Evolution Mining Australia’S Newest Mid-Tier Gold Producer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

APPENDIX 4E EVOLUTION MINING LIMITED ACN 084 669 036 and CONTROLLED ENTITIES ANNUAL FINANCIAL REPORT for the Year Ended 30 June 2020

APPENDIX 4E EVOLUTION MINING LIMITED ACN 084 669 036 AND CONTROLLED ENTITIES ANNUAL FINANCIAL REPORT For the year ended 30 June 2020 Results for Announcement to the Market Key Information 30 June 2020 30 June 2019 Up / (down) % Increase/ $'000 $'000 $'000 (decrease) Revenues from contracts with customers 1,941,863 1,509,824 432,039 29% SPACE Earnings before Interest, Tax, Depreciation & Amortisation (EBITDA) 1,029,432 730,262 299,170 41% SPACE Statutory profit before income tax , 314,826 , % SPACE Profit from ordinary activities after income tax attributable to the members , 218,188 , % Dividend Information Amount Franked amount per share per share Cents Cents Final dividend for the year ended 30 June 2020 Dividend to be paid on 25 September 2020 9.0 9.0 Space Interim dividend for the year ended 30 June 2020 Dividend fully paid on 27 March 2020 7.0 7.0 Space Final dividend for the year ended 30 June 2019 Dividend fully paid on 27 September 2019 6.0 6.0 Net Tangible Assets 30 June 2020 30 June 2019 $ $ Net tangible assets per share 1.47 1.45 Earnings Per Share 30 June 2020 30 June 2019 Cents Cents Basic earnings per share 17.71 12.86 Diluted earnings per share 17.62 12.78 Additional Appendix 4E disclosure requirements can be found in the notes to these financial statements and the Directors' Report attached thereto. This report is based on the consolidated financial statements which have been audited by PricewaterhouseCoopers. Evolution Mining Limited Directors' Report 30 June 2020 Directors' Report The Directors present their report together with the consolidated financial report of the Evolution Mining Limited Group, consisting of Evolution Mining Limited ("the Company") and the entities it controlled at the end of, or during, the year ended 30 June 2020. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Aussie Mine 2016 the Next Act

Aussie Mine 2016 The next act www.pwc.com.au/aussiemine2016 Foreword Welcome to the 10th edition of Aussie Mine: The next act. We’ve chosen this theme because, despite gruelling market conditions and industry-wide poor performance in 2016, confidence is on the rise. We believe an exciting ‘next act’ is about to begin for our mid-tier miners. Aussie Mine provides industry and financial analysis on the Australian mid-tier mining sector as represented by the Mid-Tier 50 (“MT50”, the 50 largest mining companies listed on the Australian Securities Exchange with a market capitalisation of less than $5bn at 30 June 2016). 2 Aussie Mine 2016 Contents Plot summary 04 The three performances of the last 10 years 06 The cast: 2016 MT50 08 Gold steals the show 10 Movers and shakers 12 The next act 16 Deals analysis and outlook 18 Financial analysis 22 a. Income statement b. Cash flow statement c. Balance sheet Where are they now? 32 Key contributors & explanatory notes 36 Contacting PwC 39 Aussie Mine 2016 3 Plot summary The curtain comes up Movers and shakers The mining industry has been in decline over the last While the MT50 overall has shown a steadying level few years and this has continued with another weak of market performance in 2016, the actions and performance in 2016, with the MT50 recording an performances of 11 companies have stood out amongst aggregated net loss after tax of $1bn. the crowd. We put the spotlight on who these movers and shakers are, and how their main critic, their investors, have But as gold continues to develop a strong and dominant rewarded them. -

Metals & Mining Sector Profile

Metals & Mining Sector Profile Overview The Metals & Mining sector is the largest industry sector by number of companies with over 650 involved in mineral exploration, development and production in over 100 countries. The sector comprises several of the world’s largest diversified resource companies, including global giants such as BHP Billiton and Rio Tinto, as well as a representation of potential future industry leaders in the mid-tier producers and junior miners. The sector has always been reliant on equity markets to provide the funding required for the capital intensive development of mineral projects or the funding of higher risk exploration to locate new deposits. Investors in the Australian market have supported over 290 new junior resource floats since 2009. Reasons to list Metals & Mining companies S&P/ASX 200 v S&P/ASX 300 Metals & Mining on ASX 175 • Access to capital: 150 – A global market with a wide range of institutional and retail investors 125 – Australia has the 6th largest pool of investment assets in the l world and the largest in Asia* 100 Leve • A natural destination for international mining capital - 75 a developed market in one of the world’s major mining regions Index 50 • Peer Group: list alongside key industry players • Opportunities for SMEs: a broad service offering for early 25 stage and mature companies 0 7 7 9 8 1 7 3 * Source: Austrade, Investment Company Institute, Worldwide Mutual Fund 4 Jul 1 Jul 1 Jul 1 Jul 15 Jul 12 Jul 16 Jul 1 Jul 10 Jan 11 Jul 0 Jul 0 Jan 17 Jan 13 Jan 15 Jul 0 Jan 12 Jan 16 Jan -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD -

Aon Non Executive Director Survey Participating Organisations (Pdf, 181.66Kb)

Proprietary and Confidential Constituent Organisations . Abacus Property Group . Bendigo and Adelaide Bank Limited . Accent Group Limited . BHP Group Limited . Adelaide Brighton Ltd. Bingo Industries Ltd. Afterpay Touch Group Limited . Blackmores Limited . AGL Energy Limited . Blue Sky Alternative Investments Ltd. Alacer Gold Corp. Bluescope Steel Limited . ALS Ltd. Boral Limited . Altium Limited . Brambles Limited . Altura Mining Ltd. Bravura Solutions Limited . Alumina Ltd. Breville Group Limited . AMA Group Ltd. Brickworks Ltd. amaysim Australia Ltd. Bubs Australia Ltd. Amcor Plc . BWX Ltd. AMP Ltd. Caltex Australia Ltd. Ansell Limited . Cardno Limited . APA Group . Carnarvon Petroleum Limited . APN Industria REIT . Carsales.Com Limited . Appen Ltd. Cedar Woods Properties Limited . ARB Corp. Ltd. Centuria Capital Group . Ardent Leisure Group Ltd. Challenger Limited . Arena REIT . Champion Iron Ltd. Aristocrat Leisure Limited . Charter Hall Group . Arq Group Ltd. Charter Hall Long WALE REIT . Asaleo Care Ltd. Charter Hall Retail REIT . ASX Limited . Chorus Ltd. Atlas Arteria . CIMIC Group Ltd. AUB Group Limited . Class Ltd. (Australia) . Auckland International Airport Ltd. Clean Teq Holdings Limited . Audinate Group Ltd. Cleanaway Waste Management Ltd. Aurelia Metals Limited . Clinuvel Pharmaceuticals Limited . Aurizon Holdings Ltd. Coca-Cola Amatil Ltd. AusNet Services Ltd. Cochlear Limited . Austal Limited . Codan Limited . Australia & New Zealand Banking Group . Coles Group Ltd. Ltd. Collins Foods Limited . Australian Agricultural Co. Ltd. Commonwealth Bank of Australia . Australian Pharmaceutical Industries Ltd. Computershare Limited . Australian Scholarships Group . Cooper Energy Limited . Automotive Holdings Group Ltd. Coopers Brewery Ltd . Avanti Finance Limited . Corporate Travel Management Limited . Aventus Group . Costa Group Holdings Ltd. Aveo Group . Credit Corp. Group Ltd. Avita Medical Ltd. Cromwell Property Group . Baby Bunting Group Ltd. -

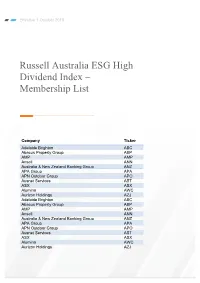

Russell Australia ESG High Dividend Index – Membership List

Effective 1 October 2018 Russell Australia ESG High Dividend Index – Membership List Company Ticker Adelaide Brighton ABC Abacus Property Group ABP AMP AMP Ansell ANN Australia & New Zealand Banking Group ANZ APA Group APA APN Outdoor Group APO Ausnet Services AST ASX ASX Alumina AWC Aurizon Holdings AZJ Adelaide Brighton ABC Abacus Property Group ABP AMP AMP Ansell ANN Australia & New Zealand Banking Group ANZ APA Group APA APN Outdoor Group APO Ausnet Services AST ASX ASX Alumina AWC Aurizon Holdings AZJ Company Ticker Bendigo and Adelaide Bank BEN Bega Cheese BGA Boral BLD Bank of Queensland Ltd. BOQ Beach Energy BPT Bluescope Steel BSL Brambles BXB Commonwealth Bank of Australia CBA Coca-Cola Amatil CCL Challenger CGF Charter Hall Group CHC CIMIC Group CIM Cromwell Property Group CMW Cochlear COH Computershare CPU Charter Hall Retail REIT CQR CSL CSL CSR CSR Caltex Australia CTX Cleanaway Waste Management CWY DuluxGroup DLX Downer Group DOW Dexus Property Group DXS Evolution Mining EVN Fortescue Metals Group FMG Genworth Mortgage Insurance Australia GMA Goodman Group GMG Graincorp GNC Growthpoint Properties Australia GOZ GPT Group GPT Healthscope HSO Insurance Australia Group IAG IOOF Holdings IFL Infigen Energy IFN Independence Group NL IGO Iluka Resources ILU Investa Office Fund IOF Incitec Pivot Ltd IPL Lend Lease Group LLC Magellan Financial Group MFG Mirvac Group MGR Medibank Private MPL Macquarie Group MQG National Australia Bank NAB Company Ticker Scentre Group SCG Shopping Centres Australasia Property Group SCP Sandfire Resources NL SFR Stockland SGP Sonic Healthcare SHL Santos STO Super Retail Group SUL Suncorp Group SUN Sydney Airport SYD Transurban Group TCL Tassal Group TGR Telstra Corp TLS Vicinity Centers VCX Westpac Banking Corp WBC Wesfarmers WES WorleyParsons Ltd. -

Dow Jones Sustainability Australia Index

Effective as of 23 September 2019 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia & New Zealand Banking Group Ltd Australia Banks National Australia Bank Ltd Australia Banks Westpac Banking Corp Australia Banks CIMIC Group Ltd Australia Capital Goods Brambles Ltd Australia Commercial & Professional Services Downer EDI Ltd Australia Commercial & Professional Services Addition Star Entertainment Grp Ltd Australia Consumer Services Tabcorp Holdings Ltd Australia Consumer Services Janus Henderson Group PLC United Kingdom Diversified Financials Macquarie Group Ltd Australia Diversified Financials Oil Search Ltd Australia Energy Woodside Petroleum Ltd Australia Energy Coles Group Ltd Australia Food & Staples Retailing Fisher & Paykel Healthcare Corp Ltd New Zealand Health Care Equipment & Services Asaleo Care Ltd Australia Household & Personal Products Insurance Australia Group Ltd Australia Insurance QBE Insurance Group Ltd Australia Insurance BHP Group Ltd Australia Materials Boral Ltd Australia Materials Addition Evolution Mining Ltd Australia Materials Addition Fletcher Building Ltd New Zealand Materials Addition Fortescue Metals Group Ltd Australia Materials Iluka Resources Ltd Australia Materials Incitec Pivot Ltd Australia Materials Independence Group NL Australia Materials Addition Newcrest Mining Ltd Australia Materials Orica Ltd Australia Materials Orocobre Ltd Australia Materials Rio Tinto Ltd Australia Materials Sims Metal Management Ltd Australia Materials South32 Ltd Australia Materials -

BUY Pilbara Minerals

Metals & Mining For FCA purposes this is a Marketing Communication Pilbara Minerals 2 June 2016 Initiating Coverage BUY Mining a piece of the future Pilbara Minerals is developing the Pilgangoora lithium deposit in Western Australia Current Share Price AUc65 that should be developed into a 2Mt/year mine producing 330kt/year of high grade Target Price AUc85 spodumene. We expect initial capex of A$184 million with opex of A$252/t of Market Capitalisation AUD744.2m concentrate compared to a LOM assumed spodumene price of US$550/t. Lithium is Shares In Issue 1,145m a key component in batteries for both electric vehicles and domestic and industrial RIC/BLBG PLS.ASX/PLS.AU power storage. We value the project at 1.0x our 7% NAV and initiate coverage with Avg. Daily Volume (3M) 10,075,165 Net Cash/(Debt) (m) (06/16F) AUD165.0m a BUY recommendation and a target price of A$0.85/share. Current share price(s) timed at 4:30pm on 31/05/16 ● High grade hard rock lithium in a low risk jurisdiction - PLS owns a 100% interest SharePrice in the high grade Pilgangoora lithium tantalite project in Western Australia, which is 1.2 the world's second largest spodumene-tantalite Resource hosting more than 1Mt of 1 0.8 lithium oxide. The project is located within 120 km from Port Headland near to both rail 0.6 infrastructure and the Great Northern Highway. The project should be developed as an 0.4 open pit mine with annual production of approximately 330kt/year of 6% spodumene 0.2 0 concentrate (48kt/year Lithium Carbonate Equivalent) and 274klb of tantalite over Jun-15 Sep-15 Dec-15 Mar-16 May-16 an initial life of 15 years. -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it.