NPRC Letterhead Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NAST Letter to the Congressional Military Family Caucus 7.21.20

July 21, 2020 Congressional Military Family Caucus Representative Sanford Bishop Representative Cathy McMorris Rodgers 2407 Rayburn HOB 1035 Longworth HOB Washington, D.C. 20515 Washington, D.C. 20515 President Deborah Goldberg, MA Dear Rep. Bishop and Rep. McMorris Rodgers: Executive Committee Henry Beck, ME As we celebrate the 30th Anniversary of the passage of the Americans with Disabilities Act David Damschen, UT Tim Eichenberg, NM (ADA), we can be proud of its positive impact on veterans with disabilities, while acknowledging Michael Frerichs, IL that there is much left to do. Dennis Milligan, AR Kelly Mitchell, IN The main purpose of the ADA is to provide people with disabilities equality of opportunity, full Shawn Wooden, CT participation in society, independent living, and economic self-sufficiency. But for more than two Executive Director decades after its passage, economic self-sufficiency was impossible for some. People with Shaun Snyder disabilities who need government benefits in order to live independently were blocked from saving 1201 Pennsylvania Ave, NW money. Without savings, economic self-sufficiency is unattainable. And without being able to Suite 800 fully participate in the economy, the other goals will not be fully realized. Washington, DC 20004 When the Achieving a Better Life Experience (ABLE) Act was passed into law in 2014, many www.NAST.org Americans with disabilities were empowered to save their own money to help pay for their disability expenses without fear of losing federal and state benefits. The Act was a meaningful step forward for people with disabilities. However, it came up short. After more than five years, and on the 30th birthday of the ADA, millions of Americans with disabilities, including veterans, still remain ineligible to open an ABLE account simply because they acquired their disability after they turned 26 years old. -

BIOGRAPHIES Fiona Ma, California State Treasurer

BIOGRAPHIES Fiona Ma, California State Treasurer Fiona Ma is California’s 34th State Treasurer. She was elected on November 6, 2018 with more votes (7,825,587) than any other candidate for treasurer in the state's history. She is the first woman of color and the first woman Certified Public Accountant (CPA) elected to the position. The State Treasurer’s Office was created in the California Constitution in 1849. It provides financing for schools, roads, housing, recycling and waste management, hospitals, public facilities, and other crucial infrastructure projects that better the lives of residents. California is the world’s fifth-largest economy and Treasurer Ma is the state’s primary banker. Her office processes more than $2 trillion in payments within a typical year and provides transparency and oversight for an investment portfolio of more than $90 billion, approximately $20 billion of which are local government funds. She also is responsible for $85 billion in outstanding general obligation and lease revenue bonds of the state. The Treasurer works closely with the State Legislature to ensure that its members know the state’s financial condition as they consider new legislation. She gives her own recommendations for the annual budget. Treasurer Ma was a member of the State Assembly from 2006-2012, serving as Speaker pro Tempore from 2010 to 2012. She built a reputation as a solution-oriented public servant and was adept at building unlikely coalitions to overcome California's most complex problems. Prior to serving as Speaker pro Tempore, she was Assembly Majority Whip and built coalitions during a state budget crisis to pass groundbreaking legislation that protected public education and the environment while also expanding access to health care. -

CA Students Urge Assembly Members to Pass AB

May 26, 2021 The Honorable Members of the California State Assembly State Capitol Sacramento, CA 95814 RE: Thousands of CA Public School Students Strongly Urge Support for AB 101 Dear Members of the Assembly, We are a coalition of California high school and college students known as Teach Our History California. Made up of the youth organizations Diversify Our Narrative and GENup, we represent 10,000 youth leaders from across the State fighting for change. Our mission is to ensure that students across California high schools have meaningful opportunities to engage with the vast, diverse, and rich histories of people of color; and thus, we are in deep support of AB101 which will require high schools to provide ethnic studies starting in academic year 2025-26 and students to take at least one semester of an A-G approved ethnic studies course to graduate starting in 2029-30. Our original petition made in support of AB331, linked here, was signed by over 26,000 CA students and adult allies in support of passing Ethnic Studies. Please see appended to this letter our letter in support of AB331, which lists the names of all our original petition supporters. We know AB101 has the capacity to have an immense positive impact on student education, but also on student lives as a whole. For many students, our communities continue to be systematically excluded from narratives presented to us in our classrooms. By passing AB101, we can change the precedent of exclusion and allow millions of students to learn the histories of their peoples. -

S/L Sign on Letter Re: Rescue Plan State/Local

February 17, 2021 U.S. House of Representatives Washington, D.C. 20515 U.S. Senate Washington, D.C. 20510 Dear Members of Congress: As elected leaders representing communities across our nation, we are writing to urge you to take immediate action on comprehensive coronavirus relief legislation, including desperately needed funding for states, counties, cities, and schools, and an increase in states’ federal medical assistance percentage (FMAP). President Biden’s ambitious $1.9 trillion American Rescue Plan will go a long way towards alleviating the significant financial strain COVID-19 has placed on our states, counties, cities, and schools, and the pocketbooks of working families. Working people have been on the frontlines of this pandemic for nearly a year and have continued to do their jobs during this difficult time. Dedicated public servants are still leaving their homes to ensure Americans continue to receive the essential services they rely upon: teachers and education workers are doing their best to provide quality education and keep their students safe, janitors are still keeping parks and public buildings clean, while healthcare providers are continuing to care for the sick. Meanwhile, it has been ten months since Congress passed the CARES Act Coronavirus Relief Fund to support these frontline workers and the essential services they provide. Without significant economic assistance from the federal government, many of these currently-middle class working families are at risk of falling into poverty through no fault of their own. It is a painful irony that while many have rightly called these essential workers heroes, our country has failed to truly respect them with a promise to protect them and pay them throughout the crisis. -

10 State Auditors and Treasurers

May 27, 2020 (Name) (Title) (Company) (Address) (City/State/Zip) Dear (Salutation): We write to you today in our capacity as top fiscal officers in each of our respective states. As you know, there is a nationwide shortage of ventilators in rotation to serve the estimates of patients that are anticipated to need them as a result of COVID-19 complications. For that reason, we are asking manufacturers of ventilators to do their part to assist overburdened healthcare systems caring for critically ill patients, by agreeing to release all service manuals, service keys, and schematics during this crisis, enabling hospitals to make repairs to ventilators and maximize their supply and ability to serve more COVID-19 patients. Our healthcare workers are putting their own health and safety on the line every day to care for these patients and are desperate for ready solutions and expanded access to functioning ventilators, which we urge manufacturers to support, especially in this time of grave circumstances. We are in a public health emergency where every second is vital. In some instances, service contracts have forced hospitals to wait more than a week for a manufacturer’s technician to service equipment. Hospitals are forced to take their own safety measures, disallowing external technicians to enter their facilities, at the risk of more people coming into direct contact with the coronavirus. We fear that this issue will hurt rural or needy hospitals even harder, as often they may be using secondhand equipment without a maintenance contract or access to a service technician with the manufacturer’s repair information. -

California Legislature 2011-12

“I pledge allegiance to the flag of the United States of America and to the Republic for which it stands, one Nation under God, indivisible, with liberty and justice for all.” I EDMUND G. BROWN JR. GOVERNOR OF CALIFORNIA III GAVIN NEWSOM LIEUTENANT GOVERNOR IV DARRELL STEINBERG PRESIDENT PRO TEMPORE OF THE SENATE V JOHN A. PÉREZ SPEAKER OF THE ASSEMBLY VI FIONA MA SPEAKER PRO TEMPORE OF THE ASSEMBLY VII Memoranda VIII CALIFORNIA LEGISLATURE AT SACRAMENTO Biographies and Photographs of SENATE AND ASSEMBLY MEMBERS AND OFFICERS List of SENATE AND ASSEMBLY MEMBERS, OFFICERS, ATTACHES, COMMITTEES and RULES OF THE TWO HOUSES and Standards of Conduct of the Senate Together With a List of the Members of Congress, State Officers, Etc. 2011–12 REGULAR SESSION (2011 Edition) Convened December 6, 2010 Published August 2011 GREGORY SCHMIDT Secretary of the Senate E. DOTSON WILSON Chief Clerk of the Assembly IX SENATE LEADERSHIP President pro Tempore Darrell Steinberg (D) Majority Leader Ellen M. Corbett (D) Democratic Caucus Chair Kevin de León Republican Leader Bob Dutton Republican Caucus Chair Bob Huff Republican Whip Doug La Malfa Senate Rules Committee: Darrell Steinberg (D) (Chair); Tom Harman (R) (Vice Chair); Elaine Alquist (D); Kevin de León (D); Jean Fuller (R). X CONTENTS PAGE California Representatives in Congress ................. 13 Directory of State Officers ..................................... 16 Constitutional Officers ....................................... 16 Legislative Department ...................................... 20 SENATE ................................................................ 21 Biographies and Photographs of Senators ......... 23 Biographies and Photographs of Officers .......... 49 Senatorial Districts............................................. 51 Senators—Occupations, District Addresses ....... 53 Senate Chamber Seating Chart .......................... 64 Standing Committees ......................................... 65 Senators and Committees of Which They Are Members........................................ -

Fiona Ma, CPA for STATE TREASURER Investing in California’S Future

Fiona Ma, CPA FOR STATE TREASURER Investing in California’s Future EXPERIENCED Fiona Ma is a Certified Public Tax Accountant and currently serves on the California State Board of Equalization, where she works to As a CPA and member of the State Board protect the rights for taxpayers while also ensuring that California of Equalization, Fiona Ma understands collects its fair share of tax revenues. investment and finance. She has the expertise to serve as State Treasurer, As one of two Certified Public Accountants (CPAs) to ever have served on overseeing trillions of dollars in state the Board, Ma understands the challenges that businesses and taxpayers transactions and managing California’s face today. As Chair, she has worked tirelessly to uphold the highest level of multi-billion dollar investment portfolio. integrity in government and fought to increase accessibility, accountability and transparency over the Board the taxpayer money it oversees. Prior to serving on the Board of Equalization, Ma was elected to the California PRINCIPLED State Assemblywoman from 2006-2012. She was the first Asian American As State Treasurer, Fiona Ma will ensure woman to become Speaker pro Tempore of the State Assembly. that California’s investments are sound, In the Assembly, Ma passed laws to protect consumers, help working families earning positive returns for our citizens. pay their bills prevent the spread of Hepatitis B, increase access to quality She will advocate for socially responsible healthcare, and provide equal rights for all Californians. investment that expands jobs, protects our environment and improves education. As Chair of the Assembly Select Committee on Domestic Violence, Ma wrote legislation to strengthen the law and protect victims of domestic violence. -

Treasurer Fiona Ma's 2019 Year-End Review

Fiona Ma, CPA Treasurer State of California December 19, 2019 Dear Friends, The science fiction writer William Gibson, who created the term “cyberspace,” is also credited with observing that “… the future is already here, it’s just not distributed evenly.” That’s also a good way to describe one of the overarching goals of my administration as California’s 34th Treasurer – which is to recognize the future and make sure it is distributed evenly. As the State Treasurer for the world’s fifth largest economy, I take my job very seriously and thank the 7.8 million voters who elected me on November 6, 2018. I was sworn-in on January 8, 2019 and am fortunate to work with 450 highly motivated, ethical, and trained professionals at the State Treasurer’s Office (STO). And although I don’t mention specific people by name here, I want to personally thank my dedicated team at the STO for safeguarding our public funds and serving our constituents with distinction. SERVING AS THE STATE’S BANKER All taxes, fines, fees, interest, and penalties come through my office. That totals more than $2 trillion each year. Pursuant to State law, the State Treasurer serves as agent for sale on all State bonds. For example, from July to December, the STO sold $7.65 billion of bonds, including: $4.23 billion of voter-approved general obligation bonds, including $1.74 billion for new projects and $2.49 billion of refunding bonds. The refunding bonds will save the State’s General Fund $883 million over the next 20 years, or $742.6 million on a present value basis. -

2011 Political Contributions (July 1 – December 31)

2011 Political Contributions (July 1 – December 31) Amgen is committed to serving patients by transforming the promise of science and biotechnology into therapies that have the power to restore health or even save lives. Amgen recognizes the importance of sound public policy in achieving this goal, and, accordingly, participates in the political process and supports those candidates, committees, and other organizations who work to advance healthcare innovation and improve patient access. Amgen participates in the political process by making direct corporate contributions as well as contributions through its employee-funded Political Action Committee (“Amgen PAC”). In some states, corporate contributions to candidates for state or local elected offices are permissible, while in other states and at the federal level, political contributions are only made through the Amgen PAC. Under certain circumstances, Amgen may lawfully contribute to other political committees and political organizations, including political party committees, industry PACs, leadership PACs, and Section 527 organizations. Amgen also participates in ballot initiatives and referenda at the state and local level. Amgen is committed to complying with all applicable laws, rules, and regulations that govern such contributions. The list below contains information about political contributions for the second half of 2011 by Amgen and the Amgen PAC. It includes contributions to candidate committees, political party committees, industry PACs, leadership PACs, Section 527 organizations, and state and local ballot initiatives and referenda. These contributions are categorized by state, political party (if applicable), political office (where applicable), recipient, contributor (Amgen Inc. or Amgen PAC) and amount. Candidate Office State Party Office Sought Committee/PAC Name Candidate Name Corp. -

January - December 2019

Gilead Sciences, Inc. Corporate Political Contributions January - December 2019 Contributions to State and Local Candidates State Amount Bates for Secretary of State 2022 California $4,700 Blanca Rubio for Assembly 2020 California $1,500 Chris Ward for Assembly 2020 California $4,700 Dr. Weber for Assembly 2020 California $4,700 Friends of Frank Bigelow for Assembly 2020 California $1,500 Gipson for Assembly 2020 California $4,700 Glazer for Senate 2020 California $1,500 Grove for Senate 2022 California $1,500 Heath Flora for Assembly 2020 California $1,500 Holden for Assembly 2020 California $1,500 Ian Calderon for Assembly 2020 California $1,500 Jay Obernolte for Assembly 2020 California $1,500 Jim Cooper for Assembly 2020 California $1,500 John Laird for Senate 2020 California $4,700 Lorena Gonzalez for Assembly 2020 California $4,700 Marc Berman for Assembly 2020 California $1,500 Moorlach for Senate 2020 California $1,500 Nazarian for Assembly 2020 California $4,700 Phil Ting for Assembly 2020 California $4,700 Portantino for Senate 2020 California $1,500 Re-Elect Fiona Ma for State Treasurer 2022 California $2,500 Re-Elect Ken Cooley for Assembly 2020 California $1,500 Rodriguez for Assembly 2020 California $1,500 Rudy Salas for Assembly 2020 California $1,500 Steven Bradford for Senate 2020 California $1,000 Susan Rubio for Senate 2022 California $1,500 Tom Daly for Assembly 2020 California $1,500 Tyler Diep for Assembly 2020 California $1,500 Waldron for Assembly 2020 California $1,500 Wilk for Senate 2020 California $1,500 Allison Tant For House District 9 Florida $500 Campaign to Elect Doug Broxson for Florida Senate Florida $1,000 Colleen Burton Campaign Florida $500 Darryl Rouson Campaign Florida $1,000 Debbie Mayfield Campaign Florida $1,000 Dotie Joseph Campaign 2020 Florida $500 Jackie Toledo Campaign Florida $500 Perry E. -

November 4,2014 General Election Summary Report Results

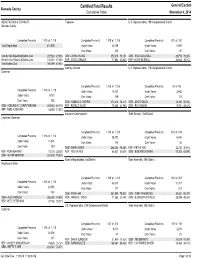

Certified Final Results General Election Alameda County Cumulative Totals November 4, 2014 REGISTRATION & TURNOUT Treasurer U.S. Representative, 15th Congressional District Alameda County Completed Precincts: 1,118 of 1,118 Completed Precincts: 1,118 of 1,118 Completed Precincts: 510 of 510 Total Registration 814,009 Under Votes: 22,059 Under Votes: 5,895 Over Votes: 123 Over Votes: 47 Vote by Mail Reporting Ballots Cast 227,583 27.96% DEM - JOHN CHIANG 272,615 79.15% DEM - ERIC SWALWELL 89,778 70.85% Election Day Reporting Ballots Cast 139,016 17.08% REP - GREG CONLON 71,802 20.85% REP - HUGH BUSSELL 36,934 29.15% Total Ballots Cast 366,599 45.04% Attorney General U.S. Representative, 17th Congressional District Governor Completed Precincts: 1,118 of 1,118 Completed Precincts: 98 of 98 Completed Precincts: 1,118 of 1,118 Under Votes: 18,427 Under Votes: 2,442 Under Votes: 9,733 Over Votes: 119 Over Votes: 53 Over Votes: 192 DEM - KAMALA D. HARRIS 272,218 78.21% DEM - MIKE HONDA 16,160 50.58% DEM - EDMUND G. ''JERRY'' BROWN 293,081 82.17% REP - RONALD GOLD 75,835 21.79% DEM - RO KHANNA 15,791 49.42% REP - NEEL KASHKARI 63,593 17.83% Insurance Commissioner State Senator, 10th District Lieutenant Governor Completed Precincts: 1,118 of 1,118 Completed Precincts: 418 of 418 Completed Precincts: 1,118 of 1,118 Under Votes: 28,273 Under Votes: 6,244 Under Votes: 14,341 Over Votes: 115 Over Votes: 35 Over Votes: 190 DEM - DAVE JONES 268,384 79.35% REP - PETER KUO 32,727 30.91% REP - RON NEHRING 71,135 20.20% REP - TED GAINES 69,827 20.65% DEM - BOB WIECKOWSKI 73,163 69.09% DEM - GAVIN NEWSOM 280,933 79.80% Board of Equalization, 2nd District State Assembly, 15th District Secretary of State Completed Precincts: 1,118 of 1,118 Completed Precincts: 203 of 203 Completed Precincts: 1,118 of 1,118 Under Votes: 33,617 Under Votes: 11,317 Under Votes: 22,385 Over Votes: 117 Over Votes: 221 Over Votes: 148 DEM - FIONA MA 261,500 78.56% DEM - TONY THURMOND 39,031 50.47% DEM - ALEX PADILLA 256,280 74.49% REP - JAMES E. -

Summary Report

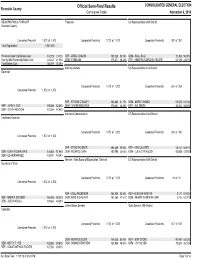

Official Semi-Final Results CONSOLIDATED GENERAL ELECTION Riverside County Cumulative Totals November 6, 2018 REGISTRATION & TURNOUT Treasurer US Representative 36th District Riverside County Completed Precincts: 1,072 of 1,072 Completed Precincts: 1,072 of 1,072 Completed Precincts: 397 of 397 Total Registration 1,040,218 Precincts Reporting Ballots Cast 142,750 13.72% REP - GREG CONLON 181,326 50.76% DEM - RAUL RUIZ 70,363 56.99% Vote by Mail Reporting Ballots Cast 224,229 21.56% DEM - FIONA MA 175,871 49.24% REP - KIMBERLIN BROWN PELZER 53,109 43.01% Total Ballots Cast 366,979 35.28% Attorney General US Representative 41st District Governor Completed Precincts: 1,072 of 1,072 Completed Precincts: 264 of 264 Completed Precincts: 1,072 of 1,072 REP - STEVEN C BAILEY 183,669 51.15% DEM - MARK TAKANO 55,678 61.16% REP - JOHN H. COX 190,566 52.55% DEM - XAVIER BECERRA 175,441 48.85% REP - AJA SMITH 35,364 38.84% DEM - GAVIN NEWSOM 172,084 47.45% Insurance Commissioner US Representative 42nd District Lieutenant Governor Completed Precincts: 1,072 of 1,072 Completed Precincts: 380 of 380 Completed Precincts: 1,072 of 1,072 NPP - STEVE POIZNER 191,439 55.94% REP - KEN CALVERT 76,114 58.91% DEM - ELENI KOUNALAKIS 148,444 51.66% DEM - RICARDO LARA 150,794 44.06% DEM - JULIA C PEACOCK 53,088 41.09% DEM - ED HERNANDEZ 138,901 48.34% Member, State Board of Equalization, District 4 US Representative 50th District Secretary of State Completed Precincts: 1,072 of 1,072 Completed Precincts: 31 of 31 Completed Precincts: 1,072 of 1,072 REP - JOEL ANDERSON 184,926 52.49% REP - DUNCAN HUNTER 9,171 57.63% REP - MARK P.