For Immediate Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Proposed Final Judgment: U.S. V. Entercom Communications Corp

Case 1:17-cv-02268 Document 2-1 Filed 11/01/17 Page 1 of 20 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA UNITED STATES OF AMERICA, Plaintiff, v. ENTERCOM COMMUNICATIONS CORP. and CBS CORPORATION, Defendants. PROPOSED FINAL JUDGMENT WHEREAS, Plaintiff, United States of America, filed its Complaint on November 1, 2017, the United States and defendants Entercom Communications Corp. and CBS Corporation, by their respective attorneys, have consented to the entry of this Final Judgment without trial or adjudication of any issue of fact or law, and without this Final Judgment constituting any evidence against or admission by any party regarding any issue of fact or law; AND WHEREAS, defendants agree to be bound by the provisions of this Final Judgment pending its approval by the Court; AND WHEREAS, the essence of this Final Judgment is the prompt and certain divestiture of certain rights or assets by the defendants to assure that competition is not substantially lessened; AND WHEREAS, the United States requires defendants to make certain divestitures for the purpose of remedying the loss of competition alleged in the Complaint; Case 1:17-cv-02268 Document 2-1 Filed 11/01/17 Page 2 of 20 AND WHEREAS, defendants have represented to the United States that the divestitures required below can and will be made, and that defendants will later raise no claim of hardship or difficulty as grounds for asking the Court to modify any of the divestiture provisions contained below; NOW THEREFORE, before any testimony is taken, without trial or adjudication of any issue of fact or law, and upon consent of the parties, it is ORDERED, ADJUDGED, AND DECREED: I. -

SAGA COMMUNICATIONS, INC. (Exact Name of Registrant As Specified in Its Charter)

2017 Annual Report 2017 Annual Letter To our fellow shareholders: Every now and then I am introduced to someone who knows, kind of, who I am and what I do and they instinctively ask, ‘‘How are things at Saga?’’ (they pronounce it ‘‘say-gah’’). I am polite and correct their pronunciation (‘‘sah-gah’’) as I am proud of the word and its history. This is usually followed by, ‘‘What is a ‘‘sah-gah?’’ My response is that there are several definitions — a common one from 1857 deems a ‘‘Saga’’ as ‘‘a long, convoluted story.’’ The second one that we prefer is ‘‘an ongoing adventure.’’ That’s what we are. Next they ask, ‘‘What do you do there?’’ (pause, pause). I, too, pause, as by saying my title doesn’t really tell what I do or what Saga does. In essence, I tell them that I am in charge of the wellness of the Company and overseer and polisher of the multiple brands of radio stations that we have. Then comes the question, ‘‘Radio stations are brands?’’ ‘‘Yes,’’ I respond. ‘‘A consistent allusion can become a brand. Each and every one of our radio stations has a created personality that requires ongoing care. That is one of the things that differentiates us from other radio companies.’’ We really care about the identity, ambiance, and mission of each and every station that belongs to Saga. We have radio stations that have been on the air for close to 100 years and we have radio stations that have been created just months ago. -

The New1037 Project Glam Free Prom Dresses and Tux Rentals for Girls and Guys in Need

CONTACT: Chele Fassig, Promotion Director 704 - 227-8012 [email protected] The New1037 Project Glam Free Prom Dresses and Tux Rentals for Girls and Guys in Need CHARLOTTE, N.C. – Wednesday, March 8, 2017 – The New1037/WSOC is giving away free Prom dresses to area high school girls in need! It’s happening on Saturday, March 11 at a 1037 booth in the Carolina Place Mall in Pineville. Starting at 10am, the New1037 will offer beautiful, donated Prom dresses for girls to keep, as well as free tux rentals courtesy of Men’s Wearhouse, for high school guys to borrow. The New1037 is currently asking listeners to empty their closets and donate prom dresses, bridesmaid dresses and formal gowns for Project Glam. This concept was created by The New 1037 Team. ”For three successful years, our New1037 Project Glam has offered local girls the opportunity to find that perfect dress that they might not have been able to afford, so they get to look glamorous on Prom Night! ” said DJ Stout, operations manager and program director for WSOC. “I can’t think of a more worthwhile way to help make their prom dreams come true.” Donated dresses are now being accepted at The New 1037 Studios located at 1520 South Boulevard Suite 300 and the eight locations of Elite Cleaners in Charlotte and Matthews and Indian Trail through March 10. Special thanks to our partners Carolina Place Mall, Lily Rose Bridal, JCPenney, Sears, and Reeves Enterprises. The New 1037 is available on-air, online at thenew1037.com and through the iRadioNow app on a variety of mobile devices. -

![Beasley and CBS Asset Exchange Agreement 10-2-14 FINAL[3]](https://docslib.b-cdn.net/cover/5769/beasley-and-cbs-asset-exchange-agreement-10-2-14-final-3-485769.webp)

Beasley and CBS Asset Exchange Agreement 10-2-14 FINAL[3]

News Announcement For Immediate Release CONTACT: B. Caroline Beasley, Chief Financial Officer Joseph N. Jaffoni Beasley Broadcast Group, Inc. JCIR 239/263-5000; [email protected] 212/835-8500 or [email protected] BEASLEY BROADCAST GROUP ENTERS INTO ASSET EXCHANGE AGREEMENT WITH CBS RADIO Beasley to Exchange Five Radio Stations in Philadelphia and Miami for Fourteen Stations in Tampa, Charlotte and Philadelphia Transaction Expected to be Accretive to Beasley’s Station Operating Income NAPLES, Florida, October 2, 2014 – Beasley Broadcast Group, Inc. (NASDAQ: BBGI) (“Beasley” or “Beasley Broadcast”), a large- and mid-size market radio broadcaster announced today that it entered into an asset exchange agreement with CBS Radio, whereby Beasley will exchange five stations in Philadelphia and Miami for fourteen CBS Radio stations in Tampa-St. Petersburg, Charlotte and Philadelphia. Pursuant to the terms of the agreement, there is no cash consideration or other contingent consideration to be paid by either party beyond the asset exchange. The planned asset exchange will substantially broaden and diversify Beasley’s local radio broadcasting platform and revenue base with fourteen new stations that are geographically complementary to the Company’s ongoing operations while also presenting financial and operating synergies with the Company’s ongoing station portfolio and digital operations. Beasley Broadcast Group expects the transaction to be accretive to its station operating income in the first eighteen months of ownership. Station operating income or “SOI,” a non-GAAP financial measure, consists of net revenue less station operating expenses. The transaction is expected to close in the fourth quarter of 2014, subject to Federal Communications Commission approval, the expiration of the applicable Hart-Scott-Rodino waiting period and other customary closing conditions. -

SAGA COMMUNICATIONS, INC. (Exact Name of Registrant As Specified in Its Charter)

2016 Annual Report 2016 Annual Letter To our fellow shareholders: Well…. here we go. This letter is supposed to be my turn to tell you about Saga, but this year is a little different because it involves other people telling you about Saga. The following is a letter sent to the staff at WNOR FM 99 in Norfolk, Virginia. Directly or indirectly, I have been a part of this station for 35+ years. Let me continue this train of thought for a moment or two longer. Saga, through its stockholders, owns WHMP AM and WRSI FM in Northampton, Massachusetts. Let me share an experience that recently occurred there. Our General Manager, Dave Musante, learned about a local grocery/deli called Serio’s that has operated in Northampton for over 70 years. The 3rd generation matriarch had passed over a year ago and her son and daughter were having some difficulties with the store. Dave’s staff came up with the idea of a ‘‘cash mob’’ and went on the air asking people in the community to go to Serio’s from 3 to 5PM on Wednesday and ‘‘buy something.’’ That’s it. Zero dollars to our station. It wasn’t for our benefit. Community outpouring was ‘‘just overwhelming and inspiring’’ and the owner was emotionally overwhelmed by the community outreach. As Dave Musante said in his letter to me, ‘‘It was the right thing to do.’’ Even the local newspaper (and local newspapers never recognize radio) made the story front page above the fold. Permit me to do one or two more examples and then we will get down to business. -

Power 98 Charlotte, NC Announces Three New Hosts

For More Information Contact: Jeff Anderson, Operations Mgr Power 98 [email protected] Power 98 Charlotte, NC Announces Three New Hosts Charlotte, NC – March 10, 2017-- Beasley Media Group’s Power 98/WPEG-FM “Charlotte’s Plug For New Hip-Hop and R&B!” announces details of recent staff changes. After an extensive search, Jeff Anderson has hired Ya Girl Nikki for the Evening host on Power 98, heard weekdays from 7pm – Midnight. Nikki most recently served as a part-time on air announcer at WPEG’s sister station (WZFX) in Fayetteville, NC. Nikki’s talent has caught my attention for years!” said Operations Manager Jeff Uzi D Anderson. “I’m totally convinced that Nikki’s impressive work ethic, excellence in production, and outstanding energy will bring a needed boost to Charlotte’s airwaves.” Additionally, Brian Mr. Incognito Robinson, who has served as afternoon talent, will shift into his new role as a new member of The Maddhouse Morning Show. He will also continue his duties as Power 98 Music Director. “Mr. Incognito has proven himself as a creative and multi-talented team player, said Anderson. “His addition to the morning team is not only a major move, but he also compliments the team for a thriving future as an elite live and local morning show.” With Mr. Incognito moving to mornings, this means that the afternoon position will be filled by newcomer John Sport E. Odie Adams. Sport E. Odie is well known in Charlotte and has established a highly respectable and reputable street presence in the Queen City. -

V 101.9 Charlotte, NC Announces Series of Staff Alignments

For More Information Contact: Jeff Anderson, Operations Mgr V 101.9 WBAV [email protected] V 101.9 Charlotte, NC Announces Series of Staff Alignments Charlotte, NC – March 10, 2017-- Beasley Media Group’s V 101.9/WBAV-FM “Your Favorite Throwbacks and Todays R&B!” announces details of recent staff alignments. Cortney Hicks, who has served as afternoon talent, will shift into her new role as the Daytime announcer from 10am – 3pm. She will also continue her duties as V 101.9 Music Director. “The on air finesse that Cortney brought to afternoons, will be the jolt that we need in middays. She has a unique ability to make every listener believe she’s their personal friend,” noted Operations Manager Jeff Anderson. With Cortney Hicks moving to middays, this means that the afternoon position will be filled by a familiar friend, named Tone X. Tone X has performed on a wide array of platforms. He was a mainstay as writer and talent on BET’s “The Mo’Nique Show”, and currently still tours with comedian and Academy Award winning actress Mo’Nique. Tone-X was previously one of the co-host of “No Limit Larry and the Morning Madd House” on WPEG Power 98 FM for 12 years, and is now making his return as the new Afternoon host on WBAV from 3pm – 7pm. WBAV also welcomes back Derrick “Fly Ty” Jacobs. Fly Ty was previously on WBAV as afternoon drive co-host, and has also worked within the Charlotte market, but now “The People’s Host” is back with Beasley. -

Program Director Randy Sherwyn Produces and Hosts 12-Hour Radio Christmas Special Broadcast to Military Personnel for 16Th Consecutive Year –

NEWS ANNOUNCEMENT DECEMBER 22, 2015 Contact: Randy Sherwyn Program Director Sunny 106.3 WJPT-FM 239.344.9826, [email protected] www.christmasacrossthelands.com BEASLEY MEDIA CELEBRATES THE 16TH ANNIVERSARY OF “CHRISTMAS ACROSS THE LANDS!” - Program Director Randy Sherwyn Produces and Hosts 12-Hour Radio Christmas Special Broadcast to Military Personnel for 16th Consecutive Year – “Christmas Across the Lands” Airs Locally on Sunny 106.3 WJPT-FM and B 103.9 WXKB-FM FORT MYERS and NAPLES, Florida, December 22, 2015 – Randy Sherwyn, Program Director for Beasley Media Group’s Sunny 106.3 WJPT-FM and 106.3 HD2 Solid Gold 106, will host the 16th annual “Christmas Across the Lands,” a 12-hour radio Christmas show that airs mainly on Christmas Eve and Christmas Day in markets across the globe. Locally, “Christmas Across the Lands” will be broadcast on Sunny 106 WJPT-FM beginning Christmas Eve Morning at 9:00 a.m. and will then run for 24 hours during Christmas Eve and Christmas Day. It will also air on Beasley Media Southwest Florida sister station B103.9 WXKB-FM starting at 10 a.m. on Christmas Eve. Originating sixteen years ago as a heartfelt gift and tribute to our troops stationed overseas, as well as a holiday companion for all, “Christmas Across the Lands” is written, produced, and hosted by Randy Sherwyn. With Beasley since 1991, Mr. Sherwyn updates and freshens the show every year, and once again “Christmas Across the Lands” for 2015 is an updated mix of music and interviews. New interviews include Donny Osmond, Kelly Clarkson, Karolyn Grimes (“Zuzu”), Chicago, and more. -

Beasley Broadcast Group, Inc. Beasley

George G. Beasley Revocable Trust, dated May 26, 1998 100% George Beasley Estate Reduction Trust, GGB Family Enterprise, Inc. dated June 7, 1999 1% GP 99% LP GGB II Family Limited Partnership 54.5% Beasley Broadcast Group, Inc. 100% Sole Member Beasley Mezzanine Holdings, LLC 0.25% LP 100% Owner See Attachment 2 Beasley Media Group, Inc. 100% LP & GP 100% Sole Member Beasley-Reed Beasley Acquisition Media Partnership Group, LLC 99.75% See Attachment 1 WQAM License LP WYUU-FM Safety Harbor, FL (Facility ID 18512) Attachment 1 Beasley Media Group, LLC Fayetteville, NC Atlanta, GA Facility Facility Call Sign City State ID Call Sign City State ID W299CA Fayetteville NC 151893 WAEC(AM) Atlanta GA 22132 W232CI Fayetteville NC 139804 WWWE(AM) Hapeville GA 71603 WAZZ(AM) Fayetteville NC 72058 WFLB(FM) Laurinburg NC 9078 WKML(FM) Lumberton NC 37252 WUKS(FM) St. Pauls NC 39239 WZFX(FM) Whiteville NC 32376 Augusta, GA Facility Call Sign City State ID Fort Myers-Naples, FL W238AU Augusta GA 151831 Facility Call Sign City State ID WCHZ-FM Warrenton GA 17129 W243BM Suncoast Estates FL 146788 WDRR(FM) Martinez GA 14667 W251AL Fort Myers FL 139037 WGAC(AM) Augusta GA 4435 W268AH Bonita Springs FL 138952 WGAC-FM Harlem GA 24423 W282BY Fort Myers FL 139201 WGUS-FM New Ellenton SC 25467 W286AK Naples FL 138900 WHHD(FM) Clearwater SC 24148 WJBX(AM) North Ft. Myers FL 4437 WKXC-FM Aiken SC 24147 WJPT(FM) Ft. Myers Villas FL 74080 WRDW(AM) Augusta GA 87174 WRXK-FM Bonita Springs FL 73976 WWCN(FM) Ft. -

2019 Committees Roster.Xlsx

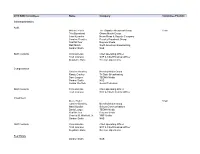

2019 NAB Committees Name Company Committee Position Joint Committees Audit Michael Fiorile The Dispatch Broadcast Group Chair Trila Bumstead Ohana Media Group John Kueneke News-Press & Gazette Company Caroline Beasley Beasley Broadcast Group Paul McTear Raycom Media Matt Mnich North American Broadcasting Gordon Smith NAB Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Stephanie Bone Director, Operations Compensation Caroline Beasley Beasley Media Group Randy Gravley Tri State Broadcasting Dave Lougee TEGNA Media Gordon Smith NAB Jordan Wertlieb Hearst Television Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Investment Steve Fisher Chair Caroline Beasley Beasley Media Group Marci Burdick Schurz Communications David Lougee TEGNA Media Paul McTear Raycom Media Charles M. Warfield, Jr. YMF Media Gordon Smith NAB Staff Contacts Chris Ornelas Chief Operating Officer Trish Johnson SVP & Chief Financial Officer Stephanie Bone Director, Operations Real Estate Gordon Smith NAB 2019 NAB Committees Name Company Committee Position Caroline Beasley Beasley Media Group Michael Fiorile The Dispatch Broadcast Group Paul Karpowicz Meredith Corporation Charles M. Warfield, Jr. YMF Media Staff Contact Steve Newberry EVP, Strategic Planning and Industry Affairs Bylaws Committee Darrell Brown Bonneville International Corp. Susan Fox The Walt Disney Company Kathy Clements Tribune Broadcasting Company John Zimmer Zimmer Radio of Mid-Missouri, Inc. Carolyn Becker Riverfront Broadcasting LLC Collin Jones Cumulus Media Inc. Caroline Beasley Beasley Media Group Randy Gravley Tri State Communications Inc Jordan Wertlieb Hearst Television Inc. Staff Contact Rick Kaplan General Counsel and EVP, Legal and Regulatory Affairs Dues Committee Tom Walker Mid-West Family Broadcasting Dave Santrella Salem Media Group Joe DiScipio Fox Television Stations, LLC Ralph Oakley Quincy Media, Inc. -

Beasley Media Group Licenses, Llc Eeo Public File Report

BEASLEY MEDIA GROUP LICENSES, LLC EEO PUBLIC FILE REPORT This Report covers full-time vacancy recruitment data for the Period: November 23, 2018 – November 22, 2019 1) Employment Unit: Beasley Media Group Licenses, LLC - Boston 2) Unit Members (Stations and Communities of License): WBOS-FM, Brookline, MA WBQT-FM, Boston, MA WKLB-FM, Waltham, MA WROR-FM, Framingham, MA WRCA(AM), Watertown, MA WBZ-FM, Boston, MA 3) EEO Contract Information for Employment Unit: Mailing Address: Telephone Number: 617-822-9600 Contact Person: John Coury 55 Morrissey Boulevard Business Manager Boston, MA 02125 [email protected] 4) Job Title Referral Source Referring Hiree: (a) Morning Show Co-Host - WKLB Management Referral (b) Program Director – WROR Management Referral (c) HR/AP Coordinator On Air Recruitment (d) Marketing Director Management Referral (e) Promotions Coordinator Employee Referral (f) On Air Personality/Host - WBOS Industry Referral (g) Morning Show Producer, WKLB Management Referral (h) Promotions Director, WROR Management Referral (i) Promotions Coordinator – WKLB/WBOS Management Referral (j) Videographer-Editor bbgi.com (k) Morning Show Host – WROR Management Referral (l) National/Local Sales Coordinator Internal Candidate (m) Morning Show Host/Anchor- WKLB Radio and Music Pros Newsletter (n) Afternoon Drive Announcer- WKLB Internal Candidate Stations WBOS‐FM, WBQT‐FM, WKLB‐FM, WBZ‐FM, WROR‐FM and WRCA are Equal Opportunity Employers. (a) Morning Show Co‐Host, WKLB‐FM Referral Source(s) of Hiree: Management Referral Did Recruitment # of Name of Organization Telephone Source Interviewees Notified of Job Vacancy Contact Address Number Request Referred Notification Yes or No Beasley Media Group 1520 South Blvd. Ste. -

![BBGI Station Swap Close FINAL 12-20-17[1]](https://docslib.b-cdn.net/cover/0480/bbgi-station-swap-close-final-12-20-17-1-2530480.webp)

BBGI Station Swap Close FINAL 12-20-17[1]

For Immediate Release CONTACT: Heidi Raphael Joseph Jaffoni, Jennifer Neuman Vice President of Corporate Communications JCR Beasley Broadcast Group, Inc. 212/835-8500 or [email protected] 239/659-7332 [email protected] BEASLEY BROADCAST GROUP COMPLETES EXCHANGE OF WMJX-FM, BOSTON FOR WBZ-FM, BOSTON NAPLES, Florida and BOSTON, Massachusetts (December 20, 2017) – Beasley Broadcast Group, Inc. (Nasdaq: BBGI) (“Beasley” or “the Company”), a large- and mid-size market radio broadcaster, announced today that it completed the previously announced asset exchange with Entercom Communications Corp. (NYSE: ETM) (“Entercom”), whereby Beasley exchanged WMJX-FM, 106.7MHz Boston and $12 million cash for WBZ-FM, 98.5 MHz Boston. Caroline Beasley, Chief Executive Officer of Beasley Broadcast Group, commented, “The addition of WBZ-FM to our broadcast portfolio highlights Beasley’s focus on premium local programming and content and is complementary to our five other radio stations and digital operations in the Boston market. Throughout Beasley Broadcast Group’s 56 year history, we have actively managed our station portfolio with the goal of serving the communities where we operate with the best local programming and brands, diversifying our operations, managing risk and improving financial results. The addition of WBZ-FM to our portfolio addresses all of these strategic objectives as it strengthens our company’s presence and commitment to locally originated content in the Boston market. “Focusing on strong core programming and targeted original local content is the foundation of Beasley’s operating strategy and has proven vital to the Company’s long-term ratings strength and success. Professional sports are unique in that strong bonds are formed between local fans across multiple generations based on shared traditions and a continued passion for their teams.