Company Briefing Notes on Half Yearly Results for FY

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Update on Aircraft Equipage

ADS-B TF/3-IP/14 International Civil Aviation Organization The Third Meeting of Automatic Dependent Surveillance – Broadcast (ADS-B) Study and Implementation Task Force (ADS-B TF/3) Bangkok, 23-25 March 2005 Agenda Item 4: Review States’ activities on trials and demonstration of ADS-B AIRCRAFT EQUIPAGE UPDATE (Prepared by Greg Dunstone, Airservices Australia) (Presented by Greg Dunstone, Airservices Australia) SUMMARY An update on Aircraft equipage 1 Background 1. This paper is a brief update on aircraft equipage 2 Airlines detected 2.1 The following Aircraft Operators have been detected by Australian ADS-B ground stations: QANTAS, Virgin Blue, Jetstar, Emirates, Air New Zealand, Pacific Blue Eva Air, Virgin Atlantic, Asiana, Vietnam, Malaysian, British Airways Singapore Airlines Cargo, Thai, Korean, Air Mauritius, Air China, Cathay Pacific, China Airlines, UPS Airlines, QANTASLink (Sunstate), Sunshine Express, Royal Flying Doctor Service, Bundy Flying School, Sunshine Coast Rescue Helicopters 3 Aircraft types detected 3.1 The following aircraft types have been detected: B747, B767, B737, B777, A320, A330, A340, B200, SH36, DHC8, BK17, B206, J200 4 Statement by Cathay Pacific Airlines 4.1 Cathay Pacific Airlines advised Airservices Australia, and authorised the release of the following: “I can confirm that CX has a program in place to equip all its aircraft with ADS-B before the end of 2005. This is obviously subject to the usual engineering constraints, but so far we are on target to meet the year end deadline for completion. We are quite happy that this information be published ….. ” 5 Statement by United Airlines 5.1 As the ISPACG meeting in Brisbane, United Airlines advised that they would equip all their international aircraft with ADS-B out. -

Qantaslink Timetable

Terms of Use All data shown in this service is a property of Qantas, is for information only and is subject to change at any time. Given the flexible nature of Qantas schedules, our PDF Timetable may not reflect the latest information. By accessing the information, the user acknowledges that Qantas will not be responsible or liable to the user, or any other party, for any direct or indirect damages or costs resulting from any use of this information, including without limitation any discrepancies, in the actual timings of flights and timings started in this product. Qantas is under no obligation to maintain or support the service and to the extent permitted by applicable law excludes liability for direct or indirect damages in connection with the use of the service or of any data contained in this product. How to use the PDF Timetable The timetable has two sections, the bookmark or navigation area on the left-hand side and timetable on the right hand side. Bookmarks The bookmarks are your navigation for the timetable. All departure cities are listed alphabetically and are indicated by the word ©From©. If you click on one of these links it will take you directly to the part of the timetable that shows flights from the city selected. All the from cities have a + mark next to them. If you click on the + mark it will show you a list of destinations you can go to from that departure city. They are indicated by the word ©To©. If you click on one of these links it will take you directly to the part of the timetable that shows flights to the city selected. -

Regional Express Holdings Limited Was Listed on the ASX in 2005

Productivity Commission Inquiry Submission by Regional Express Contents: Section 1: Background about Regional Express Section 2: High Level Response to the Fundamental Question. Sections 3 – 6: Evidence of Specific Issues with respect to Sydney Airport. Section 7: Response to the ACCC Deemed Declaration Proposal for Sydney Airport Section 8: Other Airports and Positive Examples Section 9: Conclusions 1. Background about Regional Express 1.1. Regional Express was formed in 2002 out of the collapse of the Ansett group, which included the regional operators Hazelton and Kendell, in response to concerns about the economic impact on regional communities dependent on regular public transport air services previously provided by Hazelton and Kendell. 1.2. Regional Express Holdings Limited was listed on the ASX in 2005. The subsidiaries of Regional Express are: • Regional Express Pty Limited ( Rex ), the largest independent regional airline in Australia and the largest independent regional airline operating at Sydney airport; • Air Link Pty Limited, which provides passenger charter services and based in Dubbo NSW, • Pel-Air Aviation Pty Limited, whose operations cover specialist charter, defence, medivac and freight operations; and • the Australian Airline Pilot Academy Pty Limited (AAPA ) which provides airline pilot training and the Rex pilot cadet programme. 1.3. Rex has regularly won customer service awards for its regional air services and in February 2010, Rex was awarded “Regional Airline of the Year 2010” by Air Transport World. This is only the second time that an Australian regional airline has won this prestigious international award, the previous occasion being in 1991 when this award was won by Kendell. -

Oneworld Circle Trip Explorer 3030V131 18Dec17

oneworld Circle Trip Explorer AIR TARIFF AY / BA / CX / IB / JL / KA / LA / MH / NU / QF / QR / RJ / S7 / UL RULE 3030 / CTR2 Eff 18 December 2017 Fares ex Australia – AUD200 reduction to LONEWC3 & LONEWC4 0. APPLICATION Fares governed by this rule apply to First/Business/ Economy Circle Trip travel via AY/BA/CX/IB/JL/KA/LA/MH/NU/QF/QR/RJ/S7/UL operated services Worldwide. Fares governed by this rule can be used to create Circle-Trips. Capacity Limitations The carrier shall limit the number of passengers carried on any one flight at fares governed by this rule and such fares will not necessarily be available on all flights. The number of seats which the carrier shall make available on a given flight will be determined by the carrier’s best judgement. Other Conditions Fares apply only if purchased prior to departure. The fare to be charged is determined by the highest class travelled and the number of geographic continents in the itinerary, including the continent of origin and continents transited. The Fare Basis corresponds to the number of continents and class purchased. Fare Basis Continents Economy Business First 3 LONEWC3 DONEWC3 AONEWC3 4 LONEWC4 DONEWC4 AONEWC4 For the purpose of this rule, continents are defined as: Europe-Middle East (including Algeria, Morocco, Russia west of the Urals, Tunisia, Egypt, Libya and Sudan) Africa Asia (including Kazakhstan, Kyrgyzstan, Russia east of the Urals, Tajikistan, Turkmenistan and Uzbekistan) South West Pacific 1 | Rule 3030 oneworld Circle Trip Explorer Passenger Expenses Not permitted. Fares Refer GDS. 4. FLIGHT APPLICATION / ROUTINGS Fares only apply on AY/BA/CX/IB/JL/KA/LA/MH/NU/QF/QR/RJ/S7/UL. -

7 Regional Airports and Opportunities for Low-Cost Carriers in Australia

7 Regional airports and opportunities for low-cost carriers in Australia A. Collins, D. A. Hensher & Z. Li The University of Sydney, Australia Abstract Australia is vitally dependent on aviation services for delivering passenger accessibility to many rural and remote locations. The majority of airports in Australia are regional airports. There are real opportunities for a number of regional airports to improve their services for the region through the introduction of low-cost carriers (LCCs). The aim of this paper is to investigate this potential, through a formal model system of the entire aviation network in Australia, focusing on identifying influences on passenger demand and flights offered, and the role of air fares and number of competitors on each route. Keywords: regional airports; low-cost carriers; regular passenger transport; structural equation system; three stage least squares (3SLS) 1 Introduction Australia is vitally dependent on aviation services for delivering passenger accessibility to many rural and remote locations. In 2005–06, over 40.93 billion passenger kilometres or 11.47% of the total domestic passenger transport task (including metropolitan travel) was serviced by aviation [1]. Conservatively this represents over 46% of all intra- and inter-state aircraft movements and 13% of revenue passenger activity. As the Australian population progressively, albeit slowly, migrates away from the capital cities along the coast and inland, a number of towns that were once small centres servicing a hinterland have grown to become sizeable hubs for substantial regional activity. The role of aviation has grown in response to the need for improved accessibility to these regional hubs. -

Media Release

MEDIA RELEASE 18 June 2014 - For immediate distribution Airnorth to operate Darwin-Gove-Cairns route Airnorth, the premier airline of Northern Australia, is pleased to announce that from 18 August it will commence operating return services from Darwin to Gove and onto Cairns, a route currently being serviced by codeshare partner Qantas Airways under their QantasLink brand. Airnorth will operate full service daily flights in their state-of-the-art 76-seat Embraer E170 jet fleet. “Airnorth have a continued commitment, as we have done so for many years, to providing quality scheduled air services to the communities of the Gulf region,” said Michael Bridge, Airnorth’s Chief Executive Officer. “In introducing these services Airnorth will be able to continue to provide sustainable air services to Nhulunbuy for the long-term. Additionally we will also be seeking to expand the current codeshare arrangements which are in place across our domestic and international network with Qantas Airways to include the Nhulunbuy services”. “Airnorth now operates an extensive airline and contract charter network covering most of Northern Australia as well as providing services to our nearest neighbour, Timor Leste and Manila in the Philippines.” The airline also recently signed an interline agreement with Malaysian Airlines, enabling passengers to combine their domestic Airnorth itinerary with international flights from Darwin to Kuala Lumpur and beyond with their Malaysian Airlines itinerary. Airnorth’s Darwin-Gove-Cairns Schedule (all in local times) Departure Arrival Flight Number Mon Tues Wed Thu Fri Sat Sun Time Time Darwin to Gove TL160 0745 0900 Gove to Cairns TL160 0945 1200 Cairns to Gove TL161 1330 1450 Gove to Darwin TL161 1520 1630 Prices start from $179.00 Gove to Cairns and from $169.00 Gove to Darwin and bookings can be made, commencing this afternoon, online at www.airnorth.com.au, through Airnorth Reservations freecall 1800 627 474 or through your local travel agent. -

The Evolution of Low Cost Carriers in Australia

AVIATION ISSN 1648-7788 / eISSN 1822-4180 2014 Volume 18(4): 203–216 10.3846/16487788.2014.987485 THE EVOLUTION OF LOW COST CARRIERS IN AUSTRALIA Panarat SRISAENG1, Glenn S. BAXTER2, Graham WILD3 School of Aerospace, Mechanical and Manufacturing Engineering, RMIT University, Melbourne, Australia 3001 E-mails: [email protected] (corresponding author); [email protected]; [email protected] Received 30 June 2014; accepted 10 October 2014 Panarat SRISAENG Education: bachelor of economics, Chulalongkorn University, Bangkok, Thailand, 1993. Master of business economics, Kasetsart University, Bangkok, Thailand, 1998. Affiliations and functions: PhD (candidate) in aviation, RMIT University, School of Aerospace, Mechanical and Manufacturing Engineering. Research interests: low cost airline management; demand model for air transportation; demand forecasting for air transportation. Glenn S. BAXTER, PhD Education: bachelor of aviation studies, the University of Western Sydney, Australia, 2000. Master of aviation studies, the University of Western Sydney, Australia, 2002. PhD, School of Aviation, Griffith University, Brisbane, Australia, 2011. Affiliations and functions: Lecturer in Aviation Management and Deputy Manager of Undergraduate Aviation Programs, at RMIT University, School of Aerospace, Mechanical and Manufacturing Engineering. Research interests: air cargo handling and operations; airport operations and sustainability; supply chain management. Graham WILD, PhD Education: 2001–2004 – bachelor of science (Physics and Mathematics), Edith Cowan University. 2004–2005 – bachelor of science honours (Physics), Edith Cowan University. 2008 – Graduate Certificate (Research Commercialisation), Queensland University of Technology. 2006–2008 – master of science and technology (Photonics and Optoelectronics), the University of New South Wales. 2006–2010, PhD (Engineering), Edith Cowan University. Affiliations and functions: 2010, Postdoctoral research associate, Photonics Research Laboratory, Edith Cowan University. -

Airline Competition in Australia Report 3: March 2021

Airline competition in Australia Report 3: March 2021 accc.gov.au Australian Competition and Consumer Commission 23 Marcus Clarke Street, Canberra, Australian Capital Territory, 2601 © Commonwealth of Australia 2021 This work is copyright. In addition to any use permitted under the Copyright Act 1968, all material contained within this work is provided under a Creative Commons Attribution 3.0 Australia licence, with the exception of: the Commonwealth Coat of Arms the ACCC and AER logos any illustration, diagram, photograph or graphic over which the Australian Competition and Consumer Commission does not hold copyright, but which may be part of or contained within this publication. The details of the relevant licence conditions are available on the Creative Commons website, as is the full legal code for the CC BY 3.0 AU licence. Requests and inquiries concerning reproduction and rights should be addressed to the Director, Content and Digital Services, ACCC, GPO Box 3131, Canberra ACT 2601. Important notice The information in this publication is for general guidance only. It does not constitute legal or other professional advice, and should not be relied on as a statement of the law in any jurisdiction. Because it is intended only as a general guide, it may contain generalisations. You should obtain professional advice if you have any specific concern. The ACCC has made every reasonable effort to provide current and accurate information, but it does not make any guarantees regarding the accuracy, currency or completeness of that information. Parties who wish to re-publish or otherwise use the information in this publication must check this information for currency and accuracy prior to publication. -

Media Release

MEDIA RELEASE 29 February 2016 – For immediate distribution Airnorth Welcomes Qantas Codeshare on New Wellcamp Routes Airnorth has announced the expansion of a codeshare arrangement to see the inclusion of Qantas on new direct jet services between Toowoomba Brisbane West Wellcamp Airport – Melbourne and Toowoomba – Cairns*. The new codeshare arrangement will also provide Qantas Frequent Flyers with the opportunity to earn and redeem Qantas Points. Airnorth Chief Executive Officer Daniel Bowden welcomed the inclusion of the Qantas code on the new Airnorth Wellcamp services. “The new flights will allow both outbound and inbound customers from Toowoomba and the wider Darling Downs, to directly access Melbourne and Cairns with the added Qantas codeshare travel options and associated benefits.” “By partnering with Qantas on these services we’re expanding not only our codeshare network but our ability to offer customers in regional communities greater access to quality airline services.” QantasLink Chief Executive Officer John Gissing said that Qantas customers would be presented with a new range of benefits when the new codeshare services commence. “Our Toowoomba customers will be able to earn Qantas Points and enjoy seamless connectivity to Qantas’ domestic and international networks.” Toowoomba Brisbane West Wellcamp Airport General Manager Mr Phil Gregory said this announcement will further benefit locals who are already supporting the newly built, modern and convenient, Toowoomba Wellcamp Airport and its existing services. Customers and travel agents will be able to book Qantas codeshare services from 08 March 2016 for flights operating from 28 March 2016. The service will welcome passengers on board Airnorth’s state-of–the-art Embraer E170 jets, coupled with an exceptional customer service on 7 direct return flights from Toowoomba to Melbourne and 3 direct return flights from Toowoomba to Cairns. -

Submission of Qantas Airways

THE SENATE RURAL AND REGIONAL AFFAIRS AND TRANSPORT REFERENCES COMMITTEE INQUIRY INTO AIRPORT AND AVIATION SECURITY QANTAS GROUP SUBMISSION JANUARY 2015 CONTENTS 1 EXECUTIVE SUMMARY ............................................................................................. 3 2 QANTAS GROUP ...................................................................................................... 4 2.1 Qantas Group Structure ....................................................................................... 4 2.2 Qantas Group Operations .................................................................................... 4 2.3 The Qantas Group Partner and Investment Businesses ......................................... 4 3 AVIATION SECURITY REGULATORY ENVIRONMENT ................................................... 5 3.1 International Civil Aviation Organisation .............................................................. 5 3.2 Australian Aviation Transport Security Act & Regulations ..................................... 5 3.3 Australian Transport Security Program ................................................................. 5 3.4 International Air Transport Association ................................................................ 5 4 QANTAS SECURITY, FACILITATION & RESILIENCE ....................................................... 6 4.1 Qantas Expenditure on Security ........................................................................... 6 4.2 Departmental Structure ...................................................................................... -

Qantas Frequent Flyer Benefits Guidebook

BENEFITS GUIDEBOOK Making the most of your membership≥ GF3001Mar10 1 Contents≥ 2 Membership overview 7 Earning points 8 In the air 21 On the ground 47 Using points 49 Award flights and upgrades 67 Qantas Frequent Flyer Store 73 Your account 81 Where your points could take you 91 Terms and conditions 128 Contact details 129 Index This easy guide to your membership explains it all, step by step. Read on to find out how you can get the most from your membership and keep the guide handy so you’re familiar with the Terms and Conditions of the program. The index at the back of this guide will help you to find the information you need easily. The information is current as at the date of publication (March 2010). You’ll always find the latest information at qantas.com/frequentflyer 2 3 Don’t forget to give us your email address Then you will be amongst the first to know about our member specials, including Award Flight opportunities Welcome aboard! and special offers from our program partners. You have a lot to look forward to as a Qantas Make the most of your membership. Simply make Frequent Flyer sure we have your email address and register your There are so many ways you can enjoy our program. email preferences – just go to ‘Your Profile’ under You can earn Qantas Frequent Flyer points every time you ‘Your Account’ at qantas.com/frequentflyer fly on eligible flights* with Qantas, Jetstar, oneworld® to register your email preferences. You can also Alliance Airlines and our partner airlines. -

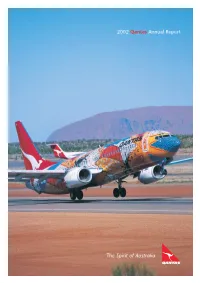

2002 Qantas Annual Report

2002 Qantas Annual Report The Spirit of Australia QF Qantas was founded in the Queensland outback 20 02 in 1920 and is Australia’s largest domestic and international airline. Registered originally as Queensland and Northern Territory Aerial Services Limited (QANTAS), the airline has built a reputation for excellence in safety, operational reliability, engineering and maintenance, and customer service. Qantas operates a fleet of 187 aircraft across a network spanning 142 destinations in 32 countries. Qantas carried more than 27 million passengers this year and employs more than 33,000 staff who speak more than 50 different languages. Qantas also operates subsidiary businesses in specialist markets such as Qantas Holidays and Qantas Flight Catering. p1 Report from the p5 Review of our p24 Board of p26 Corporate p27 Financial Chairman and Business Directors Governance Review Chief Executive Officer Qantas Airways Limited ABN 16 009 661 901 QF 20 02 Chief Executive Officer Geoff Dixon Chairman Margaret Jackson to our fellow shareholders It has been a dramatic and at times traumatic year for Qantas and the global aviation industry. The events of 11 September 2001 changed the industry forever and the collapse of Ansett has transformed the Australian aviation market. Qantas performed well in the face of these tumultuous events and this was a tribute to our management and staff. p1 PROFIT BEFORE TAX OF $631.0 MILLION. REVENUE OF $11.3 BILLION Net Profit Attributable to Passengers Carried Members of the Company 000 $M 27,128 517.3 22,147 428.0 415.4 421.6 20,485 19,236 18,865 304.8 QF 20 02 02 01 00 99 98 02 01 00 99 98 A TUMULTUOUS YEAR In last year’s annual report, Qantas was able to add the equivalent of about seven we noted that Qantas had performed well in a years’ growth, virtually overnight.