Is Europe Becoming the Most Dynamic Knowledge Economy In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

North America Other Continents

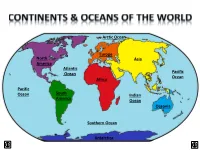

Arctic Ocean Europe North Asia America Atlantic Ocean Pacific Ocean Africa Pacific Ocean South Indian America Ocean Oceania Southern Ocean Antarctica LAND & WATER • The surface of the Earth is covered by approximately 71% water and 29% land. • It contains 7 continents and 5 oceans. Land Water EARTH’S HEMISPHERES • The planet Earth can be divided into four different sections or hemispheres. The Equator is an imaginary horizontal line (latitude) that divides the earth into the Northern and Southern hemispheres, while the Prime Meridian is the imaginary vertical line (longitude) that divides the earth into the Eastern and Western hemispheres. • North America, Earth’s 3rd largest continent, includes 23 countries. It contains Bermuda, Canada, Mexico, the United States of America, all Caribbean and Central America countries, as well as Greenland, which is the world’s largest island. North West East LOCATION South • The continent of North America is located in both the Northern and Western hemispheres. It is surrounded by the Arctic Ocean in the north, by the Atlantic Ocean in the east, and by the Pacific Ocean in the west. • It measures 24,256,000 sq. km and takes up a little more than 16% of the land on Earth. North America 16% Other Continents 84% • North America has an approximate population of almost 529 million people, which is about 8% of the World’s total population. 92% 8% North America Other Continents • The Atlantic Ocean is the second largest of Earth’s Oceans. It covers about 15% of the Earth’s total surface area and approximately 21% of its water surface area. -

1 Executive Summary Mauritius Is an Upper Middle-Income Island Nation

Executive Summary Mauritius is an upper middle-income island nation of 1.2 million people and one of the most competitive, stable, and successful economies in Africa, with a Gross Domestic Product (GDP) of USD 11.9 billion and per capita GDP of over USD 9,000. Mauritius’ small land area of only 2,040 square kilometers understates its importance to the Indian Ocean region as it controls an Exclusive Economic Zone of more than 2 million square kilometers, one of the largest in the world. Emerging from the British colonial period in 1968 with a monoculture economy based on sugar production, Mauritius has since successfully diversified its economy into manufacturing and services, with a vibrant export sector focused on textiles, apparel, and jewelry as well as a growing, modern, and well-regulated offshore financial sector. Recently, the government of Mauritius has focused its attention on opportunities in three areas: serving as a platform for investment into Africa, moving the country towards renewable sources of energy, and developing economic activity related to the country’s vast oceanic resources. Mauritius actively seeks investment and seeks to service investment in the region, having signed more than forty Double Taxation Avoidance Agreements and maintaining a legal and regulatory framework that keeps Mauritius highly-ranked on “ease of doing business” and good governance indices. 1. Openness To, and Restrictions Upon, Foreign Investment Attitude Toward FDI Mauritius actively seeks and prides itself on being open to foreign investment. According to the World Bank report “Investing Across Borders,” Mauritius has one of the world’s most open economies to foreign ownership and is one of the highest recipients of FDI per capita. -

Countries and Continents of the World: a Visual Model

Countries and Continents of the World http://geology.com/world/world-map-clickable.gif By STF Members at The Crossroads School Africa Second largest continent on earth (30,065,000 Sq. Km) Most countries of any other continent Home to The Sahara, the largest desert in the world and The Nile, the longest river in the world The Sahara: covers 4,619,260 km2 The Nile: 6695 kilometers long There are over 1000 languages spoken in Africa http://www.ecdc-cari.org/countries/Africa_Map.gif North America Third largest continent on earth (24,256,000 Sq. Km) Composed of 23 countries Most North Americans speak French, Spanish, and English Only continent that has every kind of climate http://www.freeusandworldmaps.com/html/WorldRegions/WorldRegions.html Asia Largest continent in size and population (44,579,000 Sq. Km) Contains 47 countries Contains the world’s largest country, Russia, and the most populous country, China The Great Wall of China is the only man made structure that can be seen from space Home to Mt. Everest (on the border of Tibet and Nepal), the highest point on earth Mt. Everest is 29,028 ft. (8,848 m) tall http://craigwsmall.wordpress.com/2008/11/10/asia/ Europe Second smallest continent in the world (9,938,000 Sq. Km) Home to the smallest country (Vatican City State) There are no deserts in Europe Contains mineral resources: coal, petroleum, natural gas, copper, lead, and tin http://www.knowledgerush.com/wiki_image/b/bf/Europe-large.png Oceania/Australia Smallest continent on earth (7,687,000 Sq. -

Geography Notes.Pdf

THE GLOBE What is a globe? a small model of the Earth Parts of a globe: equator - the line on the globe halfway between the North Pole and the South Pole poles - the northern-most and southern-most points on the Earth 1. North Pole 2. South Pole hemispheres - half of the earth, divided by the equator (North & South) and the prime meridian (East and West) 1. Northern Hemisphere 2. Southern Hemisphere 3. Eastern Hemisphere 4. Western Hemisphere continents - the largest land areas on Earth 1. North America 2. South America 3. Europe 4. Asia 5. Africa 6. Australia 7. Antarctica oceans - the largest water areas on Earth 1. Atlantic Ocean 2. Pacific Ocean 3. Indian Ocean 4. Arctic Ocean 5. Antarctic Ocean WORLD MAP ** NOTE: Our textbooks call the “Southern Ocean” the “Antarctic Ocean” ** North America The three major countries of North America are: 1. Canada 2. United States 3. Mexico Where Do We Live? We live in the Western & Northern Hemispheres. We live on the continent of North America. The other 2 large countries on this continent are Canada and Mexico. The name of our country is the United States. There are 50 states in it, but when it first became a country, there were only 13 states. The name of our state is New York. Its capital city is Albany. GEOGRAPHY STUDY GUIDE You will need to know: VOCABULARY: equator globe hemisphere continent ocean compass WORLD MAP - be able to label 7 continents and 5 oceans 3 Large Countries of North America 1. United States 2. Canada 3. -

ICS South Africa

Integrated Country Strategy South Africa FOR PUBLIC RELEASE FOR PUBLIC RELEASE Table of Contents 1. Chief of Mission Priorities ................................................................................................................ 2 2. Mission Strategic Framework .......................................................................................................... 4 3. Mission Goals and Objectives .......................................................................................................... 6 4. Management Objectives ................................................................................................................ 12 FOR PUBLIC RELEASE Approved: August 22, 2018 1 FOR PUBLIC RELEASE 1. Chief of Mission Priorities There are tremendous opportunities to broaden U.S. engagement in South Africa which stand to benefit both countries. Over 600 U.S. companies already operate in South Africa, some for over 100 years; furthermore, many of them use South Africa as a platform for operations and a springboard for expansion into the rest of Africa. South Africa is therefore the single most critical market hub to a population expecting to double to two billion people in the next 30 years. While some resentment of the United States continues from the apartheid era, there is also recognition of American activism that helped end apartheid. In polls, the United States is seen very favorably by every day South Africans, who respond positively to American politics, culture, and goods. South Africa’s economy is the most -

An Information Visualization Application Case to Understand the World Happiness Report

An information visualization application case to understand the World Happiness Report Nychol Bazurto-Gomez1[0000−0003−0881−6736], Carlos Torres J.1[0000−0002−5814−6278], Raul Gutierrez1[0000−0003−1375−8753], Mario Chamorro3[0000−0002−7247−8236], Claire Bulger4[0000−0002−3031−2908], Tiberio Hernandez1[0000−0002−5035−4363], and John A. Guerra-Gomez1;2[0000−0001−7943−0000] 1 Imagine group, Universidad de los Andes, Bogota, Colombia fn.bazurto,cf.torres,ra.gutierrez,jhernand,[email protected] 2 UC Berkeley, California, Berkeley, United States 3 Make it happy, San Francisco, United States [email protected] 4 World Happiness Report, San Francisco, United States [email protected] Abstract. Happiness is one of the most important components in life, however, qualifying happiness is not such a happy task. For this purpose, the World Happiness Report was created: An annual survey that mea- sures happiness around the globe. It uses six different metrics: (i) healthy life expectancy, (ii) social support, (iii) freedom to make life choices, (iv) perceptions of corruption, (v) GDP per capita, and (vi) generosity. Those metrics combined in an index rank countries by their happiness. This in- dex has been published by means of a static report that attempts to explain it, however, given the complexity of the index, the creators have felt that the index hasn't been explained properly to the community. In order to propose a more intuitive way to explore the metrics that compose the index, this paper presents an interactive approach. Thanks to our information visualization, we were able to discover insights such as the many changes in the happiness levels of South Africa in 2013, a year with statistics like highest crime rate and country with most pub- lic protests in the world. -

FACTSHEET: Cardiovascular Diseases in South Africa

FACTSHEET: Cardiovascular diseases in South Africa Globally… Cardiovascular diseases (CVDs), commonly referred to as heart disease or stroke, are the number 1 cause of death around the world 1 in 3 deaths globally are as result of CVD, yet the majority of premature heart disease and stroke is preventable1 In 2010 CVD cost US$ 863 billion – this is estimated to rise by 22% to US$ 1,044 billion by 20302 80% of CVD deaths occur in low- to middle-income countries. In South Africa… Non-communicable diseases (NCDs), including CVDs, are estimated to account for 43% of total adult deaths in South Africa CVDs account for almost a fifth (18%) of these deaths Some of the CVD related risks factors in adults in South Africa are outlined below: 18% of the population smoke tobacco 11 litres of pure alcohol consumed per person 1 in 3 South African adults (33.7%) have hypertension which can increase risk of heart attack, heart failure, kidney disease or stroke 31.3% adults in South Africa are obese In South Africa, the proportion of CVD deaths in women aged between 35–59 years is one and a half times more likely than that of women in the United States.3 Obesity in South Africa4 70% of women and a third of men in South Africa are classified as overweight or obese 40% of women in South Africa are obese 1 in 4 girls and 1 in 5 boys between the ages of 2 – 14 years are overweight or obese. Taking action… In February 2016, South Africa became the first African country to announce plans to introduce a new tax on sugar-sweetened drinks5 The ‘sugar tax’ will come into force from April 2017 A 2013 study by the Human Sciences Research Council in Johannesburg suggested a link between sugar and obesity, concluding that one in five South Africans consume an excessive amount of sugar6 In 2013, the South African Government introduced legislation in line with targets set to reduce salt intake to less than 5g a day per person by 2020. -

John F. Helliwell, Richard Layard and Jeffrey D. Sachs

2018 John F. Helliwell, Richard Layard and Jeffrey D. Sachs Table of Contents World Happiness Report 2018 Editors: John F. Helliwell, Richard Layard, and Jeffrey D. Sachs Associate Editors: Jan-Emmanuel De Neve, Haifang Huang and Shun Wang 1 Happiness and Migration: An Overview . 3 John F. Helliwell, Richard Layard and Jeffrey D. Sachs 2 International Migration and World Happiness . 13 John F. Helliwell, Haifang Huang, Shun Wang and Hugh Shiplett 3 Do International Migrants Increase Their Happiness and That of Their Families by Migrating? . 45 Martijn Hendriks, Martijn J. Burger, Julie Ray and Neli Esipova 4 Rural-Urban Migration and Happiness in China . 67 John Knight and Ramani Gunatilaka 5 Happiness and International Migration in Latin America . 89 Carol Graham and Milena Nikolova 6 Happiness in Latin America Has Social Foundations . 115 Mariano Rojas 7 America’s Health Crisis and the Easterlin Paradox . 146 Jeffrey D. Sachs Annex: Migrant Acceptance Index: Do Migrants Have Better Lives in Countries That Accept Them? . 160 Neli Esipova, Julie Ray, John Fleming and Anita Pugliese The World Happiness Report was written by a group of independent experts acting in their personal capacities. Any views expressed in this report do not necessarily reflect the views of any organization, agency or programme of the United Nations. 2 Chapter 1 3 Happiness and Migration: An Overview John F. Helliwell, Vancouver School of Economics at the University of British Columbia, and Canadian Institute for Advanced Research Richard Layard, Wellbeing Programme, Centre for Economic Performance, at the London School of Economics and Political Science Jeffrey D. Sachs, Director, SDSN, and Director, Center for Sustainable Development, Columbia University The authors are grateful to the Ernesto Illy Foundation and the Canadian Institute for Advanced Research for research support, and to Gallup for data access and assistance. -

World Happiness REPORT Edited by John Helliwell, Richard Layard and Jeffrey Sachs World Happiness Report Edited by John Helliwell, Richard Layard and Jeffrey Sachs

World Happiness REPORT Edited by John Helliwell, Richard Layard and Jeffrey Sachs World Happiness reporT edited by John Helliwell, richard layard and Jeffrey sachs Table of ConTenTs 1. Introduction ParT I 2. The state of World Happiness 3. The Causes of Happiness and Misery 4. some Policy Implications references to Chapters 1-4 ParT II 5. Case study: bhutan 6. Case study: ons 7. Case study: oeCd 65409_Earth_Chapter1v2.indd 1 4/30/12 3:46 PM Part I. Chapter 1. InTrodUCTIon JEFFREY SACHS 2 Jeffrey D. Sachs: director, The earth Institute, Columbia University 65409_Earth_Chapter1v2.indd 2 4/30/12 3:46 PM World Happiness reporT We live in an age of stark contradictions. The world enjoys technologies of unimaginable sophistication; yet has at least one billion people without enough to eat each day. The world economy is propelled to soaring new heights of productivity through ongoing technological and organizational advance; yet is relentlessly destroying the natural environment in the process. Countries achieve great progress in economic development as conventionally measured; yet along the way succumb to new crises of obesity, smoking, diabetes, depression, and other ills of modern life. 1 These contradictions would not come as a shock to the greatest sages of humanity, including Aristotle and the Buddha. The sages taught humanity, time and again, that material gain alone will not fulfi ll our deepest needs. Material life must be harnessed to meet these human needs, most importantly to promote the end of suffering, social justice, and the attainment of happiness. The challenge is real for all parts of the world. -

2018 South Africa Economic Update

SOUTH AFRICA ECONOMIC UPDATE World Bank | April 2018 Edition 11 World JOBS AND INEQUALITY Public Disclosure Authorized © 2018 The International Bank for Reconstruction and Development/THE WORLD BANK 1818 H Street NW Washington, DC 20433 USA All rights reserved Photos: Flickr, Pexels, Shutterstock and World Bank. CONTENTS Contents i Acknowledgments iii Foreword iv Abbreviations v Executive Summary vi CHAPTER 1 CHAPTER 2 Recent Economic Developments 1 Jobs and Inequality 23 Global Economic Developments 2 South Africa Remains Trapped in a Cycle of High Real Sector Developments in South Africa 6 Inequality and Slow Job Creation 24 Labor Market Developments in South Africa 12 Creating More and Better Jobs to Reduce Fiscal Developments in South Africa 14 Income Inequalities 36 Inflation and Monetary Policy in South Africa 16 Conclusion 48 The External Sector in South Africa 17 The Outlook for South Africa 19 References 49 Annex: Modeling Prospective Policy Scenarios 51 FIGURES Figure 1.1: Global activity indicators 2 Figure 1.2: Global financial indicators 3 Figure 1.3: StasSA's GDP revisions - fourth versus third quarter 2017 releases 7 Figure 1.4: Commodity price forecasts 9 Figure 1.5: Historical decomposition of domestic output 10 Figure 1.6: GDP by expenditure 11 Figure 1.7: Gross fixed capital formation and business confidence 12 Figure 1.8: Labor market developments 13 Figure 1.9: Changes in fiscal revenue and expenditure, 2018-2021 15 Figure 1.10: Debt-to-GDP ratio with contingent liability scenarios 16 Figure 1.11: Current account -

Global Economic Prospects, June 2021

30th A World Bank Group anniversary Flagship Report edition JUNE 2021 Global Economic Prospects Global Economic Prospects JUNE 2021 Global Economic Prospects © 2021 International Bank for Reconstruction and Development / The World Bank 1818 H Street NW, Washington, DC 20433 Telephone: 202-473-1000; Internet: www.worldbank.org Some rights reserved 1 2 3 4 24 23 22 21 This work is a product of the staff of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy, completeness, or currency of the data included in this work and does not assume responsibility for any errors, omissions, or discrepancies in the information, or liability with respect to the use of or failure to use the information, methods, processes, or conclusions set forth. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Nothing herein shall constitute or be construed or considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, all of which are specifically reserved. Rights and Permissions This work is available under the Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO) http://creativecommons.org/licenses/by/3.0/igo. Under the Creative Commons Attribution license, you are free to copy, distribute, transmit, and adapt this work, including for commercial purposes, under the following conditions: Attribution —Please cite the work as follows: World Bank. -

World Population Ageing 2019

World Population Ageing 2019 ST/ESA/SER.A/444 Department of Economic and Social Affairs Population Division World Population Ageing 2019 United Nations New York, 2020 The Department of Economic and Social Affairs of the United Nations Secretariat is a vital interface between global policies in the economic, social and environmental spheres and national action. The Department works in three main interlinked areas: (i) it compiles, generates and analyses a wide range of economic, social and environmental data and information on which States Members of the United Nations draw to review common problems and take stock of policy options; (ii) it facilitates the negotiations of Member States in many intergovernmental bodies on joint courses of action to address ongoing or emerging global challenges; and (iii) it advises interested Governments on the ways and means of translating policy frameworks developed in United Nations conferences and summits into programmes at the country level and, through technical assistance, helps build national capacities. The Population Division of the Department of Economic and Social Affairs provides the international community with timely and accessible population data and analysis of population trends and development outcomes for all countries and areas of the world. To this end, the Division undertakes regular studies of population size and characteristics and of all three components of population change (fertility, mortality and migration). Founded in 1946, the Population Division provides substantive support on population and development issues to the United Nations General Assembly, the Economic and Social Council and the Commission on Population and Development. It also leads or participates in various interagency coordination mechanisms of the United Nations system.