There's No Place Like Dunelm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

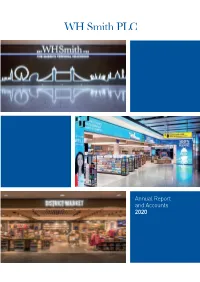

Annual Report and Accounts 2020 About Us

Annual Report and Accounts 2020 About us • WH Smith PLC is a global travel retailer with a smaller business located on the UK high street. • WHSmith Travel is a world- leading travel retailer with a presence in over 30 countries across the globe, mainly in airports. The UK Travel business is in a wide range of locations including airports, hospitals, railway stations and motorway service areas. Outside of the UK, our biggest market is in North America. • WHSmith High Street is present on most of the significant high streets and shopping centres in the UK, mainly in prime locations. • WHSmith reaches customers online via whsmith.co.uk, its specialist personalised greetings cards and gifts website funkypigeon.com, its specialist online pen shop cultpens.com and through its personalised stationery websites treeofhearts.co.uk and dottyaboutpaper.co.uk. • WHSmith employs approximately 14,000 colleagues. • WH Smith PLC is listed on the London Stock Exchange (SMWH) and is included in the FTSE 250 Index. • A commitment to the principles of sustainability is a key focus for WHSmith as it continues on its journey to be a better business. • Find out more about WHSmith at whsmithplc.co.uk. Contents Strategic report Strategic Strategic report Group at a glance 2 Business model and strategy 4 Our markets 5 Chairman’s statement 7 Chief Executive’s review 8 – Review of operations: Travel 11 – Review of operations: High Street 14 – Financial review 16 Key performance indicators 20 Principal risks and uncertainties 21 – Brexit 27 Group at a glance – Viability -

FTF - FTF Franklin UK Rising Dividends Fund August 31, 2021

FTF - FTF Franklin UK Rising Dividends Fund August 31, 2021 FTF - FTF Franklin UK Rising August 31, 2021 Dividends Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date 0673123 ASSOCIATED BRITISH FOODS PLC 155,000 £3,069,000 2.01% N/A N/A 0989529 ASTRAZENECA PLC 84,000 £7,151,760 4.68% N/A N/A 0263494 BAE SYSTEMS PLC 575,000 £3,268,300 2.14% N/A N/A BYQ0JC6 BEAZLEY PLC 680,000 £2,662,200 1.74% N/A N/A 3314775 BLOOMSBURY PUBLISHING PLC 660,000 £2,329,800 1.52% N/A N/A B3FLWH9 BODYCOTE PLC 275,000 £2,652,375 1.74% N/A N/A 0176581 BREWIN DOLPHIN HOLDINGS -

Dunelm Group Plc Plc Group Dunelm Report Annual Accounts And

Dunelm Group plc Dunelm Group Annual Report and Accounts for the period ended 29 June 2019 Accounts for the period ended 29 and Annual Report Dunelm Group plc Annual Report and Accounts for the period ended 29 June 2019 Stock code: DNLM At Dunelm, we love homes and are just as obsessed by the products that go in them. We’re the UK’s No. 1 homewares retailer offering our customers a wide range of products to enhance every room in their home. We focus on style, quality and value and are always working hard to make our We’re a multichannel retailer with 170 superstores, two high customers’ lives a little easier. street stores and our website, dunelm.com, featuring extended ranges and delivery convenience (home delivery and reserve & collect) via multi-device functionality and our own delivery fleet. We are really proud of our business culture and we like to do Our purpose is to help everyone things our own way. We’re committed to our suppliers and create a home they love. making Dunelm a great place to work for our colleagues. Investment proposition 01 Well positioned for growth 03 Operating model Our growth record has been strong with 40 consecutive years Our low cost operating model provides a solid platform for of increased sales and we’re always looking out for ways to continued growth. We’ve invested intelligently over the years sell more to our customers. We have a significant opportunity and remain agile enough to respond quickly to changes in to continue to grow in the UK as we become the customer’s the marketplace. -

Phoenix Unit Trust Managers Manager's Interim Report

130535_BothUKEqIncmIR_v6 14/01/2016 11:46 Page 1 PHOENIX UNIT TRUST MANAGERS MANAGER’S INTERIM REPORT For the half year: 16 May 2015 to 15 November 2015 PUTM BOTHWELL UK EQUITY INCOME FUND 130535_BothUKEqIncmIR_v6 14/01/2016 11:46 Page 2 130535_BothUKEqIncmIR_v6 14/01/2016 11:46 Page 3 Contents Investment review 2-3 Portfolio of investments 4-7 Top ten purchases and sales 8 Statistical information 9-11 Statements of total return & change in net assets attributable to unitholders 12 Balance sheet 13 Distribution table 14 Corporate information 15 1 130535_BothUKEqIncmIR_v6 14/01/2016 11:46 Page 4 Investment review Performance Review Over the review period, the UK Equity Income Fund returned -6.2%, which compares with a benchmark return of -9.6 %. (Source: Lipper, bid-to-bid, net income reinvested for six months to 15/11/2015.) Standardised Past Performance Nov 14-15 Nov 13-14 Nov 12-13 Nov 11-12 Nov 10-11 % growth % growth % growth % growth % growth PUTM Bothwell UK Equity Income (B) (Inc) 0.83 3.35 18.86 6.14 -8.37 Benchmark* -2.20 3.09 24.22 8.54 -2.10 *FTSE All Share ex IT. Source: Lipper, bid to bid to 15 November each year. Past Performance is not a guide to future performance. The value of units and the income from them can go down as well as up and is not guaranteed. You may not get back the full amount invested. Please note that all past performance figures are calculated without taking the initial charge into account. 2 130535_BothUKEqIncmIR_v6 14/01/2016 11:46 Page 5 Investment review Portfolio and Market Review Key transactions included the purchase of ARM Holdings In the first half of the review period, investor sentiment in in the technology sector. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Frasers Group FRAS Retailers — GBP 6.975 at close 22 September 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 22-Sep-2021 22-Sep-2021 22-Sep-2021 7 160 170 1D WTD MTD YTD 160 Absolute 2.1 6.2 4.3 54.5 6.5 150 Rel.Sector 1.1 6.2 1.0 29.3 150 Rel.Market 0.8 4.7 5.0 39.1 6 140 140 5.5 VALUATION 130 130 5 Trailing 120 120 Relative Price Relative Price Relative 4.5 110 PE -ve Absolute Price (local currency) (local Price Absolute 110 4 EV/EBITDA 8.5 100 100 PB 2.9 3.5 90 PCF 7.0 3 90 80 Div Yield 0.0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Price/Sales 1.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 1.2 100 100 100 Div Payout 0.0 90 90 90 ROE -ve 80 80 80 Share Index) Share Share Sector) Share - - 70 70 70 DESCRIPTION 60 60 60 50 The Company a retailing of sports and leisure 50 50 RSI RSI (Absolute) 40 clothing, footwear and equipment, wholesale 40 40 distribution and sale of sports and leisure clothing, 30 footwear and equipment under Group owned or 30 20 30 licensed brands and licensing of Group brands. -

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

Royal London UK Equity Income Life PDF Factsheet

Adventurous 31 August 2021 Life Fund SW Royal London UK Equity Income Fund Life Asset Allocation (as at 31/08/2021) This document is provided for the purpose of UK Equities 100.0% information only. This factsheet is intended for individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. This material should not be relied upon as sufficient information to support an investment decision. The portfolio data on this factsheet is updated on a quarterly basis. Fund Aim Royal London describe their fund's aim as follows: To achieve a combination of income and some capital growth. The Fund invests mainly in the shares of UK companies which Sector Breakdown (as at 31/07/2021) pay a higher level of income. The Fund may Industrials 21.2% also invest a small portion in other UK shares.Please note: the Scottish Widows unit- Financials 20.8% linked funds aim to provide long-term growth in Consumer Discretionary 13.2% the price of units. Any income generated will Health Care 9.2% not be distributed, but added to the fund value. Utilities 8.8% Basic Fund Information Basic Materials 7.3% Fund Launch Date 14/11/2016 Consumer Staples 6.5% Fund Size £2.0m Energy 6.5% Real Estate 4.5% Sector ABI UK Equity Income Technology 2.0% ISIN GB00BYPG4316 MEX ID SWBXT Regional Breakdown (as at 31/08/2021) SEDOL BYPG431 Manager Name Richard Marwood, Niko de Walden Manager Since 21/05/2021, 21/05/2021 Top Ten Holdings The composition of asset mix and asset allocation may change at any time and exclude cash (as at 31/08/2021) unless otherwise stated ASTRAZENECA PLC 5.4% BRITISH AMERICAN TOBACCO 3.9% GLAXOSMITHKLINE 3.9% ROYAL DUTCH SHELL PLC 3.9% RIO TINTO 3.6% IG GROUP HLDGS 3.2% IMI CO 3.0% 3I GROUP PLC 2.9% CLOSE BROS GROUP PLC 2.8% RELX NV 2.7% TOTAL 35.3% Page 1 Past Performance Fund Rating Information 50% Overall Morningstar - Rating Morningstar Analyst 25% Rating FE fundinfo Crown Rating 0% The FE fundinfo Crown Rating relates to this fund. -

Jpmorgan Funds Europe Dynamic Small Cap Fund a (Perf) EUR This Fund Is Managed by Jpmorgan Asset Management (Europe) S.À.R.L

29 March, 2021 JPMorgan Funds Europe Dynamic Small Cap Fund A (perf) EUR This fund is managed by JPMorgan Asset Management (Europe) S.à.r.l. EFC Classification Equity Europe Small/Mid Cap Price +/- Date 52wk range 57.89 EUR 0.94 26/03/2021 33.76 58.64 Issuer Profile Administrator JPMorgan Asset Management (Europe) S.à.r.l. Investment Objective: The Sub-Fund aims to maximise long-term capital growth by Address Route de Trèves 6 2633 investing primarily in an aggressively managed portfolio of small capitalisation European companies. Investment Policy: At least 67% of the Sub-Fund's assets (excluding cash and City Senningerberg cash equivalents) will be invested in equity securities of small capitalisation companies Tel/Fax +352 (0)3 410 30 20 that are domiciled in, or carrying out the main part of their economic activity in, a Website www.jpmorganassetmanagement.lu European country. Market capitalisation is the total value of a company's shares and may fluctuate materially over time. Small capitalisation companies are those whose market capitalisation is within the range of the market capitalisation of companies in the General Information Benchmark for the Sub-Fund at the time of purchase. The Sub-Fund uses an investment ISIN LU0210072939 process that is based on systematic investments in equity securities with specific style Fund Type Capitalization characteristics, such as value, quality and momentum in price and earnings trends. Quote Frequency daily Historical research has demonstrated that such... Quote Currency EUR Currency EUR Chart -

Funds Holdings

NPORT-EX 2 2102_0001495922.htm ERShares Entrepreneur 30 ETF - Now known as ERShares Entrepreneurs ETF since February 5th 2021 September 30, 2020 (Unaudited) Schedule of Investments Summary Table Percentage of Fair Value Communications 26.6% Consumer Discretionary 18.9 Financials 7.1 Health Care 12.5 Technology 34.9 Total 100.0% Portfolio holdings and allocations are subject to change. As of September 30, 2020, percentages in the table above are based on total investments. Such total investments may differ from the percentages set forth in the following Schedule of Investments which are computed using the Fund's total net assets. Schedule of Investments Shares Fair Value Common Stocks — 97.4% Communications — 25.9% 5,556 Alphabet, Inc., Class A † $ 8,142,873 30,043 Facebook, Inc., Class A † 7,868,262 13,706 Netflix, Inc. † 6,853,411 22,478 Roku, Inc. † 4,243,846 6,000 Trade Desk, Inc. (The), Class A † 3,112,680 82,901 Twitter, Inc. † 3,689,095 14,371 VeriSign, Inc. † 2,943,899 36,854,066 Consumer Discretionary — 18.5% 4,087 Amazon.com, Inc. † 12,868,860 33,329 Copart, Inc. † 3,504,878 15,575 Tesla, Inc. † 6,681,831 11,000 Wayfair, Inc., Class A † 3,201,110 26,256,679 Financials — 6.9% 4,352 BlackRock, Inc. 2,452,570 29,979 Intercontinental Exchange, Inc. 2,999,399 26,508 Square, Inc., Class A † 4,308,875 9,760,844 Health Care — 12.1% 13,253 Masimo Corp. † 3,128,503 6,501 Regeneron Pharmaceuticals, Inc. † 3,639,130 19,004 ResMed, Inc. -

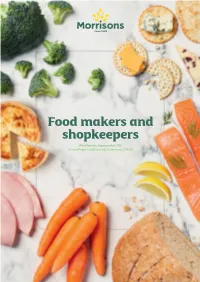

To the Members of Wm Morrison Supermarkets PLC

Wm Morrison Supermarkets PLC Supermarkets Morrison Wm Annual Report and Financial Statements 2019/20 Food makers and shopkeepers Wm Morrison Supermarkets PLC Annual Report and Financial Statements 2019/20 WorldReginfo - 9eac5a70-241d-4711-9340-0d4caeff5eb1 Living our purpose Our core purpose is the reason the business exists and underpins everything we do. To make food we’re where everyone’s and provide all proud of effort is worthwhile As food makers and shopkeepers, Food is at our heart. Our manufacturing Our colleagues are our biggest asset. we make and provide food capability and Market Street are unique Food makers and shopkeepers, with talent points of difference coming up through the organisation, surrounded by experience and know how Farming apprenticeship fund Market Street £2m 92% We’ve opened up £2m of of our customers shop our government apprenticeship Market Street. It is a key levy fund to develop the next reason for customers generation of farmers. choosing to shop at Morrisons. Financial highlights Profit before tax, exceptional items Group revenue Group like-for-like (LFL) sales (exc. fuel)* and net retirement benefit interest1 £17.5bn (0.8)% £408m +3.0% 2019/20 17.5 2019/20 (0.8)% 2019/20 408 2018/19 17.7 2018/19 4.8% 2018/192 396 2017/181 17.3 2017/18 2.8% 2017/183 374 2016/17 16.3 2016/17 1.9% 2016/17 337 2015/16 16.1 2015/161 (2.0)% 2015/164 242 1 2017/18 Group revenue on a 53 week basis. 1 2015/16 does not include wholesale 1 Referred to as ‘profit before tax and exceptionals*’.