Current State and Future of Toronto's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

" We Are Family?": the Struggle for Same-Sex Spousal Recognition In

INFORMATION TO USERS This manuscript has been reproduced from the microfilm master. UMI films the text directly from the original or copy submitted. Thus, some thesis and dissertation copies are in typewriter face, while others may be fmrn any type of computer printer, The quality of this reproduction is dependent upon the quality of the copy submitted. Broken or indistinct print, colored or poor quality illustrations and photographs, print bleedthrough, substandard margins, and improper alignment can adversely affect reprodudion. In the unlikely event that the author did not send UMI a complete manuscript and there are missing pages, these will be noted. Also, if unauthorized copyright material had to be removed, a note will indicate the deletion. Oversize materials (e-g., maps, drawings, &arb) are reproduced by sectioning the original, beginning at the upper left-hand comer and continuing from left to tight in equal sections with small overlaps. Photographs included in the original manuscript have been reproduced xerographically in this copy. Higher quality 6' x 9" black and Mite photographic prints are available for any photographs or illustratims appearing in this copy for an additional charge. Contact UMI directly to order. Bell 8 Howell Information and Leaning 300 North Zeeb Road, Ann Arbor, MI 48106-1346 USA 800-521-0600 "WE ARE FAMILY'?": THE STRUGGLE FOR SAME-SEX SPOUSAL RECOGNITION IN ONTARIO AND THE CONUNDRUM OF "FAMILY" lMichelIe Kelly Owen A thesis submitted in conformity with the requirements for the degree of Doctor of Philosophy Department of Sociology and Equity Studies in Education Ontario Institute for Studies in Education of the University of Toronto Copyright by Michelle Kelly Owen 1999 National Library Bibliothiique nationale l*B of Canada du Canada Acquisitions and Acquisitions et Bibliographic Services sewices bibliographiques 395 Wellington Street 395. -

City of Toronto — Detached Homes Average Price by Percentage Increase: January to June 2016

City of Toronto — Detached Homes Average price by percentage increase: January to June 2016 C06 – $1,282,135 C14 – $2,018,060 1,624,017 C15 698,807 $1,649,510 972,204 869,656 754,043 630,542 672,659 1,968,769 1,821,777 781,811 816,344 3,412,579 763,874 $691,205 668,229 1,758,205 $1,698,897 812,608 *C02 $2,122,558 1,229,047 $890,879 1,149,451 1,408,198 *C01 1,085,243 1,262,133 1,116,339 $1,423,843 E06 788,941 803,251 Less than 10% 10% - 19.9% 20% & Above * 1,716,792 * 2,869,584 * 1,775,091 *W01 13.0% *C01 17.9% E01 12.9% W02 13.1% *C02 15.2% E02 20.0% W03 18.7% C03 13.6% E03 15.2% W04 19.9% C04 13.8% E04 13.5% W05 18.3% C06 26.9% E05 18.7% W06 11.1% C07 29.2% E06 8.9% W07 18.0% *C08 29.2% E07 10.4% W08 10.9% *C09 11.4% E08 7.7% W09 6.1% *C10 25.9% E09 16.2% W10 18.2% *C11 7.9% E10 20.1% C12 18.2% E11 12.4% C13 36.4% C14 26.4% C15 31.8% Compared to January to June 2015 Source: RE/MAX Hallmark, Toronto Real Estate Board Market Watch *Districts that recorded less than 100 sales were discounted to prevent the reporting of statistical anomalies R City of Toronto — Neighbourhoods by TREB District WEST W01 High Park, South Parkdale, Swansea, Roncesvalles Village W02 Bloor West Village, Baby Point, The Junction, High Park North W05 W03 Keelesdale, Eglinton West, Rockcliffe-Smythe, Weston-Pellam Park, Corso Italia W10 W04 York, Glen Park, Amesbury (Brookhaven), Pelmo Park – Humberlea, Weston, Fairbank (Briar Hill-Belgravia), Maple Leaf, Mount Dennis W05 Downsview, Humber Summit, Humbermede (Emery), Jane and Finch W09 W04 (Black Creek/Glenfield-Jane -

I Was Here Episode 1: Church Street with Brian Sambourne and Richard

I Was Here Episode 1: Church Street with Brian Sambourne and Richard Isaac Please Note: These transcripts reflect a taped conversation and as such might not read as grammatically correct in every instance. Introduction Catherine: I Was Here was created with generous financial support from the Accessibility Project at the G. Raymond Chang School of Continuing Education, Ryerson University. The views and opinions expressed in this podcast are those of the storytellers and are in no way endorsed by, or representative of, the G. Raymond Chang School of Continuing Education. Disclaimer Catherine: A warning to those of you who may be listening with small children, this episode features frank discussion of sexual practices. Cold Open Brian: And he was still full of tears, and he said to me, Brian, why me and not you? You were randy in your day. You had sexual partners. Now this sears you, when you hear, and you think to yourself, why me and not you. And I just said to him, Wayne, just luck, that’s all it was. [music] Interview 1 Catherine: You are listening to I Was Here, a podcast featuring older adults who have interesting stories about, or long histories with, spaces and places in Toronto. I am your host, Catherine Dunphy. [music] Catherine: In this episode, I am talking to: Brian: Brian Sambourne. I am age 66. I came out in the 1970s in the gay and lesbian community through MCC. I continued to be involved in my community and I thrive because of it. Richard: Richard Isaac. I am 73. -

Graffiti Management Plan – Streetartoronto (Start) Partnership Programs 2013 Grant Allocation Recommendations

STAFF REPORT ACTION REQUIRED Graffiti Management Plan – StreetARToronto (StART) Partnership Programs 2013 Grant Allocation Recommendations Date: May 9, 2013 To: Licensing and Standards Committee From: General Manager, Transportation Services Wards: All Reference p:\2013\ClusterB\tra\pr\ls13005pr Number: SUMMARY StreetARToronto (StART) was launched in 2012 as a public/private partnership program and a central feature of Council's new Graffiti Management Plan, a proactive approach to eliminating graffiti vandalism while supporting street art that adds character and visual interest to city streets. StART is funded as a Community Partnership and Investment Program (CPIP) grant of $375,890.00 from the former Graffiti Transformation Program and is administered by the Public Realm Section in Transportation Services, which also has carriage of coordination and implementation of many parts of the Graffiti Management Plan. StART is part of the City's Clean Toronto Together Campaign, which links citizens with city government to keep Toronto streets clean and free of posters and graffiti vandalism. In 2012, StART provided funding to 20 organizations resulting in the installation of 48 pieces of mural art. Two programs have been developed under the StART umbrella. The StART Partnership program provides up to $30,000.00 per application for non-profit arts organizations to create street art. The StART Diversion and Education program provides up to $20,000.00 per application for programs that engage at-risk youth who have been arrested for graffiti vandalism and diverted through the court system. The parameters for these programs were established by Council in the Graffiti Management Plan. This report recommends funding for 26 community-based groups in the above-noted categories. -

TO360 Year One Round Two Consultation Report

Consultation Report TO360 Wayfinding Strategy (Phase III) – Year One, Round Two Consultation, March 2018 Table of Contents BACKGROUND ...................................................................................................................................1 DETAILED FEEDBACK: AREAS 1 & 2 .....................................................................................................6 DETAILED FEEDBACK: AREA 3 ........................................................................................................... 12 DETAILED FEEDBACK: AREA 4 ........................................................................................................... 20 DETAILED FEEDBACK: AREAS 5 & 6 ................................................................................................... 28 This Consultation Report documents feedback shared in the March 2018 Local Mapping Open Houses for TO360 — Phase III. It was shared with participants for review before being finalized. Background Toronto 360 (TO360) is an effort to help people find their way by making streets, neighbourhoods, and the city more legible. Following the successful completion of a pilot project in the Financial District in 2015, the City began a five-year city-wide rollout in 2017. This rollout is focused on developing a map database that will support the future production of wayfinding maps. In Year One of the rollout, the TO360 team is developing the map database in an area bounded roughly by Lake Ontario, Royal York Road, St. Clair Avenue, and Warden Avenue. In -

Community Action Policing Activities for 1999/2000

Community Action Policing Activities for 1999/2000 (City Council at its regular meeting held on October 3, 4 and 5, 2000, and its Special Meetings held on October 6, 2000, October 10 and 11, 2000, and October 12, 2000, adopted this Clause, without amendment.) The Policy and Finance Committee recommends the adoption of the Recommendation of the Task Force on Community Safety, embodied in the following communication (September 18, 2000) from the City Clerk: Recommendation: The Task Force on Community Safety, at its meeting on September 12, 2000, recommended to the Policy and Finance Committee the adoption of the report (July 31, 2000) from the Commissioner of Community and Neighbourhood Services summarizing the Community Action Policing (CAP) activities undertaken by Community and Neighbourhood Services in 1999/2000. _________ (Report dated July 31, 2000, addressed to the Task Force o n Community Safety from the Commissioner of Community and Neighbourhood Services Department) Purpose: This report summarizes the Community Action Policing (CAP) activities undertaken by Community and Neighbourhood Services (CNS) in 1999 - 2000. Financial Implications and Impact Statement: There are no financial implications with respect to this report Recommendations: It is recommended that: (1) the report on the Perceptions of Safety amongst Homeless People in Toronto as contained in Appendix 2 of this report, be referred to Police Services and to the relevant City of Toronto Departments for appropriate action; and (2) the appropriate City officials be authorized and directed to take the necessary steps to give effect thereto. Background: At its July 1999 meeting, Toronto Council adopted Policy and Finance report no. -

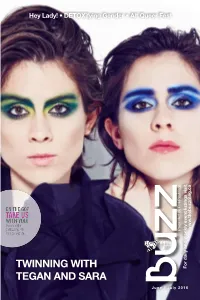

Twinning with Tegan and Sara

TEGAN ANDSARA TWINNING WITH Hey Lady!•DETOXifyingGenderAltQueerFest June / July2016 Presented by PinkPlayMags For daily and weekly event listings visit www.thebuzzmag.ca 2 June / July 2016 theBUZZmag.ca theBUZZmag.ca June / July 2016 3 Issue #013 The Editor Here we go again. It’s summer, and Publisher + Creative Director: time to show our Pride. Here in Toronto Antoine Elhashem we’re lucky enough to have one of the Editor-in-Chief: Bryen Dunn biggest Pride festivals in the world, Art Director: and this month the organization has Mychol Scully declared June as the first ever Pride General Manager: Kim Dobie Month. Sales Representatives: In celebration of this milestone we’ve had our Events Carolyn Burtch, Michael Wile, Sami Boudjenane Editor compile a special selection of Pride related events in the city for our Wigged Out column. This Events Editor: is in addition to our extensive regular events listing. Sherry Sylvain Scan through as there will certainly be something for Counsel: everyone from partiers to parents. Lai-King Hum, Hum Law Firm For our feature articles we had Daniela Costa chat with Tegan Quin, from the queer twin Canadian music Regular Columnists: duo Tegan and Sara. They have a new album out Cat Grant, Paul Bellini, Boyd Kodak, Sherry Sylvain, that includes the catchy single, “Boyfriend”, and you Donnarama can find out how to attend their private show here Feature Writers: in Toronto the end of this month. As well, Raymond Helkio chatted with Detox from RuPaul’s Drag Race Daniela Costa, Raymond Helkio about the gender myth, pride and living life large. -

Church and Wellesley Brochure V4.Indd

Retail for Lease 68 Wellesley Street East, Toronto Newly Renovated Space! Located in the heart of Toronto’s Vibrant Village CBRE Limited, Real Estate Brokerage Property Highlights Ground Floor BARBERSHOP 68 Wellesley St East Size: 1,769 sq. ft . MOBILE PHONE Net Rent: Please call listing agents DOWN DOWN DOWN TMI: $26.00 per sq.ft . (est.) Available: Immediate CAFE • Located at the corner of Church and Wellesley Street • A minute walk to the Wellesley Subway Station and in close proximity to Ryerson University, The Eaton Centre and Yonge & Dundas Square 1,769 SF DOWN CONVENIENCE STORE 'B' SHOE STORE CONVENIENCE STORE 'A' HALAL RESTAURANT DOWN PIZZA PIZZA UP UP CHURCH STREET CHURCH WELLESLEY STREET Subject Church Street Property Wellelsey Street Newly Renovated Interior Newly Renovated Façade The Location Church-Wellesley Village The Property is located in the heart of the vibrant Church Wellesley Village also known as “The Village”, nestled in the heart of Toronto’s downtown core. The subject property is located at the intersection of Church & Wellesley, the centre of the neighbourhood, and is surrounded by popular shops, restaurants and bars. Every June, The Village hosts Pride Month, one of the largest Pride festivals in the world and draws a crowd of over a million supporters from around the globe. 12,061 new units in the immediate surrounding area Units/ Condominium Status Stories 15 16 1 SUBJECT PROPERTY 430 units 1 66 Wellesley St E Pre-Construc on 43 storeys WELLESLEY STREET 335 units 14 Freshii Wine Rack 2 Alter Condominium Under -

For Lease | 411 Church Street

ForRetail Lease 411 Church Street Overview Located just steps away from Yonge and College, Ryerson University and across the Street from Maple Leaf Gardens, 411 Church Street is a strong retail development with 572 residential units and over 7,000 square feet of premium retail space. With an abundance of public transit in 411 CHURCH STREET close proximity including the College Subway stop, the area has become one of the most accessible in the city. Significant residential density has welcomed a breadth of new retailers and consumers into area making the Church and Wellesley Village one of the most desirable neighbourhoods to live, work, and play in Toronto. The ground floor offers three exceptional retail units all featuring substaintial frontage onto Church Street. At the corner of Church and Wood is a signature restaurant opportunity with operable windows and a prominent patio opportunity on Wood Street. With soaring ceiling heights of 21 FT, 411 Church Street is a premium retail opportunity for high-profile restaurant, fitness, quick service food, and CHURCH STREET health and wellness tenants. YONGE STREET Property details RETAIL 1: 3,839 SF RETAIL 2: LEASED RETAIL 3: LEASED AVAILABLE: Immediately TERM: 10 years NET RENT: Contact Listing Agent ADDITIONAL RENT: $20.55 PSF (2021) Highlights • Shadow-anchored by Loblaws, LCBO, and Joe Fresh at Maple Leaf Gardens • Strong pedestrian traffic highlighted by a significant Ryerson University popula- tion comprised of 43,000 students (growth of 7,000 students over the last 5 years) • Incredible 21 FT ceiling heights and a modern glass façade offering signature branding • Direct access to shipping and receiving for all units • Unit 1 – signature corner restaurant opportunity with patio on Wood Street • Unit 2 / 3 – small format retail spaces with ample frontage on Church Street Within 1km radius Demographics Source: Statistics Canada 77,135 169,348 Population Daytime Population $65,167 44,572 Avg. -

Intention to Designate 64 Wellesley Street East Under Part IV, Section 29 of the Ontario Heritage Act

~TORONTO REPORT FOR ACTION Intention to Designate 64 Wellesley Street East under Part IV, Section 29 of the Ontario Heritage Act Date: January 15, 2019 To: Toronto Preservation Board Toronto and East York Community Council From: Senior Manager, Urban Design/Heritage, City Planning Division Wards: Ward 13 – Toronto Centre SUMMARY This report recommends that City Council include the property at 64 Wellesley Street East on the City of Toronto’s Heritage Register and state its intention to designate the property under Part IV, Section 29 of the Ontario Heritage Act. Located on the north side of Wellesley Street between Yonge and Church streets, the property contains a five-storey apartment building that was completed in 1931 according to the designs of Toronto architect J. E. H. Paisley. Following research and evaluation it has been determined that the property at 64 Wellesley Street East meets Ontario Regulation 9/06, the provincial criteria prescribed for municipal designation under Part IV, Section 29 of the Ontario Heritage Act for its design, associative and contextual value. The inclusion of the property at 64 Wellesley Street East on the City’s Heritage Register and its designation under Part IV, Section 29 of the Ontario Heritage Act would identify all the property’s cultural heritage values and heritage attributes. Properties on the Heritage Register will be maintained and conserved in accordance with the Official Plan Heritage Policies. Designation enables City Council to review alterations to the site, enforce heritage property standards and maintenance, and refuse demolition. RECOMMENDATIONS The Senior Manager, Urban Design/Heritage, City Planning Division that: Inclusion on Heritage Register and Intention to Designate – 64 Wellesley Street East Page 1 of 21 1. -

6.1The Black Queer Youth Initiative

CASE STUDY THE BLACK QUEER YOUTH INITIATIVE: CHALLENGING RACISM, 6 .1 STIGMA & EXCLUSION Adam Benn Introduction The Black Queer Youth (BQY) Initiative is a group for Black, African, Caribbean and multiracial youth, aged 29 and under, who also identify as LGBTQ2S. For over 16 years, BQY has been one of the only spaces exclusively for youth who are both Black and queer- identified in Canada, and has grown from a monthly group facilitated by Black queer community volunteers into a fully-fledged project of the Supporting Our Youth Program at the Sherbourne Health Centre in downtown Toronto, Ontario. Over these years, BQY youth and facilitators have devised a safe space for their community, where Black queer identities are celebrated and honoured while simultaneously facing the challenges of racism, stigma and exclusion—issues that have plagued the program’s participants and other Black queer youth from before BQY’s inception until today. This case study provides information on the BQY Initiative.1 History: The Emergence of Racialized LGBTQ2S Organizations in Toronto In 1985, readers of the magazine The Body Politic, at the time Canada’s oldest—and one of North America’s most prominent—lesbian and gay publications, found “a lengthy article exploring highly charged questions of racial and sexual politics” (Churchill, 2003, p. 114). The debate was sparked by a personal advertisement submitted by a gay White man requesting “a young well built BM [Black man] for houseboy” (Body Politic Collective, 1985). With these 31 words, Toronto’s LGBTQ community was embroiled in a debate around race, sexuality and identity. -

Ce Document Est Tiré Du Registre Aux Fins De La Loi Sur Le Patrimoine De L

This document was retrieved from the Ontario Heritage Act Register, which is accessible through the website of the Ontario Heritage Trust at www.heritagetrust.on.ca. Ce document est tiré du registre aux fins de la Loi sur le patrimoine de l’Ontario, accessible à partir du site Web de la Fiducie du patrimoine ontarien sur www.heritagetrust.on.ca. i riji' TRXIT F::J frlilltfiil i; i iii v' .:l t,t i',.ir'i?[ltA 8'.E.cl1tr'f',$ Ulli S. Watkiss Mtnnomo Citv Clerk City Clerk's Office Secretadat Tel: 416-392-7033 Bosalind Dvers Fax:41&397-0111 Toronto and East York Community Council email: [email protected] City Hall,2"0 Floor, West Web: www.toronto.ca 100 Queen Street West Toronto, Ontario MsH 2N2 IN TIIE MATTER OF THE ONTARIO IIERITAGE ACT R.S.O. 1990 CHAPTER 0.18 AND 68 WELLESLEY STREET EAST (WILLIAM MCBEAN TERRACE) CITY OF TORONTO, PROVINCE OF ONTARIO NOTICE OF PASSING OF BY.LAW 937627 Ontario Inc. Ontario Heritage Trust c/o T&Y Property Management Inc. 10 Adelaide Street East 2 Steeles Avenue West. Unit 2 Toronto. Ontario Toronto, Ontario M5C 1J3 L4J lAI Attn: Henry To Take notice that the Council of the City of Toronto has passed By-law No. 914-2014 to designate the property at 68 Wellesley Street East (William McBean Terrace) as being of cultural heritage value or interest. Dated at Toronto this 29th day of September ,2014. Ulli VWatkiss Authority: Toronto and East York Community Council Item29.8, as adopted by City of Toronto Council on February 19 and 20,2014 CITY OF TORONTO BY-LAW No.