EMMIS COMMUNICATIONS CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Qrli'anal N 5 J'8)Ol I Initial Notice Ofintention to Make Ephemeral Recordings 'C&Ct ~&Pg Under the Section 112 Statutory License

QRlI'ANAL N 5 J'8)ol I Initial Notice ofIntention to Make Ephemeral Recordings 'C&Ct ~&pg Under the Section 112 Statutory License In accordance with 37 CFR 201.35, fhe transmission service set forth herein files with the Library of Congress, Copyright Office, an initial notice stating the Service's intention to obtain statutory license, to the extent required by law, under Section 112(e) of Title 17 ofthe United States Code, as amended by Public Law 105-304, 112 Stat. 2860. 1. Name of Service: Emmis Communications Co oration 2. Mailing Address: 40 Monument Circle Suite 700 Indiana olis IN 46204 tli atgeogr pEiic locatioii. 3. Website Address of Service: See attached list. the Service, or::ivti ere iiifovmati on rriuy be poli d'urger tIie: reguEatioris ooiiceriiirig tEie1itse ofsouiid"rei ordilgs must'::be prii'ided. 4. Officer or Authorized Representative of Service: 1. Name: R. Bruce Rich 2. Title: Counsel to Emmis Communications Co oration 3. Address: Weil Gotshal k Man es LLP 767 Fifth Avenue New York NY 10153 4. Telephone: 212-310-8000 5. Facsimile 212-310-8007 6. Bate: 1/17/01 7. Signature: DC1 11026411011277501! .DOC112845.0003 EMMIS COMMUNICATIONS CORPORATION STREAMING SITES www.emmis.corn www.k-hits.corn www.q101.corn www.1057thepoint.corn www.kshe95.corn www.wluk.corn www.hi99.corn www.khon.corn www.wens.corn www.wthi.corn www.wibc.Com www.wftx.corn www.radionow93.corn www.wb18.corn www.radio971fm.corn www.koin.corn www.wtlc.corn www.krqe.corn www.cd1019.corn www.wsaz.corn www.power106.corn www.ksn.corn www.thema111041.corn www.kgmb.corn www.987kissfm.corn www.kmtv3.corn www.hot97.corn www.kgun9.corn www.thepeak.corn www.ksnt.corn www.kzla.corn www.kkltfm.corn www.620ktar.corn www.kmvp860.corn www.power92jams.corn DC1 197686&01Q3D$01!.DOCi41625.0003. -

For Immediate Release Thursday, January 10, 2019 Contact: Ryan

For Immediate Release Thursday, January 10, 2019 Contact: Ryan Hornaday, EVP/CFO & Treasurer [email protected] 317.266.0100 Emmis Announces Third Quarter Earnings Outperforms markets both quarter and year-to-date Indianapolis...Emmis Communications Corporation (NASDAQ: EMMS) today announced results for its third fiscal quarter ending November 30, 2018. Emmis’ radio net revenues for the third fiscal quarter were $28.7 million, down from $34.0 million in the prior year. Sales of radio stations (KPWR in LA in August 2017 and four radio stations in St. Louis on April 30, 2018) make Emmis’ reported results not comparable year-over-year. Pro forma for all radio station sales, Emmis’ third quarter radio revenues, as reported to Miller Kaplan, which excludes barter and certain other revenues, were up 5% in markets that were up 2%. “With this quarter’s strong performance, Emmis is now outperforming its markets through the first nine months of this fiscal year– quite an achievement,” said Emmis Chairman and CEO Jeff Smulyan. “Political revenues certainly helped, but we also saw growth in our core advertising categories, all of which contributed to Emmis having its strongest quarter in four years. New York and Indianapolis both outperformed their markets and continue to produce strong ratings, which should help sustain Emmis’ revenue growth. That certainly appears to be the case in January and February, where both months are pacing up mid-to-high single digits.” A conference call regarding earnings will be hosted today at 9 a.m. Eastern today by dialing 1-517-623-4891 with passcode Emmis. -

EMMIS COMMUNICATIONS CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 for the Fiscal Year Ended February 28, 2018 Transition Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 for the Transition Period from to . EMMIS COMMUNICATIONS CORPORATION (Exact name of registrant as specified in its charter) INDIANA (State of incorporation or organization) 0-23264 (Commission file number) 35-1542018 (I.R.S. Employer Identification No.) ONE EMMIS PLAZA 40 MONUMENT CIRCLE SUITE 700 INDIANAPOLIS, INDIANA 46204 (Address of principal executive offices) (317) 266-0100 (Registrant’s Telephone Number, Including Area Code) SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT: None SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT: Class A common stock, $.01 par value of Emmis Communications Corporation Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all documents and reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2019 Committees Roster.Xlsx

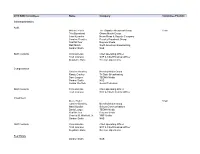

2019 NAB Committees Name Company Committee Position Joint Committees Audit Michael Fiorile The Dispatch Broadcast Group Chair Trila Bumstead Ohana Media Group John Kueneke News-Press & Gazette Company Caroline Beasley Beasley Broadcast Group Paul McTear Raycom Media Matt Mnich North American Broadcasting Gordon Smith NAB Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Stephanie Bone Director, Operations Compensation Caroline Beasley Beasley Media Group Randy Gravley Tri State Broadcasting Dave Lougee TEGNA Media Gordon Smith NAB Jordan Wertlieb Hearst Television Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Investment Steve Fisher Chair Caroline Beasley Beasley Media Group Marci Burdick Schurz Communications David Lougee TEGNA Media Paul McTear Raycom Media Charles M. Warfield, Jr. YMF Media Gordon Smith NAB Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Stephanie Bone Director, Operations Real Estate Gordon Smith NAB 2019 NAB Committees Name Company Committee Position Caroline Beasley Beasley Media Group Michael Fiorile The Dispatch Broadcast Group Paul Karpowicz Meredith Corporation Charles M. Warfield, Jr. YMF Media Staff Contact Steve Newberry EVP, Strategic Planning and Industry Affairs Bylaws Committee Darrell Brown Bonneville International Corp. Susan Fox The Walt Disney Company Kathy Clements Tribune Broadcasting Company John Zimmer Zimmer Radio of Mid-Missouri, Inc. Carolyn Becker Riverfront Broadcasting LLC Collin Jones Cumulus Media Inc. Caroline Beasley Beasley Media Group Randy Gravley Tri State Communications Inc Jordan Wertlieb Hearst Television Inc. Staff Contact Rick Kaplan General Counsel and EVP, Legal and Regulatory Affairs Dues Committee Tom Walker Mid-West Family Broadcasting Dave Santrella Salem Media Group Joe DiScipio Fox Television Stations, LLC Ralph Oakley Quincy Media, Inc. -

Webcast Metrics Monthly Ranker

TRITON DIGITAL’S WEBCAST METRICS® MONTHLY RANKER MARZO 2019 ACERCA DE WEBCAST METRICS® El servicio de medición de streaming Webcast Metrics es el estándar de la industria para datos de consumo de audio en línea. Provee datos confiables y validados que permite a los publishers de audio de todo el mundo analizar el consumo de su contenido de audio por horario, tipo de dispositivo, ubicación geográfica, plataforma de distribución, etc. ACERCA DE LOS RANKERS Los Webcast Metrics® Rankers son una lista de publishers y redes de audio digital con mejor desempeño según lo medido por el servicio de medición de streaming Webcast Metrics de Triton. Los publishers se clasifican globalmente y en tres regiones distintas: EE. UU., América Latina y EMEA. • El Global Publisher Ranker verifica la cantidad de streams sin calificar dónde se consumen • Los rankers regionales cuantifican el consumo según la ubicación de los oyentes • Todas las mediciones dentro de los rankers Webcast Metrics incluyen transmisiones escuchadas con y sin anuncios. ACERCA DE LOS RANKINGS Los rankings se computan por promedio de sesiones activas (AAS) y también se muestran sesiones iniciadas (SS) y tiempo promedio de escucha (ATSL). EXPLICACIÓN DE LAS MEDICIONES El promedio de sesiones activas o AAS representa la cantidad promedio de sesiones en cualquier momento específico del período reportado sin incluir sesiones no válidas. El AAS se puede calcular dividiendo el total de horas de escucha (TLH) por la cantidad de horas dentro del período reportado (AAS = TLH / horas en el período). El total de horas de escucha o THL se define como la cantidad total de horas que la estación/publisher ha transmitido durante sesiones con una duración de al menos un minuto dentro del período reportado. -

Hartley Adkins Amy Hughes Val Maki Joe D'angelo Laurie Kahn Jennifer

Hartley Adkins Joe D’Angelo Bill Hendrich Amy Hughes President - Integrated SVP-Broadcast Radio EVP DOS Revenue Strategy - iHeartMedia Xperi, Inc, DTS/HD Radio Cox Media Group Entercom Communications [email protected] [email protected] [email protected] [email protected] Laurie Kahn Susan Larkin Denyse Mesnik Val Maki Founder/Chief Multi-Tasker Regional VP President President/CEO Media Staffing Group Entercom Communications Mesnik Group Brandovation [email protected] [email protected] [email protected] [email protected] Jennifer Morelli Ginny Morris Beth Neuhoff Dan Spears SVP-Live Events/Experieces Chairperson/CEO CEO VP-Industry Relations Entercom Communications Hubbard Radio Neuhoff Media BMI [email protected] [email protected] [email protected] [email protected] Erika Sylvia Kim Johnson Erica Farber Georgia Beasley Controller Director of Sales President/CEO Manager-Professional Dev Emmis Communications Radio Advertising Bureau Radio Advertising Bureau Radio Advertising Bureau [email protected] [email protected] [email protected] [email protected] Luisa Banks Jill Bernhardt Taylor Brown Alexandra Byrnes Michelle Mazzara Kate Maguire Elizabeth Nifong Debbie Payne Cox Media Group Cumulus Media Neuhoff Media Entercom Communications BMI Summit Media Beasley Media Group Cumulus Media Atlanta, GA Atlanta, GA Springfield, IL Sacramento, CA Nashville, TN Omaha, NE Charlotte, NC Los Angeles, CA Yvonne Cheng Katy Dempsey Jaime Frankel Adella Fremstad-Nolen -

Attachment A

Attachment A _ -_ --_-- _4_.__ Figure 1 "'~ KfPH(TVl, ( GradeA _ ....... - . .. _- Flu ... ~KH.OT.FM.. IS: ~ ~ lmVIm ,// Sbow~ ,~cn / "~KMRR(FM) H i 1 mVIm KOMR(FML '.... 1 ",Vim o..oII~':"1\ - ~~:'i T."""1\.--~ .GIIf" Son en. $_ 1+1 Illy C. "V 1f4IiI " --.- K1VVV(TV) KolInIy Gi"adeA -. ,-"""""" uma TUrbyFill KKMR(FM) APP lmVim Veil SQn .- EJl<dt : Al1Alca CIlnlttl Si."" VlI1lI """... Sulbe Rl.iby RaPlro E-atl Un"""" $1_ . BlaCk COnIou... HBC S1allons • Red Contours NoglIios ~. -- D_ 50 0 100 150 200 JOG ~ , ",,",~_~,3 RADIO/TV CROSS OWNERSHIP STUDY PHOENIX. ARIZONA {hI 1'11:11. I,1IIHhIJ &. Rm:i..k·~, Inc Saras~Jla. f:IHnd;1 VOICE STUDY - PHOENIX, AZ RADIO METRO Independent TV Daily and Radio Newspapers Cable Owners 29 1 Detailed View (after proposed transaction) I. Univision Communications Inc. KTVW-TV Phoenix, AZ KFPH(TV) Flagstaff, AZ KHOT-FM Paradise Valley, AZ KHOV-FM Wickenburg, AZ KOMR-FM Sun City, AZ KMRR-FM Globe,AZ KKMR-FM Arizona Ci ,AZ 2. Gannett Co., Inc. KPNX(TV) Mesa,AZ KNAZ-TV Flagstaff, AZ KMOH-TV Kingman, AZ A.H. Belo Corp. KTVK(TV) Phoenix, AZ ~ KASWTV Phoenix, AZ I 4. I Meredith Corporation KPHO-TV Phoenix, AZ ~-- - I 5. KUSK, Inc. KUSK(TV) Prescott, AZ 6. Arizona State Board ofRegents For Arizona KAET(TV)* Phoenix, AZ State University KSAZ-TV Phoenix, AZ 7 Fox Television Stations, Inc. 1L. __ KUTP TV Phoenix, AZ ~I Scripps Howard Broadcasting Company KNXV-TV Phoenix, AZ ! 9. I Trinity Broadcasting ofArizona, Inc. KPAZ-TV Phoenix, AZ ! !e---- I 10. -

SECURITIES and EXCHANGE COMMISSION Washington, D.C

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 12 or 15(d) of The Securities Exchange Act of 1934 Date of Report: October 2, 2000 LEE ENTERPRISES, INCORPORATED ----------------------------------------------------- (Exact name of registrant as specified in its charter) Delaware 1-6227 42-0823980 - --------------- ----------- ------------------- (State or other (Commission (IRS Employer jurisdiction of File Number) Identification No.) incorporation) 215 N. Main Street, Davenport, IA 52801-1924 - --------------------------------------- --------------- (Address of principal executive offices) ZIP Code (319) 383-2100 --------------------------------------------------- (Registrant's telephone number, including area code) Item 2. Acquisition or Disposition of Assets On October 1, 2000 (the "Closing Date") Registrant and its wholly-owned subsidiary, New Mexico Broadcasting Co. ("NMBC"), completed the sale of their eight network-affiliated and seven satellite stations to Emmis Communications Corporation, of Indianapolis, Indiana ("Emmis") (the "Sale"). Registrant received $559.5 million (the "Purchase Price"), plus $21,194,526 of Preliminary Working Capital (as defined below) in cash from Emmis pursuant to the terms of a Purchase and Sale Agreement by and among Lee, NMBC and Emmis dated May 7, 2000 (the "Agreement"). The Purchase Price was determined as a result of arm-length negotiations between unrelated parties. In negotiating the Purchase Price and others terms, Registrant was assisted by Credit Suisse First Boston and McFarland Dewy & Co. LLC. Registrant will use the proceeds of the Sale to continue the expansion of its publishing, online and information services businesses. The Sale was effected by Emmis' purchase of all the outstanding shares of common stock of KOIN-TV, Inc. and SJL of Kansas Corp. -

SECURITIES and EXCHANGE COMMISSION Washington, D.C

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K/A CURRENT REPORT Pursuant to Section 12 or 15(d) of The Securities Exchange Act of 1934 Date of Report: May 8, 2000 LEE ENTERPRISES, INCORPORATED ----------------------------------------------------- (Exact name of registrant as specified in its charter) Delaware 1-6227 42-0823980 - --------------- ----------- ------------------- (State or other (Commission (IRS Employer of jurisdiction File Number Identification No.) incorporation) 215 N. Main Street, Davenport, IA 52801-1924 - --------------------------------------- ---------- (Address of principal executive offices) ZIP Code (319) 383-2100 --------------------------------------------------- (Registrant's telephone number, including area code) Item 5. Other Events On May 7, 2000 the Registrant and its wholly-owned subsidiary, New Mexico Broadcasting Co. ("NMBC"), entered into an agreement to sell certain of their broadcasting properties, consisting of eight network-affiliated and seven satellite television stations, to Emmis Communications Corporation ("Emmis")(the "Sale"). The purchase price is approximately $562,500,000. The Sale is subject to various conditions, including Hart-Scott-Rodino clearance and approval by the Federal Communications Commission, and other customary contingencies for a transaction of this nature. The Sale is anticipated to be completed later this year. The Sale will be effected by Emmis' purchase of all the outstanding shares of common stock of KOIN-TV, Inc and SJL of Kansas Corp. from Registrant -

Nab Engineering Achievement Award Winners 1959 – 2019

NAB ENGINEERING ACHIEVEMENT AWARD WINNERS 1959 – 2019 2019 2011 RADIO RADIO Gary Cavell, Cavell, Mertz & Associates, Manassas, Va. L. Robert du Treil, du Treil, Lundin & Rackley, Inc., Sarasota, Fla. TELEVISION Cindy Hutter Cavell, Cavell, Mertz & Associates, Manassas, Va. TELEVISION 2018 Thomas B. Keller, Renowned Television Technology Innovator 2010 RADIO Carl T. Jones, Jr., Carl T. Jones Corporation, Springfield, Va. RADIO Steve Church, Telos Systems, Cleveland, Ohio TELEVISION Mark Aitken, Sinclair Broadcast Group, Inc., Hunt Valley, Md. TELEVISION Mark Richer, ATSC, Washington, D.C. SERVICE TO BROADCAST ENGINEERING 2009 Clay Freinwald, Bustos Media Holdings, LLC, Seattle, Wash. 2017 RADIO Jack Sellmeyer, Sellmeyer Engineering, Lucas, Texas RADIO TELEVISION John Kean, Cavell, Mertz & Associates, Manassas, Va. Sterling Davis, Cox Broadcasting, Atlanta, Ga. TELEVISION 2008 John Lyons, The Durst Organization, New York, N.Y. RADIO 2016 Thomas B. Silliman, Electronics Research, Inc., Chandler, Ind. RADIO TELEVISION Andrew Laird, Journal Broadcast Group, Milwaukee, Wis. Antoon Uyttendaele, ABC Inc., New York, N.Y. TELEVISION 2007 Richard Chernock, Triveni Digital, Princeton, N.J. RADIO 2015 Louis A. King, Kintronic Laboratories, Inc., Bristol, Tenn. RADIO TELEVISION Thomas F. King, Kintronic Labs, Bristol, Tenn. Victor Tawil, Association for Maximum Service Television, TELEVISION Washington, D.C. Richard Friedel, Fox Networks Engineering and Operations, 2006 Los Angeles, Calif. RADIO SERVICE TO BROADCAST ENGINEERING Benjamin Dawson, Hatfield and Dawson, Seattle, Wash.; Ray Conover, Hubbard Broadcasting, St. Paul, Minn. Ronald Rackley, du Treil, Lundin and Rackley, Inc., Sarasota Fla. 2014 TELEVISION S. Merrill Weiss, Merrill Weiss Group LLC, Metuchen, N.J. RADIO Jeff Littlejohn, Clear Channel Media and Entertainment, 2005 Cincinnati, Ohio RADIO TELEVISION Milford Smith, Greater Media, Inc., East Brunswick, N.J. -

Federal Communications Commission IX. NOTICE of PROPOSED

Federal Communications Commission FCC 03-127 IX. NOTICE OF PROPOSED RULEMAKING 657. In the Local Radio Section of this Order, we replaced our current contour-overlap methodology for defining radio markets with a geography-based market definition. For areas of the country covered by Arbitron Metro markets, we adopted the Metro market as the relevant radio market for purposes of determining compliance with the local radio ownership rule. A significant portion of the country, however, is not covered by Metro markets. We initiate this rulemaking proceeding to define radio markets for those areas. 658. We seek comment on how to draw specific market boundaries in areas of the country not located in Arbitron Metros. What factors should we consider in grouping radio stations into markets? We propose that radio markets be county-based, as Arbitron Metros are. We seek comment on that proposal. In the western United States, counties are significantly larger. We seek comment on whether we should, like Arbitron, divide counties into separate radio markets in certain circumstances. We also propose that radio stations be assigned to radio markets based on the location of their communities of license We seek comment on this proposal. 659. We seek comment on whether we should rely on any pre-existing market definitions in delineating radio markets for non-Metro areas. As indicated in the Local Radio Section, Arbitron traditionally has based its Metro definitions on the Metropolitan Area (MA) definitions developed by OMB. Should we also do the same for non-Metro areas? OMB recently released new MA definitions based on the results of the 2000 Census.1372The 935 new MAS, moreover, cover a greater portion of the country. -

Voice of the Broadcasting Industry Volume 22, Issue 11

November 2005 Voice of the Broadcasting Industry Volume 22, Issue 11 $8.00 USA $12.50 Canada-Foreign RADIORADIO NEWS ® NEWS and TV subsidiary. Lincoln hadn’t been in broadcasting, but Chairman How should HD Radio and CEO Jon Boscia likes what he sees and says the company will keep the broadcast unit—with a name change expected. be numbered? Jefferson-Pilot Communications currently provides about 10% of the Lots of people in radio are excited about opportunities for multicasting operating profits at Jefferson-Pilot Corporation. That will translate to with HD Radio and a handful of stations are already offering a second about 4% of the operating profits at the merged company. HD program channel in addition to the HD channel duplicating their RBR observation: The value of the Jeff-Pilot Communications sub- analog programming. Of course, there aren’t very many HD receivers sidiary wasn’t broken out from the main deal. However, Jeff-Pilot sup- out in the marketplace yet—and even fewer second-generation receiv- plies considerable financial data about the broadcast operation, although ers capable of tuning to the second channel. For now, those second it doesn’t separate radio and TV, so we can come up with a ballpark channels are being called HD-2, but there’s a debate going on inside the figure. The broadcast division had $239 million in revenues in 2004, radio industry about how HD should be numbered going forward. about 6% of the company’s total of 4.1 billion. Jeff-Pilot Communica- Cox Radio kicked off the debate by asking other radio groups for tions reported broadcast cash flow of $108 million for 2004.