Complaint: U.S. V. Anheuser-Busch Inbev SA/NV and Grupo Modelo S.A.B. De C.V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Anticipated Acquisition by Anheuser-Busch Inbev NV/SA of Grupo Modelo SAB De CV

Anticipated acquisition by Anheuser-Busch InBev NV/SA of Grupo Modelo SAB de CV ME/5582/12 The OFT’s decision on reference under section 33(1) given on 14 November 2012. Full text of decision published 29 November 2012. Please note that the square brackets indicate figures or text which have been deleted or replaced in ranges at the request of the parties or third parties for reasons of commercial confidentiality. PARTIES 1. Anheuser-Busch InBev NV/SA (ABI) is a global drinks manufacturer headquartered in Belgium. ABI produces and distributes a number of beers and other drinks in 23 countries and sells beer in over 100 countries. In the United Kingdom (UK), ABI’s brands include Budweiser, Stella Artois and Becks. ABI was created in 2008 as a result of the merger between the InBev NV/SA (InBev) and Anheuser-Busch Companies, Inc (Anheuser- Busch).1 2. Grupo Modelo S.A.B de C.V. (Modelo) is a Mexican brewer that exports its beers to over 180 countries primarily through agreements with local importers/distributors. In the UK almost all of Modelo’s sales are made under the Corona brand2 and exclusively distributed by Molson Coors, another brewer.3 Modelo’s business is run entirely through its operating 1 Anticipated acquisition by InBev NV/SA of Anheuser-Busch Companies Inc, OFT decision dated 18 November 2008. 2 Modelo’s other brands are Pacifico Clara, Negro Modelo and Modelo Especial, each of which has negligible sales in the UK. Consequently, the OFT’s analysis concentrates on the competition effects arising from the acquisition of the Corona brand in particular. -

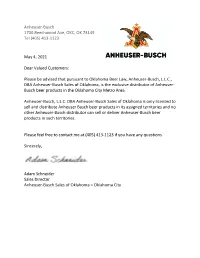

Ss22-C223031 Sole Source Documentation

Anheuser-Busch 1700 Beechwood Ave, OKC, OK 73149 Tel (405) 413-1123 May 4, 2021 Dear Valued Customers: Please be advised that pursuant to Oklahoma Beer Law, Anheuser-Busch, L.L.C., DBA Anheuser-Busch Sales of Oklahoma, is the exclusive distributor of Anheuser- Busch beer products in the Oklahoma City Metro Area. Anheuser-Busch, L.L.C. DBA Anheuser-Busch Sales of Oklahoma is only licensed to sell and distribute Anheuser Busch beer products in its assigned territories and no other Anheuser-Busch distributor can sell or deliver Anheuser-Busch beer products in such territories. Please feel free to contact me at (405) 413-1123 if you have any questions. Sincerely, Adam Schneider Sales Director Anheuser-Busch Sales of Oklahoma – Oklahoma City Anheuser-Busch Sales of Oklahoma Q2 2021 OFF PREMISE PRICE SHEET - OKC Effective: 4/5/21-7/4/21 Updated 3/16/21 ABSO BRAND PACK SIZE SIZE CARRIER PACK COUNT FRONTLINE DISCOUNT EDLP UNIT COST UPC CODE CODE *Rita's* Rita with a Twist of BL Lime. 8.0% ABV Ritas Lime-A-Rita 12PK 8OZ CAN 2$ 25.40 $ 3.40 $ 22.00 $ 11.00 0-18200-19987-5 10513 Ritas Lime-A-Rita 12PK 25OZ CAN 12$ 27.49 $ 3.49 $ 24.00 $ 2.00 0-18200-25014-9 16825 Ritas Mang-O-Rita 12PK 8OZ CAN 2$ 25.40 $ 3.40 $ 22.00 $ 11.00 0-18200-22989-3 26834 Ritas Mang-O-Rita 12PK 25OZ CAN 12$ 27.49 $ 3.49 $ 24.00 $ 2.00 0-18200-25533-5 16826 Ritas Straw-Ber-Rita 12PK 8OZ CAN 2$ 25.40 $ 3.40 $ 22.00 $ 11.00 0-18200-20993-2 10531 Ritas Straw-Ber-Rita 12PK 25OZ CAN 12$ 27.49 $ 3.49 $ 24.00 $ 2.00 0-18200-25505-2 16827 Ritas Water-Melon-Rita 12PK 8OZ CAN 2$ 25.40 -

Cocktails Wine

Cocktails campfire sling 11 forager’s gimlet 14 *Whiskey, smoked maple syrup, chocolate *Gin, blueberry rosemary cordial, fresh bitters, burnt orange oil lime, torched rosemary fall bay whiskey sour 11 camp margarita 14 Bourbon, fresh lemon juice, simple syrup, Reposado, Luxardo, Honeydew Jalapeno egg white**, hot cinnamon bitters Shrub, fresh lime, fresh orange, melon ball ann-apple-is 13 a2n 15 *Vodka, fresh green apple juice, Dark rum, *Navy strength rum, fresh fresh lemon juice, cinnamon sugar rim pineapple, fresh orange, campari, Navy Hill soda float boozy slushies *denotes regional spirits Ask your bartender for the daily flavors Wine By the Glass sparkling Cava Brut, Poema, Catalonia, Spain NV .................................................... 8 rosé Pinot Noir Rosé, SeaGlass, Monterey, CA, US (2018) ....................................... 8 white Pinot Gris, Erath Vineyards, OR, US (2018) .............................................. 10 Saira Albarino, Raimat, Catalonia, Spain (2018) ......................................... 10 Sauvignon Blanc, Villa Maria, Marlborough, New Zealand (2018) ............................ 8 Chardonnay, Barboursville Vineyards, VA, US (2017) ...................................... 12 red Pinot Noir, Z. Alexander Brown, CA, US (2015) .......................................... 10 Cab Franc, Ox-Eye Vineyards, Shenandoah Valley, VA, US (2016) ........................... 14 Blend, Troublemaker, Central Coast, CA, US (NV) ......................................... 12 Malbec, Catena Zapata Vineyard, Mendoza, -

Anheuser-Busch Inbev

Our Dream: Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV Best Beer Company Bringing People Together For a Better World Contents 1 Our Manifesto 2 Letter to Shareholders 6 Strong Strategic Foundation 20 Growth Driven Platforms 36 Dream-People-Culture 42 Bringing People Together For a Better World 49 Financial Report 155 Corporate Governance Statement Open the foldout for an overview of our financial performance. A nheuser-Busch InBev Annual / 2014 Report Anheuser-Busch InBev 2014 Annual Report ab-inbev.com Our Dream: Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV Best Beer Company Bringing People Together For a Better World Contents 1 Our Manifesto 2 Letter to Shareholders 6 Strong Strategic Foundation 20 Growth Driven Platforms 36 Dream-People-Culture 42 Bringing People Together For a Better World 49 Financial Report 155 Corporate Governance Statement Open the foldout for an overview of our financial performance. A nheuser-Busch InBev Annual / 2014 Report Anheuser-Busch InBev 2014 Annual Report ab-inbev.com Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV About Revenue was Focus Brand volume EBITDA grew 6.6% Normalized profit Net debt to EBITDA 47 063 million USD, increased 2.2% and to 18 542 million USD, attributable to equity was 2.27 times. Anheuser-Busch InBev an organic increase accounted for 68% of and EBITDA margin holders rose 11.7% Driving Change For of 5.9%, and our own beer volume. was up 25 basis points in nominal terms to Anheuser-Busch InBev (Euronext: ABI, NYSE: BUD) is the leading AB InBev’s dedication to heritage and quality originates from revenue/hl rose 5.3%. -

Pricebook Creator

���� OLYMPICDISTRIBUTING EAGLE Locally based, family-owned sinw 19.54 BEER, PACKAGE, WINE, SPIRITS MIXERS & NON-A[COHOlIG PRICE BOOK July 2021 Proudly serving South King, Pierce, Thurston, Kitsap, Mason, Grays Harbor & Pacific Counties. *Not all products available in all areas. Please check withyour sales rep for producta vailable in your area. The prices reflected in the Olympic Eagle Price Books are for WSLCB licensed retailers only and are subject to change without notice. Service exceeding customer expectations. Table of Contents - Mixers TASTE OF FLORIDA MIXERS 1 TOF BLUE CURACAO PET 1 TOF GREEN APPLE NR 1 TOF GRENADINE PET 1 TOF LIME JUICE PET 1 TOF MARGARITA MIX PET 1 TOF MED BLOODY MARY NR 1 TOF PEACH MIX NR 1 TOF PINA COLADA PET 1 TOF SOUR MIX PET 1 TOF SPICY BLOODY MARY NR 1 TOF STRAWBERRY PUREE PET 1 TOF TRIPLE SEC PET 1 Table of Contents - Package BUD ICE 3 KING COBRA 7 LEFFE 10 BUD ICE 3 KING COBRA 7 LEFFE BLONDE 10 BUD LIGHT 3 LANDSHARK 7 PATAGONIA CERVEZA 10 BUD LIGHT 3 LAND SHARK LAGER 7 PATAGONIA BOHEMIAN PILSNER 10 BUD LIGHT CHELADA 3 MD 20/20 7 PATAGONIA CERVEZA PILSNER 10 BUD LIGHT CHELADA 3 MD 20/20 ISLAND PINEAPPLE 7 SPATEN 10 BUD LIGHT CHELADA FUEGO 3 MD 20/20 SWEET BLUE RASPBERRY 7 SPATEN OKTOBERFEST 10 BUD LIGHT CHELADA MANGO 3 MD 20/20 TANGY ORANGE 7 ST. PAULI GIRL 10 BUD LIGHT LEMONADE 3 MICHELOB 7 ST PAULI GIRL 10 BUD LIGHT LEMONADE 3 MICHELOB 7 ST. PAULI NON-ALCOHOL 10 BUD LIGHT LEMONADE VARIETY PK 3 MICHELOB AMBERBOCK 7 ST PAULI GIRL N.A. -

Craft Beer Expansion in the United States Alex J

Claremont Colleges Scholarship @ Claremont CMC Senior Theses CMC Student Scholarship 2016 Craft Beer Expansion in the United States Alex J. Herrera Claremont McKenna College Recommended Citation Herrera, Alex J., "Craft Beer Expansion in the United States" (2016). CMC Senior Theses. Paper 1279. http://scholarship.claremont.edu/cmc_theses/1279 This Open Access Senior Thesis is brought to you by Scholarship@Claremont. It has been accepted for inclusion in this collection by an authorized administrator. For more information, please contact [email protected]. Claremont McKenna College The Craft Beer Expansion in the United States SUBMITTED TO PROFESSOR OANA TOCOIAN AND DEAN PETER UVIN BY ALEX HERRERA FOR SENIOR THESIS FALL 2015 NOVEMBER 30, 2015 Table of Contents Abstract……………………………………………………………………………1 Introduction………………………………………………………………………..2 Additional Economic Principles...………………………………………….........10 Responses from Anheuser Busch InBev and MillerCoors………………………17 Beer Market Forecast…………………………………………………………….25 Conclusion.………………………………………………………………………32 Appendix…………………………………………………………………………35 Works Cited……………………………………………………………………...37 Abstract For centuries the world’s biggest breweries, including Anheuser-Busch InBev and MillerCoors, have been producing America’s favorite beers like Budweiser and Coors Light. However, more recently smaller, craft breweries have seen significant expansion as a growing number of Americans are drinking craft beers. How has this recent trend affected the beer market in the United States? More specifically, how has the recent success of craft breweries affected Anheuser-Busch InBev and MillerCoors? I examine the economic factors that have led to craft beer’s success in a highly competitive market, and further, how this success has impacted Anheuser-Busch InBev and MillerCoors. My study reveals that the premier quality of craft beer has distinctively separated itself from the traditional American lagers, like Coors and Bud Light. -

Draft Beer Cocktails

DRAFT BEER COCKTAILS WEIHENSTEPHANER HEFEWEISSBIER 20oz $8.00 APLHA HIVE DIPA 10oz $8.50 ROOT BEER MOSCOW MULE Vodka, ginger beer, fresh-squeezed lime German Hefeweizen ABV 5.4% Crowler $14.00 American IIPA ABV 9.1% Crowler $22.00 juice, lime garnish $8 Bayerische Staatsbrauerei, Germany 1.5L Boot $25.00 COOP Ale Works, Oklahoma City, OK SPRECHER ROOT BEER mug $3.50 Old Fashioned Root Beer Crowler $6.00 FRULI 10oz $7.25 NEXT COAST pint $6.00 HOUSE MARGARITA El Jimador Silver 100% blue agave $8 Sprecher Brewing Co., Glendale, WI Strawberry Fruit Beer ABV 4.1% Crowler $16.80 American IPA ABV 7.0% Crowler $9.50 Brouwerij Huyghe, Melle, Belgium Goose Island Brewery Co, Chicago, IL LIGHT BLUEBERRY MINT MOJITO Cruzan Rum, Lime Agave Elixer, ME SO HONEY pint $6.50 FRESH SQUEEZED pint $6.50 blueberries, mint $8 PABST BLUE RIBBON pint $4.00 Pale Wheat Ale ABV 5.5% Crowler $10.40 American IPA ABV 6.4% Crowler $10.00 American Adjunct Lager ABV 4.74% Crowler $6.40 Belching Beaver Brewery, Vista, CA Deschutes Brewery, Bend, OR Pabst Brewing Co., Los Angeles, CA BLATT BLOODY MARY House-made Bloody Mary juice, vodka SEAQUENCH 10oz $5.50 ODELL IPA pint $6.00 $8 MODELO ESPECIAL pint $5.25 Leipzig Gose ABV 4.9% Crowler $14.00 American Indian Pale Ale ABV 7.2% Crowler $9.50 American Adjunct Lager ABV 4.4% Crowler $8.40 Dogfish Head, Milton, DE Odell Brewing Co., Fort Collins, CO Grupo Modelo, S.A de C.V. Mexico City, Mexico OLD FASHIONED Templeton Rye whiskey, muddled Bada Bing FRUITLANDS 10oz $8.50 SUN REAPER 10oz $9.00 cherry, orange slice and cherry -

Grupo Modelo, Mexico's Largest Brewery, Has Dramatically

Minster DAC-H200-96 cupping press and coil line in production at Grupo Modelo’s can plant located in Zacatecas, Mexico. rupo Modelo, Mexico’s largest brewery, has dramatically increased Gproduction at its Zacatecas can plant with the addition of a new Stolle Hyperdyne Cupping System, featuring a Minster DAC-H200 cupping press and a Minster MSCF-72 servo cupper feed. Now producing more than six million cans a day, the Zacatecas plant supplies cans to seven Modelo breweries. Founded in 1925, the Modelo group brews and distributes 12 brands of beer, including Corona Extra, the number one Mexican beer sold in the world. Other popular brands include Modelo Especial, Negra Modelo, Victoria and Pacifico. The latest cupping line at Modelo’s Zacatecas plant is the second of two Hyperdyne Systems, recognized as the Minster’s new MSCF-72 servo cupper feed has helped increase productivity highest production cupping systems at Modelo’s Zacatecas Can Plant. available in the can industry. die features non-round blank for metal savings, and Capable of speeds of up to 350 strokes per minute, numerous innovations and features designed for the newest Hyperdyne System features state-of-the- efficient press operation along with part and scrap art 14-out tooling provided by Stolle Machinery. The removal. repeatability and eliminate the need for a special foundation. The hydrostatic piston guiding system and a temperature- stabilized frame allow for extreme accuracy. In addition, Minster’s patented quick lift feature provides for quick and easy tool access and release of die jams at the bottom of the stroke. -

Inbev and Anheuser-Busch

A09-10-0015 Andrew Inkpen InBev and Anheuser-Busch In early June 2008, Belgian-based InBev NV launched an unsolicited $46.4 billion bid to acquire Anheuser- Busch Co., owner of the 132-year-old Budweiser brand. The combination would create the world’s largest brewer, with sales of about $36 billion annually. Carlos Brito, CEO of InBev, said that the deal “will create a stronger, more competitive, sustainable global company which will benefit all stakeholders.”1 The initial response from Anheuser was noncommittal, stating that the company “will pursue the course of action that is in the best interests of Anheuser-Busch’s stockholders.” On June 26, Anheuser’s board formally rejected InBev’s original proposal of $65 a share, saying it substantially undervalued the company. The board indicated that it would be open to a higher price. In mid-July, InBev raised its offer to $70 a share, and the Anheuser board voted to accept the deal, recogniz- ing that a better offer was unlikely. The $70 price represented a substantial premium for Anheuser shareholders. InBev management would now have to prove to their shareholders that the premium was justified. The Brewing Industry The basic beer brewing process is quite straightforward. Malted barley (malt) is the primary ingredient, although other grains such as unmalted barley, corn, rice, or wheat can also be used. Yeast, hops, and water are the other main ingredients. The most challenging aspects of industrial-scale brewing are maintaining quality control across large volumes, multiple products, and different production sites, and ensuring that costs are closely managed. -

Corona Extra Was Introduced in the United States in 1981, and Became the Fastest Growing Imported Beer in U.S

Corona Extra was introduced in the United States in 1981, and became the fastest growing imported beer in U.S. history. Corona Extra has been brewed and bottled in Mexico by Grupo Modelo since 1926. Grupo Modelo is Mexico's largest brewer, operating seven state-of-the-art breweries throughout Mexico and currently exporting Corona to more than 150 countries worldwide. Corona Extra is also the #6 selling beer overall in the U.S., with a 27.7% share of the import market. Corona Extra is also the #6 selling beer overall in the U.S. with more than a 29% share of the import market. Average growth rate in the U.S. for the last 10 years (1998-2007) is 8.3%. Corona delivers a unique fun, sun and beach state of mind. It is a brand that doesn't take itself too seriously or try too hard to impress. It is defined by a laid back image originally created by Corona consumers when it first became available in the U.S. and which remains the Brand's foundation today. Due in large measure to its very universal appeal, Corona has in recent years moved beyond the import category and has positioned itself as a formidable competitor against domestic beers as well. Corona is made with the finest quality blend of barley, yeast, imported hops and water. Corona's smooth taste offers the perfect balance between heavier European imports and lighter domestic beer. 3.6% alcohol by weight, 4.6% alcohol by volume, 0 grams of fat, 148 calories per 12-oz. -

Grupo Modelo En Los Inicios Del Siglo Xxi1

Instituto Internacional PI-79 SAN TELMO GRUPO MODELO EN LOS INICIOS DEL SIGLO XXI1 Grupo Modelo, fundado en 1925 en México, era en el 2003 el líder en la elaboración, distribución y venta de cerveza en México, con una participación de mercado total (nacional y exportación) al 31 de diciembre de 2003 del 63.1%. Contaba con siete plantas cerveceras en la República Mexicana, con una capacidad instalada de 51.0 millones de hectolitros anuales de cerveza. Su portafolio de productos, abarcaba diez marcas, destacando Corona Extra (Coronita en España), la cerveza mexicana de mayor venta en el mundo, Modelo Especial, Victoria, Pacífico, Negra Modelo y otras de carácter regional. Exportaba cinco marcas con presencia en más de 150 países y era importador exclusivo en México de las cervezas producidas por la compañía estadounidense Anheuser-Busch, entre las cuales se incluían las marcas Budweiser y Bud Light. Desde 1994, Grupo Modelo cotizaba en la Bolsa Mexicana de Valores. Sus acciones desde esa fecha se habían revalorizado un 500%. El 13 de noviembre del 2003 Grupo Modelo, inició su cotización en Latibex, mercado en euros para empresas latinoamericanas de la Bolsa de Madrid, con la intención de fomentar la negociación de sus títulos entre los inversores institucionales españoles y europeos. Desde 1998, en los Estados Unidos, Corona se situaba como la primera, entre más de 500 cervezas importadas después de haber destronado a Heineken, que ocupaba dicha posición, desde el levantamiento de la prohibición en la década de los 30. Desde 1993 Grupo Modelo y Anheuser-Busch entraron en un acuerdo de joint-venture, donde Anheuser-Busch obtendría hasta un 50,2% de las acciones del grupo, formadas por un 35,12% de Grupo Modelo y un 23,35% en Diblo2. -

ABI/Grupo Modelo Case Study

MERGER ANTITRUST LAW ABI/Grupo Modelo (Full Set of Case Materials) Professor Dale Collins Georgetown University Law Center ABI/GRUPO MODELO Table of Contents AB Inbev/Grupo Modelo (2013) Anheuser-Busch InBev, Press Release, Anheuser-Busch InBev and Grupo Modelo to Combine, Next Step in Long and Successful Partnership (June 29, 2012) ................................................................................................ 4 Constellation Brands, News Release, Constellation Brands Inc. to Acquire Remaining 50 Percent Interest in Crown Imports Joint Venture (June 29, 2012) .............................................................................................. 11 U.S. Dept. of Justice, Antitrust Div., News Release, Justice Department Files Antitrust Lawsuit Challenging Anheuser-Busch Inbev’s Proposed Acquisition of Grupo Modelo (Jan. 31, 2013)............................................... 13 Complaint, United States v. Anheuser-Busch InBev SA/NV, No. 1:13-cv-00127 (D.D.C. filed Jan. 31, 2013) ........................................... 16 Constellation Brands, Inc.’s and Crown Imports LLC’s Motion to Intervene As Defendants (Feb. 7, 2013) ....................................................................... 43 Anheuser-Busch InBev, Press Release, Anheuser-Busch InBev and Constellation Brands Announce Revised Agreement for Complete Divestiture of U.S. Business of Grupo Modelo (Feb. 14, 2013) .................................................. 79 Joint Motion to Stay Proceedings (Feb. 20, 2013) ..............................................