Is Lilly in Need of a Transformational Deal?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fully Human Domain Antibody Therapeutics: the Best of Both Worlds

Drug Discovery Fully Human Domain Antibody Therapeutics: The Best of Both Worlds By combining the therapeutic benefits of small molecule drugs with those of fully human antibodies, Domain Antibodies are expected to have strong therapeutic and commercial potential. By Robert Connelly at Domantis Robert Connelly is Chief Executive Officer of Domantis. He has over 22 years’ commercial experience of the life science sector, including that gained in the fields of diagnostics, drug discovery technologies and antibody therapeutics. Prior to joining Domantis, he was CEO of Veritas Pharmaceuticals (Los Angeles, USA), an in vivo imaging start-up company. He spent over five years with IGEN International, latterly as Senior Vice President and General Manager, Life Sciences, where he took part in the company’s IPO and financing rounds, raising $130 million. The first 11 years of his career were spent at Abbott Laboratories in sales, marketing and management positions. Domain Antibodies (dAbs) are the smallest functional variable regions of either the heavy (VH) or light (VL) binding units of antibodies. At Domantis, we are chains of human antibodies. Domantis scientists applying our proprietary know-how in dAbs to deliver have used the variable domains sequences of human human therapies that address large, unmet medical antibodies to create a series of large and highly needs in areas such as inflammation, cancer and functional libraries of fully human dAbs, with each autoimmune diseases. Three and a half years after library comprising at least 1010 different dAbs. The opening our laboratories, we have a dozen proprietary dAbs selected from these libraries are both specific therapeutic programmes underway, and an additional for their biological target and are well folded and eight therapeutic programmes with partners. -

Lilly to Acquire Imclone Systems in $6.5 Billion Transaction

Lilly to Acquire ImClone Systems in $6.5 Billion Transaction Creates a Global Leader in Oncology Biopharmaceuticals Boosts Oncology Pipeline With Up to Three Promising Targeted Therapies in Phase III in 2009 INDIANAPOLIS and NEW YORK, Oct 06, 2008 /PRNewswire-FirstCall via COMTEX News Network/ -- Eli Lilly and Company (NYSE: LLY) and ImClone Systems Inc. (Nasdaq: IMCL) today announced that the boards of directors of both companies have approved a definitive merger agreement under which Lilly will acquire ImClone through an all cash tender offer of $70.00 per share, or approximately $6.5 billion. The offer represents a premium of 51 percent to ImClone's closing stock price on July 30, 2008, the day before an acquisition offer for ImClone was made public. ImClone's board recommends that ImClone's shareholders tender their shares in the tender offer. Additionally, certain entities associated with ImClone's chairman, Carl C. Icahn, holding approximately 14 percent of ImClone's outstanding common stock, have agreed to tender their shares in the tender offer. This strategic combination will create one of the leading oncology franchises in the biopharmaceutical industry, offering both targeted therapies and oncolytic agents along with a pipeline spanning all phases of clinical development. The combined oncology portfolio will target a broader array of solid tumor types including lung, breast, ovarian, colorectal, head and neck, and pancreatic, positioning Lilly to pursue treatments of multiple cancers. Combining with ImClone will further strengthen Lilly's growing portfolio of first-in-class and best-in-class pharmaceutical products, enabling Lilly to better support oncologists, with the ultimate goal of delivering better outcomes for cancer patients. -

11/09/2016 Provider Subsystem Healthcare and Family Services Run Time: 20:25:21 Report Id 2794D051 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 11/09/2016 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 20:25:21 REPORT ID 2794D051 PAGE: 01 NUMERIC COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 01/01/2017 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 00002 ELI LILLY AND COMPANY 00145 STIEFEL LABORATORIES, INC, 00003 E.R. SQUIBB & SONS, LLC. 00149 WARNER CHILCOTT PHARMACEUTICALS INC. 00004 HOFFMANN-LA ROCHE 00168 E FOUGERA AND CO. 00006 MERCK & CO., INC. 00169 NOVO NORDISK, INC. 00007 GLAXOSMITHKLINE 00172 IVAX PHARMACEUTICALS, INC. 00008 WYETH LABORATORIES 00173 GLAXOSMITHKLINE 00009 PFIZER, INC 00178 MISSION PHARMACAL COMPANY 00013 PFIZER, INC. 00182 GOLDLINE LABORATORIES, INC. 00015 MEAD JOHNSON AND COMPANY 00185 EON LABS, INC. 00023 ALLERGAN INC 00186 ASTRAZENECA LP 00024 SANOFI-AVENTIS, US LLC 00187 VALEANT PHARMACEUTICALS NORTH AMERICA 00025 PFIZER, INC. 00206 LEDERLE PIPERACILLIN 00026 BAYER HEALTHCARE LLC 00224 KONSYL PHARMACEUTICALS, INC. 00029 GLAXOSMITHKLINE 00225 B. F. ASCHER AND COMPANY, INC. 00032 SOLVAY PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 00037 MEDA PHARMACEUTICALS, INC. 00245 UPSHER-SMITH LABORATORIES, INC. 00039 SANOFI-AVENTIS, US LLC 00258 FOREST LABORATORIES INC 00046 AYERST LABORATORIES 00259 MERZ PHARMACEUTICALS 00049 PFIZER, INC 00264 B. BRAUN MEDICAL INC. 00051 UNIMED PHARMACEUTICALS, INC 00281 SAVAGE LABORATORIES 00052 ORGANON USA INC. 00299 GALDERMA LABORATORIES, L.P. 00053 CSL BEHRING 00300 TAP PHARMACEUTICALS INC 00054 ROXANE LABORATORIES, INC. 00310 ASTRAZENECA LP 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00327 GUARDIAN LABS DIV UNITED-GUARDIAN INC 00062 ORTHO MCNEIL PHARMACEUTICALS 00338 BAXTER HEALTHCARE CORPORATION 00064 HEALTHPOINT, LTD. 00378 MYLAN PHARMACEUTICALS, INC. -

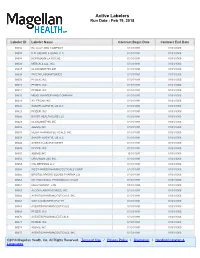

Active Labelers Run Date : Feb 19, 2018

Active Labelers Run Date : Feb 19, 2018 Labeler ID Labeler Name Contract Begin Date Contract End Date 00002 ELI LILLY AND COMPANY 01/01/1991 01/01/3000 00003 E.R. SQUIBB & SONS, LLC. 01/01/1991 01/01/3000 00004 HOFFMANN-LA ROCHE 01/01/1991 01/01/3000 00006 MERCK & CO., INC. 01/01/1991 01/01/3000 00007 GLAXOSMITHKLINE 01/01/1991 01/01/3000 00008 WYETH LABORATORIES 01/01/1991 01/01/3000 00009 PFIZER, INC 01/01/1991 01/01/3000 00013 PFIZER, INC. 01/01/1991 01/01/3000 00014 PFIZER, INC 01/01/1991 01/01/3000 00015 MEAD JOHNSON AND COMPANY 01/01/1991 01/01/3000 00023 ALLERGAN INC 01/01/1991 01/01/3000 00024 SANOFI-AVENTIS, US LLC 01/01/1991 01/01/3000 00025 PFIZER, INC. 01/01/1991 01/01/3000 00026 BAYER HEALTHCARE LLC 01/01/1991 01/01/3000 00029 GLAXOSMITHKLINE 01/01/1991 01/01/3000 00032 ABBVIE INC. 01/01/1991 01/01/3000 00037 MEDA PHARMACEUTICALS, INC. 01/01/1991 01/01/3000 00039 SANOFI-AVENTIS, US LLC 01/01/1991 01/01/3000 00046 AYERST LABORATORIES 01/01/1991 01/01/3000 00049 PFIZER, INC 01/01/1991 01/01/3000 00051 ABBVIE INC 10/01/1997 01/01/3000 00052 ORGANON USA INC. 01/01/1991 01/01/3000 00053 CSL BEHRING LLC 01/01/1991 01/01/3000 00054 WEST-WARD PHARMACEUTICALS CORP. 01/01/1991 01/01/3000 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 01/01/1991 01/01/3000 00062 ORTHO MCNEIL PHARMACEUTICALS 01/01/1991 01/01/3000 00064 HEALTHPOINT, LTD. -

Boot Camp Roster Through July 2015

Participants in our GMP Boot Camps have come from these companies AB Biotechnologies Irisys, Inc. Abbott Vascular IVX Animal Health Acacia Biomedical Pte Ltd. J & J Packaging Actavis Pharmaceuticals Johnson Matthey Adhesives Research Karl Storz Endovision AHC Products, Inc. Kenco Management Services Alcon Labs King Pharmaceuticals Alk-Abello Source Materials Kleen Test Products Allergan, Inc. Kosan Amax Nutrasource KV Pharmaceutical American Red Cross La Jolla Pharmaceuticals Aptalis Pharmaceuticals Label World Artes Medical Labortorios Sophia Astellas Pharma Technologies Leica Microsystems Astra Zeneca Mayo Clinic Atex Technologies, Inc. Medicomp Inc. Auer Precision Co. Merck Avail Medical Metor-Logics Avema Pharma Solutions NBTY B. Braun Medical Nexgen Pharma BASF Nitto Denko Technical Inc. Baxa Corp. Norwich Pharmaceuticals Baxter Healthcare Novartis Animal Health US, Inc. Bayer Nuskin Enterprises Beckman Coulter Nutri-Mack Beiersdorf Inc. NuWorld Beauty Bend Research Oakley Biovail Ohm Laboratories Block Medical Organogenesis Inc. Boston Scientific Pacira Pharmaceuticals Bradley Corp. Palm Beach Pharmaceuticals Bristol-Myers Squibb Par Pharmaceutical Inc. CAMAG Pennakem LLC Carl Zeiss Meditec, Inc. Peter Cremer North America Cepheid Pfizer Church & Dwight Co. Philip Morris USA Cornerstone Research and Development Philliips Medisize GMP Training Systems, Inc. P.O. Box 2585 Orange, CA 92859 714-289-1233 www.GMPTrainingSystems.com Participants in our GMP Boot Camps have come from these companies CR Bard PL Developments Daiichi Sankyo Pharma Development Protab Laboratories Danisco USA Purdue Pharmaceuticals Dial Eisai Qm5 DSI, Inc. Ranbaxy Labs DSM Pharmaceuticals Raptor Pharmaceuticals Earthwise Nutritionals Regeneron Pharmaceuticals Edwards Lifesciences RJ Reynolds Co. Elan Robinson Pharma Co. Endosonics Romark Labs Eurand, Inc. Rosendin Electric Flextronics, Inc. Sanofi aventis FMI Schick, division of Energizer Forest Labs Sensible Organics Foster Corporation Shire Pharmaceuticals Garmon Corp. -

05/09/2016 Provider Subsystem Healthcare and Family Services Run Time: 04:25:50 Report Id 2794D052 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 05/09/2016 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 04:25:50 REPORT ID 2794D052 PAGE: 01 ALPHA COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 07/01/2016 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 68782 (OSI) EYETECH 55513 AMGEN USA 00074 ABBOTT LABORATORIES 58406 AMGEN/IMMUNEX 68817 ABRAXIS BIOSCIENCE, LLC 53746 AMNEAL PHARMACEUTICALS 16729 ACCORD HEALTHCARE INCORPORATED 65162 AMNEAL PHARMACEUTICALS LLC 42192 ACELLA PHARMACEUTICALS, LLC 69238 AMNEAL PHARMACEUTICALS, LLC 10144 ACORDA THERAPEUTICS, INC. 53150 AMNEAL-AGILA, LLC 00472 ACTAVIS 00548 AMPHASTAR PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 69918 AMRING PHARMACEUTICALS, INC. 45963 ACTAVIS INC. 66780 AMYLIN PHARMACEUTICALS, INC. 46987 ACTAVIS KADIAN LLC 55724 ANACOR PHARMACEUTICALS 49687 ACTAVIS KADIAN LLC 10370 ANCHEN PHARMACEUTICALS, INC. 14550 ACTAVIS PHARMA MFGING PRIVATE LIMITED 43595 ANGELINI PHARMA, INC. 61874 ACTAVIS PHARMA, INC. 62559 ANIP ACQUISITION COMPANY 67767 ACTAVIS SOUTH ATLANTIC 54436 ANTARES PHARMA, INC. 66215 ACTELION PHARMACEUTICALS U.S., INC. 52609 APO-PHARMA USA, INC. 52244 ACTIENT PHARMACEUTICALS 60505 APOTEX CORP. 75989 ACTON PHARMACEUTICALS 63323 APP PHARMACEUTICALS, LLC. 69547 ADAPT PHARMA INC. 43485 APRECIA PHARMACEUTICALS COMPANY 76431 AEGERION PHARMACEUTICALS, INC. 42865 APTALIS PHARMA US, INC 50102 AFAXYS, INC. 58914 APTALIS PHARMA US, INC. 10572 AFFORDABLE PHARMACEUTICALS, LLC 13310 AR SCIENTIFIC, INC. 27241 AJANTA PHARMA LIMITED 08221 ARBOR PHARM IRELAND LIMITED 17478 AKORN INC 60631 ARBOR PHARMACEUTICALS IRELAND LIMITED 24090 AKRIMAX PHARMACEUTICALS LLC 24338 ARBOR PHARMACEUTICALS, INC. 68220 ALAVEN PHARMACEUTICAL, LLC 59923 AREVA PHARMACEUTICALS 00065 ALCON LABORATORIES, INC. 76189 ARIAD PHARMACEUTICALS, INC. 00998 ALCON LABORATORIES, INC. 24486 ARISTOS PHARMACEUTICALS, INC. -

March 24, 2009 the Honorable Harry Reid the Honorable Mitch

March 24, 2009 The Honorable Harry Reid The Honorable Mitch McConnell Senate Majority Leader Senate Minority Leader United States Senate United States Senate Capitol Building S-221 Capitol Building S-230 Washington, DC 20510-7020 Washington, DC 20510-7010 Fax: (202) 224-7362 Fax: (202) 224-2574 The Honorable Nancy Pelosi The Honorable John A. Boehner Speaker of the House House Minority Leader United States House of Representatives United States House of Representatives Capitol Building H-232 Capitol Building H-204 Washington, DC 20515-6501 Washington, DC 20515-6537 Fax: (202) 225-4188 Fax: (202) 225-5117 Dear Congressional Leadership: The 200 undersigned companies and trade associations write today to express our strong opposition to provisions in the Administration's budget to increase taxes on U.S. companies that are competing for business in international markets. Together, we provide millions of high-paying American jobs that depend on our ability to compete in the global economy. Ninety-five percent of the world’s consumers live outside of the United States. American companies seeking to serve these consumers rely on growth in these markets to restart economic growth and create jobs for Americans. In fact, 22 million Americans work for U.S. multinationals while millions of other Americans are employed by the thousands of small and medium-sized companies that supply and service U.S. multinationals. American companies require only a level playing field in international tax policy. Unfortunately, the Administration's proposal to repeal “deferral” would impose a unilateral tax on the foreign earnings of American companies, upsetting the competitive balance between U.S. -

Imclone and Bristol-Myers Team up for Cancer Treatment in Japan

www.asiabiotech.com Industry Watch Japan ImClone and Bristol-Myers Team up for Erbitux mClone Systems and Bristol-Myers Squibb are working together on a lead product, Erbitux (Cetuximab), used to treat patients with colorectal disease. Erbitux is an IIgG1 monoclonal antibody that inhibits the epidermal growth factor receptor (EGFR). They have submitted an application with the Japanese Pharmaceuticals and Medical Devices Agency for the use of Erbitux (Cetuximab). The filing in Japan leads into the development of collaboration between ImClone Systems, Bristol-Myers Squibb and Merck. The Japanese submission was based on results from studies conducted in Europe and Japan which confirm the activity of Erbitux in patients with metastatic colorectal cancer. About Imclone Systems ImClone Systems is dedicated to developing and commercializing novel therapeutic products in the field of oncology. Their efforts have resulted in a broad spectrum of innovative product candidates with potential application in multiple tumor types. ImClone Systems operates in two locations. Its corporate and scientific headquarters is in New York City, which houses the company’s research and executive offices, and its campus in Branchburg, New Jersey. The Branchburg facility is home to the manufacturing, product development, finance, clinical, regulatory and quality assurance and commercial operations departments. About Bristol-Myers Squibb Bristol-Myers Squibb is a global pharmaceutical and related health care products company whose mission is to extend and enhance human life. Bristol-Myers Squibb manufactures hundreds of different products and is a leader in the discovery and manufacture of innovative therapies for cardiovascular disease, central nervous system disorders, oncology, virology, metabolics, and immunology. -

FY06 Pharmaceutical Marketing Disclosures Report

Pharmaceutical Marketing Disclosures For the period July 1, 2005 to June 30, 2006 Report of Vermont Attorney General William H. Sorrell June 26, 2007 Contact: Julie Brill Assistant Attorney General (802) 828-5479 Pharmaceutical Marketing Disclosures: Report of Vermont Attorney General William H. Sorrell on Payments to Physicians June 26, 2007 Index Page: I. Executive Summary 3 II. Description of Vermont’s Payment Disclosure Law 4 III. Amendments to Prior Pharmaceutical Marketing Disclosure Reports filed by the Vermont Attorney General's Office 5 IV. Summary of Pharmaceutical Marketing Expenditures 6 1. Total Payments of Each Pharmaceutical Manufacturer 6 2. Payments of all Manufacturers Organized by Recipient Type 7 3. Payments by Nature of Expenditure 10 4. Payments by Purpose of Expenditure 10 5. Trade Secret Declarations 11 V. Enforcement Actions 12 Appendix: Tab 1: 33 V.S.A. §2005 13 Tab 2: FY 06 Tables 17 Tab 3: FY 05 Tables as Revised 25 Tab 4: FY 04 Tables as Revised 34 Tab 5: FY 03 Tables as Revised 43 2 Pharmaceutical Marketing Disclosures: Report of Vermont Attorney General William H. Sorrell on Payments to Physicians June 26, 2007 I. Executive Summary This is the fourth report of Vermont Attorney General William H. Sorrell on Pharmaceutical Marketing Disclosures. It is based upon disclosures pertaining to payments made during the period July 1, 2005, through June 30, 2006 (FY 06) by pharmaceutical marketers, of the amount of money the companies paid during the past fiscal year on consulting and speaker fees, travel expenses, gifts, and other payments to physicians, hospitals, universities and others authorized to prescribe or dispense pharmaceutical products. -

[ Emc-Lusinnufll'lergcrta'rgets

US 20070255633Al (19) United States (12) Patent Application Publication (10) Pub. N0.: US 2007/0255633 A1 Kridel (43) Pub. Date: NOV. 1, 2007 (54) SYSTEMS AND METHODS FOR INVESTING (52) US. Cl. ....................................................... .. 705/35 (76) Inventor: FIVJigiam J. Kridel, New York, NY (57) ABSTRACT The present invention discloses systems and methods for Correspondence Address? creating and managing ?nancial instruments and indexes PAUL’ HASTINGS’ JANOFSKY & WALKER comprised of securities for companies in subsectors of the LLP economy. These ?nancial instruments alloW investment in R0' BOX 919092 subsectors of the economy Will still being able to minimize SAN DIEGO CA 92191-9092 ’ risk by diversi?cation. The indexes serve as benchmarks for (21) App1_ NO; 11/465,768 companies in the subsectors of the economy. A procedure may be used to identify the securities to include in the (22) Filed: Allg- 18, 2006 ?nancial instruments. This procedure may include (a) iden _ _ tifying securities for companies in a sector of the economy; Related U's‘ Apphcatlon Data (b) limiting the identi?ed securities to those for companies (60) Provisional application No. 60/778,492, ?led on Mar. in a SubSeCIOr Of the SBCIOI‘ Of the economy; (0) applying 1, 2006. focus rules to further limit the identi?ed securities to those _ _ _ _ for companies Who are focused in the subsector of the Pubhcatlon Classl?catlon economy; and (d) limiting the securities included in the (51) Int, Cl, ?nancial instrument or index to those that satisfy other G06Q 40/00 (2006.01) objective criteria. ETF RULE. SET->| APPLICATION’ ' "1 _. -

Table of Contents

Table of contents Executive Summary Chapter 1 – Introduction Chapter 2 – Trends in drug delivery dealmaking 2.1. Introduction 2.2. Drug delivery partnering over the years 2.3. Bigpharma drug delivery dealmaking activity 2.4. Big biotech drug delivery dealmaking activity 2.5. Most active drug delivery dealmakers 2.6 Drug delivery partnering by deal type 2.7. Drug delivery partnering by disease type 2.8. Partnering by drug delivery technology type 2.9. Average deal terms for drug delivery partnering 2.9.1 Drug delivery headline values 2.9.2 Drug delivery upfront payments 2.9.3 Drug delivery milestone payments 2.9.4 Drug delivery royalty rates 2.10. The anatomy of drug delivery partnering 2.11. Drug delivery or specialty pharma? 2.11.1. Is specialty pharma the only way for drug delivery? 2.11.2. Best practice for optimizing drug delivery program development 2.11.3. The anatomy of a drug delivery deal 2.11.3.a. Case study 1: Alpharma – Durect 2.11.3.b. Case study 2: Bayer – MDRNA 2.11.3.c. Case study 3: Endo Pharmaceuticals – BioDelivery Sciences Chapter 3 – Leading drug delivery deals 3.1. Introduction 3.2. Top drug delivery deals by value Chapter 4 – Bigpharma drug delivery deals 4.1. Introduction 4.2. How to use bigpharma drug delivery partnering deals 4.3. Big pharma drug delivery partnering company profiles Abbott Actavis Inc (formerly Watson Pharmaceuticals) Actavis (merged with Watson Pharmaceuticals Oct 2012) Actelion Allergan Amgen Astellas AstraZeneca Baxter International Bayer Biogen Idec Boehringer Ingelheim Bristol-Myers Squibb Celgene CSL Daiichi Sankyo Dainippon Sumitomo Eisai Eli Lilly Endo Pharmaceuticals Forest Laboratories Galderma Gilead Sciences GlaxoSmithKline Grifols Hospira Johnson & Johnson Kyowa Hakko Kirin Lundbeck Menarini Merck & Co Merck KGaA Mylan Novartis Novo Nordisk Otsuka Pfizer Purdue Roche Sanofi Shionogi Shire Takeda Teva UCB Valeant Warner Chilcott Chapter 5 – Bigbiotech drug delivery deals 5.1. -

Manufacturers and Wholesalers Street City ST Zip Acorda Therapeutics

Manufacturers and Wholesalers Street City ST Zip 454 Life Sciences 50 Industrial Rd. Branford CT 06405 Acclarent, Inc. 1525-B O'Brien Dr. Menlo Park CA 94025 Ace Surgical Supply, Inc. 1034 Pearl St. Brockton MA 02301 Acorda Therapeutics, Inc. 420 Sawmill River Road Ardsley NY 10532 Acorda Therapeutics, Inc. 15 Skyline Drive Hawthorne NY 10532 Actavis 400 Interpace Parkway Parsippany NJ 07054 Actelion Pharmaceuticals US, Inc. 5000 Shoreline Court, Suite 200 S. San Francisco CA 94080 A-Dec, Inc. 2601 Crestview Dr. Newberg OR 97132 Advanced Respiratory, Inc. Advanced Sterilization Products 33 Technology Drive Irvine CA 92618 Aegerion Pharmaceuticals, Inc. 101 Main Street, Suite 1850 Cambridge MA 02142 Afaxys, Inc. PO Box 20158 Charleston SC 29413 Affordable Pharmaceuticals, LLC Akrimax Pharmaceuticals, LLC 11 Commerce Drive, 1st Floor Cranford NJ 07016 Alamo Pharma Services, Inc. Alexion Pharmaceuticals, Inc. 352 Knotter Drive Cheshire CT 06410 Alkermes, Inc. 852 Winter Street Waltham MA 02451 Allen Medical Systems, Inc. 825 Winter Waltham MA 02461 Allos Therapeutics, Inc AMAG Pharmaceuticals, Inc. 1100 Winter Street Waltham MA 02451 Amarin Pharmaceuticals AMATECH Corporation American Homecare Federation 31 Moody Rd Enfield CT 06083 American Homecare Federation 95 E. Ashley Ave. West Springfield WA 01089 American Medical Systems, Inc. 1700 Bren Road West Minnetonka MN 55343 American Regent, Inc. Amgen, Inc. 1 Amgen Center Drive Thousand Oaks CA 91320 Amgen, USA Amphastar Pharmaceuticals, Inc. 11570 Sixth St. Rancho Cucamnga CA 91730 Amylin Pharmaceutical, Inc. 9360 Towne Center Drive San Diego CA 92121 Anda ApoPharma USA Inc. 9605 Medicl Center Dr., Suite 390 Rockville MD 20850 Applied Medical Distribution Corporation 22872 Avenida Empress Rancho Santa Margarita CA 92688 Applied Medical Resources Corporation 22872 Avenida Empress Rancho Santa Margarita CA 92688 Arbor Pharmaceutical LLC Arbor Pharmaceutical Sales LLC Arbor Pharmaceuticals, Inc.