Shapoorji Pallonji and Company Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IPA Mumbai Membership As on 31 May 2019.Xlsx

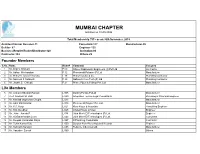

MUMBAI CHAPTER Installed on 18-09-2005 Total Membership 745 - as on 30th November, 2019 Architect/Interior Designer-11 Consultant-117 Manufacturer-95 Builder- 87 Engineer-120 Business/Retailer/Trader/Distributor-128 Institution-04 Contractor-154 Others-29 Founder Members S.No. Name Mem # Company Category 1 Mr. Dilip V. Bhimani F 09 Shree Padmavati Engineers (I) Pvt Ltd Contractor 2 Mr. Adhar Mirchandani F 12 Phenoweld Polymer (P) Ltd Manufacturer 3 Dr. Phiroze Framroze Karaka F 19 Phiroz Karaka & Co. Plumbing Contractor 4 Mr. Nariman F Nallaseth F 20 Nallaseth Com Tech (P) Ltd Plumbing Contractor 5 Mr. Jayant S. Chheda F 21 Prince Pipes & Fittings Pvt. Ltd Manufacturer Life Members 6 Mr. Avinash Bhaskar Ranade L 005 Darling Pumps PvtLtd Manufacturer 7 Prof. Subhash M Patil L 009 Integrated Techno-Legal Consultants Plumbing & Structural Engineer 8 Mr. Keshab Jagmohan Chopra L 013 Manufacturer 9 Mr. Adar Mirchandani L 018 Phenoweld Polymer Pvt. Ltd. Manufacturer 10 Mr. K.S. Kogje L 021 Kisor Kogje & Associate Consulting Engineer 11 Mr. K.D. Deodhar L 025 Chalet Hotels Limited Engineer 12 Mr. John Joseph P. L 034 John Mech-El Technologies (P) Ltd. Engineer 13 Mr. Ajit Balachandra Joshi L 043 John Mech-El Technologies (P) Ltd. Consultant 14 Mr. Deepak Karsandas Daiya L 047 D'Plumbing Consultants Contractor 15 Mr. Tuhin Kumar Das L 050 Sarovar Park Plaza Hotels & Resorts Engineer 16 Mr. Subhash Sanzgiri L 055 Reliance Industries Ltd. Manufacturer 17 Mr. Vasudev Suresh L 069 Others 18 Mr. Mantripragada Prakash Kumar L 078 Unicorn Holdings (P) Ltd. Hotel Industries 19 Mr. -

The Tata-Mistry Dispute: Quo Vadis, HR News, Ethrworld

05/10/2020 The Tata-Mistry Dispute: Quo Vadis, HR News, ETHRWorld NEWS SITES Sign in/Sign up Follow us: NEWS TRENDS WORKPLACE 4.0 HRTECH HR TV ENGAGE ADVISORY BOARD BRAND SOLUTIONS INTERVIEWS INDUSTRY EXPERT SPEAK CXO MOVEMENT INTERNATIONAL CAREERS FOR TOMORROW WHITEPAPER MORE HR News / Latest HR News / Industry The Tata-Mistry Subscribe to our Newsletters 100000+ Industry Leaders Dispute: Quo Vadis have already joined If the reported eorts of the two groups to settle their Your Email JOIN NO dispute before the next hearing were to succeed, it would mean a lost opportunity to not have the Supreme Court of India weigh in on the foundational principles of corporate governance—that of voice and exit for INDUSTRY shareholders—that this dispute is about. 28 mins ago ETHRWorld Contributor October 01, 2020, 20:40 IST Mumbai: Bidi workers struggle amid COVID-19 lockdown 2 hrs ago Over 1 lakh local shops, kiranas to facilitate Amazon India's delivery this festive season Ratan Tata (L) and Cyrus Mistry (R) https://hr.economictimes.indiatimes.com/news/industry/the-tata-mistry-dispute-quo-vadis/78431843 1/11 05/10/2020 The Tata-Mistry Dispute: Quo Vadis, HR News, ETHRWorld By J Ramachandran, Savithran Ramesh, K S 2 hrs ago Paytm, Manikandan other startups vow to Last week, the Shapoorji Pallonji Group (SP Group) ght announced its intention to exit the Tata Group after Google's clout: the Supreme Court restrained it from further pledging Report its shares in Tata Sons until the next hearing. The SP Group’s decision signals a rather bitter end to the 2 hrs ago seven-decades-long relationship that turned publicly Tourism businesses sour in 2016 with the abrupt dismissal of Cyrus Mistry hit as sta as Chairman of Tata Sons. -

Sarova, a World Where Home Is Truly Redefined

Welcome to Sarova, A world where home is truly redefined. Where every experience is bright and adds colour to life. From the expanse to the tiny corners, each tells a different story. Each delivers an unexpected experience, which transports you to a world you only imagined. Life here is a spectacle, which makes living here remarkable. It’s time to look forward to a new experience every day. It’s time to live like you’ve always wanted. Welcome to AN UNENDING EXPANSE OF Colourful experiences A new home is a dream coming to life. It's the amalgamation of vision, aspiration, and hard work. So, when it comes to your new home, what you look for are experiences that make you happier, enrich you everyday, and give you the space to find your centre. Sarova is not just home, it's your Experience City. The 55-acre project is poised to become one of Mumbai City's largest integrated town- ships and the most ambitious venture of SD Corporation. A melting pot of vibrant life- styles, the core focus of Sarova is to celebrate living and to build an integrated space driven by its community. Interspersed with land- scaped greens and open spaces, expertly curated residential, retail and entertainment experiences are brought together in one framework to deliver a spectacular life. CLOSE TO HOME. A home is complete only when Closerit's tobuzzing withheart life, inside-out. That's why, happiness finds you at every corner at Sarova. THAKUR VILLAGE, KANDIVALI (E) MUMBAI MAHARASHTRA INDIA MAHARASHTRA MUMBAI BORIVALI WEST BORIVALI EAST THANE UPCOMING THANE - BORIVALI -

Cyrus Mistry (11Th

NATIONAL COMPANY LAW APPELLATE TRIBUNAL, NEW DELHI Company Appeal (AT) No. 254 of 2018 IN THE MATTER OF: Cyrus Investments Pvt. Ltd. ….Appellant Vs. Tata Sons Ltd. & Ors. ….Respondents Present: For Appellant: Mr. C. A. Sundaram, Mr. Arun Kathpalia and Mr. K.G. Raghavan, Sr. Advocates with Mr. Somashekhar Sundresan, Mr. Manik Dogra, Mr. Rohan Jaitley, Ms. Rohini Musa, Mr. Abhishek Venkatraman, Mrs. Sonal Jaitley Bakshi, Mr. Jaiyesh Bakhshi, Mr. Apurva Diwanji, Mr. Ravi Tyagi, Mr. Shubhanshu Gupta, Ms. Sanya Kapoor, Ms. Rini Badoni, Mr. Akshay Doctor, Mr. Devashish, Mr. Parag Sawant and Mr. Gunjan Shah, Advocates. For Respondents: Dr. A.M. Singhvi and Mr. Rajiv Nayyar, Sr. Advocates with Mr. Prateek Seksaria, Ms. Ruby Singh Ahuja, Ms. Tahira Karanjawala, Mr. Anupm Prakash, Mr. Avishkar Singhvi, Mr. Arjun Sharma, Mr. Sahil Monga, Mr. Utkarsh Maria, Mr. L. Nidhiram Sharma and Mr. Baij Nath Patel, Advocates for R-1. Mr. Harish N. Salve, Sr. Advocate with Mr. Dhruv Dewan, Mr. Nitesh Jain, Mr. Rohan Batra, Ms. Reena Choudhary, Ms. Yashna Mehta and Mr. Nitesh Jain, Advocates for R-2. Mr. Amit Sibal, Senior Advocate with Ms. Ruby Singh Ahuja, Ms. Tahira Karanjawala, Mr. Arjun Sharma, Mr. Sahil Monga, Mr. Utkarsh Maria, Advocates for R-3, 5 & 7. Mr. Mohan Parasaran, Sr. Advocate with Mr. ZalAndyarujina, Mr. J.N. Mistry, Ms. Namrata Parikh, Mr. Ashwin Kumar D.S, Mr. Sidharth Sharma, Mr. Saswat Pattnaik, Mr. Aditya 2 Panda, Mr. Kartik Anand and Ms. Aditi Dani, Advocates for R-6, 16 to 22. Mr. Janak Dwarkadas, Sr. Advocate with Mr. Akshay Makhija, Mr. -

PALLONJI MISTRY, a LEADER PAR EXCELLENCE Padma Bhushan for Mr Pallonji Mistry

VOLUME 6 ISSUE 2 APRIL 2016 LIFETIME HONOUR Padma Bhushan for Mr Pallonji Mistry PALLONJI MISTRY, A LEADER PAR EXCELLENCE Padma Bhushan for Mr Pallonji Mistry Shapoorji Pallonji Group (SP) Chairman Emeritus, Mr Pallonji Shapoorji Mistry, receives the Padma Bhushan from President of India, Shri Pranab Mukherjee, at Rashtrapati Bhawan, in New Delhi, on March 28, 2016 2 | VOLUME NO. 06 | ISSUE 2 | April 2016 WWW.AFCONS.COM Making Headlines From VC & MD`s Desk UP Expressway Industrial Devel- opment Authority (UPEIDA) has awarded an Appreciation Certificate for achieving 7.22 million safe man- ours without any lost time incident at 'Thank you for ALEP Pkg II on March 11, 2016 IRCLASS Systems and Solution Pvt Ltd has awarded a certificate for inspiring us' quality work at Chenab site on February 24, 2016 Reliance Industries Limited has awarded an Appreciation certificate for achieving 8 million safe man hours without LTI at RIL J3 project on February 03, 2016 Chennai Metro Rail Limited (CMRL) It fills my heart with pride to be part of a Group whose has been awarded an Appreciation Chairman Emeritus is awarded the Padma Bhushan. Letter for achieving highest percent- Mr Pallonji Mistry is an inspiration for the entire SP Group age in Monthly Audit Rating Score and for future generations who will join the ranks. audit (MARS audit from March -14 to Dec -15) at CMRL Package UAA 01 His unwavering focus on business and the enormous site on February 02, 2016 contribution to society will be talked about for ages. Mr Mistry has set examples for Indians not only in the country UPEIDA has awarded an Apprecia- but also overseas. -

212 2020 31 1503 27229 Jud

1 REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NOs.440-441 0F 2020 TATA CONSULTANCY SERVICES LIMITED ¼ APPELLANT(S) VERSUS CYRUS INVESTMENTS PVT. LTD. AND ORS. ¼ RESPONDENT(S) WITH CIVIL APPEAL NOs.13-14 0F 2020 CIVIL APPEAL NOs.442-443 0F 2020 CIVIL APPEAL NOs.19-20 0F 2020 CIVIL APPEAL NOs.444-445 0F 2020 CIVIL APPEAL NOs.448-449 0F 2020 CIVIL APPEAL NOs.263-264 0F 2020 CIVIL APPEAL NO.1802 0F 2020 J U D G M E N T 1. Lis in the Appeals 1.1 Tata Sons (Private) Limited has come up with two appeals in Civil Appeal Nos.13-14 of 2020, challenging a final order dated 18-12-2019 passed by the National Company Law Appellate Tribunal (ªNCLATº for short) (i) holding as illegal, the proceedings of 2 the sixth meeting of the Board of Directors of TATA Sons Limited held on 24.10.2016 in so far as it relates to the removal of Shri Cyrus Pallonji Mistry (ªCPMº for short); (ii) restoring the position of CPM as the Executive Chairman of Tata Sons Limited and consequently as a Director of the Tata Companies for the rest of the tenure; (iii) declaring as illegal the appointment of someone else in the place of CPM as Executive Chairman; (iv) restraining Shri Ratan N. Tata (ªRNTº for short) and the nominees of Tata Trust from taking any decision in advance; (v) restraining the Company, its Board of Directors and Shareholders from exercising the power under Article 75 of the Articles of Association against the minority members except in exceptional circumstances and in the interest of the Company; and (vi) declaring as illegal, the decision of the Registrar of Companies for changing the status of Tata Sons Limited from being a public company into a private company. -

Shapoorji Pallonji Solar PV Private Limited: Rating Withdrawn

October 28, 2020 Shapoorji Pallonji Solar PV Private Limited: Rating withdrawn Summary of rating action Instrument* Previous Rated Amount Current Rated Amount Rating Action (Rs. Crore) (Rs. Crore) Term Loan 190.0 190.0 [ICRA]BBB-&**withdrawn Total 190.0 190.0 *Instrument details are provided in Annexure-1;**on watch with developing implications Rationale The rating assigned to bank facilities of Shapoorji Pallonji Solar PV Private Limited (SPSPPL) has been withdrawn at the request of the company and as the said instruments have been fully repaid and there is no amount outstanding against the rated instruments. The same is in accordance with ICRA's policy on withdrawal and suspension. While ICRA has taken note of the completion of acquisition of the company by Kohlberg Kravis Roberts (KKR) in October 2020, ICRA could not engage with the new promoter and does not have adequate information to suggest that the credit risk has changed since the time the rating was last reviewed. Key rating drivers and their description The key rating drivers have not been captured as the rated instruments have been withdrawn. Liquidity position: Not applicable Rating sensitivities: Not applicable Link to the last Press Release published on ICRA website: Click here and here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies ICRA’s Policy on Withdrawal and Suspension of Rating Approach for rating debt instruments backed by third-party explicit support Not applicable as ICRA does not have information pertaining to the linkages and Parent/Group Support strategy for the new promoter Consolidation/Standalone Not Applicable About the company SPSPPL operates a 30 MW AC solar project at Alliyandhal village in Thirunnamalai District, in Tamil Nadu, won through competitive bidding under the State Solar Policy. -

Shapoorji Pallonji and Company Private Limited

Shapoorji Pallonji and Company Private Limited June 26, 2018 Summary of rated instruments Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) [ICRA]AA+ (Stable)/[ICRA]A1+ Non-fund based limits 10,000 15,000 Assigned/outstanding [ICRA]AA+ (Stable)/[ICRA]A1+; Fund-based limits 3,500 3,500 Outstanding Commercial Paper 2,500 2,500 [ICRA]A1+; Outstanding Total 16,000 21,000 *Instrument details are provided in Annexure-1 Rating action ICRA has assigned the long-term rating of [ICRA]AA+ (pronounced ICRA double A plus) and short-term rating of [ICRA]A1+ (pronounced ICRA A one plus) to Rs.5,000 crore (enhanced from Rs.10,000 crore to Rs.15,000 crore) non-fund based facilities of Shapoorji Pallonji and Company Private Limited (SPCPL). ICRA also has an outstanding long-term rating of [ICRA]AA+ and short-term rating of [ICRA]A1+ on the fund-based facilities of SPCPL aggregating to Rs. 3,500 crore. ICRA also has an outstanding short-term rating of [ICRA]A1+ on the Rs. 2,500 crore Commercial Paper (CP) programme. The outlook for the long-term ratings is ‘Stable’. Rationale The assigned rating takes into account SPCPL’s status as the flagship company of the Shapoorji Pallonji Group (SP Group), having a well-established presence in the construction, real estate and infrastructure business. The ratings take into account the financial flexibility enjoyed by the SP Group driven by strong investment portfolio comprising of listed and unlisted equity investments as well as large land and property holdings. -

NCLAT's Order

NCLAT’s Order - Reinstating Cyrus Mistry Why in news? The National Company Law Appellate Tribunal (NCLAT) reinstated Cyrus Mistry as Chairman of Tata Sons and Director of the Tata Group of companies for the remainder of his tenure. Who is Cyrus Mistry? Cyrus Mistry, son of Pallonji Mistry, is the owner of Shapoorji Pallonji group and the biggest stakeholder in the Tata group. Mistry was the sixth chairman of Tata Sons and had taken over in 2012 after Ratan Tata. Relations were seen as amicable between Mistry and Tata. However, after differences of opinions with group patriarch Ratan Tata, Mistry was ousted as both Chairman and Director in October 2016. This was done in a surprise move by the Tata Sons board. Mistry later moved the National Company Law Tribunal (NCLT). The Mumbai bench had upheld Mistry’s removal from his positions at Tata Sons and other Group companies. What is NCLAT’s decision? The appellate tribunal, NCLAT held Mistry’s sacking and the subsequent appointment of N Chandrasekaran to the top post at Tata Sons illegal. The move to take Tata Sons private has also been declared illegal and reversed. NCLAT set aside the 2017 order by the Mumbai bench of the NCLT. The current NCLAT order included directions on several major questions of corporate governance. Article 75 of the Articles of Association of the Tata Group grants Tata Sons the right to transfer the ‘ordinary shares’ of any shareholder. This can be done bypassing a special resolution in the presence of nominated directors of Tata Trusts. The NCLAT has barred Tata Sons from taking any action against Mistry, Shapoorji Pallonji, Cyrus Investments, and other minority shareholders under this provision. -

![SD Corporation Private Limited: Ratings Downgraded to [ICRA]A2(CE)](https://docslib.b-cdn.net/cover/1748/sd-corporation-private-limited-ratings-downgraded-to-icra-a2-ce-2631748.webp)

SD Corporation Private Limited: Ratings Downgraded to [ICRA]A2(CE)

October 09, 2020 S. D. Corporation Private Limited: Ratings downgraded to [ICRA]A2(CE); Rating placed on watch with negative implications and withdrawn Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) [ICRA]A2(CE)@; Downgraded from [ICRA]A1(CE); Rating placed on Commercial Paper 750.0 0.0 watch with negative implications and withdrawn Total 750.0 0.0 *Instrument details are provided in Annexure-1 Rating Without Explicit Credit [ICRA]A4+ Enhancement Note: The (CE) suffix mentioned alongside the rating symbol indicates that the rated instrument/facility is backed by some form of explicit credit enhancement. This rating is specific to the rated instrument/facility, its terms and its structure and does not represent ICRA’s opinion on the general credit quality of the entity concerned. The last row in the table above also captures ICRA’s opinion on the rating without factoring in the explicit credit enhancement Rationale The revision in rating of structured CP programme follows the revision in the short-term rating of Shapoorji Pallonji and Company Private Limited (SPCPL, Guarantor) to [ICRA]A2 (pronounced ICRA A two) from [ICRA]A1 (pronounced ICRA one). The ratings for SPCPL have been placed on watch with negative implications. The rating has been withdrawn at the request of the company and upon receipt of confirmation of no debt outstanding against the rated facility. This is in accordance with ICRA’s policy on withdrawal and suspension of credit rating. For link to previous -

Canadian Companies That Do Business in India

APRIL 2015 CANADIAN COMPANIES THAT DO BUSINESS IN INDIA: NEW LANDSCAPES, NEW PLAYERS AND THE OUTLOOK FOR CANADA THE ASIA PACIFIC FOUNDATION OF CANADA WOULD LIKE TO THANK THE FOLLOWING PARTNERS FOR THEIR GENEROUS SUPPORT OF THIS PROJECT. LEAD PARTNER PARTNERS 2 ASIA PACIFIC FOUNDATION OF CANADA - FONDATION ASIE PACIFIQUE DU CANADA CANADIAN COMPANIES THAT DO BUSINESS IN INDIA CANADIAN COMPANIES THAT DO BUSINESS IN INDIA: NEW LANDSCAPES, NEW PLAYERS AND THE OUTLOOK FOR CANADA Douglas Goold Douglas Goold is a research consultant (India) with the Asia Pacific Foundation of Canada, PARTNERS and was recently director of APF Canada’s National Conversation on Asia and senior editor. He was previously president and CEO of the Canadian Institute of International Affairs/Canadian International Council, and is a noted author, journalist and commentator. He was co-author, with Andrew Willis, of The Bre-X Fraud, a national number-one bestseller, and a national columnist for The Globe and Mail as well as editor of Report on Business and Report on Business Magazine. He received his PhD from Cambridge University and is the recipient of two Killam Postdoctoral Fellowships. CANADIAN COMPANIES THAT DO BUSINESS IN INDIA: NEW LANDSCAPES, NEW PLAYERS AND THE OUTLOOK FOR CANADA 3 Gate of India in New Delhi 4 ASIA PACIFIC FOUNDATION OF CANADA - FONDATION ASIE PACIFIQUE DU CANADA TABLE OF CONTENTS Foreword ————————————————————————————————————————————————————————————————— 6 Executive Summary ——————————————————————————————————————————————————————————— 10 Acknowledgements -

Shapoor Mistry to Spruce up the Shapoorji Pallonji Group

Shapoor Mistry to spruce up the Shapoorji Pallonji Group Pallonji Mistry has handed over the baton of the nearly 150 years old Shapoorji Pallonji Group to his elder son Shapoor Mistry (47), who is an avid horse breeder. Shapoor who was recently made chairman of the Mumbai based $2.5 billion construction and real estate conglomerate, has a challenging task ahead of bringing a new dynamism in the group by converting it into a more contemporary, globally oriented and integrated enterprise with synergies across the group’s companies. The group has just completed a re-branding exercise with a new logo and slogan – ‘Built to last’ – aimed to convey trust and dynamism. Construction and real estate contribute over 60% to the group’s revenues but the group is also present in the consumer goods segment with its home cleaning equipment, security systems and air and water purifiers. Shapoor wants the SP name to be more visible as a consumer brand. Shapoor also wants to take the group to international markets through acquisitions, both in developed and emerging markets. The group has also hired experts to execute his plans. Former PricewaterhouseCoopers director Jai Mavani is a case in point who joined the group as Executive Director, Merger and Acquisitions. Besides injecting the fresh blood, the group has also initiated a re-structuring exercise based on the recommendations of Boston Consulting Group. The group has restructured businesses across 11 of its companies into 19 verticals. Verticalisation will help companies in overlapping sectors to work more in tandem. As Shapoor settles in his new role, comparisons would be made with his younger brother Cyrus who would take over leadership position at the Tata group.