Washington Post Media Each Week

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hunt Cover C 5/2/08 2:43 PM Page 1

Hunt cover C 5/2/08 2:43 PM Page 1 Want towin a week in paradise? Want tohave some good,crazy fun? Joinus today,May18,at noon downtown for an adventure you’ll never forget. TWPMFor details,turn toPage16. MAY 18,2008 Magazine Template 4/28/08 12:38 PM Page 1 -BTU%BZT -FBUIFSEBZT .BZUIUI EBZTPGWFSZBUUSBDUJWFQSJDFT UPEJTDPWFS3PDIF#PCPJTiTBWPJSGBJSFw 8"4)*/(50/ 8JTDPOTJO "WFOVF /8 8BTIJOHUPO %$ 5FM 4"-& )0634 .PO4BU BN QN 0QFO 4VO .BZ UI UI GSPN /PPO QN XXXSPDIFCPCPJTDPN /PU UP CF VTFE JO DPOKVODUJPO XJUI BOZ PUIFS QSPNPUJPOBM PGGFS BOE EPFT OPU BQQMZ UP QSJPS PSEFST 5_18 contents 5/2/08 3:58 PM Page 1 May18, 2008CONTENTS (1) Read the instructions on Page 16. (2) Join us before noon downtown. (3) Solve the Post Hunt Puzzles before anyone else. 10 (4) Spend an expense-paid vacation for four in this little corner of paradise. STORY ON PAGE 16 FIRST THINGS FIRST 2 Editor’s Note 2 Cul de Sac 4 Second Glance 6 Date Lab 8 Then & Again 10 Making It 11 Editor’s Query 12 First Person Singular 14 Dilbert 34 DEPARTMENTS 44 Dining Thai Ki and Ping by Charlie Chiang’s 16 BY TOM SIETSEMA COVER STORY After winning the Hunt, 46 The Puzzle you’ll need five nights ‘It’s Not What It Looks Like’ 16 at a Florida resort. BY MERL REAGLE GO! 47 Significant Others BY DAVE BARRY, GENE WEINGARTEN AND TOM SHRODER Home Invasion BY JEANNE MARIE LASKAS Join the first-ever Post Hunt, and spend an adventure-filled afternoon that you’ll 48 Below the Beltway Teddy Stole need years of therapy to forget. -

Periodicalspov.Pdf

“Consider the Source” A Resource Guide to Liberal, Conservative and Nonpartisan Periodicals 30 East Lake Street ∙ Chicago, IL 60601 HWC Library – Room 501 312.553.5760 ver heard the saying “consider the source” in response to something that was questioned? Well, the same advice applies to what you read – consider the source. When conducting research, bear in mind that periodicals (journals, magazines, newspapers) may have varying points-of-view, biases, and/or E political leanings. Here are some questions to ask when considering using a periodical source: Is there a bias in the publication or is it non-partisan? Who is the sponsor (publisher or benefactor) of the publication? What is the agenda of the sponsor – to simply share information or to influence social or political change? Some publications have specific political perspectives and outright state what they are, as in Dissent Magazine (self-described as “a magazine of the left”) or National Review’s boost of, “we give you the right view and back it up.” Still, there are other publications that do not clearly state their political leanings; but over time have been deemed as left- or right-leaning based on such factors as the points- of-view of their opinion columnists, the make-up of their editorial staff, and/or their endorsements of politicians. Many newspapers fall into this rather opaque category. A good rule of thumb to use in determining whether a publication is liberal or conservative has been provided by Media Research Center’s L. Brent Bozell III: “if the paper never met a conservative cause it didn’t like, it’s conservative, and if it never met a liberal cause it didn’t like, it’s liberal.” Outlined in the following pages is an annotated listing of publications that have been categorized as conservative, liberal, non-partisan and religious. -

Donald Trump Division and Union EPISODE TRANSCRIPT

Donald Trump Division and union EPISODE TRANSCRIPT Listen to Presidential at http://wapo.st/presidential This transcript was run through an automated transcription service and then lightly edited for clarity. There may be typos or small discrepancies from the podcast audio. LILLIAN CUNNINGHAM: Nearly a year ago, I started a journey back in time through the American presidency. I left the newsroom and drove down along the dark Potomac River to Mount Vernon, George Washington's home, on a cold winter night. There were crackling fires and reanactors. What I didn't mention back in that very first episode, though, was that there was also pop music piped in over the stereo system, making it really hard to record those little fire sounds. This whole project has kind of been that way. Things haven't gone as planned -- tape recorders have broken, Lyndon Johnson experts have fallen sick with laryngitis right before interviews. But even more than those unexpected twists and turns, is that the present has shown up over and over and over in the past. Fast forward 44 weeks to last night -- election night. And suddenly, all I could see was the past poking its way into the present. I watched the results roll in on the newsroom screens until early into the morning. And I thought about all the elections that have come before. George H.W. Bush sitting alone in his hotel room, mourning his loss to Bill Clinton in 1992. The Chicago Tribune going to press with the wrong headline about Dewey defeating Truman in 1948. -

THE EFFECTS of FACT-CHECKING THREAT Results from a Field Experiment in the States

NEW AMERICA FOUNDATION Research Paper THE EFFECTS OF FACT-CHECKING THREAT Results from a field experiment in the states Brendan Nyhan and Jason Reifler* October 2013 Executive summary Politicians in the United States are coming under increasing scrutiny from fact-checkers like PolitiFact, Factcheck.org, and the Washington Post Fact Checker, who examine the accuracy of public statements that are often reported without challenge by traditional news organizations. However, we know little about the effects of this practice, especially on public officials. One possibility is that fact-checking might help to deter the dissemination of misinformation, especially for candidates and legislators at lower levels of government who receive relatively little scrutiny and are sensitive to potential threats to re-election. To test this hypothesis, we conducted a field experiment during the 2012 campaign evaluating the effects of reminding state legislators about the electoral and reputational threat posed by fact-checking. Our experimental sample consisted of nearly 1200 legislators in nine states with state PolitiFact affiliates. We found that legislators who were sent reminders that they are vulnerable to fact-checking were less likely to receive a negative PolitiFact rating or have the accuracy of their statements questioned publicly than legislators who were not sent reminders. These results suggest that the electoral and reputational threat posed by fact-checking can affect the behavior of elected officials. In this way, fact-checking could play an important role in improving political discourse and strengthening democratic accountability. * Brendan Nyhan ([email protected]) is an Assistant Professor in the Department of Government at Dartmouth College. -

The Pulitzer Prizes 2020 Winne

WINNERS AND FINALISTS 1917 TO PRESENT TABLE OF CONTENTS Excerpts from the Plan of Award ..............................................................2 PULITZER PRIZES IN JOURNALISM Public Service ...........................................................................................6 Reporting ...............................................................................................24 Local Reporting .....................................................................................27 Local Reporting, Edition Time ..............................................................32 Local General or Spot News Reporting ..................................................33 General News Reporting ........................................................................36 Spot News Reporting ............................................................................38 Breaking News Reporting .....................................................................39 Local Reporting, No Edition Time .......................................................45 Local Investigative or Specialized Reporting .........................................47 Investigative Reporting ..........................................................................50 Explanatory Journalism .........................................................................61 Explanatory Reporting ...........................................................................64 Specialized Reporting .............................................................................70 -

ROADTRIP Jeffersonian Thanksgiving Festival

SOURCE 11-21-04 DC EE M10 CMYK Sunday, November The Washington Post M10 21, 2004 x ROADTRIP Tipsheet WHAT’S ON SALE WHEN Jeffersonian Thanksgiving Festival Everyone knows that the day after Thanksgiving offers some of the biggest bargains of the year, as stores slash prices in an effort to draw early holiday shoppers. But the obnoxious crowds and never-ending lines can be daunting for even the most dedicated bargain-hunter. Want the savings without the stress? Hold out instead for seasonal sales, when items are marked down for a number of reasons: Bathing suits are moved out to make room for fall sweaters, air conditioners are discounted to lure customers in balmy springtime, or cell phones go for a song simply because salespeople are desperate to meet their quotas. It’ll take a little planning, but the money you save will make it well worth your while. Here’s a month-by- month guide to help you on your way. — Sara Cardace NOV DEC JAN Blankets and quilts; Cell phones (thanks Calendars for off-season real to holiday the new year, estate promos), end- holiday of-season decorations, women’s linens, shoes and televisions clothing, WHERE: Charlottesville, Va. baby furniture WHY: Quilts, aboriginal art and a jaunt back in time. HOW FAR: About 115 miles, or 2 hours from the District. FEB MAR APR Furs, Air conditioners, Carpets and If you’ve ever wanted to rub elbows with the likes of bedroom frozen foods rugs, garden Thomas Jefferson or James Madison, now’s your chance: furniture, (March is tools, get-ready- This week, downtown Charlottesville turns back the clock sofas, Frozen Foods for-summer to the days of the American Revolution at the 11th annual winter Month!), house- Jeffersonian Thanksgiving Festival. -

Newspapers Round a Bend

Reprinted from the November/December 2013 issue of The Financial Manager magazine Newspapers Round a Bend Big bets by Jeffrey Bezos and John Henry, along with recent moves by Warren Buffett, suggest that new views are developing about print media’s worth. The second in a series of four articles on media valuations. By JOHN S. SANDERS ew aNalysts were sur- mature segment: newspapers. Over the past broken in 2013 with a number of large-mar- prised by the surge in merger 12 months the newspaper sector has become ket acquisitions. The activity reflects a new and acquisition activity that is even more vibrant and has turned some type of buyer and likely offers a window into taking place in sectors like tele- important corners. Purchase-price cash flow the future of the newspaper industry. vision and telecommunications multiples have strengthened; newspapers are A number of questions beg to be asked. this year. The combination of a being acquired in larger markets again, and Why does the pace of small-to-medium Fstrengthening economy, record-low lending some of the best minds in the business world market newspaper acquisitions continue rates and improved financial markets sup- are diversifying into daily newspapers. unabated? Why have we seen an increase in ported landmark transactions like Gannett A year ago, the prevailing logic was that large-market acquisitions, as exemplified by Co.’s $2.2 billion acquisition of Belo Corp.’s large-market papers were permanently dis- Jeff Bezos’ acquisition of the The Washington television stations and Verizon’s recently tressed and offered diminishing economic Post and John Henry’s acquisition of the The announced purchase of Vodafone’s stake in potential, primarily because the markets they Boston Globe? And yet in the midst of this Verizon Wireless for $130 billion. -

U.S. Media Reporting of Sea Level Rise & Climate Change

U.S. media reporting of sea level rise & climate change Coverage in national and local newspapers, 2001-2015 Akerlof, K. (2016). U.S. media coverage of sea level rise and climate change: Coverage in national and local newspapers, 2001-2015. Fairfax, VA: Center for Climate Change Communication, George Mason University. The cover image of Miami is courtesy of NOAA National Ocean Service Image Gallery. Summary In recent years, public opinion surveys have demonstrated that people in some vulnerable U.S. coastal states are less certain that sea levels are rising than that climate change is occurring.1 This finding surprised us. People learn about risks in part through physical experience. As high tide levels shift ever upwards, they leave their mark upon shorelines, property, and infrastructure. Moreover, sea level rise has long been tied to climate change discourses.2 But awareness of threats can also be attenuated or amplified as issues are communicated across society. Thus, we turned our attention to the news media to see how much reporting on sea level rise has occurred in comparison to climate change from 2001-2015 in four of the largest and most prestigious U.S. newspapers—The Washington Post, The New York Times, Los Angeles Times, and The Wall Street Journal—and four local newspapers in areas of high sea level rise risk: The Miami Herald, Norfolk/Virginia Beach’s The Virginian-Pilot, Jacksonville’s The Florida Times-Union, and The Tampa Tribune.3,4 We find that media coverage of sea level rise compared to climate change is low, even in some of the most affected cities in the U.S., and co-occurs in the same discourses. -

How Distorted Districts Lead to Distorted Laws by Liz Kennedy and Billy Corriher October 2, 2017

RHODE ISLAND: How Distorted Districts Lead to Distorted Laws By Liz Kennedy and Billy Corriher October 2, 2017 The principle of “one person, one vote” requires states to redraw their election districts every 10 years in order to account for changes in population.1 In most states, legislators can manipulate district boundaries to benefit their own political party.2 This manipula- tion, called gerrymandering, weakens voters’ ability to affect election outcomes and exercise accountability over government. Distorted election districts lead to skewed representation and legislators who are less responsive to the will of the voters. In Rhode Island, the Legislature draws districts after receiving recommendations from an 18-member commission for which the vast majority of members are appointed by the majority leaders in both houses of the state’s Legislature.3 Though Gov. Lincoln Chafee was an independent, Democrats controlled both houses during the 2010 redistricting cycle.4 In the 2016 election, Republicans won 35 percent of the aggregate General Assembly vote but came away with only 13 percent of seats.5 Democratic legislators in the other states discussed in a recent Center for American Progress report6 supported increases in the minimum wage or opposed bans on local increases, however, the Democratic Legislature in Rhode Island pre-empted a Providence ordinance raising the minimum wage to $15 an hour for hotel workers.7 One Democratic legislator said, “It’s more important it be on the state and not every city and county having their own minimum -

AJR Retreating from the World.Pdf

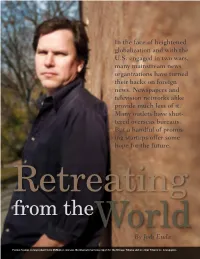

In the face of heightened globalization and with the U.S. engaged in two wars, many mainstream news organizations have turned their backs on foreign news. Newspapers and television networks alike provide much less of it. Many outlets have shut- tered overseas bureaus. But a handful of promis- ing startups offer some hope for the future. Retreating from theWorld By Jodi Enda tori soper Former foreign correspondent Colin McMahon oversees the international news report for the Chicago Tribune and six other Tribune Co. newspapers. This arTiCle was Funded by a granT FroM The open soCieTy insTiTuTe. uring more than two decades at the Chicago to describe a modern, industrialized, assembly line approach to DTribune, Colin McMahon reported from bureaus in Mexico foreign (and sometimes national) news. And while the chain’s City, Moscow, Baghdad and Buenos Aires. He served as foreign particular method of providing identical pages for a variety of editor, directing a cadre of correspondents as they covered the papers might not be the national norm, its pared-down vision invasion of Iraq, the war in Afghanistan, the Palestinian upris- of foreign reporting is. ing. He was dispatched to Jerusalem for six months. It was Eighteen newspapers and two chains have shuttered every a heady life of globe-trotting that not only allowed him to be one of their overseas bureaus in the dozen years since AJR a witness to history, but to bring stories from the far corners first surveyed foreign coverage for the Project on the State of of the globe home to readers in America’s third-largest city, the American Newspaper (see “Goodbye, World,” November readers who live in Chicago’s distinctively ethnic neighbor- 1998). -

How Archives Make News James Boylan

HOW ARCHIVES MAKE NEWS JAMES BOYLAN ABSTRACT The author analyzed the "image" of archives and archivists in 300 news clippings dated from 1981 to 1984. Three types of stories were found: (1) those in which archives and archivists played a secondary role, (2) those in which they appeared in an arranged "pseudo-event," and (3) those in which they were portrayed substantively. In the last group, few stories discussed seri- ous issues; instead, they employed metaphors of accumulation and rot. Such treatment may reflect the political weakness of archivists. The article concludes that archivists should try to provide full, honest information to journalists, to create pseudo-events of legitimate interest, and to encourage stories on archival policies and social roles. In 1983, the president of the Society of American Archivists, David B. Gracy II, declared that the focus - or the chief worry - of his time in office would be "the image and stereotype that non-archivists have of the archivist and archival." He painted a dismaying portrait of "the image of the archivist in the public mind": Some think it is an image of shabby grandeur. Others think it is an im- age of an unessential person. Still others think there is no image at all ....But no archivist with whom I have talked is satisfied, or even com- fortable, with the general image or stereotype carried by the public at large ....Indeed, our weak image is so pervasive that we can disregard it no longer. This issue is important, he suggested, not so much as a matter of self-esteem as of necessity, for the public and public officials will not indefinitely support an enterprise and a profession that they find dispensable.' The business of polishing one's image is far from simple, as Daniel J. -

Motion to Dismiss and in Opposition to the United States’ Emergency Application for Temporary Restraining Order and Motion for Preliminary Injunction

Case 1:20-cv-01580-RCL Document 9 Filed 06/18/20 Page 1 of 54 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA THE UNITED STATES OF AMERICA, Plaintiff, Civil Action No. 20-1580-RCL v. JOHN R. BOLTON, Defendant. DEFENDANT’S COMBINED MEMORANDUM IN SUPPORT OF HIS MOTION TO DISMISS AND IN OPPOSITION TO THE UNITED STATES’ EMERGENCY APPLICATION FOR TEMPORARY RESTRAINING ORDER AND MOTION FOR PRELIMINARY INJUNCTION June 18, 2020 Charles J. Cooper, Bar No. 248070 Michael W. Kirk, Bar No. 424648 COOPER & KIRK, PLLC 1523 New Hampshire Avenue, NW Washington, DC 20036 Telephone: (202) 220-9600 Facsimile: (202) 220-9601 Email: [email protected] Counsel for Defendant John R. Bolton Case 1:20-cv-01580-RCL Document 9 Filed 06/18/20 Page 2 of 54 TABLE OF CONTENTS Page TABLE OF AUTHORITIES .......................................................................................................... ii INTRODUCTION ...........................................................................................................................1 STATEMENT ..................................................................................................................................4 ARGUMENT .................................................................................................................................20 MOTION TO DISMISS UNDER RULE 12(b)(6) ........................................................................20 OPPOSITION TO APPLICATION FOR TEMPORARY RESTRAINTING ORDER AND MOTION FOR PRELIMINARY INJUNCTION ................................................................28