FIMA Daily Insight

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trading Summary First Quarter of 2017

Trading Summary First quarter of 2017 Zagreb, April 2017. This publication was prepared and published by the Zagreb Stock Exchange Inc., Ivana Lučića 2a/22, Zagreb (hereinafter: Exchange). The publication is intended to provide information to the public and shall not be deemed to constitute an offer or invitation to buy or advice on trade or investment in financial instruments or opinion on the terms of the purchase or sale of any financial instrument mentioned therein whether favourable or not, nor should it be relied on as a substitute for own judgement or assessment by any user of this publication. The Exchange waives responsibility and liability for any damage which might arise out of the use of information contained therein. Further use of information available in this publication is permitted by the Exchange provided that the source is cited. Copyright © 2017. Zagreb Stock Exchange Zagreb Ivana Lučića 2a/22 All rights reserved. Content: 1 TRADING .................................................................................................................................. 1 1.1 COMPARISION WITH PREVIOUS QUARTER .............................................................................................................. 1 1.2 COMPARISON WITH PREVIOUS YEAR ..................................................................................................................... 2 1.3 MONTHLY TRADING OVERVIEW ........................................................................................................................... 4 -

Possibilities of Applying Markowitz Portfolio Theory on the Croatian Capital Market

POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL MARKET Dubravka Pekanov Starčević, Ph.D. J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Ana ZRNIć, Ph.D. Student, J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Tamara Jakšić, BEcon, student J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL... MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN POSSIBILITIES OF APPLYING Abstract In order to achieve the maximum possible profit by taking the lowest possible risk, investors build a stock portfolio consisting of a specific number of stocks which, according to the principle of diversification, significantly reduce the risk of loss. To build a portfolio, in developed capital markets investors have used the Markowitz portfolio optimization model for many years that enables us to find an optimal risk-return trade-off by selecting certain stock combinations. Despite the development of the Zagreb Stock Exchange, i.e., the central trading venue in the Republic of Croatia, the Croatian capital market is still under- developed. It is characterized by numerous shortcomings such as low liquidity, lack of transparency, high stock price volatility and insufficient traffic. Accord- ingly, the aim of this paper is to provide an insight into the functioning of the Dubravka Pekanov Starčević • Ana Zrnić • Tamara Jakšić: Dubravka Pekanov Starčević • Ana Zrnić Tamara 520 Croatian capital market and to examine the possibility of building an optimal stock portfolio by using the Markowitz model. -

Beat Project

BEAT PROJECT WP 3 – Cross Border cluster development on maritime technologies/Blue Technologies for knowledge sharing Activity 3.1. Assessment of conditions for transnational cluster development_DM 3.1.2 List of Organizations European Regional Development Fund www.italy-croatia.eu/acronym CROATIANS COMPANIES ............................................................................................................................................ 3 SHIPPING (SEA) ............................................................................................................................................................... 3 SHIP AND CARGO AGENTS .............................................................................................................................................. 5 CREW AND VESSEL MANAGEMENT .............................................................................................................................. 10 MOORING, PILOT AND TUG SERVICES .......................................................................................................................... 15 PORT OPERATORS ......................................................................................................................................................... 17 CARGO CONTROL AND INSPECTION ............................................................................................................................. 19 SHIP INSPECTION ......................................................................................................................................................... -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE January 8, 2013 Stocks on ZSE traded higher today. CROBEX increased 0.24% to ZSE STOCK MARKET 1,808.40 pts while blue chip CROBEX10 gained 0.21% to 1,010.86 pts. CROBEX Last 1.808,4 Regular stock turnover amounted to HRK 14.4 million. % daily 0,24% Integrated telecom HT (HTRA CZ) topped the liquidity board collecting % YTD 3,91% HRK 4.3 million in turnover. The price increased 0.9% to HRK 210.70. CROBEX10 last 1010,9 Fertilizers producer Petrokemija (PTKMRA CZ) also came to focus again % daily 0,21% with HRK 1.5 million in turnover while price gained 5.5% to HRK 240.0. % YTD 4,05% Petrokemija was in investors’ focus few months ago, after speculations on Government selling its share of 1.7 million shares (50.6% of capital). Stock Turnov er (HRK m) 14,37 A few days ago Mladen Pejnović, head of the State Office for State Total MCAP (HRK bn) 194,39 Property Management confirmed government’s plans to privatize Source: w w w .zse.hr Petrokemija. Auto-parts producer AD Plastik (ADPLRA CZ) came to focus trading in -4,0% -2,0% 0,0% 2,0% 4,0% 6,0% blocks. The price advanced 1% to HRK 115.99 on HRK 1.3 million in PTKM-R-A ATPL-R-A turnover. AD Plastik currently trades at P/E=7.7, P/S=0.7 and DDJH-R-A P/Bv=0.7. VPIK-R-A LKPC-R-A Tobacco and tourism Adris group preferred share (ADRSPA CZ) was VIRO-R-A KORF-R-A also in investors’ focus with HRK 0.7 million in turnover while price KNZM-R-A slipped 1.3% to HRK 262.20. -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE March 16, 2012 Croatian equities recorded an upward movement today; CROBEX ZSE STOCK MARKET gained 0.74% to 1,844.03 pts while blue chip CROBEX10 accelerated CROBEX Last 1.844,0 0.41% to 1,008.60 pts. Total turnover of the day reached HRK 30.4 % daily 0,74% million. % YTD 5,97% Integrated telecom operator HT (HTRA CZ) topped the liquidity board CROBEX10 last 1008,6 as usual with HRK 5.6 million in turnover and increasing 0.49% to HRK % daily 0,41% 216.05. % YTD 3,32% Construction engineering company Ingra (INGRRA CZ) followed Stock Turnov er (HRK m) 30,44 collecting HRK 2.3 million in turnover and advancing 2.9% to HRK 8.40. Total MCAP (HRK bn) 187,00 Frozen foods producer Ledo (LEDORA CZ) came to focus with HRK 2.1 Source: w w w .zse.hr million in turnover while price accelerated 2.33% to HRK 6,049.97. Other companies from Agrokor concern were among better performers today. Agricultural producer Vupik (VPIKRA CZ) and kiosk chain Tisak -10,0% -5,0% 0,0% 5,0% 10,0% 15,0% 20,0% (TISKRA CZ) increased 4.59% and 4.53%, respectively, largest RIVP-R-A domestic retail chain Konzum (KNZMRA CZ) accelerated 5.76% to HRK DLKV-R-A KNZM-R-A 165.99 while food producer Belje (BLJERA CZ) declined 1.98% to HRK LKRI-R-A 89.20. ATPL-R-A INGR-R-A Heavy constructor Viadukt (VDKTRA CZ) rocketed 30.32% to HRK 245 THNK-R-A DDJH-R-A after company informed investors about new contract signed in total PTKM-R-A worth HRK 516 million, related to construction of Zagreb airport. -

Pregled Trgovine

Trading Summary First half of 2017 Zagreb, July 2017. This publication was prepared and published by the Zagreb Stock Exchange Inc., Ivana Lučića 2a/22, Zagreb (hereinafter: Exchange). The publication is intended to provide information to the public and shall not be deemed to constitute an offer or invitation to buy or advice on trade or investment in financial instruments or opinion on the terms of the purchase or sale of any financial instrument mentioned therein whether favourable or not, nor should it be relied on as a substitute for own judgement or assessment by any user of this publication. The Exchange waives responsibility and liability for any damage which might arise out of the use of information contained therein. Further use of information available in this publication is permitted by the Exchange provided that the source is cited. Copyright © 2017. Zagreb Stock Exchange Zagreb Ivana Lučića 2a/22 All rights reserved. Content: 1 TRADING......................................................................................................................... 1 1.1 COMPARISION WITH PREVIOUS HALF .......................................................................................... 1 1.2 COMPARISON WITH PREVIOUS YEAR ........................................................................................... 2 1.3 MONTHLY TRADING OVERVIEW ................................................................................................. 3 1.4 INDICES ............................................................................................................................... -

Raiffeisen Weekly Report, Nr. 32/2017

Raiffeisen Weekly Report Number 32 September 4th, 2017 Real Q2 GDP growth rate at 2.8%yoy GDP real growth rate The first Q2 17 GDP estimate reported continuation of economic growth at a 4 faster pace with real GDP rising by +2.8%yoy. The positive contribution came 3 from domestic demand (+3.3%) while the contribution of net-foreign demand was 2 negative (–0.5%), as a result of higher real growth rate of imports (4.6%yoy) 1 compared to the exports (3.6%yoy), confirming the relatively high import de- % 0 pendence of the Croatian economy. –1 Breakdown by components showed that the largest positive contribution to the –2 GDP volume change came from household consumption with the highest rate –3 since Q1 08 (+3.8%yoy in real terms). Strong household consumption levels Q2 12 Q1 13 Q2 13 Q1 14 Q2 14 Q1 15 Q2 15 Q1 16 Q3 16 Q1 17 Q2 17 Q3 12 Q4 12 Q3 13 Q4 13 Q3 14 Q4 14 Q3 15 Q4 15 Q2 16 Q4 16 are not much of a surprise since high-frequency indicators reported a solid re- Sources: CBS, Economic RESEARCH/RBA tail trade growth, increasing optimism, improvements in consumer confidence, growth of employment, declining unemployment and an increase in disposable income. One should mention that household consumption growth was not ac- companied by an increase in the levels of borrowing and loans, as was the Retail trade, real changes, yoy case in the pre-crisis period. Government consumption increased by 1.7%yoy 8 in real terms while GFCF real growth decelerated to 3.2%yoy, possibly because 7 particular companies postponed their investment decisions due to the uncertainty 6 related to Agrokor. -

CEE CIS Committee Decision

INDEX COMMITTEE DECISIONS Topic: CEE & CIS Index Committee Decisions From: Wiener Börse AG / Market & Product Development Date: December 17, 2008 New RFs for all indices were determined on the basis of closing prices of December 17, 2008. All adjustments will be implemented after the close of the trading session on December 19, 2008. The Index Committee has decided upon the following adjustments: CTX, CECE, SCECE, CECETR , CECExt effective December 22, 2008 New Number Name ISIN New FF New RF of Shares CENTRAL EUROP. MEDIA BMG200452024 36.024.273 0,75 CEZ CZ0005112300 0,37 ERSTE GROUP BANK AT0000652011 317.012.763 1,00 HTX, CECE, SCECE, CECETR , CECExt effective December 22, 2008 New Number Name ISIN New FF New RF of Shares FHB MORTGAGE BANK HU0000078175 0,75 MAGYAR OLAJ GAZI HU0000068952 0,65 OTP BANK HU0000061726 0,75 0,57 RICHTER GEDEON HU0000067624 0,88 PTX, CECE, SCECE, CECETR , CECExt effective December 22, 2008 New Number Name ISIN New FF New RF of Shares AGORA PLAGORA00067 46.391.570 TVN PLTVN0000017 169.154.223 0,50 SETX, CECExt effective December 22, 2008 New Number Name ISIN New FF New RF of Shares ERICSSON N.TESLA HRERNTRA0000 0,50 INA HRINA0RA0007 0,10 PODRAVKA HRPODRRA0004 0,50 AIK BANKA RSAIKBE79302 1,00 ATLANTSKA PLOVIDBA HRATPLRA0008 1,00 Please note: Due to the suspension of Banca Transilvania, the committee has decided that there will be no determination of new representation factors in the course of the December committee. NTX effective December 22, 2008 New Number Name ISIN New FF New RF of Shares ERSTE GROUP BANK AT0000652011 317.012.763 OTP BANK HU0000061726 0,75 OMV AG AT0000743059 0,50 VOESTALPINE AT0000937503 164.599.032 CENTRAL EUROP. -

Is Capital Structure Important in Contemporary Finance Relations?

IS CAPITAL STRUCTURE IMPORTANT IN CONTEMPORARY FINANCE RELATIONS? DEAN UČKAR Juraj Dobrila University of Pula, Faculty of Economics and Tourism »Dr. Mijo Mirković«, Pula, Croatia, e-mail: [email protected]. Abstract The various combinations of sources of financing that a business uses in its operations have multiple impacts on the generation of its cash flow. Such influence can be viewed from the aspect of forming the total cost of financing the company, from the aspect of investments where such an indicators represents the minimum level of required profitability of investment projects, as well as from the aspect of investors in an enterprise where different capital structure carries with it a different level of financial risk. It is therefore not surprising that there is considerable scientific interest in this issue and numerous researches conducted on this topic. Moreover, the relevance of the subject is also evidenced by the fact that there are numerous theories on the formation of capital structure and its consequences on the valuation of the company, that is, the influence on the market value of the company's shares. This paper will determine the average values of the formation of the capital and financial structure of Croatian companies listed on the Zagreb Stock Exchange. The analysis of 30 companies over a ten-year period from 2009 to 2018 will seek to show the impact that the formed capital structure has on profitability. By establishing a negative link between the selected debt indicators Keywords: capital structure, and the profitability indicators, the validity of contemporary financial structure, capital structure theories, which have their starting point in debt ratios, behavioral finance and are specific for developed financial profitability ratios, capital structure markets, has been rejected. -

Domestic Vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets

Sinisa Bogdan, Suzana Baresa, and Zoran Ivanovic. 2016. Domestic vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets. UTMS Journal of Economics 7 (2): 197–208. Preliminary communication (accepted August 27, 2016) DOMESTIC VS INTERNATIONAL RISK DIVERSIFICATION POSSIBILITIES IN SOUTHEASTERN EUROPEAN STOCK MARKETS Sinisa Bogdan Suzana Baresa Zoran Ivanovic1 Abstract Modern portfolio theory is one of the most important investment decision tools in finances. In 1952 Harry Markowitz set the foundations of the Modern portfolio theory, since than this theory was a backbone of many studies that dealt with investment decisions. This research applies mean-variance portfolio optimization on the international Southeastern Europe and domestic Croatian stock market exchange. Aim of this research is to compare risk diversification possibilities on the Southeastern European capital markets and on the Croatian Capital market. By analyzing nine stock market indices in the Southeastern Europe and twenty stocks from Zagreb Stock Exchange in the period of 36 months, results clearly show that internationally diversified portfolios offer better portfolio risk reduction than domestically diversified portfolios. Lowest achieved risk in international portfolio outperformed lowest achieved risk in domestic portfolio. Since risk is lower, returns are also much lower compared to domestic stock portfolios. Results of this research also report that domestic stock portfolios outperformed international portfolios at the risk level equal or higher than 0,97%, for the same risk, domestic portfolios offer greater returns. Keywords: Modern portfolio theory, portfolio optimization, stock portfolio, stock market indices, Zagreb stock exchange. Jel Classification: G11; C61 INTRODUCTION One of the investment theory assumptions is that investors should diversify their portfolios. -

2019 Transparency Report Deloitte D.O.O. Date Published 30 April 2020 Updated 20 October 2020

2019 Transparency Report Deloitte d.o.o. Date published 30 April 2020 Updated 20 October 2020 00 2019 Transparency Report | Contents Contents Contents 1 Deloitte leadership message 2 Deloitte network 4 What Deloitte Audit & Assurance brings to capital markets 7 External and internal audit quality monitoring 12 Independence, ethics, and additional disclosures 15 Appendices Error! Bookmark not defined. Appendix A | EU EEA audit firms 20 Appendix B | Financial information 22 Appendix C | Public interest entities 23 01 2019 Transparency Report | Deloitte d.o.o. leadership message 1 Deloitte d.o.o. leadership message This report sets out the practices and processes that are currently employed by Deloitte d.o.o., in accordance with the requirements of the Audit Act (Official Gazzete 127/2017) and the European Union’s Regulation 537/2014 on specific requirements regarding statutory audit of public-interest entities. All information provided in this report relates to the situation of Deloitte Croatia on 31 December 2019, except if indicated otherwise. We are witnesses to the conduct of business activities, including the procedures for auditing financial statements and related services at times that are out of the ordinary, but we also remain responsible for meeting our professional obligations to the community, our employees and our clients. As the effects of the coronavirus epidemic become more apparent, Deloitte emphasizes a key responsibility to the capital markets, which is to carry out top quality audits. In today's environment, investors and stakeholders are seeking an impartial opinion on the financial statements of companies more than ever before. The main priority of Deloitte's leadership is the safety and well-being of Deloitte's professionals, as well as the quality of the professional practices performed, which is why major areas of action have been established that are coordinated both globally and locally. -

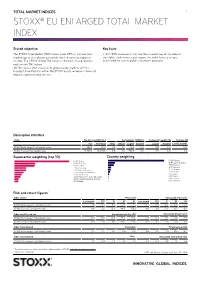

Stoxx® Eu Enlarged Total Market Index

TOTAL MARKET INDICES 1 STOXX® EU ENLARGED TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX EU Enlarged Total Market Index 266.7 121.0 0.6 0.1 10.3 0.0 8.5 0.0 N/A STOXX Europe Total Market Index 12,763.5 10,020.5 9.5 2.6 250.9 0.0 2.5 0.0 3.0 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX EU Enlarged Total Market Index 1.2 -3.4 6.4 0.1 1.7 14.7 -4.9 6.3 0.0 0.3 STOXX Europe Total Market Index 0.4 2.0 18.3 44.5 55.2 4.8 2.9 17.9 12.7 8.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX EU Enlarged Total Market Index 15.1 15.0 16.3 23.2 25.3 -0.1 -0.4 0.4 0.0 -0.0 STOXX Europe Total Market Index 11.0 11.1 11.5 20.0 21.6 -0.9 0.3 1.3 0.6 0.4 Index to benchmark Correlation Tracking error (%) STOXX EU Enlarged Total Market Index 0.7 0.7 0.7 0.8 0.9 10.3 10.7 11.9 12.3 12.7 Index to benchmark Beta Annualized information ratio STOXX EU Enlarged Total Market Index 1.0 0.9 1.0 1.0 1.0 0.8 -0.8 -0.8 -1.0 -0.6 1 For information on data calculation, please refer to STOXX calculation reference guide.