Merlin-Annual-Report-And-Accounts-2012.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chessington World of Adventures Guide

Chessington World of Adventures Guide Overview One of three theme parks located in Greater London that are operated by Merlin Entertainments Group, Chessington World of Adventures combines a host of rides and shows with a world-class zoo. Whereas nearby LEGOLAND Windsor is aimed at families with kids aged 2-12, and Thorpe Park caters for teens and young adults, Chessington offers something for just about every age group. In addition to the theme park and zoo, the site is also home to the Holiday Inn Chessington, a safari-themed hotel that overlooks the Wanyama Village & Reserve area. History The origins of Chessington World of Adventures can be traced back to 1931, when a new zoo was established in the grounds of a fourteenth century country mansion by entrepreneur Reginald Goddard. The zoo was eventually acquired by the Pearsons Group in 1978, which subsequently merged with the Madame Tussauds chain to form The Tussauds Group. The newly-formed company embarked on an ambitious £12 million project to build a theme park on the site, and Chessington World of Adventures opened to the public in 1987. Attractions Africa Penguins of Madagascar Live: Operation Cheezy Dibbles User rating: (3 votes) Type: Live show Opening date: Mar 23, 2012 A new Madagascar-themed show set to open in 2015 to celebrate the "Year of the Penguins" Penguins of Madagascar Mission: Treetop Hoppers User rating: (2 votes) Type: Drop tower Height: 20 feet Manufacturer: Zamperla Model: Jumpin' Star Minimum rider height: 35 inches Opening date: 2001 Penguins of Madagascar Mission: Treetop Hoppers is a child-friendly take on the classic drop tower attraction. -

Introduction to Merlin Entertainments Plc March 2018

INTRODUCTION TO MERLIN ENTERTAINMENTS PLC MARCH 2018 MERLIN ENTERTAINMENTS PLC : Introduction to Merlin Entertainments CONTENTS 1. Summary Investment Highlights 2. Introduction to Merlin 3. Six Strategic Growth Drivers 4. Brands and Assets 5. Financial Dynamics and Performance 6. Board and Management MERLIN ENTERTAINMENTS PLC : Introduction to Merlin Entertainments 2 SUMMARY INVESTMENT HIGHLIGHTS A global leader in Structurally Capital discipline location based attractive and strong cash entertainment markets flow 66 million visitors, with Growth in leisure spend, Group ROCE of 9.1% over 120 attractions in international travel and £315 million operating 25 countries1 short breaks free cash flow2 Exclusive, global license to own and Global success operate Leader in themed with Midway roll LEGOLAND parks accommodation out Opportunity for 20 c.3,500 rooms, with 110 attractions1 with parks longer term strong pipeline significant roll out potential 1 As at 30 December, 2017 2 EBITDA less Existing Estate Capex MERLIN ENTERTAINMENTS PLC : Introduction to Merlin Entertainments 3 Summary Investment Highlights PROGRESS SINCE 2013 Visitors EBITDA EPS 66.0m £474m 20.5p (+6.2m) (+22%)1 (+21%)1 >1,200 24 Two New accommodation New Midway attractions New LEGOLAND rooms Parks 1 Reported currency MERLIN ENTERTAINMENTS PLC : Introduction to Merlin Entertainments 4 Summary Investment Highlights 2. INTRODUCTION TO MERLIN 5 Introduction to Merlin WORLD OF ATTRACTIONS Merlin is a global leader in location based entertainment, with 66 million visitors, in over -

Alzheimer's Society (AS)

Chartered Postgraduate Diploma in Marketing (Level 7) 561 – Analysis and Decision Case Study December 2012 and March 2013 Global Theme Park Industry © The Chartered Institute of Marketing 2012 Analysis and Decision – Case Study Important guidance notes for candidates regarding the pre-prepared analysis The examination is designed to assess knowledge and understanding of the Analysis and Decision syllabus, in the context of the relevant case study. The examiners will be marking candidates’ scripts on the basis of the tasks set. Candidates are advised to pay particular attention to the mark allocation on the examination paper and plan their time accordingly. The role is outlined in the Candidate’s Brief and candidates will be required to recommend clear courses of action. Candidates should acquaint themselves thoroughly with the case study and be prepared to follow closely the instructions given to them on the examination day. Candidates are advised not to waste valuable time collecting unnecessary data. The cases are based upon real-life situations and all the information about the chosen organisation is contained within the case study. No useful purpose will therefore be served by contacting companies in the industry and candidates are strictly instructed not to do so as it may cause unnecessary confusion. As in real life, anomalies may be found in the information provided within this case study. Please state any assumptions, where necessary, when answering tasks. The Chartered Institute of Marketing is not in a position to answer queries on case data. Candidates are tested on their overall understanding of the case and its key issues, not on minor details. -

ANNUAL REPORT and ACCOUNTS 2016 Merlin Entertainments Plc Annual Report and Accounts 2016 HIGHLIGHTS

ANNUAL REPORT AND ACCOUNTS 2016 Merlin Entertainments plc Annual Report and Accounts 2016 HIGHLIGHTS Financial KPIs Visitors Revenue 52 weeks: 63.8m +1.3% (53 weeks: 65.1m) 52 weeks: £1,428m +11.7% (53 weeks: £1,457m) Like for like growth +1.4% 2016 63.8 2016 1,428 2015 62.9 2015 1,278 2014 62.8 2014 1,249 Underlying EBITDA Underlying operating profit R 52 weeks: £433m +7.7% (53 weeks: £451m) 52 weeks: £302m +3.6% (53 weeks: £320m) 2016 433 2016 302 2015 402 2015 291 2014 411 2014 311 Profit before tax Basic EPS 52 weeks: £259m +9.2% (53 weeks: £277m) 52 weeks: 19.5p +15.7% (53 weeks: 20.8p) 2016 259 2016 19.5 2015 237 2015 16.8 2014 226 2014 16.0 Return on capital employed R Adjusted EPS R 52 weeks: 9.6% (53 weeks: 10.2%) 52 weeks: 19.5p +9.3% (53 weeks: 20.8p) 2016 9.6% 2016 19.5 2015 9.7% 2015 17.8 2014 10.6% 2014 17.7 Non-financial KPIs 2015 2016 Customer satisfaction R - Based on customer satisfaction surveys. Our target is a score over 90%. 94% 94% Staff engagement - Based on annual employee surveys (see page 44). Our target is a score over 80%. 89% 89% Health and safety R - The Medical Treatment Case (MTC) rate captures the rate of guest injuries requiring n/a 0.06 external medical treatment relative to 10,000 guest visitations. The MTC rate is a new measure in 2016. How we report our results This year we are reporting on the 53 weeks to 31 December 2016. -

Attractions Management

Attractionswww.attractionsmanagement.com management MFC(, H))'(' KFJLGGCP=@IJK+; KFE<NQ<8C8E; Attractionswww.attractionsmanagement.com management MFC(, H))'(' K?<N@Q8I;@E>NFIC;F= ?8IIPGFKK<I K?<D8>@:ËJ89FLKKF9<>@E @E;<M<CFGD<EK K_\dfjk\oZ`k`e^gifa\Zkj le[\inXpXifle[k_\^cfY\ LEISU OF RE S M K?<D<G8IBJ R E A D E J:@<E:<:<EKI<J I Y A 0 QFFJ8HL8I@LDJ 3 3 0 DLJ<LDJ?<I@K8>< Y A 30 I E D years A K<:?EFCF>P E R S M O E F R ;<JK@E8K@FEJ L U S E I <OGFJ N8K<IG8IBJ M@J@KFI8KKI8:K@FEJ D<IC@E<EK<IK8@ED<EKJ >8CC<I@<J :?@<=<O<:LK@M<E@:BM8IE<P8E;?@JKFGK<8DK8CB89FLKK?<:FDG8EPËJ=LKLI< <EK<IK8@ED<EK François Fassier I Parc Asterix EDUCATION PASSION PEOPLE Stay connected. Stay informed. Stay ahead. egdYjXZYWn The conference and tradeshow for the attractions and leisure industry in Europe. Update your profile on www.IAAPA.org/EAS and we will keep you informed. ATTRACTIONS MANAGEMENT EDITOR’S LETTER OTHER DIMENSIONS ON THE COVER: The Wizarding World he glorious world of 3D has hit the mainstream, with fi lms like Alice in of Harry Potter, p36 Wonderland, Clash of the Titans and Avatar drawing record audiences. Suddenly, from being a treat confi ned to specialist attractions like IMAX, people READER SERVICES T can enjoy 3D in their local cinema. Apple is allegedly even developing the unoffi cially SUBSCRIPTIONS named ‘ispecs’ – glasses which will enable us to enjoy 3D fi lms while on the move. -

Introduction to Merlin Entertainments

INTRODUCTION TO MERLIN ENTERTAINMENTS MARCH 2015 1 WHAT IS MERLIN? Global leader in location based entertainment with world class brands Midway Attractions No. 1 in Europe and No. 2 only to Disney worldwide1 Two products Midway: indoor, up to two hour dwell time, located in city centres or resorts LEGOLAND Parks Theme parks: outdoor, 1 – 2 day destination venues increasingly with on-site accommodation Three Operating Groups2 Midway Attractions (92 attractions, 42% of 2014 revenue) LEGOLAND Parks (6 parks, 31% of revenue) Resort Theme Parks Resort Theme Parks (6 parks3, 27% of revenue) Supported by Merlin Magic Making, our unique creative and production resource 1 2 | Based on number of visitors as reported by AECOM 2013 Theme Index 2 Number of attractions as at 27 December, 2014 3 Excluding Gardaland Water park in Milan 1 UNIQUE PORTFOLIO OF FAMILY ENTERTAINMENT BRANDS AND ICONIC ASSETS High quality, chainable international brands with global appeal Brands positioned across all key target demographics Portfolio provides substantial benefits “Amazing Discovery” “Famous Fun” “Playful Learning” Midway Natural hedge across geographic markets and target demographics Attractions Opportunities to create “clusters” Ability to leverage scale and synergies Significant roll out opportunity - “100+ potential sites identified” “Scary Fun” “Inspiring Perspective” Potential to expand portfolio with further brands “Playful Learning” Leading global brands (LEGO, LEGOLAND) Attractive target demographic (families with children 2 – 12) LEGOLAND High levels -

Merlin's Magic

Merlin's Magic Merlin Entertainments Group is bringing Madame Tussauds, LEGOLAND, aquariums and more to retail centers that have a leisure focus. Jaime Lackey erlin Entertainments Group has been expanding rapidly M in Europe during the last 10 years, and the company became the world's second largest operator of visitor attractions (after Disney) when it acquired The Tussauds Group from Dubai Inter national Capital LLC in 2007. Now the company is poised to expand its presence in the U.S. - and it is looking at locations in major metropolitan markets as well as tourism-driven secondary markets. The company, which is based in the United Kingdom, has 52 attractions in 12 countries. Approximately 32· million people visit the company's attractions each year, with roughly half of the visi tors attending the nine outdoor theme parks and half of those going to the 43 indoor attractions. According to Johannes Mock, director r\ rendering of The Pepsi Globe at Mcadmdands Xanadu, \\'hich \\'ill bc of site selection worldwide for Merlin 287 feet tall and \\ill offer views of Manhattan and the Hudson Ri\'cr. Entertainments Group, the company is Thc Pepsi Globe \-\'ill be the tallest obsenation wheel in the u.S. interested in locating its concepts in top tier retail centers as well as introducing Mock. He notes that the brands attract LAJ'JD Discovery Centre is a Miniland its indoor brand components to its larger high quality customers who are enjoying that depicts the skyline of the closest outdoor theme parks. leisure time with their families. major city - built in LEGO bricks, of "\Ve have an aggressive growth plan," "Merlin Entertainments Group has a course. -

2019 Interim Results Performance to Date Broadly in Line with Board Expectations

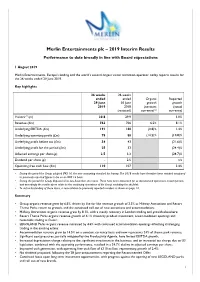

Merlin Entertainments plc – 2019 Interim Results Performance to date broadly in line with Board expectations 1 August 2019 Merlin Entertainments, Europe’s leading and the world’s second-largest visitor attraction operator, today reports results for the 26 weeks ended 29 June 2019. Key highlights 26 weeks 26 weeks ended ended Organic Reported 29 June 30 June growth growth 2019 2018 (constant (actual (restated) currency)(2) currency) Visitors(1) (m) 30.8 29.9 3.0% Revenue (£m) 763 706 6.5% 8.1% Underlying EBITDA (£m) 191 188 (0.8)% 1.4% Underlying operating profit (£m) 79 88 (14.2)% (10.8)% Underlying profit before tax (£m) 34 43 (21.6)% Underlying profit for the period (£m) 25 33 (24.4)% Adjusted earnings per share (p) 2.5 3.3 (24.7)% Dividend per share (p) - 2.5 n/a Operating free cash flow (£m) 110 107 2.4% • During the period the Group adopted IFRS 16, the new accounting standard for leasing. The 2018 results have therefore been restated compared to previously reported figures to be on an IFRS 16 basis. • During the period the Group disposed of its two Australian ski resorts. These have been accounted for as discontinued operations in both periods and accordingly the results above relate to the continuing operations of the Group excluding the ski fields. • To aid understanding of these items, a reconciliation to previously reported numbers is shown on page 12. Summary • Group organic revenue grew by 6.5%, driven by like for like revenue growth of 2.3% as Midway Attractions and Resort Theme Parks return to growth, and the continued roll -

TEA/ERA Theme Park Attendance Report

TETEA/EA/ERRAA TThemeheme PPararkk AAttttendendancancee ReRepporortt © 2007 TEA and ERA TEA/ERA Theme Park Attendance Report 2006 Executive Publisher: TEA Executive Editor: Gene Jeffers Introduction Research: Economics Research Associates Editor: Judith Rubin One of the goals of TEA from the very start of the Publishers: InPark Magazine, Park World association was to be an industry leader in terms © 2007 TEA/ERA. All Rights Reserved. of information, education and standards and practices. With the introduction of this report, TEA Headquarters TEA moves ever-closer to fulfilling that goal. 175 E. Olive, Suite 100 Burbank, CA 91502, USA Tel. +01-818-843-8497 www.teaconnect.org This report is, plain and simple, the industry About TEA standard for attendance data as compiled by The TEA (formerly Themed Entertainment Association) is Economics Research Associates (ERA). ERA’s an international nonprofit organization founded in 1991 annual theme park attendance report has always to represent the creators of compelling experiences and been a must-read for the industry—a tool for places worldwide—from architects to designers, techni- journalists; a resource for industry professionals cal specialists to master planners, scenic fabricators to artists, and builders to feasibility analysts—some 6,500 and others. TEA is proud to be working with ERA creative specialists working in nearly 500 firms in 39 dif- to release and distribute this report. We look ferent countries. forward to continuing the relationship and the production cycle, so that you can look forward to About ERA Economics Research Associates is an international con- a regular stream of these useful educational sulting firm focused on economic analysis for the enter- materials. -

Merlin Entertainments

This document comprises a prospectus (the “Prospectus”) relating to Merlin Entertainments plc (the “Company”) prepared in accordance with the Prospectus Rules of the Financial Conduct Authority made under section 73A of the Financial Services and Markets Act 2000 (the “FSMA”) and has been prepared in connection with the Global Offer and Admission. This Prospectus has been approved by the Financial Conduct Authority in accordance with section 78A ofthe FSMA and has been made available to the public in the UK in accordance with paragraph 3.2 of the Prospectus Rules. The Company, its Directors (whose names appear on page 76 of this Prospectus) and Fru Hazlitt accept responsibility for the information contained in this Prospectus. To the best of the knowledge of the Company and the Directors (who have taken all reasonable care to ensure that such is the case), the information contained in this Prospectus is in accordance with the facts and contains no omission likely to affect its import. Application will be made to the Financial Conduct Authority for all of the Ordinary Shares, issued and to be issued in connection with the Global Offer, to be admitted to listing on the Official List and to the London Stock Exchange for such Ordinary Shares to be admitted to trading on the London Stock Exchange’s main market for listed securities (together “Admission”). Conditional dealings in the Ordinary Shares are expected to commence on the London Stock Exchange at 8.00 a.m. (London time) on 12 November 2013. It is expected that Admission will become effective and that unconditional dealings will commence in the Ordinary Shares on the London Stock Exchange at 8.00 a.m. -

Introduction to Merlin Entertainments

INTRODUCTION TO MERLIN ENTERTAINMENTS APRIL 2016 WHAT IS MERLIN? Global leader in location based entertainment with world class brands Midway Attractions No. 1 in Europe and No. 2 only to Disney worldwide1 Two products Midway: indoor, up to two hour dwell time, located in city centres or resorts LEGOLAND Parks Theme parks: outdoor, 1 – 3 day destination venues increasingly with on-site accommodation Three Operating Groups2 Midway Attractions (99 attractions, 44% of 2015 revenue) LEGOLAND Parks (6 parks, 34% of revenue) Resort Theme Parks Resort Theme Parks (6 parks, 22% of revenue) Supported by Merlin Magic Making, our unique creative and production resource 2 | 1 Based on number of visitors as reported by AECOM 2014 Theme Index 2 Number of attractions as at 26 December, 2015 1 UNIQUE PORTFOLIO OF FAMILY ENTERTAINMENT BRANDS AND ICONIC ASSETS High quality, chainable international brands with global appeal Brands positioned across all key target demographics Portfolio provides substantial benefits “Amazing Discoveries” “Famous Fun” “Playful Learning” Natural hedge across geographic markets and target demographics Midway Attractions Opportunities to create “clusters” and “own the visit” Ability to leverage scale and synergies Significant roll out opportunity – 40 new attractions by the end of 2020 “Scary Fun” “Revealing Perspective” “Hilarious with 100+ potential locations identified Misadventures” Potential to expand portfolio with further brands “Playful Learning” Leading global brands (LEGO, LEGOLAND) Attractive target demographic (families -

Fairground Attractions: a Genealogy of the Pleasure Ground

Philips, Deborah. "Pleasure Gardens, Great Exhibitions and Wonderlands: A genealogy of the carnival site." Fairground Attractions: A Genealogy of the Pleasure Ground. London: Bloomsbury Academic, 2012. 7–30. Bloomsbury Collections. Web. 1 Oct. 2021. <http:// dx.doi.org/10.5040/9781849666718.ch-001>. Downloaded from Bloomsbury Collections, www.bloomsburycollections.com, 1 October 2021, 12:49 UTC. Copyright © Deborah Philips 2012. You may share this work for non-commercial purposes only, provided you give attribution to the copyright holder and the publisher, and provide a link to the Creative Commons licence. 1 Pleasure Gardens, Great Exhibitions and Wonderlands A genealogy of the carnival site he theme park offers a version of the carnivalesque to the pleasure seeker, Tbut it is a tightly controlled and organised form of pleasure. The theme park is distinct in its difference from the fairground or carnival in that it is (although it may sedulously disguise the fact) a bounded and contained space. The daily processions of fl oats through the Disneyland Main Streets and their equivalents in other theme parks appear to mimic street carnivals, but Main Street is not an open or public space but a site accessed only by payment of a (substantial) entry fee. The shopping outlets and market stalls dotted throughout the theme park give the impression of individual entrepreneurs competing for custom, but this is illusory; all the trade in a theme park is owned and controlled by the theme park company, and all the most successful contemporary theme parks are now in the hands of global corporations. Like the shops and stalls of the theme park, what seems to be an array of competing brands and attractions are in fact in the hands of very few entertainment corporations.