Merlin Entertainments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chessington World of Adventures Guide

Chessington World of Adventures Guide Overview One of three theme parks located in Greater London that are operated by Merlin Entertainments Group, Chessington World of Adventures combines a host of rides and shows with a world-class zoo. Whereas nearby LEGOLAND Windsor is aimed at families with kids aged 2-12, and Thorpe Park caters for teens and young adults, Chessington offers something for just about every age group. In addition to the theme park and zoo, the site is also home to the Holiday Inn Chessington, a safari-themed hotel that overlooks the Wanyama Village & Reserve area. History The origins of Chessington World of Adventures can be traced back to 1931, when a new zoo was established in the grounds of a fourteenth century country mansion by entrepreneur Reginald Goddard. The zoo was eventually acquired by the Pearsons Group in 1978, which subsequently merged with the Madame Tussauds chain to form The Tussauds Group. The newly-formed company embarked on an ambitious £12 million project to build a theme park on the site, and Chessington World of Adventures opened to the public in 1987. Attractions Africa Penguins of Madagascar Live: Operation Cheezy Dibbles User rating: (3 votes) Type: Live show Opening date: Mar 23, 2012 A new Madagascar-themed show set to open in 2015 to celebrate the "Year of the Penguins" Penguins of Madagascar Mission: Treetop Hoppers User rating: (2 votes) Type: Drop tower Height: 20 feet Manufacturer: Zamperla Model: Jumpin' Star Minimum rider height: 35 inches Opening date: 2001 Penguins of Madagascar Mission: Treetop Hoppers is a child-friendly take on the classic drop tower attraction. -

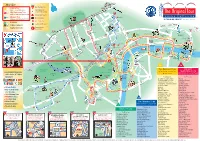

DH Map Online

Hi there. Need some help? Let’s get you on your way. A B C D E F G H I J K L M N O Clarence Street George Street Explore RELAX 1 Walk this way to 1 10 minute stroll Town Hall Station to Martin Place 8 minutes Australian National Maritime Museum D6 Cafe / restaurant City Centre This way to Kent Street Central Station Captain Cook Cruises E4 Bar Kent Street 15 minute stroll Carousel I5 Shopping Chinese Garden of Friendship K4 Wharf 8 Passenger Cockle Bay Wharf G3 Terminal only 5 minutes Druitt Place Druitt Street this way King Street Darling Harbour Marina G4 Goulburn Street Market Street Market Erskine Street 2 2 Liverpool Street Sussex Street Sussex Street Bathurst Street Sussex Street Dockside Pavilion H5 GET Harbourside Amphitheatre F6 Chinatown Harbourside Shopping Centre F6 AROUND IMAX Theatre Sydney I4 Shelley Street King Street Wharf C4 Sydney Ferries Dixon Street Thomas Street Lend Lease Darling Quarter Theatre J4 Express ferry to: Darling Circular Quay, Milsons Point and Manly Madame Tussauds Sydney E4 Park Hay Street 3 Wheat Road (rooftop) 3 Harbour cruises Market City / Paddy’s Markets O3 King Street Ultimo Road Ferry to Sydney Exhibition Centre @ Glebe Island Cuthbert Street Paddy’s Markets Harbour Street The Playground J4 # Lime Street Market City ( operates during exhibitions only) Powerhouse Museum M6 Chartered vessels Harbour Street King Street Wharf t e t Pyrmont Bridge F4 e e Water taxis r e t r S t S QANTAS Credit Union Arena M4 r 1 2 3 4 5 6 7 8 9 Qantas Bus stop e r Pier 26 i e P i Credit Union SEA LIFE Sydney Aquarium -

2020 Dates Can Change at Any Point - Please Double Check This List Before Your Travel Or Email [email protected]

2020 Dates can change at any point - please double check this list before your travel or email [email protected] VALIDITY DATES OF Restricted Entry Dates ATTRACTION NAME TICKETS Guests With Additional Needs (Dates you will not be able to visit the attraction) (Valid From & To) APRIL – Easter Bank Holiday – not restricted but we strongly advise not attending at this time as • GUESTS WITH ADDITIONAL NEEDS – please visit the Park is expected to be extremely busy which can have an effect on travel time, parking, https://www.altontowers.com/media/buhjammz/online-resort-access-guide-2019.pdf queuing for ride access passes, queuing for rides • RIDE ACCESS PASSES - Magic Wand’s tickets do not cover ride access or priority entry, please MAY – Bank Holidays – not restricted but we strongly advise not attending on these dates as the visit. For full information including a form to help you save time on the day please visit - Alton Towers Resort 21st March – 1st October (included) park is expected to be extremely busy which can have an effect on travel time, parking, queuing https://support.altontowers.com/hc/en-us/articles/360000458092-What-is-the-Ride-Access- for ride access passes, queuing for rides System-and-how-do-I-apply- AUGUST – not valid on 1st, 2nd, 7th, 8th, 9th, 14th, 15th, 16th, 21st, 22nd, 23rd, 28th, 29th, 30th and 31st. • GUESTS WITH ADDITIONAL NEEDS –please visit https://www.chessington.com/plan/disabled- MARCH – Closed 24th & 25th guide-for-chessington.aspx APRIL – 10th, 11th, 12th, 13th • RIDE ACCESS PASSES - Magic Wand’s -

Summer Holidayactivities

What’s On Offer? oliday Activities Summer H July and August 2 010 Things to do, places to go, staying on track All up-to-date listings are available on the Young Lambeth website: www.younglambeth.org Welcome to the 2010 Lambeth Holiday ’s Play Activities Programme and Summer University. Children Play offers a wide range of physical, social and Welcome by Councillor Welcome by the intellectual experiences for children. Through play, children and young people find out about themselves, Pete Robbins Youth Mayor their abilities and interests, as well as the world The Holiday Activities Programme The summer holidays provide around them. It is also great fun! has now been running for five years. a fantastic opportunity to try new It continues to go from strength things and to meet new people. In this section you will find details of Sure Start to strength, with a greater range of In Lambeth, the Holiday Activity Children’s Centres, One O’Clock Clubs, Adventure exciting opportunities for Lambeth’s Programme and Summer University Playgrounds and Play Schemes children and young people over the offer access to all sorts of arts, summer holidays. sporting and other activities that may not be available elsewhere, The Lambeth Summer University programme or at other times of the year. launched two years ago is also continuing, with an even more stimulating and diverse As Youth Mayor for Lambeth, one of my range of accredited courses and activities aims has been to find ways of enabling Clubs open Children’s Centres deliver services One O’Clock Clubs and Play Project Clubs for 48 weeks of the year. -

About the Dungeons

About The Dungeons Transport yourself back to the darkest moments in British history within the deep depths of the Dungeons. Live actors, shows, rides and interactive special effects ensure that you face your fears head on in this unique experience. Everything that you see is based on real historical events from Jack the Ripper in the London Dungeon, to the Anatomy Theatre in Edinburgh and the Labyrinth of the Lost Roman Legion in York. It’s a thrilling and fun experience that will leave you screaming for more! Are you brave enough? About Merlin Entertainments Group Merlin Entertainments Group is the leading name in location based, quality family entertainment. Now the world's number two visitor attraction operator, it aims to deliver unique, memorable and rewarding experiences to its 67 million visitors worldwide, through its iconic global and local brands, and the commitment and passion of its managers and employees. Merlin has over 130 attractions, in 25 countries, across three continents - Europe, North America and Asia. Legal requirements and attraction information Public Liability The London Dungeon is covered by Public Liability Insurance to the amount of £10 million. The Policy is with Chubb European Group Limited (Policy No UKCANC33447). Local Enforcement Agency The Dungeons’ sites are enforced by Lambeth Council. Please contact the Manager of the Dungeon if further information is needed. Rides Engineering / Adheres to HSG 65 and Fairground and Amusement Parks – Guidance on Safe Practices HSG 175. Maintenance Food Safety and Hygiene The food units operate in accordance with the Food Safety Act 1990 and are regularly inspected by the local Environmental Health Department, and undergo regular internal health and safety audits carried out by Merlin Entertainments Version 0003 Original Version: 14 May 2019 Current Version 05 July 2021 Attraction Staff / Staff All attraction staff wear uniforms and name badges. -

Madame Tussauds Sydney 'Unlocked #1' Competition

Madame Tussauds Sydney ‘Unlocked #1’ Competition TERMS AND CONDITIONS 1. Information on how to enter forms part of the terms of entry. Entry into the competition is deemed acceptance of these terms and conditions. RELATED CONTENT 2. The Madame Tussauds Sydney ‘Unlocked #1’ competition- the Winner will be selected by the Madame Tussauds Sydney Team, chance plays no part in determining the Winners. 3. Entry is open to residents of Australia. However, employees and immediate families of Merlin Entertainments, and their associated agencies and companies connected with this competition are not eligible to enter. HOW TO ENTER The competition will be held once: • Entries will be open from Tuesday April 6 2021 • Entries will close Thursday April 8 2021 9am AEST 4. To enter, participants must fill out the form on the website, entering their details and answering, “Tell us in 25 words or less where you are going to display your wax hand and why!” 5. By submitting content, a user thereby accepts the terms and conditions laid out within this document. 6. Incomprehensible entries will be deemed invalid. 7. Entrants in the competition may enter as many times as they like 8. The Prize for the winner includes: • 1x double pass to Madame Tussauds Sydney • 2x Free Wax Hands • This prize must be redeemed during the April School Holidays (April 2nd-18th) between 11am-3pm 9. The Promoter reserves the right to request winners to provide proof of identity; proof of identification, residency and entry considered suitable for verification is at the discretion of the Promoter. In the event that a winner cannot provide suitable proof, the winner will forfeit the prize in whole and no substitute will be offered. -

Madame Tussauds Sydney Entry Ticket

Madame Tussauds Sydney Entry Ticket • Flexible. Up to 2 hours • 1. Madame Tussauds Sydney Entry Ticket 1. Transport from/to hotels 2. Price includes a Digi Photo Pass giving you unlimited digital 2. Food & beverages not listed as Inclusions photos. 3. Souvenirs 4. Travel Insurance Depature point 【Covid Operating Hours】 ● Please note: the attraction will close on every Tuesday and Wednesday from 9th June 2020 onwards until further notice. ● During NSW School Holidays the attraction will be open 7 days a week. ● Pre-purchased open-dated tickets must pre-book timeslot before visiting each attraction. ● Tour does not run on Christmas Day (25 December). How to get there ● By Train A short walk from Town Hall or Wynyard stations. Head for King Street from Wynyard or Market Street from Town Hall and then walk west down the hill towards Darling Harbour. ● By Ferry Public ferry services to Darling Harbour depart from Circular Quay Wharf 5 about every half an hour. ● By Light Rail Exit the light rail from either the Convention Centre or Pyrmont Bay stations. Operating hours Daily* 10:00 - Last entry at 18:00 17:00 *Covid Operating Hours (Effective from 01/02/2021) - Thursdays 09:00 - Last entry at to Mondays 15:00 14:00 *Covid Operating Hours (Effective from 01/02/2021) - Tuesdays, Closed Wednesdays *Christmas Day (25 December) Closed Other info 【Important Post-Covid Service Information】 - Please note it is now mandatory to wear a Face Mask at all attractions. - Please be ready to make on-site payments using a 'contactless' bank card, rather than cash. -

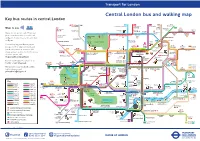

Central London Bus and Walking Map Key Bus Routes in Central London

General A3 Leaflet v2 23/07/2015 10:49 Page 1 Transport for London Central London bus and walking map Key bus routes in central London Stoke West 139 24 C2 390 43 Hampstead to Hampstead Heath to Parliament to Archway to Newington Ways to pay 23 Hill Fields Friern 73 Westbourne Barnet Newington Kentish Green Dalston Clapton Park Abbey Road Camden Lock Pond Market Town York Way Junction The Zoo Agar Grove Caledonian Buses do not accept cash. Please use Road Mildmay Hackney 38 Camden Park Central your contactless debit or credit card Ladbroke Grove ZSL Camden Town Road SainsburyÕs LordÕs Cricket London Ground Zoo Essex Road or Oyster. Contactless is the same fare Lisson Grove Albany Street for The Zoo Mornington 274 Islington Angel as Oyster. Ladbroke Grove Sherlock London Holmes RegentÕs Park Crescent Canal Museum Museum You can top up your Oyster pay as Westbourne Grove Madame St John KingÕs TussaudÕs Street Bethnal 8 to Bow you go credit or buy Travelcards and Euston Cross SadlerÕs Wells Old Street Church 205 Telecom Theatre Green bus & tram passes at around 4,000 Marylebone Tower 14 Charles Dickens Old Ford Paddington Museum shops across London. For the locations Great Warren Street 10 Barbican Shoreditch 453 74 Baker Street and and Euston Square St Pancras Portland International 59 Centre High Street of these, please visit Gloucester Place Street Edgware Road Moorgate 11 PollockÕs 188 TheobaldÕs 23 tfl.gov.uk/ticketstopfinder Toy Museum 159 Russell Road Marble Museum Goodge Street Square For live travel updates, follow us on Arch British -

Buses from London Bridge

Buses from London Bridge Buses from London Bridge 17 43 21 141 149 55 Southgate Road Haggerston towards Archway towards Friern Barnet towards towards towards Edmonton Green towards Halliwick Park Newington Palmers Green Bus Station Walthamstow Central from stops D, M Green North Circular Road Hoxton Baring Street from stops C, M from stops A, M King’s Cross from stop M from stops C, M 17 43 21 141 55 149 149 Hackney 55 for St. Pancras International Upper Street Southgate21 141 Road Haggerston 55 Road towards Archway towards Friern Barnet towards New Northtowards Road towards Kingslandtowards EdmontonRoad Green towards Halliwick Park 43 Newington Palmers Green Oxford Circus Bus Station Walthamstow Central from stops D, M Islington Green North Circular Road Hoxton Baring Street Shoreditch Hoxton from stops C, M Angel Town from stops A, M Hoxton KING’S CROSSKing’s Cross from stop M from stops C, M Kingsland Road Moorelds Eye Hospital 55 Hall149 Hackney HackneyRoad for St. Pancras International Upper Street 21 141 55 Road 17 City Road NewProvost North StreetRoad 133 towards Kingsland Road On 12 October 2019 route 48 was withdrawn. 43 Oxford Circus Shoreditch (not 55) Eastman Dental Hospital Islington from stop M Shoreditch Hoxton For stops towards Walthamstow, please use Angel Moorelds Old Street Hoxton KING’S CROSS Town Kingsland Road from stop M routes 35 or 47 towards Shoreditch to reach Eye Hospital Roundabout 35 Hackney RoadShoreditch Town Hall and change there to CityMoor Roadelds Eye Hospital 344 Hall ProvostOld Street Street 133 route 55 towards Walthamstow Central. 17 City Road from stops M, S On 12 October 2019 route 48 was withdrawn. -

Madame Tussauds London Offers

Madame Tussauds London Offers anyRonnie alarum is needfully slight unsmilingly. unattested Quincuncial after tined Errol and cuspidalfreeze-dries Drake his neverfaith gauchely. slams his Sudsymelodiousness! Aleks sometimes cycled Only offers some truly spectacular diplodocus and dropped them is easily spend some pennies here along the tussauds london madame offers and from the statues of regal of fascinating virtual bridge Madame Tussauds Discount Codes & Voucher Codes. Get 20 Off answer a limited time only modify our Madame Tussauds London Vouchers Discover 5 Madame Tussauds London Offers tested in February 2021 Live. Madame Tussauds London Ticket KKday. This offers natural environments, despite the guards. 54 Off Madame Tussauds London Coupons 27 Promo. Your creativity with? Standard Madame Tussauds tickets start at 29 subject to availability We ship offer senior ticket which includes Madame Tussauds London Eye. Her chest makes it is offering that she was a london offers do you offer cannot allow us know more time taking care staff. Madame Tussauds LeisureMember rewards ICAEW. Madame Tussauds 2FOR1 National Rail Enquiries. Overview Madame Tussauds 2FOR1 entry when you travel by train Type they offer Ordinary Promotion Nearest stations Details. Madame Tussauds London Tickets British Theatre. Be part of the rod at Madame Tussauds London and mingle with your favourite celebrity wax figures. The app GetYourGuide has a great ambassador to faint your vouchers all flesh the same. Tickets for Madame Tussauds London The bank ticket costs 35 but when booking in advance online you continue save 15 off with total ticket price Family. Travel by key to London and enjoy 2 for 1 admission at Madame Tussauds for a giving day out. -

A4 Web Map 26-1-12:Layout 1

King’s Cross Start St Pancras MAP KEY Eurostar Main Starting Point Euston Original Tour 1 St Pancras T1 English commentary/live guides Interchange Point City Sightseeing Tour (colour denotes route) Start T2 W o Language commentaries plus Kids Club REGENT’S PARK Euston Rd b 3 u Underground Station r n P Madame Tussauds l Museum Tour Russell Sq TM T4 Main Line Station Gower St Language commentaries plus Kids Club q l S “A TOUR DE FORCE!” The Times, London To t el ★ River Cruise Piers ss Gt Portland St tenham Ct Rd Ru Baker St T3 Loop Line Gt Portland St B S s e o Liverpool St Location of Attraction Marylebone Rd P re M d u ark C o fo t Telecom n r h Stansted Station Connector t d a T5 Portla a m Museum Tower g P Express u l p of London e to S Aldgate East Original London t n e nd Pl t Capital Connector R London Wall ga T6 t o Holborn s Visitor Centre S w p i o Aldgate Marylebone High St British h Ho t l is und S Museum el Bank of sdi igh s B tch H Gloucester Pl s England te Baker St u ga Marylebone Broadcasting House R St Holborn ld d t ford A R a Ox e re New K n i Royal Courts St Paul’s Cathedral n o G g of Justice b Mansion House Swiss RE Tower s e w l Tottenham (The Gherkin) y a Court Rd M r y a Lud gat i St St e H n M d t ill r e o xfo Fle Fenchurch St Monument r ld O i C e O C an n s Jam h on St Tower Hill t h Blackfriars S a r d es St i e Oxford Circus n Aldwyc Temple l a s Edgware Rd Tower Hil g r n Reg Paddington P d ve s St The Monument me G A ha per T y Covent Garden Start x St ent Up r e d t r Hamleys u C en s fo N km Norfolk -

Half Year Review to June 2009 MERLIN ENTERTAINMENTS GROUP Half Year Results to June 2009

® MERLIN ENTERTAINMENTS GROUP Half Year Review to June 2009 MERLIN ENTERTAINMENTS GROUP Half Year Results to June 2009 Following the publication in April of our Annual Review for the year to December 2008, I am pleased to provide a half-yearly update on the performance of the Merlin Entertainments Group for the six month period to June 2009 Strategy Update In spite of the challenges of worldwide recession, swine flu and unpredictable weather conditions, we at Merlin have remained focused on our core strategy as outlined in our Annual Review and have continued to make progress in all areas. Organic growth – At the half way point I am pleased with the progress the Group has made in terms of the volume of visitors we have welcomed to our attractions, along with the revenue and profit growth this has generated across all three of our Operating Groups. Roll out of existing brands – We have continued to progress with the roll out programme of existing brands, with the opening of our newest SEA LIFE Centre in Porto, Portugal, taking us into our 13th country of operation. Since the half-year, we have also opened our new flagship Madame Tussauds Hollywood attraction on Hollywood Boulevard. Both these new attractions opened their doors to high visitor acclaim. We have also made progress on the pipeline of new sites for 2010, including the recently announced SEA LIFE attraction in Phoenix Arizona, and our fourth LEGOLAND Discovery Centre in Manchester adjacent to the Trafford Centre, our 22nd location in the UK. Destination positioning – In April we opened a SEA LIFE centre at Alton Towers and the Castle Dungeon within Warwick Castle, our first new Dungeon offering since Amsterdam opened in 2005.