In This Issue………

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

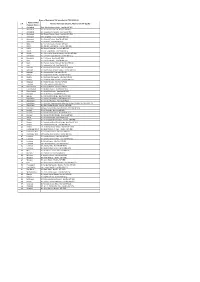

S N. Name of TAC/ Telecom District Name of Nominee [Sh./Smt./Ms

Name of Nominated TAC members for TAC (2020-22) Name of TAC/ S N. Name of Nominee [Sh./Smt./Ms] Hon’ble MP (LS/RS) Telecom District 1 Allahabad Prof. Rita Bahuguna Joshi, Hon’ble MP (LS) 2 Allahabad Smt. Keshari Devi Patel, Hon’ble MP (LS) 3 Allahabad Sh. Vinod Kumar Sonkar, Hon’ble MP (LS) 4 Allahabad Sh. Rewati Raman Singh, Hon’ble MP (RS) 5 Azamgarh Smt. Sangeeta Azad, Hon’ble MP (LS) 6 Azamgarh Sh. Akhilesh Yadav, Hon’ble MP (LS) 7 Azamgarh Sh. Rajaram, Hon’ble MP (RS) 8 Ballia Sh. Virendra Singh, Hon’ble MP (LS) 9 Ballia Sh. Sakaldeep Rajbhar, Hon’ble MP (RS) 10 Ballia Sh. Neeraj Shekhar, Hon’ble MP (RS) 11 Banda Sh. R.K. Singh Patel, Hon’ble MP (LS) 12 Banda Sh. Vishambhar Prasad Nishad, Hon’ble MP (RS) 13 Barabanki Sh. Upendra Singh Rawat, Hon’ble MP (LS) 14 Barabanki Sh. P.L. Punia, Hon’ble MP (RS) 15 Basti Sh. Harish Dwivedi, Hon’ble MP (LS) 16 Basti Sh. Praveen Kumar Nishad, Hon’ble MP (LS) 17 Basti Sh. Jagdambika Pal, Hon’ble MP (LS) 18 Behraich Sh. Ram Shiromani Verma, Hon’ble MP (LS) 19 Behraich Sh. Brijbhushan Sharan Singh, Hon’ble MP (LS) 20 Behraich Sh. Akshaibar Lal, Hon’ble MP (LS) 21 Deoria Sh. Vijay Kumar Dubey, Hon’ble MP (LS) 22 Deoria Sh. Ravindra Kushawaha, Hon’ble MP (LS) 23 Deoria Sh. Ramapati Ram Tripathi, Hon’ble MP (LS) 24 Faizabad Sh. Ritesh Pandey, Hon’ble MP (LS) 25 Faizabad Sh. Lallu Singh, Hon’ble MP (LS) 26 Farrukhabad Sh. -

Parliament of India R a J Y a S a B H a Committees

Com. Co-ord. Sec. PARLIAMENT OF INDIA R A J Y A S A B H A COMMITTEES OF RAJYA SABHA AND OTHER PARLIAMENTARY COMMITTEES AND BODIES ON WHICH RAJYA SABHA IS REPRESENTED (Corrected upto 4th September, 2020) RAJYA SABHA SECRETARIAT NEW DELHI (4th September, 2020) Website: http://www.rajyasabha.nic.in E-mail: [email protected] OFFICERS OF RAJYA SABHA CHAIRMAN Shri M. Venkaiah Naidu SECRETARY-GENERAL Shri Desh Deepak Verma PREFACE The publication aims at providing information on Members of Rajya Sabha serving on various Committees of Rajya Sabha, Department-related Parliamentary Standing Committees, Joint Committees and other Bodies as on 30th June, 2020. The names of Chairmen of the various Standing Committees and Department-related Parliamentary Standing Committees along with their local residential addresses and telephone numbers have also been shown at the beginning of the publication. The names of Members of the Lok Sabha serving on the Joint Committees on which Rajya Sabha is represented have also been included under the respective Committees for information. Change of nominations/elections of Members of Rajya Sabha in various Parliamentary Committees/Statutory Bodies is an ongoing process. As such, some information contained in the publication may undergo change by the time this is brought out. When new nominations/elections of Members to Committees/Statutory Bodies are made or changes in these take place, the same get updated in the Rajya Sabha website. The main purpose of this publication, however, is to serve as a primary source of information on Members representing various Committees and other Bodies on which Rajya Sabha is represented upto a particular period. -

Dual Edition

YEARS # 1 Indian American Weekly : Since 2006 VOL 15 ISSUE 20 ● NEW YORK / DALLAS ● MAY 14 - MAY 20, 2021 ● ENQUIRIES: 646-247-9458 ● [email protected] www.theindianpanorama.news 12 OPPOSITION LEADERS WRITE TO PM MODI, US lifts most mask DEMANDING FREE MASS VACCINATION, guidance in key step back SUSPENSION OF CENTRAL VISTA PROJECT to post - Covid normalcy Fully vaccinated Americans can ditch their masks in most settings, even indoors or in large groups. WASHINGTON (TIP): President Joe Biden took his biggest step yet toward declaring a victory over the coronavirus pandemic - as public health officials said fully vaccinated Americans can ditch their masks in most settings, even indoors or in large groups. "Today is a great day for America in our long battle with coronavirus," Biden said in the In a joint letter to PM Modi, 12 opposition White House Rose Garden on Thursday,May 13, party leaders, including Sonia Gandhi, have demanded Central govt to provide calling the US vaccination program an foodgrains to the needy and Rs 6,000 "historical logistical achievement." monthly to the unemployed. - File photo of The guidance shift Thursday, May 13, is a Prime Minister Narendra Modi | Twitter turning point in the fight against Covid-19 and @BJP4India comes as US caseloads fall and vaccinations NEW DELHI (TIP): In a joint letter rise. It signals a broad return to everyday to Prime Minister Narendra Modi, lifeand is also a bet that any surge in spread May 12, 12 Opposition parties have from relaxed guidelines won't be enough to urged the government to immediately reverse progress in inoculations. -

Lok Sabha ___ Bulletin – Part I

LOK SABHA ___ BULLETIN – PART I (Brief Record of Proceedings) ___ Tuesday, June 18, 2019/Jyaistha 28, 1941(Saka) ___ No. 2 11.00 A.M. 1. Observation by the Speaker Pro tem* 11.03 A.M. 2. Oath or Affirmation The following members took the oath or made the affirmation, signed the Roll of Members and took their seats in the House:- Sl. Name of Member Constituency State Oath/ Language No. Affirmation 1 2 3 4 5 6 1. Shri Santosh Pandey Rajnandgaon Chhattisgarh Oath Hindi 2. Shri Krupal Balaji Ramtek(SC) Maharashtra Oath Marathi Tumane 3. Shri Ashok Mahadeorao Gadchiroli-Chimur Maharashtra Oath Marathi Nete (ST) 4. Shri Suresh Pujari Bargarh Odisha Oath Odia 5. Shri Nitesh Ganga Deb Sambalpur Odisha Oath English 6. Shri Er. Bishweswar Mayurbhanj (ST) Odisha Oath English Tudu 7. Shri Ve. Viathilingam Puducherry Puducherry Oath Tamil 8. Smt. Sangeeta Kumari Bolangir Odisha Oath Hindi Singh Deo 9. Shri Sunny Deol Gurdaspur Punjab Oath English *Original in Hindi, for details, please see the debate of the day. 2 1 2 3 4 5 6 10. Shri Gurjeet Singh Aujla Amritsar Punjab Oath Punjabi 11. Shri Jasbir Singh Gill Khadoor Sahib Punjab Affirmation Punjabi (Dimpa) 12. Shri Santokh Singh Jalandhar (SC) Punjab Oath Punjabi Chaudhary 13. Shri Manish Tewari Anandpur Sahib Punjab Oath Punjabi 14. Shri Ravneet Singh Bittu Ludhiana Punjab Oath Punjabi 15. Dr. Amar Singh Fatehgarh Sahib Punjab Oath Punjabi (SC) 16. Shri Mohammad Faridkot (SC) Punjab Oath Punjabi Sadique 17. Shri Sukhbir Singh Badal Firozpur Punjab Oath Punjabi 18. Shri Bhagwant Mann Sangrur Punjab Oath Punjabi 19. -

![[I N D I a N I N D U S T R I E S a S S O C I a T I O N]](https://docslib.b-cdn.net/cover/4306/i-n-d-i-a-n-i-n-d-u-s-t-r-i-e-s-a-s-s-o-c-i-a-t-i-o-n-1824306.webp)

[I N D I a N I N D U S T R I E S a S S O C I a T I O N]

[I N D I A N I N D U S T R I E S A S S O C I A T I O N] th AGENDA (28 IIA ANNUAL GENERAL MEETING ) Venue : - “JW Marriott Mussoori Walnut Grove Resort & Spa”, Massouri , Uttrakhand Date : - 1st August, 2019 Time : - 11.00 AM to 02.30 PM Duration : - 3 Hours and 30 Minutes Sno Agenda Item Time Durati IS/D* Agenda piloted By Remarks on 1 Welcome of 11.00- 30 IS Sh. Sunil Vaish, Delegates & 11.30 Minutes President IIA 2018- Introduction by all 19, Sh. Manmohan IIA delegates. Agarwal, General Secretary IIA 2018-19 2 Minutes of 27th 11.30- 5 IS Sh. Manmohan Minutes are AGM held on 2nd 11.35 Minutes Agarwal, General placed Annex.-I August 2018 at Goa Secretary IIA 2018-19 page to . 3 IIA activities & 11.35- 15 IS Sh. Manmohan Outlines of the Achievements 11.50 Minutes Agarwal, General activities & 2018-19 Secretary IIA 2018-19 achievement for 2018-19 are placed at Appendix.-I page to . 3 IIA Balance Sheet & 11.50- 15 IS/D Sh. S.B. Jakhotia IIA Balance Income Expenditure 12.05 Minutes Treasurer IIA, 2018- Sheet and Statement of IIA 19 Income/Expendi Head Office for the ture details are year 2018-19 as placed at recommended by Appendix-II. CEC for approval of AGM 4 Address by 12.05- 15 outgoing President 12.20 Minutes IIA Shri Sunil Vaish 5 Handing over of IIA 12.20- 5 Flag by outgoing 12.25 Minutes President to Newly Elected President of IIA and exchange of Chair. -

Departmentally Related Standing Committees

LOK SABHA DEPARTMENTALLY RELATED STANDING COMMITTEES SUMMARY OF WORK SEVENTEENTH LOK SABHA (2019-20) LOK SABHA SECRETARIAT, NEW DELHI October, 2020/Kartika, 1942 (Saka) 1 LOK SABHA DEPARTMENTALLY RELATED STANDING COMMITTEES SUMMARY OF WORK (SEVENTEENTH LOK SABHA) (2019-20) LOK SABHA SECRETARIAT NEW DELHI October, 2020/Kartika, 1942 (Saka) 2 Cte. Coord. Br. No. 62 © 2020 By LOK SABHA SECRETARIAT Published under Rule 382 of the Rules of Procedure and Conduct of Business in Lok Sabha. 3 PREFACE This Brochure attempts to present in concise form information about the activities of the 16 Departmentally Related Standing Committees (DRSCs) during the year 2019-20 serviced by the Lok Sabha Secretariat. The main functions of DRSCs are to consider the Demands for Grants of the concerned Ministries/Departments, to examine such Bills pertaining to the concerned Ministries/Departments as are referred to the Committee, to consider any aspect of the annual reports of Ministries/Departments and to consider National Basic Long Term Policy Documents presented to the Houses and referred to the Committee. The Committees make report to the Houses on each of the matter referred to them. 2. For the sake of convenience, a Statement namely At A Glance showing sittings held, reports presented (DFG, Original, Bills, ATR) has also been prepared. New Delhi; SNEHLATA SHRIVASTAVA 23 rd October, 2020 Secretary-General 1 Kartika, 1942 (Saka) 4 CONTENTS PAGE At a Glance 6 CHAPTERS Name of DRSC ONE Committee on Agriculture 7 TWO Committee on Information Technology 19 THREE -

Comrade Krishna Chakraborty Is No More Veteran Member of SUCI(C) West Bengal Contd

ELECTRONIC VERSION PRINT COPY NOT AVAILABLE Volume 54 No. 19 Organ of the SOCIALIST UNITY CENTRE OF INDIA (COMMUNIST) Subscription Free May 15, 2021 Founder Editor-in-Chief : COMRADE SHIBDAS GHOSH Distributed via Internet Let the 63 billionaires who own Comrade Krishna Chakraborty Rs. 29 lakh crores donate is no more handsomely to Covid Relief Fund — demand people [Comrade Provash Ghosh, General Secretary, SUCI (Communist), urges people of India to sign the following memorandum to the Prime Minister asking for some urgent steps to combat the Covid menace.] To Shri Narendra Damodardas Modi The Hon’ble Prime Minister Government of India New Delhi Dear Sir, With grave concern, pain and shock we want to draw your attention to the grim fact that before the country could overcome the disastrous impact of the first corona wave, it has again been gripped by the second wave. First wave claimed thousands of lives and made millions of workers jobless, when your government miserably failed to give due attention to adopting necessary measures as you were engaged in ‘Namaste Trump festival’. Meanwhile, signal of second wave was given by the Western countries and you got some time to prepare for preventive measures. But again you did nothing as you became busy in construction of Ram Mandir, Central Vista and electoral scramble for power in some states by spending hundreds of crores of rupees. Now, the country is witnessing procession of human deaths and nobody knows where it will end. There is acute shortage of number of hospitals, beds, ICUs, oxygen, Comrade Krishna Chakraborty, former member of the Polit Bureau ventilators, medicines, doctors, nurses, medical persons etc. -

Seventeenth Series, Vol. I, First Session, 2019/1941 (Saka) No

17.06.2019 1 C O N T E N T S Seventeenth Series, Vol. I, First Session, 2019/1941 (Saka) No. 1, Monday, June 17, 2019 /Jyaistha 27, 1941 (Saka) S U B J E C T P A G E S OFFICERS OF LOK SABHA 2 COUNCIL OF MINISTERS 3-10 NATIONAL ANTHEM 12 OBSERVANCE OF SILENCE 12 ANNOUNCEMENTS BY THE SPEAKER PROTEM (i) Welcome to Members of 17th Lok Sabha 13 (ii) Making and subscribing an oath or affirmation 31 LIST OF MEMBERS ELECTED TO LOK SABHA 14-29 NOMINATIONS TO PANEL OF CHAIRPERSONS 30 MEMBERS SWORN 32-59 17.06.2019 2 OFFICERS OF LOK SABHA THE SPEAKER Shri Om Birla PANEL OF CHAIRPERSONS** Shri Kodikunnil Suresh Shri Brijbhushan Sharan Singh Shri Bhartruhari Mahtab SECRETARY GENERAL Shrimati Snehlata Shrivastava Elected on 19.06.2019. ** Nominated on 07.06.2019. The following two separate orders were issued by the President of India on 07.06.2019. 1. Whereas the office of the Speaker will become vacant immediately before the commencement of the first meeting of the House of the People on June 17, 2019 and the office of the Deputy Speaker is also vacant. Now, therefore, in exercise of the powers conferred upon me by clause (1) of article 95 of the Constitution of India, I hereby appoint Dr. Virendra Kumar, a Member of the House of the People, to perform the duties of the office of the Speaker from the commencement of the sitting of the House of People on June 17, 2019 till election of the Speaker by the said House. -

Parliament of India R a J Y a S a B H a Committees

Com. Co-ord. Sec. PARLIAMENT OF INDIA R A J Y A S A B H A COMMITTEES OF RAJYA SABHA AND OTHER PARLIAMENTARY COMMITTEES AND BODIES ON WHICH RAJYA SABHA IS REPRESENTED (Corrected upto 30th June, 2020) RAJYA SABHA SECRETARIAT NEW DELHI (30th June, 2020) Website: http://www.rajyasabha.nic.in E-mail: [email protected] OFFICERS OF RAJYA SABHA CHAIRMAN Shri M. Venkaiah Naidu SECRETARY-GENERAL Shri Desh Deepak Verma PREFACE The publication aims at providing information on Members of Rajya Sabha serving on various Committees of Rajya Sabha, Department-related Parliamentary Standing Committees, Joint Committees and other Bodies as on 30th June, 2020. The names of Chairmen of the various Standing Committees and Department-related Parliamentary Standing Committees along with their local residential addresses and telephone numbers have also been shown at the beginning of the publication. The names of Members of the Lok Sabha serving on the Joint Committees on which Rajya Sabha is represented have also been included under the respective Committees for information. Change of nominations/elections of Members of Rajya Sabha in various Parliamentary Committees/Statutory Bodies is an ongoing process. As such, some information contained in the publication may undergo change by the time this is brought out. When new nominations/elections of Members to Committees/Statutory Bodies are made or changes in these take place, the same get updated in the Rajya Sabha website. The main purpose of this publication, however, is to serve as a primary source of information on Members representing various Committees and other Bodies on which Rajya Sabha is represented upto a particular period. -

Aam Aadmi to Seal Bigwigs' Fate Today

Follow us on: facebook.com/dailypioneer RNI No.2016/1957, REGD NO. SSP/LW/NP-34/2019-21 @TheDailyPioneer instagram.com/dailypioneer/ Established 1864 OPINION 8 WORLD 12 SPORT 16 Published From NURTURE TIES TRUMP, US MEDIA IN OPEN SRH TO FACE KXIP IN DELHI LUCKNOW BHOPAL BHUBANESWAR RANCHI RAIPUR CHANDIGARH THAT BIND WAR ON ANNUAL DINNER DATE IPL CLASH DEHRADUN HYDERABAD VIJAYWADA *Late City Vol. 155 Issue 116 LUCKNOW, MONDAY APRIL 29, 2019; PAGES 16 `3 *Air Surcharge Extra if Applicable RANBIR, ALIA ENJOY THEIR MOVIE} DATE } 14 VIVACITY www.dailypioneer.com Aam aadmi to seal bigwigs’ fate today 27% pre-monsoon Royals, CMs’ sons, ex-Ministers among 961 in fray in 9 States rain deficit critical PNS n NEW DELHI for Indian farming he voting for fourth phase Tof Lok Sabha (LS) elections Highest 38% for 71 seats in nine States on Monday would witness in the battle ring sons of Chief deficiency Ministers, royals, former Union Ministers, film celebrities as in northwest also a bitterly-found contest between fire-brand student leader Kanhaiya Kumar and part this year BJP candidate and Union Minister Giriraj Singh. PNS n NEW DELHI The fate of 961 candidates will be decided by about 12.79 he India Meteorological crore voters, including in Uttar TDepartment (IMD) has Pradesh, Rajasthan, Polling officials carry EVMs and other election materials as they leave for poll recorded 27 per cent less pre- Mahrashtra, Mahdhya Pradesh, duties from a distribution centre, on the eve of the 4th of phase of Lok Sabha monsoon rainfall from March recorded 23 per cent Bihar and West Bengal. -

Page1.Qxd (Page 1)

DAILY EXCELSIOR, JAMMU TUESDAY, APRIL 30, 2019 (PAGE 11) From page 1 Immigration system server Decision on alleged violations of model 64 pc turnout in 4th phase, Life-imprisonment to 3 in murder case faces tech glitches, 6 6443 when he was on his way to that the accused persons will flights delayed code by Modi, Rahul, Shah today violence in WB Kathua from Jammu in a very mend their ways or change their NEW DELHI, Apr 29: Birbhum seat, leaving several Samajwadi Party’s alleged that brutal manner on April 28, 2005. life as good citizen". NEW DELHI, Apr 29: The local poll authorities in EC's guidelines because he had people injured. many EVMs malfunctioned and After hearing APP Davinder "In fact apart from the inci- Maharashtra are learnt to have not sought votes for any party, an Hundreds of passengers The Election Commission In Barabani, BJP candidate in Kannauj, from where SP Sharma for the State whereas dent in question, prosecution told the EC here that Prime official said the matter is before had a harrowing time at the will take a decision on com- from Asansol and Union chief Akhislesh Yadav’s wife Advocate A Salathia for the could not establish any such past Minister Narendra Modi's EC and it would decide on it Delhi airport early today as plaints of model code violations Minister Babul Supriyo’s vehi- and sitting MP Dimple Yadav is accused, the court observed, criminal history against the con- remarks asking first-time voters Tuesday. the immigration system serv- by Prime Minister Narendra cle was vandalised allegedly by contesting, several party work- "the accused persons have com- victs/accused though the APP to dedicate their vote to those A decision on Shah's reported er faced technical issues for Modi, BJP chief Amit Shah and TMC workers outside a polling ers were prevented from com- mitted the murder in very brutal has submitted during the argu- who carried out the Balakot air remarks on 'Modi ji ki vayu sena' around one-and-a-half hours, Congress president Rahul station while in Dubrajpur area ing out of their homes to vote. -

2 April Page 3

Imphal Times Supplementary issue Page 3 Notification for 4th phase of Lok Nagaland 160 star campaigners to Sabha elections to be issued today garner support for lone Lok Sabha seat Agency The nomination will start today for Chatra while sitting BJP MP, V D Agency Minister Smriti Irani are expected Shurhozelie Liezietsu. Also among New Delhi April 02, Shahjahanpur, Kheeri, Hardoi, Ram would be contesting from Kohima, April 2, to be crowd pullers given their the other campaigners are former Mishrikh, Unnao, Farrukhabad, Palamu. Ghuran Ram from RJD and fan-following in the state. Chief Minister TR Zeliang, working Notification for the fourth phase of Etawah, Kannauj, Kanpur, Akbarpur, Sushma Mehta would be CPI-ML The lone Lok Sabha seat of Hema Malini is a household name presidents Huskha Yepthomi and Lok Sabha Elections will be issued Jalaun, Jhansi and Hamirpur seats. candidate from Palamu. From Nagaland will see a teeth- in the Nagaland and is popularly Apong Pongener, Rajya Sabha MP today. Seventy-one constituencies Many high profile leaders are Lohardagga, sitting BJP MP and clenching contest, with as many known as “Dream girl” and KG Kenye, former home minister spread over 9 states will go to polls expected to file their paper which Minister of State, Sudarshan Bhagat as 160 star campaigners leading “Basanti” for her hit films like Kuzholuzo Nienu, former ministers in this phase on 29 of this month. includes Samajwadi Party nominee is the party candidate. Congress battle for the four parties – the ‘Dream Girl’ and ‘Sholay’. Imkong L Imchen, Yitachu, The last date of filing of and Wife of Akhilesh Yadav who is has not declared its candidate from BJP, Congress, Naga Peoples’ BJP national general secretary and Chotisuh Sazo, Chumben Murry, nominations is 9th April, scrutiny the candidate from Kannauj, Senior Lohardagga.