Breaking News

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Autogrill Group 2008 Sustainability Report

Autogrill Group 2008 Sustainability Report 2008 Sustainability Report Autogrill Group Contents Introduction 02 How to read the Sustainability Report 03 Results and objectives 06 Message of the CEO 07 The Autogrill Group 08 The Group’s development 010 Vision, Mission and Strategy 011 The concession business 012 Business sectors 017 The brands 018 The organization model Autogrill’s sustainability 020 The road to sustainability 022 The Code of Ethics 023 Afuture, a project and philosophy for a sustainable future 026 The Corporate Governance system 035 Clear policies towards stakeholders 036 SA8000 Ethical Certification 037 Awards and recognitions in 2008 037 Sustainability rating The economic dimension of sustainability 038 039 Highlights: main economic indicators 042 Sales by sector and channel 045 Autogrill on the financial markets 046 Shareholders 046 Economic value generated and distributed The social dimension of sustainability 048 051 Highlights: main social indicators 052 Human resources management and valorization 067 Consumer transparency 074 Partner relationships 079 Investing in the community The environmental dimension of sustainability 086 089 Highlights: main environmental indicators 090 Managing the relation with the environment 093 Impact of activities on the environment 100 Sales point innovation 103 Training and communication The GRI-G3 indicators 104 The Independent Auditors’ Report 111 Glossary 113 Contents The Autogrill Group Introduction Each year the Sustainability Report (hereinafter referred to as “Report”) attempts to provide its readers with a greater understanding of the complex relationships that make up the Auto- grill world. The significant growth over the past few years has transformed the Autogrill Group (referred to as “Autogrill,” “Company,” or “Group”) into a highly recognized organization, synony- mous not only with complete and quality products, but also with a style and a way of being for ever changing people, cultures and markets, making the most of each unique element. -

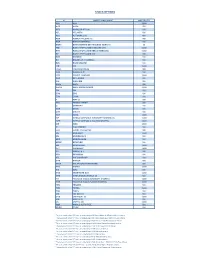

Stoxx® All Europe Total Market Index

TOTAL MARKET INDICES 1 STOXX® ALL EUROPE TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX All Europe Total Market Index 13,768.8 10,453.0 7.2 1.7 250.9 0.0 2.4 0.0 3.0 STOXX Global Total Market Index 54,569.6 44,271.7 6.1 1.3 618.0 0.0 1.4 0.0 3.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX All Europe Total Market Index 0.3 2.0 18.1 43.3 55.0 3.8 3.0 17.7 12.4 8.9 STOXX Global Total Market Index 2.3 7.7 21.7 49.4 78.4 30.7 11.5 21.2 13.9 11.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX All Europe Total Market Index 11.0 11.2 11.6 19.9 21.1 -1.0 0.3 1.3 0.6 0.4 STOXX Global Total Market Index 8.2 7.9 8.1 12.8 22.5 1.1 1.4 2.3 1.0 0.5 Index to benchmark Correlation Tracking error (%) STOXX All Europe Total Market Index 0.9 0.9 0.9 0.9 0.9 5.8 6.1 6.3 10.0 10.2 Index to benchmark Beta Annualized information ratio STOXX All Europe Total Market Index 1.2 1.2 1.2 1.4 1.3 -3.5 -1.3 -0.6 -0.0 -0.2 1 For information on data calculation, please refer to STOXX calculation reference guide. -

Annual Report 2017

ANNUAL REPORT 2017 FOCUS STORY MEMORABLE CUSTOMER SHOPPING EXPERIENCE WITH THE NEW GENERATION STORE: read the focus story on the digital strategy on page 30 – 35. 3 DUFRY GROUP – A LEADING GLOBAL TRAVEL RETAILER DUFRY AG (SIX: DUFN; BM&FBOVESPA: DAGB33) IS A LEADING GLOBAL TRAVEL RETAILER OPERATING OVER 2,200 DUTY-FREE AND DUTY-PAID SHOPS IN AIRPORTS, CRUISE LINES, SEAPORTS, RAILWAY STATIONS AND DOWNTOWN TOURIST AREAS. DUFRY EMPLOYS OVER 29,000 (FTE) PEOPLE. THE COMPANY, HEADQUARTERED IN BASEL, SWITZERLAND, OPERATES IN 64 COUNTRIES ON ALL FIVE CONTINENTS. ANNUAL REPORT 2017 CONTENT MANAGEMENT REPORT Dufry at a Glance 6 – 7 1 Highlights 2017 8 – 9 Message from the Chairman of the Board of Directors 10 – 13 Statement of the Chief Executive Officer 14 – 18 Organizational Structure 19 Board of Directors 20 – 21 Group Executive Committee 22 – 23 Dufry Investment Case 24 – 25 Dufry Strategy 26 – 79 Dufry Divisions 46 – 65 SUSTAINABILITY REPORT Sustainability 80 – 92 2 Community Engagement 93 – 98 FINANCIAL REPORT Report of the Chief Financial Officer 102– 105 3 Financial Statements 107 – 212 Consolidated Financial Statements 108 – 201 Financial Statements Dufry AG 202 – 211 GOVERNANCE REPORT Corporate Governance 213 – 236 4 Remuneration Report 237 – 250 Information for Investors and Media 252 – 253 Address Details of Headquarters 253 5 1 Management Report DUFRY ANNUAL REPORT 2017 DUFRY AT A GLANCE TURNOVER GROSS PROFIT IN MILLIONS OF CHF IN MILLIONS OF CHF MARGIN 8,800 5,000 8,400 4,900 71 % 4,800 70 % 7,800 4,500 69 % 7,200 4,200 68 % 6,600 -

Stock Options

STOCK OPTIONS ID UNDERLYING SHARE MULTIPLIER A2A A2A 5,000 ACE ACEA 500 STS ANSALDO STS (8) 500 ATL ATLANTIA 500 AGL AUTOGRILL (9) 500 AZM AZIMUT HOLDING (7) 500 BGN BANCA GENERALI 100 BMPS BANCA MONTE DEI PASCHI DI SIENA (1) 50 PMI BANCA POPOLARE DI MILANO (11) 5,000 BPE BANCA POPOLARE EMILIA ROMAGNA 1,000 BP BANCO POPOLARE (10) 100 BRE BREMBO 100 BC BRUNELLO CUCINELLI 100 BZU BUZZI UNICEM 100 CIR CIR 1,000 CNHI CNH INDUSTRIAL 500 DAN DANIELI & C. 100 CPR DAVIDE CAMPARI 1,000 DLG DE' LONGHI 500 DIA DIASORIN 500 ENEL ENEL 500 EGPW ENEL GREEN POWER 1,000 ENI ENI 500 ERG ERG 500 EXO EXOR 100 F FIAT (2) 500 FNC FINMECCANICA 500 G GENERALI 100 GEO GEOX 500 GTK GTECH 100 HER HERA 1,000 ISP INTESA SANPAOLO (ORDINARY SHARES) (3) 1,000 ISPR INTESA SANPAOLO (SAVING SHARES) 1,000 IRE IREN 1,000 IT ITALCEMENTI 100 LUX LUXOTTICA GROUP 500 MS MEDIASET 1,000 MB MEDIOBANCA 500 MED MEDIOLANUM 500 MONC MONCLER 500 MN MONDADORI 1,000 PLT PARMALAT 1,000 PC PIRELLI & C. 500 PRY PRYSMIAN 100 SFL SAFILO GROUP 100 SPM SAIPEM 500 SFER SALVATORE FERRAGAMO 500 SRS SARAS 1,000 SIS SIAS 500 SRG SNAM RETE GAS 1,000 STM STMICROELECRONICS (4) 500 TIT TELECOM ITALIA (ORDINARY SHARES) 1,000 TITR TELECOM ITALIA (SAVING SHARES) 1,000 TEN TENARIS 500 TRN TERNA 5,000 TOD TOD'S 100 UBI UBI BANCA 500 UCG UNICREDIT (5) 1,000 UNI UNIPOL (6) 500 US UNIPOL SAI 1,000 WDF WORLD DUTY FREE 500 YOOX YOOX 100 1 The series with a final "X" have an underlying of 50 Banca Monte dei Paschi di Siena shares The series with a final "Y" have an underlying of 10 Banca Monte dei Paschi di Siena -

Autogrill Acquires the Remaining 49.95% of Aldeasa from Altadis and Successfully Acquires 100% of World Duty Free Europe from BAA

The Group becomes the world’s leading provider in the airport retail market Autogrill acquires the remaining 49.95% of Aldeasa from Altadis and successfully acquires 100% of World Duty Free Europe from BAA • The Enterprise Value of the two transactions is €1,070 million, representing a multiple of 12.2x on the combined pro-forma 2007 Ebitda pre-synergies • The two transactions will be funded through fully committed new debt facilities • The integration of Aldeasa, WDF and Alpha Group will enable the Autogrill Group to achieve synergies of about €40 million a year by 2011 • The two acquisitions will be Earnings Neutral in 2008 and Accretive from 2009 (post-exceptional items and excluding the impact of amortization) Milan, 10 March 2008 – Autogrill (Milan: AGL IM) is pleased to announce the acquisition of the remaining 49.95%1 of Aldeasa S.A. from Altadis S.A., bringing its stake in Aldeasa to 99.90%, and the acquisition of 100% of World Duty Free Europe Limited from BAA Limited. These acquisitions follow on from the purchase of 49.95% of Aldeasa in 2005 and of Alpha Group Plc. in 2007. These landmark transactions are a major step in the growth path of Autogrill, from a single country food service provider to a global travel service provider for “people on the move”. Autogrill strengthens its presence in the fast growing travel retail market segment, maintaining its operational and strategic focus. Aldeasa and WDF, together with Alpha Group, will create the world’s leading provider in the airport retail market, with the largest platform in Europe and room for further development in other growing markets. -

Hudson Ltd. Class a Common Shares This Is the Initial Public Offering of Hudson Ltd

Subject to completion Preliminary Prospectus dated January 19, 2018 PRELIMINARY PROSPECTUS 39,417,765 Shares Hudson Ltd. Class A Common Shares This is the initial public offering of Hudson Ltd. The selling shareholder named in this prospectus is selling all of the Class A common shares offered hereby. We are not selling any of the Class A common shares in this offering and will not receive any proceeds from the sale of the Class A common shares. We expect the public offering price to be between $19.00 and $21.00 per share. Prior to this offering, no public market existed for our Class A common shares. Our Class A common shares have been approved for listing on the New York Stock Exchange under the symbol “HUD.” Following this offering, we will have two classes of common shares outstanding: Class A common shares and Class B common shares. The rights of the holders of our Class A common shares and our Class B common shares are identical, except with respect to voting and conversion. Each Class A common share is entitled to one vote per share and is not convertible into any other shares of our share capital. Each Class B common share is entitled to 10 votes per share and is convertible into one Class A common share at any time. In addition, each Class B common share will automatically convert into one Class A common share upon any transfer thereof to a person or entity that is not an affiliate of the holder of such Class B common share. -

Lemanik Sicav

LEMANIK SICAV SocieÂteÂd'Investissement aÁCapital Variable Unaudited Semi-Annual Report as at November 30, 2014 R.C.S.: Luxembourg B 44.893 No subscription can be received on the basis of this annual report. Subscriptions are only valid if made on the basis of the current prospectus supplemented by the latest annual report, the Key Investor Information Document (KIID) and the most recent semi-annual report, if published thereafter. LEMANIK SICAV TABLE OF CONTENTS Page ORGANISATION....................................................................................................................................... 5 STATEMENT OF NET ASSETS ................................................................................................................. 9 STATEMENT OF OPERATIONS AND CHANGES IN NET ASSETS .............................................................. 18 STATISTICAL INFORMATION ................................................................................................................... 27 LEMANIK SICAV - ASIAN OPPORTUNITY ................................................................................................. 45 STATEMENT OF INVESTMENTS AND OTHER NET ASSETS.................................................................. 45 GEOGRAPHICAL CLASSIFICATION OF INVESTMENTS ......................................................................... 51 INDUSTRIAL CLASSIFICATION OF INVESTMENTS ................................................................................ 52 LEMANIK SICAV - ITALY......................................................................................................................... -

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 18.01.2016 Page 1

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 18.01.2016 Page 1 ***************************************************************************** AMENDMENTS ARE MARKED AS FOLLOWS: INSERTIONS ARE UNDERLINED DELETIONS ARE CROSSED OUT ***************************************************************************** […] Annex A in relation to subsection 1.6 of the Contract Specifications: Futures on Shares of Product Group ID* Cash Contract Minimum Currency ID Market-ID* Size Price ** Change […] 3i Group PLC IIIF GB01 XLON 1000 0.0001 GBX Admiral Group PLC FLNH GB01 XLON 1000 0,0001 GBX Altice N.V. ATCF NL01 XMAS 100 0.0001 EUR AT&T INC. DTVF US02 XNAS 100 0.0001 USD Azimut Holding S.p.A. HDBI IT01 XMIL 1000 0.0001 EUR Balda AG BADF DE01 XETR 100 0.0001 EUR Banca Monte dei Paschi di Siena MPIG IT01 XMIL 1000 0.0001 EUR S.p.A. Baxter International Inc. BAXF US01 XNYS 100 0.0001 USD BHP Billiton PLC-Basket BLTF GB01 XLON 1000 0.0001 GBX C.M.B. (Cie Maritime Belge) SA Actions MAIF BE01 XBRU 100 0,0001 EUR Nouvelles au Port.o.N. DMG MORI SEIKI AG GLDF DE01 XETR 100 0.0001 EUR EMC Corp. [Mass.] EMCF US01 XNYS 100 0.0001 USD Eurazeo RFXH FR01 XPAR 100 0.0001 EUR Google Inc. GOOF US02 XNAS 100 0.0001 USD GTECH S. p. A. N4GG IT01 XMIL 1000 0.0001 EUR Hermes International S.A. HMIH FR01 XPAR 100 0.0001 EUR Inditex (bar) IXDK ES01 XMAD 100 0.0001 EUR Inditex(bar) S.A. IXDL ES01 XMAD 100 0.0001 EUR International Game Technology IGTF US01 XNYS 100 0.0001 USD Interparfums S.A. -

Weekly Stock Market Report for Telecom Italia Retail Shareholders

Telecom Italia Shareholders’ Club Weekly Stock Market Report for Telecom Italia Retail Shareholders May 11th – May 15th, 2015 Telecom Italia Shareholders’ Club Weekly Performance of Major Worldwide Market Stock Exchanges 1.4% 1.8% 0.9% 0.9% 0.4% 0.5% 0.7% 0.2% 0.3% -0.9% -1.2% -1.9% -2.2% (USD) CAC 40 (Paris) MERVAL (ARG) (USD) S&P 500 (USD) DAX (Frankfurt) IBEX35 (Madrid) FTSE MIB (Milan) FTSE MIB NIKKEI 225 (JPG) 225 NIKKEI FTSE 100 (London) NASDAQ COMPOSITE MEXICO BOLSA (MXN) BRAZIL BOVESPA (BRL)BRAZIL BOVESPA DOW JONES INDUS. AVG HAN SENG (HONG KONG) Performance (∆%)* Last 52 weeks Daily average volume ** Market Index Point as of 1 1 6 1 from Low High 1 1 Cap. 15-May-15 week month months year Jan. '15 Price Price week month (mln. local cur.) Europe FTSE MIB (Milan) 23,473 0.7% 1.9% 21.3% 13.7% 23.5% 17,556 24,082 868,791,462 720,027,428 482,940 FTSE 100 (London) 6,960 -1.2% -0.5% 3.7% 1.5% 6.0% 6,073 7,123 782,690,662 774,912,945 1,915,246 DAX (Frankfurt) 11,447 -2.2% -2.1% 21.0% 18.9% 16.7% 8,355 12,391 91,335,208 93,308,978 1,111,014 CAC 40 (Paris) 4,994 -1.9% -2.9% 17.2% 12.1% 16.9% 3,789 5,284 120,926,246 146,179,042 1,344,205 IBEX35 (Madrid) 11,317 -0.9% -0.4% 8.5% 8.0% 10.1% 9,371 11,885 376,801,606 414,751,528 639,984 America DOW JONES INDUS. -

Annual Report 2019 Dufry Group – a Leading Global Travel Retailer

ANNUAL REPORT 2019 DUFRY GROUP – A LEADING GLOBAL TRAVEL RETAILER DUFRY AG (SIX: DUFN) IS A LEADING GLOBAL TRAVEL RETAILER OPERATING OVER 2,400 DUTY-FREE AND DUTY-PAID SHOPS IN AIRPORTS, CRUISE LINES, SEAPORTS, RAILWAY STATIONS AND DOWNTOWN TOURIST AREAS. DUFRY EMPLOYS OVER 31,000 (FTE) PEOPLE. THE COMPANY, HEADQUARTERED IN BASEL, SWITZERLAND, OPERATES IN 65 COUNTRIES ON ALL SIX CONTINENTS. ANNUAL REPORT 2019 CONTENT MANAGEMENT REPORT Dufry at a Glance 4 – 5 1 Highlights 2019 6 – 7 Message from the Chairman of the Board of Directors 8 – 11 Statement from the Chief Executive Officer 12 – 16 Organizational Structure 17 Board of Directors 18 – 19 Global Executive Committee 20 – 21 Dufry Investment Case 22 – 23 Dufry Strategy 24 – 77 Dufry Divisions 48 – 65 SUSTAINABILITY REPORT Sustainability 78 – 101 2 Community Engagement 102 – 108 FINANCIAL REPORT Report from the Chief Financial Officer 110 – 114 3 Financial Statements 115 – 228 Consolidated Financial Statements 116 – 214 Financial Statements Dufry AG 215 – 227 GOVERNANCE REPORT Corporate Governance 229 – 251 4 Remuneration Report 252 – 269 Information for Investors and Media 272 – 273 Address Details of Headquarters 273 Read the full focus story on page 30 – 37 3 1 Management Report DUFRY ANNUAL REPORT 2019 DUFRY AT A GLANCE TURNOVER IN MILLIONS OF CHF 9,000 8,400 7,800 7,200 6,600 6,000 5,400 4,800 4,200 3,600 3,000 2,400 1,800 1,200 600 0 2015 2016 2017 2018 2019 GROSS PROFIT EQUITY FREE CASH FLOW IN MILLIONS OF CHF MARGIN IN MILLIONS OF CHF 5,200 69 % 400 4,800 68 % 3 % BORDER, DOWNTOWN -

25C, Boulevard Royal, L-2449 Luxembourg R.C.S

BFF Luxembourg S.à r.l. Societé à responsabilité limitée Registered office: 25C, boulevard Royal, L-2449 Luxembourg R.C.S. Luxembourg B 195343 Messrs Banca Farmafactoring S.p.A. Via Domenichino, 5 20149, Milan Luxembourg, March 8, 2018 Ref.: Banca Farmafactoring S.p.A. – Shareholders’ General Meeting to be held on April 5, 2018 Filing of the list for the appointment of the Board of Statutory Auditors Dear Sirs, With the present letter, the undersigned BFF Luxembourg S.à r.l., shareholder of Banca Farmafactoring S.p.A. (the “Bank”) owner of No. 77.685.903 shares, equal to 45.7% of the Bank’s share capital, with reference to the Shareholders’ General Meeting to be held on April 5, 2018, convened to discuss and resolve, inter alia, on the “Appointment of the Board of Statutory Auditors. Related resolutions”, considered the “Board of Directors Report on Item Six on the Agenda for the General Shareholders’ Meeting” (the “Report”), pursuant to Article 22 of the Bank’s By-Laws, submits the following list of candidates, listed through a sequential numbering: Section I – Regular Auditors 1. Marco Lori, born in Cerchio (AQ) on August 31, 1956, Tax Code LROMRC56M31C492P; 2. Patrizia Paleologo Oriundi, born in Milan (MI) on January 24, 1957, Tax Code PLLPRZ57A64F205V; 3. Luca Rossi, born in Casalpusterlengo (LO) on March 12, 1967, Tax Code RSSLCU67C12B910B; Section II – Alternate Auditors 1. Giancarlo De Marchi, born in Genova (GE) on May 13, 1950, Tax Code DMRGCR50E13D969G; 2. Fiorenza Dalla Rizza, born in Milan (MI) on September 30, 1961, Tax Code DLLFNZ61P70F205S. -

IDEM Statistics September 2015 EQUITY DERIVATIVES TRADING

IDEM Statistics September 2015 EQUITY DERIVATIVES TRADING STOCK OPTIONS TURNOVER eur m 480 000 STANDARD CONTRACTS 18 000 STOCK FUTURES INDEX OPTIONS INDEX miniFUTURES 400 000 15 000 INDEX FUTURES 320 000 12 000 240 000 9 000 160 000 6 000 80 000 3 000 0 0 JUL AUG SEP Note: the notional turnover is computed as the product of contracts number, price and index multiplier for index futures; contracts number, price and size multiplier for stock futures; contracts number, strike prices and index multiplier for index options; contracts number, strike prices and sizes for stock options. MONTHLY TURNOVER INDEX FUTURES * INDEX MINIFUTURES ** INDEX OPTIONS STOCK FUTURES *** STOCK OPTIONS TOTAL STANDARD TURNOVER STANDARD TURNOVER STANDARD TURNOVER STANDARD TURNOVER STANDARD TURNOVER STANDARD TURNOVER CONTRACTS eur ML CONTRACTS eur ML CONTRACTS eur ML CONTRACTS eur ML CONTRACTS eur ML CONTRACTS eur ML September 2014 818 371 85 325 340 132 7 091 315 665 16 247 40 421 141 1 762 397 5 268 3 276 986 114 072 October 2014 976 621 93 784 581 702 11 149 453 897 21 797 32 975 52 2 157 536 6 417 4 202 731 133 198 November 2014 663 850 64 180 383 976 7 425 266 709 12 881 84 920 138 1 850 615 5 497 3 250 070 90 120 December 2014 870 777 82 606 405 379 7 751 240 549 11 623 192 703 679 1 572 583 4 701 3 281 991 107 359 January 2015 847 796 82 010 465 858 9 011 302 508 14 784 64 853 211 1 788 802 5 220 3 469 817 111 236 February 2015 543 984 57 627 292 735 6 200 366 275 19 398 278 884 806 1 942 516 5 710 3 424 394 89 741 March 2015 901 221 101 705 360 665 8 146 344