Raigarh Champa Rail Infrastructure Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

6 Chattisgarh Village Kapan, District Janjgir Champa

Ongoing Infrastructure Development (ID) Projects under MSE-CDP (as on 31.12.17) S. No. State Location of project 1 Andhra Pradesh JRD Industrial Estate, Kanuru, Vijayawada, Krishna District 2 Andhra Pradesh ID Centre at Kopparthy, Kadapa District 3 Andhra Pradesh ID Centre at Amudalavalasa, Srikkakulam Distirctc 4 Arunachal Bame, Distt. West Siang, Arunachal Pradesh. Pradesh 5 Assam Amingaon Export Promotion Industrial Park (EPIP) in Kamrup (Metro) District 6 Assam Pathshala, Barpeta 7 Chattisgarh Village Kapan, District Janjgir Champa 8 Haryana Industrial Estate, Phase-1, Rai, District Sonepat 9 Haryana Industrial Estate, Karnal 10 Haryana Industrial Estate, Kundli, Sonepat 11 J&K Industrial Complex, Khonmoh 12 J&K Electronic Complex Rangreth, District Badgam, J&K 13 J&K Industrial Estate, Batal Ballain, Phase-I, Udhampur 14 Karnataka New Industrial Estate, Harohali, Kanakpur, Ramanagar 15 Kerala Industrial Estate at Poovanthuruthu, Kottayam 16 Kerala Upgradation of Industrial Estate at Edayar, Ernakulam 17 Madhya Pradesh New industrial estate (Food Cluster) at Barodi, Shivpuri District 18 Madhya Pradesh New industrial estate (Ratlam Namkeen and Allied Food Industries Cluster) at Karmadi village, Ratlam district 19 Manipur New Industrial Estate at Chandel 20 Manipur New Industrial Estate at Ukhrul 21 Manipur New Industrial Estate at Churachandpur 22 Punjab Industrial Infrastructure in Focal Point, Phase-IV, Ludhiana 23 Rajasthan New ID Centre, Hanumangarh Road, Sri Ganga Nagar 24 Rajasthan Kishanghat Industrial Area, Jaisalmer 25 Tamilnadu -

List of Eklavya Model Residential Schools in India (As on 20.11.2020)

List of Eklavya Model Residential Schools in India (as on 20.11.2020) Sl. Year of State District Block/ Taluka Village/ Habitation Name of the School Status No. sanction 1 Andhra Pradesh East Godavari Y. Ramavaram P. Yerragonda EMRS Y Ramavaram 1998-99 Functional 2 Andhra Pradesh SPS Nellore Kodavalur Kodavalur EMRS Kodavalur 2003-04 Functional 3 Andhra Pradesh Prakasam Dornala Dornala EMRS Dornala 2010-11 Functional 4 Andhra Pradesh Visakhapatanam Gudem Kotha Veedhi Gudem Kotha Veedhi EMRS GK Veedhi 2010-11 Functional 5 Andhra Pradesh Chittoor Buchinaidu Kandriga Kanamanambedu EMRS Kandriga 2014-15 Functional 6 Andhra Pradesh East Godavari Maredumilli Maredumilli EMRS Maredumilli 2014-15 Functional 7 Andhra Pradesh SPS Nellore Ozili Ojili EMRS Ozili 2014-15 Functional 8 Andhra Pradesh Srikakulam Meliaputti Meliaputti EMRS Meliaputti 2014-15 Functional 9 Andhra Pradesh Srikakulam Bhamini Bhamini EMRS Bhamini 2014-15 Functional 10 Andhra Pradesh Visakhapatanam Munchingi Puttu Munchingiputtu EMRS Munchigaput 2014-15 Functional 11 Andhra Pradesh Visakhapatanam Dumbriguda Dumbriguda EMRS Dumbriguda 2014-15 Functional 12 Andhra Pradesh Vizianagaram Makkuva Panasabhadra EMRS Anasabhadra 2014-15 Functional 13 Andhra Pradesh Vizianagaram Kurupam Kurupam EMRS Kurupam 2014-15 Functional 14 Andhra Pradesh Vizianagaram Pachipenta Guruvinaidupeta EMRS Kotikapenta 2014-15 Functional 15 Andhra Pradesh West Godavari Buttayagudem Buttayagudem EMRS Buttayagudem 2018-19 Functional 16 Andhra Pradesh East Godavari Chintur Kunduru EMRS Chintoor 2018-19 Functional -

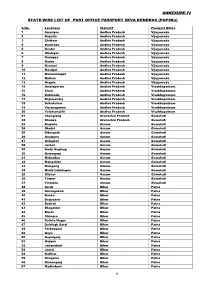

Annexure-Iv State-Wise List of Post Office Passport Seva

ANNEXURE-IV STATE-WISE LIST OF POST OFFICE PASSPORT SEVA KENDRAS (POPSKs) S.No. Locations State/UT Passport Office 1 Anantpur Andhra Pradesh Vijayawada 2 Bapatla Andhra Pradesh Vijayawada 3 Chittoor Andhra Pradesh Vijayawada 4 Gudivada Andhra Pradesh Vijayawada 5 Guntur Andhra Pradesh Vijayawada 6 Hindupur Andhra Pradesh Vijayawada 7 Kadappa Andhra Pradesh Vijayawada 8 Kodur Andhra Pradesh Vijayawada 9 Kurnool Andhra Pradesh Vijayawada 10 Nandyal Andhra Pradesh Vijayawada 11 Narasaraopet Andhra Pradesh Vijayawada 12 Nellore Andhra Pradesh Vijayawada 13 Ongole Andhra Pradesh Vijayawada 14 Amalapuram Andhra Pradesh Visakhapatnam 15 Eluru Andhra Pradesh Visakhapatnam 16 Kakinada Andhra Pradesh Visakhapatnam 17 Rajamundry Andhra Pradesh Visakhapatnam 18 Srikakulam Andhra Pradesh Visakhapatnam 19 Vizianagaram Andhra Pradesh Visakhapatnam 20 Yelamanchili Andhra Pradesh Visakhapatnam 21 Changlang Arunachal Pradesh Guwahati 22 Khonsa Arunachal Pradesh Guwahati 23 Barpeta Assam Guwahati 24 Dhubri Assam Guwahati 25 Dibrugarh Assam Guwahati 26 Goalpara Assam Guwahati 27 Golaghat Assam Guwahati 28 Jorhat Assam Guwahati 29 Karbi Anglong Assam Guwahati 30 Karimganj Assam Guwahati 31 Kokrajhar Assam Guwahati 32 Mangaldoi Assam Guwahati 33 Nawgong Assam Guwahati 34 North Lakhimpur Assam Guwahati 35 Silchar Assam Guwahati 36 Tezpur Assam Guwahati 37 Tinsukia Assam Guwahati 38 Arrah Bihar Patna 39 Aurangabad Bihar Patna 40 Banka Bihar Patna 41 Begusarai Bihar Patna 42 Bettiah Bihar Patna 43 Bhagalpur Bihar Patna 44 Buxar Bihar Patna 45 Chhapra Bihar Patna -

Annexure –II LIST of OPERATIONAL POST OFFICE PASSPORT SEVA

Annexure –II LIST OF OPERATIONAL POST OFFICE PASSPORT SEVA KENDRAS (POPSK) S.No. Locations State/UT Passport Office 1 Amalapuram Andhra Pradesh Visakhapatnam 2 Anantpur Andhra Pradesh Vijayawada 3 Bapatla Andhra Pradesh Vijayawada 4 Chittoor Andhra Pradesh Vijayawada 5 Eluru Andhra Pradesh Visakhapatnam 6 Gudivada Andhra Pradesh Vijayawada 7 Guntur Andhra Pradesh Vijayawada 8 Hindupur Andhra Pradesh Vijayawada 9 Kadappa Andhra Pradesh Vijayawada 10 Kakinada Andhra Pradesh Visakhapatnam 11 Kodur Andhra Pradesh Vijayawada 12 Kurnool Andhra Pradesh Vijayawada 13 Nandyal Andhra Pradesh Vijayawada 14 Narasaraopet Andhra Pradesh Vijayawada 15 Nellore Andhra Pradesh Vijayawada 16 Ongole Andhra Pradesh Vijayawada 17 Rajamundry Andhra Pradesh Visakhapatnam 18 Srikakulam Andhra Pradesh Visakhapatnam 19 Vizianagaram Andhra Pradesh Visakhapatnam 20 Yelamanchili Andhra Pradesh Visakhapatnam 21 Changlang Arunachal Pradesh Guwahati 22 Khonsa Arunachal Pradesh Guwahati 23 Barpeta Assam Guwahati 24 Dhubri Assam Guwahati 25 Dibrugarh Assam Guwahati 26 Goalpara Assam Guwahati 27 Golaghat Assam Guwahati 28 Jorhat Assam Guwahati 29 Karbi Anglong Assam Guwahati 30 Karimganj Assam Guwahati 31 Kokrajhar Assam Guwahati 32 Mangaldoi Assam Guwahati 33 Nawgong Assam Guwahati 34 North Lakhimpur Assam Guwahati 35 Silchar Assam Guwahati 36 Tezpur Assam Guwahati 37 Tinsukia Assam Guwahati 38 Arrah Bihar Patna 39 Banka Bihar Patna 40 Begusarai Bihar Patna 41 Bettiah Bihar Patna 42 Bhagalpur Bihar Patna 43 Buxar Bihar Patna 44 Chhapra Bihar Patna 45 Dalmia Nagar Bihar -

Village & Townwise Primary Census Abstract, Janjgir-Champa, Part-XII

CENSUS OF INDIA 2001 SERIES - 23 CHHATTISGARH DISTRICT CENSUS HANDBOOK PART-A&B JANJGIR-CHAMPA DISTRICT VILLAGE & TOWN.. DIRECTORY VILLAGE & TOWNWISE PRIMARY CENSUS ABSTRACT Prabhakar Bansod, Director of the Indian Administrative Service Directorate of Census Operations, Chhattisgarh Prc;:>duct Code No. 22-006-2001-Cen-Book(E) Shivrinarayan, Janjgir-Champa Shivrinarayan temple is situated about 65 kms. far from district headquarter on the bank of Mahanadi. It is believed that it is a place of meeting of Bhagwan Ram and Shabari of Ramayana. Shivrinarayan temple was built by Kalchuri kings and it has its archeological importance. It is a religious tourist centre. A great fair is conducted here during full moon of Magh for 15 days. (iv) U~--::E-:" o _, ,~'~~~ ~~~~~Jrs, ~-- ----~--- _____ __ ' _____ _ -i -I -( -I -I .-1 o 000000 r+ r+ r+ ,-to r+ r+ (/) e..e.9..e_e_::_ o -i "1J»ZZZZ o o.,cccC ::0 ""0 ro 3333 c0O"O"O"'o- () OJ -N 0" mroro(tl ,-+",-....,.." .... r _. :;' o o -lo o :r: gifj~~s.s. (_ :r: '.10 Vl » ~~;;t0;; '" » -I ? ~~?~ z ~;S .._.,1O::JaJ_. Vl" ro 0'" ~ (): G) ., ". Ul » $ :::0 :::0 . , ...... 0Jf.OCDCDCO If L A I :r: (.NOlO () ::JUlO 0' ..,.1'-' v\ I (.No ~o » s::: IJ » I "o - o .. C', co o 1fV:: ,,~l' . ------ lui _"'I en .~ 1'~ /'(1 .S. ~o» ~(l{ ~/}e:\// .... .. Gl '1', J'\ o H, '0o o ~ _. ~ ____ J . _______._. ___ _ 0, Contents Pages Foreword Preface xi. A cJmow Jedgem ent xiii. D istr:ict H :ighlights - 2001 Census lin portant statistics :in the d:isb::ict xvii. -

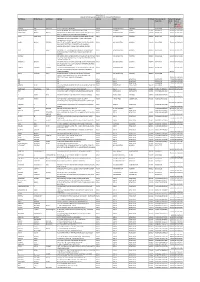

Annexure-V State/Circle Wise List of Post Offices Modernised/Upgraded

State/Circle wise list of Post Offices modernised/upgraded for Automatic Teller Machine (ATM) Annexure-V Sl No. State/UT Circle Office Regional Office Divisional Office Name of Operational Post Office ATMs Pin 1 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA PRAKASAM Addanki SO 523201 2 Andhra Pradesh ANDHRA PRADESH KURNOOL KURNOOL Adoni H.O 518301 3 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM AMALAPURAM Amalapuram H.O 533201 4 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Anantapur H.O 515001 5 Andhra Pradesh ANDHRA PRADESH Vijayawada Machilipatnam Avanigadda H.O 521121 6 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA TENALI Bapatla H.O 522101 7 Andhra Pradesh ANDHRA PRADESH Vijayawada Bhimavaram Bhimavaram H.O 534201 8 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA VIJAYAWADA Buckinghampet H.O 520002 9 Andhra Pradesh ANDHRA PRADESH KURNOOL TIRUPATI Chandragiri H.O 517101 10 Andhra Pradesh ANDHRA PRADESH Vijayawada Prakasam Chirala H.O 523155 11 Andhra Pradesh ANDHRA PRADESH KURNOOL CHITTOOR Chittoor H.O 517001 12 Andhra Pradesh ANDHRA PRADESH KURNOOL CUDDAPAH Cuddapah H.O 516001 13 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM VISAKHAPATNAM Dabagardens S.O 530020 14 Andhra Pradesh ANDHRA PRADESH KURNOOL HINDUPUR Dharmavaram H.O 515671 15 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA ELURU Eluru H.O 534001 16 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudivada Gudivada H.O 521301 17 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudur Gudur H.O 524101 18 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Guntakal H.O 515801 19 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA -

One Time ODF+ & ODF++ Updated.Xlsx

ODF++ Certified: 489 State Number of ULB Certified ODF++ Andhra Pradesh 4 Chandigarh 1 Chhattisgarh 168 Delhi 2 Gujarat 26 Haryana 13 Himachal Pradesh 1 Jharkhand 2 Karnataka 2 Madhya Pradesh 108 Maharashtra 115 Odisha 2 Punjab 17 Rajasthan 6 Telangana 2 Uttar Pradesh 18 Uttarakhand 2 Grand Total 489 ULB Census Code State District ULB 802947 Andhra Pradesh Visakhapatnam Greater Visakhapatnam 802969 Andhra Pradesh Krishna Vijaywada 803014 Andhra Pradesh Chittoor Tirupati 802988 Andhra Pradesh Prakasam Ongole 800286 Chandigarh Chandigarh Chandigarh 801911 Chhattisgarh Koria Baikunthpur_C 801912 Chhattisgarh Koria Manendergarh 801913 Chhattisgarh Koria Khongapani 801914 Chhattisgarh Koria Jhagrakhand 801915 Chhattisgarh Koria Nai ledri 801916 Chhattisgarh Koria Chirimiri 801918 Chhattisgarh Balrampur Balrampur_C 801919 Chhattisgarh Balrampur Wadrafnagar 801921 Chhattisgarh Surajpur Jarhi 801922 Chhattisgarh Balrampur Kusmi 801926 Chhattisgarh Surajpur Premnagar 801927 Chhattisgarh Sarguja Ambikapur 801928 Chhattisgarh Kathua Lakhanpur_C 801929 Chhattisgarh Balrampur Rajpur_C 801930 Chhattisgarh Sarguja Sitapur_CH 801932 Chhattisgarh JashpurNagar Jashpur 801934 Chhattisgarh JashpurNagar Kotba 801936 Chhattisgarh Raigarh Lailunga 801937 Chhattisgarh Raigarh Gharghora 801939 Chhattisgarh Raigarh Raigarh 801941 Chhattisgarh Raigarh Kharsia 801944 Chhattisgarh Raigarh Baramkela 801945 Chhattisgarh Korba Katghora 801948 Chhattisgarh Korba Pali_C 801949 Chhattisgarh Korba Korba 801950 Chhattisgarh Janjgir-Champa Jangir Naila 801951 Chhattisgarh -

ONE Time ODF+&ODF++.Xlsx

ODF++ Certified: 292 State Number of ULB Certified ODF++ Andhra Pradesh 4 Chandigarh 1 Chhattisgarh 148 Delhi 2 Gujarat 12 Haryana 11 Jharkhand 1 Karnataka 1 Madhya Pradesh 40 Maharashtra 57 Odisha 1 Punjab 2 Rajasthan 5 Telangana 2 Uttar Pradesh 5 Grand Total 292 ULB Census Code State District ULB 802947 Andhra Pradesh Visakhapatnam Greater Visakhapatnam 802969 Andhra Pradesh Krishna Vijaywada 803014 Andhra Pradesh Chittoor Tirupati 801911 Chhattisgarh Koria Baikunthpur_C 801912 Chhattisgarh Koria Manendergarh 801913 Chhattisgarh Koria Khongapani 801914 Chhattisgarh Koria Jhagrakhand 801915 Chhattisgarh Koria Nai ledri 801916 Chhattisgarh Koria Chirimiri 801918 Chhattisgarh Balrampur Balrampur_C 801919 Chhattisgarh Balrampur Wadrafnagar 801921 Chhattisgarh Surajpur Jarhi 801922 Chhattisgarh Balrampur Kusmi 801926 Chhattisgarh Surajpur Premnagar 801927 Chhattisgarh Sarguja Ambikapur 801928 Chhattisgarh Kathua Lakhanpur_C 801929 Chhattisgarh Balrampur Rajpur_C 801930 Chhattisgarh Sarguja Sitapur_CH 801932 Chhattisgarh JashpurNagar Jashpur 801934 Chhattisgarh JashpurNagar Kotba 801936 Chhattisgarh Raigarh Lailunga 801937 Chhattisgarh Raigarh Gharghora 801939 Chhattisgarh Raigarh Raigarh 801941 Chhattisgarh Raigarh Kharsia 801944 Chhattisgarh Raigarh Baramkela 801945 Chhattisgarh Korba Katghora 801948 Chhattisgarh Korba Pali_C 801949 Chhattisgarh Korba Korba 801950 Chhattisgarh Janjgir-Champa Jangir Naila 801951 Chhattisgarh Janjgir-Champa Akaltara 801953 Chhattisgarh Janjgir-Champa Nawagarh_j 801960 Chhattisgarh Janjgir-Champa Kharod 801964 -

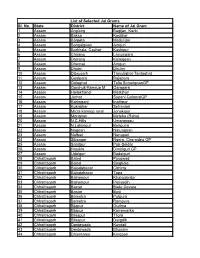

Jal Grams-List I

List of Selected Jal Grams Sl. No. State District Name of Jal Gram 1 Assam Anglong Bogijan, Karbi 2 Assam Baksa Kosijhar 3 Assam Barpeta Madulijan 4 Assam Bongaigoan Amguri 5 Assam Borkhala, Cachar Kashipur 6 Assam Chirang Laojuripara 7 Assam Darrang Kalaigoan 8 Assam Dhemaji Amguri 9 Assam Dhubri Dhubri 10 Assam Dibrugarh Tamulighat-Tentaghat 11 Assam Goalpara Rajapara 12 Assam Golaghat Telia SonarigoanGP 13 Assam Gorchuk-Kamrup M Garopara 14 Assam Hailakhandi Matkjhuri 15 Assam Jorhat Supani GolamalGP 16 Assam Karimganj Inathpur 17 Assam Kokrajhar Sefranjari 18 Assam Mirza kamrup rural Jonakipur 19 Assam Morigoan Meteka (Raha) 20 Assam N.C.Hills Umarangsu 21 Assam N.Lakimpur Behpuria 22 Assam Nagoan Natuagoan 23 Assam Nalbari Nanapari 24 Assam Sibsagar Ngera, Charaideo GP 25 Assam Sonitpur Pub-Soidar 26 Assam tinsukia Dimiriguri GP 27 Assam Udalguri Badalguri 28 Chhattisgarh Balod Pusawad 29 Chhattisgarh Balod Singhola 30 Chhattisgarh Balodabazar Chhirra 31 Chhattisgarh Balodabazar Topa 32 Chhattisgarh Balrampur Khatwabrdar 33 Chhattisgarh Balrampur Pariyadih 34 Chhattisgarh Bastar Bade Devara 35 Chhattisgarh Bastar Burji 36 Chhattisgarh Bemetra Putpura 37 Chhattisgarh Bemetra Rampura 38 Chhattisgarh Bijapur Gudma 39 Chhattisgarh Bijapur Karremarka 40 Chhattisgarh Bilaspur Tilora 41 Chhattisgarh Bilaspur Durgdih 42 Chhattisgarh Dantewada Kundeli 43 Chhattisgarh Dantewada Bhogam 44 Chhattisgarh Dhamtaree Korgaon Sl. No. State District Name of Jal Gram 45 Chhattisgarh Dhamtaree Chhuhi 46 Chhattisgarh Durg Nikum 47 Chhattisgarh Durg Mohlai -

Trainers' Training Programme on Entrepreneurship Development

2nd Floor,Chitrapur Bhavan,15th Cross,8th Main,Malleshwaram,BANGALORE-560055 Ph:080 23462875;Fax:23462876;Email:[email protected];Website:WWW.rudsetacademy.org Trainers’ Training Programme on Entrepreneurship Development Batch No.31 03 to 15 June 2013 List of Participants Sl. Name Designation RSETI Address Residential Address Bank No 1. Dr.Mahesh Dutt Bali SPC for J & K -- Sector No.5, House National No.218, Channi-Himmat Academy of Jammu – 180 015 RUDSETI J & K 2. K.C.Sharma SPC for H.P -- House opp. HPSEB Rest National House, Lohna Village Academy of PO Bundla Tea Estate RUDSETI Palampur – 176 061 Dist. Kangra, H.P. 3. S.Pushparaj SPC for -- 301, Shekawati Enclave National Rajasthan 35 Lajpath Marg Academy of ‘C’ Scheme RUDSETI Jaipur, Rajasthan 4. Kanchan Pal Singh SPC for U.P. -- MIG Flat C-7, Third Floor National Near Telephone Academy of Exchange, Lal Diggi Road RUDSETI Aligarh – 202 001 5. Pradip Kumar Talukdar SPC for -- House No.8 National Assam and Jogesh Das Path Academy of other North Hatigaon RUDSETI East Region Guwahati – 781 038 States Assam 6. Nand Kishore Sahi SPC for Bihar -- Sukhdeonagar National Kali Mandir Street Academy of Ratu Road, Hehal RUDSETI Ranchi – 834 005 Jharkhand 7. Awadh Kishore Jha SPC for -- National Games HSG. National Jharkhand Complex, Khelgaon, Academy of Sector – I, Block – 8, RUDSETI Flat No.401, Hotwar, Ranchi – 835 217 8. Dilip Kumar Mitra SPC for W.B -- 18/2 Padma Babu Road National P.O. Bally Academy of Howrah – 711 201, W.B RUDSETI 9. Rajendra kumar Dalal SPC for M.P -- Kanha Avenue National Flat No.303, Academy of 11, Gumasta Nagar RUDSETI Indore – 452 009, M.P 10. -

First Name Middle Name Last Name Address Country State

Biocon Limited Amount of unclimed and unpaid Interim dividend for FY 2010-11 First Name Middle Name Last Name Address Country State District PINCode Folio Number of Amount Proposed Securities Due(in Date of Rs.) transfer to IEPF (DD- MON-YYYY) JAGDISH DAS SHAH HUF CK 19/17 CHOWK VARANASI INDIA UTTAR PRADESH VARANASI BIO040743 150.00 03-JUN-2018 RADHESHYAM JUJU 8 A RATAN MAHAL APTS GHOD DOD ROAD SURAT INDIA GUJARAT SURAT 395001 BIO054721 150.00 03-JUN-2018 DAMAYANTI BHARAT BHATIA BNP PARIBASIAS OPERATIONS AKRUTI SOFTECH PARK ROAD INDIA MAHARASHTRA MUMBAI 400093 BIO001163 150.00 03-JUN-2018 NO 21 C CROSS ROAD MIDC ANDHERI E MUMBAI JYOTI SINGHANIA CO G.SUBRAHMANYAM, HEAD CAP MAR SER IDBI BANK LTD, INDIA MAHARASHTRA MUMBAI 400093 BIO011395 150.00 03-JUN-2018 ELEMACH BLDG PLOT 82.83 ROAD 7 STREET NO 15 MIDC, ANDHERI EAST, MUMBAI GOKUL MANOJ SEKSARIA IDBI LTD HEAD CAPITAL MARKET SERVIC CPU PLOT NO82/83 INDIA MAHARASHTRA MUMBAI 400093 BIO017966 150.00 03-JUN-2018 ROAD NO 7 STREET NO 15 OPP SPECIALITY RANBAXY LABORATORI ES MIDC ANDHERI (E) MUMBAI-4000093 DILIP P SHAH IDBI BANK, C.O. G.SUBRAHMANYAM HEAD CAP MARK SERV INDIA MAHARASHTRA MUMBAI 400093 BIO022473 150.00 03-JUN-2018 PLOT 82/83 ROAD 7 STREET NO 15 MIDC, ANDHERI.EAST, MUMBAI SURAKA IDBI BANK LTD C/O G SUBRAMANYAM HEAD CAPITAL MKT SER INDIA MAHARASHTRA MUMBAI 400093 BIO043568 150.00 03-JUN-2018 C P U PLOT NO 82/83 ROAD NO 7 ST NO 15 OPP RAMBAXY LAB ANDHERI MUMBAI (E) RAMANUJ MISHRA IDBI BANK LTD C/O G SUBRAHMANYAM HEAD CAP MARK SERV INDIA MAHARASHTRA MUMBAI 400093 BIO047663 150.00 03-JUN-2018 -

District Disaster Fire Safety Management Plan YEAR

GOVERNM ENT OF CHHATTISGARH DDiissttrriicctt DDiissaasstteerr FFiirree SSaaffeettyy MMaannaaggeemmeenntt PPllaann YYEEAARR -- 22002200 DDIISSTTRRIICCTT –– JJAANNJJGGIIRR--CCHHAAMMPPAA STATE DISASTER MANAGEMENT AUTHORITY, C.G. REVENUE & DISASTER MANAGEMENT DEPARTMENT MAHANADI BHAWAN, MANTRALAYA, ATAL NAGAR, RAIPUR, CHHATTISGARH Acknowledgment Under the leadership of Hon’ble Chief Minister of Chhattisgarh and Hon’ble Minister, Government of Chhattisgarh Revenue and Disaster Management Department, Chief Secretary Government of Chhattisgarh and Relief Commissioner and Secretary of Revenue and Disaster Management Department, we express gratitude towards all those who have contributed to the preparation of District Disaster Fire Safety Management Plan. According to the guidelines of Disaster Management Act 2005, this scheme has been prepared for public utility. District Disaster Fire Safety Management Plan has been prepared with the aligned departments for the utmost benefit of the ‘community’. The role of each of the department has been determined, to ensure coordination, preparation and appropriate action in the same manner before, during and after the disaster. Ms. Reeta Shandilya, Secretary, Mr. K.D. Kunjam, Joint Secretary and Mr. A.K. Pillai Office superintendent Department of Revenue and Disaster Management, has given special cooperation for the preparation of District Disaster Fire Safety Management Plan. For the preparation of actual structure of District Disaster Fire Safety Management Plan, special contribution is given by the Disaster Management Consultants Mr. Dilip Singh Rathore, Mr. Prashant Kumar Pandey, Mrs. Chetna, Ms. Jaya Sahu, Mr. Jitendra Solanki and Mr. S. Sreejit. District Nodal Officer of Revenue and Disaster Management Department and other officers of related departments have given their major vital Contribution with Cooperation for the document preparation required for the plan.