AC Alternatives Equity Market Neutral - TF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kaufmann Large Cap Growths M a As of 3/31/21

Kaufmann Large Cap Growth SMA as of 3/31/21 Communication Services Activision Blizzard, Inc. Alphabet Inc. Facebook, Inc. Netflix, Inc. Pinterest, Inc. The Walt Disney Company T-Mobile US, Inc. Consumer Discretionary Airbnb, Inc. Alibaba Group Holding Limited - ADR Amazon.com, Inc. Coupang LLC Etsy, Inc. Floor & Decor Holdings, Inc. Home Depot, Inc. Las Vegas Sand Corp. lululemon athletica inc. MercadoLibre, Inc. NIKE, Inc. The TJX Companies, Inc. Consumer Staples Costco Wholesale Corporation Estee Lauder Cos., Inc., Class A Energy New Fortress Energy, Inc. Financials BlackRock, Inc. JPMorgan Chase & Co. KKR & Co., Inc Class COMMON MSCI Inc. The Goldman Sachs Group, Inc. Health Care Abbott Laboratories Alcon Inc. Alnylam Pharmaceuticals, Inc. Argenx SE - ADR Catalent, Inc. Charles River Laboratories International, Inc. Danaher Corp. Dexcom, Inc. Edwards Lifesciences Corporation Genmab A/S - ADR IDEXX Laboratories, Inc. Intuitive Surgical, Inc. Moderna, Inc. Sarepta Therapeutics, Inc. Stryker Corp. Ultragenyx Pharmaceutical, Inc. Veeva Systems Inc. Vertex Pharmaceuticals, Inc. Zai Lab Limited - ADR Zoetis Inc. Industrials CoStar Group, Inc. Generac Holdings, Inc. IHS Markit Ltd Roper Technologies, Inc. Trane Technologies Public Limited Company Verisk Analytics, Inc. Information Technology Advanced Micro Devices, Inc. Apple Inc. Coupa Software, Inc. Fidelity National Information Services, Inc. GDS Holdings Ltd.- ADR GoDaddy, Inc. Marvell Technology Group Ltd. Mastercard, Inc. Microsoft Corporation Nuance Communications, Inc. PagSeguro Digital Ltd. PayPal Holdings, Inc. Qualcomm, Inc. Qualtrics International, Inc. salesforce.com, inc. ServiceNow, Inc. Shopify, Inc. Splunk, Inc. Unity Software, Inc. Visa Inc. Workday, Inc. Materials Air Products and Chemicals, Inc. Ecolab Inc. Scotts Co. The Sherwin-Williams Company Real Estate Crown Castle International Corp. -

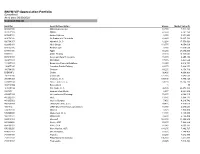

Securities at Value BT WALDEN MIDCAP FUND 31-Aug-21

Securities At Value BT WALDEN MIDCAP FUND 31-Aug-21 Ticker Description Shares/Par Market Value A US AGILENT TECHNOLOGIES INC 9,650.0000 1,693,285.50 AKAM US AKAMAI TECHNOLOGIES INC 8,650.0000 979,612.50 ARE US ALEXANDRIA REAL ESTATE EQ 4,675.0000 964,779.75 AME US AMETEK, INC. 7,350.0000 999,379.50 APH US AMPHENOL CORP - CLASS A 13,475.0000 1,032,589.25 ANSS US ANSYS INC 2,650.0000 968,204.00 ATR US APTARGROUP INC. 8,800.0000 1,186,240.00 AZPN US ASPEN TECHNOLOGY INC 11,025.0000 1,427,737.50 ATO US ATMOS ENERGY CORP 11,575.0000 1,128,678.25 AZO US AUTOZONE, INC. 875.0000 1,355,506.25 AVB US AVALONBAY COMMUNITIES INC 4,575.0000 1,050,328.50 AVY US AVERY DENNISON CORP 8,775.0000 1,977,797.25 BKR US BAKER HUGHES CO 85,800.0000 1,954,524.00 BR US BROADRIDGE FIN. SOLUTIONS 6,975.0000 1,201,234.50 BRO US BROWN & BROWN INC 18,825.0000 1,092,791.25 CBOE US CBOE GLOBAL MARKETS INC 10,400.0000 1,311,960.00 CRI US CARTER'S INC 15,150.0000 1,551,057.00 CERN US CERNER CORP. 13,200.0000 1,007,820.00 CHE US CHEMED CORPORATION 3,125.0000 1,489,687.50 CHD US CHURCH AND DWIGHT, INC 13,250.0000 1,108,495.00 CTXS US CITRIX SYSTEMS INC 10,425.0000 1,072,419.75 ED US CONSOLIDATED EDISON INC 16,350.0000 1,233,607.50 COO US COOPER COS 3,200.0000 1,442,272.00 CMI US CUMMINS INC 4,500.0000 1,061,910.00 CONE US CYRUSONE INC 9,875.0000 760,177.50 DCI US DONALDSON CO INC. -

2020 Q1 Sawgrass FF

Investment Statement June 30, 2021 Ormond Beach Firefighters Pension Trust Fund Diversified Large Growth Equity Gregory S. Gosch, Institutional Client Services (904) 493-5506 1579 The Greens Way, Suite 20 Jacksonville Beach, FL 32250 www.saw-grass.com Portfolio Review Portfolio Market Values Portfolio Summary Change in Portfolio Market Value Asset Class Total Cost Market Value Percent of Assets Beginning Market Value on 03/31/2021 $4,321,633.21 Equity $2,683,259.40 $4,518,862.64 98.3% Additions $0.00 Cash & Equivs. $77,110.59 $77,110.59 1.7% Withdrawals -$30,353.69 TOTAL $2,760,369.99 $4,595,973.23 100% Investment Gain/Loss $310,432.01 Ending Market Value on 06/30/2021 $4,595,973.23 Asset Allocation Equity Cash & Equivs. 98% 2% STABILITY | CONSISTENCY | COMMITMENT 2 Portfolio Performance TOTAL RETURNS FOR SELECT PERIODS Ormond Beach Firefighters Pension Trust Fund 06/30/2021 Quarter Year Latest Latest Latest Latest Since To Date To Date One Year Three Year Five Year Ten Year Inception* Total Account 7.19 11.32 31.15 21.03 18.39 - 15.87 Russell 1000 Growth 11.93 12.99 42.50 25.14 23.66 - 18.44 Equities 7.25 11.43 31.54 21.71 19.07 - 16.52 Russell 1000 Growth 11.93 12.99 42.50 25.14 23.66 - 18.44 S&P 500 8.55 15.25 40.79 18.67 17.65 - 15.39 Fixed Income - - - - - - - Cash and Equiv. - - - 1.03 0.90 - 0.54 Other - - - - - - - *Since Inception 04/25/12 Performance is Gross of Fees unless otherwise noted Returns for periods of one year or longer are annualized STABILITY | CONSISTENCY | COMMITMENT 3 Portfolio Performance TOTAL RETURNS GROSS FOR SELECT PERIODS Ormond Beach Firefighters Pension Trust Fund 06/30/2021 45.0% 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% QTD YTD 1 Year 3 Year 5 Year Since Inception Portfolio Russell 1000 Growth *Since Inception 04/25/12 Returns for periods of one year or longer are annualized STABILITY | CONSISTENCY | COMMITMENT 4 Portfolio Holdings Security Quantity Unit Cost Total Cost Price Market Value Pct of Assets Common Stock Consumer Discretionary TRACTOR SUPPLY CO COM 369.00 149.35 55,109.22 186.06 68,656.14 1.5 NIKE INC. -

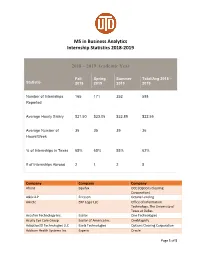

MS in Business Analytics Internship Statistics 2018-2019

MS in Business Analytics Internship Statistics 2018-2019 2018 – 2019 Academic Year Fall Spring Summer Total/Avg 2018 – Statistic 2018 2019 2019 2019 Number of Internships 165 171 252 588 Reported Average Hourly Salary $21.50 $23.05 $22.89 $22.55 Average Number of 35 35 39 36 Hours/Week % of Internships in Texas 65% 65% 55% 62% # of Internships Abroad 2 1 2 5 Company Company Company 4front Equifax OCC (Options Clearing Corporation) A&G LLP Ericsson Octane Lending AArete ERP Logic LLC Office of Information Technology, The University of Texas at Dallas Accufire Technology Inc. Essilor One Technologies Acuity Eye Care Group Essilor of America Inc. OneMagnify Adaptive3D Technologies LLC Exela Technologies Options Clearing Corporation Addison Health Systems Inc. Experis Oracle Page 1 of 5 Aditi Consulting e-Zest Solutions Inc. OrderMyGear Aditi Staffing EZLynx Oriental Trading Company Adobe Systems Fathomd Inc. Parks Associates Advatix Federal Reserve Bank of Dallas PepsiCo Aeris Communications FedEx Services Perot Museum of Nature and Science AG Technologies FHL Bank Dallas Peterbilt Motors Company Agilent Technologies Finastra PMG Albertsons Companies Fiserv Polytronix Inc. Allegiant Travel Company Five Point Five Solutions (Tesser Populus Group LLC Insights) Allegis Group FleetPride Inc. Presbyterian Healthcare Services Allied Stone Inc. Flipt PricewaterhouseCoopers (PwC) Ally Financial Fortech Energy Inc. Primary Services LP ALM First Financial Advisors LLC Fossil Group Prime Medstaff LLC Alpha Business Images FourPoint Energy LLC Primus Global Services Inc. American Airlines Fresenius Medical Care Priority Health American College of Emergency Fresenius Medical Care North Priority Health Physicians America American Heart Association Frontdoor Pro Unlimited Inc. -

Franklin Growth Fund Advisor Class United States - Retail December 31, 2019

Class A Franklin Growth Fund Advisor Class United States - Retail December 31, 2019 Fund Commentary Performance Review • Broad gauges of US equities marked a string of new record highs as the nation’s economy continued exhibiting some positive fundamentals throughout 2019’s fourth quarter, while financial market activity reflected investors’ generally rising optimism about trade and the economy. • For the quarter, the fund’s Advisor Class shares returned 8.15%, and its benchmark, the S&P 500 Index, returned 9.07%. Past performance is not an indicator or a guarantee of future performance. QUARTERLY KEY PERFORMANCE DRIVERS Stocks Sectors Amgen Inc. Consumer Discretionary (Stock Selection) Helped ASML Holding NV ADR Consumer Staples (Underweight) Apple Inc. Utilities (Underweight) Boeing Company Industrials (Overweight) Hurt Northrop Grumman Corporation Health Care (Stock Selection) Verisk Analytics Inc Materials (Stock Selection, Overweight) • In the industrials sector, aerospace contractor Northrop Grumman underperformed after issuing weak third-quarter earnings and disappointing guidance due, in part, to its aerospace business. • Weaker-than-expected margins offset positive revenue growth for data analytics provider Verisk Analytics in the industrials sector. Verisk invests substantially in new product innovation across its businesses, and we have been encouraged by the company’s realigned strategy that focuses on services with sustainable recurring revenue. • Conversely, increased demand for 5G chips and an improved outlook for trade helped the shares of semiconductor equipment company ASML Holding in the information technology sector. ONE-MONTH KEY PERFORMANCE DRIVERS Stocks Sectors Mettler-Toledo International Inc. Consumer Discretionary (Stock Selection) Helped ASML Holding NV ADR Real Estate (Stock Selection) Catalent Inc Consumer Staples (Stock Selection) Boeing Company Industrials (Overweight) Hurt Northrop Grumman Corporation Financials (Stock Selection) Alaska Air Group, Inc. -

FB M&A Update

Software M&A Update 4Q 2019 CONTENTS REPORT HIGHLIGHTS 2 Deal Analytics . The fourth quarter of 2019 saw the fewest number of deals closed in 7 Largest Deals over three years in the Software sector 9 Public Comps 11 Industry Trend . Overall deal volume in 2019 was down 17% from 2018 13 Our Service Offerings 14 Selected Transactions . 2019 lower middle-market transaction volume in the $0 - 50MM EV 15 Our M&A Deal Leaders tranche decreased while the larger $50-500MM EV tranche saw a meaningful rise in transaction volume from 2018 Trevor Hulett Managing Director . Strategic buyers have been more active than PE investors over the [email protected] last six years, but we saw a comeback by PE in 2019, especially in total capital invested Jason Qiao Analyst . The acquisition of Carbon Black by VMware in an approximately $2.3 [email protected] billion deal represented the largest deal in Q4 For more information on R.L Hulett & Co. Stock prices trended higher through 2019 while valuation multiples or this report please visit our website at slightly declined rlhulett.com or call us at (314) 721-0607 Page 2 Software M&A Update | 4Q 2019 Global Deal Analytics We tracked all 729 deals in Q4 2019 across the globe, 50% of which came from the North America market. Europe was the second most active market, with 250 deals in the Software sector. These two regions witnessed 84% of the transactions reported in Q4. 250 366 62 20 0 1-100 101-300 >300 Canada: 38 United States Regions In the North American market, the West Coast region was the most active area in terms of Software M&A transactions in Q4 because of the West Coast: 88 location advantage (Silicon Valley), with 88 closed deals. -

AC Alternatives Disciplined Long Short - TF

AC Alternatives Disciplined Long Short - TF Schedule of Investments as of 2019-12-31 (Unaudited) Holding Shares/Principal Amount Market Value ($) Apple Inc 2,139 628,117 CDW Corp/DE 4,252 607,356 Microsoft Corp 3,786 597,052 Facebook Inc 2,848 584,552 Royal Gold Inc 4,730 578,242 Verizon Communications Inc 9,411 577,835 Intuit Inc 2,204 577,294 EMCOR Group Inc 6,683 576,743 Oracle Corp 10,781 571,177 Progressive Corp/The 7,877 570,216 Comerica Inc 7,801 559,722 Amazon.com Inc 302 558,048 Coca-Cola Co/The 9,939 550,124 Hershey Co/The 3,739 549,558 Visa Inc 2,915 547,728 Mastercard Inc 1,827 545,524 Republic Services Inc 6,030 540,469 AutoZone Inc 443 527,750 PayPal Holdings Inc 4,875 527,329 Wells Fargo & Co 9,744 524,227 Thermo Fisher Scientific Inc 1,592 517,193 PepsiCo Inc 3,708 506,772 KLA Corp 2,695 480,168 Fifth Third Bancorp 15,615 480,005 Essent Group Ltd 8,739 454,341 PS Business Parks Inc 2,693 443,995 IHS Markit Ltd 5,865 441,928 Alphabet Inc 321 429,944 Booz Allen Hamilton Holding Corp 6,019 428,131 CoStar Group Inc 698 417,613 Qorvo Inc 3,565 414,360 East West Bancorp Inc 8,500 413,950 Cadence Design Systems Inc 5,914 410,195 United Community Banks Inc/GA 13,075 403,756 ANSYS Inc 1,403 361,146 Bank of America Corp 10,014 352,693 Discover Financial Services 4,068 345,048 JPMorgan Chase & Co 2,190 305,286 Flagstar Bancorp Inc 7,584 290,088 Valvoline Inc 12,163 260,410 American Tower Corp 1,125 258,548 Keysight Technologies Inc 2,514 258,012 Synchrony Financial 7,111 256,067 Motorola Solutions Inc 1,550 249,767 Builders FirstSource -

Verisk Analytics Achieves Global-Local Balance with Verisk Health

VERISK ANALYTICS ACHIEVES GLOBAL-LOCAL BALANCE WITH VERISK HEALTH Ina M. Sebastian and Barbara H. Wixom OCTOBER 2017 | CISR WP NO. 424 | 13 PAGES CASE STUDY an in-depth description of a firm’s approach to an IT management issue (intended for MBA and executive education) INFORMATION BUSINESS This case describes how Verisk Health, the former healthcare services business of Verisk Analytics, developed two critical types of capabilities DATA MONETIZATION to successfully monetize data analytics in the challenging healthcare mar- CAPABILITIES ketplace: foundational capabilities, and capabilities for driving customer BUSINESS ANALYTICS action. It further illustrates how Verisk Analytics—an information busi- ness with a diversification operating model—developed organizational practices that targeted a “global-local balance,” enabling the company to respond to local needs while leveraging enterprise-wide capabilities. © 2017 Massachusetts Institute of Technology. All rights reserved. Sebastian and Wixom | CISR Working Paper No.424 | 2 CONTENTS Instructor Note ...................................................................................................................................... 3 Verisk Analytics, Inc. ....................................................................................................................... 5 Verisk Health ............................................................................................................................................ 5 Foundational Capabilities: Transforming Data Into Insight -

Verisk Capabilities

Our vision is to be the world’s most effective and responsible data analytics company in pursuit of our customers’ most strategic opportunities. Discover our capabilities 3/17 The Verisk Way™ We’re committed to serving our customers with the highest level of quality, service, and innovation in all we do. That’s The Verisk Way. Three powerful principles guide the way we approach our work: SERVE We take great satisfaction anticipating the needs of our customers and colleagues and in exceeding their expectations. ADD VALUE We see each day as an opportunity to add value by continually improving quality, productivity, and timeliness. INNOVATE We’re passionate about visualizing the future and being thought leaders in order to achieve a better tomorrow. We do things The Verisk Way because we want our customers, colleagues, shareholders, and communities to flourish. Who We Are Verisk Analytics is a leading data analytics provider serving customers in insurance, natural resources, and financial services. We’ve been delivering data, analytics, and decision support services to our customers for more than 45 years. Headquartered in Jersey City, New Jersey, we’re a socially responsible global company with offices and customers in nearly 80 countries around the world. Our industry-leading brands include ISO, Xactware, AIR Worldwide, Argus, and Wood Mackenzie. Verisk Analytics is a member of Standard & Poor’s S&P 500® Index and part of the Nasdaq-100 Index. In 2016, Forbes magazine named Verisk Analytics to its World’s Most Innovative Companies list and to its America’s Best Large Employers list. Verisk is one of only 14 companies to appear on both lists. -

Crspmig1 U.S. Mid Cap Growth Index 3-31-20

R QUARTERLY PERFORMANCE QUARTER ENDING TICKER SYMB0L U.S. MID CAP 3-31-20 CRSPMIG1 GROWTH INDEX ABOUT THE CRSP U.S. MID CAP GROWTH INDEX The Center for Research in Security Prices (CRSP) is The CRSP U.S. Growth Style Indexes are part of the recognized leading provider of research-quality, CRSP’s investable index family. Once securities are historical market data and returns. Founded in 1960 assigned to a size-based market cap index, they are to develop the first definitive measurement of long-run made eligible for assignment to a growth or value market returns, CRSP has long been an integral part index using CRSP’s multifactor model. of the academic and commercial world of financial and economic research. Since its inception, CRSP has CRSP classifies growth securities using the following partnered with the investment industry to develop and factors: future long-term growth in earnings per maintain databases and market indexes that are widely share (EPS), future short-term growth in EPS, 3-year used by academics and commercial practitioners. historical growth in EPS, 3-year historical growth in sales per share, current investment-to-assets ratio, and return on assets. 10-YEAR CUMULATIVE INDEX LEVELSMid GrowthAS OF MARCH 2020 400 350 300 250 200 150 100 50 0 3/31/2010 7/30/2010 3/31/2011 7/29/2011 3/30/2012 7/31/2012 3/28/2013 7/31/2013 3/31/2014 7/31/2014 3/31/2015 7/31/2015 3/31/2016 7/29/2016 3/31/2017 7/31/2017 3/29/2018 7/31/2018 3/29/2019 7/31/2019 3/31/2020 11/30/2010 11/30/2011 11/30/2012 11/29/2013 11/28/2014 11/30/2015 11/30/2016 -

BNYM VIF:Appreciation Portfolio (Unaudited) As of Date: 06/30/2020 Common Stocks

BNYM VIF:Appreciation Portfolio (Unaudited) As of date: 06/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002824100 Abbott Laboratories 84,700 7,744,121 00287Y109 AbbVie 62,550 6,141,159 00724F101 Adobe Systems 8,900 3,874,259 009158106 Air Products & Chemicals 43,225 10,437,109 02079K107 Alphabet, Cl. C 12,294 17,378,921 02209S103 Altria Group 118,575 4,654,069 023135106 Amazon.com 8,000 22,070,560 037833100 Apple 74,250 27,086,400 B908F01 ASML Holding 28,150 10,360,045 053015103 Automatic Data Processing 15,415 2,295,139 09247X101 BlackRock 17,375 9,453,564 11133T103 Broadridge Financial Solutions 15,950 2,012,731 13645T100 Canadian Pacific Railway 23,375 5,968,573 166764100 Chevron 69,200 6,174,716 B3BQMF6 Chubb 36,400 4,608,968 191216100 Coca-Cola 171,075 7,643,631 20030N101 Comcast, Cl. A 199,490 7,776,120 518439104 Estee Lauder, Cl. A 59,700 11,264,196 30231G102 Exxon Mobil 1 45 30303M102 Facebook, Cl. A 90,185 20,478,308 5253973 Hermes International 2,677 2,234,286 45866F104 Intercontinental Exchange 72,975 6,684,510 461202103 Intuit 13,350 3,954,137 46120E602 Intuitive Surgical 7,400 4,216,742 46625H100 JPMorgan Chase & Co. 89,475 8,416,019 4061412 LVMH Moet Hennessy Louis Vuitton 15,150 6,635,683 574795100 Masimo 8,625 1,966,414 57636Q104 Mastercard, Cl. A 14,000 4,139,800 580135101 McDonald's 33,200 6,124,404 594918104 Microsoft 163,885 33,352,236 641069406 Nestle, ADR 65,600 7,244,864 654106103 NIKE, Cl. -

Verisk Analytics, Inc. (VRSK) Investor Day

Corrected Transcript 06-Dec-2018 Verisk Analytics, Inc. (VRSK) Investor Day Total Pages: 80 1-877-FACTSET www.callstreet.com Copyright © 2001-2018 FactSet CallStreet, LLC Verisk Analytics, Inc. (VRSK) Corrected Transcript Investor Day 06-Dec-2018 CORPORATE PARTICIPANTS Stacey Jill Brodbar Lisa Bonalle Hannan Analyst, Verisk Analytics, Inc. President-Verisk Financial Services, Verisk Analytics, Inc. Scott G. Stephenson Bill Churney Chairman, President & Chief Executive Officer, Verisk Analytics, Inc. President-AIR Worldwide, Verisk Analytics, Inc. Mark V. Anquillare Neal Anderson Chief Operating Officer & Executive Vice President, Verisk Analytics, President-Wood Mackenzie, Verisk Analytics, Inc. Inc. Nicholas Daffan Neil Spector Executive Vice President & Chief Information Officer, Verisk Analytics, President-ISO, Verisk Analytics, Inc. Inc. Mike Fulton Lee M. Shavel President-Xactware Solutions, Verisk Analytics, Inc. Chief Financial Officer & Executive Vice President, Verisk Analytics, Inc. Richard Della Rocca President-ISO Claims Analytics, Verisk Analytics, Inc. ...................................................................................................................................................................................................................................................... OTHER PARTICIPANTS Henry Sou Chien Tim J. McHugh Analyst, BMO Capital Markets (United States) Analyst, William Blair & Co. LLC Manav Patnaik Toni M. Kaplan Analyst, Barclays Capital, Inc. Analyst, Morgan Stanley & Co. LLC William