Release of 2018 Research Reports

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 5 Station Descriptions And

Appendix 5 Station Descriptions and Technical Overview Stage 2 light rail transit (LRT) stations will follow the same standards, design principles, and connectivity and mobility requirements as Stage 1 Confederation Line. Proponent Teams were instructed, through the guidelines outlined in the Project Agreement (PA), to design stations that will integrate with Stage 1, which include customer facilities, accessibility features, and the ability to support the City’s Transportation Master Plan (TMP) goals for public transit and ridership growth. The station features planned for the Stage 2 LRT Project will be designed and built on these performance standards which include: Barrier-free path of travel to entrances of stations; Accessible fare gates at each entrance, providing easy access for customers using mobility devices or service animals; Tactile wayfinding tiles will trace the accessible route through the fare gates, to elevators, platforms and exits; Transecure waiting areas on the train platform will include accessible benches and tactile/Braille signs indicating the direction of service; Tactile warning strips and inter-car barriers to keep everyone safely away from the platform edge; Audio announcements and visual displays for waiting passengers will precede each train’s arrival on the platform and will describe the direction of travel; Service alerts will be shown visually on the passenger information display monitors and announced audibly on the public-address system; All wayfinding and safety signage will be provided following the applicable accessibility standards (including type size, tactile signage, and appropriate colour contrast); Clear, open sight lines and pedestrian design that make wayfinding simple and intuitive; and, Cycling facilities at all stations including shelter for 80 per cent of the provided spaces, with additional space protected to ensure cycling facilities can be doubled and integrated into the station’s footprint. -

Confidentiality Agreement to [email protected] Or Return by Fax at 613 782 2296

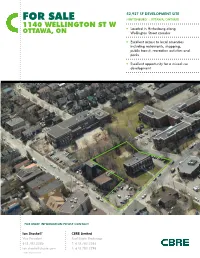

52,927 SF DEVELOPMENT SITE FOR SALE HINTONBURG :: OTTAWA, ONTARIO 1140 WELLINGTON ST W Located in Hintonburg along OTTAWA, ON Wellington Street corridor Excellent access to local amenities including restaurants, shopping, public transit, recreation activities and parks Excellent opportunity for a mixed use development FOR MORE INFORMATION PLEASE CONTACT Ian Shackell* CBRE Limited Vice President Real Estate Brokerage 613.782.2285 T: 613.782.2266 [email protected] F: 613.782.2296 *Sales Representative FOR SALE 1140 WELLINGTON ST W OTTAWA, ON 52,927 SF DEVELOPMENT SITE :: HINTONBURG :: OTTAWA, ONTARIO HINTONBURG, OTTAWA, ON Property Overview Total Site Area 52,927 SF Gross Building Area 12,000 SF Zoning Traditional Mainstreet / Institutional Located in Hintonburg, this site represents a large development opportunity that permits a wide range of uses including mid-high rise residential use, retirement home, community centre, hotel, instructional facility, office, place of worship, recreational and athletic facility and a number of other mixed uses. This offering represents an excellent development opportunity with a site size of approximately 52,927 SF. The location of the property provides excellent access to nearby shopping, restaurants, recreational activities and public transportation. There is an existing two and one half storey building on site that measures approximately 12,000 SF in gross floor area, including the partially above grade basement. The property is being sold through a tender process with a bid date of May 23rd, 2012 at 4:00pm. For more information, including the complete offering memorandum, the planning report completed by FoTenn Consultants, a site survey and more, please sign and return the attached Confidentiality Agreement to [email protected] or return by fax at 613 782 2296. -

1339 Wellington St., Ottawa

Integrity. Dedication. Professionalism. OFFICE SPACE FOR LEASE 1339 Wellington St., Ottawa Be a part of the action in Wellington Village! Spacious office suite available in the heart of Wellington Village, the perfect location for businesses desiring a lively and convenient location that is easy to access by car and Price: $14.00/sf public transportation. Daily cleaning services and all utilities OPC: $18.68/sf included. Parking available on-site. Wellington Village and neighbouring Hintonburg are Suite 202 - approx. 2,032 sf popular evening destinations for dining, entertainment, and cultural events. Home to many independent shops, unique eateries, and beautiful galleries. CONTACT: 613-759-8383 ext. 265 [email protected] Jason Shinder, Broker of Record Executive Vice President, Principal District Realty Corporation Brokerage 1 1339 Wellington Street, Ottawa districtrealty.com The information as herewith enclosed has been obtained from sources we believe to be reliable, but we make no representation or warranties, express or implied, as to the accuracy of the information. All references to square footage and other information contained herein are approximate and subject to change. Prospective Purchasers/Tenants shall not construe the information as legal advice. All properties are subject to change or withdrawl without notice. Integrity. Dedication. Professionalism. OFFICE SPACE FOR LEASE 1339 Wellington St., Ottawa Tunney’s Pasture . Station Scott Street HINTONBURG W. eet gton Str We llin Holland Ave 10 min. walk to Tunney’s -

Arrangement and Description of Peterborough's Historical Hospital Records Includes

Arrangement and Description of Peterborough’s Historical Hospital Records Includes: Final Report By Rebecca Lindsay Completed for: Peterborough Museum and Archive Supervising Professor: Sharon Beaucage-Johnson, Trent University Trent Centre for Community-Based Education Department: Forensics Course Code: 4890Y Course Name: Forensic Community-Based Education Research Project Term: Fall/Winter 2011-12 Date of Project Submission: April 2012 Project ID: 4219 Call Number: Table of Contents Abstract ........................................................................................................................................... 3 Acknowledgements ......................................................................................................................... 4 Ket Research Terms ........................................................................................................................ 5 Introduction .................................................................................................................................... 6 Methods ........................................................................................................................................ 10 Results ........................................................................................................................................... 15 Conclusion ..................................................................................................................................... 19 Literature Cited ............................................................................................................................ -

Carling Avenue, the Property Is in Close Proximity to the Ottawa Civic Hospital and the PARKING Royal Ottawa Mental Health Centre

CARLING 1081AVENUE [ PARKDALE MEDICAL BUILDING ] Jessica Whiting Sarah Al-Hakkak Senior Sales Representative Sales Representative +1 613 683 2208 +1 613 683 2212 [email protected] [email protected] CARLING 1081AVENUE PARKDALE MEDICAL BUILDING INCENTIVE: Sign a new 5+ year lease by September 30, 2019 to receive 6 months of net rent free! [ HIGHLIGHTS ] AVAILABLE AREA 662 SF - 6,917 SF NET RENT $16.00 PSF Turnkey options On-site parking Available available & rapid transit at immediately doorstep ADDITIONAL RENT Join existing medical tenants in a professionally managed building. $16.95 PSF Located at the corner of Parkdale Avenue and Carling Avenue, the property is in close proximity to the Ottawa Civic Hospital and the PARKING Royal Ottawa Mental Health Centre. On-site amenities include a café 1:1,000 SF | $100/MONTH and a pharmacy. CARLING 1081AVENUE PARKDALE MEDICAL BUILDING [ AVAILABLE SPACE ] SUITE SIZE (SF) B2 812 202 662 207 4,274 308 4,372 403 678 409 673 502 1,345 600 6,917 [ UPCOMING SPACE ] SUITE SIZE (SF) DATE 704 944 NOV 2019 705 2,000 JUNE 2019 706 2,000 JUNE 2019 ON-SITE CAFÉ CARLING 1081AVENUE [ FLOOR PLAN ] PARKDALE MEDICAL BUILDING SUITE 207 - 4,274 SF CARLING 1081AVENUE [ FLOOR PLAN ] PARKDALE MEDICAL BUILDING SUITE 409 - 673 SF CARLING 1081AVENUE [ FLOOR PLAN ] PARKDALE MEDICAL BUILDING SUITE 502 - 1,345 SF CARLING 1081AVENUE [ FLOOR PLAN ] PARKDALE MEDICAL BUILDING SUITE 600 - 6,917 SF PORTAGE BRIDGE ELGIN STREET EDDY STREET WELLINGTON STREET ALBERT STREET SLATER STREET CARLINGLAURIER AVENUE AVENUE -

Revised 2021-08

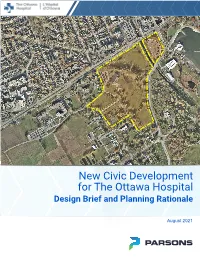

New Civic Development for The Ottawa Hospital Design Brief and Planning Rationale – Master Site Plan August 5th 2021 New Civic Development for The Ottawa Hospital Design Brief and Planning Rationale - Master Site Plan Applications for: Site Plan Control, Master Site Plan and Lifting of Holding Zone August 5th 2021 Prepared by: Parsons with HDR and GBA Page 1 New Civic Development for The Ottawa Hospital Design Brief and Planning Rationale - Master Site Plan August 5th 2021 TABLE OF CONTENTS 1.0 INTRODUCTION ................................................................................................................................................................ 1 1.1 Local Context .............................................................................................................................................................. 1 1.2 Site Significance ......................................................................................................................................................... 4 1.3 Existing Potential for Transportation Network .......................................................................................................... 4 1.4 Site Topography and Open Space ............................................................................................................................. 5 2.0 DESIGN BRIEF .................................................................................................................................................................. 6 2.1 Design Vision and Design -

READ Minutes Final Mar 9, 2015

READ Rosemount Expansion and Development Group Meeting #4 Approved Notes Monday, March 9, 2015 7:00 pm Hintonburg Community Centre, Basement Meeting Room Notes Present: Richard Van Loon, (Chair),Bonnie Campbell (WBCA), Barb Clubb (a/recorder), Linda Hoad, Alayne McGregor,Jeanette Rule (Champlain Park), Lindsay Setzer, Valerie Stam Regrets received: Emilie Hayes, Megan Therrien, Katie Alexander Action List: see minutes for details Action: Chair Van Loon to follow-up with a more formal meeting with the Mayor or designate. Action: Chair Van Loon to set up meeting with FOPLA president, Action: Valerie Stam will invite Dick Stewart (well versed in Section 37 and Development Charges) to come to the next READ meeting. Linda to keep on researching development charges. Action: Chair Van Loon will send a letter to the presidents of all the associations. Action: Jeanette Rule will create a list of the names and email contacts of the President of each of the associations, for Richard to use. Action: Linda will speak to Emilie Hayes liaison for the Somerset West Community Health Centre about possible help that the SWCHC could provide. Action: Jeanette Rule will work with Emily Addison to coordinate an email and Google drive account in READ’s name. Action: Richard will investigate Ottawa AM Radio (CBC) and Alan Neal (CBC All in a Day-afternoon) for contact at the appropriate time. Action agreed to date: o READ Should try to get article in The CentretownBuzz http://www.centretownbuzz.com/ (Possibly the April issue). Contact is Archie Campbell. o Paulette will write article for Newswest o Bonnie will contact EMC News o READ communications committee to coordinate above activity. -

Report on the April 11, 2016 Meeting Meeting on the Issue of the Ottawa Hospital Expansion and the Possible Use of Land from the Central Experimental Farm

Report on the April 11, 2016 meeting Meeting on the issue of the Ottawa Hospital expansion and the possible use of land from the Central Experimental Farm Hosted by the Agricultural Institute of Canada (AIC), the meeting included representatives from: • Office of the Minister of Agriculture and Agri-Food • Office of the Member of Parliament for Ottawa Centre and Minister of the Environment • Office of the Member of Provincial Parliament for Ottawa Centre and Ontario Minister of Community Safety and Correctional Services • Ottawa Civic Hospital • Friends of the Farm • Councillor Jeff Leiper, Kitchissippi Ward • Councillor Riley Brockington, River Ward • Civic Hospital Neighbourhood Association • Carlington Community Association • Agriculture Canada’s Central Experimental Farm Advisory Council • Coalition to Protect the Experimental Farm General Consensus There was unanimous agreement on the following items: • Engaging the community is a priority and an important component of this process. • Openness and transparency is important The great majority of stakeholders present agreed that: • That public consultations on the issue should be held Vital Information Needed Specific information was identified as being a crucial part of a meaningful consultation. This includes: • Historical information about the proposed sites – including the Historic Site Management Plan and Commemorative Integrity Statement. • Report about what activities take place on the site (including research) – and how it is being funded. • Any reports generated by outside -

Appendix a Consultation Record

APPENDIX A CONSULTATION RECORD MEETING REPORT Date: July 14, 2014 Project: O-Train Extension EA Date of meeting: June 26, 2014 Project Number: 3414015-000 Location: Honeywell Room, Author: E. Sangster Ottawa City Hall Purpose: Transit Design and Operations Workshop Attendees: Initial E-Mail Steven Boyle, City of Ottawa SB [email protected] Alex Carr, City of Ottawa AC [email protected] Vivi Chi, City of Ottawa VC [email protected] Dennis Gratton, City of Ottawa DG [email protected] Frank McKinney, City of Ottawa FM [email protected] Kornel Mucsi, City of Ottawa KM [email protected] Pat Scrimgeour, City of Ottawa PSC [email protected] Colin Simpson, City of Ottawa CS [email protected] Derek Washnuk, City of Ottawa DW [email protected] Yvon Larochelle, OMCIAA YL [email protected] Alex Stecky-Efantis, OMCIAA AS [email protected] Paul Croft, Parsons Corporation PC [email protected] David Hopper, Parsons Corporation DH [email protected] Scott Bowers, MMM Group SB [email protected] Tim Dickinson, MMM Group TD [email protected] Paul Nimigon, MMM Group PN [email protected] Emily Sangster, MMM Group ES [email protected] Peter Steacy, MMM Group PST [email protected] DISTRIBUTION: All Attendees Item Details Action By 1. Introductions CS and PST provided an introduction to the study team, objectives, process and rationale. 2. Operational Considerations DH provided an overview of the existing OC Transpo network, which the O-Train extension will support. Transit network planning principles to be considered as part of this study include coverage, capacity, reliability, and legibility. -

Four Privatized P3 Ontario Hospital Projects

Backgrounder ______________________________________________________________________________ Four Privatized P3 Ontario Hospital Projects Royal Ottawa Mental Health Centre The P3 Royal Ottawa Mental Health Centre opened October 27, 2006. With the Brampton Civic Hospital, the Royal Ottawa was the first hospital in Ontario to be designed, built, financed and maintained by the private sector. The hospital was originally designed to hold 284 beds at a cost of $95 million. It opened two years later as a 188 bed hospital costing $146 million -- $51 million over the original target budget and significantly smaller than planned. The hospital CEO has said that the Royal Ottawa has to pay $1,090,259 monthly over 248 months (22 years and 8 months) at an interest rate of 6.33 per cent. (See attached Ottawa Citizen story, January 26, 2009.) OPSEU has released two reports on the P3 indicating that the problems encountered in the new P3 exceed a tolerable level of errors and omissions, inconvenience and risk. Problems have had a serious impact on operating efficiency. The hospital CEO claimed that most of the "teething" problems had nothing to do with the P3 arrangement for financing the project. Nevertheless he also states: "When I got here, we had 54 major deficiencies that needed to be fixed and all I've been doing is fixing things and making sure the place runs well". There have been many calls for a review of the project by the auditor general in light of revelations by the auditor concerning the Brampton P3 hospital, but they have been resisted by the hospital. (See attached January 26 Citizen story.) North Bay Regional Health Centre The Request for Proposals (RFP) for the North Bay Regional Health Centre was released March 3 2006. -

December 2020

December 2020 The art of accessibility When it opens in 2028, every day, thousands of and to strive for “universal accessibility,” a design patients, staff and visitors will come to The Ottawa approach that assumes people will come to the Hospital’s new Civic hospital campus. When new hospital with a range of abilities, which need to they arrive, clear, intuitive wayfinding will make it be accommodated in a wide range of accessible easy to move through the buildings. Patients will building features and equipment to be used by communicate with families, friends, even their everyone. clinical teams, through smart television sets in their The latest advances in accessibility technology rooms. Accessible washrooms, clinical areas, public will be applied to the new hospital, including new- spaces, and staff areas will be welcoming and age communication devices that accommodate comfortable for everyone, for people of all abilities. persons with hearing loss, speech and “By ensuring that the space is designed to meet communication disabilities. Each patient room will the needs of all people, we can improve the have a Smart television that will facilitate video relay experience of staying, visiting or working at the services, medical charting, and even sign language new hospital, and remove unnecessary stress,” interpretation. said Marnie Peters, Accessibility expert on the GBA Project Advisory Team for the new Civic development. “No matter someone’s age, abilities or body size, we have to be able to accommodate them,” added Peters, a world-renowned expert in creating accessible spaces, and a former gold medalist in the Sydney Paralympics for wheelchair basketball. -

Parc Laroche Park

Parc Laroche Park Laroche Park - Renewal Project - 25 July 2018 Parc Laroche - projet de renouvellement - 25 juillet 2018 Laroche Park Mechanicsville Community Ottawa Park Renewal Project Presentation July 25th, 2018 City of Ottawa Recreation, Culture and Facilities Services Parks and Facilities Planning Laroche Park - Renewal Project - 25 July 2018 Parc Laroche - projet de renouvellement - 25 juillet 2018 Welcome and introduction Project team Background Opportunities Environmental Risk Management Plan Previous Investigations Recent Investigations Recommendations Park Master Plan Contextual Plan Existing Site Existing Constraints Park Amenities Project scope and Design Option 1/ Option 1 and existing Option 2/ Option 2 and existing Community Building Concepts Program Breakdown Option 1 Option 2 Process and Community Consultation Laroche Park - Heart of the Mechanicsville Community Q & A Laroche Park - Renewal Project - 25 July 2018 Parc Laroche - projet de renouvellement - 25 juillet 2018 Project team City of Ottawa Parks and Facilities Planning - Recreation, Culture and Facilities Services Infrastructure Services - Landscape Architecture, Architecture, Engineering Planning and Infrastructure Services and Economic Development Environmental Remediation Unit - Corporate Services Planning Approvals - Planning and Infrastructure Services and Economic Development Asset Management /Forestry Management Branch/Parks and Grounds Public Works and Environmental Services Ward Councillor External Consulting team Ruhland Landscape Architecture and Associates,