ATAP) Alberta Environment and Parks 206 Provincial Building Alberta Water & Wastewater Operations 9621 – 96 Avenue Association (AWWOA) Bag 900-14 Athabasca Watershed Council Aquatera Peace River AB T8S 1T4 Aspen Regional Water Services 780.624.6274 GWST Water and Environmental Inc. [email protected] Lakeland Industry and Community Association (LICA) nadc.ca Lesser Slave Lake Watershed Council Mighty Peace Watershed Alliance This brochure was last updated in Northern Alberta Development Council Northern Lakes College June 2019 Portage College Rural Municipalities of Alberta (RMA) Vision Guiding Principles: The group seeks to ensure that sustainable water systems are available to every northern 1. Share information on water and wastewater community. regulations and responsibilities -

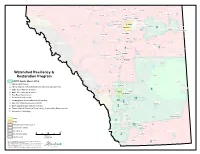

Watershed Resiliency and Restoration Program Maps

VU32 VU33 VU44 VU36 V28A 947 U Muriel Lake UV 63 Westlock County VU M.D. of Bonnyville No. 87 18 U18 Westlock VU Smoky Lake County 28 M.D. of Greenview No. 16 VU40 V VU Woodlands County Whitecourt County of Barrhead No. 11 Thorhild County Smoky Lake Barrhead 32 St. Paul VU County of St. Paul No. 19 Frog Lake VU18 VU2 Redwater Elk Point Mayerthorpe Legal Grande Cache VU36 U38 VU43 V Bon Accord 28A Lac Ste. Anne County Sturgeon County UV 28 Gibbons Bruderheim VU22 Morinville VU Lamont County Edson Riv Eds er on R Lamont iver County of Two Hills No. 21 37 U15 I.D. No. 25 Willmore Wilderness Lac Ste. Anne VU V VU15 VU45 r Onoway e iv 28A S R UV 45 U m V n o o Chip Lake e k g Elk Island National Park of Canada y r R tu i S v e Mundare r r e Edson 22 St. Albert 41 v VU i U31 Spruce Grove VU R V Elk Island National Park of Canada 16A d Wabamun Lake 16A 16A 16A UV o VV 216 e UU UV VU L 17 c Parkland County Stony Plain Vegreville VU M VU14 Yellowhead County Edmonton Beaverhill Lake Strathcona County County of Vermilion River VU60 9 16 Vermilion VU Hinton County of Minburn No. 27 VU47 Tofield E r i Devon Beaumont Lloydminster t h 19 21 VU R VU i r v 16 e e U V r v i R y Calmar k o Leduc Beaver County m S Leduc County Drayton Valley VU40 VU39 R o c k y 17 Brazeau County U R V i Viking v e 2A r VU 40 VU Millet VU26 Pigeon Lake Camrose 13A 13 UV M U13 VU i V e 13A tt V e Elk River U R County of Wetaskiwin No. -

Big Lakes County Response to COVID-19

BIG LAKES COUNTY 5305-56 Street Box 239, High Prairie, AB T0G 1E0 T / (780) 523-5955 F/ (780) 523-4227 For Immediate Release Big Lakes County Response To COVID-19 March 18, 2020: Since January, Big Lakes County has been carefully monitoring and developing a proactive strategy to address any risks associated with COVID-19 for our residents, visitors, and employees. Moving forward, we will continue to work closely with Alberta Health Services and the Alberta Emergency Management Agency in monitoring this rapidly changing situation. On March 17, 2020, Premier Jason Kenny declared a Public Health Emergency in an effort to combat the growing spread of COVID-19. We would like to assure you that the interest of community health and safety is our priority. Effective immediately, the County is taking the following steps to help reduce the risk to our residents, visitors, and employees. Big Lakes County will continue to fully operate core services, including Fire Services, Utilities, Solid Waste, Airports, and Road Safety throughout the duration of this pandemic. Changes to County Operations • Big Lakes County Administration Buildings & FCSS Offices – CLOSED Effective immediately, the Big Lakes County Administration Buildings and Family and Community Support Services (FCSS) Offices are closed to the public until further notice. Information and services will be available by phone (780-523-5955) and email ([email protected]) only. The County staff directory can be found here: https://www.biglakescounty.ca/contact/county-directory • Utility Penalties – WAIVED Big Lakes County is waiving all penalties on utility bills for the months of April and May. -

Communities Within Specialized and Rural Municipalities (May 2019)

Communities Within Specialized and Rural Municipalities Updated May 24, 2019 Municipal Services Branch 17th Floor Commerce Place 10155 - 102 Street Edmonton, Alberta T5J 4L4 Phone: 780-427-2225 Fax: 780-420-1016 E-mail: [email protected] COMMUNITIES WITHIN SPECIALIZED AND RURAL MUNICIPAL BOUNDARIES COMMUNITY STATUS MUNICIPALITY Abee Hamlet Thorhild County Acadia Valley Hamlet Municipal District of Acadia No. 34 ACME Village Kneehill County Aetna Hamlet Cardston County ALBERTA BEACH Village Lac Ste. Anne County Alcomdale Hamlet Sturgeon County Alder Flats Hamlet County of Wetaskiwin No. 10 Aldersyde Hamlet Foothills County Alhambra Hamlet Clearwater County ALIX Village Lacombe County ALLIANCE Village Flagstaff County Altario Hamlet Special Areas Board AMISK Village Municipal District of Provost No. 52 ANDREW Village Lamont County Antler Lake Hamlet Strathcona County Anzac Hamlet Regional Municipality of Wood Buffalo Ardley Hamlet Red Deer County Ardmore Hamlet Municipal District of Bonnyville No. 87 Ardrossan Hamlet Strathcona County ARGENTIA BEACH Summer Village County of Wetaskiwin No. 10 Armena Hamlet Camrose County ARROWWOOD Village Vulcan County Ashmont Hamlet County of St. Paul No. 19 ATHABASCA Town Athabasca County Atmore Hamlet Athabasca County Balzac Hamlet Rocky View County BANFF Town Improvement District No. 09 (Banff) BARNWELL Village Municipal District of Taber BARONS Village Lethbridge County BARRHEAD Town County of Barrhead No. 11 BASHAW Town Camrose County BASSANO Town County of Newell BAWLF Village Camrose County Beauvallon Hamlet County of Two Hills No. 21 Beaver Crossing Hamlet Municipal District of Bonnyville No. 87 Beaver Lake Hamlet Lac La Biche County Beaver Mines Hamlet Municipal District of Pincher Creek No. 9 Beaverdam Hamlet Municipal District of Bonnyville No.