CHIM-Factsheet.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Environmental, Social and Governance Report

2018 Environmental, Social and Governance Report Attached herewith the 2018 Environmental, Social and Governance Report of Zijin Mining Group Co., Ltd.* (the “Company”) for the period from 1 January 2018 to 31 December 2018. Investors and shareholders are advised by the board of directors to exercise caution when dealing in the securities of the Company. This report is written in both Chinese and English. In the case of any discrepancies, the Chinese version shall prevail over its English version. Fujian, the PRC, 24 July 2019 * The Company’s English name is for identification purposes only 1 Content Page Definition 5 Part I. 2018 Environmental, Social and Regulatory Report 7 Remarks by the chairman 9 About the report 12 Company profile 13 Enterprise culture 14 The core ideas of Zijin enterprise culture 14 A responsible Zijin - leading sustainable management 15 Missions and goals for social responsibilities 15 Social responsibility beliefs 15 Management system of social responsibilities 16 Social responsibility risk management 16 Communication with stakeholders 16 Major awards received in respect of corporate responsibility during 2018 18 Earn respect with quality products - driving industrial innovation 19 Corporate governance 19 Scientific and technological innovation 20 Sustainable exploitation of resources 23 Supply chain management 25 Product quality and customer satisfactory management 25 Prohibition of commercial bribery and corruption 26 A green Zijin - focusing on energy conservation and emission reduction 29 Environmental management -

Conflict Minerals Report for 2019, We Have Completed Our Analysis of The

Conflict Minerals Report For 2019, we have completed our analysis of the suppliers for Amazon electronic devices, fashion and apparel, and other consumer products that fall within the scope of the applicable rules (collectively, in-scope products). A majority of these suppliers certified that they: did not use gold, tin, tungsten, or tantalum in parts or components for our in-scope products; did not source these minerals from the Democratic Republic of the Congo or an adjoining country, referred to as the DRC region; or sourced these minerals from a smelter or refiner that complies with a responsible mineral sourcing validation program such as the Responsible Minerals Assurance Process. The remaining suppliers are still completing investigations of their supply chains. As discussed in the Conclusion, for 2019, we identified no suppliers that were sourcing minerals through a supply chain that benefitted armed groups in the DRC region. Pursuant to the Securities and Exchange Commission’s conflict minerals rules, we designed our due diligence on the source and chain of custody of the gold, tin, tungsten, and tantalum in our in-scope products in accordance with the OECD’s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas Third Edition, and the related Supplements on Tin, Tantalum and Tungsten and on Gold. We undertook the steps described below as part of our due diligence process: Establish strong company management systems We are committed to avoiding the use of minerals that have fueled conflict, and we expect our suppliers to support our efforts to identify the origin of gold, tin, tungsten, and tantalum used in products that we manufacture or contract to manufacture. -

The Mineral Industry of China in 2016

2016 Minerals Yearbook CHINA [ADVANCE RELEASE] U.S. Department of the Interior December 2018 U.S. Geological Survey The Mineral Industry of China By Sean Xun In China, unprecedented economic growth since the late of the country’s total nonagricultural employment. In 2016, 20th century had resulted in large increases in the country’s the total investment in fixed assets (excluding that by rural production of and demand for mineral commodities. These households; see reference at the end of the paragraph for a changes were dominating factors in the development of the detailed definition) was $8.78 trillion, of which $2.72 trillion global mineral industry during the past two decades. In more was invested in the manufacturing sector and $149 billion was recent years, owing to the country’s economic slowdown invested in the mining sector (National Bureau of Statistics of and to stricter environmental regulations in place by the China, 2017b, sec. 3–1, 3–3, 3–6, 4–5, 10–6). Government since late 2012, the mineral industry in China had In 2016, the foreign direct investment (FDI) actually used faced some challenges, such as underutilization of production in China was $126 billion, which was the same as in 2015. capacity, slow demand growth, and low profitability. To In 2016, about 0.08% of the FDI was directed to the mining address these challenges, the Government had implemented sector compared with 0.2% in 2015, and 27% was directed to policies of capacity control (to restrict the addition of new the manufacturing sector compared with 31% in 2015. -

Jiangxi Copper Company Limited Multi-Metal Combined RGG and RSG Compliance Report (Year 2019)

Jiangxi Copper Company Limited Multi-metal Combined RGG and RSG Compliance Report (Year 2019) Jiangxi Copper Company Limited 29 April 2020 Contents Introduction................................................................................................................. 2 1. Company Profile ..................................................................................................... 3 2. Compliance Overview ............................................................................................ 4 Step 1: Establish Strong Company Management Systems ......................................... 4 Step 2: Identify and Assess Risks in the Supply Chain .............................................. 6 Step 3: Design and Implement Strategy to Respond to Identified Risks .................... 10 Step 4: Carry out Independent Third-Party Audit of Refiner's Due Diligence Practices11 Step 5: Report Annually on Supply Chain Due Diligence ........................................ 12 3. Management Conclusion ..................................................................................... 12 4. Others .................................................................................................................... 13 5. Appendixes ........................................................................................................... 13 5.1 Countries of Origin of Annex for the Year 2019 ............................................... 13 5.2 Independent Limited Assurance Report .......................................................... -

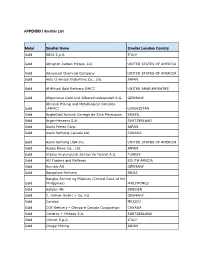

2020 Appendix I Smelter List

APPENDIX I Smelter List Metal Smelter Name Smelter Location Country Gold 8853 S.p.A. ITALY Gold Abington Reldan Metals, LLC UNITED STATES OF AMERICA Gold Advanced Chemical Company UNITED STATES OF AMERICA Gold Aida Chemical Industries Co., Ltd. JAPAN Gold Al Etihad Gold Refinery DMCC UNITED ARAB EMIRATES Gold Allgemeine Gold-und Silberscheideanstalt A.G. GERMANY Almalyk Mining and Metallurgical Complex Gold (AMMC) UZBEKISTAN Gold AngloGold Ashanti Corrego do Sitio Mineracao BRAZIL Gold Argor-Heraeus S.A. SWITZERLAND Gold Asahi Pretec Corp. JAPAN Gold Asahi Refining Canada Ltd. CANADA Gold Asahi Refining USA Inc. UNITED STATES OF AMERICA Gold Asaka Riken Co., Ltd. JAPAN Gold Atasay Kuyumculuk Sanayi Ve Ticaret A.S. TURKEY Gold AU Traders and Refiners SOUTH AFRICA Gold Aurubis AG GERMANY Gold Bangalore Refinery INDIA Bangko Sentral ng Pilipinas (Central Bank of the Gold Philippines) PHILIPPINES Gold Boliden AB SWEDEN Gold C. Hafner GmbH + Co. KG GERMANY Gold C.I Metales Procesados Industriales SAS COLOMBIA Gold Caridad MEXICO Gold CCR Refinery - Glencore Canada Corporation CANADA Gold Cendres + Metaux S.A. SWITZERLAND Gold CGR Metalloys Pvt Ltd. INDIA Gold Chimet S.p.A. ITALY Gold Chugai Mining JAPAN Gold Daye Non-Ferrous Metals Mining Ltd. CHINA Gold Degussa Sonne / Mond Goldhandel GmbH GERMANY Gold DODUCO Contacts and Refining GmbH GERMANY Gold Dowa JAPAN Gold DSC (Do Sung Corporation) KOREA, REPUBLIC OF Gold Eco-System Recycling Co., Ltd. East Plant JAPAN Gold Eco-System Recycling Co., Ltd. North Plant JAPAN Gold Eco-System Recycling Co., Ltd. West Plant JAPAN Gold Emirates Gold DMCC UNITED ARAB EMIRATES Gold GCC Gujrat Gold Centre Pvt. -

China Molybdenum Co (3993 HK)

China Thursday , 25 January 2018 INITIATE COVERAGE BUY China Molybdenum Co (3993 HK) An Emerging Global Mining Giant; Riding On Cobalt And Copper Momentum Share Price HK$5.97 China Molybdenum Co has evolved into one of the world’s leading mining Target Price HK$6.78 companies with diversified resources exposure. We forecast 40%+ EPS CAGR in Upside +13.0% 2017-20, given: a) our positive view on copper and cobalt in the medium to long term, b) the likelihood of tungsten and molybdenum’s high-margin advantage COMPANY DESCRIPTION persisting, and c) the niobium and phosphate segments providing stable cash flows. Initiate coverage with BUY and target price of HK$6.78 on DCF life-of-mine valuation. China Molybdenum Co is a mineral mining and exploration company engaged in the Copper: Positive outlook in the medium term on solid fundamentals. From a global mining and processing of molybdenum, perspective, we favour copper among base metals for the next 2-3 years given: a) supply tungsten, copper, cobalt, niobium and constraint due to under-investment, mines’ grade declines and elevated mine strike risks; phosphate minerals. and b) demand supported by traditional consumption and rising adoption of electric vehicles (EV). We expect LME copper prices to stay high at US$7,000-7,200/tonne in STOCK DATA 2018-20. China Molybdenum Co (CMOC) owns two world-class copper mines Tenke GICS sector Materials Fungurume Mining S.A (Tenke) and Northparkes Mine (Northparkes) with a combined Bloomberg ticker: 3993 HK mined copper production of 240k-260k tpa. Shares issued (m): 3,933.5 Market cap (HK$m): 200,112.6 Cobalt: Riding on EV momentum. -

Annual Report 2020

CONTENTS Financial Figures 002 Definitions 003 Corporate Information 007 Organisation Structure 009 The Group 010 Shareholder Information 011 Chairman’s Statement 013 Management Discussion and Analysis 016 Directors and Senior Management 038 Corporate Governance Report 047 Report of the Directors 062 Independent Auditor’s Report 084 Consolidated Statement of Profit or Loss 089 Consolidated Statement of Comprehensive Income 090 Consolidated Statement of Financial Position 091 Consolidated Statement of Changes in Equity 093 Consolidated Statement of Cash Flows 095 Notes to the Consolidated Financial Statements 098 Five Years Financial Summary 203 002 SINOTRUK (HONG KONG) LIMITED | ANNUAL REPORT 2020 FINANCIAL FIGURES 2020 2019 Increase/(Decrease) % Operating results (RMB million) Revenue 98,198 62,613 35,585 56.8 Gross profit 19,585 12,219 7,366 60.3 Profit attributable to owners of the Company 6,851 3,474 3,377 97.2 Profitability and Liquidity Gross profit ratio (%) 19.9 19.5 0.4 2.1 Net profit ratio (%) 7.6 6.3 1.3 20.6 Current ratio (time) 1.1 1.3 (0.2) (15.4) Trade receivable turnover (days) 41.9 71.2 (29.3) (41.2) Trade payable turnover (days) 186.1 174.2 11.9 6.8 Sales volume (units) HDTs — Domestic 247,454 129,424 118,030 91.2 — Export (including affiliated export) 30,961 40,009 (9,048) (22.6) Total 278,415 169,433 108,982 64.3 LDTs 181,013 109,280 71,733 65.6 Buses 228 1,187 (959) (80.8) Trucks sold under auto financing services 69,300 34,133 35,167 103.0 Per share data Earnings per share - basic (RMB) 2.48 1.26 1.22 96.8 2020 final dividend per share HKD 1.04 0.39 0.65 166.7 or RMB 0.88 0.36 0.52 144.4 Note: In April 2020, the Group acquired the entire equity interests in Datong Gear from CNHTC. -

Jiangxi Copper

HONG KONG Jiangxi Copper Not quite copper-bottomed We transfer coverage of Jiangxi Copper (JXC) to Matty Zhao with a cautious view (downgrade to Neutral from OP) and price target of HK$15 (from HK$22), 9% downside. We expect copper price to remain weak in 2013-14F due to a worsen supply surplus. It will be hard for JXC to outperform the HSI given its high EPS sensitivity to copper prices, ROE drop from 18% in 2011 to below 7% in 2014E and potential consensus EPS cut (we are 16%/40% below consensus in 2013/14F). It is at 15x 2014E PER, and our PT implies 13.7x 2014PER. 358 HK Neutral Our commodity team expects $6,550/t copper price in 2014 . Supply surplus to worsen in 2014: Given the strong investments in copper Price (at 08:01, 10 May 2013 GMT) HK$16.42 projects in the past few years, our commodity team forecasts 3%/8% mined 12-month target HK$ 15.00 copper supply growth in 2013/14F but 3.5%/4.8% demand growth only. Upside/Downside % -8.6 Valuation HK$ 15.00 . Our commodity team see a worsen surplus in 2014 of 728kt (vs. 221kt in 2013) - Sum of Parts and remain cautious on copper prices with a 6% drop in 2013E to $7,458/t GICS sector Materials Market cap HK$m 56,846 and another 12% in 2014E to $6,550/t. The strong YTD supply growth (8%y-y 30-day avg turnover US$m 38.6 from Chile mines) and high inventory level add more near term concerns. -

Interim Report Important Notice

(A Sino-foreign joint venture joint stock limited company incorporated in the People's Republic of China) (Stock Code.H Share: 0358.A Share: 600362) 2019 Interim Report Important Notice (I) The Board, the Supervisory Committee and the Directors, the Supervisors and senior management of Jiangxi Copper Company Limited warrant that they severally and jointly accept responsibility for the truthfulness, accuracy and completeness of the information contained in the interim report and that there are no false representations, misleading statements contained therein or material omissions therefrom. (II) All the Directors of the Company attended the Board meeting to approve, among others, the interim results for the six months ended 30 June 2019. (III) The interim financial report of the Company and its subsidiaries has not been audited, but the interim financial information prepared in accordance with IFRSs has been reviewed by Ernst & Young and considered and approved by the Audit Committee. (IV) The Company’s chairman, Mr. Long Ziping, the principal accounting responsible person, Mr. Yu Tong, and Head of Financial Department (accounting chief), Mr. Ai Fuhua, warrant the truthfulness, accuracy and completeness of the financial report set out in the interim report. (V) Proposal of profit distribution plan or transfer of capital reserve to share capital during the reporting period after consideration by the Board: The Company will not make any proposal of profit distribution plan or transfer capital reserve to share capital. (VI) Statement for the risks involved in the forward-looking statement: The interim report contains forward-looking statements that involve future plans and development strategies which do not constitute a commitment by the Company to its investors. -

Exhibit 1.01 Elbit Systems Ltd. Conflict Minerals Report for the Year

Exhibit 1.01 Elbit Systems Ltd. Conflict Minerals Report For the Year Ended December 31, 2020 In Accordance with Rule 13p-1 under the Securities Exchange Act of 1934 A. Introduction This Conflict Minerals Report (this “Report”) of Elbit Systems Ltd. (together with its wholly-owned subsidiaries, “Elbit Systems” or “we”) for the year ended December 31, 2020 is presented to comply with Rule 13p-1 (the “CM Rule”) under the Securities Exchange Act of 1934. The CM Rule was adopted by the U.S. Securities and Exchange Commission (“SEC”) to implement reporting and disclosure requirements related to “conflict minerals” under Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Pursuant to Section 1502, publicly traded companies, such as Elbit Systems, must report to the SEC whether “conflict minerals” (tantalum, tin, tungsten and gold) (“3TG”) originating in the Democratic Republic of Congo (“DRC”) or adjoining countries (Angola, Burundi, The Central African Republic, The Republic of the Congo, Rwanda, South Sudan, Tanzania, Uganda and Zambia) (the “Covered Countries”) are present in the products the company manufactures or contracts to manufacture, if any of the 3TG is necessary to the functionality or production of such products. The CM Rule was adopted because the sale of 3TG mined in the Covered Countries has funded armed conflicts in that region, and those conflicts have led to numerous human rights abuses and atrocities. Unless otherwise defined herein, the terms used in this Report have the meanings ascribed to them in the CM Rule, Form SD and SEC Release No. 34-67716 issued by the SEC in 2012. -

Broadcom Limited Conflict Minerals Report for the Calendar Year Ended December 31, 2016

Broadcom Limited Conflict Minerals Report For The Calendar Year Ended December 31, 2016 This Conflict Minerals Report (this “Report”) of Broadcom Limited for the calendar year ended December 31, 2016 (the “Reporting Period”) is filed in accordance with Rule 13p-1 under the Securities Exchange Act of 1934, as amended (the “Rule”) and pursuant to the Company’s Specialized Disclosure Report on Form SD (“Form SD”) for the Reporting Period filed with the Securities and Exchange Commission (the “SEC”). The Rule imposes certain reporting and disclosure obligations on SEC registrants for which cassiterite, columbite- tantalite, gold, wolframite, or their derivatives, which are limited to tin, tantalum and tungsten (“conflict minerals”) are necessary to the functionality or production of a product manufactured, or contracted to be manufactured, by the registrant. References in this Report to “Broadcom,” “the Company,” “we,” “our,” or “us” refer to Broadcom Limited and its subsidiaries, on a consolidated basis, unless otherwise indicated or the context otherwise requires. Company and Product Overview Broadcom is a leading designer, developer and global supplier of a broad range of semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products. We have a history of innovation and offer thousands of products that are used in end products such as enterprise and data center networking, home connectivity, set-top boxes, broadband access, telecommunications equipment, smartphones and base stations, data center servers and storage systems, factory automation, power generation and alternative energy systems, and electronic displays. We have four reportable segments: wired infrastructure, wireless communications, enterprise storage and industrial & other. -

APPENDIX I Smelter List

APPENDIX I Smelter List Metal Smelter Name Smelter Location Country Gold 8853 S.p.A. ITALY Gold Abington Reldan Metals, LLC UNITED STATES OF AMERICA Gold Advanced Chemical Company UNITED STATES OF AMERICA Gold Aida Chemical Industries Co., Ltd. JAPAN Gold Al Etihad Gold Refinery DMCC UNITED ARAB EMIRATES Gold Allgemeine Gold-und Silberscheideanstalt A.G. GERMANY Almalyk Mining and Metallurgical Complex Gold (AMMC) UZBEKISTAN Gold AngloGold Ashanti Corrego do Sitio Mineracao BRAZIL Gold Argor-Heraeus S.A. SWITZERLAND Gold Asahi Pretec Corp. JAPAN Gold Asahi Refining Canada Ltd. CANADA Gold Asahi Refining USA Inc. UNITED STATES OF AMERICA Gold Asaka Riken Co., Ltd. JAPAN Gold Atasay Kuyumculuk Sanayi Ve Ticaret A.S. TURKEY Gold AU Traders and Refiners SOUTH AFRICA Gold Aurubis AG GERMANY Gold Bangalore Refinery INDIA Bangko Sentral ng Pilipinas (Central Bank of the Gold Philippines) PHILIPPINES Gold Boliden AB SWEDEN Gold C. Hafner GmbH + Co. KG GERMANY Gold Caridad MEXICO Gold CCR Refinery - Glencore Canada Corporation CANADA Gold Cendres + Metaux S.A. SWITZERLAND Gold Chimet S.p.A. ITALY Gold Chugai Mining JAPAN Gold Daye Non-Ferrous Metals Mining Ltd. CHINA Gold Degussa Sonne / Mond Goldhandel GmbH GERMANY Gold DODUCO Contacts and Refining GmbH GERMANY Gold Dowa JAPAN Gold DS PRETECH Co., Ltd. KOREA, REPUBLIC OF Gold DSC (Do Sung Corporation) KOREA, REPUBLIC OF Gold Eco-System Recycling Co., Ltd. East Plant JAPAN Gold Emirates Gold DMCC UNITED ARAB EMIRATES Gold GCC Gujrat Gold Centre Pvt. Ltd. INDIA Gold Geib Refining Corporation UNITED STATES OF AMERICA Gold Gold Refinery of Zijin Mining Group Co., Ltd. CHINA Gold Great Wall Precious Metals Co., Ltd.