Faqs: Team Volunteer Grants Revised January 29, 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Catholic Community Services of Lane County, Inc

CATHOLIC COMMUNITY SERVICES OF LANE COUNTY, INC. FINANCIAL STATEMENTS AND SINGLE AUDIT INFORMATION For the Years Ended June 30, 2016 and 2015 CATHOLIC COMMUNITY SERVICES OF LANE COUNTY, INC. FINANCIAL STATEMENTS AND SINGLE AUDIT INFORMATION For the Years Ended June 30, 2016 and 2015 TABLE OF CONTENTS Page Independent Auditor’s Report 1 - 2 Financial Statements: Statements of Financial Position 3 - 4 Statements of Activities 5 - 6 Statements of Functional Expenses 7 - 8 Statements of Cash Flows 9 Notes to Financial Statements 10 - 15 Single Audit Information: Schedule of Expenditures of Federal Awards 16 Notes to Schedule of Expenditures of Federal Awards 17 Independent Auditor’s Report on Internal Control Over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 18 - 19 Independent Auditor’s Report on Compliance for Each Major Program and on Internal Control Over Compliance Required by the Uniform Guidance 20 - 21 Schedule of Findings and Questioned Costs 22 INDEPENDENT AUDITOR’S REPORT To the Board of Directors Catholic Community Services of Lane County, Inc. Eugene, Oregon Report on the Financial Statements We have audited the accompanying financial statements of Catholic Community Services of Lane County, Inc. (a nonprofit organization), which comprise the statements of financial position as of June 30, 2016 and 2015, and the related statements of activities, functional expenses, and cash flows for the years then ended, and the related notes to the financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. -

Wednesday, May 10, 2017 – 6:00 P.M. Meeting of the San Marcos Community Foundation Grant Funding Committee San Marcos Room 1 Civic Center Drive San Marcos, Ca 92069

Agenda MEETING OF THE SAN MARCOS COMMUNITY FOUNDATION WEDNESDAY, MAY 10, 2017 – 6:00 P.M. MEETING OF THE SAN MARCOS COMMUNITY FOUNDATION GRANT FUNDING COMMITTEE SAN MARCOS ROOM 1 CIVIC CENTER DRIVE SAN MARCOS, CA 92069 Cell Phones: As a courtesy to others, please silence your cell phone or pager during the meeting and engage in conversations outside the meeting room. Americans with Disabilities Act: If you need special assistance to participate in this meeting, please contact the Board Secretary at (760) 744-1050, ext. 3116. Notification 48 hours in advance will enable the City to make reasonable arrangements to ensure accessibility to this meeting. Assisted listening devices are available for the hearing impaired. Please see the Board Secretary if you wish to use this device. Public Comment: If you wish to address the Board on any agenda item, please complete a “Request to Speak” form. Be sure to indicate which item number you wish to address. Comments are limited to FIVE minutes. The Oral Communication segment of the agenda is for the purpose of allowing the public to address the Board on any matter NOT listed on the agenda. The Board is prohibited by state law from taking action on items NOT listed on the Agenda. However, they may refer the matter to staff for a future report and recommendation. If you wish to speak under “Oral Communications,” please complete a “Request to Speak” form as noted above. Agendas: Agenda packets are available for public inspection 72 hours prior to scheduled meetings at the Administration Department located on the second floor of City Hall, 1 Civic Center Drive, San Marcos, during normal business hours. -

Parishes Find Alpha Key Part of 'Divine Renovation' Plans

Envelope support inside, see ad on Page 3 VOL. 57, NO. 9 DIOCESE OF OAKLAND MAY 13, 2019 www.catholicvoiceoakland.org Serving the East Bay Catholic Community since 1963 Copyright 2019 With fewer refugees, CCEB resettlement program ends By Michele Jurich Staff writer With the U.S. government continuing to severely limit the number of refugees who enter the country under its auspices, Catholic Charities of the East Bay has ended its resettlement program. While the agen- cy was scheduled to receive 100 refugees in fiscal year 2019, which began Oct. 1, 2018, the agency received just eight. The last arrived Feb. 7. The 90-day service contract with Martinez the government ended May 8. The numbers had been reduced over the last two years. DOMINIQUE GHEKIERE-MINTZ/SPECIAL TO THE CATHOLIC VOICE DOMINIQUE THE GHEKIERE-MINTZ/SPECIAL TO CATHOLIC The previous year, CCEB was projected Alpha participants met at St. Joan of Arc parish in San Ramon in March. to receive 145; 100 were received. Nationally, accord- ing to Refugee Council Sister Lang Parishes find Alpha key part USA, the Trump administration has admitted only 12,151 refugees, which is less than 40 percent of the historically low 30,000 refugee admis- sions goal. of ‘Divine Renovation’ plans Jewish Family and Community Services East Bay in Berkeley and the International By Michele Jurich Rescue Committee in Oakland will con- Staff writer tinue to resettle refugees in the East Bay. As parishes throughout the Diocese What is Alpha? Those who have received assistance of Oakland embark on ambitious “Divine from Catholic Charities in the past can still Renovation” plans, they find that Alpha Alpha is a series of sessions request assistance in legal and housing courses are a key component. -

Volunteering Policy

My Volunteering Policy The purpose of this policy is to outline the opportunities and procedures for Thomson Reuters employees to engage in community volunteering activities. By allowing all regular employees time off to volunteer, Thomson Reuters can continue to invest in its local communities, and have a meaningful impact on the world around us one community at a time. Thomson Reuters encourages employees from across the business to take part in volunteering activities with recognized charities and community organizations including accredited schools. To enable this we offer all regular full-time and part-time employees* time off with pay for at least 2 days or 16 hours per calendar year (pro-rated for part-time staff). *Part-time employees are eligible if their regularly scheduled hours are 20 or more per week. Multiply the number of hours worked in a day by two; the result is the annual number of hours eligible for paid time off to volunteer (4 hours a day x 2 = 8 hours a year). GUIDELINES FOR VOLUNTEERING Volunteering during working hours is at your manager’s discretion and subject to the needs of the business. You should obtain your manager’s approval to use paid time off to volunteer and then log your paid volunteer hours into My Community. For full details of how to apply for volunteering, read our My Volunteer FAQ in My Community. RECOGNIZED CHARITIES AND COMMUNITY ORGANIZATIONS Through this policy and our programs we support organizations that are registered as a charity not-for-profit or tax exempt organizations and accredited schools. -

Annual Report for the Fiscal Year 2002-2003

A nnual Report 2002 - 2003 The Ontario Trillium Foundation Investing in communities 45 Charles Street East, Fifth Floor Toronto, Ontario M4Y 1S2 Telephone: 416.963.4927 Toll free: 1.800.263.2887 Fax: 416.963.8781 TTY: 416.963.7905 The Ontario Trillium Foundation, an agency of the Ministry of Culture, receives annually $100 million of government funding generated through Ontario's charity casino initiative June 30, 2003 The Honourable David H. Tsubouchi Minister of Culture 12th floor, Ferguson Block 77 Wellesley Street West Toronto, Ontario, M7A 1N3 Dear Minister: On behalf of the Board of Directors of the Ontario Trillium Foundation, I am pleased to submit a copy of our Annual Report for the fiscal year 2002-2003. In it you will find a brief narrative that details goals achieved and the challenges met by our volunteers and staff. Also included is a list of grants made under our various programs as well as audited financial statements. Through the allocation of $100 million from the government’s charity casino initiative, we have been able to improve the quality of life of Ontarians, build strong communities, and contribute to the province’s economic strength. The Foundation’s volunteer Grant Review Teams and the members of the Board of Directors, supported by an able professional staff, continue to provide outstanding leadership. All of us share a collective pride in the Foundation’s continuing accomplishments, as described in this report. We value the effective working relationship the Ontario Trillium Foundation has with your ministry, and we look forward to continuing to work together to build healthy, caring and economically strong communities in Ontario. -

Thank You for Being a Part of the CHOICE Humanitarian Family

ENTER Thank you for being a part of the CHOICE Humanitarian family Dear Friends, The year 2017 was EPIC for CHOICE Humanitarian and we owe this to our global family. The CHOICE community is an incomparable group of people who care deeply for all human beings. Together we believe that living on less than $1.90 is absurd and must end in our lifetime. Since I joined CHOICE over 9 years ago, I have seen countless people lift themselves out of extreme poverty. Through our expedition program nearly 700 of you last year, a record number, also witnessed the work first-hand. You saw that while CHOICE might be the catalyst, the villagers - with their entrepreneurial spirit and hard work- take ownership of their own development. Thank you for believing in them! I invite you to leave your Our single most important accomplishment last year will inform how international development is approached. legacy with CHOICE A three-year pilot program in Nepal scaled our proven Model of Leadership Development from a single village Humanitarian, giving future approach to a district level. All 68,000 people in 180 villages were impacted. The 1,800 families who began generations the knowledge in extreme poverty have made their way out through income-generating opportunities. Economic development continues to be our most effective exit strategy. that you were a part of placing extreme poverty in We aggressively scaled-up our measurement and evaluation program and the numbers confirm the results! a museum where it belongs! Extreme poverty can end when the people are given access to opportunities and can drive the process themselves. -

Volunteer Team-Builder and Donation Drive

FOUND - PDF.1215693 (VOLUNTEER RESOURCE GUIDE UPDATE) | V4 | 8.5”X11” | ART DIRECTOR: SM | COPYWRITER: MH Volunteer Team-Builder and Donation Drive Resource Guide See what’s inside: • Checklists • Project Guidelines • Required Sign-In Form • Volunteer Team-Builder Event Information Template Volunteer Team-Builder and Donation Drive Resource Guide page 1 of 7 rev. 05/2015 FOUND - PDF.1215693 (VOLUNTEER RESOURCE GUIDE UPDATE) | V4 | 8.5”X11” | ART DIRECTOR: SM | COPYWRITER: MH The CarMax Foundation is committed to helping you plan and execute a rewarding, meaningful experience for your team of Associates. We’ve prepared this guide to make it easy for you to successfully coordinate a volunteer activity and ensure your community organization receives the donation from the CarMax Cares Volunteer Grants Program. As the Volunteer Project Coordinator (VPC), you are responsible for coordinating the activity from start to finish. You also serve as a liaison between CarMax, The CarMax Foundation, and your community organization. If you haven’t yet chosen your volunteer project, The Foundation is available to help you find resources, organizations, and activities that fit your needs. Acceptable volunteer activities include building repairs and painting, sorting items at a food pantry, and reading to seniors or children. Acceptable donation drives collect blood, food, toys, and clothing. Please contact us if you have any questions. We look forward to working with you and your team! Sincerely, Chasity Miller The CarMax Foundation [email protected] (804) 747-0422 Volunteer Team-Builder and Donation Drive Resource Guide page 2 of 7 rev. 05/2015 FOUND - PDF.1215693 (VOLUNTEER RESOURCE GUIDE UPDATE) | V4 | 8.5”X11” | ART DIRECTOR: SM | COPYWRITER: MH Volunteer Events Checklist __ 1. -

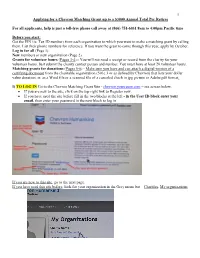

1 Applying for a Chevron Matching Grant up to a $3000 Annual Total Per Retiree

1 Applying for a Chevron Matching Grant up to a $3000 Annual Total Per Retiree For all applicants, help is just a toll-free phone call away at (866) 751-6031 8am to 4:00pm Pacific time Before you start: Get the EIN (ie. Tax ID number) from each organization to which you want to make a matching grant by calling them. List their phone numbers for reference. If you want the grant to come through this year, apply by October. Log in for all (Page 1) New members or new organization (Page 2) Grants for volunteer hours (Pages 3-4) - You will not need a receipt or record from the charity for your volunteer hours. Just submit the charity contact person and number. You must have at least 20 volunteer hours. Matching grants for donations (Pages 5-6) - Make sure you have and can attach a digital version of a certifying document from the charitable organization (501c.3 or as defined by Chevron) that lists your dollar value donation, ie. as a Word file or a scanned file of a canceled check in jpg picture or Adobe pdf format. I) TO LOG IN Go to the Chevron Matching Grant Site - chevron.yourcause.com – see screen below. If you are new to the site, click on the top right link to Register now. If you have used the site before fill in the two blocks at the left - in the User ID block enter your email, then enter your password in the next block to log in. If you are new to this site, go to the next page. -

Arts and Education Council Now Accepting 2018 Pnc Program Grant Applications

FOR IMMEDIATE RELEASE Contact: Emily Hellmuth Director of Marketing and Communications, Arts and Education Council 314.289.4131 or [email protected] ARTS AND EDUCATION COUNCIL NOW ACCEPTING 2018 PNC PROGRAM GRANT APPLICATIONS Grants of $2,500 to $5,000 available for arts programs addressing community needs in bi-state region ST. LOUIS – March 12, 2018 – The Arts and Education Council (A&E) announced today that applications for 2018 PNC Program Grants are now open. PNC Program Grants, underwritten by the PNC Foundation through a $40,000 named fund, provide merit-based grants of $2,500 to $5,000 to small to medium-sized organizations in the St. Louis bi-state region that offer arts and arts education programs contributing to the elements of a vibrant community. Since 2012, this collaboration between A&E and PNC has provided funding to 176 organizations serving 41 Missouri communities and six Illinois communities for programs that have increased access to the arts for hundreds of thousands of adults and children in the region. “The Arts and Education Council believes the arts are critical to creating and sustaining vibrant communities and we are grateful to have PNC as a partner who shares that belief,” said Cynthia A. Prost, A&E president and CEO. “The arts foster innovation, energize neighborhoods, inspire our kids, promote cross-cultural understanding and enrich our lives. With PNC Program Grants, A&E is investing in arts programs throughout our region that ensure this ripple effect of the arts is felt and celebrated by the entire community.” Last year’s grants funded 31 diverse arts programs, including: Bach Society of Saint Louis’ 2018 St. -

Get Involved with Medshare

Get Involved with MedShare A guide to engaging your organization's Corporate Social Responsibility goals with MedShare's mission. 2019 National Headquarters & Southeast Distribution Center | 3240 Clifton Springs Road | Decatur, GA 30034 | 770.323.5858 Western Region Distribution & Volunteer Center | 2937 Alvarado Street | San Leandro, CA 94577 | 510.567.7070 Northeast Region Volunteer & Collection Center | 701 Penhorn Avenue, Unit #3, P.O. Box 2075 | Secaucus, NJ 07096 | 201.866.6090 www.medshare.org Our Mission MedShare is a 501c(3) humanitarian aid organization dedicated to improving the quality of life of people, communities and our planet by sourcing and directly delivering surplus medical supplies and equipment to communities in need around the world. In our 20 year history, MedShare has donated over $220 million worth of life saving medical supplies and equipment to serve more than 20 million patients in 103 countries. MedShare has equipped more than 800,000 healthcare professionals with the tools they need to save lives. In addition to our donations, MedShare’s engineers have provided biomedical equipment training and support to over 7,000 healthcare professionals across the globe. MedShare has earned a 4-star rating by Charity Navigator for 14 consecutive years for excellence in financial accountability and transparency! $13 million 1.5 million 67 50,000 in aid patients served by countries received healthcare donated in 2018 MedShare donations MedShare supplies professionals in 2018 in 2018 equipped in 2018 Our Volunteers Shree Swaminarayan Temple volunteers serve at MedShare’s Northeast Region Volunteer Center regularly. 20,000 volunteers drive our global impact. Without these dedicated humanitarians, our mission would not be possible. -

Chevron Humankind Program Guidelines

chevron humankind program guidelines Table of contents Chevron Humankind .............................................................................................................................. 1 Scope .................................................................................................................................................... 2 Contribution limits .................................................................................................................................. 2 Eligible participants ................................................................................................................................ 2 Eligible recipient organizations ............................................................................................................... 2 Restrictions on contribution recipients and payments ............................................................................ 3 Allowable financial contribution methods and processing ....................................................................... 4 Volunteer requirements for grant requests ............................................................................................. 4 Special considerations for supporting charitable fundraising events....................................................... 5 Match and volunteer grant request deadlines ........................................................................................ 5 Chevron Corporation governance ......................................................................................................... -

Download As A

NEWSLETTER FEBRUARY-MARCH 2019 PROJECT ROZANA BUILDING BETTER UNDERSTANDING BETWEEN ISRAELIS AND PALESTINIANS THROUGH HEALTH EDITORIAL n progressive political circles I am sometimes asked why I work on initiatives like Project Rozana when peace negotiations between the IIsraelis and Palestinians are non-existent. Wouldn’t a singular focus on affecting political change be more effective? A harsher criticism of the work we do is that it ‘normalizes’ the unsustainable status quo on the West Bank and Gaza. While every conflict has its unique causes and characteristics, I think it is instructive to look at the experience of the situation in Northern Ireland, Kenneth Bob, or ‘The Troubles’ as they were called. After many years of seemingly intractable Chair Project Rozana USA political conflict and violence, at the time of the Good Friday Agreement in I believe that in fact 1998, there were 5,000 co-existence projects underway between Catholics and both a political track Protestants. The agreement needed to be approved by voters in two separate and grassroots work are referendums (Northern Ireland and the Republic of Ireland), and experts agree that the existence of grassroots support developed through these contacts was essential elements of an essential for the wide margins of passage. Israeli-Palestinian peace strategy. While Project It is important to note that the funding for much of this effort came from Rozana makes no claims the International Fund for Ireland (IFI) and there are proposals pending in to directly affect the governmental venues around the world, including in the U.S. Congress to macro-political track, establish a similar International Fund for Israeli-Palestinian Peace.