Your Advisor and Financial Partner

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investors Presentation

Investors Presentation as of 31.12.2014 Ameria Group at a glance Professional advisory and banking services unified by high-level expertise and professional dedication CORPORATE, RETAIL AND INVESTMENT BANKING ADVISORY ASSET MANAGEMENT PROPERTY DEVELOPMENT Universal bank with The leader in the market of One of the first investment Company providing real integrated corporate, retail professional advisory services companies in Armenia, estate development and and investment banking of Armenia (since 1998) providing client tailored asset management services (since services (founded in 1910 as a management solutions (since 2010) branch of Caucasian Trade 2001) Bank) Mission and values Towards excellence and diversity OUR MISSION OUR VALUES Bringing leadership and dynamic development in Armenia and the region as a financial and advisory Client-oriented approach and superior service group committed to long-term dynamic economic quality development Being a client-oriented and reliable partner Trust and satisfaction of our clients Delivering innovations based on the best practice in Principles of business ethics and information financial and advisory services, business processes transparency Building a Dream Team of qualified, motivated and High level of professionalism and team spirit efficient staff 3 Our Partners and Directors Names talk for themselves Andrew Mkrtchyan 19 years of experience in investment and management advisory by Chairman of the Board standing at the roots of investment banking establishment in Armenia, (CEO, Ameria Group) board member in a number of private/public organizations. Prominent investment banker with more than 21 years of experience, key Ruben Vardanian figure in Russia’s capital markets establishment, a Founding Partner of Board Member Moscow School of Management SKOLKOVO , board member at numerous (Chairman of the Board, entities in Russia and abroad, member of the Economic Advisory Board at IDEA Foundation) the IFC, the private-sector arm of the World Bank Group. -

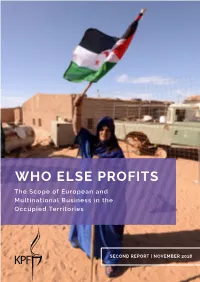

Who Else Profits the Scope of European and Multinational Business in the Occupied Territories

WHO ELSE PROFITS The Scope of European and Multinational Business in the Occupied Territories SECOND RepORT | NOVEMBER 2018 A Saharawi woman waving a Polisario-Saharawi flag at the Smara Saharawi refugee camp, near Western Sahara’s border. Photo credit: FAROUK BATICHE/AFP/Getty Images WHO ELse PROFIts The Scope of European and Multinational Business in the Occupied Territories This report is based on publicly available information, from news media, NGOs, national governments and corporate statements. Though we have taken efforts to verify the accuracy of the information, we are not responsible for, and cannot vouch, for the accuracy of the sources cited here. Nothing in this report should be construed as expressing a legal opinion about the actions of any company. Nor should it be construed as endorsing or opposing any of the corporate activities discussed herein. ISBN 978-965-7674-58-1 CONTENTS INTRODUCTION 2 WORLD MAp 7 WesteRN SAHARA 9 The Coca-Cola Company 13 Norges Bank 15 Priceline Group 18 TripAdvisor 19 Thyssenkrupp 21 Enel Group 23 INWI 25 Zain Group 26 Caterpillar 27 Biwater 28 Binter 29 Bombardier 31 Jacobs Engineering Group Inc. 33 Western Union 35 Transavia Airlines C.V. 37 Atlas Copco 39 Royal Dutch Shell 40 Italgen 41 Gamesa Corporación Tecnológica 43 NAgoRNO-KARABAKH 45 Caterpillar 48 Airbnb 49 FLSmidth 50 AraratBank 51 Ameriabank 53 ArmSwissBank CJSC 55 Artsakh HEK 57 Ardshinbank 58 Tashir Group 59 NoRTHERN CYPRUs 61 Priceline Group 65 Zurich Insurance 66 Danske Bank 67 TNT Express 68 Ford Motor Company 69 BNP Paribas SA 70 Adana Çimento 72 RE/MAX 73 Telia Company 75 Robert Bosch GmbH 77 INTRODUCTION INTRODUCTION On March 24, 2016, the UN General Assembly Human Rights Council (UNHRC), at its 31st session, adopted resolution 31/36, which instructed the High Commissioner for human rights to prepare a “database” of certain business enterprises1. -

INVESTOR PRESENTATION Content

30-June-2019 INVESTOR PRESENTATION Content Ameriabank at a Glance Armenia Macro Indicators Armenian Banking Sector Indicators Ameriabank Financial Results Ameriabank Strategy Highlights Annex 1 Investment Highlights The Leading Bank in Armenia st 1 in the market Impressive by key financial indicators since Above Average Stable and 2015 Growth resilient emerging Above 20% 5-yr economy, with CAGR in key high GDP growth, financial metrics low inflation and stable exchange rates Attractive Macro Superior customer Fundamentals service, proven Best practice corporate governance leadership not only by system and principles, professional financials but also by and experienced management culture and values team Innovator and Strong Team and Trend Setter Corporate Culture 2 The Leading Bank in Armenia Overview The largest universal bank in Armenia, offering corporate, investment Assets 15.4% and retail banking services. Loans 17.2% 1st in the market by key financial indicators: assets, loans, liabilities, net profit and equity Liabilities 16.0% Major contributor to Armenian banking sector development Ongoing appreciation and quality recognitions by reputable global Equity 11.8% institutions Net Profit 14.5% Highest possible credit ratings for an institution operating in Armenia Ameriabank Market Share Ratings S&P Ownership structure Long-term B+ Short-term B Outlook stable EBRD SACP bb- 18 1027 17.8% Branches Employees Moody's Ameria Group (CY) Ltd 56.5% Bank Deposits (LC) Ba3/NP ESPS Bank Deposits (FC) B1/NP Holding Ltd BCA ba3 11.7% 133 2252 -

Investors Presentation

INVESTORS PRESENTATION as of 31.03.2015 Ameria Group at a Glance Armenia Macro Indicators Armenian Banking sector indicators Ameriabank Balance Sheet Ameriabank Income statement Ratios and Statements Annex 1: Ameriabank statements and Peers 1 Ameria Group at a glance Professional advisory and banking services unified by high‐level expertise and professional dedication ADVISORY: LEGAL, TAX CORPORATE, RETAIL AND PROPERTY MANAGEMENT INVESTMENT BANKING DEVELOPMENT The leader in the market of Universal bank with Company providing real professional advisory integrated corporate, retail estate development and services of Armenia (since and investment banking management services (since 1998) services (founded in 1910 as 2010) a branch of Caucasian Trade Bank) 2 Mission and values Towards excellence and diversity OUR MISSION OUR VALUES TO IMPROVE THE QUALITY OF LIFE BY: Providing WORLD‐CLASS financial Client‐oriented approach and superior service 1 services and business solutions 1 quality to our customers Implementing business and social projects Trust and satisfaction of our clients 2 significantly impacting the 2 WELL‐BEING of the society Creating unique corporate culture and Principles of business ethics and information 3 development model of an international 3 transparency company, uniting the efforts of SUCCESSFUL PEOPLE Consistently INCREASING our High level of professionalism and 4 SHAREHOLDER VALUE 4 team spirit 3 Our partners and Directors Names talk for themselves ANDREW MKRTCHYAN RUBEN VARDANIAN NOUBAR AFEYAN ROBERT VON REKOWSKY GOR -

2020 Q2 Investor Presentation

30-June-2020 INVESTOR PRESENTATION Content Ameriabank at a Glance 2020 Q2 Snapshot 2020 Q2 Financial Results Strategy Highlights Appendices 1 The Leading Bank in Armenia Overview Assets 14.8% The largest universal bank in Armenia, offering corporate, investment and retail banking services. Loans 15.8% 1st in the market by key financial indicators: assets, liabilities and equity Liabilities 15.3% Major contributor to Armenian banking sector development Ongoing appreciation and quality recognitions by reputable global Equity 11.9% institutions Net Profit Highest possible credit ratings within current sovereign rating constraints. 11.3% Ameriabank Market Share Ratings Ownership structure S&P Long-term B+ EBRD 17.76% Short-term B Outlook stable ESPS SACP bb- 19 1083 45 Imast Group Holding Ltd Branches Employees Terminals (CY) Ltd* 11.83% Moody's 48.95% Bank Deposits (LC) Ba3/NP ADB Bank Deposits (FC) B1/NP 13.94% BCA ba3 Afeyan Foundation 146 2847 515 CRA Ba3(cr)/NP for Armenia Inc. ATMs POS Virtual POS 7.53% Outlook stable Terminals Terminals * Ameria Group (CY) Ltd was renamed to Imast Group (CY) Ltd 2 Investment Highlights The Leading Bank in Armenia 1st in the market by key financial Omni channel indicators since Distribution Stable and 2015 resilient emerging Platform with economy, with Focus on Digital high GDP growth, 88% offloading low inflation and ratio stable exchange rates Attractive Macro Superior customer Fundamentals service, proven Best practice corporate governance leadership not only by system and principles, professional financials but also by and experienced management culture and values team Innovator and Strong Team and Trend Setter Corporate Culture 3 Content Ameriabank at a Glance 2020 Q2 Snapshot 2020 Q2 Financial Results Strategy Highlights Appendices 4 2020 Q2 Achievements Assets of AMD 885 B 1st Liabilities of AMD 780 B 2nd a leader Loans* of AMD 597 B 2nd per 2020 Q2 results Equity of AMD 106 B 1st Profit of AMD 4.6 B 3rd S&P re-affirms Ameriabank’s ‘B+’ Rating with Stable Outlook. -

Vision and Message from the Management Major

CONTENTS 3 VISION AND MESSAGE FROM THE MANAGEMENT 8 MAJOR ACHIEVEMENTS IN 2011 12 ABOUT THE BANK 13 Ameria Group 14 Main Milestones of Development 16 Partners 18 OUR PHILOSOPHY AND VALUES 19 Mission and Philosophy 19 Our Values 20 Strategy 20 Corporate Social Responsibility 22 CORPORATE GOVERNANCE AND RISK MANAGEMENT 23 Ameriabank Stakeholders 23 Ameriabank Management 25 Organizational Structure of the Bank 26 HR Management 28 Core Management Principles 29 Client Relationship Management 29 Risk Management 32 EXTERNAL ENVIRONMENT 33 Macroeconomic prerequisites 35 Legal Framework, Government Regulations, Financial Infrastructure 39 Banking Sector of Armenia 40 Position of Ameriabank in the Banking Sector of Armenia 44 BANK DEVELOPMENT RESULTS 46 Bank Key Growth Indicators 47 Asset Operations 48 Resource Base 49 Development of Management System, Technologies and Infrastructure 50 Clients and New Products 52 CORPORATE BANKING 58 RETAIL BANKING 64 INVESTMENT BANKING AND TRADING OPERATIONS 66 AMERIABANK STRATEGIC GOALS AND PLANS FOR 2012 70 FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS’ REPORT 78 USEFUL INFORMATION ABOUT THE BANK 1 VISION AND MESSAGE FROM THE MANAGEMENT Freedom to express more 3 VISION OF AND MESSAGE FROM THE MANAGEMENT Dear Ladies and Gentlemen We are pleased to announce the year 2011 to be another Throughout 2011 we remained committed to our efficiency year of success and quality growth of Ameriabank, due to the providing policy and we will stay consistent and loyal in 2012. trust and loyalty of our clients, efficient work of management and members of the Board of Directors, as well as invaluable One of our major strategic goals for 2012 is the development of contribution of our shareholders. -

INVESTOR PRESENTATION Content

31-March-2020 INVESTOR PRESENTATION Content Ameriabank at a Glance 2020 Q1 Snapshot External Environment Ameriabank Financial Results Ameriabank Strategy Highlights Annex 1 Investment Highlights The Leading Bank in Armenia 1st in the market by key financial Omni channel indicators since Distribution Stable and 2015 resilient emerging Platform with economy, with Focus on Digital high GDP growth, 87% offloading low inflation and ratio stable exchange rates Attractive Macro Superior customer Fundamentals service, proven Best practice corporate governance leadership not only by system and principles, professional financials but also by and experienced management culture and values team Innovator and Strong Team and Trend Setter Corporate Culture 2 The Leading Bank in Armenia Overview Assets 15.5% The largest universal bank in Armenia, offering corporate, investment and retail banking services. Loans 16.2% 1st in the market by key financial indicators: assets, loans, liabilities and Liabilities 16.1% equity Major contributor to Armenian banking sector development Equity 12.1% Ongoing appreciation and quality recognitions by reputable global institutions Net Profit 12.8% Highest possible credit ratings within current sovereign rating constraints. Ameriabank Market Share Ratings Ownership structure S&P Long-term B+ EBRD 17.76% Short-term B Outlook stable ESPS SACP bb- 19 1067 45 Ameria Group Holding Ltd Branches Employees Terminals (CY) Ltd 11.83% 48.95% Moody's Bank Deposits (LC) Ba3/NP ADB Bank Deposits (FC) B1/NP 13.94% BCA ba3 Afeyan Foundation -

INVESTOR PRESENTATION Content

31-March-2019 INVESTOR PRESENTATION Content Ameriabank at a Glance Armenia Macro Indicators Armenian Banking Sector Indicators Ameriabank Financial Results Ameriabank Strategy Highlights Annex 1 Investment Highlights The Leading Bank in Armenia st 1 in the market Impressive by key financial indicators since Above Average Stable and 2015 Growth resilient emerging Above 20% 5-yr economy, with CAGR in key high GDP growth, financial metrics low inflation and stable exchange rates Attractive Macro Superior customer Fundamentals service, proven Best practice corporate governance leadership not only by system and principles, professional financials but also by and experienced management culture and values team Innovator and Strong Team and Trend Setter Corporate Culture 2 The Leading Bank in Armenia Overview The largest universal bank in Armenia, offering corporate, investment Assets 15.1% and retail banking services. Loans 17.2% 1st in the market by key financial indicators: assets, loans, liabilities, net profit and equity Liabilities 15.7% Major contributor to Armenian banking sector development Ongoing appreciation and quality recognitions by reputable global Equity 11.9% institutions Net Profit 14.8% Highest possible credit ratings for an institution operating in Armenia Ameriabank Market Share Ratings S&P Ownership structure Long-term B+ Short-term B Outlook stable EBRD SACP bb- 19 933 17.8% Branches Employees Moody's Ameria Group (CY) Ltd 56.5% Bank Deposits (LC) B1/NP ESPS Bank Deposits (FC) B2/NP Holding Ltd BCA b1 11.7% 125 2021 350 -

Annual Report Contents

2 0 1 9 annual report contents OVERVIEW Ameriabank at a glance 2 Chairman’s Statement 5 Chief Executive’s Review 7 Historic Milestones 9 Global Partners 11 Awards 13 STRATEGIC REPORT External Environment 15 Banking Sector in Armenia 20 Position of Ameriabank in the Banking Sector of Armenia 27 Business Model and Strategy 30 Retail Banking 33 Corporate and Investment Banking (CIB) 39 Trading 50 Innovation and Digitalization 52 Environmental and Social Governance 60 RISK MANAGEMENT Risk Management Objectives and Principles 63 Risk Appetite 66 Key Risks and Risk Profile 67 Risk Management Framework 79 Risk Organization and Governance 81 GOVERNANCE REPORT Chairman's Corporate Governance Statement 87 Corporate Governance Structure 88 Board of Directors 89 Board Committees 91 Members of the Board of Directors 93 Management Board and CEO 100 Organizational Chart 107 Our People 110 RESPONSIBILITY STATEMENT 116 FINANCIAL STATEMENTS Independent Auditor’s Report 119 Financial Statements 124 APPENDIX Abbreviations 205 OVERVIEW 2 Ameriabank at a glance Ameriabank is a dynamically developing bank and one of the major and most stable financial institutions in Armenia with clearly formulated digital agenda. Being the B first investment bank in Armenia, Ameriabank is now a universal bank offering innovative corporate, investment and retail banking services in a comprehensive package of banking solutions. Ameriabank is the leading bank in Armenia as measured by all key financial indicators (assets, liabilities, loans portfolio, net profit and equity) according to the 2019 year reportable data. In line with its mission of “improving the quality of life”, Ameriabank is currently going through a transformation process to become a more customer-centric bank, by enhancing digital capabilities and developing new products and solutions based on the evolving needs and preferences of the customers. -

Your Advisor and Financial Partner

Your advisor and financial partner As of 30.09.2014 Ameria Group at a glance Professional advisory and banking services unified by high-level expertise and professional dedication CORPORATE, RETAIL AND INVESTMENT BANKING ADVISORY ASSET MANAGEMENT Universal bank with The leader in the market of One of the first investment integrated corporate, retail professional advisory services companies in Armenia, and investment banking of Armenia (since 1998) providing client tailored asset services (founded in 1910 as a management solutions (since branch of Caucasian Trade 2001) Bank) Mission and values Towards excellence and diversity OUR MISSION OUR VALUES Bringing leadership and dynamic development in Armenia and the region as a financial and advisory Client-oriented approach and superior service group committed to long-term dynamic economic quality development Being a client-oriented and reliable partner Trust and satisfaction of our clients Delivering innovations based on the best practice in Principles of business ethics and information financial and advisory services, business processes transparency Building a Dream Team of qualified, motivated and High level of professionalism and team spirit efficient staff 3 Our Partners and Directors Names talk for themselves Andrew Mkrtchyan 18 years of experience in investment and management advisory by Chairman of the Board standing at the roots of investment banking establishment in Armenia, (CEO, Ameria Group) board member in a number of private/public organizations. Prominent investment banker with more than 21 years of experience, key Ruben Vardanian figure in Russia’s capital markets establishment, a Founding Partner of Board Member Moscow School of Management SKOLKOVO , board member at numerous (Chairman of the Board, entities in Russia and abroad, member of the Economic Advisory Board at IDEA Foundation) the IFC, the private-sector arm of the World Bank Group. -

Freedom to Achieve More

FREEDOM TO ACHIEVE MORE ANNUAL REPORT CONTENTS 3 Message from Management 62 Bank Development Results 4 Message from Ruben Vardanian 63 Key Growth Indicators 6 Message from Artak Hanesyan 67 Assets 8 Major Achievements in 2013 70 Liabilities 12 About Ameria Group 73 Development of Management Systems, 13 Ameria Group of Companies Technologies and Infrastructure 16 Historic Milestones of Development 75 Clients and New Products 20 Global Partners 76 Corporate Banking 22 Philosophy and Values 79 Business Lending 23 Mission and Philosophy 82 Finance Lease 25 Our Values 83 Factoring 25 Strategy 85 Trade Finance 26 Corporate Social Responsibility 86 Retail Banking 28 Corporate Governance and Risk Management 89 Retail Lending 29 Ameriabank Shareholders 94 Payment Cards 29 Ameriabank Management 97 Salary Projects 32 Core Management Principles 97 Money Transfers 33 Organizational Chart of the Bank 98 Investment Banking 35 Corporate Governance and Risk Management and Trading Operations 37 HR Management 99 Financial Institutions 39 Client Relationship Management 99 Corporate Finance 40 Risk Management 101 Capital Markets 44 External Environment 103 Mergers and Acquisitions 45 Macroeconomic Prerequisites 105 Trading 51 Legal Framework, Government Regulations, 106 Ameriabank Strategic Goals and Plans for 2014 Financial Infrastructure 110 Financial Statements 54 Banking Sector of Armenia and Independent Auditors Report 58 Position of Ameriabank in the Banking Sector of Armenia 118 Useful Information about the Bank 2 ANNUAL REPORT 2013 обращение руководства MESSAGE FROM MANAGEMENT Message from Ruben Vardanian Dear Ladies and Gentlemen I am happy to announce that due to trust for the 4th consecutive year has undertaken the Board by engaging independent board members and loyalty of our clients, proficiency of our organization of Christmas charity auction aimed and following corporate governance codes and management team and Board members, as well at medical treatment of 17 kids with various policies. -

Loan Portfolio

Ameriabank at a Glance 2021 Q1 Snapshot 2021 Q1 Financial Results Strategy Highlights Appendices Investor Presentation 01 Ameriabank.am The Leading Bank in Armenia 1 1st in the market by key financial indicators since 2015, offering a window onto the whole Armenian Economy Omni channel Distribution Platform with Focus on Digital 2 92% offloading ratio* Innovator and Trend Setter Superior customer service, proven leadership by culture and 3 values, doing business responsibly and promoting ESG culture in Investment the country, first Green Bond issuer in the country. Best in class Governance Practices Best practice corporate governance and unique culture, Highlights 4 professional and experienced management team Robustness and Resilience with Significant Growth Potential Sustaining decent performance during challenging times, post- 5 pandemic accelerated growth and enhanced profitability. Attractive Macro Fundamentals Emerging economy, with proven resilience towards crises and 6 external shocks, high average economic growth, low inflation and stable exchange rate. Investor Presentation 02 Ameriabank.am * Share of transactions performed via distance and digital channels in total number of bank's transactions. The Leading Bank in Armenia 20 1,132 43 Overview The largest universal bank in Armenia, offering corporate, investment and retail banking services. 654 151 3,106 1st in the market by key financial indicators: assets, liabilities, loans, deposits, profit and equity Major contributor to Armenian banking sector development Ongoing appreciation and quality recognitions by reputable global institutions Ratings Ownership Highest possible credit ratings within current sovereign rating Structure constraints. S&P EBRD B+ Long-Term 17.74% B Assets 15.2% Short-Term negative EPS Holding LTD Outlook 11.92% Loans 17.1% SACP bb- Imast Group (CY) LTD 48.9% Liabilities 15.6% ADB Bank deposits Ba3/NP 13.93% Equity 12.5% BCA B1 Ba3(cr)/NP Afeyan foundation for Net Profit 20.2% CRA Armenia inc.