Forstanderskapsmøte I

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1892 Konfirmanter 1

1892 Konfirmanter 1 Nr. Ind- Konfirmantens Fødsels- Dåps- Fødested Oppholdssted Foreldrenes navn og stilling Vaksinert Kunnsk. Anmerk. skrevet fulle navn dato dato karakter ________ 01. Jens Langfeldt 16.09.78 22.09.78 Oftenæs Nye Hellesund Skibsfører Anton Fritz Langfeldt 30.07.79 megetgodt Søgne Søgne og hustru Inga Tobine Jensdtr. Langfeldt 02. Johan Arndt 26.10.77 04.11.77 Bergstøl Stray Abeidsmand Torjus Asbjørnsen 07.09.92 megetgodt Torjussen Greipstad Torridal og hustru Anne Regine Andersdtr. Stray 03. Aksel Ingeman 15.05.78 30.05.78 Hævaager Dversnes Sømand Kristen Aslaksen og 16.05.88 godt Kristensen Søgne Randøsund hustru Talette Mathilde Olsdtr. 1893 Konfirmanter 2 Nr. Ind- Konfirmantens Fødsels- Dåps- Fødested Oppholdssted Foreldrenes navn og stilling Vaksinert Kunnsk. Anmerk. skrevet fulle navn dato dato karakter ________ 01. Peder Erlandsen 22.09.79 Kristianssand Kristianssand Arbeider Johan Erlandsen og 19.04.93 megetgodt Aflagt kunnskaps- hustru Torborg Gundersdtr. – godt prøve 01.10.93. 02. Hans Laurits 23.02.78 10.03.78 Stangenes Stangenes Skipper Hans Hermansen og 04.08.90 megetgodt Do. Hermansen Randøsund Randøsund hustru Thalette Hansen 03. Aslak Olsen 10.10.78 Rabbersvig Rabbersvig Gaardbr. Ole Aanensen Rabbersvig 11.09.93 godt Do. Randøsund Randøsund og hustru Inger Aasille Aslaksdtr. 04. Anne Marie 02.11.78 Lund Prestvigen Skipper Nils Gabriel Andersen og 15.03.82 megetgodt Do. Andersen Oddernes Oddernes hustru Hanne Marie, f. Kristensen 05. Maren Severine 30.08.78 Prestvigen Prestvigen Dampskibsfører Lars Vilhelm Lund 22.06.85 megetgodt Do. Lund Oddernes Oddernes og hustru Maren Søverine Jørgensdtr. 06. Anna Baroline 15.10.79 Kristianssand Hundsøen Skomager Aanen Aanensen og 18.11.91 megetgodt Do. -

By Bus to Gimlemoen, Kristiansand

Welcome to Kristiansand – the administrative, business and cultural capital of South Norway! Kristiansand is the county capital of Vest-Agder, which together with the neighbouring counties constitutes the Sørlandet region. The sheltered coastline with scenic fishing villages and vast uninhabited areas is one of the region's most valuable assets and provides unforgettable experiences. A short inland drive by car brings visitors to the scenic Setesdal valley with some of the oldest preserved rural wooden settlements in Norway. We have enclosed some information that you might find helpful and intersting. Enjoy the 2019 European Integration Summer School (EISS) and have a great time at the University of Agder and in Norway! Website: www.uia.no/eiss Facebook: https://www.facebook.com/eissUiA/ 1 1. Transportation To and from KRISTIANSAND: BY PLANE The following airlines have flights to Kristiansand: • SAS with flights to/from Oslo, Bergen, Stavanger (NO), and Copenhagen (DK) • KLM with flights to/from Amsterdam (NL) • Norwegian with flights to/from Oslo (NO) • Wizzair with flights to/from Gdansk (PL) …to and from Kristiansand airport, Kjevik: Bus Take the airport express bus (FLYBUSSEN) to Spicheren Fitness Centre (situated at Campus Kristiansand). The trip takes approx. 20 minutes from the airport. You can check the schedule online at http://www.akt.no. Taxi Trips to and from the airport to campus takes about 15-20 minutes and cost 350 NOK (40 EUR) depending on the time of the day (app. 415 NOK – 45 EUR after 8pm). Taxis are stationed at the taxi stand located next to the terminal. They can also be requested by phone: • Taxi Sør – phone: (+47) 38 02 80 00 • Agder Taxi – phone: (+47) 38 00 20 00 BY TRAIN The Sørlandet Railway travels from Oslo via Kristiansand to Stavanger. -

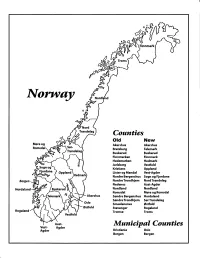

Norway Maps.Pdf

Finnmark lVorwny Trondelag Counties old New Akershus Akershus Bratsberg Telemark Buskerud Buskerud Finnmarken Finnmark Hedemarken Hedmark Jarlsberg Vestfold Kristians Oppland Oppland Lister og Mandal Vest-Agder Nordre Bergenshus Sogn og Fjordane NordreTrondhjem NordTrondelag Nedenes Aust-Agder Nordland Nordland Romsdal Mgre og Romsdal Akershus Sgndre Bergenshus Hordaland SsndreTrondhjem SorTrondelag Oslo Smaalenenes Ostfold Ostfold Stavanger Rogaland Rogaland Tromso Troms Vestfold Aust- Municipal Counties Vest- Agder Agder Kristiania Oslo Bergen Bergen A Feiring ((r Hurdal /\Langset /, \ Alc,ersltus Eidsvoll og Oslo Bjorke \ \\ r- -// Nannestad Heni ,Gi'erdrum Lilliestrom {", {udenes\ ,/\ Aurpkog )Y' ,\ I :' 'lv- '/t:ri \r*r/ t *) I ,I odfltisard l,t Enebakk Nordbv { Frog ) L-[--h il 6- As xrarctaa bak I { ':-\ I Vestby Hvitsten 'ca{a", 'l 4 ,- Holen :\saner Aust-Agder Valle 6rrl-1\ r--- Hylestad l- Austad 7/ Sandes - ,t'r ,'-' aa Gjovdal -.\. '\.-- ! Tovdal ,V-u-/ Vegarshei I *r""i'9^ _t Amli Risor -Ytre ,/ Ssndel Holt vtdestran \ -'ar^/Froland lveland ffi Bergen E- o;l'.t r 'aa*rrra- I t T ]***,,.\ I BYFJORDEN srl ffitt\ --- I 9r Mulen €'r A I t \ t Krohnengen Nordnest Fjellet \ XfC KORSKIRKEN t Nostet "r. I igvono i Leitet I Dokken DOMKIRKEN Dar;sird\ W \ - cyu8npris Lappen LAKSEVAG 'I Uran ,t' \ r-r -,4egry,*T-* \ ilJ]' *.,, Legdene ,rrf\t llruoAs \ o Kirstianborg ,'t? FYLLINGSDALEN {lil};h;h';ltft t)\l/ I t ,a o ff ui Mannasverkl , I t I t /_l-, Fjosanger I ,r-tJ 1r,7" N.fl.nd I r\a ,, , i, I, ,- Buslr,rrud I I N-(f i t\torbo \) l,/ Nes l-t' I J Viker -- l^ -- ---{a - tc')rt"- i Vtre Adal -o-r Uvdal ) Hgnefoss Y':TTS Tryistr-and Sigdal Veggli oJ Rollag ,y Lvnqdal J .--l/Tranbv *\, Frogn6r.tr Flesberg ; \. -

Schulte M. the Scandinavian Dotted Runes

UDC 811.113.4 Michael Schulte Universitetet i Agder, Norge THE SCANDINAVIAN DOTTED RUNES For citation: Schulte M. The Scandinavian dotted runes. Scandinavian Philology, 2019, vol. 17, issue 2, pp. 264–283. https://doi.org/10.21638/11701/spbu21.2019.205 The present piece deals with the early history of the Scandinavian dotted runes. The medieval rune-row or fuþork was an extension of the younger 16-symbol fuþark that gradually emerged at the end of the Viking Age. The whole inventory of dotted runes was largely complete in the early 13th century. The focus rests on the Scandina- vian runic inscriptions from the late Viking Age and the early Middle Ages, viz. the period prior to AD 1200. Of particular interest are the earliest possible examples of dotted runes from Denmark and Norway, and the particular dotted runes that were in use. Not only are the Danish and Norwegian coins included in this discussion, the paper also reassesses the famous Oddernes stone and its possible reference to Saint Olaf in the younger Oddernes inscription (N 210), which places it rather safely in the second quarter of the 11th century. The paper highlights aspects of absolute and rela- tive chronology, in particular the fact that the earliest examples of Scandinavian dot- ted runes are possibly as early as AD 970/980. Also, the fact that dotted runes — in contradistinction to the older and younger fuþark — never constituted a normative and complete system of runic writing is duly stressed. In this context, the author also warns against overstraining the evidence of dotted versus undotted runes for dating medieval runic inscriptions since the danger of circular reasoning looms large. -

Administrative and Statistical Areas English Version – SOSI Standard 4.0

Administrative and statistical areas English version – SOSI standard 4.0 Administrative and statistical areas Norwegian Mapping Authority [email protected] Norwegian Mapping Authority June 2009 Page 1 of 191 Administrative and statistical areas English version – SOSI standard 4.0 1 Applications schema ......................................................................................................................7 1.1 Administrative units subclassification ....................................................................................7 1.1 Description ...................................................................................................................... 14 1.1.1 CityDistrict ................................................................................................................ 14 1.1.2 CityDistrictBoundary ................................................................................................ 14 1.1.3 SubArea ................................................................................................................... 14 1.1.4 BasicDistrictUnit ....................................................................................................... 15 1.1.5 SchoolDistrict ........................................................................................................... 16 1.1.6 <<DataType>> SchoolDistrictId ............................................................................... 17 1.1.7 SchoolDistrictBoundary ........................................................................................... -

Nedbørhendelse 7. Og 8. September 2018

NO. 24/2018 METEOROLOGI METinfo Oslo, 23.10.2018 Hendelserapport Kraftig regnvær Østafjells 7-8 september 2018 [ Vibeke Thyness, Hanne Beate Skattør, Jostein Mamen ] Figur 1. Satellittbilde og radar . Innhold Sammendrag 2 Rapport 4 1.1 Kort beskrivelse 4 1.2 Lang Beskrivelse 4 1.3 Varsel 5 1.3.1 Tirsdag 4. september: Gult Farevarsel: Utfordrende situasjon. Vær 5 oppmerksom 1.3.2 Onsdag 5. september: Gult nivå Østafjells opprettholdt 5 1.3.3 Torsdag 6. september: Gult nivå, justert, og utvidet til Rogaland 5 1.3.4 Fredag 7. september: Oransje nivå Buskerud, Telemark, Vestfold. 7 Gult nivå Agder. Nytt gult varsel Østfold, Oslo, Akershus. Gult varsel Rogaland kanselleres. 1.4 Observasjoner fra det aktuelle området 9 1.4.1 Døgnnedbør 8.,9. og 10. september 9 1.4.2 Største to-og tredøgns nedbør i perioden 7.-10. september 11 1.4.3 1-tmes og 3-timers nedbør 13 1.5 Sjeldenhet 16 1.6 Konsekvenser/Skader/Mediaklipp 16 1.7 Oppsummering/Konklusjon 17 1 Meteorologisk institutt Oslo Bergen Tromsø Org.nr 971274042 Pb 43, Blindern Allégaten 70 Pb 6314, Langnes [email protected] 0313 Oslo 5007 Bergen 9293 Tromsø www.met.no / www.yr.no T. 480 72 536 T. 480 68 406 T. 480 68 191 Sammendrag Fredag 7. september lå et lavtrykk tilnærmet stille utenfor Rogaland med tilhørende kaldfront inn i Skagerrak. Fronten hadde en sakte bevegelse nordover, og brukte hele fredag kveld og halve lørdag på å passere Sør-Norge. I varmlufta foran fronten dannet det seg smale linjer med kraftige regn-og tordenbyger, som ble kontinuerlig opprettholdt av kontrasten mellom de varme luftmassene foran fronten og den kjølige lufta som presset på bak. -

Vessel Import to Norway in the First Millennium AD Composition And

VESSEL IMPORT TO NORWAY IN THE FIRST MILLENNIUM A.D Composition and context. by Ingegerd Roland Ph.D. thesis. Institute of Archaeology, University College London, June 1996. ProQuest Number: 10017303 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. uest. ProQuest 10017303 Published by ProQuest LLC(2016). Copyright of the Dissertation is held by the Author. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. Microform Edition © ProQuest LLC. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 Abstract : More than 1100 complete or fragmentary imported vessels in bronze, glass, wood, horn, clay and silver from the first millennium A.D. have been found in Norway, approximately 80% of them in graves. The extensive research already carried out has produced a vast body of literature, which generally keeps within strict chronological boundaries, concentrating on vessels from either the Roman Period, the Migration Period, or the Viking Age. Two main approaches to the material have traditionally been applied: 1) typo logical studies, on the basis of which trade connections and systems have been discussed from different theoretical perspectives, and 2) imports as status markers, from which hierarchical social systems of a general kind have been inferred. Only very rarely have their function as vessels attracted any serious consideration, and even more rarely their actual local context. -

Kirkesteder Vestagder.Pdf (11.84Mb)

KILDEGJENNOMGANG Middelalderske kirkesteder i Vest-Agder fylke Oddernes kirke, Kristiansand kommune. Foto: C. Christensen Thomhav. Riksantikvaren. Desember 2016 INNHOLD INNLEDNING .......................................................................................................................... 3 KRISTIANSAND KOMMUNE .............................................................................................. 4 ODDERNES (hovedkirke) ................................................................................................... 4 TVEIT ................................................................................................................................... 6 STA. MARIA KAPELLET PÅ VE. Nedlagt kirkested. .................................................... 8 INDRE FLEKKERØY HAVN. Nedlagt kirkested. .......................................................... 10 MANDAL KOMMUNE ......................................................................................................... 12 HOLUM .............................................................................................................................. 12 HARKMARK ..................................................................................................................... 14 HALSÅ [Halsa] (MANDAL, hovedkirke). ....................................................................... 16 SÅNUM. Nedlagt kirkested. ................................................................................................ 18 FARSUND KOMMUNE ....................................................................................................... -

Final Draft Thesis 15122019

Master’s Thesis 2019 30 ECTS Faculty of Landscape and Society Department of International Environment and Development Studies The city as an actor in International Relations: The case of cross-border city networks seen from Kristiansand, Norway Linn Chloe Cueto Hagstrøm Master of Science International Relations i The Department of International Environment and Development Studies, Noragric, is the international gateway for the Norwegian University of Life Sciences (NMBU). Eight departments, associated research institutions and the Norwegian College of Veterinary Medicine in Oslo. Established in 1986, Noragric’s contribution to international development lies in the interface between research, education (Bachelor, Master and PhD programmes) and assignments. The Noragric Master theses are the final theses submitted by students in order to fulfil the requirements under the Noragric Master programme ‘International Environmental Studies’, ‘International Development Studies’ and ‘International Relations’. The findings in this thesis do not necessarily reflect the views of Noragric. Extracts from this publication may only be reproduced after prior consultation with the author and on condition that the source is indicated. For rights of reproduction or translation contact Noragric. © Linn Chloe Hagstrøm, December 2019 [email protected] Noragric Department of International Environment and Development Studies P.O. Box 5003 N-1432 Ås Norway Tel.: +47 64 96 52 00 Fax: +47 64 96 52 01 Internet: http://www.nmbu.no/noragric ii Declaration I, Linn Chloe Cueto Hagstrøm, declare that this thesis is a result of my research investigations and findings. Sources of information other than my own have been acknowledged and a reference list has been appended. This work has not been previously submitted to any other university for award of any type of academic degree. -

3479 72Dpi.Pdf

Forord Hunsfos Fabrikker A/S er pålagt av Statens forurensningstilsyn (SFT) å foreta konsekvensundersøkelser av utslipp fra fabrikken. Undersøkelsen har vært gjennomført i perioden 1992-1995 i forbindelse med en nedtrapping av de organiske utslippene. Den rutinemessige overvåkingen av Otra, som administreres av Statens forurensningstilsyn, gjennomføres samtidig. Denne undersøkelsen er en del av Statlig program for forurensningsovervåking. Konsekvensundersøkelsen og overvåkingsundersøkelsen er i perioden samkjørt og finansieres med midler fra Hunsfos Fabrikker A/S, Norsk Wallboard A/S, SFT og Vassdragsrådet for Nedre Otra. Den foreliggende rapporten omhandler i første rekke resultater fra 1992-1995. Programmet er konsentrert om den nedre delen av Otra og er rettet direkte mot effekter av industriutslipp og kloakktilførsler. Undersøkelser i Otras øvre del er bare i begrenset grad omtalt. Teknisk etat i Evje og Hornnes kommune og Gunnar Ose har tatt prøvene i den øvre delen av Otra, fra Evje og oppover. Disse prøvene er analysert ved Agderforskning - Teknikk i Grimstad. Vannprøver fra nedre Otra er samlet inn av Kristiansand Ingeniørvesen og analysert på NIVA. Karl Jan Aanes og Torleif Bækken har gjennomført bunndyrundersøkelsene. Eli-Anne Lindstrøm har hatt ansvar for innsamling og analyser av begroingsorganismer i nedre del av Otra. I 1995 ble det dessuten gjennomført en kartlegging av høyere vannvegetasjon nedenfor Vennesla. Undersøkelsen er gjennomført og rapportert av Tor Erik Brandrud. Grimstad, juni 1996 Øyvind Kaste 2 INNHOLDSFORTEGNELSE -

Stortingsvalget 1933

NORGES OFFISIELLE STATISTIKK. IX. 26. STORTINGSVALGET 1933 (Élections en 1933 pour le «Storting».) UTGITT AV STORTINGETS KONTOR. OSLO. I KOMMISJON HOS H. ASCHEHOUG & CO. 1934. OSLO - O. FREDR. ARNESENS BOK- OG AKSIDENSTRYKKERI - 1934, Forord. Nærværende statistikk er utarbeidet efter samme system som de efter valgene i 1921, 1924, 1927 og 1930 utkomne. Første del, som inneholder de almindelige statistiske Oplysninger (tab. 1—4, s. 1—30). er utarbeidet av fullmektig i Stortinget P. A. "Wessel-Berg på grunnlag av de fra valgstyrenes formenn innsendte skjematiske opgaver. Disse Lar som før i stor utstrekning måttet sammenholdes med og suppleres ved hjelp av de til Stortingets kontor innsendte valgdokumenter. Annen del inneholder den politiske fordeling av stemmene. Fordelingen er skjedd på grunnlag av de på hvert enkelt parti falne listestemmer under sammenhold med de øvrige valgdokumenter og innsendte opgaver. Utregningen som omfatter s. 31—150, er foretatt av førstesekretær ved Stortingets kontor Karl Bjørnstad. — De siste sider (tab. 5—6, s. 151—160) er utarbeidet av arkivar i Stortinget Y. H af f ner. Oslo i mars 1934. P. A. Wessel-Berg. Karl Bjørnstad. Valgdistrikter, valgsogn m. v. I tiden 1 september 1930—1 september 1933 er foretatt følgende endringer med hensyn til jurisdiksjonsgrenser og navn: 1. Ved kgl. resolusjon 12 desember 1930 blev Kråkstad herred (Akershus fylke) delt i to herreder, Kråkstad og Ski. Delingen trådte i kraft 1 juli 1931. 2. Ved kgl. resolusjon 23 januar 1931 blev herredsnavnet Hølandet (Sør-Trøndelag fylke) forandret til Hølonda. 3. Den 6 mars 1931 er sanksjonert lov om forandring i lov av 4 juni 1929 om navne- skifte for byen Trondhjem — hvorefter navnet blev Trondheim. -

Kristiansand – the Administrative, Business and Cultural Capital of South Norway!

We Welcome You! to Kristiansand – the administrative, business and cultural capital of South Norway! Kristiansand is the county capital of Vest-Agder, which together with the neighbouring counties constitutes the Sørlandet region. The sheltered coastline with scenic fishing villages and vast uninhabited areas is one of the region's most valuable assets and provides unforgettable experiences. A short inland drive by car brings visitors to the scenic Setesdal valley with some of the oldest preserved rural wooden settlements in Norway. We have enclosed some information that you might find helpful and intersting. Enjoy the 2017 European Integration Summer School (EISS) and have a great time at the University of Agder and in Norway! Website: https://www.uia.no/en/studier/european-integration-summer-school-eiss Facebook: https://www.facebook.com/eissUiA/ 1 1. Transportation To and from KRISTIANSAND: BY PLANE The following airlines have flights to Kristiansand: • SAS with flights to/from Oslo, Bergen, Stavanger, and Copenhagen (NO) • KLM with flights to/from Amsterdam (NL) • Norwegian with flights to/from Oslo (NO) • Wizzair with flights to/from Gdansk (PL) …to and from the Kristiansand airport, Kjevik: Bus Take the bus no. 35 to Spicheren Fitness Centre (situated at Gimlemoen campus). The trip takes approx. 20 minutes from the airport. You can check the schedule online at http://www.akt.no. Taxi Trips to and from the airport to Gimlemoen takes about 15-20 minutes and cost 350 NOK (40 EUR) depending on the time of the day (app. 415 NOK – 45 EUR after 8pm). Taxis are stationed at the taxi stand located next to the terminal.