Streaming Media Services: Netflix, Amazon, Hulu, Q1 2014, 2015 & 2016 Youtube and an Ever Growing List of Even Newer Players

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AT&T-Time Warner Merger Overview

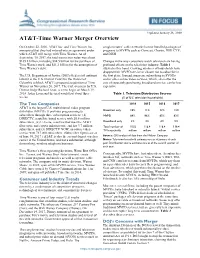

Updated January 26, 2018 AT&T-Time Warner Merger Overview On October 22, 2016, AT&T Inc. and Time Warner Inc. conglomerates’ cable networks license bundled packages of announced that they had entered into an agreement under programs to MVPDs such as Comcast, Charter, DIRECTV, which AT&T will merge with Time Warner. As of and DISH. September 30, 2017, the total transaction value was about $105.8 billion, including $84.5 billion for the purchase of Changes in the way consumers watch television are having Time Warner stock, and $21.3 billion for the assumption of profound effects on the television industry. Table 1 Time Warner’s debt. illustrates this trend. Growing numbers of households have dropped their MVPD service or chosen not to subscribe in The U.S. Department of Justice (DOJ) filed a civil antitrust the first place. Instead, many are subscribing to SVODs lawsuit in the U.S. District Court for the District of and/or other online video services, which, even after the Columbia to block AT&T’s proposed acquisition of Time cost of separately purchasing broadband service, can be less Warner on November 20, 2017. The trial, overseen by U.S. expensive. District Judge Richard Leon, is set to begin on March 19, 2018. Judge Leon said the trial would last about three Table 1. Television Distribution Sources weeks. (% of U.S. television households) The Two Companies 2014 2015 2016 2017 AT&T is the largest U.S. multichannel video program distributor (MVPD). It provides programming to Broadcast only 10% 11% 12% 13% subscribers through three subscription services: (1) MVPD 88% 86% 85% 82% DIRECTV, a satellite-based service with 20.6 million subscribers, (2) U-Verse, a service that uses the AT&T Broadband only 2% 3% 4% 5% fiber optic and copper infrastructure and has 3.7 million Total number of 115.5 116.4 116.4 118.4 subscribers, and (3) DIRECTV NOW, an online video TV households million million million million service with 787,000 subscribers. -

Ftc-2018-0091-D-0015-163436.Pdf

December 28, 2018 The Honorable Joseph Simons Chairman Federal Trade Commission 600 Pennsylvania Avenue, NW Washington, DC 20580 Dear Chairman Simons, Thank you for inviting public comment on the question of whether U.S. antitrust agencies should publish new vertical merger guidelines, and how those guidelines should address competitive harms, transaction-related efficiencies, and behavioral remedies. We submit these comments on behalf of the Writers Guild of America West (“WGAW”), a labor organization representing more than 10,000 professional writers of motion pictures, television, radio, and Internet programming, including news and documentaries. Our members and the members of our affiliate, Writers Guild of America East (jointly, “WGA”) create nearly all of the scripted entertainment viewed in theaters and on television today as well as most of the original scripted series now offered by online video distributors (“OVDs”) such as Netflix, Hulu, Amazon, Crackle, and more. The Non-Horizontal Merger Guidelines (“Guidelines”), originally issued in 1984,1 are the governing document of U.S. vertical antitrust enforcement. They rely, however, upon outdated economic theories that not only fail to promote and protect competition, but, in some cases, obstruct appropriate antitrust enforcement. Large vertical mergers in key industries have caused harm to consumers and failed to deliver on their promised innovations, efficiencies, and public benefits. The current Guidelines’ bias toward false negatives, or non-findings of harm, enables incumbents to consolidate market power and undermine competition. Recent vertical mergers in the telecommunications and entertainment industries illustrate the deficiencies of the current regulatory regime and provide evidence of the need for new guidelines. -

Cartoon Network and Palace Entertainment Develop Premier Hotel Experience

OCT. 30, 2018 CARTOON NETWORK AND PALACE ENTERTAINMENT DEVELOP PREMIER HOTEL EXPERIENCE The Network’s First Hotel Will Open Summer 2019 October 30, 2018 – Some of the world’s most well-loved cartoon characters will be coming to life through a partnership announced today by Cartoon Network and Palace Entertainment. The Cartoon Network Hotel will be the premier family lodging experience in Central Pennsylvania. Joining a global portfolio of great Cartoon Network family experiences, the Network’s first hotel will feature 165 rooms and immerse guests in the animation and antics of characters from shows like Adventure Time, We Bare Bears, and The Powerpuff Girls. Through a combination of character animation and creative technology, the entire property will offer fun and unexpected ways to experience the animated worlds of Cartoon Network from the moment of arrival. The nine-acre destination will feature an interactive lobby with surprises around every corner, a brand-new resort-style pool and water play zone, an outdoor amphitheater with an oversized movie screen, lawn games, fire pits and more! The experience continues inside, where each guest room and suite will feature interchangeable show theming that can be customized around children’s preferences to make each visit a new adventure. An indoor pool, game room, kids play area, and Cartoon Network store will keep the fun going regardless of the season. The Cartoon Network Hotel is centrally located along the Route 30 commercial stretch in the heart of Lancaster County and is just steps from the castle doors of Dutch Wonderland Family Amusement Park. Palace Entertainment currently owns and operates more than 20 amusement parks, water parks, and family entertainment centers across the United States and Australia. -

AFS Year 7 Slate MASTER

AFS YEAR 7 FILM SLATE "1 AFS 2018-2019 FILM THEMES *Please note that this thematic breakdown includes documentary features, documentary shorts, animated shorts and episodic documentaries American Arts & Culture Entrepreneurism Chasing Trane! Blood, Sweat & Beer! Gentlemen of Vision! Chef Flynn! Honky Tonk Heaven: Legend of the Dealt! Broken Spoke! Ella Brennan: Commanding the Table! Jake Shimabukuro: Life on Four Strings Good Fortune! More Art Upstairs! Knife Skills! Moving Stories! New Chefs on the Block! Obit! One Hundred Thousand Beating Hearts! Restless Creature: Wendy Whelan! Human Rights Score: A Film Music Documentary! STEP! A Shot in the Dark! All-American Family! Disability Rights Bending the Arc! A Shot in the Dark! Cradle! All-American Family! Edith + Eddie! Cradle! I Am Jane Doe! Dealt! The Prosecutors! I’ll Push You! Unrest! Pick of the Litter! LGBTQI Reengineering Sam! Served Like a Girl! In A Heartbeat! Unrest! The S Word: Opening the Conversation Stumped# About Suicide! Stumped! "2 Mental Health Awareness Sports Cradle! A Shot in the Dark! Served Like a Girl! All-American Family! The S Word: Opening the Conversation Baltimore Boys! About Suicide! Born to Lead: The Sal Aunese Story! The Work! Boston: The Documentary! Unrest! Down The Fence! We Breathe Again! Run Mama Run! Skid Row Marathon! The Natural World and Space Take Every Wave: The Life of Laird A Plastic Ocean! Hamilton Above and Beyond: NASA’s Journey to STEM Tomorrow! Frans Lanting: The Evolution of Life! Bombshell: The Hedy Lamarr Story! Mosquito! Dream Big: -

Warnermedia O Home Box Office, Inc

WarnerMedia o Home Box Office, Inc. and family companies including: . HBO Digital Services, Inc. HBO Home Entertainment, Inc. HBO Service Corporation . HBO Retail Ventures, Inc. Europe • HBO Bulgaria EOOD • HBO Adria d.o.o. • HBO Europe s.r.o. • HBO Adria SRB Lt. Belgrade. • HBO Holding Zrt. • HBO Polska Sp. z.o.o. • HBO Romania Srl • HBO poslovne storitve d.o.o. • HBO Code Labs International GmbH. • HBO Europe Original Programming Limited • HBO Nordic Services Denmark APS • HBO Nordic Services Norway AS • HBO Nordic Services Finland Oy • Home Box Office Spain Ventures, S.L. • HBO Nordic AB . Asia • Home Box Office (Taiwan) Co. Ltd. • Home Box Office (Singapore) Pte. Ltd. • Affiliates Asia, L.L.C. • HBO Pacific Partners, V.O.F. Canada • HBO Canada Services, Inc. o Turner Broadcasting System Inc. and family companies including: . Bleacher Report, Inc. Cable News International, Inc. Cable News Network, Inc. Cartoon Interactive Group, Inc. Cartoon Network Enterprises, Inc. Catch Sports LLC . CNE Tours, Inc. (F/K/A Cartoon Network Shop, Inc.) . CNN Interactive Group, Inc. Court TV Digital LLC . Courtroom Television Network LLC . Filmstruck LLC . Great Big Story, LLC . iStreamPlanet Co., LLC . Retro, Inc. Superstation, Inc. TBS Interactive Group, Inc. TCM Interactive Group, Inc. The Cartoon Network, Inc. TNT Interactive Group, Inc. TNT Originals, Inc. Turner Broadcasting Sales, Inc. Turner Classic Movies, Inc. Turner Digital Basketball Services, Inc. Turner Data Solutions, LLC . Super Deluxe, LLC (F/K/A Turner Digital Entertainment, LLC) . Turner Entertainment Networks, Inc. Turner Festivals, Inc. (F/K/A Turner Direct Retailing, Inc.) . Turner Media Ventures, Inc. Turner Network Sales, Inc. -

Your Twitter Advertisers

These advertisers have included you in one or more tailored audiences. @120sports @1776 @1800contacts @2020companies @20jeans @23andme @3drobotics @3scale @76 @7eleven @a1originalsauce @a_i @aarp @abaenglish @abc_thecatch @abercrombie @abetteror @achievers @ackshaey @acorn_stairlift @acorns @acura @acuracanada @adaptive_sys @adconion_direct @adhearthstone @adska360 @adstest6 @adultswim @advilrelief @adwords @aerie @aeropostale @ageofish @aha_io @ahmadshafey @ahs_careers @aibgb @aiginsurance @aip_publishing @airtable @airtime @aldo_shoes @alexandani @alfredstate @all_laundry @allyapp_de @alterrecrute @altoros @amalbe_clothing @amazon @amazonjp @amazonkindle @amctheatres @americanfunds @americanxroads @americastire @amfam @amica @amtrak @angieslist @angietribecatbs @anovaculinary @ansible @anthembusiness @anthology @aperolspritzita @appanniejapan @applebees @appliedsystems @arabicfbs @areyouthirstie @argos_online @asabovesobelow @asana @asklloydsbank @aspokesman @atomtickets @atosfr @att @attdeals @attsmallbiz @audi @audible_com @audienseco @audiuk @auth0 @autosoftdms @autotrader_com @avanadefrance @avvo @babiesrus @badmoms @baltimoresun @bananarepublic @bankofamerica @bankofscotbiz @barackobama @barclayscorp @baristabar @barronsonline @basecamp @battlecamp @battlefield @bauschlomb @beatport @beats1 @beatsbydre @beenverified @beggin @belk @belvita @bench @bentleymotors @betabrand @betfair @betterdotcom @betterment @betterworks @bhillsmd @bhphotovideo @biggerbooks @bigstock @bitly @bizfinyc @blackhatmovie @blackrock @bleacherreport @blizzheroes -

The Paley Center for Media and Cartoon Network Present: Cartoon Network: 25 Years of Drawing on Creativity

THE PALEY CENTER FOR MEDIA AND CARTOON NETWORK PRESENT: CARTOON NETWORK: 25 YEARS OF DRAWING ON CREATIVITY Exclusive Exhibit to Run at the Paley Center’s New York and Beverly Hills Locations Exhibit to Feature Immersive Activities, Screenings, and Panel Discussions with Cartoon Network Talent and Creative Teams NEW YORK, NY – August 30, 2017 -- Twenty-five years ago, the way we enjoyed cartoons changed forever when Cartoon Network launched as the very first twenty four-hour network dedicated to animation. To celebrate this incredible milestone, Cartoon Network and The Paley Center for Media will present Cartoon Network: 25 Years of Drawing on Creativity. This exclusive exhibit will premiere at the Paley Center’s New York location on September 16, and will run through October 8. At the conclusion of the New York run, the exhibit will open at the Paley Center’s Beverly Hills location on October 14, and will run until November 19. Visitors will experience the creative process from sketch to screen and beyond with an in-depth look at Steven Universe, tour special exhibits including stop-motion sets from Adventure Time, and photo ops with sculptures from The Powerpuff Girls and Cartoon Network's newest hit O.K. KO! Let’s Be Heroes! “It was a crazy idea to start, but a crazy good idea that led to twenty-five years of laughter and innovation,” said Cartoon Network President Christina Miller. “We are very thankful to our talent, team and, of course, our fans. We are proud to be celebrating this milestone with Paley Center.” “We’re thrilled to welcome visitors into the visually exciting world of Cartoon Network,” said Maureen J. -

HHICC STREAMING SERVICES.Pdf

STREAMING - AN INTRO TO THE POSSIBILITIES MAY 18, 2020 • GOAL – TO PROVIDE AN OVERVIEW OF CURRENT SERVICES AVAILABLE FOR VIDEO STREAMING AND DEMONSTRATE THE LEADING ONES • AGENDA • STREAMING OVERVIEW • ACCESS – WIFI AND TV SMART SYSTEMS • LEADING SERVICES BY TYPE – BOB’S PICKS DEMO • LIVE TV • RECORDED –MOVIES , SERIES • MUSIC • CAUTION THIS MARKET IS CHANGING ALL THE TIME - SO SHOP FOR DEVICES AND CONTENT - YOUR CHOICES CAN IMPACT SAVINGS STREAMING - THE BASICS Internet Internet Access Device OR Smart System Spectrum or Hargray INTERNET SITE Netflix Amazon Prime TV YouTube TV Pandora ETC. ACCESS TO INTERNET – LOCALLY • DOWNLOAD SPEED IS CRITICAL - > 30 MBPS – 100 IDEAL – 1000 (1GIG POSSIBLE ) • HARGRAY – FIBER CABLE –MODEM /ROUTER • SPECTRUM – COAX CABLE – MODEM / ROUTER • ROUTER AND/OR MESH SYSTEM MAY BE NEEDED FOR COVERAGE • SPEED TEST SITE – EXAMPLE - SPEEDTEST.NET NEW OPTION • SATELLITE “STARLINK” FROM SPACEX – END OF 2020 DEVICE OR SMART SYSTEM NEEDED FOR STREAMING • STREAMING SMART SYSTEM makes it pOssible tO access and stream (VieW) cOntent frOm the internet primarily tO yOur teleVisiOn. COmparisOn chart attached to presentatiOn. DEVICE OR SMART SYSTEM Internet Access INTERNET SITE Spectrum or Hargray Netflix Amazon Prime TV YouTube TV Pandora ETC. ACCESS TO SITES – TV SMART SYSTEMS • STREAMING CAPABILITY BUILT INTO TV • OFTEN CONVENIENT IF THEY OFFER STREAMING SITES YOU WANT • DEVICES LIKE ROKU CAN PROVIDE ALL SMART FEATURES • SINGLE REMOTE CONTROLS ALL TV FUNCTIONS –MOST NOW HAVE GOOD VOICE COMMANDS • KEY FEATURES TO LOOK FOR ARE SEARCH FUNCTION, EASY TO NAVIGATE BETWEEN SITES (CHANNELS), AUTOMATIC UPDATES OF SYSTEM • LEADING SYSTEM ROKU –BUILT IN OR DEVICE (DEMO) ROKU DEVICE OR SMART SYSTEM STREAMING SERVICES ARE INTERNET SITES • STREAMING SERVICES are rapidly eVOlVing sOurces fOr Entertainment COntent DEVICE. -

Program Guide 2019

PROGRAM GUIDE 2019 MONDAY -FRIDAY SATURDAY SUNDAY 6:00 AM Top news stories of the day 6:00 AM Top news stories of the day 6:00 AM Top news of the day 6:15 AM APN Custom Content 6:15 AM APN Custom Content 7:00 AM HLN Morning Express 7:00 AM HLN Weekend Express 7:00 AM HLN Weekend Express 8:00 AM HLN Morning Express 7:15 AM APN Custom Content 7:15 AM APN Custom Content 8:15 AM APN Custom Content 7:30 AM Boom Cartoon (APN) 7:30 AM Boom Cartoon (APN) 9:00 AM CNNI Money 8:00 AM HLN Weekend Express 8:00 AM Inside Politics 9:45 AM APN Custom Content 8:15 AM APN Custom Content 8:15 AM APN Custom Content 9:00 AM HLN Weekend Express 9:00 AM State of the Union 10:00 AM CNNI Travel 9:15 AM APN Custom Content 9:15 AM APN Custom Content 9:30 AM CNN Vital Signs (APN) 9:30 AM CNN Vital Signs (APN) 10:30AM APN Custom Content 10:00 AM Great Big Story Show 10:00 AM Fareed Zakaria GPS 11:00 AM Vital Signs 11:30:AM APN Custom Content 10:30 AM HBO/Real Sports + APN 10:15 AM HBO Real Sports + APN 12:00 PM CNNI Quest Express 10:45 AM APN Custom Content 10:30 AM APN Custom Content 11:00 AM HLN Weekend Express 11:00 AM HLN Weekend Express 12:30 PM APN Custom Content 11:15 AM APN Custom Content 11:15 AM APN Custom Content 1:00 PM Top news with Brianna Keilar 12:00 PM CNNI Sports 12:00 PM CNNI World Sport 1:15PM APN Custom Content 12:30PM CNNI Inside (Africa, Middle East) 12:30PM HBO Real Sports + APN 2:00PM Anthony Bourdain 12:45 PM APN Custom Content 3:00 PM Top stories of the day 1:00 PM Top news stories of the day 1:00 PM APN Family 30 min 1:15 PM APN Custom -

1 of 7 a U T O M O T I V E GM/Onstar General Motors Unveiled Plans to Embed Onstar Business Driver, a New In

AUTOMOTIVE GM/OnStar General Motors unveiled plans to embed OnStar Business Driver, a new in- vehicle advertising platform, into 2+ million vehicles – nearly two-thirds of their car fleet – by the close of the year. The new marketing channel will be integrated into the car’s dashboard and double as a car management device, measuring the health of the car, traffic information, driving directions and geo-targeted advertising to its drivers. BROADBAND FCC/Privacy The FCC’s latest proposal for broadband privacy rules calls for Internet Service Providers to obtain users’ affirmative consent before using data about their activity for ad targeting purposes. CORPORATE Google Last week, Google introduced a pair of Pixel phones featuring a powerful camera, long lasting battery (7 hours and 15 minutes), a dedicated headphone jack, and 24-hour live customer care. Other features include: running off the newly introduced operating system Nugget; Google Home, its Amazon Echo rival that responds to voice commands; the Daydream View, a fabric virtual reality headset; Google Wifi, a multipoint network system; and an upgraded Chromecast media streaming dongle. Snap/IPO Snap, formerly Snapchat, is readying the paperwork for an IPO early next year that could value the company at $25 billion, making it one of the largest companies to debut in the U.S. since 2008, according to Dealogic, as reported by The Wall Street Journal: Pricing Date Company Market Valuation (Billions) 9.14 Alibaba $167.6 5.12 Facebook $81.2 10.09 Banco Santander Brasil $50.4 11.10 GM $49.5 3.08 Visa $42.5 5.14 JD.com $26.0 3.17 Snap $25.0 2.11 Kinder Morgan $21.2 12.13 Hilton Worldwide $19.7 7.14 Synchrony Financial $19.1 DIGITAL Apple/App Store/ Apple has ventured into the search advertising business by starting to show ads Search related to users’ searches in its App Store. -

The Death of Physical Media: the Dangers of Streaming and the End of the Home Library

Portland State University PDXScholar University Honors Theses University Honors College 11-21-2019 The Death of Physical Media: The Dangers of Streaming and the End of the Home Library Amelia Eichler Portland State University Follow this and additional works at: https://pdxscholar.library.pdx.edu/honorstheses Part of the Other Film and Media Studies Commons Let us know how access to this document benefits ou.y Recommended Citation Eichler, Amelia, "The Death of Physical Media: The Dangers of Streaming and the End of the Home Library" (2019). University Honors Theses. Paper 803. https://doi.org/10.15760/honors.821 This Thesis is brought to you for free and open access. It has been accepted for inclusion in University Honors Theses by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. 1 Eichler The Death of Physical Media: The Dangers of Streaming and the End of the Home Library By Amelia Eichler An undergraduate honors thesis submitted in partial fulllment of the requirements for the degree of Bachelor of Arts in University Honors and Film Thesis Adviser Mark Berrettini Portland State University 2019 2 Eichler As technology has changed throughout the 20th and 21st century, the way in which movies are viewed within the home has changed dramatically. The home library has taken on many different forms throughout history. The German philosopher, Walter Benjamin, wrote about this magical relationship between collector and object in his essay “Unpacking My Library”. To him, ownership of an object allowed the collector to unlock memories of its past and “renew the old world”, while also creating new memories with that object (Klinger 65). -

Digital Flows from TCM to Filmstruck

Digital Flows from TCM to FilmStruck Hemrani Vyas, Turner Classic Movies - Programming Since its inception in 1994, Turner Classic Movies has operated much like a traditional broadcast network—using a “broad” programming flow to create themes for its daily schedule. The 24-hour programming is a flow that only changes when primetime begins—so audiences are receiving two separate narrative structures, more specifically a clear day and night part. This structure of flow has now carried over into TCM’s newest digital property; FilmStruck. While the site is not a constant streaming service, the film bundles are heavily curated, consisting of hosted introductions and bonus materials (replicating the TCM linear model). It was announced in February 2018 that FilmStruck would collaborate with the Warner Bros. Archive to now host the largest streaming classic film library—aptly called TCM Select. Warner Archive has now sunset its streaming services and all previous members have transitioned to FilmStruck—a flow in itself. In an effort to bridge the gap between the predominantly younger, cable-less, cinephiles who gravitate towards FilmStruck and the Criterion Collection (whose entire library is housed within the service), and the intrepid cable-subscribing TCM fan, the TCM Select “channel” was added. This new channel allows exclusive streaming access to the Warner Brothers classic film library; golden age classics typically found on the linear network are now readily available to audiences that most likely no longer carry a cable subscription. With the video rental era quickly fading, streaming audiences today are arguably over served in accessibility to contemporary films—spanning all studios and countries.