Interruptions and Exceptions to Laytime in a Nutshell

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frequently Overlooked Risk Management Issues in Contracts of Affreightment and Sale Contracts

Frequently overlooked risk management issues in contracts of affreightment and sale contracts 2021 AMPLA Queensland Conference Chris Keane MinterEllison 18 June 2021 The focus of today’s presentation - risk associated with two contracts used to facilitate the export of Australian commodities: . the sale contract / offtake agreement / supply agreement (sale contract) . the contract of affreightment / voyage charterparty / bill of lading (sea carriage contract) Specific focus is on risk and risk mitigation options that are frequently overlooked (both at the time of contract formation and also when disputes arise) 2 Risk arising out of seemingly straightforward issues . Duration of the sale contract - overarching issue that impacts on many other considerations; legal and commercial considerations will overlap . Port(s) of loading and port(s) of discharge - relevant considerations include: access to certain berths; special arrangements regarding loading and unloading; port congestion and other factors likely to cause delay; and the desirability of not requiring a CIF buyer to nominate a specific port of unloading (e.g. “one safe port and one safe berth at any main port(s) in China…”) . Selection of vessel - risk will depend on which party to the sale contract is responsible for arranging the vessel; CIF sellers need to guard against the risk of selecting an unsuitable vessel; FOB sellers need to ensure they have a right to reject an unsuitable vessel nominated by the buyer 3 Risk arising out of seemingly straightforward issues . Selection of contractual carrier - needs to be considered as an issue separate from the selection of the vessel; what do you know (and not know) about the carrier?; note the difficulties the contractual carrier caused for both the seller and buyer in relation to the ‘Maryam’ at Port Kembla earlier this year; proper due diligence is critical; consider (among other things) compliance with anti-slavery, anti-bribery and sanctions laws and issues concerning care of seafarers, safety and environment . -

Volume Contracts of Affreightment – Some Features and Principles

Volume Contracts of Affreightment – Some Features and Principles Lars Gorton 1 Introduction ………………………………………………………………….…. 62 1.1 General Background ……………………………………………………… 62 1.2 Some Contractual Points …………..……………………………………... 62 1.3 Frame Agreements ………………………………………………………... 64 1.4 Some General Points Related to Distributorship Agreements and Volume Contracts ………………………………………. 66 1.5 Some Further Overriding Points ……………………………………….…. 67 2 Contract Forms ………………………………………………………………… 68 3 Law, Contract and Terminology ……………………………………………… 69 4 The SMC Rules on Volume Contracts ……………………………………..…. 70 5 Characteristics of COA’s ……………………………………………………… 71 6 The Generic Nature of the COA ………………………………………………. 72 7 Some of the Parameters of the COA ………………………...……………….. 76 7.1 The Ships Involved Under the Volume Contract ………………………… 76 7.2 Time Elements in Connection with COA’s ………………………………. 76 7.3 Cargo and Cargo Quantity and Planning of Voyages ………………….… 77 8 Breach and Consequences of Breach …………………………………………. 78 8.1 Generally, Best Efforts and Cooperation …………………………………. 78 8.2 Consequences of the Owners’s Breach …………………………………... 78 8.3 Consequences of the Charterer’s Breach …………………………………. 78 9 Some Comparisons with Distributorship Agreements in English Law ….…. 78 10 Some COA Cases Involving “Evenly spread” ……………………………….. 82 10.1 “Evenly spread” …………………………………………………………... 82 10.2 Mitigation of Damages …………………………………………………… 85 11 Freight, Demurrage and Similar ……………………………………………… 88 11.1 General Points ………..…………………………………………………... 88 11.2 Freight Level …………………………………………………………….. -

Table of Clauses

Table of Clauses Preamble VESSEL Clause 1. Vessel LAYDAYS DATE / CANCELLING DATE, etc. Clause 2. Laydays Date etc. Clause 3. Cancelling Date LOADING Clause 4. Advance Notices Clause 5. Notice of Readiness to Load and Counting of Laytime Clause 6. Cleanliness of Vessel Clause 7. Utilization of Holds and Hatches Clause 8. Loading Methods and Costs Clause 9. Rate of Loading Clause 10. Risk, Liability and Expense of Loading and Trimming DISCHARGING Clause 11. Advance Notices Clause 12. Notice of Readiness to Discharge and Counting of Laytime Clause 13. Rate of Discharging Clause 14. Discharging Methods and Costs Clause 15. Cleaning after Discharging LOADING and DISCHARGING Clause 16. Demurrage and Despatch Money Clause 17. Warping Clause 18. Vacating Berth Clause 19. Draft Survey Clause 20. Opening and Closing of Hatches Clause 21. Ballasting, etc. Clause 22. Handling of Equipment on Board Clause 23. Stevedore Damage Clause 24. Owners’ Liability for Damage GENERAL Clause 25. Freight Payment Clause 26. Dues, Taxes and Charges Clause 27. Bill of Lading Clause 28. Lien Clause 29. Liberty Clause 30. Oil Pollution Charter Party Clause (Non Tankers) Clause 31. BIMCO AMS Clause for Voyage Charter Parties Clause 32. Protective Clauses (a) BIMCO General Clause Paramount (b) Both-to-Blame Collision Clause (c) General Average and New Jason Clause (d) War Risks (VOYWAR 2004) Clause 33. Force Majeure Clause 34. BIMCO Strike Clause Clause 35. BIMCO General Ice Clause for Voyage Charter Parties Clause 36. Agency Clause 37. BIMCO ISPS/MTSA Clause for Voyage Charter Parties 2005 Clause 38. Brokerage Clause 39. BIMCO Dispute Resolution Clause Clause 40. -

PERFORMANCE and CANCELLATION of CHARTERPARTIES SUSPENSION / WITHDRAWAL / TERMINATION Notices, Damages and Potential Pitfalls

PERFORMANCE AND CANCELLATION OF CHARTERPARTIES SUSPENSION / WITHDRAWAL / TERMINATION Notices, damages and potential pitfalls A. INTRODUCTION The minds of owners and charterers alike are presently focused (as they should) on the Covid19 outbreak and how they can either utilise existing clauses or put together new clauses dealing with Covid19 in an attempt to refuse to perform or get out of a charter or prevent their contractual counterparty from doing so. Penningtons Manches Cooper has already issued a number of articles and circulars (as well as a contractual tool kit) in respect of the effect of Covid19, the business interruption aspects of it as well as the way forward. But what happens in circumstances where an existing contract is no longer desirable (or indeed financially viable) and one of the contractual counterparties wishes to no longer be bound it, either because of, for example, the state of the market or because the other party are not performing their end of the deal, whether as a result of Covid19 or otherwise? A number of other considerations will of course be relevant (amongst others, the parties’ commercial relationships, the state of the market, the ability to enforce against the non-performing party) but the purpose of this article is to act as a reminder of the various options available to an owner and charterer in the context of refusing to perform or getting out of a charterparty. The above will be considered against a background of seeking to resolve disputes before they even arise, with a view to limiting (to the extent feasible) the costs and delays incurred where the parties engage in arbitration/ litigation proceedings. -

Case 3:19-Cv-01259-JR Document 88 Filed 01/06/21 Page 1 of 16

Case 3:19-cv-01259-JR Document 88 Filed 01/06/21 Page 1 of 16 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF OREGON SHELTER FOREST INTERNATIONAL Case No. 3:19-cv-01259-JR ACQUISITION, INC., an Oregon Corporation, OPINION AND ORDER Plaintiff, v. COSCO SHIPPING (USA) INC., a Delaware Corporation; COSCO SHIPPING LINES (NORTH AMERICA) INC., a Delaware Corporation; COSCO SHIPPING TERMINALS (USA) LLC, a Delaware LLC; RUDY ROGERS, an individual; COSCO SHIPPING LINES CO., LTD.; and JANE AND JOHN DOES NOS. 1-3, Defendants. _______________________________________ RUSSO, Magistrate Judge: Shelter Forest International Acquisition, Inc. (“SFI”) filed this action against defendants COSCO Shipping (USA) Inc., COSCO Shipping Lines (North America) Inc., COSCO Shipping Terminals (USA) LLC, Rudy Rogers, and COSCO Shipping Lines Co., Ltd. (“CSL”) alleging multiple contractually-based claims under state law.1 All parties have consented to allow a Magistrate Judge enter final orders and judgment in this case in accordance with Fed. R. Civ. P. 73 and 28 U.S.C. § 636(c). CSL now moves for summary judgement on its remaining counterclaim pursuant to Fed. R. Civ. P. 56. For the reasons stated below, CSL’s motion is granted in part and denied in part. 1 All parties except CSL were subsequently voluntarily dismissed. Page 1 – OPINION AND ORDER Case 3:19-cv-01259-JR Document 88 Filed 01/06/21 Page 2 of 16 BACKGROUND CSL is a shipping company based in China operating a fleet of oceangoing containerships that transport cargo internationally, including between China and the United States. SFI is an Oregon corporation that imports and distributes lumber, plywood, and other building materials. -

Marine Charter Default Insurance

Marine Practice CHARTER DEFAULT INSURANCE In response to shipowners’ increasing concerns about charterers’ solvency, Marsh has developed an industry-first product that protects owners from damaging financial losses. Backed by both insurers and a leading financial institution, Marsh’s Charter Default product provides a mix of fixed recovery guarantee and credit insurance, tailored to the shipowner’s particular requirements. Covering both outstanding debt at the time of an insolvency and the loss of future revenue for a set period, the product de-risks important revenue streams, thereby assisting owners to attract better terms fr om lenders by reducing counterparty credit risk. i • Charter Default Insurance PRODUCT OVERVIEW PROTECTING REVENUE AGAINST THE RISK OF FINANCIAL DEFAULT f Financial default is a recurring problem. Recent high profile cases of shipping companies filing for bankruptcy have again highlighted counterparty risk in the shipping sector f Companies with ships on charter are exposed to loss of revenue if their charterer folds or, at best, to enforced renegotiation of charter hire terms f The risk of default increases at times of global financial uncertainty f Fixed Recovery Guarantees and Credit Insurance protect against the risk of charterer default f For a listed company, de-risking the revenue stream can improve stock prospects f De-risking the revenue stream can also attract better terms from lenders Marsh • 1 CREDIT INSURANCE FIXED RECOVERY GUARANTEE Key FeaTuRes • an insurance policy designed to compensate an owner -

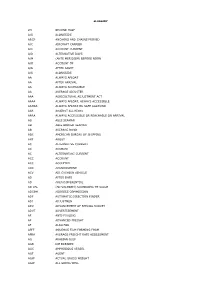

13-SHIPPING-GLOSSARY.Pdf

GLOSSARY 2H SECOND HALF A/S ALONGSIDE A&CP ANCHORS AND CHAINS PROVED A/C AIRCRAFT CARRIER A/C ACCOUNT CURRENT A/D ALTERNATIVE DAYS A/M (ANTE MERIDIEM) BEFORE NOON A/O ACCOUNT OF A/S AFTER SIGHT A/S ALONGSIDE AA ALWAYS AFLOAT AA AFTER ARRIVAL AA ALWAYS ACCESSIBLE AA AVERAGE ADJUSTER AAA AGRICULTURAL ADJUSTMENT ACT AAAA ALWAYS AFLOAT, ALWAYS ACCESSIBLE AAOSA ALWAYS AFLOAT OR SAFE AGROUND AAR AGAINST ALL RISKS AARA ALWAYS ACCESSIBLE OR REACHABLE ON ARRIVAL AB ABLE SEAMAN AB ABLE BODIED SEAMAN AB AVERAGE BOND ABS AMERICAN BUREAU OF SHIPPING ABT ABOUT AC ALTERNATIVE CURRENT AC ACCOUNT AC ALTERNATING CURRENT ACC ACCOUNT ACC ACCEPTED ACK ACKNOWLEDGE ACV AIR CUSHION VEHICLE AD AFTER DATE AD AREA DIFFERENTIAL AD VAL (AD VALOREM) ACCORDING TO VALUE ADCOM ADDRESS COMMISSION ADF AUTOMATIC DIRECTION FINDER ADJ ADJUSTMEN ADV ADVANCEMENT OF SPECIAL SURVEY ADVT ADVERTISEMENT AF ANTI-FOULING AF ADVANCED FREIGHT AF ALSO FOR AFFF AQUEOUS FILM FORMING FOAM AFRA AVERAGE FREIGHT RATE ASSESSMENT AG ARABIAN GULF AGB ICE BREAKER AGC AMPHIBIOUS VESSEL AGT AGENT AGW ACTUAL GROSS WEIGHT AGW ALL GOING WELL AH AFTER HATCH AHD AHEAD AHL AUSTRALIAN HOLD LADDERS AHTS ANCHOR HANDLING TUD AND SUPPLY VESSEL AIS AUTOMATIC IDENTIFICATION SYSTEM ALERT AUTOMATIC LIFE-SAVING EMERGENCY RADIO TRANSMITTER ALRS ADMIRALTY LIST OF RADIO SIGNALS ALT ALTERNATING AM ABOVE MENTIONED AM AIR MAIL AMSL ABOVE MEAN SEA LEVEL AMT AMOUNT AMVER AUTOMATED MUTUAL ASSISTANCE VESSEL RESCUE SYSTEM AMWELSH AMERICANISED WELSH COAL CHARTER PARTY ANERA ASIA-NORTH AMERICA WESTBOUND RATE AGREEMENT ANOP -

Documents of the Shipping Transport: Historical Origins, Legal Validity & Commercial Practice

Journal of Shipping and Ocean Engineering 10 (2020) 47-56 Doi: 10.17265/2159-5879/2020.02.005 D DAVID PUBLISHING Documents of the Shipping Transport: Historical Origins, Legal Validity & Commercial Practice Ioannis Voudouris, and Evi Plomaritou Frederick University, Cyprus Abstract: The bill of lading and charterparty are vital for international trade and transport. To signify their enduring importance, this paper firstly seeks to illuminate the earliest historical evidence relating to the bill of lading and charterparty, and secondly, discuss their current legal and commercial nature and functions as well as their relationship with other transport documents such as the booking note, cargo manifest, mate’s receipt, and delivery order. In this context, the paper examines the lifecycle of transport as regards the documents used in the bulk and liner markets. Key words: Bill of lading, charterparty, sea waybill, booking note, delivery order, Mate’s receipt, Cargo manifest. 1. Introduction upon their shipment on board the ship (shipped bill of lading). The most important documents governing the commercial and legal relationships between the parties 2. Historical Origins of the Bill of Lading, in international sea transport are the bill of lading and Charterparty, Sea Waybill and Other the charterparty. Among other things, these Transport Documents documents define the obligations as well as the The (non-negotiable) sea waybill and the respective costs and earnings of the contracting parties, (negotiable) bill of lading are nowadays the primarily the shipowner or carrier and the charterer or best-known ocean transport documents that are still in shipper. In addition, other documents, such as booking use. -

Sample Copy 12

1. Shipbroker 2. Place and Date 3. Owners 4. Charterers 5. Vessel’s name/type 6. Cargo carrying capacity (about in mtons) / 7. Cubic capacity 8. Owners´ P&I Club 9. Built – Class – Flag – GT – NT (grain/bale) / 10. Present position 11. ETA Loadport Sample copy 12. Laytime not to commence before 13. Cancelling date 14. Sailing telex/telegram to sent to: when the vessel leaves her last port before loading 15. Loading Port(s) 16. Discharging Port(s) 17. Cargo description – Quantity in mtons 18. Freight rate 19. Freight payment (prepaid/payable on right and true per delivery) mton 20. Laytime for loading and discharging. Fill in a) and b) or for total laytime loading and discharging c) a) Laytime for loading non reversible b) Laytime for discharging non reversible c) Total laytime for loading and 21. Demurrage/despatch rate discharging reversible 22. Brokerage % of the amount of freight and deadfreight shall be paid by the Owners to: 23. Agents at loading port(s) 24. Agents at discharging port(s) Copyright © 2006 Yara. Recommended by BIMCO. All rights reserved. This BIMCO SmartCon document may not be copied, duplicated, reproduced or distributed without the permission of the copyright owners. Originally issued as HYDROCHARTER 1st of January 1923. Amended July 1997. Re-issued as YARACHARTER January 2006. 25. Special Provisions It is mutually agreed that this Contract shall be performed subject to the conditions contained in this Charter Party which shall include Part I as well as Part II. In the event of a conflict of conditions, the provisions of Part I shall prevail over those of Part II to the extent of such conflict. -

An Appraisal of Demurrage Policies and Charges of Maritime Operators

An Appraisal of Demurrage Policies and Charges of Maritime Operators in Nigerian Seaport Terminals: the Shipping Industry and Economic Implications Procjena politika i trošarina pomorskih operatora na prekostojnice u nigerijskim morskim terminalima: implikacije na brodarstvo i ekonomiju Obed Ndikom Nwokedi, Theophilus C. Sodiq, Olusegun Buhari Department of Maritime Management Department of Maritime Management Department of Maritime Management Technology Technology Technology Federal University of Technology Federal University of Technology Federal University of Technology Owerri Owerri Owerri e-mail: [email protected] e-mail: [email protected] Kenneth Okeke Okechukwu Department of Maritime Management DOI 10.17818/NM/2017/3.3 Technology UDK 656.615:330.13 Federal University of Technology Review / Pregledni rad Owerri Paper accepted / Rukopis primljen: 27. 2. 2017. Summary This research evaluated the demurrage policies and charges of selected shipping KEY WORDS companies and terminal operators in the Lagos ports and the implications in the demurrage economy and shipping industry in Nigeria. It adopted the survey approach to gather policies data from the dominant container operators (carriers) and the terminal operators. maritime operators Demurrage duration and categorization of the demurrage periods and charges for each seaports period by the selected operators were collected and compared using the statistical tool shipping industry of analysis of variance to determine if there are differences among the charges and charging systems. It was found that, significant differences do not exist in the average rate of demurrage charges per container per day among the shipping companies and terminal operators in Lagos seaports. The study also found that there is no significant difference in the average amount charged as demurrage among the shipping companies and terminal operators in the three differing periods of demurrage duration in Lagos ports, Nigeria. -

Cargo Liens for Unpaid Hire and Freight Due Under a Time Or Voyage Charterparty

Cargo liens for unpaid hire and freight due under a time or voyage charterparty During periods in which the global shipping economy is volatile, the likelihood of unpaid freight or hire occurs with higher frequency. Recently, the Club has witnessed charterers facing difficulty in meeting their obligation to pay freight due under a charterparty. In such circumstances, the shipowner may want to know if he is able to exercise a lien on the cargo until he has been paid the freight or hire due under the charterer. There must be a right of lien in the charterparty By Gho Sze Kee, Deputy Claims Manager The shipowner needs to determine if the charterparty will grant him a possessory lien over the cargo for the unpaid freight and As such, where the bill of lading incorporates a lien clause for unpaid hire. The more clearly a lien clause is drafted, the easier it is for the hire (as opposed to freight), the shipowners then has a right under shipowner to determine the scope of the lien clause and therefore the bill of lading to lien the cargo regardless of whether it is owned exercise his possessory lien for the unpaid freight or hire. by the charterers. Examples of widely drafted lien clauses that extend to and protect the shipowners right to lien, are clause 8 of GENCON 1994 Clause 1 of CONGENBILL All terms and conditions, liberties and exceptions of the Charter charterparty and clause 23 of NYPE 93. Party, dated as overleaf, including the Law and Arbitration Only when hire or freight under a charterparty becomes ‘due’ and Clause, are herewith incorporated. -

Charterer's Liability Insurance

CHARTERER’S LIABILITY INSURANCE A TYPE OF P&I INSURANCE Candidate number: Supervisor: Wilhelmsen Trine-Lise Semester of submission: Spring 2007 Deadline for submission: September 1, 2007 Date of submission: 28 August 2007 Number of words: 15810 1 Introduction 1 1.1 What is charterer’s liability insurance? 1 1.2 Charter parties suitable to charterer’s liability insurance 1 1.3 Why did I choose this topic? 2 2 Legal Sources 2 2.1 Statutes 2 2.1.1 China 3 2.1.2 Norway and England 3 2.2 Contractual sources 3 2.2.1 P&I rules 3 2.2.2 Charter parties 4 3 Charterer’s Risks 4 3.1 Risk from “safe-port clause” 4 3.2 Liability for damage to the ship during loading and discharging 5 3.3 Liability for damage caused by the cargo 5 3.4 Obligation to pay general average contributions 6 3.5 Legal expenses 6 4 Overview of Charterer’s Liability Insurance Policy 6 5 Liability Cover 7 5.1 Cover for liability from the “safe-port clause” 7 5.1.1 Interpretation of this cover 7 5.1.2 Legal basis of liability of the charterer in relation to safe-port clause 8 5.1.2.1 Chinese law 9 5.1.2.2 Norway 9 5.1.2.3 England 10 5.1.3 Situation of “non-safety” in the port 10 5.1.3.1 Rough weather conditions 10 5.1.3.2 Political risks 12 5.1.3.3 The time of “non-safety” 14 5.1.4 Conclusion 16 5.2 Cover for liability during loading and discharging 17 5.3 Cover for liability of damage caused by the cargo 18 I 6 General Average Cover 21 6.1 P&I coverage for General Average 21 6.2 Charterer’s liability to pay General Average costs in the charter contract 22 6.3 Legal basis of liability to pay General Average 23 6.3.1 China 23 6.3.2 Norway 23 7 Legal Expenses Cover 24 7.1 P&I insurance 24 7.1.1 China 25 7.1.2 Norway 26 7.1.3 England 26 7.2 Freight, Demurrage and Defense Insurance (F.D.