UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reality Inspired Games: Expanding the Lens of Games’ Claims to Authenticity

Reality Inspired Games: Expanding the Lens of Games’ Claims to Authenticity Robyn McMillan, Darshana Jayemanne, Iain Donald School of Design and Informatics, Division of Games and Arts University of Abertay Bell Street, Dundee DD1 1HG +44 1382 308000 [email protected] [email protected] [email protected] ABSTRACT This paper considers the potentials of contemporary games staking claims to realism through documentary and journalistic techniques as part of a wide-ranging cultural and technological phenomenon– ‘Reality Inspired Games’ or RIGs (Maurin, 2018). We argue that RIGs employ design techniques and strategies of legitimation that are valuable to the reactive development cycles in the indie sector, whilst also being beneficial for academic research and development. Through examining traditional documentary and the concept of Bruzzi’s performative documentary (2006) we highlight how this concept may allow developers to negotiate performativity and authenticity in their videogames. We discuss examples of such games in the realm of indie productions, such as That Dragon, Cancer (2016), This War of Mine (2014), and My Child Lebensborn (2018) and Bury Me, My Love (2017). All of which represent new ground for game design, documentary and journalistic techniques that have influenced our work on the MacMillan project. Keywords Reality Inspired Games, Documentary, Performativity, Indie “Much like photographs, paintings, literature and music are capable of transmitting the full range of the human experience from one human to another, so too can games. Due to their interactivity, games are capable of a higher form of communication, one which actively engages the participant and makes them a part of the experience rather than a passive observer” (Brathwaite & Sharp, 2010, p315). -

UPC Platform Publisher Title Price Available 730865001347

UPC Platform Publisher Title Price Available 730865001347 PlayStation 3 Atlus 3D Dot Game Heroes PS3 $16.00 52 722674110402 PlayStation 3 Namco Bandai Ace Combat: Assault Horizon PS3 $21.00 2 Other 853490002678 PlayStation 3 Air Conflicts: Secret Wars PS3 $14.00 37 Publishers 014633098587 PlayStation 3 Electronic Arts Alice: Madness Returns PS3 $16.50 60 Aliens Colonial Marines 010086690682 PlayStation 3 Sega $47.50 100+ (Portuguese) PS3 Aliens Colonial Marines (Spanish) 010086690675 PlayStation 3 Sega $47.50 100+ PS3 Aliens Colonial Marines Collector's 010086690637 PlayStation 3 Sega $76.00 9 Edition PS3 010086690170 PlayStation 3 Sega Aliens Colonial Marines PS3 $50.00 92 010086690194 PlayStation 3 Sega Alpha Protocol PS3 $14.00 14 047875843479 PlayStation 3 Activision Amazing Spider-Man PS3 $39.00 100+ 010086690545 PlayStation 3 Sega Anarchy Reigns PS3 $24.00 100+ 722674110525 PlayStation 3 Namco Bandai Armored Core V PS3 $23.00 100+ 014633157147 PlayStation 3 Electronic Arts Army of Two: The 40th Day PS3 $16.00 61 008888345343 PlayStation 3 Ubisoft Assassin's Creed II PS3 $15.00 100+ Assassin's Creed III Limited Edition 008888397717 PlayStation 3 Ubisoft $116.00 4 PS3 008888347231 PlayStation 3 Ubisoft Assassin's Creed III PS3 $47.50 100+ 008888343394 PlayStation 3 Ubisoft Assassin's Creed PS3 $14.00 100+ 008888346258 PlayStation 3 Ubisoft Assassin's Creed: Brotherhood PS3 $16.00 100+ 008888356844 PlayStation 3 Ubisoft Assassin's Creed: Revelations PS3 $22.50 100+ 013388340446 PlayStation 3 Capcom Asura's Wrath PS3 $16.00 55 008888345435 -

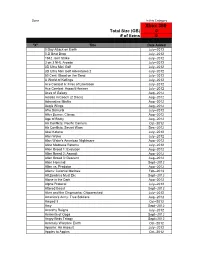

Xbox 360 Total Size (GB) 0 # of Items 0

Done In this Category Xbox 360 Total Size (GB) 0 # of items 0 "X" Title Date Added 0 Day Attack on Earth July--2012 0-D Beat Drop July--2012 1942 Joint Strike July--2012 3 on 3 NHL Arcade July--2012 3D Ultra Mini Golf July--2012 3D Ultra Mini Golf Adventures 2 July--2012 50 Cent: Blood on the Sand July--2012 A World of Keflings July--2012 Ace Combat 6: Fires of Liberation July--2012 Ace Combat: Assault Horizon July--2012 Aces of Galaxy Aug--2012 Adidas miCoach (2 Discs) Aug--2012 Adrenaline Misfits Aug--2012 Aegis Wings Aug--2012 Afro Samurai July--2012 After Burner: Climax Aug--2012 Age of Booty Aug--2012 Air Conflicts: Pacific Carriers Oct--2012 Air Conflicts: Secret Wars Dec--2012 Akai Katana July--2012 Alan Wake July--2012 Alan Wake's American Nightmare Aug--2012 Alice Madness Returns July--2012 Alien Breed 1: Evolution Aug--2012 Alien Breed 2: Assault Aug--2012 Alien Breed 3: Descent Aug--2012 Alien Hominid Sept--2012 Alien vs. Predator Aug--2012 Aliens: Colonial Marines Feb--2013 All Zombies Must Die Sept--2012 Alone in the Dark Aug--2012 Alpha Protocol July--2012 Altered Beast Sept--2012 Alvin and the Chipmunks: Chipwrecked July--2012 America's Army: True Soldiers Aug--2012 Amped 3 Oct--2012 Amy Sept--2012 Anarchy Reigns July--2012 Ancients of Ooga Sept--2012 Angry Birds Trilogy Sept--2012 Anomaly Warzone Earth Oct--2012 Apache: Air Assault July--2012 Apples to Apples Oct--2012 Aqua Oct--2012 Arcana Heart 3 July--2012 Arcania Gothica July--2012 Are You Smarter that a 5th Grader July--2012 Arkadian Warriors Oct--2012 Arkanoid Live -

COMPARATIVE VIDEOGAME CRITICISM by Trung Nguyen

COMPARATIVE VIDEOGAME CRITICISM by Trung Nguyen Citation Bogost, Ian. Unit Operations: An Approach to Videogame Criticism. Cambridge, MA: MIT, 2006. Keywords: Mythical and scientific modes of thought (bricoleur vs. engineer), bricolage, cyber texts, ergodic literature, Unit operations. Games: Zork I. Argument & Perspective Ian Bogost’s “unit operations” that he mentions in the title is a method of analyzing and explaining not only video games, but work of any medium where works should be seen “as a configurative system, an arrangement of discrete, interlocking units of expressive meaning.” (Bogost x) Similarly, in this chapter, he more specifically argues that as opposed to seeing video games as hard pieces of technology to be poked and prodded within criticism, they should be seen in a more abstract manner. He states that “instead of focusing on how games work, I suggest that we turn to what they do— how they inform, change, or otherwise participate in human activity…” (Bogost 53) This comparative video game criticism is not about invalidating more concrete observances of video games, such as how they work, but weaving them into a more intuitive discussion that explores the true nature of video games. II. Ideas Unit Operations: Like I mentioned in the first section, this is a different way of approaching mediums such as poetry, literature, or videogames where works are a system of many parts rather than an overarching, singular, structured piece. Engineer vs. Bricoleur metaphor: Bogost uses this metaphor to compare the fundamentalist view of video game critique to his proposed view, saying that the “bricoleur is a skillful handy-man, a jack-of-all-trades who uses convenient implements and ad hoc strategies to achieve his ends.” Whereas the engineer is a “scientific thinker who strives to construct holistic, totalizing systems from the top down…” (Bogost 49) One being more abstract and the other set and defined. -

![Digis]: Canon 40D Vs](https://docslib.b-cdn.net/cover/4548/digis-canon-40d-vs-244548.webp)

Digis]: Canon 40D Vs

riistvara tarkvara fototehnika mobiilid kodutehnika Ajakirjaga kaasas CD-ROM Lk 9 Hind 35.90 kr 35.90 Hind oktoober 2007 2007 oktoober Nr 30, 30, Nr vaid [digis]: Canon 40D vs. Nikon D300! uures testis: 22-tolliseds monitorid Katsetame uut iMaci koduarvutina tundi Bio- Shockiga: kõik hinded 70 10/10! Kuidas oma Järele proovitud ja hinnatud: mobiiltelefonist l Olympuse uus peegelkaamera GPS teha? l Sony Ericssoni roheline telefon l Creative Xdock muusikasüsteem ja suur hulk muid vidinaid Kas mu uus auto peaks olema roosa-lilla-kreemikas? 4X^bZPePbcPcP0VP_P[YdST[TcTXbcT[T ZâbX\dbcT[T[TXPSPdc^^bcd_[PP]XSTb 0dc^[TWTddTbceTTQXbcePbcdbT <X[[XbTXSPdc^bXS_PZdcPZbTb^^SdbWX]]PVP.EPPcPPdc^[TWcTTb^^SdbXVP_ÊTe ddT]SP\Tâ[TePPSTcPdc^\ââYPcTb^^Sdb_PZZd\XbcTbc <X[[XbcPdc^cb^^eXcPQ0dc^[TWc.EPPcPPdc^[TWcTTcTbcXS^[T\TcTbcX]dSYPWX]]P]dSbPSd Pdc^bXSEPPcPâ[T\X[[XbTS^]Z^]ZaTTcbT\dST[X_[dbbXSYP\XX]dbTS <X[[X]TZPbdcPcdSPdc^^]ePbcd_XSPe.EPPcPPdc^[TWcTTZPbdcPcdS[XbPZb0dc^[TWT WX]]PVdcT[TYPTZb_TacXSTPaeP\dbcT[T[TXPSZP\TXTZ^Sd[TWTZPbdcPYPcTWX]STSYPWX]]P]VdS Z^]ZaTTcbT[T\dST[X[T BX]dPdc^^bcdYdWcX]cTa]TcXb) digi > oktoober 2007 28 > suur võitlus: Canon 40D vs. Nikon D300 värske kraam 35 > Sony Ericsson T650i kolumnistid Henrikule meeldib roheline 8 > Kaaneplaat 36 > Samsung i70 Jalgpall ja palju kasulikku kraami Üks õige kaamera peab ikka muusikat ka mängima 11 > Must lind HP uus mänguarvuti muudab maailma 37 > Logitech Wave Klaveril Viive Ernesaks 18 > Üks-null Kui suur on Eesti energiatarbimine? 38 > Creative Xdock ja vastuvõtja Marconi versus Edison 20 > Naistekas -

Nummer 2 - December 2008

Nummer 2 - December 2008 Ny ordning!s.7-15 Demo + krati!?s.17 Blåmes?s.18-19 Fackavgiftens.27 Skyddet CYs.28 Arbetsmiljöansvarig Lars Smith sidorna 30-32. Fackexpeditionsansvarig Kicki El Gomati Förhandlingsansvarig Gunnar Öhman sidan 28. Försäkring o pensionsansvarig Cyrus Pairawan sidorna 30-32. Hemsideansvarig informerar Mikael Lind sidan 3. Informationsansvarig informerar Mikael Lind sidorna 3, 17-19. Introduktionsansvarig Kicki El Gomati Jämstäldhetsansvarig Anette Bergström Kultur o fritidsansvarig Babak Sadeghi Mångfald o integrationsansvarig Anette Bergström Rehabiliteringsansvarig Serg Zadruzny sidorna 30-32. Rekryteringsansvarig Kicki El Gomati Studieansvarig informerar Mikael Lind Ungdomsansvarig Kim Ekström 2 Innehåll Redaktion De ansvarigas sidor 2 Ansvarig utgivare Klubb 120 Skribenter Kubbens öppettider 3 Cyrus Pairawan Cyrus Pairawan (CP) Kollektivavtalet på väg ut... 3 Mikael Lind (ML) Veolias löften inte värda nå’t! 3 Chefredaktör Jan Melakoski (JM) En uppmaning!! 3 Mikael Lind Mats Örnsved (MÖ) Ledaren 4-5 Lars Smith (LS) Antifackliga kontraktet 5 Serg Zadruzny (SZ) Klubbens nya valorning 7-15 Klubb 119 skribenter Gunnar Öhman (GÖ) Demo + krati 17 Blåmes 18-19 Kollektivavtalsförhandlingar 29 Arbetarrörelsens Tankesmedja 20-26 Inga höjda avgiftsklasser 2009 27 Skyddsombuden i CY 28 Bonusen på turistkorten 28 Veolias löften Lösningen på förra korsordet 28-29 Försäkringskassans nya regler 30-32 inte värda nå’t! Medlemsresa till Tallin 34 Mycket långt tid har Fast än frågan stötts Korsordstävlingen 35 nu passerat sedan och blötts och mycket Vivendi über alles 37-39 Veolia lovade att tid har gått åt till at ta Efterlysning av skribenter 40 beställa och sätta upp fram den grafik som Expeditionens anslagstavlor åt SEKO skulle tryckas på tav- i varje spärr. -

Geometry Wars 3: Dimensions Available Now

Geometry Wars 3: Dimensions Available Now Next Chapter in the Award-Winning Geometry Wars™ Franchise is Newest Title Released under the Sierra™ Label SANTA MONICA, Calif.--(BUSINESS WIRE)-- Today marks the newest addition to the Sierra™ library of games with the release of Geometry Wars 3: Dimensions. This frenetic arcade shooter from developer Lucid Games is the latest installment in the Geometry Wars franchise. The new game advances the series to unexplored frontiers, bringing its retro-inspired action and energy to more platforms than ever before with an added twist to its classic gameplay - 3D grids! "Geometry Wars is a part of our DNA," said Craig Howard, Co-founder of Lucid Games. "Several of us here worked on prior games in the series, and we've had ideas kicking around in our heads for where it could go next. Partnering with Sierra to bring those visions to life has been an amazing experience." Geometry Wars 3: Dimensions is an exciting evolution of the fast-paced twin-stick shooter gameplay the Geometry Wars franchise helped define nearly a decade ago. While the game's look should be immediately familiar to hardcore fans, it features new 3D action and gameplay modes, a dedicated single-player campaign with 50 levels and revamped online cooperative and competitive multiplayer. It also adds five unique companion drones, new power-ups, electrifying boss battles and community leaderboards. There are also Classic Arcade modes available for those still hungry for the original Geometry Wars experience. Lucid Games' partnership with the Sierra label has given the developer an opportunity to remain independent, but still be able to create the game they dreamed about. -

How the Top 5 Games Companies Went Global

White paper How the Top 5 Games Companies Went Global Alpha St Andrew’s House St Andrew’s Road Every company had to start somewhere. Some were founded by a well-respected Cambridge CB4 1DL businessman or businesswoman and received a raft of initial investment. Others started United Kingdom out in somebody’s garage, and yet have still ended up dominating their market globally. @thisisalphalive In fact, there is a surprising correlation between the garage-start-up company and the names that have become global giants. That list includes Amazon, Apple, Disney and Google, and there are many more started in a one-person office. thisisalpha.com The question of how these companies have built from such small beginnings to positions of global dominance is a significant one. Other businesses at differing stages are keen to emulate them. There are, of course, many factors underlying such success. Great product is one; great business strategy another. But that isn’t enough to get you across continents. Successful global expansion comes down to effective localisation, and the top five global players can tell us a lot about undertaking the process correctly. The Best of the Best Let’s take the top five firms in the Games sector. It’s worth differentiating between the pure games developers or publishers and those who also provide hardware or other software, such as Sony, Nintendo and Microsoft. Much of the latter firms’ revenue comes from these other sources, so the top five games firms we will look at are the pure publishers and developers whose revenue is the highest. -

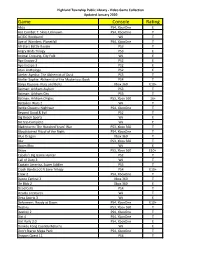

Game Console Rating

Highland Township Public Library - Video Game Collection Updated January 2020 Game Console Rating Abzu PS4, XboxOne E Ace Combat 7: Skies Unknown PS4, XboxOne T AC/DC Rockband Wii T Age of Wonders: Planetfall PS4, XboxOne T All-Stars Battle Royale PS3 T Angry Birds Trilogy PS3 E Animal Crossing, City Folk Wii E Ape Escape 2 PS2 E Ape Escape 3 PS2 E Atari Anthology PS2 E Atelier Ayesha: The Alchemist of Dusk PS3 T Atelier Sophie: Alchemist of the Mysterious Book PS4 T Banjo Kazooie- Nuts and Bolts Xbox 360 E10+ Batman: Arkham Asylum PS3 T Batman: Arkham City PS3 T Batman: Arkham Origins PS3, Xbox 360 16+ Battalion Wars 2 Wii T Battle Chasers: Nightwar PS4, XboxOne T Beyond Good & Evil PS2 T Big Beach Sports Wii E Bit Trip Complete Wii E Bladestorm: The Hundred Years' War PS3, Xbox 360 T Bloodstained Ritual of the Night PS4, XboxOne T Blue Dragon Xbox 360 T Blur PS3, Xbox 360 T Boom Blox Wii E Brave PS3, Xbox 360 E10+ Cabela's Big Game Hunter PS2 T Call of Duty 3 Wii T Captain America, Super Soldier PS3 T Crash Bandicoot N Sane Trilogy PS4 E10+ Crew 2 PS4, XboxOne T Dance Central 3 Xbox 360 T De Blob 2 Xbox 360 E Dead Cells PS4 T Deadly Creatures Wii T Deca Sports 3 Wii E Deformers: Ready at Dawn PS4, XboxOne E10+ Destiny PS3, Xbox 360 T Destiny 2 PS4, XboxOne T Dirt 4 PS4, XboxOne T Dirt Rally 2.0 PS4, XboxOne E Donkey Kong Country Returns Wii E Don't Starve Mega Pack PS4, XboxOne T Dragon Quest 11 PS4 T Highland Township Public Library - Video Game Collection Updated January 2020 Game Console Rating Dragon Quest Builders PS4 E10+ Dragon -

Llega La Quinta Temporada De Call of Duty®: Modern Warfare®

Llega la Quinta Temporada de Call of Duty®: Modern Warfare® Activision ha querido convocar al jugador de fútbol Jorge Resurrección, conocido como Koke, a una cita muy especial, coincidiendo con la llegada de la Temporada 5 a Call of Duty®: Modern Warfare®. El deportista, seguidor de la franquicia desde hace años, ha estado disfrutando del contenido gratuitoCall of Duty: Warzone desde su lanzamiento, el pasado mes de marzo. “La apertura del Acropolis National Arena en esta Quinta Temporada de Call of Duty: Modern Warfare es lo que todos estábamos esperando y, por fin, podemos disfrutarlo”, ha mencionado Koke Resurrección. “Esta vez yo tengo ventaja, ya que conozco los lugares más recónditos de un estadio”, ha comentado el jugador entre risas. “Warzone me ha proporcionado horas de distracción durante el confinamiento y, ahora, lo hará para desconectar de la vuelta a los entrenamientos”. El desarrollador Infinity Ward es el encargado de esta actualización, en la que el mapa de Warzone ampliará su espacio de juego gracias a la apertura del estadio, del interior de la estación de trenes, y a la llegada de un colosal tren de carga que se encuentra en continuo movimiento, y que podrá ser utilizado como base móvil de operaciones. Pero, esto no es todo, los usuarios podrán disfrutar de cuatro nuevos mapas multijugador en el lanzamiento: una nueva experiencia Guerra Terrestre, dos mapas 6v6, y un mapa en el modo Tiroteo, preparado para ofrecer un combate frenético. Naturalmente, estas novedades estarán respaldadas por nuevos modos de juego tanto en el multijugador, como en Warzone, así como por un Pase de Batalla que incluye una gran cantidad de contenido, que podrá obtenerse de forma gratuita. -

Annual Financial Report and Audited Consolidated Financial Statements for the Year Ended December 31, 2008 Tuesday March 03, 2009

Annual Financial Report and Audited Consolidated Financial Statements for the Year Ended December 31, 2008 Tuesday March 03, 2009 VIVENDI Société anonyme with a Management Board and Supervisory Board with a share capital of €6,436,133,182 Head Office: 42 avenue de Friedland – 75380 PARIS CEDEX 08 – FRANCE IMPORTANT NOTICE: READERS ARE STRONGLY ADVISED TO READ THE IMPORTANT DISCLAIMERS AT THE END OF THIS FINANCIAL REPORT. Annual Financial Report and Audited Consolidated Financial Statements for the Year Ended December 31, 2008 Vivendi /2 TABLE OF CONTENTS Tuesday March 03, 2009 SELECTED KEY CONSOLIDATED FINANCIAL DATA.........................................................................................................................................5 I – 2008 FINANCIAL REPORT ................................................................................................................................................................................6 SUMMARY OF THE 2008, 2007 AND 2006 MAIN DEVELOPMENTS................................................................................................................6 1 2008 MAIN DEVELOPMENTS......................................................................................................................................................................7 1.1 MAIN DEVELOPMENTS IN 2008 .......................................................................................................................................................................7 1.2 MAIN DEVELOPMENTS SINCE DECEMBER -

Game Developers Conference Europe Wrap, New Women’S Group Forms, Licensed to Steal Super Genre Break Out, and More

>> PRODUCT REVIEWS SPEEDTREE RT 1.7 * SPACEPILOT OCTOBER 2005 THE LEADING GAME INDUSTRY MAGAZINE >>POSTMORTEM >>WALKING THE PLANK >>INNER PRODUCT ART & ARTIFICE IN DANIEL JAMES ON DEBUG? RELEASE? RESIDENT EVIL 4 CASUAL MMO GOLD LET’S DEVELOP! Thanks to our publishers for helping us create a new world of video games. GameTapTM and many of the video game industry’s leading publishers have joined together to create a new world where you can play hundreds of the greatest games right from your broadband-connected PC. It’s gaming freedom like never before. START PLAYING AT GAMETAP.COM TM & © 2005 Turner Broadcasting System, Inc. A Time Warner Company. Patent Pending. All Rights Reserved. GTP1-05-116-104_mstrA_v2.indd 1 9/7/05 10:58:02 PM []CONTENTS OCTOBER 2005 VOLUME 12, NUMBER 9 FEATURES 11 TOP 20 PUBLISHERS Who’s the top dog on the publishing block? Ranked by their revenues, the quality of the games they release, developer ratings, and other factors pertinent to serious professionals, our annual Top 20 list calls attention to the definitive movers and shakers in the publishing world. 11 By Tristan Donovan 21 INTERVIEW: A PIRATE’S LIFE What do pirates, cowboys, and massively multiplayer online games have in common? They all have Daniel James on their side. CEO of Three Rings, James’ mission has been to create an addictive MMO (or two) that has the pick-up-put- down rhythm of a casual game. In this interview, James discusses the barriers to distributing and charging for such 21 games, the beauty of the web, and the trouble with executables.