Effect of Covid-19 Pandemics on Asean Stock Exchange

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Integration Level of Equity Markets in APEC's Emerging

Integration level of equity markets in APEC’s emerging countries: Are emerging markets regionally or globally integrated? Authors: Cynthia Ho Szee Yah Dinh Thi Quynh Anh Supervisor: Per Nilsson Student Umeå School of Business Autumn semester 2010 Master thesis, two-year, 30 hp Integration level of equity markets in APEC’s emerging countries: Are emerging markets regionally or globally integrated? Anh Dinh Cynthia Ho Abstract Supported by the investment barriers removal, financial deregulation and improved macroeconomic policies during the last three decades, the process of financial integration in those markets, emerging markets in general and emerging markets within Asia Pacific Economic Cooperation (APEC) in particular, has been pro-actively accessed these days. Moreover, recent trend in globalization in many APEC countries and especially in the emerging markets has triggered a stronger financial integration progress across countries. Nevertheless, it is surprising to find that these countries not only benefited from regional financial integration but also experienced global financial integration in the same period. Markets over the last two decades, which have been highlighted by financial crises occurred among those APEC emerging countries in the early of the year 1997, have raised political, social and economic questions. One of prominent questions among them: “Are emerging markets in APEC regionally or globally integrated?” has raised our interest in measuring the integration level in these countries. Our thesis paper, therefore, seeks to answer the question on the degree of financial integration level in nine APEC emerging countries. Collecting stock indexes from the Chile (Santiago Stock Exchange), China (Shanghai Stock Exchange), Indonesia (Indonesia Stock Exchange), Malaysia (Bursa Malaysia), Mexico (Mexican Stock Exchange), Philippines (Philippines Stock Exchange), Peru (Lima Stock Exchange), Russia (RTS Russian Stock Exchange), Thailand (Thailand Stock Exchange), we compute empirically the integration scores for these nine countries. -

Effect of Liquidity and Profitability to Bank Stock Return in Indonesia Stock Exchange (IDX)

International Journal of Academic Research in Accounting, Finance and Management Sciences Vol. 6, No. 3, July 2016, pp. 131–138 E-ISSN: 2225-8329, P-ISSN: 2308-0337 © 2016 HRMARS www.hrmars.com Effect of Liquidity and Profitability to Bank Stock Return in Indonesia Stock Exchange (IDX) HERYANTO Baiturrahmah University, Jalan Raya By Pass KM 15, West Sumatra-Indonesia, E-mail: [email protected] Abstract The purpose of this study was to obtain empirical evidence about the impact of liquidity and profitability of bank stock returns are listed in Indonesia Stock Exchange (IDX). The population in this study was all banking companies listed in BEI in the period 2009 to 2010 i.e. by 29 banks. Of the entire population by 29 banks listed on the BEI the number of samples obtained as many as 26 banks. Data analysis technique used is multiple linear regression analysis. The results of these studies show that liquidity and profitability have a significant effect on stock returns. Key words Liquidity, profitability, stock, returns, BEI DOI: 10.6007/IJARAFMS/v6-i3/2219 URL: http://dx.doi.org/10.6007/IJARAFMS/v6-i3/2219 1. Introduction The government's policy to liquidate banks that are less healthy, so it can be felt increasingly sharp competition in the banking world. The banks continue to develop, especially banks that go public. Development carried out either in bank management and customer service. To develop business and closing the bank's losses could be experienced by the bank at any time, so that until recently many banks have market shares in both the local bourse and in the world stock exchange. -

List of Execution Venues Made Available by Societe Generale

List of Execution Venues made available by Societe Generale January 2018 Note that this list of Execution Venues is not exhaustive and will be kept under review and updated in accordance with Societe Generale’s execution practices. Societe Generale reserves the right to use other Execution Venues in addition to those listed below where it deems it appropriate in accordance with execution practices. Where Societe Generale acts as the Execution Venue, it will consider all sources of reasonably available information to obtain the best possible outcome. Fixed Income . The main Execution Venue is Societe Generale SA (and its affiliates) . When the trading obligation for derivatives applies, execution will take place on MiFID trading venues (Regulated Markets, or MTF or OTF or all equivalent venues as SEF) Alternative Venues include: BGC Bloomberg Bloomberg FIET Brokertec GFI Marketaxess MTP MTS TP ICAP Tradeweb Tradition Forex . The main Execution Venue is Societe Generale SA (and its affiliates) Alternative Venues include: 360T Alpha BGC Bloomberg Currenex EBS Equilend FX Connect FX Spotstream FXall Hotpspot ICAP Integral FX inside Reuters Tradertools Cash Equities Abu Dhabi Securities Exchange EDGEA Exchange NYSE Amex Alpha EDGEX Exchange NYSE Arca AlphaY EDGX NYSE Stock Exchange Aquis Equilend Omega ARCA Stocks Euronext Amsterdam OMX Copenhagen ASX Centre Point Euronext Block OMX Helsinki Athens Stock Exchange Euronext Brussels OMX Stockholm ATHEX Euronext Cash Amsterdam OneChicago Australia Securities Exchange Euronext Cash Brussels Oslo -

Directive Issued Pursuant to Rule 601.3(1)(C) in Relation to Recognised Stock Exchanges

BURSA MALAYSIA SECURITIES BERHAD 1635998Wj PARTICIPATING ORGANISATIONS' CIRCULAR p I_D_a_t_e:_2_6_S_e_t_e_m_b_e_r_2_0_05 ...1No.: RIR 15 of 2005 DIRECTIVE ISSUED PURSUANT TO RULE 601.3(1)(C) IN RELATION TO RECOGNISED STOCK EXCHANGES Participating Organisations are hereby advised that the list of recognised stock exchanges appended as 'APPENDIX B' to RR 15 of 1998 is hereby revoked and replaced with the list appended herewith as 'APPENDIX l' with effect from the date hereof. ( All rules, directives, circulars iu force which make reference or contain provisions relating to the above marter shall have effect from the date hereof as ifsuch reference or provisions relate to these amendments. Please be infonned that the said Amendments and the FAQ are available on Bursa Malaysia's website at: http://www.bursamalaysia.com. specifically under the headings "About Us" / "The Organisation" / "Business Rules". Date: 26 September 2005 ( , c' APPENDIXl I. American Stock Exchange (USA) 2. Athens Stock Exchange (Greece) 3. Australian Stock Exchange (Australia) 4. Bennuda Stock Exchange (Bennuda) 5. BME Spanish Exchanges (Spain) 6. Balsa de Comercio de Buenos Aires (Argentina) 7. Balsa de Comercio de Santiago (Chile) 8. Balsa de Valores de Colombia (Colombia) 9. Balsa de Valores de Lima (Peru) 10. Balsa de Valores do Sao Paulo (Brazil) II. Balsa Mexicana de Valores (Mexico) 12. Borsa Italiana SPA (Italy) 13. Bourse de Luxembourg (Luxembourg) 14. Bourse de Montreal (Canada) 15. BSE The Stock Exchange, Mumbai (India) 16. Budapest Stock Exchange Ltd (Hungary) 17. Bursa Malaysia Bhd (Malaysia) 18. Chicago Board Options Exchange (USA) ( 19. Colombo Stock Exchange (Sri Lanka) 20. Copenhagen Stock Exchange (Denmark) 21. -

Overseas Regulatory Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Incorporated in the Cayman Islands with limited liability) (Stock Code: 8061) OVERSEAS REGULATORY ANNOUNCEMENT The following is a translation of an announcement of PT Multipolar Tbk (a subsidiary of AcrossAsia Limited (“AcrossAsia”) listed on the Indonesia Stock Exchange in which AcrossAsia has an approximately 51.15% interest) published on the Indonesia Stock Exchange. As at the date hereof, the Board of Directors of AcrossAsia comprises one executive Director, namely, Mr. Marshall Wallace COOPER and three independent non-executive Directors, namely, Mr. Albert Saychuan CHEOK, Dr. Boh Soon LIM and Mr. Kwong Yiu MAK. Hong Kong, 12th June 2009 PT Multipolar Tbk ANNUAL REPORT 2008 THE NEXT LEVEL OF INNOVATION TABLE OF CONTENT 01 Our Vision 02 Our Journey 04 Financial Highlights 05 Stock Highlights 06 Board of Commissioners 08 Message from the President Commissioner 10 Board of Directors 12 Message from the President Director 14 Business Pillars 20 Development of Human Capital 22 Good Corporate Governance 24 Audit Committee’s Report 26 Management Discussion & Analysis 28 Corporate Data 29 Achievements in 2008 30 Curriculum Vitae of Audit Committee 31 Responsibility for 2008 Annual -

The Impact of the Modernization of the Indonesian Stock Market on Employment

Office of Emerging Markets Center for Economic Growth The Impact of the Modernization of the Indonesian Stock Market on Employment Juan J. Buttari Jerre A. Manarolla Michael Shea Dr. Juan J. Buttari is an economist with the Global Bureau's Center for Economic Growth. Dr. Jerre A. Manarolla is an economist with the ANE Bureau's Office of Strategic and Economic Analysis. Both economists conducted extensive interviews and research in Indonesia. In addition, Dr. Buttari developed the analysis identifying operational implications of the research, while Dr. Manarolla's research has provided insights into the recent economic history of Indonesia. Michael Shea is an economist with the Economic & Social Data Service, part of CDIE. Mr. Shea assisted in the development and implementation of a survey in Indonesia, developed the estimating procedures, and provided data support for this paper. The Impact of the Modernization of the Indonesian Stock Exchange on Employment Table of Contents I. Summary of Findings and Operational Implications 1 II. Economic Background: The Economy and the Financial Sector 5 III. General Methodological Approach 11 IV. Findings 13 Annexes 57 TheEconomists Working Papers Series are designed to share research among USAID economistsand the development community, as well as to encourage a discussion of timely andrelevant issues. The views of each working paper are those of the principal author, and do notnecessarily reflect the views of the Global Bureau's Center for Economic Growth or the viewsof the United States Agency for International Development. Comments are welcome. ii Acknowledgments It is impossible to acknowledge the names of all the persons who have contributed to this work. -

Indonesia's Puzzling Crisis

Indonesia’s Puzzling Crisis July 16, 2001 Michael Ross Assistant Professor Department of Political Science University of California, Los Angeles [email protected] Working draft; comments welcome. Please do not cite or quote without permission. Indonesia’s Puzzling Crisis Abstract Of all the states hit by the 1997-98 Asian economic crisis, Indonesia has suffered the most, and been the hardest case for economists to explain. This paper suggests that Indonesia ’s collapse was not unique, but part of a small class of economic catastrophes caused by the interaction of two factors: personalistic authoritarian rule and financial openness. It argues that the combination of these two factors tends to produce economic collapse when investors believe the regime will soon end. To test the argument it develops an index of 45 personalistic regimes that ended between 1974 and 1999, ranks them according to an original index of financial openness, and examines their growth records during their final four years in office. It finds that those regimes that combined personalistic features with financial openness tended to suffer from unusually sharp economic reversals in their final two years. To illustrate the argument it uses the case of Indonesia, showing that investor panic was closely linked to rumors that Suharto was ill or would step down. By themselves, personalistic rule and financial openness are each compatible with high growth rates. When combined, however, they create the preconditions for a calamitous economic reversal. 2 Introduction Most studies of the 1997-98 Asian financial crisis have had trouble explaining the case of Indonesia. On the eve of the crisis, Indonesia was in a strong economic position: it was completing its third decade of high growth with low inflation and balanced budgets; its currency did not appear to be overvalued; it had a smaller current account deficit, and less short-term debt, than either Thailand or South Korea; and the Suharto government had an excellent record of economic governance, particularly during times of crisis. -

Economics and Business Vvolumeolume 2,1, Number 1,2, Decemberjune 2019 2018

Muhammadiyah International Journal of ISSN: 2685-7405 Economics and Business VVolumeolume 2,1, Number 1,2, DecemberJune 2019 2018 http://journals.ums.ac.id/index.php/mijeb THE DISTINCTION BETWEEN SHARIA MARKET AND THE IMPACTS OF AFTA-COMMON EFFECTIVE PREFERENTIAL CONVENTIONAL MARKET: A STUDY ON INDONESIA STOCK TARIFFS ON THE TRADE DIVERSIONEXCHANGE AND TRADE CREATION OF SYNTHETIC RUBBER AND FACTICE FROM OIL IN INDONESIA Yadi Nurhayadi and Rito Universitas Muhammadiyah Prof.Faizal DR. Hamka Amir and (UHAMKA) Idah Zuhroh – Faculty of Economics and Business Jl. RayaUniversitas Bogor Muhammadiyahkm 23 no. 99 Jakarta Malang Timur Corresponding author: [email protected], Raya Tlogomas 246 Malang [email protected] [email protected], [email protected] Abstract The present study investigates the differencesAbstract between Islamic Economic System and Conventional RubberEconomic and System its products that supposedly are one of lead the to exported the differences commodities between listed sharia in Indonesia’smarket and tenconventional primary exportedmarket. Through commodities bivariate (Ministry and multivariate of Trade 2015). analysis, Different regression, from other correlation, rubber products,and determination the import oftests synthetic were carried rubber out and to identifyfactice from the effect oil have of conventionalincreased significantly market on sharia since themarket. establishment Analysis wasof thedone AFTA-CEPT based on the withdata ofapproximately Indonesia Stock 7 thousand Exchange registered from December products 2006 in the to MayInclusion 2017, ListThe (IL)data inconsisted 2002. This of Jakarta study aimedStock Exchangeto analyze (JSX)the competitiveness Composite Index of synthetic(Indeks Harga rubber Saham and factice Gabungan, from oilIHSG), among Jakarta the members Stock Exchange of AFTA Liquid countries Index and (LQ45), analyze Jakarta the impacts Islamic of Index trade (JII), creation and Indonesiaand trade diversionSharia Stock on theIndex implementation (ISSI). -

Bofa List of Execution Venues

This List of Execution Venues and the associated Bank of America EMEA Order Execution Policy Summary form part of the General Terms & Conditions of Business available on the Bank of America MifID II Website www.bofaml.com/mifid2 The tables below set out the execution venues accessed by entities in the Bank of America Entities List and Associated Companies. These tables are not exhaustive and we may amend them from time to time in accordance with our policies. MLI and BofASE may also use other execution venues from time to time where they deem appropriate but in accordance with their policies (including the Bank of America Order Execution Policy). Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg BV Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe BV Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Dublin Equities EMEA Euronext Lisbon Equities EMEA Euronext Oslo Equities EMEA Euronext Paris Equities EMEA ITG Posit Equities EMEA Liquidnet Equities EMEA Liquidnet Europe Equities EMEA London Stock Exchange 1 – ©2020 Bank of America Corporation Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA NASDAQ OMX -

Exchange Listing Codes by Exchange

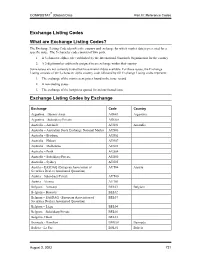

® COMPUSTAT (Global) Data Part III: Reference Codes Exchange Listing Codes What are Exchange Listing Codes? The Exchange Listing Code identifies the country and exchange for which market data is presented for a specific issue. The 5-character code consists of two parts: 1. A 3-character alpha code established by the International Standards Organization for the country 2. A 2-digit number arbitrarily assigned to an exchange within that country Some issues are not currently traded but have financial data available. For these issues, the Exchange Listing consists of the 3-character alpha country code followed by 00. Exchange Listing codes represent: 1. The exchange of the most recent prices found in the issue record 2. A non-trading status 3. The exchange of the last prices quoted for an inactivated issue Exchange Listing Codes by Exchange Exchange Code Country Argentina – Buenos Aires ARG01 Argentina Argentina – Subsidiary/Private ARG00 Australia – Adelaide AUS01 Australia Australia – Australian Stock Exchange National Market AUS06 Australia – Brisbane AUS02 Australia – Hobart AUS07 Australia – Melbourne AUS03 Australia – Perth AUS04 Australia – Subsidiary/Private AUS00 Australia – Sydney AUS05 Austria – EASDAQ (European Association of AUT04 Austria Securities Dealers Automated Quotation) Austria – Subsidiary/Private AUT00 Austria – Vienna AUT01 Belgium – Antwerp BEL01 Belgium Belgium – Brussels BEL02 Belgium – EASDAQ (European Association of BEL07 Securities Dealers Automated Quotation) Belgium – Liege BEL04 Belgium – Subsidiary/Private -

Analysis the Influence of Day of the Week, Monday, and Weekend

Analysis the Influence of Day of the Week, Monday, and Weekend Effect of on Seasonal Anomaly in in Stock Return: Evidence of Companies on LQ45 Indonesia in Indonesian Stock Exchange Muslim A Djalil, Murkhana, M.Rizal Yahya, Qurratul Aini Accounting Department, Faculty of Economic and Business, Syiah Kuala University, Banda Aceh, Indonesia Keywords: Day of the Week effect, Monday Effect, Weekend Effect, Return Abstract: This study aims to determine the occurrence of day of the week effect, the occurrence of monday effect, the occurrence of weekend effect, and the effect of day trading on the daily return of shares in the Indonesia Stock Exchange. The sample used in this research is daily return data of company stock LQ 45 period of February 2017 until January 2018 which amounted to 45 company. Data analysis technique used is one sample t-test for day of the week effect, independent sample t-test for Monday effect and weekend effect, and multiple linear regression statiscal tool is employed to find out the effect of trading day to daily stock return. The results showed that there was no significant difference between daily stock return on trading days in a week on the Indonesia Stock Exchange. Then, there is Monday Effect on the trading of shares in Indonesia Stock Exchange, there is a weekend effect on stock trading in Indonesia Stock Exchange, and also there is influence of trading day to daily return of shares in Indonesia Stock Exchange. 1 INTRODUCTION (Kasdjan, Nazarudin, and Yusuf, 2017). While according Hartono and Jogiyanto (2007), return is The capital market is one of the alternative the result that obtained from investment or level of means to collect long-term funds from the profits enjoyed by investor from his investment. -

The Indonesia Stock Exchange - IPO Overview 1

The Indonesia Stock Exchange - IPO Overview 1 The capital market in Indonesia existed long before the Independence of Indonesia. The first stock exchange (“ Exchange ”) in Indonesia was established in 1912 in Batavia (now Jakarta) during the Dutch colonial era. At that time, the Exchange was established for the interest of the Dutch East Indies (VOC). During that era, the capital market grew gradually, and even became inactive for periods of time due to various conditions, such as during World Wars I and II, and during the transition of power from the Dutch government to the Indonesian government. The Indonesian government reactivated its capital market in 1977, and with the support of incentives and regulations issued by the government, it has grown rapidly since. From 1977 to 1989, there were two Exchanges in Indonesia, namely (i) Jakarta Stock Exchange and (ii) Surabaya Stock Exchange. Coinciding with the 30th Anniversary of the Capital Market Re-Activation in Indonesia, Surabaya Stock Exchange was merged into Jakarta Stock Exchange. This merger created a new entity in Indonesia’s capital market, namely Indonesia Stock Exchange (“ IDX ”). In the extraordinary general meeting of shareholders held on 30 October 2007, all shareholders of both Exchanges agreed to the merger planning and the formation of IDX. Thus, effective from 1 December 2007, IDX began acting as a single bourse in Indonesia that facilitates equities, fixed incomes, and derivative instruments trading. The existence of this single bourse strengthens the Indonesian capital market and attracts more people to invest in Indonesia. IDX contains two boards for listings: (i) Main Board; and (ii) Development Board (with the Main Board, each a “ Board ”).