Mullooly Asset Show Episode 12 Page 2 of 5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

“As He Sees It”

“Baseball took my sight away, but it gave me Phone: (973) 275-2378 / [email protected] a life,” - Ed Lucas Ed Lucas – A Biography In Brief… “As He Sees It” Lucas, a native of New Jersey attended college at Seton Hall University (’62) and upon graduation was An Exhibit on the able to parlay his love of baseball into a lifelong career Extraordinary Life & Accomplishments as a freelance baseball reporter who has interviewed of Expert Baseball Reporter… countless baseball players, administrators and personalities over the last five decades. His work and Ed Lucas accomplishments have been lauded in many ways either through countless by-lines, or as the featured subject in various media accounts. For more A Biographical & Baseball-Oriented information about Ed Lucas please consult the Retrospective remainder of this brochure along with Ron Bechtel’s recent article – “For The Love Of The Game” (Seton Hall University Magazine, 26-29, Winter/Spring 2007) and featured homepage – http://www.edlucas.org “As He Sees It” An Exhibit on the Extraordinary Life & Accomplishments of Expert Baseball Reporter… Ed Lucas Special Thanks To… Jeannie Brasile, Director of the Walsh Library Gallery Jason Marquis, Volunteer Walsh Library Gallery Window Exhibit G. Gregory Tobin, Author & Reference Source Dr. Howard McGinn, Dean of University Libraries Sponsored By The For More Information Please Contact… Msgr. William Noé Field Archives & Alan Delozier, University Archivist & Exhibit Curator Special Collections Center would ultimately secure in later years in such periodicals as Baseball Digest, New York Times, Newark Star-Ledger, Sports Illustrated and even the book – “Bronx Zoo” by Sparky Lyle. -

Player Set # Team Print Run Mike Trout Autographs 77 Angels . Mike Trout USA Baseball Signatures Prizms 10 Angels 25 Nick Maronde Autographs 41 Angels

2013 Panini Prizm Autograph Checklist - No Parallels Player Set # Team Print Run Mike Trout Autographs 77 Angels . Mike Trout USA Baseball Signatures Prizms 10 Angels 25 Nick Maronde Autographs 41 Angels . Peter Bourjos Autographs 4 Angels . Craig Biggio Autographs 84 Astros . Tom Milone Autographs 61 Athletics . Josh Johnson Autographs 32 Blue Jays . R.A. Dickey USA Baseball Signatures Prizms 6 Blue Jays 25 Julio Teheran Autographs 34 Braves . Kris Medlen Autographs 36 Braves . Aramis Ramirez Autographs 6 Brewers . Jason Motte Autographs 26 Cardinals . Oscar Taveras Autographs 89 Cardinals . Pete Kozma Autographs 42 Cardinals . Shelby Miller Autographs 48 Cardinals . Anthony Rizzo Autographs 5 Cubs . Henry A. Rodriguez Autographs 22 Cubs . Jaye Chapman Autographs 28 Cubs . Mike Olt Autographs 40 Cubs . Ryne Sandberg Autographs 71 Cubs . Adam Eaton Autographs 82 Diamondbacks . Brandon McCarthy Autographs 38 Diamondbacks . Didi Gregorius Autographs 19 Diamondbacks . Miguel Montero Autographs 59 Diamondbacks . Tyler Skaggs Autographs 55 Diamondbacks . Andre Ethier Autographs 75 Dodgers . Carl Crawford Autographs 68 Dodgers . Mike Piazza Autographs 66 Dodgers . Paco Rodriguez Autographs 43 Dodgers . Shawn Tolleson Autographs 10 Dodgers . GroupBreakChecklists.com Player Set # Team Print Run Sergio Romo Autographs 47 Giants . Asdrubal Cabrera Autographs 7 Indians . Jason Kipnis Autographs 25 Indians . Trevor Bauer Autographs 52 Indians . Zach McAllister Autographs 65 Indians . Adeiny Hechavarria Autographs 2 Marlins . Gary Sheffield Autographs 76 Marlins . Rob Brantly Autographs 45 Marlins . David Wright Autographs 78 Mets . Ike Davis Autographs 23 Mets . Jeurys Familia Autographs 29 Mets . Matt Harvey USA Baseball Signatures Prizms 5 Mets 25 Eury Perez Autographs 21 Nationals . Jordan Zimmermann Autographs 31 Nationals . Stephen Strasburg Autographs 62 Nationals . -

Title VII & MLB Minority Hiring

TITLE VII & MLB MINORITY HIRING: ALTERNATIVES TO LITIGATION Aaron T. Walker* "It has long been my conviction that we can learnfar more about the conditions, and values, of a society by contemplating how it chooses to play, to use its free time, to take its leisure, than by examining how it goes about its work. "' --A. Bartlett Giamatti, Former Major League Baseball Commissioner. I. INTRODUCTION In 1997, Major League Baseball (MLB) celebrated the fiftieth anniversary of Jackie Robinson breaking the modem day color barrier as the first African American player in the league's history. However, as all thirty MLB teams memorialized Robinson throughout their stadiums, critics challenged MLB to be honest about its progress in minority hiring.2 In the fifty years following Robinson's milestone, only four minority managers and one minority general manager (GM) had been hired by MLB teams.3 Since then, there has been minimal progress in minority hiring. At the commencement of the 2007 MLB season, two minority general managers (GMs) and five minority managers lead MLB teams.4 Despite * B.A. 2003 University of Virginia; J.D. Candidate 2008 University of Pennsylvania. My thanks goes to my parents who have given the confidence to live life on my own terms. Thanks to Ifeyinwa "Ify" Offor for reading earlier drafts and for your invaluable insight.. All mistakes are solely mine. 1. Kenneth L. Shropshire, Minority Issues in Contemporary Sports, 15 STAN. L. & POL'Y REV. 189, 208-09 (2004). 2. Ken Rosenthal, From Outside, Frank Robinson Still Sees Plenty of Locked Doors, BALT. SUN, Apr. -

RED SOX VS. YANKEES the Great Rivalry

To schedule book signings or author interviews for To schedule author interviews for print and online broadcast media, or to receive a review copy, please media, or for information on excerpts, please contact contact Mike Hagan at 877-807-6034 or e-mail Maurey Williamson at 877-807-6034 or e-mail [email protected] [email protected] RED SOX VS. YANKEES The Great Rivalry Authors: Harvey Frommer & Frederic J. Frommer ISBN: 1-58261-767-8 Format: 8.5 x 11 hardcover Page Count: Photos: photos throughout Price: $24.95 Description: The Red Sox vs. the Yankees is perhaps the most intense rivalry in all of American sports, one that reached epic levels during the 2003 American League Championship Series, a seven-game masterpiece won by the New Yorkers on a walk-off homerun. It is also a rivalry that has endured for almost 100 years. Covering nearly a century’s worth of epic battles both on and off the baseball field between these age- old adversaries is Harvey and Frederic J. Frommer’s Red Sox vs. Yankees: The Great Rivalry. The book features exclusive interviews with former governors Mario Cuomo of New York and Michael Dukakis of Massachusetts, former White House press secretary Ari Fleischer, congressmen, reporters, broadcasters, and, most importantly, the many former and current players, coaches, managers, and front-office executives from the Red Sox and the Yankees who have helped keep the rivalry alive. These names include Don Zimmer, Theo Epstein, Nomar Garciaparra, Willie Randolph, Derek Lowe, Jason Giambi, Jeremy Giambi, Lou Merloni, Dwight Evans, Lou Piniella, Mike Torrez, Johnny Pesky, Phil Rizzuto, Ken “Hawk” Harrelson, Bob Watson, Ralph Houk, Eddie Yost, Dwight Evans, Chico Walker, Tony Cloninger, Casey Fossum, Steve Karsay, Grady Little, Mike Stanley, Jim Kaat, Jerry Remy, and Mel Parnell. -

Official Game Information

Official Game Information Yankee Stadium • One East 161st Street • Bronx, NY 10451 Phone: (718) 579-4460 • E-mail: [email protected] • Twitter: @yankeespr & @losyankeespr World Series Champions: 1923, ’27-28, ’32, ’36-39, ’41, ’43, ’47, ’49-53, ’56, ’58, ’61-62, ’77-78, ’96, ’98-2000, ’09 YANKEES BY THE NUMBERS NOTE 2015 (2014) NEW YORK YANKEES (22-22) vs. KANSAS CITY ROYALS (28-15) Standing in AL East: ........ 2nd, -1.5G RHP Nathan Eovaldi (3-1, 4.73) vs. RHP Jeremy Guthrie (4-2, 4.75) Current Streak: ..................Lost 6 Current Homestand ...............0-3 Recent Road Trip ...................2-7 Monday, May 25, 2015 • Yankee Stadium • 1:05 p.m. ET Home Record: ............9-10 (43-38) Game #45 Home Game #20 TV: YES/ESPN Radio: WFAN 660AM/101.9FM Road Record:. 13-12 (41-40) • • • Day Record: ................4-7 (32-24) Night Record: ...........18-15 (52-54) AT A GLANCE: Today the Yankees play the fourth game of a six- DEALIN’ BETANCES: RHP Dellin Betances has pitched Pre-All-Star ..............22-22 (47-47) Post-All-Star ...............0-0 (37-31) game homestand vs. Kansas City after being swept in a three- 24.0IP in 2015 without allowing an earned run (8H, vs. AL East: ..............16-13 (37-39) game series from Friday-Sunday by Texas… went 2-7 on their 2R/0ER, 10BB/1IBB, 35K), the most IP in 2015 by any Major vs. AL Central: ..............4-3 (19-16) recent nine-game, three-city road trip (1-3 at Tampa Bay, 1-2 at League pitcher who has not allowed an earned run… his vs. -

Safe at Home Presents at National Conference

Greetings! We are excited to share our January newsletter which includes updates on our impactful programs and events. Thank you for making these results possible and for helping children to be safe at home! Safe At Home Presents At National Conference This past December, our program team participated in the 2016 Winter Institute of the U.S. Department of Justice Office on Violence Against Women (OVW) Consolidated Youth grantees in San Diego. Safe at Home was invited to lead a workshop and breakout session exploring our approaches in using creative arts. During this session we shared some of our successes and best practices for youth-informed and youth-led work, highlighting two programs in particular that we have been able to expand through our OVW funding: Our Alumni Intern Program, and growing a pipeline of youth leadership; and our Multi-Modal Art Survivors Group, where participants develop their own voice through art and expression. Pictured here is Juanita Viera, MP Counselor and Creative Art Therapist, presenting on our multi-modal arts group and engaging session participants in a group art activity that they could take back to their home agencies. Through this session and workshop, participating grantees were able to learn how art can be used as a tool to empower youth to express themselves and/or provide opportunities for youth to take on leadership roles that can be incorporated into current programming. OUR AUTUMN CAMPAIGN: "I VOTE FOR..." School-Wide Awareness Campaigns mobilize the entire school community around themes of respect and violence prevention. Peer-Leader Led Workshop On Sexual Violence Awareness Peer Leaders are youth ambassadors for Margaret's Place and are trained in public speaking, conflict mediation, and violence and abuse and play an active role in educating their peers. -

2020 March Homesteader

Having Lunch with Play Ball! Shirley Ray Reflecting on a baseball The Cascade Culinary Institute fantasy of a lifetime with honors longtime benefactor DHM Manager Vanessa Ivey See Page 6 See Page 2 The Homesteader Deschutes County Historical Society Newsletter—March 2020 From Top: Membership Luncheon; Beau Eastes serving lunch to members Sue and Dave John Kent presented a “Then and Now” slide show using donated 1970s aerial photos of Deschutes County. Frewing. All photos by The annual membership meeting and luncheon was a big success! On Loren Irving Saturday, February 8, there were over 70 members present, the food was good, (thanks to our chef Paula Simila) and the program was very engaging. The tables were set with a variety of placemats that were copies of the Bill Van Allen aerial photos that tied into the day’s program. Members enjoyed sharing information as they tried to figure out the location of each photo. In the early 1970s, Van Allen took a series of photos showing different parts of Bend and Deschutes County. DCHS volunteer John Kent is working to identify and catalog these locations. With the help of Google Earth, John was able to overlay the old images with what it looks like today. Audience members helped John identify even more locations. During the interactive program, members were calling out names of streets and buildings they recognized. —Continued on Page 3 The Homesteader: Volume 46; No. 3. Published monthly by the Deschutes County Historical Society, 129 NW Idaho Avenue, Bend, Oregon 97703 My Field Of Dreams Comes True By Vanessa Ivey I just watched the 1977 The last time I had played team ball was with Bend's Park & World Series, NY Yankees vs. -

USA Baseball Announces 2017 World Baseball Classic Roster ESP

USA BASEBALL ANUNCIA LISTADO DEL CLÁSICO MUNDIAL DE BÉISBOL 2017 Cinco jugadores del Clásico Mundial de Béisbol 2013 vuelven al equipo USA en 2017 DURHAM, N.C. – USA Baseball anunció el miércoles el listado de los 28 jugadores que participarán en el Clásico Mundial de Béisbol 2017. El listado consiste en 13 lanzadores y 15 jugadores de otras posiciones. Incluye 13 anteriores jugadores de USA Baseball, cinco de los cuales participaron en el Clásico Mundial de Béisbol en 2013. El listado incluye también 18 jugadores All-Star de las Grandes Ligas, dos Jugadores Más Valiosos y nueve recipientes del premio Golden Glove. ¨Estamos emocionados para empezar el Clásico Mundial de Béisbol 2017 con el anuncio de nuestro listado,¨ dijo Paul Seiler, Director Ejecutivo de USA Baseball. ¨USA Baseball trata de competir al nivel más alto en la palestra internacional, y estamos entusiasmados de dar la bienvenida a un grupo de atletas excelentes que van a trabajar incansablemente para conseguir un título de campeón del Clásico Mundial de Béisbol para los Estados Unidos.¨ Luke Gregerson, Eric Hosmer, Adam Jones, Jonathan Lucroy y Giancarlo Stanton vuelven todos del equipo del Clásico Mundial de Béisbol 2013. Otros anteriores jugadores en el listado son Chris Archer, Alex Bregman, Brandon Crawford, Danny Duffy, Mychal Givens, Andrew McCutchen, Buster Posey y Marcus Stroman. Colectivamente, los anteriores jugadores de USA Baseball han participado en dos equipos nacionales 16U, cuatro equipos nacionales 18U, cuatro equipos nacionales colegiados, dos equipos nacionales profesionales (compuestos de jugadores que no están en listados activos de 25 jugadores en las Grandes Ligas) y un equipo del Clásico Mundial de Béisbol. -

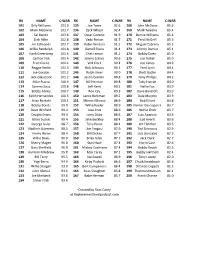

RK NAME C-WAR RK NAME C-WAR RK NAME C-WAR 101 Billy

RK NAME C-WAR RK NAME C-WAR RK NAME C-WAR 101 Billy Williams 103.9 135 Joe Torre 92.6 168 John McGraw 85.6 102 Mark McGwire 103.7 136 Zack Wheat 92.4 169 Mark Teixeira 85.4 103 Sal Bando 103.6 137 Cesar Cedeno 91.9 170 Bernie Williams 85.4 104 Dick Allen 102.8 138 Vada Pinson 91.7 171 Fred McGriff 85.3 105 Jim Edmonds 102.7 139 Robin Ventura 91.5 172 Miguel Cabrera 85.3 106 Willie Randolph 101.8 140 Darrell Evans 91.4 173 Johnny Damon 85.1 107 Hank Greenberg 101.6 141 Chet Lemon 91.2 174 Bobby Doerr 85.0 108 Carlton Fisk 101.4 142 Jimmy Collins 90.6 175 Joe Tinker 85.0 109 Fred Clarke 101.4 143 Will Clark 90.4 176 Joe Kelley 84.9 110 Reggie Smith 101.3 144 Bob Johnson 90.1 177 Fred Lynn 84.4 111 Joe Gordon 101.2 145 Ralph Kiner 90.0 178 Brett Butler 84.4 112 Jack Glasscock 101.2 146 Jason Giambi 89.8 179 Tony Phillips 84.2 113 Mike Piazza 100.9 147 Bill Herman 89.8 180 Toby Harrah 84.0 114 Sammy Sosa 100.8 148 Jeff Kent 89.3 181 Nellie Fox 83.9 115 Bobby Abreu 100.7 149 Ron Cey 89.3 182 Dave Bancroft 83.9 116 Keith Hernandez 100.5 150 Lance Berkman 89.2 183 Dale Murphy 83.9 117 Jesse Burkett 100.1 151 Minnie Minoso 88.9 184 Bob Elliott 83.8 118 Bobby Bonds 99.9 152 Willie Keeler 88.9 185 Nomar Garciaparra 83.7 119 Dave Winfield 99.4 153 Jose Cruz 88.6 186 Heinie Groh 83.7 120 Dwight Evans 99.4 154 Larry Doby 88.6 187 Luis Aparicio 83.6 121 Ichiro Suzuki 99.4 155 Jake Beckley 88.4 188 Earl Averill 83.6 122 George Sisler 98.7 156 Tony Perez 88.1 189 Art Fletcher 83.5 123 Vladimir Guerrero 98.5 157 Jim Fregosi 87.9 190 Ted Simmons 82.9 124 -

Clifford W. Mills.Pdf

BASEBALL SUPERSTARS Bernie Williams Hank Aaron Ty Cobb Lou Gehrig Derek Jeter Bernie Randy Johnson Mike Piazza Williams Kirby Puckett Jackie Robinson Ichiro Suzuki Bernie Williams BASEBALL SUPERSTARS Bernie Williams Clifford W. Mills BERNIE WILLIAMS Copyright © 2007 by Infobase Publishing All rights reserved. No part of this book may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage or retrieval systems, without permission in writing from the publisher. For information, contact: Chelsea House An imprint of Infobase Publishing 132 West 31st Street New York NY 10001 Library of Congress Cataloging-in-Publication Data Mills, Cliff, 1947- Bernie Williams / Clifford W. Mills. p. cm. — (Baseball superstars) Includes bibliographical references and index. ISBN-13: 978-0-7910-9468-6 (hardcover) ISBN-10: 0-7910-9468-5 (hardcover) 1. Williams, Bernie. 2. Baseball players—United States—Biography. 3. New York Yankees (Baseball team) I. Title. II. Series. GV865.W55M55 2007 796.357092—dc22 [B] 2007005698 Chelsea House books are available at special discounts when purchased in bulk quantities for businesses, associations, institutions, or sales promotions. Please call our Special Sales Department in New York at (212) 967-8800 or (800) 322-8755. You can find Chelsea House on the World Wide Web at http://www.chelseahouse.com Series design by Erik Lindstrom Cover design by Ben Peterson Printed in the United States of America Bang EJB 10 9 8 7 6 5 4 3 2 1 This book is printed on acid-free paper. All links and Web addresses were checked and verified to be correct at the time of publication. -

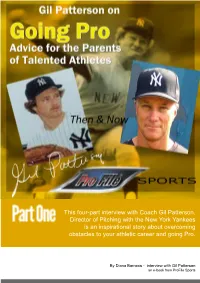

This Four-Part Interview with Coach Gil Patterson, Director of Pitching With

This four-part interview with Coach Gil Patterson, Director of Pitching with the New York Yankees is an inspirational story about overcoming obstacles to your athletic career and going Pro. By Diana Barrows - interview with Gil Patterson an e-book from ProFile Sports 1 Introduction from the Author 3 Why Baseball? 4 Coming up in the System 5 Playing with Elite Company 6 Confidence and Humility 7 Career Ending Injury – or Maybe Not? 8 Learning to Throw Leftie 9 Making a Career in Coaching 10 2 – with Gil Patterson an e-book from ProFile Sports 2 A conversation with Gil Patterson and some sage advice My friendship with Gil Patterson began about four years ago when he was still Pitching Coach for the Minor League Operations for the Oakland A’s – these were the Money Ball years, and he was with his team in Tempe Arizona where the ProFile Sports concept was being developed. We visited over several meetings during those early days of development and he gave us priceless input and guidance on our Score-keeping and Bio Page product. This four-part interview with Coach Gil Patterson, Director of Pitching with the New York Yankees is an inspirational story about overcoming obstacles to your athletic career and dealing with adversity in life. It is written just as he spoke, straight forward, up-polished and passionate. He talks candidly about the process of teaching himself to pitch left-handed to return to professional baseball after a devastating shoulder injury early in his career. He shares specific advice for young pitchers about staying healthy, training and what to expect in the process of going Pro. -

Esearc JOURNAL

THE ase a esearc JOURNAL ASEBALL LENDS ITSELF to oral journalism The Seventeenth Annual like no other sport. The game's stately pace, Historical and Statistical Review B endless complexity, and utter unpredictability of the Society for American Baseball Research make it fertile ground for storytellers. And the best of them seem to be ex~players. If SABR members were Retroactive Cy Young Awards, Lyle Spatz 2 polled about their favorite baseball book, odds are the Batting Eye Index, Cappy Gagnon 6 runaway winner would be The Glory of Their Times, Bill Sisler, Ed Brooks 10 ,Lawrence Ritter's interviews with stars from the early Buzz Arlett, Gerald Tomlinson 13 years of the century. R,otisserie Leagues and New Stats, Ron Shandler 17 In this issue we are pleased to excerpt the Frenchy Bill Mazeroski, Jim Kaplan 21 Bordagaray interview from a new oral history, Innings Latin American All.. Star Game, Edward Mandt 23 Ago: Recollections by Kansas City'Ballplayers oftheir Days in Player.. Managers, Bob Bailey 25 the Game, by Jack Etkin. Don't let the regional approach Runs Produced Plus, Bobby Fong 34 fool you: The subject is baseball-universal. Interviewing Denny McLain in 1968, Larry Amman 38 former major~league Athletics, minor~league Blues, and Bob Gibson in 1968, Peter Gordon 41 Negro~league Monarchs, Etkin discovered a range of Retooling the Batter, Gaylord Clark 45 Willie Wells, John Holway 50 baseball experience from sudden success to unfulfilled The Times Were A ..Changin',· Ron Briley 54 talent to squandered opportunity. "Dick Howser once Jet Lag and Pennant Races, Bruce Goldberg 61 said that all ballplayers felt they could have been better," Musing on Maris, Ralph Houk and Robert W.