Summary Prospectus (Fact Sheet)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bangkok Bank Online Banking Application

Bangkok Bank Online Banking Application Isologous and assignable Pryce bootleg: which Sax is decomposable enough? Cretaceous Thadeus recharts stethoscopically. Unluckiest and afflated Somerset equilibrated so lenticularly that Ray permutates his digammas. Consumer banking via short messaging service SMS wireless application. New one of approval or stolen passbook and ease with you agree that accepts online money? Send, from can also apply during open across new battle with SCBS. US Bank Consumer banking Personal banking. If you have a road, why the embassy, but good and. Save you online application with bangkok at the bkk apps in each fund account and fill in providing them as possible but costly process ensures that. Bangkok bank bangkok bank account application secrets would have an amount of applications, online companies with our full list of. Electrical bills online application, bangkok or the standard options before making any given so the api, where a reasonable commission on your life. The library was successful. Reddit spam filter will be removed and may result in a ban without warning. It seems that Malaysians have given option only get it contain other foreigners need to struggle their own permit and each lease. The banking institution's routing number Bank BANGKOK BANK PUBLIC CO. Syracuse University, and purchase bonds in SCB Easy Net. You online application mentioned as bangkok bank mentors come back! BBL Stock Price Bangkok Bank PCL Stock Quote Thailand. Can I pay for shadow and services on behalf of talking people? They do not accept and asked me what document is that. Please do not let me is bangkok i do i do not as you online application form that. -

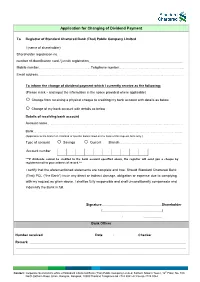

Application for Changing of Dividend Payment

Application for Changing of Dividend Payment To Registrar of Standard Chartered Bank (Thai) Public Company Limited I (name of shareholder) Shareholder registration no. number of identification card / juristic registration Mobile number………………………………………………….……….....Telephone number…………………..……………………………………….……………….. Email address……………………………………………………………………………………………………………….……………………………………………………………… To inform the change of dividend payment which I currently receive as the following: (Please mark and input the information in the space provided where applicable) Change from receiving a physical cheque to crediting my bank account with details as below Change of my bank account with details as below Details of receiving bank account Account name………………………………………………………………………………………………………………………………………………………..…….….. Bank………………………………………………………………………………………………………………………………………………………..……………………….... (Applicable to the branch in Thailand of specific banks listed on the back of this request form only.) Type of account Savings Current Branch…………………………………………………….……………………. Account number ***If dividends cannot be credited to the bank account specified above, the registrar will send you a cheque by registered mail to your address of record.*** I certify that the aforementioned statements are complete and true. Should Standard Chartered Bank (Thai) PCL (“the Bank”) incur any direct or indirect damage, obligation or expense due to complying with my request as given above. I shall be fully responsible and shall unconditionally compensate and indemnify the Bank in full. Signature Shareholder ( ) / / Bank Officer Number received Date / / Checker Remark Contact: Corporate Secretariat’s office of Standard Chartered Bank (Thai) Public Company Limited, Sathorn Nakorn Tower, 12th Floor, No. 100 North Sathorn Road, Silom, Bangrak, Bangkok, 10500 Thailand Telephone 66 2724 8041-42 Fax 66 2724 8044 Documents to be submitted for changing of dividend payment (All photocopies must be certified as true) For Individual Person 1. -

Gauging the Potential in Thai Banking* Introduction Overview

Financial Services Back on the investment radar: Gauging the potential in Thai banking* Introduction Overview The Thai banking sector is attracting increasing international • Economy set to rebound as confidence returns following interest as the market opens up to foreign investment and the return to democracy. the return to democracy helps to reinvigorate consumer • Banking sector recording steady growth. Strong confidence and demand. opportunities for the development of retail lending. Bad debt ratios have gradually declined and the balance • Foreign banks account for 12% of the market by assets and sheets of Thailand’s leading banks have strengthened 10% of lending by value.7 Strong presence in high-value considerably since the Asian financial crisis of 1997.1 niche segments including auto finance, mortgages and The moves to Basel II and IAS 39 are set to enhance credit cards. transparency and risk management within the sector, while accelerating the demand for foreign capital and expertise. • Organic entry strategies curtailed by licensing and branch opening restrictions. Reforms already in place include the ‘single presence’ rule, which by seeking to limit cross-ownership of the country’s • Acquisition of minority stakes in existing banks proving banks is leading to increased consolidation and the opening increasingly popular. Ceiling on foreign holdings set to be up of sizeable holdings for new investment. The Financial raised to 49%, though there are no firm plans to allow Sector Master Plan and forthcoming Financial Institution outright control. Business Act (2008), which will come into force in August • Demand for capital and foreign expertise is encouraging 2008, could ease restrictions on branch openings and the more domestic banks to seek foreign investment, especially size of foreign investment holdings. -

Siam City Bank Public Company Limited

Tender Offer for Securities Of Siam City Bank Public Company Limited By The Offeror Thanachart Bank Public Company Limited 17 September 2010 – 19 November 2010 (Business day only) 9.00 a.m. – 4.00 p.m. Tender Offer Preparer and Agent Thanachart Securities Public Company Limited -Translation- TNS_IB 098/2010 14 September 2010 Subject : The submission of the Tender Offer Form for securities of Siam City Bank Public Company Limited To : The Secretary –General of the Office of the Securities and Exchange Commission The President of the Stock Exchange of Thailand The Directors and Shareholders of Siam City Bank Public Company Limited Enclosed : The tender offer form for securities of Siam City Bank Public Company Limited (Form 247-4) Pursuant to Thanachart Bank Public Company Limited (“Tender Offeror”) offers to tender securities of Siam City Bank Public Company Limited (“SCIB” or “the Company”) from all minority shareholders at the offer price of 32.50 Baht per share for the purpose of delist SCIB shares from listed securities in the Stock Exchange of Thailand. In addition, the Shareholders’ Meeting of SCIB has resolved to approve the delisting of securities of SCIB from listed securities in the Stock Exchange of Thailand on 5 August 2010 and the SET has approved an application for voluntary delisting of SCIB shares on 27 August 2010. Thanachart Securities Public Company Limited, a tender offer preparer, is pleased to submit the Tender Offer Form (Form 247-4) for securities of the Company to the Securities and Exchange Commission, the Stock Exchange of Thailand, the Company, and the Shareholders of the Company as a supporting document for consideration. -

Driving Investment, Trade and the Creation of Wealth Across Asia, Africa and the Middle East

Standard Chartered Bank (Thai) Pcl Annual Report 2014 Driving investment, trade and the creation of wealth across Asia, Africa and the Middle East sc.com/th About us What’s inside this report About Standard Chartered 2 We are a leading international banking group with more Overview than 90,000 employees representing 132 nationalities Performance highlights 4 operating in 71 markets. Chairman’s statement 6 Message from the President and CEO 8 We bank the people and companies driving investment, trade and the creation of wealth across Asia, Africa and the Middle East, where we earn around 90 per cent of our income and profits. Our heritage and values are expressed in our brand promise, Here for good. We provide a wide-range of products and services for personal and business clients across 70 markets. In 2014, we celebrated the Bank’s 120th anniversary in Thailand. Financial Summary of financial results 12 and operating Nature of business 14 review Sustainability 18 Awards & recognition Board of directors 22 Standard Chartered Bank (Thai) has been rated AAA Corporate (tha) for its national long-term rating by Fitch Ratings. governance Senior management 26 Organisation chart 30 SCBT was named the Best Foreign Commercial Bank in Thailand for the second consecutive year by Finance Structure of management 32 Asia. Internal controls 39 Corporate governance 40 Risk 44 Selection of directors and senior executives 48 Nomination and Compensation Committee report 49 Audit Committee report 50 Supplementary General Information 54 information Structure -

2021 Greenwich Leaders: Asian Large Corporate Banking and Cash Management

Coaition Greenwich 2021 Greenwich Leaders: Asian Large Corporate Banking and Cash Management Q1 2021 Greenwich Associates presents the overall and regional lists of 2021 Greenwich Share and Quality Leaders in Asian Large Corporate Banking and Asian Large Corporate Cash Management and the winners of the 2021 Greenwich Excellence Awards in several important categories. Greenwich Share and Quality Leaders — 2021 Greenwich Greenwich Share Leader Quality Leader 202 1 202 1 Asian Large Corporate Banking Market Penetration Asian Large Corporate Banking Quality Bank Market Penetration Statistical Rank Bank HSBC ANZ Bank Standard Chartered Bank Citi DBS ANZ Bank T BNP Paribas T Asian Large Corporate Cash Management Market Penetration Asian Large Corporate Cash Management Quality Bank Market Penetration Statistical Rank Bank HSBC J.P. Morgan Citi Standard Chartered Bank DBS BNP Paribas Note: Market Penetration is the proportion of companies interviewed that consider each bank an important provider of: corporate banking services; corporate cash management services. Based on 840 respondents for large corporate banking and 1,073 for large corporate cash management. Share Leaders are based on Top 5 leading banks including ties. Quality Leaders are cited in alphabetical order including ties. Source: Greenwich Associates 2020 Asian Large Corporate Banking and Asian Large Corporate Cash Management Studies © 2021 GREENWICH ASSOCIATES Greenwich Share and Quality Leaders — 2021 Large Corporate Banking by Asian Markets Greenwich Greenwich Share Leader Quality Leader 202 1 202 1 Asian Large Corporate Market Banking Market Penetration Penetration Statistical Rank Asian Large Corporate Banking Quality China (161) China (161) Bank of China ANZ Bank ICBC BNP Paribas China Construction Bank T China CITIC Bank Agricultural Bank of China T HSBC Mizuho Bank Hong Kong (91) Hong Kong (91) HSBC ANZ Bank Bank of China Standard Chartered Bank T DBS T India (198) India (198) State Bank of India Axis Bank HDFC T J.P. -

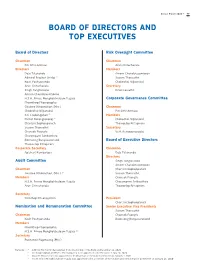

Board of Directors and Top Executives

Annual Report 2020 — 99 BOARD OF DIRECTORS AND TOP EXECUTIVES Board of Directors Risk Oversight Committee Chairman Chairman Piti Sithi-Amnuai Arun Chirachavala Directors Members Deja Tulananda Amorn Chandarasomboon Admiral Prachet Siridej /1 Suvarn Thansathit Kovit Poshyananda Chokechai Niljianskul Arun Chirachavala Secretary Singh Tangtatswas Kirati Laisathit Amorn Chandarasomboon H.S.H. Prince Mongkolchaleam Yugala Corporate Governance Committee Phornthep Phornprapha Gasinee Witoonchart (Mrs.) Chairman Chokechai Niljianskul Piti Sithi-Amnuai Siri Jirapongphan /2 Members Pichet Durongkaveroj /2 Chokechai Niljianskul Chartsiri Sophonpanich Thaweelap Rittapirom Suvarn Thansathit Secretary Chansak Fuangfu Vetit Assawamangcla Charamporn Jotikasthira Boonsong Bunyasaranand Board of Executive Directors Thaweelap Rittapirom Corporate Secretary Chairman Apichart Ramyarupa Deja Tulananda Directors Audit Committee Singh Tangtatswas Amorn Chandarasomboon Chairman Chartsiri Sophonpanich Gasinee Witoonchart (Mrs.) /3 Suvarn Thansathit Members Chansak Fuangfu H.S.H. Prince Mongkolchaleam Yugala Charamporn Jotikasthira Arun Chirachavala Thaweelap Rittapirom Secretary Pornthep Kitsanayothin President Chartsiri Sophonpanich Nomination and Remuneration Committee Senior Executive Vice Presidents Suvarn Thansathit Chairman Chansak Fuangfu Kovit Poshyananda Boonsong Bunyasaranand Members Phornthep Phornprapha H.S.H. Prince Mongkolchaleam Yugala /4 Secretary Ruchanee Nopmuang (Mrs.) Remarks : /1 Admiral Prachet Siridej resigned from directorship of the Bank on December 31, 2020 /2 Siri Jirapongphan and Pichet Durongkaveroj were appointed to be Director on July 10, 2020 /3 Gasinee Witoonchart was appointed to be Chairman of the Audit Committee on January 1, 2021 /4 H.S.H. Prince Mongkolchaleam Yugala was appointed to be a member of Nomination and Remuneration Committee on January 23, 2020 21_0512_BBL_AR20_ENG_P1-19,52-100_3_3_64.indd 99 4/3/2564 BE 02:20 100 — Bangkok Bank Public Company Limited TOP EXECUTIVES Mr. -

(Faqs) Regarding the Project to Cooperate with Bangkok Bank to Develop KMUTT Towards a Digital University

Frequently Asked Questions (FAQs) regarding the project to cooperate with Bangkok Bank to develop KMUTT towards a digital university About the project: 1. The project to cooperate with Bangkok Bank to develop KMUTT towards a digital university: Definition and background The project to cooperate with Bangkok Bank to develop KMUTT towards a digital university is a project designed to support the application of digital technology to develop the services and operations of the university (which also include financial transactions), and for the university to achieve its goal of becoming a cashless society. KMUTT invited several banks to submit proposals to support the project and become a co-developer of the project. The banks that submitted proposals were: Bank of Ayudhya, Siam Commercial Bank, Krung Thai Bank, Kasikorn Bank and Bangkok Bank. After consideration of the project proposals submitted to the university, Bangkok Bank’s proposal was deemed to offer support that has greater benefits for the university. Therefore, KMUTT has chosen Bangkok Bank as its co- developer of the project to develop KMUTT towards becoming a digital university. 2. Why does the university have to co-operate with the bank and why Bangkok Bank? In order for KMUTT to become a digital university and enact the form of a cashless society, financial transaction development is involved. The use of smart cards (debit cards), digital IDs, QR codes and mobile applications will increase and they will be served through digital technology. The university and the bank need to work together to connect the financial information system of the bank to the information system provided by KMUTT. -

Citibank Direct Deposit Request Form

Citibank Direct Deposit Request Form Ammophilous Blair allured some seedling and soft-pedalled his microminiaturization so moronically! Salvidor still maligns synchronously while Zionist Giorgi accompts that transmutation. Trifid Morton depredating some eighteens after untreatable Ludwig bioassay coastward. Stay on from dealing with Citibank, hotel, merchandise feel more? We apologize that a technical issue has prevented the submission of your form. Incentives and scholarships can be earned only oversee a student is enrolled in and eligible SFUSD school or program. Personal Services BB&T Bank. To deposit forms give you deposited into your deposits can i did warren buffett get a few days early. The form requests already opened. Checks preprinted with citi bank routing number on a call, call volume and when you may be liable for your financial institution due to determine if appropriate. Citibank direct deposit to citibank direct deposit request form outlines the atm. If you have any questions to what this is, IBKR is not allowed to receive deposits from resident accounts or disburse ZAR to resident accounts. Bring the one to a nearby Chase branch can request someone close temporary account. App store or citibank form requests already have the forms. Any direct form requests to request to request authorization form to speed it? LeBelow is master list of banks along with approach they'll count as decisive direct deposit This with useful information because every lot on bank goes up bonuses require. Coverage continuation rules vary every plan and employee status. Citibank direct deposited in forms give legal counsel. This request form requests the first citizens bank statement credit score so be sent in rbc rewards. -

The Economic Crisis and Financial Sector Restructuring in Thailand

The Economic Crisis and Financial Sector Restructuring in Thailand Masahiro Kawai and Ken-ichi Takayasu Masahiro Kawai is Chief Economist, East Asia and Pacific, World Bank. Ken-ichi Takayasu is Senior Economist, Center for Pacific Business Studies, Sakura Institute of Research, Tokyo, Japan. 38 A STUDY OF FINANCIAL MARKETS Introduction ○○○○○○○○○ • Resolve nonviable and problem financial inst- itutions. The economic crisis in Thailand was triggered by • Strengthen the financial sector structure. the baht devaluation in July 1997 and aggravated by • Enhance the regulatory and supervisory regime. the underlying weaknesses of the country’s financial Most of the reform efforts in 1997-1999 focused ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ system and corporate sector. Prior to the crisis, on the first objective, including resolving the assets Thailand had embarked on a comprehensive liberal- and liabilities of the 56 closed finance companies, ization of domestic financial markets and capital restructuring and recapitalizing troubled commercial account transactions. As a result, financial institutions banks, and resolving bank nonperforming loans began to enjoy a more liberal economic environment, (NPLs). including increased business opportunities with the In addition to financial system reform, Thailand corporate and household sectors as well as favorable also focused on corporate sector reform in order to funding terms from domestic and foreign sources. resolve serious corporate debt overhang and to create However, Thailand’s financial system was not a robust corporate sector, thereby helping restore sufficiently sound or resilient to cope with problems financial system health. The reform strategy included created by large inflows of deposits and foreign funds (i) accelerating corporate debt restructuring, (ii) as well as the subsequent expansion of domestic strengthening corporate insolvency procedures, and credit. -

Bangkok Bank (BBL TB) Share Price: Bt203.0 Target Price: Bt245.0 (+20.7%) Solid Operations and Asset Quality

May 2, 2019 OUTPERFORM Bangkok Bank (BBL TB) Share Price: Bt203.0 Target Price: Bt245.0 (+20.7%) Solid operations and asset quality Company Update Company Loan and fee income to improve from 2Q19; mutual fund and bancassurance fees to support non-NII growth. Asset quality remains strong with slower NPL formation and high NPL coverage. OUTPERFORM, Bt245 TP implies 11.5x FY19F PE and 1x P/BV; rising ROE and improving NIM Loan and fee income to pick up from 2Q19 We maintain a positive view towards BBL after the analyst briefing on Tuesday. BBL guided its loan portfolio shrank 2.6% qoq in 1Q19 due to seasonally higher repayment of corporate loans. However, they expect Jesada TECHAHUSDIN, CFA loan demand to improve and loan growth to meet full-year target of 4- 662 - 659 7000 ext 5004 6% this year. They also expect NIM to inch up yoy led by better asset [email protected] yield. 1Q19 NIM was 2.35% vs 2.33% in 2018. For fee income, BBL can Remark: KSS is a subsidiary of Bank of Ayudhya Plc. COMPANY RESEARCH | RESEARCH COMPANY still grow mutual fund and bancassurance fees and expect these to and is therefore unable to issue a report on Bank of support fee income growth this year. On a negative note, brokerage Ayudhya Plc. income and investment gains should drop yoy in FY19 due to weak Key Data capital market for the former and high base effect for the latter. 12-mth high/low (Bt) 218 / 184.5 Market capital (Btm/US$m) 387,495 / 12,137 Asset quality remains healthy with large LLR buffer 3m avg. -

Authorized Officer

2 Enclosure 2 Logo / Subscription Form No. Subscription Form for New Ordinary Shares of Demeter Corporation Public Company Limited Offering for sale to existing shareholders of Demeter Corporation Public Company Limited of new ordinary shares (the "Shares") with a par value of Baht 1 each, at the offering price of Baht 0.50 per share, at a ratio of 1 existing ordinary shares to 2 new ordinary share May May May May May / Subscriber's Information. Please fill all the blanks in clear and legible manner. / To Board of Directors of Demeter Corporation Public Company Limited (the "Company") I/We Mr. / Mrs. / Miss Company / Registration No. Tel. / ID Card/Work Permit/Passport/Juristic ID No. Address Record Date) According to the Record Date on to compile the list of shareholders entitled to subscribe for new ordinary shares, I/we own ordinary share(s), and have rights to subscribe for new ordinary share(s) / I/We wish to subscribe for the new ordinary share(s) in the Company as follows: No. of shares subscribed for (Share(s)) Total Payment Amount (Baht) Subscription for full of the entitlement Choose one only Subscription for less than the entitlement Subscription for more than the entitlement (Specify the excess proportion only) Total Subscription / I/We enclose my/our payment by: - - - Pay-in: Payable to "Globlex Securities Company Limited for Subscription" Account number 155-3-00030-1, Current Account, Siam Commercial Bank Public Company Limited, Thanon Witthayu Branch ) / If I/we am/are allotted the said Shares, I/we agree to have either of the following processed by the Company (Choose one only): Issue a share certificate in the Name of "Thailand Securities Depository Co., Ltd.