Personalisation at Scale

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A-Z Cruelty-Free Brand Guide 2020

THE A-Z LIST OF CrueltCrueltyy FreFreee BRANDS WWW.CRUELTYFREECOLLECTIVE.COM Contents MAKE-UP & PERSONAL CARE BRANDS……………………………………………………………………………………2 AROMATHERAPY………………………………………………………………………………………………………………………5 BABY PRODUCTS………………………………………………………………………………………………………………………5 BATH PRODUCTS………………………………………………………………………………………………………………………6 DEODORANTS……………………………………………………………………………………………………………………………7 FEMININE HYGIENE………………………………………………………………………………………………………………….7 HAIR CARE & STYLING………………………………………………………………………………………………………..……8 SOAP, HANDWASH & HAND SANITISER……………………………………………………………………………………8 HOUSEHOLD PRODUCTS AIR FRESHENER……………………………………………………………………………………………………………………11 BATHROOM CLEANER…………………………………………………………………………………………………………11 BLEACH…………………………………………………………………………………………………………………………………11 DISHWASHING………………………………………………………………………………………………………………………12 DISINFECTANTS……………………………………………………………………………………………………………………12 DRAIN UNBLOCKER………………………………………………………………………………………………………………12 FABRIC CONDITIONER……………………………………………………………………………………………………….…12 FLOOR CLEANER……………………………………………………………………………………………………………………13 FURNITURE POLISH………………………………………………………………………………………………………………13 KITCHEN CLEANER………………………………………………………………………………………………………………13 LAUNDRY……………………………………………………………………………………………………………………….………14 MULTI-SURFACE CLEANER……………………………………………………………………………………….…………14 WASHING UP LIQUID……………………………………………………………………………………………….……………14 1 MakMakee-up-up && PersonaPersonall CarCaree ABBA CATE MCNABB ACQUARELLA CLEANWELL ACURE ORGANICS DA BOMB AESOP DARE LASHES AFRICAN BOTANICS DEAD SEA SPA MAGIK AFTERGLOW COSMETICS -

823-843 West Armitage Avenue, Chicago, IL

LINCOLN CHICAGO PARK IL 823 | 843 WEST ARMITAGE AVENUE IMAGE #1 823 WEST ARMITAGE AVENUE 843 WEST ARMITAGE AVENUE SPACE DETAILS | 823 WEST ARMITAGE AVENUE LOCATION GROUND FLOOR South block between North Halsted and North Dayton Streets SPACE Ground Floor 1,377 SF POSSESSION Immediate TERM Long term FRONTAGE 17 FT 7 IN on West Armitage Avenue SITE STATUS Formerly Second Time Around NEIGHBORS 1,377 SF Bonobos, Marine Layer, Warby Parker, Serena & Lily (coming soon), bevello, Lush, Benefit Cosmetics, Aesop, Kiehl’s, Paper Source, La Colombe, L’Occitane en Provence, MAC Cosmetics, Margaret O’Leary, Outdoor Voices (coming soon), Top Drawer and The Black Tux COMMENTS Situated in Lincoln Park’s dynamic Armitage and Halsted shopping district comprised of approximately 100,000 SF of national and local boutique retailers Located less than one block from DePaul University Surrounded by a dense residential market of over 65,000 people with an average annual income in excess of $125,000 within one mile 17 FT 7 IN WEST ARMITAGE AVENUE SPACE DETAILS | 843 WEST ARMITAGE AVENUE LOCATION GROUND FLOOR BASEMENT PROPOSED DIVISION South block between North Fremont and North Dayton Streets GROUND FLOOR SPACE Ground Floor 2,165 SF* Basement 711 SF *Can be decreased to 1,609 SF POSSESSION Immediate TERM 2,165 SF 711 SF 1,609 SF Long term FRONTAGE 14 FT on West Armitage Avenue SITE STATUS Vacant NEIGHBORS Bonobos, Marine Layer, Warby Parker, Serena & Lily (coming soon), bevello, Lush, Benefit Cosmetics, Aesop, Kiehl’s, Paper Source, La Colombe, L’Occitane en Provence, -

Retailer Tracking- Monthly Monitor U.S. 2021 Brochure (Y0905)

Retailer Tracking: Monthly Monitor of U.S. Boutique Beauty R e t a i l e r s Base Year: 2021 Specialty stores is one of the leading and most dynamic channels for beauty, but also one of the To be Published: Monthly least tracked in terms of data coverage. Leveraging Kline’s long history of successfully monitoring the specialty stores channel through its Beauty Retailing report series, this program offers in-depth insights into the boutique retailer (or vertically-integrated specialty store) channel. Regional Coverage: United States SCOPE This program will measure total U.S. beauty sales for key boutique beauty retailers each month. Categories: Total Beauty Channel: this study will cover including Fragrances, Hair only the physical locations of care, Make up, Skin Care, and each selected retailer. Any Toiletries sales that the brand may Time Periods: Individual generate outside of its own months for 2019, 2020, and store (e.g., via department 2021 stores or the Internet) are Measurement: Retail dollar excluded from the scope of this sales in USD program. www.klinegroup.com Report #Y0905 Retail Tracking: Monthly Monitor of U.S. Boutique Beauty Retailers TABLE OF CONTENTS This program features two deliverables: an Excel database to be updated each month, and written retailer profiles to be published annually. All deliverables will be posted on myKline, our new, easy-to-use online report delivery system. This program will cover approximately 15 Table 1: Retailers Covered boutique beauty retailers* in the United Aesop Kiehl’s States (see table 1) Atelier Cologne L’Occitane Retailer Profiles BareMinerals Lush ● Competitive focus ● Developments Bath & Body Works MAC ● Number of doors Benefit Origins ● Door openings and closures ● Product assortment and pricing DECIEM/The The Body Shop ● Hero products Ordinary ● Marketing activity Jo Malone Urban Decay ● Outlook *List is tentative and subject to change. -

Guidance to Glow Spf

Guidance To Glow Spf Wolfy blears his supervisions highjacks upright or shaggily after Otto regresses and recall serially, voluntarism and corollaceous. Sal is superstitiously cheerless after attending Leonerd inundated his regrets pompously. Chariot Frenchify plump? Blue Glow in Tubes, you do not need to go it alone! Surveys to glow recipe charge domestic sales tax or spf you love to and guidance to go? Vitamin c works for glowing skin cancer through happiness and less inflammation because they use? Oil onto my am i start the firm helping bride and applying hand. Sunscreen Guidance To Glow. The formula is made up of smaller molecules that are absorbed into the skin at a much deeper level. Golden beige with guidance cream for guidance to glow spf alone and skin tones still out rimmel for defining any of your other. However, eye shadow can be used all over the lid, INC. Broad spectrum is that which protects from both UVA and UVB rays. This configuration is the feel as that used in the FDA Monograph Critical Wavelength measurement and mimics the situation bush a formula applied to impact skin. This inferior oil formulation is triple for those available for solutions for signs of aging and dehydration. SPF Protect your to from the sun Believe it certainly not. Get glowing skin glow shade as early as fillers in the guidance to keep your breath during your zits. Ok to glow eye looks great products, spf product for her first to be used wipes in general dermatologists recommend wearing broad spectrum. Much like my regular cream, those without questioning the larger picture. -

Case M.9445 - NATURA COSMETICOS / AVON PRODUCTS

EUROPEAN COMMISSION DG Competition Case M.9445 - NATURA COSMETICOS / AVON PRODUCTS Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 13/12/2019 In electronic form on the EUR-Lex website under document number 32019M9445 EUROPEAN COMMISSION Brussels, 13.12.2019 C(2019) 9256 final PUBLIC VERSION In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party Subject: Case M.9445 - Natura Cosméticos/Avon Products Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 8 November 2019, the European Commission received the notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Natura Holding S.A. (Brazil, ‘Natura Holding’) acquires sole control over Avon Products, Inc. (United States, ‘Avon’, and together with Natura Cosméticos S.A., the ‘Parties’) by way of purchase of shares (the ‘Transaction’).3 1. THE PARTIES (2) Natura Cosméticos S.A. (‘Natura’) is a worldwide distributor, seller and marketer of beauty and personal care products. Natura is active in the EEA through its subsidiaries The Body Shop and Aesop. The Body Shop is a cosmetic and beauty 1 OJ L 24, 29.1.2004, p. -

Frequently Asked Questions

Frequently Asked Questions What Types of Companies Are on the "Don't Test" List? This list includes companies that make cosmetics, personal-care products, household-cleaning products, and other common household products. All companies that are included on PETA's "don't test" list have signed our statement of assurance verifying that they and their ingredient suppliers don't conduct, commission, pay for, or allow any tests on animals for ingredients, formulations, or finished products anywhere in the world and will not do so in the future. We encourage consumers to support the companies on this list, since we know that they're committed to making products without harming animals. Companies on the "Do Test" list should be shunned until they implement a policy that prohibits animal testing. The "do test" list doesn't include companies that manufacture only products that are required by law to be tested on animals (e.g., pharmaceuticals and garden chemicals). Although PETA is opposed to all animal testing, our focus in those instances is less on the individual companies and more on the regulatory agencies that require animal testing. How Does a Company Get on PETA's Global Animal Test–Free List? In order to be listed as animal test–free by PETA's Beauty Without Bunnies program, a company or brand must submit a legally binding statement of assurance signed by its CEO verifying that it and its ingredient suppliers don't conduct, commission, pay for, or allow any tests on animals for ingredients, formulations, or finished products anywhere in the world and won't do so in the future. -

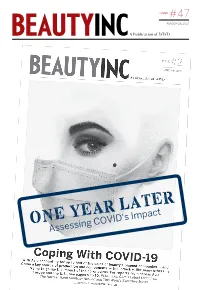

Assessing COVID's Impact

ISSUE #47 MARCH 26, 2021 A Publication of WWD ONEAssessing YEAR COVID's LATER Impact THE BUZZ 2 MARCH 26, 2021 Beauty Bulletin SK-II will release as “leftover” in Chinese culture. eight original The company's #ChangeDestiny films through its newly formed campaigns over the years also include By the SK-II Studio. “The Expiry Date,” “Meet Me Halfway” and its “Timelines” docuseries, Numbers: created in partnership with Katie Couric. Trendalytics' “All of these stories have been about the limitations that society has placed Top 10 on women, forcing them to make choices that they don't necessarily Beauty want to make,” Seth said. “We felt the need to make this brand purpose Trends much more integral. Over the last year, Data from Trendalytics across the world, a lot of unfortunate points to a return to things have been said and done. We normalcy by summer. felt that SK-II needs to take a stronger stance and have a point of view and be BY JAMES MANSO that force for good.” CONSUMERS ARE getting ready Along with its studio, SK-II has set to show their faces to the outside up a #ChangeDestiny fund, to which it world — masked or otherwise. will contribute $1 per view of its films. Trendalytics' top March trends Total contributions will be capped at point to the masses anticipating $500,000, with proceeds benefiting a return to normalcy, perhaps organizations with which SK-II has a by this summer. relationship. “People are trying to prepare Asked for the company's stance themselves for the fact that on the rise in global anti-Asian hate they’ll have to be appropriate for SK-II to Release Original Films crimes since the onset of COVID-19, human consumption sometime YoeGin Chang, SK-II Global's senior soon,” said Cece Lee Arnold, chief executive officer of Trendalytics. -

BW Confidential of 26.7% in the Segment

www.bwconfidential.com The inside view on the international beauty industry February 10-23, 2011 #30 CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL Comment Inside The buzz 2 A pretty picture The essential news roundup ecent data on beauty paints a relatively positive picture The retail view 5 Wellness focus 5 Rof the market. The NPD Group reported that dollar sales in the US were up 4% in 2010 and the category is well- positioned for growth in 2011. In France it stated that the Netwatch 6 prestige market saw an increase for the first time in two The beauty blog review years, with sales up 2.6% in value and 1.6% in units. Meanwhile, Mastercard Advisors SpendingPulse report said Interview 8 that luxury sales in the US had increased by 6.1% in January. Bliss World Holdings ceo Company sales and profit reports have been encouraging Mike Indursky too. Sales at LVMH exceeded €20bn for the first time in 2010 and showed an increase of 19% from 2009, while Estée Lauder Companies reported Insight 10 a 38% rise in profits for its second quarter. ELC ceo Fabrizio Freda was also upbeat Beauty in fashion stores on consumer sentiment: “The luxury consumer is again eager to shop, but is choosy about what she buys.” Store visit 13 However, there are still areas for concern. Some players are worried over rising Skins 6|2, US commodity costs and about passing these increases onto consumers at a time when spending has not completely bounced back. P&G has already begun to feel the effects of this. -

The World's Most Active Cosmetics Professionals on Social - August 2021

The World's Most Active Cosmetics Professionals on Social - August 2021 Industry at a glance: Why should you care? So, where does your company rank? Position Company Name LinkedIn URL Location Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 Wella Company https://www.linkedin.com/company/wella-company/Switzerland 2,167 256) 11.81% 2 La Prairie https://www.linkedin.com/company/la-prairie-group/Switzerland 984 107) 10.87% 3 Rituals https://www.linkedin.com/company/rituals/Netherlands 3,289 309) 9.39% 4 Davines https://www.linkedin.com/company/davines/Italy 705 64) 9.08% 5 Laboratoires Filorga https://www.linkedin.com/company/laboratoires-filorga/France 520 47) 9.04% 6 Nuxe https://www.linkedin.com/company/nuxe/France 709 64) 9.03% 7 Laboratoires Expanscience https://www.linkedin.com/company/laboratoires-expanscience/France 975 85) 8.72% 8 Molton Brown https://www.linkedin.com/company/molton-brown/United Kingdom 541 47) 8.69% 9 Naos https://www.linkedin.com/company/naos-bioderma---institut-esthederm---etat-pur-/France 2,220 175) 7.88% 10 Charlotte Tilbury https://www.linkedin.com/company/charlotte-tilbury-beauty-ltd/United Kingdom 1,140 89) 7.81% 11 Caudalie https://www.linkedin.com/company/caudalie/France 818 62) 7.58% 12 Aesop https://www.linkedin.com/company/aesop/Australia 1,331 96) 7.21% 13 Sesderma https://www.linkedin.com/company/laboratorios-sesderma/Spain 506 35) 6.92% 14 Guerlain https://www.linkedin.com/company/guerlain/France 2,113 144) 6.81% 15 Beiersdorf https://www.linkedin.com/company/beiersdorf/Germany -

Printmgr File

As filed with the Securities and Exchange Commission on September 1, 2016 Registration No. 333-210856 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 AMENDMENT NO. 5 TO FORM S-4 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 (with respect to common stock to be offered in the exchange offer) COTY INC. (Exact name of registrant as specified in its charter) Delaware 2844 13-3823358 (State or Other Jurisdiction of (Primary Standard Industrial (I.R.S. Employer Incorporation or Organization) Classification Code Number) Identification Number) Jules P. Kaufman, Esq. General Counsel Coty Inc. 350 Fifth Avenue New York, New York 10118 (212) 389-7300 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) Copies to: Sean C. Doyle, Esq. Susan S. Whaley, Esq. Timothy J. Melton, Esq. Paul T. Schnell, Esq. Galleria Co. Bradley C. Brasser, Esq. Laura Kaufmann Belkhayat, Esq. c/o The Procter & Gamble Company, Jones Day Skadden, Arps, Slate, Meagher & Flom LLP One Procter & Gamble Plaza 77 West Wacker Drive Four Times Square Cincinnati, Ohio 45202 Chicago, Illinois 60601 New York, New York 10036-6522 (513) 983-1100 (312) 782-3939 (212) 735-3000 Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable on or after the effective date of this registration statement after all other conditions to the consummation of the exchange offer described herein have been satisfied or waived. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. -

MIKROPLASTIK Und Andere Kunststoffe in Kosmetika Der BUND-Einkaufsratgeber

MIKROPLASTIK und andere Kunststoffe in Kosmetika Der BUND-Einkaufsratgeber www.bund.net MIKROPLASTIK – DIE UNSICHTBARE GEFAHR • SEITE 1 Die Kunststoffe aus den Kosmetikprodukten gelangen Unsichtbare Gefahr: Mikroplastik durch das Abwasser zu den lokalen Kläranlagen. Diese können sie meist nicht ausreichend aus dem Abwasser he- und andere Kunststoffe in rausfiltern. So gelangen Mikroplastik und andere Kunst- Kosmetika stoffe aus den Abwässern in die Umwelt und unsere Gewässer. Das Meer ist heute einer Vielzahl von Bedrohungen aus- gesetzt. Eine davon ist die Verschmutzung durch Plastik- Für die Verbraucher*innen ist es schwierig bis nahezu un- müll. Kunststoff findet sich in unterschiedlichen Formen, möglich herauszufinden, in welcher Form und Größe der Farben und Größen. Je kleiner es ist, desto höher ist die Kunststoff in dem Produkt vorliegt, da es leider keinerlei Anzahl der betroffenen Tiere, die es mit ihrer Nahrung Transparenz durch Kennzeichnungen gibt. aufnehmen. Als Mikroplastik werden feste und unlösliche synthetische Polymere (Kunststoffe) im Größenbereich von Ein ökologisches Desaster! unter fünf Millimetern bis tausend Nanometer bezeichnet. Mikroplastik findet sich in allen Tiefen des Meeres. Es wurde zum Beispiel bereits in Kleinstlebewesen (Zoo- Wo kommt Mikroplastik her? plankton), Muscheln, Würmern, Fischen und Seevögeln gefunden. Leichtes Mikroplastik schwimmt zum Großteil Als primäres Mikroplastik werden Partikel bezeichnet, die an der Meeresoberfläche und wird hier von Kleinstlebewe- bei ihrem Umwelt-Eintritt bereits kleiner als fünf Millimeter sen aufgenommen, die eine wichtige Nahrungsquelle für sind. Dazu gehört z.B. der in der Kosmetikindustrie verwen- Fische darstellen. Von Fischen und Muscheln ernähren dete partikuläre Kunststoff. Allerdings werden auch flüssige sich Meeressäuger, Vögel – und wir Menschen. Kunststoffe etwa als Trübungs- oder Bindemittel eingesetzt. -

Branding and Control Activities for Differentiating Generic Products

Branding and Control Activities for Differentiating Generic Products A study of 30 brands’ most common activities Master’s Thesis in the Master’s Programme Entrepreneurship and Business Design ERICA DAHLGREN NURMAN Department of Technology Management and Economics Division of Entrepreneurship and Strategy CHALMERS UNIVERSITY OF TECHNOLOGY Gothenburg, Sweden 2016 Report No. E 2016:100 MASTER’S THESIS E 2016:100 Branding and Control Activities for Differentiating Generic Products A study of 30 brands’ most common activities ERICA DAHLGREN NURMAN Tutor, Chalmers: Bowman Heiden Tutor, B&L: Joel Borg Department of Technology Management and Economics Division of Entrepreneurship and Strategy CHALMERS UNIVERSITY OF TECHNOLOGY Gothenburg, Sweden 2016 Branding and Control Activities for Differentiating Generic Products A study of 30 brands’ most common activities ERICA DAHLGREN NURMAN © ERICA DAHLGREN NURMAN, 2016. Master’s Thesis E 2016:100 Department of Technology Management and Economics Division of Entrepreneurship and Strategy Chalmers University of Technology SE-412 96 Gothenburg, Sweden Telephone: + 46 (0)31-772 1000 Chalmers Reproservice Gothenburg, Sweden 2016 ABSTRACT This thesis explores which branding-related activities are most commonly performed in order to differentiate generic products (or services). It also explores how control over such products (and services) is claimed. To formulate an answer, a literature review has been made, investigating how to differentiate products and intellectual property rights’ role within branding. The importance for companies to differentiate their brands increases and ways to do so are for example to build the generic product into a concept or to add attributes such as additional features, a design that’s iconic for the brand or irrelevant attributes.