Egypt-Annual-Report-2020.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EG-Helwan South Power Project Raven Natural Gas Pipeline

EG-Helwan South Power Project The Egyptian Natural Gas Company Raven Natural Gas Pipeline ENVIRONMENTAL AND SOCIAL IMPACT ASSESSMENT June 2019 Final Report Prepared By: 1 ESIA study for RAVEN Pipeline Pipeline Rev. Date Prepared By Description Hend Kesseba, Environmental I 9.12.2018 Specialist Draft I Anan Mohamed, Social Expert Hend Kesseba, Environmental II 27.2.2019 Specialist Final I Anan Mohamed, Social Expert Hend Kesseba, Environmental Final June 2019 Specialist Final II Anan Mohamed, Social Expert 2 ESIA study for Raven Pipeline Executive Summary Introduction The Government of Egypt (GoE) has immediate priorities to increase the use of the natural gas as a clean source of energy and let it the main source of energy through developing natural gas fields and new explorations to meet the national gas demand. The western Mediterranean and the northern Alexandria gas fields are planned to be a part from the national plan and expected to produce 900 million standard cubic feet per day (MMSCFD) in 2019. Raven gas field is one of those fields which GASCO (the Egyptian natural gas company) decided to procure, construct and operate a new gas pipeline to transfer rich gas from Raven gas field in north Alexandria to the western desert gas complex (WDGC) and Amreya Liquefied petroleum gas (LPG) plant in Alexandria. The extracted gas will be transported through a new gas pipeline, hereunder named ‘’the project’’, with 70 km length and 30’’ inch diameter to WDGC and 5 km length 18” inch diameter to Amreya LPG. The proposed project will be funded from the World Bank(WB) by the excess of fund from the south-helwan project (due to a change in scope of south helwan project, there is loan saving of US$ 74.6 m which GASCO decided to employ it in the proposed project). -

Egypt Real Estate Trends 2018 in Collaboration With

know more.. Egypt Real Estate Trends 2018 In collaboration with -PB- -1- -2- -1- Know more.. Continuing on the momentum of our brand’s focus on knowledge sharing, this year we lay on your hands the most comprehensive and impactful set of data ever released in Egypt’s real estate industry. We aspire to help our clients take key investment decisions with actionable, granular, and relevant data points. The biggest challenge that faces Real Estate companies and consumers in Egypt is the lack of credible market information. Most buyers rely on anecdotal information from friends or family, and many companies launch projects without investing enough time in understanding consumer needs and the shifting demand trends. Know more.. is our brand essence. We are here to help companies and consumers gain more confidence in every real estate decision they take. -2- -1- -2- -3- Research Methodology This report is based exclusively on our primary research and our proprietary data sources. All of our research activities are quantitative and electronic. Aqarmap mainly monitors and tracks 3 types of data trends: • Demographic & Socioeconomic Consumer Trends 1 Million consumers use Aqarmap every month, and to use our service they must register their information in our database. As the consumers progress in the usage of the portal, we ask them bite-sized questions to collect demographic and socioeconomic information gradually. We also send seasonal surveys to the users to learn more about their insights on different topics and we link their responses to their profiles. Finally, we combine the users’ profiles on Aqarmap with their profiles on Facebook to build the most holistic consumer profile that exists in the market to date. -

Newsletter #9

Newsletter #9 Cairo, 6th January 2019 Ras Ghareb Wind Energy – Project Update RGWE team wishes a happy and successful Year 2019 to all our stakeholders and readers ! The project construction progress is close to 60% mark, still slightly ahead from the original plan. More than 1,500,000 manhours have been worked at site with our Health & Safety target of no Lost Time Incident being fulfilled. The works performed by Orascom Construction under the Civil Works and Electrical Systems Agreement (CWESA) are progressing ahead of schedule. More than 110 out of the 125 Wind Turbine foundations have been poured and the internal roads are almost completed. The construction of the site buildings is progressing and in particular the Control Room building is about to reach completion. The erection of the MV/HV electrical substation is proceeding ahead of schedule. The laying of the MV and fiber optics cables connecting the Wind Turbines to the substation is also progressing well. Pouring of the 100th foundation Oil filing of step-up transformer 1 Ras Ghareb Wind Energy S.A.E., Egyptian Joint Stock Company registered under Internal Investment System Commercial register number: 104490 – Tax Card: 540 – 931 - 810 Registered office: Unit 1418, Floor 14, Nile City, Southern Tower, Ramlet Boulaq, Cairo, Egypt Branch office: Sahara Building, Plot 227, Second Sector, Fifth Settlement, New Cairo, Egypt On the wind turbines erection side, Siemens Gamesa is progressing well with the assembly of Towers, Nacelles, Hubs and Blades with currently 29 out of 125 wind turbines erected. On road 01 several turbines are assembled: RGWE is also mobilizing in view of the early operations phase of the project. -

Country Report of Egypt *

HIGH LEVEL FORUM ON GLOBAL CONFERENCE ROOM PAPER GEOSPATIAL MANAGEMENT INFORMATION NO. 4 First Forum Seoul, Republic of Korea, 24-26 October 2011 Country Report of Egypt * ___________________ * Submitted by: Mrs. Nahla Seddik Mohammed Saleh, Engineer in the GIS Department, Central Agency for Public Mobilization And Statistics 1 High Level Forum on Global Geospatial Information Management Seoul – Republic of Korea 24-26 October 2011 Egypt Report On The Development and Innovations of Egypt National geospatial Information System Prepared by Eng. Nahla Seddik Mohammed Director of Communication Systems Unit in GIS Department [email protected] CAPMAS,CAIRO, Nasr City, Salah Salem Street,B.O,BOX:2086 Tel:002024024986 Fax:002022611066 [email protected] www.capmas.gov.eg About The Department The Geographical Information Systems Department was established in 1989, to do the following tasks: 1. Establishment the administrative boundaries of Egypt for all three levels(Governorate- Ksm\Mrkz-shiakha\village). 2. Creating the digital base maps on the level of provinces Republic on a scale of 1:5000 (The coverage of digital base maps for urban areas of the republic is nearly 100%). 3. Produce different types of maps which are used in surveys, censuses and researches which are produced by CAPMAS. 4. Offering the consultations and technical support to government and private sector to build geographic information systems units from A to Z. 5. Supplying the needs of universities and research sectors by providing digital maps, cartography maps and various geographic data. 6. Continuously follow up updating of all geographical data bases for base maps and administrative boundaries at all scales of maps. -

Report 2019 Bank Audi Annual Report 2019

2019 ANNUAL REPORT EGYPT 1 BANK AUDI ANNUAL REPORT 2019 BANK AUDI ANNUAL REPORT 2019 BANK AUDI “S.A.E.” INDEPENDENT AUDITOR’S REPORT AND FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 December 2019 ANNUAL REPORT 2019 BANK AUDI “S.A.E.” BANK AUDI “S.A.E.” Annual Report 2019 01 OVERVIEW 01 OVERVIEWA. The Chairman’s Statement.............................................................. 8 B. CEO,A. The Managing Chairman’s Director's Statement............................................................... Statement............................................. 10 6 C. B.Strategic Bank Audi Direction sae Strategic & Values Direction of Bank & AudiValues................................... sae.............................. 1210 D. C.Overview Bank Audi of Group...............................................................................Bank Audi Group.......................................................... 1310 E. KeyD. Bank Financial Audi sae highlights Key Financial of Bank Highlights......................................... Audi sae.................................. 1411 F. GlobalE. The Egyptian & Regional Economy Economy in 2019....................................................... in 2019............................................ 1412 G. The Egyptian Economy in 2019.................................................... 16 022 CORPORATE GOVERNANCE CORPORATEA. Board of Directors............................................................................. GOVERNANCE 16 02 B. Governance....................................................................................... -

Greater Cairo Air Pollution Management and Climate Change Project

Public Disclosure Authorized Public Disclosure Authorized Greater Cairo Air Pollution Management and Public Disclosure Authorized Climate Change Project ENVIRONMENTAL AND SOCIAL MANAGEMENT FRAMEWORK (ESMF) Prepared by: Integral Consult© Public Disclosure Authorized A Member of Environmental Alliance ENVIRONMENTAL AND SOCIAL MANAGEMENT FRAMEWORK (ESMF) Greater Cairo Air Pollution Management and Climate Change Project Integral Consult Cairo Office 2075 El Mearaj City, Ring Road, Maadi – Cairo - Egypt Phone +202 25204515 • Fax +202 25204514 Email : [email protected] Greater Cairo Air Pollution Management and Climate Change Project Environmental and Social Management Framework (ESMF) ii Contributors to the Study Dr. Amr Osama, Integral Consult President Dr. Yasmine Kamal, Technical and Operations Manager Dr. Nermin Eltouny, Technical Team Lead Eng. Mai Ibrahim, Technical Team Lead Dr. Anan Mohamed, Social Development Consultant Eng. Fatma Adel, Senior Environmental Specialist Eng. Basma Sobhi, Senior Environmental Specialist Eng. Mustafa Adel, Environmental Specialist Eng. Lana Mahmoud, Environmental Specialist Greater Cairo Air Pollution Management and Climate Change Project Environmental and Social Management Framework (ESMF) iii TABLE OF CONTENTS List of Tables ................................................................................................................... x List of Figures ................................................................................................................ xiii List of Acronyms -

UNIVERSITY of CALIFORNIA Santa Barbara Egyptian

UNIVERSITY OF CALIFORNIA Santa Barbara Egyptian Urban Exigencies: Space, Governance and Structures of Meaning in a Globalising Cairo A Thesis submitted in partial satisfaction of the requirements for the degree Master of Arts in Global Studies by Roberta Duffield Committee in charge: Professor Paul Amar, Chair Professor Jan Nederveen Pieterse Assistant Professor Javiera Barandiarán Associate Professor Juan Campo June 2019 The thesis of Roberta Duffield is approved. ____________________________________________ Paul Amar, Committee Chair ____________________________________________ Jan Nederveen Pieterse ____________________________________________ Javiera Barandiarán ____________________________________________ Juan Campo June 2014 ACKNOWLEDGEMENTS I would like to thank my thesis committee at the University of California, Santa Barbara whose valuable direction, comments and advice informed this work: Professor Paul Amar, Professor Jan Nederveen Pieterse, Professor Javiera Barandiarán and Professor Juan Campo, alongside the rest of the faculty and staff of UCSB’s Global Studies Department. Without their tireless work to promote the field of Global Studies and committed support for their students I would not have been able to complete this degree. I am also eternally grateful for the intellectual camaraderie and unending solidarity of my UCSB colleagues who helped me navigate Californian graduate school and come out the other side: Brett Aho, Amy Fallas, Tina Guirguis, Taylor Horton, Miguel Fuentes Carreño, Lena Köpell, Ashkon Molaei, Asutay Ozmen, Jonas Richter, Eugene Riordan, Luka Šterić, Heather Snay and Leila Zonouzi. I would especially also like to thank my friends in Cairo whose infinite humour, loyalty and love created the best dysfunctional family away from home I could ever ask for and encouraged me to enroll in graduate studies and complete this thesis: Miriam Afifiy, Eman El-Sherbiny, Felix Fallon, Peter Holslin, Emily Hudson, Raïs Jamodien and Thomas Pinney. -

Mints – MISR NATIONAL TRANSPORT STUDY

No. TRANSPORT PLANNING AUTHORITY MINISTRY OF TRANSPORT THE ARAB REPUBLIC OF EGYPT MiNTS – MISR NATIONAL TRANSPORT STUDY THE COMPREHENSIVE STUDY ON THE MASTER PLAN FOR NATIONWIDE TRANSPORT SYSTEM IN THE ARAB REPUBLIC OF EGYPT FINAL REPORT TECHNICAL REPORT 11 TRANSPORT SURVEY FINDINGS March 2012 JAPAN INTERNATIONAL COOPERATION AGENCY ORIENTAL CONSULTANTS CO., LTD. ALMEC CORPORATION EID KATAHIRA & ENGINEERS INTERNATIONAL JR - 12 039 No. TRANSPORT PLANNING AUTHORITY MINISTRY OF TRANSPORT THE ARAB REPUBLIC OF EGYPT MiNTS – MISR NATIONAL TRANSPORT STUDY THE COMPREHENSIVE STUDY ON THE MASTER PLAN FOR NATIONWIDE TRANSPORT SYSTEM IN THE ARAB REPUBLIC OF EGYPT FINAL REPORT TECHNICAL REPORT 11 TRANSPORT SURVEY FINDINGS March 2012 JAPAN INTERNATIONAL COOPERATION AGENCY ORIENTAL CONSULTANTS CO., LTD. ALMEC CORPORATION EID KATAHIRA & ENGINEERS INTERNATIONAL JR - 12 039 USD1.00 = EGP5.96 USD1.00 = JPY77.91 (Exchange rate of January 2012) MiNTS: Misr National Transport Study Technical Report 11 TABLE OF CONTENTS Item Page CHAPTER 1: INTRODUCTION..........................................................................................................................1-1 1.1 BACKGROUND...................................................................................................................................1-1 1.2 THE MINTS FRAMEWORK ................................................................................................................1-1 1.2.1 Study Scope and Objectives .........................................................................................................1-1 -

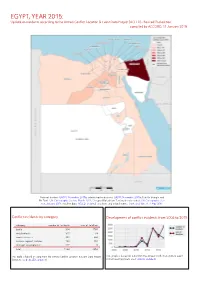

ACLED) - Revised 2Nd Edition Compiled by ACCORD, 11 January 2018

EGYPT, YEAR 2015: Update on incidents according to the Armed Conflict Location & Event Data Project (ACLED) - Revised 2nd edition compiled by ACCORD, 11 January 2018 National borders: GADM, November 2015b; administrative divisions: GADM, November 2015a; Hala’ib triangle and Bir Tawil: UN Cartographic Section, March 2012; Occupied Palestinian Territory border status: UN Cartographic Sec- tion, January 2004; incident data: ACLED, undated; coastlines and inland waters: Smith and Wessel, 1 May 2015 Conflict incidents by category Development of conflict incidents from 2006 to 2015 category number of incidents sum of fatalities battle 314 1765 riots/protests 311 33 remote violence 309 644 violence against civilians 193 404 strategic developments 117 8 total 1244 2854 This table is based on data from the Armed Conflict Location & Event Data Project This graph is based on data from the Armed Conflict Location & Event (datasets used: ACLED, undated). Data Project (datasets used: ACLED, undated). EGYPT, YEAR 2015: UPDATE ON INCIDENTS ACCORDING TO THE ARMED CONFLICT LOCATION & EVENT DATA PROJECT (ACLED) - REVISED 2ND EDITION COMPILED BY ACCORD, 11 JANUARY 2018 LOCALIZATION OF CONFLICT INCIDENTS Note: The following list is an overview of the incident data included in the ACLED dataset. More details are available in the actual dataset (date, location data, event type, involved actors, information sources, etc.). In the following list, the names of event locations are taken from ACLED, while the administrative region names are taken from GADM data which serves as the basis for the map above. In Ad Daqahliyah, 18 incidents killing 4 people were reported. The following locations were affected: Al Mansurah, Bani Ebeid, Gamasa, Kom el Nour, Mit Salsil, Sursuq, Talkha. -

Cairo ATM Address

Cairo ATM Address 1/ CITY STARS 1 Nasr city, Food Court, Phase 1 2/ CITY STARS 2 Nasr city, Food Court, Phase 2 3/ ARABELLA CLUB Arabella Country Club, 5th District, New Cairo 4/ KATTAMEYA HEIGHTS Kattameya heights, 5th District, New Cairo 5/ REHAB CITY Opened Food Court Area El Rehab City 6/ CARREFOUR MAADI City Center – Ring Road, Maadi 7/ ARKEDIA MALL Ramlet Boulak, Corniche El Nile, 4th Floor, Shoubra 8/ CFCC French Cultural Center, El Mounira 9/ SHEPHEARD HOTEL Garden City, Cornish El Nile 10/ SMG (Private) Mohandessin 11/ CRYSTAL ASFOUR 1 (Private) Industrial Zone, Shoubra El Kheima 12/ CRYSTAL ASFOUR 2 (Private) Industrial Zone, Shoubra El Kheima 13/ CRYSTAL ASFOUR 3 (Private) Industrial Zone, Shoubra El Kheima 14/ UNIVERSAL FACTORY (Private) Industrial Zone, 6th of October City 15/ ALPHA CERAMICA (Private) Industrial Zone, 6th of October City 16/ BADDAR COMPANY 63 Beginning of Cairo Ismailia Road 17/ ABOU GAHLY MOTORS (Private) Kilo 28 Cairo Ismailia Road 18/ EGYPT GOLD Industrial Zone Area A block 3/13013, Obour City 19/ AMOUN PHARMA CO. (Private) Industrial Zone, Obour City 20/ KANDIL GALVA METAL (Private) Industrial Zone, Area 5, Block 13035, El Oubour City 21/ EL AHRAM BEVERAGE CO. Idustrial Zone "A"part 24-11block number -12003, Obour City 22/ MOBICA CO. (Private) Abou Rawash, Cairo Alexandria Desert Road, After Dandy Mall to the right. 23/ COCA COLA (Pivate) Abou El Ghyet, Al kanatr Al Khayreya Road, Kaliuob Alexandria ATM Address 1/ PHARCO PHARM 1 Alexandria Cairo Desert Road, Pharco Pharmaceutical Company 2/ CARREFOUR ALEXANDRIA City Center- Alexandria 3/ SAN STEFANO MALL El Amria, Alexandria 4/ ALEXANDRIA PORT Alexandria 5/ DEKHILA PORT El Dekhila, Alexandria 6/ ABOU QUIER FERTLIZER Eltabia, Rasheed Line, Alexandria 7/ PIRELLI CO. -

Asset-Based Development: Success Stories from Egyptian Communities

Asset-Based Development: Success Stories from Egyptian Communities A Manual for Practitioners English translation of original document, published in Arabic by the Center for Development Services in Cairo, Egypt 2005 CONTENTS Acknowledgements 3 Introduction 5 Case Studies 7 Success Breeds Success 8 A Creative Community Based Composting Initiative 13 Moving Beyond Conventional Charity Work 18 Building Community Capacity 23 The Transformative Power of Art 29 Fan Sina 34 Linking Community and Government for Development 39 Peer-to-Peer Learning through the Living University 45 Bridging Gaps between Communities and Institutions 50 Rising from Modest Roots through Partnership 56 Mobilizing, Renewing and Building Assets: Methods, Tools, and Strategies 61 Identifying and Mobilizing Assets 63 Appreciative Interviewing and Analyzing Community Success 63 Mapping and Organizing 64 · Appreciative Interviewing 65 · Community Analysis of Success 67 · Positive Deviance 69 · Identifying Individual Skills: Hand, Heart, Head 71 · Mapping Community Groups or Associations 74 · Capacity Inventories 76 Linking Assets to Opportunities 78 Institutional Mapping and the Leaky Bucket 78 · Linking, Mobilizing & Organizing 79 · Mapping Institutions 81 · Leaky Bucket 84 The Role of the Intermediary 88 Fostering Broad-Based Leadership 89 Identifying “Gappers” 90 Helping Communities to Build Assets 91 Helping Communities to Link Assets to External Opportunities 92 Leading by Stepping Back 93 Tracking the Process as it Unfolds 93 Extended Case Studies 94 Success Breeds -

QIZ Ref. Sector Location Company Name Address Contact Name Title Tel Fax Mobile Email

QIZ Ref. Sector Location Company Name Address Contact Name Title Tel Fax Mobile Email Textile & Egyptian Company for Trade & Suez Canal St. Moharam Bek, El-Bar El-Kibly, Vice 3 Alexandria Salem Mohamed Salem 03-3615748 03-3618004 0122-2166302 [email protected] RMG Industry (SOGIC) Industrial Area President Textile & Shoubra El The Modern Egyptian Spinner 3 Montaser El Gabalawy St., Bahteem Old misrspain@misrsp 5 Essam Abd El Fattah Lawyer 02-2201107 02-2211184 0122-3788634 RMG Kheima (Ghazaltex) S.A.E Road, Shoubra El Kheima ain.com Textile & 120 Osman Basha Street, EL-Bar El-Kibly, Sherine Issa Hamed Managing babycoca1@babyc 8 Alexandria Baby Coca for Clothing 03-3815052 03-3815054 0122-2142042 RMG Semouha Ellish Director oca.com.eg Textile & Shoubra El Misr Company for Industrial Number 64, 15th May Road, Shoubra El- Mohamed Wadah Vice wadah@misrgrou 9 02-2208880 02-2211220 0122-7495992 RMG Kheima Investments , Private Free Zone Kheima, Kalyoubia Shamsi President p.com Textile & Misr El Ameria Spinning & Desert Road Alex/Cairo ( KM 23 ), Mohamed Ahmed Accountant export@misramre 10 Alexandria 03-2020395 03-2020390 0100-6123011 RMG Weaving Co. Petrochemical Road, Alexandria Mohamed Hegazy at Export Dep ya.com Textile & Obour City - Industrial Zone B,G Block No. Hosam El-Din General [email protected] 11 El Obour El Magmoua El Togaria 02-42157431 02-42155526 0111-7800123 RMG 22009 - Plot Industrial 2A Mohamed Mohab Manager om Textile & Shoubra El 2 El Mallah Street, Bigam Road, Shoubra El- Saber Ibrahim El Director In info@elmallahgro 12 El Mallah