Price and Volume in the Tokyo Stock Exchange : an Exploratory Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Structure and Liquidity on the Tokyo Stock Exchange

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The Industrial Organization and Regulation of the Securities Industry Volume Author/Editor: Andrew W. Lo, editor Volume Publisher: University of Chicago Press Volume ISBN: 0-226-48847-0 Volume URL: http://www.nber.org/books/lo__96-1 Conference Date: January 19-22, 1994 Publication Date: January 1996 Chapter Title: Market Structure and Liquidity on the Tokyo Stock Exchange Chapter Author: Bruce N. Lehmann, David M. Modest Chapter URL: http://www.nber.org/chapters/c8108 Chapter pages in book: (p. 275 - 316) 9 Market Structure and Liquidity on the Tokyo Stock Exchange Bruce N. Lehmann and David M. Modest Common sense and conventional economic reasoning suggest that liquid sec- ondary markets facilitate lower-cost capital formation than would otherwise occur. Broad common sense does not, however, provide a reliable guide to the specific market mechanisms-the nitty-gritty details of market microstruc- ture-that would produce the most desirable economic outcomes. The demand for and supply of liquidity devolves from the willingness, in- deed the demand, of public investors to trade. However, their demands are seldom coordinated except by particular trading mechanisms, causing transient fluctuations in the demand for liquidity services and resulting in the fragmenta- tion of order flow over time. In most organized secondary markets, designated market makers like dealers and specialists serve as intermediaries between buyers and sellers who provide liquidity over short time intervals as part of their provision of intermediation services. Liquidity may ultimately be pro- vided by the willingness of investors to trade with one another, but designated market makers typically bridge temporal gaps in investor demands in most markets.' Bruce N. -

Global IPO Trends Report Is Released Every Quarter and Looks at the IPO Markets, Trends and Outlook for the Americas, Asia-Pacific and EMEIA Regions

When will the economy catch up with the capital markets? Global IPO trends: Q3 2020 ey.com/ipo/trends #IPOreport Contents Global IPO market 3 Americas 10 Asia-Pacific 15 Europe, Middle East, India and Africa 23 Appendix 29 About this report EY Global IPO trends report is released every quarter and looks at the IPO markets, trends and outlook for the Americas, Asia-Pacific and EMEIA regions. The current report provides insights, facts and figures on the IPO market for the first nine months of 2020* and analyzes the implications for companies planning to go public in the short and medium term. You will find this report at the EY Global IPO website, and you can subscribe to receive it every quarter. You can also follow the report on social media: via Twitter and LinkedIn using #IPOreport *The first nine months of 2020 cover completed IPOs from 1 January 2020 to 30 September 2020. All values are US$ unless otherwise noted. Subscribe to EY Quarterly IPO trends reports Get the latest IPO analysis direct to your inbox. GlobalGlobal IPO IPO trends: trends: Q3Q3 20202020 || Page 2 Global IPO market Liquidity fuels IPOs amidst global GDP contraction “Although the market sentiments can be fragile, the scene is set for a busy last quarter to end a turbulent 2020 that has seen some stellar IPO performance. The US presidential election, as well as the China-US relationship post-election, will be key considerations in future cross-border IPO activities among the world’s leading stock exchanges. Despite the uncertainties, companies and sectors that have adapted and excelled in the ‘new normal’ should continue to attract IPO investors. -

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

Feb. 22, 2021 Listing Department Tokyo Stock Exchange, Inc. Outline

(Reference Translation) Feb. 22, 2021 Listing Department Tokyo Stock Exchange, Inc. Outline of Initial Listing Issue Company Name G-NEXT Inc. Scheduled Listing Date Mar. 25 2021 Market Section Mothers Current Listed Market N/A Name and Title of YOKOJI Yusuke, Representative Director Representative Address of Main Office 4-7-1 Iidabashi, Chiyoda-ku Tokyo, 102-0072 Tel. +81-3-5962-5170 (Closest Point of Contact) (Same as above) Home Page https://www.gnext.co.jp/ Date of Incorporation Jul. 12, 2001 Description of Business Developing and providing "Discoveriez", a customer relationship software Category of Industry / Information & Communication / 4179 (ISIN JP3386760007) Code Authorized Total No. of 10,750,000 shares Shares to be Issued No. of Issued Shares 3,732,200 shares (As of Feb. 22, 2021) No. of Issued Shares 4,082,200 shares (incl. treasury shares) (Note 1) The number includes newly issued shares issued through the at the Time of Listing public offering. (Note 2) The number could increase as a result of the exercise of the share options. Capital JPY 396,137 thousand (As of Feb. 22, 2021) No. of Shares per Share 100 shares Unit Business Year From Apr. 1 to Mar. 31 of the following year General Shareholders In June Meeting Record Date Mar. 31 Record Date of Surplus Sep. 30 and Mar. 31 Dividend Transfer Agent Sumitomo Mitsui Trust Bank, Limited Auditor TOHO Audit Corporation Managing Trading SMBC Nikko Securities Inc. Participant -1- © 2021 Tokyo Stock Exchange, Inc. All rights reserved. DISCLAIMER: This translation may be used only for reference purposes. This English version is not an official translation of the original Japanese document. -

Your Exchange of Choice Overview of JPX Who We Are

Your Exchange of Choice Overview of JPX Who we are... Japan Exchange Group, Inc. (JPX) was formed through the merger between Tokyo Stock Exchange Group and Osaka Securities Exchange in January 2013. In 1878, soon after the Meiji Restoration, Eiichi Shibusawa, who is known as the father of capitalism in Japan, established Tokyo Stock Exchange. That same year, Tomoatsu Godai, a businessman who was instrumental in the economic development of Osaka, established Osaka Stock Exchange. This year marks the 140th anniversary of their founding. JPX has inherited the will of both Eiichi Shibusawa and Tomoatsu Godai as the pioneers of capitalism in modern Japan and is determined to contribute to drive sustainable growth of the Japanese economy. Contents Strategies for Overview of JPX Creating Value 2 Corporate Philosophy and Creed 14 Message from the CEO 3 The Role of Exchange Markets 18 Financial Policies 4 Business Model 19 IT Master Plan 6 Creating Value at JPX 20 Core Initiatives 8 JPX History 20 Satisfying Diverse Investor Needs and Encouraging Medium- to Long-Term Asset 10 Five Years since the Birth of JPX - Building Milestone Developments 21 Supporting Listed Companies in Enhancing Corporate Value 12 FY2017 Highlights 22 Fulfilling Social Mission by Reinforcing Market Infrastructure 23 Creating New Fields of Exchange Business Editorial Policy Contributing to realizing an affluent society by promoting sustainable development of the market lies at the heart of JPX's corporate philosophy. We believe that our efforts to realize this corporate philosophy will enable us to both create sustainable value and fulfill our corporate social responsibility. Our goal in publishing this JPX Report 2018 is to provide readers with a deeper understanding of this idea and our initiatives in business activities. -

An Institutional Comparison Between European and Japanese Junior Stock Markets

INNOVATION-FUELLED, SUSTAINABLE, INCLUSIVE GROWTH Working Paper How do financial markets adapt? An institutional comparison between European and Japanese Junior stock markets Caroline Granier Sant’Anna School of Advanced Studies Valérie Revest Université Lyon 2, Triangle, Sant’Anna School of Advanced Studies Alessandro Sapio Parthenope University of Naples, Sant’Anna School of Advanced Studies 11/2017 May This project has received funding from the European Union Horizon 2020 Research and Innovation action under grant agreement No 649186 How do financial markets adapt? An institutional comparison between European and Japanese Junior stock markets Caroline Granier (Sant’Anna School of Advanced Studies, Pisa) Valérie Revest (Université Lyon 2, Triangle & Sant’Anna School of Advanced Studies, Pisa) Alessandro Sapio (Parthenope University of Naples & Sant’Anna School of Advanced Studies, Pisa) ABSTRACT Since the last decade, new Junior stock markets or second-tier stock markets have emerged in various countries, often influenced by the Alternative Investment Market, created by the London Stock Echange in 1995, and considered by numerous economic and political actors as a reference. Junior Markets are characterised by simplified listing processes and customised information standards. The creation of junior stock market segments can be seen as an instance of financialisation and of the spread of market-led financial architectures to economies traditionally characterised by credit-based financial systems, according to the evolutionary taxonomy outlined by Dosi (1990). This begs the question as to whether we are witnessing an increasing convergence towards financial systems that are typical of the Anglo-Saxon world. With these questions in mind, in this paper we perform an institutional comparison of junior stocks markets located in countries characterised by different varieties of capitalism : AIM London, AIM Italy, Alternext, Entry Standard, OMX First North, Mothers, Tokyo AIM, JASDAQ. -

(TOPIX High Dividend Yield 40 Index) December 25, 2020 Tokyo Stock

Tokyo Stock Exchange Index Guidebook (TOPIX High Dividend Yield 40 Index) December 25, 2020 Tokyo Stock Exchange, Inc. Published December 25, 2020 DISCLAIMER: This translation may be used for reference purposes only. This English version is not an official translation of the original Japanese document. In cases where any differences occur between the English version and the original Japanese version, the Japanese version shall prevail. This translation is subject to change without notice. Tokyo Stock Exchange, Inc., Japan Exchange Group, Inc., Osaka Securities Exchange Co., Ltd., Tokyo Stock Exchange Regulation and/or their affiliates shall individually or jointly accept no responsibility or liability for damage or loss caused by any error, inaccuracy, misunderstanding, or changes with regard to this translation. 1 Copyright © 2017- by Tokyo Stock Exchange, Inc. All rights reserved Contents Record of Changes................................................................................................................. 3 Introduction........................................................................................................................... 4 Ⅰ. Outline of the Index.................................................................................................... 4 Ⅱ. Index Calculation........................................................................................................ 5 1. Outline....................................................................................................................... 5 -

How Fast Do Tokyo and New York Stock Exchanges Respond to Each Other?: an Analysis with High-Frequency Data

Discussion Paper No.10 How Fast Do Tokyo and New York Stock Exchanges Respond to Each Other?: An Analysis with High-Frequency Data Yoshiro Tsutsui and Kenjiro Hirayama October 2008 GCOE Secretariat Graduate School of Economics OSAKA UNIVERSITY 1-7 Machikaneyama, Toyonaka, Osaka, 560-0043, Japan How Fast Do Tokyo and New York Stock Exchanges Respond * to Each Other?: An Analysis with High-Frequency Data Yoshiro Tsutsui Osaka University Kenjiro Hirayama Kwansei Gakuin University Abstract This paper uses one-minute returns on the TOPIX and S&P500 to examine the efficiency of the Tokyo and New York Stock Exchanges. Our major finding is that Tokyo completes reactions to New York within six minutes, but New York reacts within fourteen minutes. Dividing the sample period into three subperiods, we found that the response time has shortened and the magnitude of reaction has become larger over the period in both markets. The magnitude of response in New York to a fall in Tokyo is roughly double that of a rise. JEL Classification Numbers: G14, G15, F36 Keywords: international linkage, stock prices, market efficiency, high frequency data Correspondence: Yoshiro Tsutsui Kenjiro Hirayama Graduate School of Economics School of Economics Osaka University Kwansei Gakuin University 1-7 Machikane-yama, Toyonaka Uegahara, Nishinomiya-shi 560-0043 Japan 662-8051 Japan Phone: +81-6-6850-5223 Phone: +81-798-54-6438 Fax: +81-6-6850-5274 Fax: +81-798-54-6438 e-mail: [email protected] e-mail: [email protected] * We are especially grateful to the anonymous referee of this journal for many constructive comments which led to substantial improvements. -

The Outlook for Tokyo New Opportunities Or Long-Term Decline for Japan's Financial Sector?

T h e O u t l o o k f o r T o k y o V a n e s s a R o s s i The Outlook for Tokyo New Opportunities or Long-term Decline for Japan's Financial Sector? A Chatham House Report Vanessa Rossi Chatham House, 10 St James’s Square, London SW1Y 4LE T: +44 (0)20 7957 5700 E: [email protected] www.chathamhouse.org.uk F: +44 (0)20 7957 5710 www.chathamhouse.org.uk Charity Registration Number: 208223 The Outlook for Tokyo New Opportunities or Long-term Decline for Japan’s Financial Sector? A Chatham House Report Vanessa Rossi 1 www.chathamhouse.org.uk Chatham House has been the home of the Royal Institute of International Affairs for over eight decades. Our mission is to be a world-leading source of independent analysis, informed debate and influential ideas on how to build a prosperous and secure world for all. © Royal Institute of International Affairs, 2009 Chatham House (the Royal Institute of International Affairs) is an independent body which promotes the rigorous study of international questions and does not express opinion of its own. The opinions expressed in this publication are the responsibility of the author. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or any information storage or retrieval system, without the prior written permission of the copyright holder. The PDF file of this report on the Chatham House website is the only authorized version of the PDF and may not be published on other websites without express permission. -

Tokyo Stock Exchange Second Section Index

Tokyo Stock Exchange Second Section Index The Tokyo Stock Exchange Second Section Index is an index of all domestic common stocks listed on the TSE Second Section. Outline Number of Constituents 471 - The Tokyo Stock Exchange Second Section Index is a free-float adjusted ( As of 2021.3.31 ) market capitalization-weighted index that is calculated based on all domestic Base Date 1968/1/4 common stocks listed on the TSE Second Section. Base Point 100 - The price return index is calculated and disseminated in real-time (15 sec). - The total return index is calculated on a daily basis. Information vendor codes 1st price returnindex 2nd total return index Quick 152 Index Performance (1968.1.4=100 points) S152/TSX 9000 Tokyo Stock Exchange Second Section Index 8000 Bloomberg TSE2 <INDEX> TPXDTSE2 <INDEX> 7000 6000 5000 Refinitiv .TSI2 4000 .TSI2DV 3000 2000 1000 0 1981 2001 1968 1969 1971 1973 1975 1977 1979 1983 1985 1987 1989 1991 1993 1995 1997 1999 2003 2005 2007 2009 2011 2013 2015 2017 2019 Disclamar This document was created for the sole purpose of providing an outline explanation for index. It is not intended for solicitation for investment, nor a disclosure document pursuant to the Financial Instruments and Exchange Act. Tokyo Stock Exchange, Inc. retains all rights related to this document and does not permit the reproduction or reprinting of this document in any circumstances without prior approval. Following such date, there may be changes to the details of this document due to rule revisions and other factors without prior notification. Additionally, the information contained within this document has been prepared with the utmost care. -

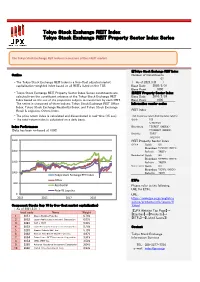

Tokyo Stock Exchange REIT Index Tokyo Stock Exchange REIT Property Sector Index Series

Tokyo Stock Exchange REIT Index Tokyo Stock Exchange REIT Property Sector Index Series The Tokyo Stock Exchange REIT Index is a measure of the J-REIT market. ■Tokyo Stock Exchange REIT Index Outline Number of Constituents 61 - The Tokyo Stock Exchange REIT Index is a free-float adjusted market ( As of 2021.3.31 ) capitalization-weighted index based on all REITs listed on the TSE. Base Date 2003/3/31 Base Point 1000 - Tokyo Stock Exchange REIT Property Sector Index Series constituents are ■REIT Property Sector Index selected from the constituent universe of the Tokyo Stock Exchange REIT Base Date 2010/2/26 Index based on the use of the properties subject to investment by each REIT. Base Point 1000 The series is composed of three indices: Tokyo Stock Exchange REIT Office Information vendor codes Index, Tokyo Stock Exchange Residential Index, and Tokyo Stock Exchange Retail & Logistics, Others Index. REIT Index - The price return index is calculated and disseminated in real-time (15 sec). (1st line:price return,2nd line:total return) - The total return index is calculated on a daily basis. Quick 155 S155/TSX Index Performance Bloomberg TSEREIT <INDEX> (Data has been re-based at 1000) TPXDREIT <INDEX> Refinitiv .TREIT .TREITDV 2500 REIT Property Sector Index Office Quick 182 BloombergTSEROFF <INDEX> 2000 Refinitiv .TREITO Residential Quick 183 BloombergTSERRSD <INDEX> 1500 Refinitiv .TREITR Retail & Logistics Quick 184 BloombergTSERRL <INDEX> 1000 Refinitiv .TREITL Tokyo Stock Exchange REIT Index Office ETFs 500 Residential Please refer to the following Retail & Logistics URL for ETFs. 0 URL: 2013 2015 2017 2019 https://www.jpx.co.jp/english/e quities/products/etfs/issues/0 Component Stocks (top 10 by free-float market capitalization) 1.html ()As of 2021.3.31 (【JPX Website Top Page】→ local code Name Weight 【Equities】→【Products】→ 1 8951Nippon Building Fund Inc. -

Tokyo Stock Price Index

s Tokyo Stock Price Index Tokyo Stock Price Index (TOPIX) is a measure of the overall trend in the stock market, and is used as a benchmark for investment in Japanese stocks. Outline Number of Constituents 2187 - Tokyo Stock Price Index (TOPIX) is calculated by Tokyo Stock Exchange. ( As of 2021.3.31 ) Base Date 1968/1/4 - TOPIX is a market benchmark with functionality as an investable index, Base Point 100 covering a wide range of Japanese stock market. TOPIX is a free-float adjusted market capitalization-weighted index. Information vendor codes - TOPIX is calculated based on all the domestic common stocks listed on (1st line:price return,2nd line:total return, the TSE First Section until April 1, 2022(the business day before the 3rd line:net total return) market restructure). - The price return index is calculated and disseminated in real-time (1 sec). Quick 151 - The total return index is calculated on a daily basis. S151/TSX S151#NR/TSE Index Performance (1968.1.4 = 100point) Bloomberg TPX <INDEX> 3500 TPXDDVD <INDEX> TPXNTR<INDEX> 3000 2500 Refinitiv .TOPX .TOPXDV 2000 .TOPXDVNET 1500 1000 ETFs 500 TOPIX Please refer to the following 0 URL for ETFs. URL: 1977 1979 1969 1971 1973 1975 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 1968 https://www.jpx.co.jp/english/e Total Return Index (ROI) ( As of 2021.3.31 ) quities/products/etfs/issues/0 1.html 1month 3month 6month 12month (【JPX Website Top Page】→ TOPIX 5.71% 9.25% 21.48% 42.13% 【Equities】→【Products】→ 【ETFs】→【Listed Issues】) Component Stocks (top 10 by free-float market capitalization) ( As of 2021.3.31 ) local codeName Sector Weight 1 7203 TOYOTA MOTOR CORPORATION Transportation Equipment 3.26% 2 9984 SoftBank Group Corp.