SOFR Term Rate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Assessment Updates

201 East Colfax Avenue Denver, CO 80203-1799 March 23, 2021 Dear Superintendents and BOCES Directors, I know you are hearing from us a lot lately and I know you have too much on your plate already. Let me get one thing out of the way—We have not yet heard back from the US DOE on our assessment waiver request. I will let you know the minute we do. We have reached out saying that time is of the essence. However, there are a lot of other things happening right now too. I’m just sorry that it is all happening at once! This is one more thing I need to make you aware of—something I know a lot of you care a lot about. Consistent with state statute, last spring CDE was scheduled to release a request for proposals (RFP) for the Colorado High School College Entrance Suite of Assessments (9th, 10th, and 11th grade exams). When COVID hit, the release was postponed. As previously announced, we released the RFP on March 10, 2021. Prospective contractors have until April 12 to submit proposals. The CDE Assessment Division is currently seeking educators to participate in the evaluation committee that will review the vendor proposals received and make a recommendation for final contract award. All committee members must be willing to sign a non-disclosure agreement and commit to attend all meetings. Meetings are scheduled for April 15 (90 minutes after 3:00 pm), May 10 (all day), May 13 (all day), and May 14 (all day, as needed). -

2021-2022 Custom & Standard Information Due Dates

2021-2022 CUSTOM & STANDARD INFORMATION DUE DATES Desired Cover All Desired Cover All Delivery Date Info. Due Text Due Delivery Date Info. Due Text Due May 31 No Deliveries No Deliveries July 19 April 12 May 10 June 1 February 23 March 23 July 20 April 13 May 11 June 2 February 24 March 24 July 21 April 14 May 12 June 3 February 25 March 25 July 22 April 15 May 13 June 4 February 26 March 26 July 23 April 16 May 14 June 7 March 1 March 29 July 26 April 19 May 17 June 8 March 2 March 30 July 27 April 20 May 18 June 9 March 3 March 31 July 28 April 21 May 19 June 10 March 4 April 1 July 29 April 22 May 20 June 11 March 5 April 2 July 30 April 23 May 21 June 14 March 8 April 5 August 2 April 26 May 24 June 15 March 9 April 6 August 3 April 27 May 25 June 16 March 10 April 7 August 4 April 28 May 26 June 17 March 11 April 8 August 5 April 29 May 27 June 18 March 12 April 9 August 6 April 30 May 28 June 21 March 15 April 12 August 9 May 3 May 28 June 22 March 16 April 13 August 10 May 4 June 1 June 23 March 17 April 14 August 11 May 5 June 2 June 24 March 18 April 15 August 12 May 6 June 3 June 25 March 19 April 16 August 13 May 7 June 4 June 28 March 22 April 19 August 16 May 10 June 7 June 29 March 23 April 20 August 17 May 11 June 8 June 30 March 24 April 21 August 18 May 12 June 9 July 1 March 25 April 22 August 19 May 13 June 10 July 2 March 26 April 23 August 20 May 14 June 11 July 5 March 29 April 26 August 23 May 17 June 14 July 6 March 30 April 27 August 24 May 18 June 15 July 7 March 31 April 28 August 25 May 19 June 16 July 8 April 1 April 29 August 26 May 20 June 17 July 9 April 2 April 30 August 27 May 21 June 18 July 12 April 5 May 3 August 30 May 24 June 21 July 13 April 6 May 4 August 31 May 25 June 22 July 14 April 7 May 5 September 1 May 26 June 23 July 15 April 8 May 6 September 2 May 27 June 24 July 16 April 9 May 7 September 3 May 28 June 25. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

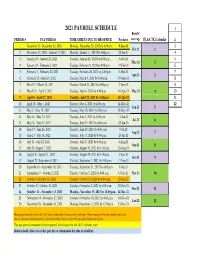

Payroll Calendar 2021

2021 PAYROLL SCHEDULE 1 Benefit PERIOD # PAY PERIOD TIME SHEETS DUE TO HR OFFICE Paydates coverage FLSA 7K Calendar 2 1 December 13- December 26, 2020 Monday, December 28, 2020 by 4:00 p.m. 8-Jan-21 3 Feb-21 1 2 December 27, 2020 - Janurary 9, 2021 Monday, January 11, 2021 by 4:00 p.m. 22-Jan-21 4 3 January 10 - January 23, 2021 Tuesday, January 26, 2021 by 4:00 p.m. 5-Feb-21 5 Mar-21 2 4 January 24 - February 6, 2021 Tuesday, February 9, 2021 by 4:00 p.m. 19-Feb-21 6 5 February 7 - February 20, 2021 Tuesday, February 26, 2021 by 4:00 p.m. 5-Mar-21 7 Apr-21 3 6 February 21 - March 6, 2021 Tuesday, March 9, 2021 by 4:00 p.m. 19-Mar-21 8 7 March 7 - March 20, 2021 Tuesday, March 23, 2021 by 4:00 p.m. 2-Apr-21 9 8 March 21 - April 3, 2021 Tuesday, April 6, 2021 by 4:00 p.m. 16-Apr-21 May-21 4 10 9 April 4 - April 17, 2021 Tuesday, April 20, 2021 by 4:00 p.m. 30-Apr-21 11 10 April 18 - May 1, 2021 Tuesday, May 4, 2021 by 4:00 p.m. 14-May-21 12 Jun-21 5 11 May 2 - May 15, 2021 Tuesday, May 18, 2021 by 4:00 p.m. 28-May-21 12 May 16 - May 29, 2021 Tuesday, June 1, 2021 by 4:00 p.m. 11-Jun-21 Jul-21 6 13 May 30 - June 12, 2021 Tuesday, June 15, 2021 by 4:00 p.m. -

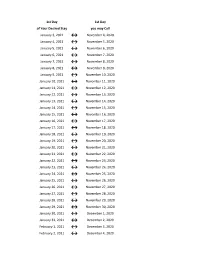

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

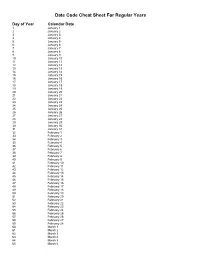

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

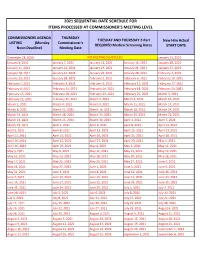

2021 Sequential Date List

2021 SEQUENTIAL DATE SCHEDULE FOR ITEMS PROCESSED AT COMMISSIONER'S MEETING LEVEL COMMISSIONERS AGENDA THURSDAY TUESDAY AND THURSDAY 2-Part New Hire Actual LISTING (Monday Commissioner's REQUIRED Medical Screening Dates START DATE Noon Deadline) Meeting Date December 28, 2020 NO MEETING SCHEDULED January 13, 2021 January 4, 2021 January 7, 2021 January 12, 2021 January 14, 2021 January 20, 2021 January 11, 2021 January 14, 2021 January 19, 2021 January 21, 2021 January 27, 2021 January 18, 2021 January 21, 2021 January 26, 2021 January 28, 2021 February 3, 2021 January 25, 2021 January 28, 2021 February 2, 2021 February 4, 2021 February 10, 2021 February 1, 2021 February 4, 2021 February 9, 2021 February 11, 2021 February 17, 2021 February 8, 2021 February 11, 2021 February 16, 2021 February 18, 2021 February 24, 2021 February 15, 2021 February 18, 2021 February 23, 2021 February 25, 2021 March 3, 2021 February 22, 2021 February 25, 2021 March 2, 2021 March 4, 2021 March 10, 2021 March 1, 2021 March 4, 2021 March 9, 2021 March 11, 2021 March 17, 2021 March 8, 2021 March 11, 2021 March 16, 2021 March 18, 2021 March 24, 2021 March 15, 2021 March 18, 2021 March 23, 2021 March 25, 2021 March 31, 2021 March 22, 2021 March 25, 2021 March 30, 2021 April 1, 2021 April 7, 2021 March 29, 2021 April 1, 2021 April 6, 2021 April 8, 2021 April 14, 2021 April 5, 2021 April 8, 2021 April 13, 2021 April 15, 2021 April 21, 2021 April 12, 2021 April 15, 2021 April 20, 2021 April 22, 2021 April 28, 2021 April 19, 2021 April 22, 2021 April 27, 2021 April -

Due Date Chart 201803281304173331.Xlsx

Special Event Permit Application Due Date Chart for Events from January 1, 2019 - June 30, 2020 If due date lands on a Saturday or Sunday, the due date is moved to the next business day Event Date 30 Calendar days 90 Calendar Days Tuesday, January 01, 2019 Sunday, December 02, 2018 Wednesday, October 03, 2018 Wednesday, January 02, 2019 Monday, December 03, 2018 Thursday, October 04, 2018 Thursday, January 03, 2019 Tuesday, December 04, 2018 Friday, October 05, 2018 Friday, January 04, 2019 Wednesday, December 05, 2018 Saturday, October 06, 2018 Saturday, January 05, 2019 Thursday, December 06, 2018 Sunday, October 07, 2018 Sunday, January 06, 2019 Friday, December 07, 2018 Monday, October 08, 2018 Monday, January 07, 2019 Saturday, December 08, 2018 Tuesday, October 09, 2018 Tuesday, January 08, 2019 Sunday, December 09, 2018 Wednesday, October 10, 2018 Wednesday, January 09, 2019 Monday, December 10, 2018 Thursday, October 11, 2018 Thursday, January 10, 2019 Tuesday, December 11, 2018 Friday, October 12, 2018 Friday, January 11, 2019 Wednesday, December 12, 2018 Saturday, October 13, 2018 Saturday, January 12, 2019 Thursday, December 13, 2018 Sunday, October 14, 2018 Sunday, January 13, 2019 Friday, December 14, 2018 Monday, October 15, 2018 Monday, January 14, 2019 Saturday, December 15, 2018 Tuesday, October 16, 2018 2019 Tuesday, January 15, 2019 Sunday, December 16, 2018 Wednesday, October 17, 2018 Wednesday, January 16, 2019 Monday, December 17, 2018 Thursday, October 18, 2018 Thursday, January 17, 2019 Tuesday, December 18, 2018 -

2021 Rezoning Review Schedule

City of Waukee | 2021 ZONING AMENDMENT REVIEW SCHEDULE APPLICATION STAFF APPLICANT PUBLIC P & Z P & Z COUNCIL COUNCIL COUNCIL COUNCIL DUE COMMENTS REVISIONS by HEARING SUBMITTAL MEETING SUBMITTAL MEETING MEETING MEETING by 5:00 p.m. SENT 5:00 p.m. DATE SET by 5:00 p.m. 6:00 p.m. by 5:00 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. [1st Consider.] [2nd Consider.] [3rd Consider.] (TUES.) (TUES.) (TUES.) (MON.) (THUR.) (TUES.) (WED.) (MON.) (MON.) (MON.) November 17 November 24 December 1 December 7 December 17 December 22 December 30 January 4 January 18 February 1 December 8 December 15 December 22 December 21 January 7 January 12 January 13 January 18 February 1 *February 16* December 22 December 29 January 5 January 4 January 21 January 26 January 27 February 1 *February 16* March 1 January 5 January 12 January 19 January 18 February 4 February 9 February 10 *February 16* March 1 March 15 January 19 January 26 February 2 February 1 February 18 February 23 February 24 March 1 March 15 April 5 February 2 February 9 February 16 *February 16* March 4 March 9 March 10 March 15 April 5 April 19 February 16 February 23 March 2 March 1 March 18 March 23 March 31 April 5 April 19 May 3 March 2 March 9 March 16 March 15 April 8 April 13 April 14 April 19 May 3 May 17 March 16 March 23 March 30 April 5 April 22 April 27 April 28 May 3 May 17 June 7 March 30 April 6 April 13 April 19 May 6 May 11 May 12 May 17 June 7 June 21 April 13 April 20 April 27 May 3 May 20 May 25 June 2 June 7 June 21 *July 6* April 27 May 4 May 11 May 17 June 3 June 8 June -

2016 7 Day Working Days Calendar

2016 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2016 306 Saturday, January 2, 2016 307 Sunday, January 3, 2016 308 Monday, January 4, 2016 309 Tuesday, January 5, 2016 310 Wednesday, January 6, 2016 311 Thursday, January 7, 2016 312 Friday, January 8, 2016 313 Saturday, January 9, 2016 314 Sunday, January 10, 2016 315 Monday, January 11, 2016 316 Tuesday, January 12, 2016 317 Wednesday, January 13, 2016 318 Thursday, January 14, 2016 319 Friday, January 15, 2016 320 Saturday, January 16, 2016 321 Sunday, January 17, 2016 322 Monday, January 18, 2016 323 Tuesday, January 19, 2016 324 Wednesday, January 20, 2016 325 Thursday, January 21, 2016 326 Friday, January 22, 2016 327 Saturday, January 23, 2016 328 Sunday, January 24, 2016 329 Monday, January 25, 2016 330 Tuesday, January 26, 2016 331 Wednesday, January 27, 2016 332 Thursday, January 28, 2016 333 Friday, January 29, 2016 334 Saturday, January 30, 2016 335 Sunday, January 31, 2016 336 Monday, February 1, 2016 337 Tuesday, February 2, 2016 338 Wednesday, February 3, 2016 339 Thursday, February 4, 2016 340 Date Number of the Calendar Date Friday, February 5, 2016 341 Saturday, February 6, 2016 342 Sunday, February -

Date of Close Contact Exposure

Date of Close Contact Exposure 7 days 10 days 14 days Monday, November 16, 2020 Tuesday, November 24, 2020 Friday, November 27, 2020 Tuesday, December 1, 2020 Tuesday, November 17, 2020 Wednesday, November 25, 2020 Saturday, November 28, 2020 Wednesday, December 2, 2020 Wednesday, November 18, 2020 Thursday, November 26, 2020 Sunday, November 29, 2020 Thursday, December 3, 2020 Thursday, November 19, 2020 Friday, November 27, 2020 Monday, November 30, 2020 Friday, December 4, 2020 Friday, November 20, 2020 Saturday, November 28, 2020 Tuesday, December 1, 2020 Saturday, December 5, 2020 Saturday, November 21, 2020 Sunday, November 29, 2020 Wednesday, December 2, 2020 Sunday, December 6, 2020 Sunday, November 22, 2020 Monday, November 30, 2020 Thursday, December 3, 2020 Monday, December 7, 2020 Monday, November 23, 2020 Tuesday, December 1, 2020 Friday, December 4, 2020 Tuesday, December 8, 2020 Tuesday, November 24, 2020 Wednesday, December 2, 2020 Saturday, December 5, 2020 Wednesday, December 9, 2020 Wednesday, November 25, 2020 Thursday, December 3, 2020 Sunday, December 6, 2020 Thursday, December 10, 2020 Thursday, November 26, 2020 Friday, December 4, 2020 Monday, December 7, 2020 Friday, December 11, 2020 Friday, November 27, 2020 Saturday, December 5, 2020 Tuesday, December 8, 2020 Saturday, December 12, 2020 Saturday, November 28, 2020 Sunday, December 6, 2020 Wednesday, December 9, 2020 Sunday, December 13, 2020 Sunday, November 29, 2020 Monday, December 7, 2020 Thursday, December 10, 2020 Monday, December 14, 2020 Monday, November -

The Judicial Council of the State of California

JUDICIAL COUNCIL OF CALIFORNIA STATEWIDE ORDER BY HON. TANI G. CANTIL-SAKAUYE, CHIEF JUSTICE OF CALIFORNIA AND CHAIR OF THE JUDICIAL COUNCIL MARCH 23, 2020 The World Health Organization, the United States Centers for Disease Control and Prevention (CDC), and the State of California have recognized that the world, country, and state face a life-threatening pandemic caused by the COVID-19 virus. As of March 23, 2020, the CDC reported that there are more than 40,000 confirmed COVID-19 cases in the United States, and more than 500 deaths. In California, the Department of Public Health reports more than 1,700 confirmed cases and more than 30 deaths. Health officials expect these figures to rise dramatically unless the population adheres to shelter- in-place guidelines and appropriate social distancing. As of this date, there is no known cure or vaccination. In response to the spread of COVID-19, Governor Newsom on March 4, 2020, declared a state of emergency in California, which was followed on March 13, 2020, by President Trump declaring a national emergency. Beginning on March 16, 2020, California counties began issuing shelter-in-place or stay-at-home orders. On March 19, 2020, Governor Newsom issued Executive Order N-33-20, requiring all Californians to stay home, subject to certain limited exemptions. Courts are included in this exemption. Schools have been closed statewide. The CDC, the California Department of Public Health, and local county health departments have recommended increasingly stringent social distancing measures of at least six feet between people, and encouraged vulnerable individuals to avoid public spaces.