2021 Plan Year Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

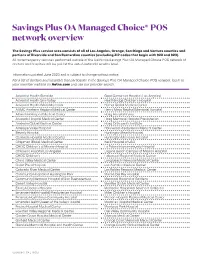

Savings Plus OA Managed Choice® POS Network Overview

Savings Plus OA Managed Choice® POS network overview The Savings Plus service area consists of all of Los Angeles, Orange, San Diego and Ventura counties and portions of Riverside and San Bernardino counties (excluding ZIP codes that begin with 922 and 923). All nonemergency services performed outside of the California Savings Plus OA Managed Choice POS network of doctors and hospitals will be paid at the out-of-network benefits level. Information updated June 2020 and is subject to change without notice. For a list of doctors and hospitals that participate in the Savings Plus OA Managed Choice POS network, log in to your member website on Aetna.com and use our provider search. Adventist Health Glendale Good Samaritan Hospital (Los Angeles) Adventist Health Simi Valley Healthbridge Children’s Hospital Adventist Health White Memorial Hemet Global Medical Center AHMC Anaheim Regional Medical Center Henry Mayo Newhall Memorial Hospital Alhambra Hospital Medical Center Hoag Hospital Irvine Alvarado Hospital Medical Center Hoag Memorial Hospital Presbyterian Anaheim Global Medical Center Hoag Orthopedic Institute Antelope Valley Hospital Hollywood Presbyterian Medical Center Beverly Hospital Huntington Beach Hospital Centinela Hospital Medical Center Huntington Memorial Hospital Chapman Global Medical Center Keck Hospital of USC CHOC Children’s at Mission Hospital La Palma Intercommunity Hospital Children’s Hospital Los Angeles Laguna Beach Campus of Mission Hospital CHOC Children’s Lakewood Regional Medical Center Chino Valley Medical Center -

Californiachoice® Small Group Advantage PPO Three-Tier Hospital Network

CaliforniaChoice® Small Group Advantage PPO three-tier hospital network With the CaliforniaChoice Advantage PPO plans, you have a choice of tiers (or levels) of hospitals to visit. Tier one hospitals offer the greatest savings to you. Tier two hospitals have the second best level of savings. Tier three hospitals — or out-of-network hospitals — offer the least out-of-pocket savings, but you’ll still be covered. Keep in mind that the tier levels aren’t based on the quality of care given at each hospital. They’re based on which hospitals have shown they’re better able to give quality care that’s also cost effective. Our three-tier levels* are: }}Tier 1 — PPO network hospitals with lower-negotiated hospital reimbursement rates. }}Tier 2 — the remaining PPO network hospitals. }}Tier 3 — non-network hospitals. * The tier levels are not based on the quality of care given at each hospital. Instead, each level stands for the hospitals that show 19685CABENABC 08/15 the best use of health care dollars. CaliforniaChoice® Small Group Advantage PPO three-tier hospital network Here is a list of the Tier-1 and Tier-2 hospitals included in the network. Any hospital not listed is considered out of network. Hospital County Tier St Rose Hospital Alameda 1 Alameda Hospital Alameda 1 Children’s Hospital Oakland Alameda 2 Valleycare Medical Center Alameda 2 Washington Hospital Alameda 2 Sutter Amador Health Center Pioneer 1 Sutter Amador Health Center Plymouth 1 Sutter Amador Hospital Amador 1 Oroville Hospital & Medical Center Butte 1 Feather River Hospital -

Access+ HMO 2021Network

Access+ HMO 2021Network Our Access+ HMO plan provides both comprehensive coverage and access to a high-quality network of more than 10,000 primary care physicians (PCPs), 270 hospitals, and 34,000 specialists. You have zero or low copayments for most covered services, plus no deductible for hospitalization or preventive care and virtually no claims forms. Participating Physician Groups Hospitals Butte County Butte County BSC Admin Enloe Medical Center Cohasset Glenn County BSC Admin Enloe Medical Center Esplanade Enloe Rehabilitation Center Orchard Hospital Oroville Hospital Colusa County Butte County BSC Admin Colusa Medical Center El Dorado County Hill Physicians Sacramento CalPERS Mercy General Hospital Mercy Medical Group CalPERS Methodist Hospital of Sacramento Mercy Hospital of Folsom Mercy San Juan Medical Center Fresno County Central Valley Medical Medical Providers Inc. Adventist Medical Center Reedley Sante Community Physicians Inc. Sante Health Systems Clovis Community Hospital Fresno Community Hospital Fresno Heart and Surgical Hospital A Community RMCC Fresno Surgical Hospital San Joaquin Valley Rehabilitation Hospital Selma Community Hospital St. Agnes Medical Center Glenn County Butte County BSC Admin Glenn Medical Center Glenn County BSC Admin Humboldt County Humboldt Del Norte IPA Mad River Community Hospital Redwood Memorial Hospital St. Joseph Hospital - Eureka Imperial County Imperial County Physicians Medical Group El Centro Regional Medical Center Pioneers Memorial Hospital Kern County Bakersfield Family Medical -

Systemwide Emergency Management Status Report

Systemwide Emergency Management Status Report UC Systemwide Emergency Management Status Report i Table of Contents Introduction ...................................................................................................................................................... 1 Systemwide Summary of Conformity with NFPA Emergency Management Standard Criteria ... 2 ERMIS Emergency Management Key Performance Indicator (KPI) ..................................................... 7 Individual Program Executive Summaries ................................................................................................. 8 Berkeley ........................................................................................................................................................ 8 Lawrence Berkeley National Laboratory ............................................................................................... 9 Davis ............................................................................................................................................................10 Davis Health System ................................................................................................................................11 Irvine ............................................................................................................................................................12 Irvine Health System ...............................................................................................................................13 Los -

Medi-Cal Managed Health Care Options in San Diego County

Medi-Cal Managed Health Care Your Medi-Cal Managed Care Health Plan Choices Options in San Diego County This material is being provided to help you better understand your choices. It is not an endorsement of any specific Medi-Cal Health Plan. Standard Medi-Cal Covered Services Welcome to Medi-Cal Managed Care Benefits Alvarado Hospital & Medical Center Scripps Mercy Hospital Chula Your Medi-Cal benefits can now be provided by a Medi-Cal Managed Care Health Plan. A Palomar Medical Center Vista Managed Care Health Plan gives you access to a network of doctors, clinics, specialists, Plan Network Paradise Valley Hospital Sharp Chula Vista Medical Center pharmacies and hospitals. Hospitals* Pomerado Hospital Sharp Coronado Hospital How Does Managed Care Work? Rady Children’s Hospital San Diego Sharp Grossmont Hospital Each Medi-Cal Managed Care Health Plan has a list of primary care providers you can choose *Call your Scripps Green Hospital Sharp Mary Birch Hospital for from. If you have a doctor now, you will need to find out if that doctor belongs to a Medi-Cal provider about Scripps Memorial Hospital Women & Newborns Managed Care Health Plan. Your primary care provider will be responsible for managing your using other Encinitas Sharp Memorial Hospital overall health care and referring you to other doctors if needed. locations in an Scripps Memorial Hospital La Jolla Sharp Mesa Vista Hospital Who Can Join a Medi-Cal Managed Care Health Plan? emergency. Scripps Mercy Hospital San Diego Tri-City Medical Center Anyone who is on Medi-Cal, lives in San Diego County, and has a qualifying aid code may UCSD Medical Center – Hillcrest choose a Medi-Cal Managed Care Health Plan. -

San Diego House Staff Association: Proposals 2018-2021

San Diego House Staff Association: Proposals 2018-2021 Page | 0 TABLE OF CONTENTS Contents INTRODUCTION / BACKGROUND ................................................................................................................. 1 A. 2018 Negotiating Committee ........................................................................................................... 1 B. Procedure ......................................................................................................................................... 1 C. Definitions ........................................................................................................................................ 1 D. Overview / Background ................................................................................................................... 1 E. The Cost of Living & The Dilemma for House Staff ......................................................................... 4 PROPOSALS ................................................................................................................................................... 6 FELLOWS ....................................................................................................................................................... 6 A. Background ....................................................................................................................................... 6 B. The Fellows’ Representatives ......................................................................................................... -

VASDHS Psychology Internship Brochure

2021-22 UCSD/VA PSYCHOLOGY INTERNSHIP TRAINING PROGRAM Department of Psychiatry University of California, San Diego VA San Diego Healthcare System Co-Directors Sandra Brown, Ph.D., ABPP Amy Jak, Ph.D. Applicant Manual Last updated September 2020 Dear Prospective Applicant, Thank you for your interest in the UCSD/VA Psychology Internship Training Program. In the following pages, you will find detailed information about our internship, including clinical training, didactic experiences, research opportunities, our faculty, and application instructions. Our program is based on the scientist-practitioner model. As such, we seek competitive applicants interested and experienced in both research and clinical practice, particularly those interested in academic careers. Clinical training and didactic experiences integrate cutting-edge evidence-based techniques with a foundation of established empirically-supported treatments and assessment. We also recognize the importance of diversity represented by our trainees and faculty, as well as in our patients. We encourage those of diverse backgrounds, in all the many ways that diversity is defined, to apply to our program. Our full-time internship has been accredited by APA since 1986 (Further information about accreditation of this program can be found at: Office of Program Consultation and Accreditation, American Psychological Association, 750 First Street, N.E., Washington, DC 20002-4242, Phone: (202) 336-5979, Fax: (202) 336-5978, Email: [email protected], Web: www.apa.org/ed/accreditation). For the 2021-2022 year, interns will earn an annual stipend of $29,212. Our competitive benefits, both for UCSD and for the VA, include health insurance, paid leave days, and paid holidays. The COVID-19 pandemic has led our faculty to implement multiple changes in our training program. -

Sharp Value Provider Network Overview

Sharp Value Provider Network Overview Physicians • Hospitals • Urgent Care Centers • Pharmacies • Other Facilities Effective January 1, 2018 Sharp Value Provider Network Medical Groups At Sharp Health Plan, we understand the importance of selecting a network that fits your lifestyle and budget. As a member, you’ll join a family of award-winning medical groups, physicians and hospitals dedicated to meeting your health care needs. The Sharp Value Provider Network offers access to a core group of physicians and hospitals to provide you with greater value. With Sharp Value, you’ll have access to more than 1,900 physicians, including Primary Care Physicians and specialists. Sharp Rees-Stealy (SRS) This medical group offers a network of more than 470 physicians, including Primary Care Physicians and specialists. Admitting hospitals include Sharp HealthCare facilities and Rady Children’s Hospital. SRS physicians are located throughout San Diego County, including: • Carmel Valley • Frost Street • Mt. Helix • San Carlos • Chula Vista • Genesee • Murphy Canyon • San Diego • Del Mar • La Mesa • Otay Ranch • Scripps Ranch • Downtown San Diego • La Mesa West • Point Loma • Sorrento Mesa • El Cajon • Mira Mesa • Rancho Bernardo Sharp Community Medical Group (SCMG) This medical group offers a network of more than1,090 physicians, including Primary Care Physicians and specialists. Admitting hospitals include Sharp HealthCare facilities, Rady Children’s Hospital and Palomar Health facilities.1 SCMG, SCMG Inland North, SCMG Graybill and SCMG Arch Health -

Table 3: 1960 - 2017 Historic Hospital List by CODE

Table 3: 1960 - 2017 Historic Hospital List by CODE County Code Hospital Name Address City Zip 1 001 ALAMEDA HOSPITAL 2070 CLINTON AVE ALAMEDA 94501 1 002 ALTA BATES HOSPITAL AT ALBANY 1247 MARIN AVENUE ALBANY 94706 1 003 ALTA BATES MEDICAL CENTER 2450 ASHBY AVENUE BERKELEY 94705 1 004 BOOTH MEMORIAL HOSPITAL 2794 GARDEN STREET OAKLAND 94701 1 005 CHILDREN'S HOSPITAL 51ST & GROVE STREETS OAKLAND 94609 1 006 CIVIC CENTER HOSPITAL FOUNDATION 390 40TH STREET OAKLAND 94609 1 007 SAN LEANDRO HOSPITAL 13855 E 14TH STREET SAN LEANDRO 94578 1 008 EDEN MEDICAL CENTER 20103 LAKE CHABOT RD CASTRO VALLEY 94546 1 009 ESKATON DOCTORS HOSPITAL OAKLAND 4600 E FAIRFAX AVENUE OAKLAND 94601 1 010 FAIRMONT HOSPITAL 15400 FOOTHILL BOULEVARD SAN LEANDRO 94578 1 011 HAYWARD HOSPITAL 770 'A' STREET HAYWARD 94541 1 012 HERRICK MEMORIAL HOSPITAL 2001 DWIGHT WAY BERKELEY 94704 1 013 ACMC-HIGHLAND CAMPUS 1411 E. 31ST ST OAKLAND 94602 1 014 KAISER HOSPITAL: SAN LEANDRO 2500 MERCED STREET SAN LEANDRO 94577 1 015 KAISER HOSPITAL: OAKLAND 275 W. MACARTHUR BLVD OAKLAND 94611 1 016 SUMMIT MEDICAL CENTER - HAWTHORNE 350 HAWTHORNE AVENUE OAKLAND 94609 1 017 NAVAL HOSPITAL: OAKLAND 8750 MOUNTAIN BOULEVARD OAKLAND 94627 1 018 OAKLAND HOSPITAL CORPORATION 2648 EAST 14TH STREET OAKLAND 94601 1 019 OGORMAN INFANT 2587 - 35TH AVENUE OAKLAND 94601 1 020 PERALTA HOSPITAL 450 - 30TH STREET OAKLAND 94609 1 021 SUMMIT MEDICAL CENTER 3100 SUMMIT STREET OAKLAND 94623 1 022 ST. ROSE HOSPITAL 27200 CALAROGA AVE HAYWARD 94540 1 023 ST. PAUL'S HOSPITAL 813 J STREET LIVERMORE 94550 1 024 VALLEYCARE MEDICAL CENTER 5555 W. -

National Trauma Data Bank Report 2006 Version 6.0 American College of Surgeons National Trauma Data Bank® 2006, Version 6.0

National Trauma Data Bank Report 2006 Version 6.0 American College of Surgeons National Trauma Data Bank® 2006, Version 6.0 Acknowledgments The American College of Surgeons Committee on Trauma wishes to thank the Health Resources and Services Administration (HRSA), the National Highway Traffic Safety Administration (NHTSA), and the Centers for Disease Control and Prevention (CDC) for their support of the NTDB. © American College of Surgeons 2006. All Rights Reserved Worldwide. American College of Surgeons National Trauma Data Bank® 2006, Version 6.0 NTDB Annual Report 2006 Editors David E. Clark, MD, FACS, Chair Richard Fantus, MD, FACS, Chair National Trauma Data Bank Subcommittee Trauma Registry Advisory Committee American College of Surgeons Committee on Trauma Leadership John J. Fildes, MD, FACS J. Wayne Meredith, MD, FACS Chair, Committee on Trauma Medical Director, Trauma Programs Division of Research and Optimal Patient Care National Trauma Data Bank Subcommittee Palmer Q. Bessey, MD, FACS Karen Brasel, MD, FACS David E. Clark, MD, FACS Arthur Cooper, MD, FACS Richard J. Fantus, MD, FACS Jeffrey S. Hammond, MD, FACS Michael D. McGonigal, MD, FACS Sidney F. Miller, MD, FACS Frederick H. Millham, MD, FACS Charles Morrow, MD, FACS Avery B. Nathens, MD, FACS Arthur L. Ney, MD, FACS Ronald D. Robertson, MD, FACS Glen H. Tinkoff, MD, FACS American College of Surgeons Staff Melanie Neal, NTDB Manager Brian Kamajian, Programmer Analyst Ishtiaq Pavel, Programmer Analyst Bart Phillips, Research Methodologist Howard Tanzman, Information Technology -

USA Customers

USA Customers ▪ Acadia General Hospital - Crowley, LA ▪ Advocate BroMenn Healthcare Hospitals - Normal, IL ▪ Advocate Christ Medical Center - Oak Lawn, IL ▪ Advocate Condell Medical Center - Libertyville, IL ▪ Advocate Good Samaritan Hospital - Downer’s Grove, IL ▪ Advocate Good Shepherd Hospital - Barrington, IL ▪ Advocate Illinois Masonic Medical Center - Chicago, IL ▪ Advocate Lutheran General Hospital - Park Ridge, IL ▪ Advocate Sherman Hospital - Elgin, IL ▪ Advocate South Suburban Hospital - Hazel Crest, IL ▪ Advocate Trinity Hospital - Chicago, IL ▪ Akron Children's Hospital - Akron, OH ▪ Alamance Regional Medical Center - Burlington, NC ▪ Alameda County Medical Center - Oakland, CA ▪ Alaska Native Medical Center - Anchorage, AK ▪ Albany Medical Center Hospital - Albany, NY ▪ Albany Stratton VA Medical Center - Albany, NY ▪ Allina, Abbott Northwestern Hospital - Plymouth, MN ▪ Allina, Buffalo Hospital - Buffalo, MN ▪ Allina, Cambridge Medical Center - Cambridge, MN ▪ Allina, District One Hospital - Faribault, MN ▪ Allina, Mercy Hospital - Coon Rapids, MN ▪ Allina, Owatonna Hospital - Owatonna, MN ▪ Allina, Philips Eye Institute - Minneapolis, MN ▪ Allina, Regina Medical Center - Hastings, MN ▪ Allina, River Falls Area Hospital - River Falls, MN ▪ Allina, St. Francis Regional Medical Center - Shakopee, MN ▪ Allina, United Hospital - St. Paul, MN ▪ Allina, Unity Hospital - Fridley, MN ▪ Annie Penn Hospital - Reidsville, NC ▪ Apollo Care, LLC - Columbia, MO ▪ Appleton Medical Center - Appleton, WI ▪ Ashland Hospital Corp Kings Daughter -

University of California, San Diego Annual Financial Report 2009–10

UNIVERSITY OF CALIFORNIA, SAN DIEGO ANNUAL FINANCIAL REPORT 2009–10 UNIVERSITY OF CALIFORNIA, SAN DIEGO ANNUAL FINANCIAL REPORT 2009–10 1 Chancellor Fox Awarded the NATIONAL MEDAL OF SCIENCE UC SAN DIEGO CHANCELLOR MARYE ANNE FOX received the National Medal of Science in 2010, the highest honor bestowed by the United States government on scientists, engineers, and inventors. A nationally recognized organic chemist and academic leader, Fox has been elected to membership in the National Academy of Sciences and the American Philosophical Society, and to fellowships in the American Academy of Arts and Sciences and the American Association for the Advance- ment of Science. She has also received honorary degrees from twelve U.S. institutions. Her research has focused on fundamental principles that were later translated into practical use in solar energy conversion, environmental remediation, and materials science. Fox is the most recent member of the UC San Diego community to receive this prestigious award. Previous living National Medal of Science recipients from UC San Diego are E. Margaret Burbidge, astrophysics (1983); Walter Munk, geophysics (1983); Michael H. Freedman, mathematics (1987); Yuan-Cheng Fung, bioen- gineering (2000); Andrew Viterbi, electrical and computer engineering (2008); and Craig Venter, pharmacology (2009). Clockwise from top: Chancellor Marye Anne Fox; Fox receives the medal from President Barack Obama at the White House, November 17, 2010; an inspirational note Fox wrote as a young girl “I always thought I would be a scientist. Once you’ve understood something that didn’t exist before, it’s almost like you have to figure out what the answer to the next question is, and generate the next question after that.