DPS 2015 Annual Report Highlights Final Long.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Keurig Dr Pepper Relocating Texas Headquarters to Frisco New Dual Headquarters Location Will Provide a Vibrant, Collaborative and Connected Workplace

FOR IMMEDIATE RELEASE February 21, 2019 MEDIA CONTACTS Keurig Dr Pepper: Frisco EDC: Dallas Cowboys Football Club: Katie Gilroy, 617-820-8971 Leigh Lyons, 972-292-5155 Joe Trahan, 972-497-4552 [email protected] [email protected] [email protected] Keurig Dr Pepper Relocating Texas Headquarters to Frisco New dual headquarters location will provide a vibrant, collaborative and connected workplace PLANO, Texas and BURLINGTON, Mass. – Keurig Dr Pepper (NYSE: KDP) today announced that the company will move its Texas headquarters from Plano to a new, 350,000 sq. ft. build-to-suit, leased facility at The Star in Frisco, Texas. The new location will be ready in 2021 and serve as one of the company’s two headquarters, with the other located in Burlington, Massachusetts. “We are excited to upgrade our Texas co-headquarters location to support the needs of our vibrant business, including enhanced technology capabilities and space to increase collaboration,” said Bob Gamgort, Chairman and CEO of Keurig Dr Pepper. “The new location at The Star in Frisco will provide a state-of the-art work environment and exciting amenities that will energize our employees and enable us to attract top talent in the area.“ The announcement follows a vote by the Frisco Economic Development Corporation Board of Directors approving an incentive package tied to certain performance criteria. Approximately 1,100 employees work in the company’s current location in Plano, which it has occupied since 1998. “This is an exciting day for the City of Frisco,” said Frisco Mayor Jeff Cheney. “Having this Fortune 500 company located in Frisco will continue to strengthen the city’s position as one of the top corporate relocation destinations in the United States. -

Allergen Information | All Soft Drinks & Minerals

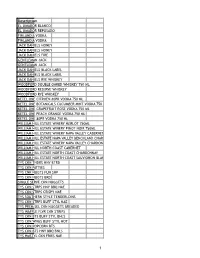

ALLERGEN INFORMATION | ALL SOFT DRINKS & MINERALS **THIS INFORMATION HAS BEEN RECORDED AND LISTED ON SUPPLIER ADVICE** DAYLA WILL ACCEPT NO RESPONSIBILITY FOR INACCURATE INFORMATION RECEIVED Cereals containing GLUTEN Nuts Product Description Type Pack ABV % Size Wheat Rye Barley Oats Spelt Kamut Almonds Hazelnut Walnut Cashews Pecan Brazil Pistaccio Macadamia Egg Crustacean Lupin Sulphites >10ppm Celery Peanuts Milk Fish Soya Beans Mollusc Mustard Sesame Seeds Appletiser 24x275ml Case Minerals Case 0 275ml BG Cox's Apple Sprkl 12x275ml Minerals Case 0 275ml BG Cranberry&Orange Sprkl 12x275ml Minerals Case 0 275ml BG E'flower CorDial 6x500ml Minerals Case 0 500ml BG E'flower Sprkl 12x275ml Minerals Case 0 275ml BG Ginger&Lemongrass Sprkl 12x275ml Minerals Case 0 275ml BG Ginger&Lemongrass Sprkl SW 12X275ml Minerals Case 0 275ml BG Pomegranate&E'flower Sprkl 12X275ml Minerals Case 0 275ml BG Strawberry CorDial 6x500ml Minerals Case 0 500ml Big Tom Rich & Spicy Minerals Case 0 250ml √ Bottlegreen Cox's Apple Presse 275ml NRB Minerals Case 0 275ml Bottlegreen ElDerflower Presse 275ml NRB Minerals Case 0 275ml Britvic 100 Apple 24x250ml Case Minerals Case 0 250ml Britvic 100 Orange 24x250ml Case Minerals Case 0 250ml Britvic 55 Apple 24x275ml Case Minerals Case 0 275ml Britvic 55 Orange 24x275ml Case Minerals Case 0 275ml Britvic Bitter Lemon 24x125ml Case Minerals Case 0 125ml Britvic Blackcurrant CorDial 12x1l Case Minerals Case 0 1l Britvic Cranberry Juice 24x160ml Case Minerals Case 0 160ml Britvic Ginger Ale 24x125ml Case Minerals Case -

CPY Document

THE COCA-COLA COMPANY 795 795 Complaint IN THE MA TIER OF THE COCA-COLA COMPANY FINAL ORDER, OPINION, ETC., IN REGARD TO ALLEGED VIOLATION OF SEC. 7 OF THE CLAYTON ACT AND SEC. 5 OF THE FEDERAL TRADE COMMISSION ACT Docket 9207. Complaint, July 15, 1986--Final Order, June 13, 1994 This final order requires Coca-Cola, for ten years, to obtain Commission approval before acquiring any part of the stock or interest in any company that manufactures or sells branded concentrate, syrup, or carbonated soft drinks in the United States. Appearances For the Commission: Joseph S. Brownman, Ronald Rowe, Mary Lou Steptoe and Steven J. Rurka. For the respondent: Gordon Spivack and Wendy Addiss, Coudert Brothers, New York, N.Y. 798 FEDERAL TRADE COMMISSION DECISIONS Initial Decision 117F.T.C. INITIAL DECISION BY LEWIS F. PARKER, ADMINISTRATIVE LAW JUDGE NOVEMBER 30, 1990 I. INTRODUCTION The Commission's complaint in this case issued on July 15, 1986 and it charged that The Coca-Cola Company ("Coca-Cola") had entered into an agreement to purchase 100 percent of the issued and outstanding shares of the capital stock of DP Holdings, Inc. ("DP Holdings") which, in tum, owned all of the shares of capital stock of Dr Pepper Company ("Dr Pepper"). The complaint alleged that Coca-Cola and Dr Pepper were direct competitors in the carbonated soft drink industry and that the effect of the acquisition, if consummated, may be substantially to lessen competition in relevant product markets in relevant sections of the country in violation of Section 7 of the Clayton Act, as amended, 15 U.S.C. -

Phoenix Open 2019 Safeway Promotion

Description EL JIMADOR BLANCO EL JIMADOR REPOSADO FINLANDIA VODKA FINLANDIA VODKA JACK DANIELS HONEY JACK DANIELS HONEY JACK DANIELS FIRE GENTLEMAN JACK GENTLEMAN JACK JACK DANIELS BLACK LABEL JACK DANIELS BLACK LABEL JACK DANIELS RYE WHISKEY WOODFORD DOUBLE OAKED WHISKEY 750 ML WOODFORD RESERVE WHISKEY WOODFORD RYE WHISKEY KETEL ONE CITROEN 80PR VODKA 750 ML KETEL ONE BOTANICALS CUCUMBER MINT VODKA 750 ML KETEL ONE GRAPEFRUIT ROSE VODKA 750 ML KETEL ONE PEACH ORANGE VODKA 750 ML KETEL ONE 80PR VODKA 750 ML WILLIAM HILL ESTATE WINERY MERLOT 750ML WILLIAM HILL ESTATE WINERY PINOT NOIR 750ML WILLIAM HILL ESTATE WINERY NAPA VALLEY CABERNET 750ML WILLIAM HILL ESTATE NAPA VALLEY BENCHLAND CHARDONNAY WILLIAM HILL ESTATE WINERY NAPA VALLEY CHARDONNAY WILLIAM HILL NORTH COAST CABERNET WILLIAM HILL ESTATE NORTH COAST CHARDONNAY WILLIAM HILL ESTATE NORTH COAST SAUVIGNON BLANC TYS CKN TNDRS HNY BTRD TYS CKN PATTIES TYS CNK NUGTS FUN SHP TYS CKN NUGTS BRD SINGLE SERVE CKN NUGGETS TYS CKN STRPS HNY BBQ NAE TYS CKN STRPS CRISPY NAE TYS SOUTHERN STYLE TENDERLOINS TYS CKN STRPS BUFF STYL NAE TYS PREM SEL CKN NUGGETS BREADED TYS WAFFLE FLVR CKN STRIPS TYS CKN BTS BUFF STYL BNLS TYS CKN WNGS BUFF STYL HOT TYS CKN POPCORN BTS TYS CKN BTS HNY BBQ BNLS TYS HMSTYL CKN FRIES NAE !1 TYS ANY'TIZER PARTY TRAY TYS CKN BRST STRPS GRILLED NAE TYS GRILLED/RDY CKN BRST O/R DCD NAE TYS ANY'TIZERS BUFFALO CKN BITES TYS ANY'TIZERS POPCORN CHICKEN TYS 4.4lb Nuggets TYS CKN BRST B/S FRZN Q4 pricing TYS CKN TNDRLS Q4 pricing TYS CORNISH TWIN PK Q4 pricing SF CD BEEF 5CT SF -

Drinks That Eat Your Teeth

Drinks That Eat Your Teeth Drink Acid (pH) Sugar (tsp in 12oz) Caffeine (grams) Calories (in 12oz) Battery Acid 1.00 0 0 0 Stomach Acid 2.00 0 0 0 Lime Juice 2.00 0 0 1 Lemon Juice 2.20 0 0 12 Cranberry Juice 2.30 11 0 205 Gatorade-Clear 2.40 5.5 0 75 Sunny Delight 2.40 6.3 0 120 Vinegar 2.40 0 0 3 Pepsi 2.49 9.8 37 150 Lemonade (Country Time) 2.50 5.4 0 90 RC Cola 2.50 0 0 160 SoBo Tropical Sugarfree 2.50 0 0 0 Coke-Cherry 2.52 8.9 34 150 Coke-Classic 2.53 9.3 34 140 Capri Sun 2.60 5.5 0 200 SoBe Strawberry-Grape 2.60 6.5 0 60 Fruit Punch (Hi-C Blast) 2.70 5.5 0 150 Lemonade (Hi-C) 2.70 5.5 0 210 Orange Crush 2.70 10.5 0 240 Tang 2.70 5.1 0 180 Powerade 2.75 4 0 115 Coke-diet,Cherry 2.80 0 34 0 Grape Juice White (Welch's) 2.80 7.8 0 240 Mellow Yellow 2.80 10.1 51 177 Mr. Pibb 2.80 0 40 150 Orange Soda (Minute Maid) 2.80 11.2 0 180 Fruit Punch (Hawaiian) 2.82 10.2 0 120 Squirt 2.85 9.5 0 0 Tea-iced (Lipton Brisk) 2.87 7 9 50 7 up-Upside Down 2.90 6.3 0 200 Cranberry Juice-White 2.90 5.5 0 175 Dr Pepper 2.92 9.5 40 160 Gatorade 2.95 5.5 0 75 Tea-iced (Lemon sweetened Nestea) 2.97 9 16.6 90 Ginger Ale (Canada Dry) 3.00 8.25 0 120 Grape White (Diet Rite) 3.00 0 0 0 Grapefruit Juice 3.00 8.75 0 150 Kool-Aid Jammers-Cherry 3.00 5.1 0 160 Sierra Mist 3.00 5.5 0 140 Surge 3.02 10 51 170 Tea-Green (Nestea) 3.04 5 11-26 120 Pepsi One 3.05 0 36 1.5 Mountain Dew-diet, Code Red 3.10 0 0 0 Pepsi-Wild Cherry 3.10 5.7 0 240 V8 Splash-Berry Blend 3.10 5.5 0 105 Vinegar, cider 3.10 0 0 0 Fresca 3.20 0 0 0 Orange Strawberry Banana (Dole) 3.20 6.3 0 180 Propel 3.20 0.4 0 0 Tea-iced (Snapple) 3.20 7.6 31.5 120 Tea-iced (Diet Snapple ) 3.20 0 0 0 Jim Muenzenberger, D.D.S. -

Keurig Dr Pepper to Gain Sales and Distribution of Key Brands in New

Media | Keurig Dr Pepper Keurig Dr Pepper to Gain Sales and Distribution of Key Brands in New York and New Jersey, Following Agreement with The Honickman Companies Brands including Canada Dry, Sunkist soda, 7UP and A&W Root Beer in 18 counties move into KDP's direct-store-delivery and independent operator network BURLINGTON, Mass., and PLANO, Texas, and PENNSAUKEN, N.J., Oct. 28, 2020 /PRNewswire/ - - Keurig Dr Pepper (NASDAQ: KDP) and The Honickman Companies jointly announced today an agreement that allows KDP to sell and distribute key KDP brands in 18 counties serving 17 million people in New York and New Jersey. These brands include Canada Dry, Sunkist soda, 7UP and A&W Root Beer, among others, and will approximately double the volume carried by KDP in the area. KDP's company-owned direct-store-delivery (DSD) operations and its existing independent operators in the area will add the brands to their current lineup, which includes Snapple, Bai, CORE Hydration and Vita Coco. The Honickman Companies, through their various entities, remain KDP's largest independent bottling partner. KDP President, Cold Beverages Derek Hopkins stated, "We are thrilled to add these KDP powerhouse brands -- led by Canada Dry -- to our sales and distribution footprint in the Northeast, increasing our scale and strengthening our partnership with our retail customers. Our DSD teams and independent operators have a proven track record of delivering results and we're bullish about the future opportunities this transaction provides. The Honickman Companies are long-term and strategic partners who have cared for and built these brands for many years. -

Table of Beverage Acidity (Ph Values Are Excerpted from Research Published in the Journal of the Americal Dental Association, 2016

Table of Beverage Acidity (pH values are excerpted from research published in the Journal of the Americal Dental Association, 2016. Other research sources may give slightly different pH values but erosiveness categories are similar.) Sodas Extremely Erosive pH below 3.0 7UP Cherry 2.98 Canada Dry Ginger Ale 2.82 Coco-Cola Caffeine Free 2.34 Coca-Cola Cherry 2.38 Coca-Cola Classic 2.37 Coco-Cola Zero 2.96 Dr. Pepper 2.88 Hawaiian Punch 2.87 Pepsi 2.39 Pepsi Max 2.39 Pepsi Wild Cherry 2.41 Schweppes Tonic Water 2.54 Erosive pH 3.0-4.0 7UP 3.24 Diet 7UP 3.48 Diet Coke 3.10 Dr. Pepper Cherry 3.06 Dr Pepper Diet 3.20 Mountain Dew 3.22 Mountain Dew Diet 3.18 Diet Pepsi 3.02 Sierra Mist Diet 3.31 Sierra Mist 3.09 Sprite 3.24 Sprite Zero 3.14 Minimally Erosive pH above 4.0 A&W Root Beer 4.27 A&W Root Beer Diet 4.57 Barq's Root Beer 4.11 Canada Dry Club Soda 5.24 Energy Drinks Extremely Erosive pH below 3.0 5-Hour Energy Extra Strength 2.82 5-Hour Energy Lemon-Lime 2.81 Jolt Power Cola 2.47 Rockstar Energy Drink 2.74 Rockstar Recovery 2.84 Erosive pH 3.0-4.0 Fuel Energy Shots Lemon-Lime 3.97 Fuel Energy Shots Orange 3.44 Jolt Ultra Sugar Free 3.14 Monster Energy 3.48 Monster Hitman Energy Shot 3.44 Monster Low Carb 3.60 Redbul Regular 3.43 Redbull Shot 3.25 Redbull Sugar Free 3.39 Rockstar Energy Cola 3.14 Rockstar Sugar Free 3.15 Waters and Sports Drinks Extremely Erosive pH below 3.0 Gatorade Frost Riptide Rush 2.98 Gatorade Lemon Lime 2.97 Gatorade Orange 2.99 Powerade Lemon Lime 2.75 Powerade Orange 2.75 Powerade Zero Lemon Lime 2.92 Powerade -

View These Patents As Valuable Assets but We Do Not View Any Single Patent As Critical to Our Success

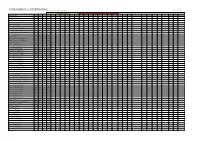

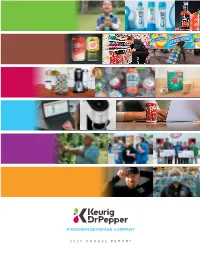

KEURIG DR PEPPER DR KEURIG 2020 ANNUAL REPORT ANNUAL 2020 A MODERN BEVERAGE COMPANY 2020 ANNUAL REPORT FINANCIAL HIGHLIGHTS All Information is presented on an Adjusted basis* 2018–2020 All amounts are in millions except Earnings Per Share 2019–2020 2018 Two-Year Twelve months ended December 31 2020 2019 Change Pro Forma Avg. Change Net Sales $11,618 $11,120 4.5% $11,024 2.7% Constant Currency Net Sales Growth 5.0% 4.1% 1 Cost of Sales 5,092 4,792 6.3% 4,864 2.3% Selling, General and Administrative Expenses 3,374 3,483 -3.1% 3,556 -2.6% Other Operating (Income) Expense, Net (39) (45) NM (16) NM Income from Operations 3,191 2,890 10.4% 2,620 10.4% Constant Currency Income from Operations Growth 10.8% 10.7% % Net Sales 27.5% 26.0% 150 bps 23.8% 185 bps Interest Expense 542 553 -2.0% 635 -7.6% Other Income, Net 17 19 -10.5% 3 NM Income before Taxes 2,632 2,318 13.5% 1,982 15.2% Provision for Income Taxes 644 591 9.0% 524 10.9% Effective Tax Rate 24.5% 25.5% -100 bps 26.4% -100 bps Net Income 1,988 1,727 15.1% 1,458 16.8% Diluted Earnings Per Share $1.40 $1.22 14.8% $1.04 16.0% Diluted Shares 1,422 1,419 0.2% 1,401 0.7% * Please refer to the Form 10-K, included with this report, for reconciliations from GAAP to Adjusted results 1 Reflects underlying net sales growth 2018–2019 KDP Management Leverage Ratio* 2020 Net Sales by Segment in billions 12/31/20 3.6X 12/31/19 4.5X 2.4X 12/31/18 5.4X $0.5 7/9/18 6.0X $1.3 *See Management Leverage Ratio reconciliation and calculation on page 12 $4.4 Operating Cash Flow in billions 2020 $2.5 2019 $2.5 $5.4 2018 $1.6 Total Shareholder Return 150% 131% 2020 Net Sales 120% Constant Currency Growth 90% 84% Coffee Systems +4.8% 60% 54% Packaged Beverages +8.5% 30% 0% Beverage Concentrates -6.2% 2016 2017 2018 2019 2020 Latin America Beverages +3.8% KDP1 S&P 500 S&P 500 Food & Beverage Index 1Represents DPS through 7/9/2018 and KDP 7/10/2018 to 12/31/2020 Bob Gamgort Chairman and Chief Executive Officer DEAR SHAREHOLDERS As I write this letter, cautious optimism is in the air. -

Beverage Listing

STAR-K KOSHER CERTIFICATION MAY 2017 BEVERAGE LISTING 7-UP CENTRAL GROCERS Golden Peach Diet Vanilla HIRES 7-UP when bearing CRC Key-Lime Lime Cream 7-UP All Natural Kiwi Strawberry Raspberry Root Beer 7-UP with Antioxidants CLUB SODA Mango Lime Tropical Remix Cherry Any Unflavored Mango Melon HONEST TEA Cranberry Passion Plum FRESCA when bearing OU Cranberry COCA COLA Pink Grapefruit Black Berry Citrus Green Freeze C2 Red Raspberry Original Citrus IBC Regular Caffeine Free Coca Cola Tangerine Peach Citrus Black Cherry Cherry Coke White Grape Cherry Limeade 7-UP PLUS Classic Coca Cola FULL THROTTLE Cream Soda Cherry with Antioxidant Coke DR. BROWN’S Blue Demon FCB Root Beer Island Fruit Coke Life Black Cherry Frozen Fury FCB Tangerine Creme Mixed Berry Coke Light Cel-Ray Night Pomegranate Coke Zero Cream RPM INCA COLA Coke with Lime Ginger Ale Sour Cherry FCB Approved when bottled in North A & W Vanilla Coke Orange Twisted America Cream Soda Root Beer Twisted FCB Root Beer CORNELL JEFF’S AMAZING NY EGG when bearing OU DR. PEPPER FUZE CREAM ADIRONDACK Cherry Beverages, Juice & Tea when when bearing OU-D, Dairy Non- when bearing OU COTT Cherry Vanilla bearing OU Cholov Yisroel Premium (when bearing OU) Pina Colada Regular AQUAFINA ALIVE Ten GATORADE JEWEL All Products COUNTRY DELIGHT Gatorade G1- Prime (when when bearing CRC when bearing CRC FANTA bearing OU) AQUAFINA FLAVOR SPLASH Apple Gatorade G2- Prime (when JOLT Grape COUNTRY TIME Banana bearing OU) Orange Burst Raspberry Country Time Light (Bottles & Banana Split* (when bearing Gatorade -

Case No. 17-Cv-00564 NC 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

Case 5:17-cv-00564-NC Document 87 Filed 09/22/17 Page 1 of 18 1 2 3 4 5 6 7 UNITED STATES DISTRICT COURT 8 NORTHERN DISTRICT OF CALIFORNIA 9 10 JACKIE FITZHENRY-RUSSELL, et al., Case No. 17-cv-00564 NC 11 Plaintiffs, ORDER DENYING DR. PEPPER’S 12 v. MOTION TO DISMISS FOR LACK OF PERSONAL JURISDICTION; 13 DR. PEPPER SNAPPLE GROUP, INC., ORDER DENYING DR. PEPPER’S et al., MOTION TO DISMISS FOR 14 FAILURE TO STATE A CLAIM Defendants. 15 Re: Dkt. No. 74 16 17 Not too long ago Jackie Fitzhenry-Russell and Robin Dale were Canada Dry Ginger United States District Court 18 Ale devotees. For instance, over the last several years, Fitzhenry-Russell bought Canada Northern District of California 19 Dry cases at a time. What was so special about Canada Dry that made Fitzhenry-Russell 20 buy it in bulk? According to her, it was her belief—based on Canada Dry’s extensive 21 advertising campaign—that the cans of ginger ale she was consuming contained actual 22 ginger root. “Contained” is the key word. According to plaintiffs’ complaint, “contained” 23 does not mean that the alleged chemical substance that gave Canada Dry its gingery flavor 24 was inspired by ginger root, or that someone engineered the substance while observing a 25 piece of ginger root from across a large auditorium. 26 The belief that Canada Dry contained ginger root was significant because, 27 according to both plaintiffs, a reason they bought Canada Dry was the well-known health 28 benefits of consuming ginger root. -

The Canada Dry Bottling Plant in Silver Spring

The Montgomery County Story Vol. 48, No.2 May 2005 The Canada Dry Bottling Plant in Silver Spring By Robin D. Ziek Since 1946, the Canada Dry Bottling Plant has been a familiarlandmark in Silver Spring. Today, as The JGB Companies incorporate it into a new residential development called "Silverton Condominium," the two-story curving portion of the Art Modeme industrial building can still be seen at the comer of Blair Mill Road and East West Highway. With the eponymous Silver Spring commemorated across the street in Acorn Park, and the B&O Railroad Station across the tracks, this comer illustrates Montgomery County history in a nutshell. Water, transportation, and industry were all important elements in the growth of Montgomery County, and, specifically, of Silver Spring. Tran~ortation was key, whether it be horse, trolley, or railroad. In the second quarter of the 20 Century new growth opportunities developed with increased sales of private automobiles, and with trucks for deliveries. By the 1930s, Silver Spring was firmly established as the premier suburban center of Montgomery County. As a new city, Silver Spring offered new homes, schools and shops. Community infra-structure included the local post office, the railroad station, fire and rescue services and a central meeting hall at the second (1927) Silver Spring Armory. National industries viewed this new suburban center as a growth opportunity, and the Canada Dry Bottling Plant illustrates a part of the story. Newly constructed Canada Dry Bottling Plant, Silver Spring, Maryland, ca. 1946. Construction was begun in 1945, and completed in 1946 for warehouse distribution. -

Bundaberg Ginger Beer, IZZE, Minute Maid Cherry Limeade Orig. & Light

The following beverages are NOT certified: Bundaberg Ginger Beer, IZZE, Minute Maid Cherry Limeade orig. & light, Dad’s Root Beer, Mike’s Hard Lemonade, Red Bull Cola, Snapple Fruit Punch, Monster Energy Drink, Kellogg’s Protein Water, Coke Products including Fanta bottled in Mexico, Hi-C Products in Cans, Bottles or Aseptic Packs. Additionally, this list is for fluid beverages only unless otherwise noted. There are many drink powders produced bearing commonly recognized names but are different formulations. Please Note: Reg. & diet are acceptable for any soda listed. This list is for soda produced and bottled in the USA only. 5- Hour Energy Drink - when bearing Star-K AHA - when bearing OU A&W - Cream Soda, Root Beer, Root Beer Ten, Root Beer w/ Aged Vanilla All Sport - when bearing OU America’s Choice - when bearing OU Aquafina (United States & Canada) Alive Enhance Water Sparkling - Black Cherry Dragonfruit, Lemon, Lemon Lime, Mango Pineapple, Orange Grapefruit, Peach Berry, Unsweetened Lemon, Unsweetened Lime, Unsweetened Raspberry, Unsweetened Strawberry, White Peach Apricot Arizona Iced Tea - when bearing OU Bai - when bearing OU Barq’s - French Vanilla Cream, Red Cream, Root Beer Ben & Jerry’s Milkshakes-when bearing KD (Dairy-non cholov yisroel) Cherry Garcia, Chocolate Fudge Brownie, Chunky Monkey Milkshake Big Red - Black Cherry, Blue, Cola, Lemon Lime, Orange, Peach, Pineapple, Red, Red Diet Caffeine free, Red Float, Root Beer Bubly Sparkling Water - Unsweetened Apple, Unsweetened Blackberry, Unsweetened Cherry, Unsweetened