Federated Kaufmann Large Cap Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

ARCTURUS THERAPEUTICS HOLDINGS INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): May 20, 2020 ARCTURUS THERAPEUTICS HOLDINGS INC. (Exact name of registrant as specified in its charter) Delaware 001-38942 32-0595345 (State or other jurisdiction (Commission (I.R.S. Employer of incorporation) File Number) Identification No.) 10628 Science Center Drive, Suite 250 San Diego, California 92121 (Address of principal executive offices) Registrant’s telephone number, including area code: (858) 900-2660 (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: Trading Name of each exchange Title of each class Symbol(s) on which registered Common stock, par value $0.001 per share ARCT The NASDAQ Stock Market LLC Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). -

ULTRAGENYX PHARMACEUTICAL INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 10-Q (Mark One) ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the quarterly period ended September 30, 2015 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the transition period from to . Commission File No. 001-36276 ULTRAGENYX PHARMACEUTICAL INC. (Exact name of registrant as specified in its charter) Delaware 27-2546083 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 60 Leveroni Court, Novato, California 94949 (Address of principal executive offices) (Zip Code) (415) 483-8800 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES R NO ☐ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES R NO ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. -

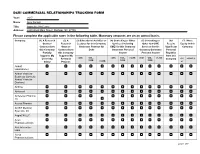

Year: 2017 Name: Amy Corneli Title: Associate Professor Address: 2200 West Main Street, Durham, NC 27705 Please Complete the Applicable Rows in the Following Table

DCRI COMMERCIAL RELATIONSHIPS TRACKING FORM Year: 2017 Name: Amy Corneli Title: Associate Professor Address: 2200 West Main Street, Durham, NC 27705 Please complete the applicable rows in the following table. Monetary amounts are on an annual basis. Company: (1) A Research (2) A (3) Educational Activities or (4) Consulting or Other (5) Consulting or (6) I (7) I Have Grant or Research Lectures for this Company Services (Including Other non-CME Receive Equity in this Contract from Grant or Generates Revenue for CME) for this Company Services for this Significant Company this Company Contract from Duke Generates Personal Company Generates Personal Partially this Company Income Personal Income Royalties Supports My Supports My from this University Research <$5K $5K– <$5K $5K– >$25K <$5K $5K– >$25K Company <$5 >$5K/1% $25K $25K $25K Salary Projects >$25K K Abbott Laboratories Abbott Vascular Business (formerly Abbott Vascular Devices) AbbVie Abiomed Acceleron Pharma Inc Acerta Pharma ACIST Medical Systems, Inc AegisCN LLC Aires Pharmaceuticals Akili Interactive Labs Akros Pharmaceuticals page 1 of 7 Alexion Amgen, Inc Amylin Pharmaceuticals, Inc. ARCA biopharma Armis Biopharma Astellas Scientific and Medical Affairs Inc AstraZeneca Baseline Study LLC Basilea Pharmaceutica International Ltd Bayer AG Biosensors International Group Ltd Boehringer Ingleheim Boston Scientific Corporation Bristol Myers Squibb Cempra Pharmaceuticals, Inc. ContraFect Corporation CPC Clinical Research CryoLife Inc 2 of 7 CSL Limited DAIICHI SANKYO COMPANY, LIMITED Datavant Inc David H Murdock Inst for Business and Culture Duke Clinical Research Institute Durata Therapeutics Eiger BioPharmaceutical s Inc Einstein HC Network Philadelphia Elesvier Eli Lilly & Company Eureka Therapeutics Evalve, Inc. Ferring Pharmaceuticals Filament BioSolutions Galectin Therapeutic Genentech General Electric Company Genetic Alliance 3 of 7 Genzyme Corporation German AFNET Gilead GlaxoSmithKline plc Grifols HeartFlow Intarcia Therapeutics, Inc. -

2016 Medicines in Development for Rare Diseases a LIST of ORPHAN DRUGS in the PIPELINE

2016 Medicines in Development for Rare Diseases A LIST OF ORPHAN DRUGS IN THE PIPELINE Autoimmune Diseases Product Name Sponsor Official FDA Designation* Development Status Actemra® Genentech treatment of systemic sclerosis Phase III tocilizumab South San Francisco, CA www.gene.com Adempas® Bayer HealthCare Pharmaceuticals treatment of systemic sclerosis Phase II riociguat Whippany, NJ www.pharma.bayer.com ARA 290 Araim Pharmaceuticals treatment of neuropathic pain in patients Phase II Tarrytown, NY with sarcoidosis www.ariampharma.com ARG201 arGentis Pharmaceuticals treatment of diffuse systemic sclerosis Phase II (type 1 native bovine skin Collierville, TN www.argentisrx.com collagen) BYM338 Novartis Pharmaceuticals treatment of inclusion body myositis Phase III (bimagrumab) East Hanover, NJ www.novartis.com CCX168 ChemoCentryx treatment of anti-neutrophil cytoplasmic Phase II (5a receptor antagonist) Mountain View, CA auto-antibodies associated vasculitides www.chemocentryx.com (granulomatosis with polyangitis or Wegener's granulomatosis), microscopic polyangitis, and Churg-Strauss syndrome * This designation is issued by the FDA's Office of Orphan Products Development while the drug is still in development. The designation makes the sponsor of the drug eligible for entitlements under the Orphan Drug Act of 1983. The entitlements include seven years of marketing exclusivity following FDA approval of the drug for the designated use. Medicines in Development: Rare Diseases | 2016 1 Autoimmune Diseases Product Name Sponsor Official FDA -

Active Labelers Run Date : Aug 28, 2018

Active Labelers Run Date : Aug 28, 2018 Labeler ID Labeler Name Contract Begin Date Contract End Date 00002 ELI LILLY AND COMPANY 01/01/1991 01/01/3000 00003 E.R. SQUIBB & SONS, LLC. 01/01/1991 01/01/3000 00004 HOFFMANN-LA ROCHE 01/01/1991 01/01/3000 00006 MERCK & CO., INC. 01/01/1991 01/01/3000 00007 GLAXOSMITHKLINE 01/01/1991 01/01/3000 00008 WYETH LABORATORIES 01/01/1991 01/01/3000 00009 PFIZER, INC 01/01/1991 01/01/3000 00013 PFIZER, INC. 01/01/1991 01/01/3000 00014 PFIZER, INC 01/01/1991 01/01/3000 00015 MEAD JOHNSON AND COMPANY 01/01/1991 01/01/3000 00023 ALLERGAN INC 01/01/1991 01/01/3000 00024 SANOFI-AVENTIS, US LLC 01/01/1991 01/01/3000 00025 PFIZER, INC. 01/01/1991 01/01/3000 00026 BAYER HEALTHCARE LLC 01/01/1991 01/01/3000 00029 GLAXOSMITHKLINE 01/01/1991 01/01/3000 00032 ABBVIE INC. 01/01/1991 01/01/3000 00037 MEDA PHARMACEUTICALS, INC. 01/01/1991 01/01/3000 00039 SANOFI-AVENTIS, US LLC 01/01/1991 01/01/3000 00046 AYERST LABORATORIES 01/01/1991 01/01/3000 00049 PFIZER, INC 01/01/1991 01/01/3000 00051 ABBVIE INC 10/01/1997 01/01/3000 00052 ORGANON USA INC. 01/01/1991 01/01/3000 00053 CSL BEHRING LLC 01/01/1991 01/01/3000 00054 WEST-WARD PHARMACEUTICALS CORP. 01/01/1991 01/01/3000 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 01/01/1991 01/01/3000 00062 ORTHO MCNEIL PHARMACEUTICALS 01/01/1991 01/01/3000 00064 HEALTHPOINT, LTD. -

Rebateable Manufacturers

Rebateable Labelers – July 2021 Manufacturers are responsible for updating their eligible drugs and pricing with CMS. Montana Healthcare Programs will not pay for an NDC not updated with CMS. Note: Some manufacturers on this list may have some NDCs that are covered and others that are not. Manufacturer ID Manufacturer Name 00002 ELI LILLY AND COMPANY 00003 E.R. SQUIBB & SONS, LLC. 00004 HOFFMANN-LA ROCHE 00006 MERCK & CO., INC. 00007 GLAXOSMITHKLINE 00008 WYETH PHARMACEUTICALS LLC, 00009 PHARMACIA AND UPJOHN COMPANY LLC 00013 PFIZER LABORATORIES DIV PFIZER INC 00015 MEAD JOHNSON AND COMPANY 00023 ALLERGAN INC 00024 SANOFI-AVENTIS, US LLC 00025 PFIZER LABORATORIES DIV PFIZER INC 00026 BAYER HEALTHCARE LLC 00032 ABBVIE INC. 00037 MEDA PHARMACEUTICALS, INC. 00039 SANOFI-AVENTIS, US LLC 00046 WYETH PHARMACEUTICALS INC. 00049 ROERIG 00051 ABBVIE INC 00052 ORGANON USA INC. 00053 CSL BEHRING L.L.C. 00054 HIKMA PHARMACEUTICAL USA, INC. 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00065 ALCON LABORATORIES, INC. 00068 AVENTIS PHARMACEUTICALS 00069 PFIZER LABORATORIES DIV PFIZER INC 00071 PARKE-DAVIS DIV OF PFIZER 00074 ABBVIE INC 00075 AVENTIS PHARMACEUTICALS, INC. 00078 NOVARTIS 00085 SCHERING CORPORATION 00087 BRISTOL-MYERS SQUIBB COMPANY 00088 AVENTIS PHARMACEUTICALS 00093 TEVA PHARMACEUTICALS USA, INC. 00095 BAUSCH HEALTH US, LLC Page 1 of 19 Manufacturer ID Manufacturer Name 00096 PERSON & COVEY, INC. 00113 L. PERRIGO COMPANY 00115 IMPAX GENERICS 00116 XTTRIUM LABORATORIES, INC. 00121 PHARMACEUTICAL ASSOCIATES, INC. 00131 UCB, INC. 00132 C B FLEET COMPANY INC 00143 HIKMA PHARMACEUTICAL USA, INC. 00145 STIEFEL LABORATORIES, INC, 00168 E FOUGERA AND CO. 00169 NOVO NORDISK, INC. 00172 TEVA PHARMACEUTICALS USA, INC 00173 GLAXOSMITHKLINE 00178 MISSION PHARMACAL COMPANY 00185 EON LABS, INC. -

Post-Event Summary

VIRTUAL BIOMANUFACTURING WORLD SUMMIT 20 NOVEMBER 16-17, 2020 POST-EVENT SUMMARY EVENT SITE EPTHOUGHTLEADERS.COM EP_BIOMAN EXECUTIVE PLATFORMS HIGHLIGHTS 200+ Attendees 99% 85% Director-Level have personal budgetary 120+ and Above responsibilities over $5M GLOBAL ORGANIZATIONS 71% have an annual company revenue over $1B Keynotes, case studies, “Excellent ‘virtual’ roundtable discussions, conference with a broad 30+ workshops and more range of presentations and great information exchange on technologies transforming the biopharmaceutical industry.” 20+ Head, Global Biologics Solution Operating Unit providers Days of virtual networking, learning and 2 sharing ideas BIOMANWORLD.COM BMWS20 2 SPEAKERS Here are just a few of our speakers: Juan Andres Patrick Yang Chief Technical Operations Chairman at Acepodia and Quality Officer & Founding Board Director at Sana Biotechnology Lou Schmukler Michael Kamarck EVP and President, Global Product Chief Technology Officer Development & Supply Alison Moore Pam Cheng Chief Technology Officer EVP, President Global Operations & IT Jerry Cacia Derek Adams SVP, Head Global Technical Development Chief Technology and Manufacturing Officer John Pinion Brendan O’Callaghan EVP Translational Sciences, SVP & Global Head Chief Quality Operations Officer of Specialty Care IA Arleen Paulino Jens Vogel SVP Global Manufacturing SVP & Global Head of Biotech Charlene Banard Craig Kennedy Global Head of Technical Operations SVP Global Supply Chain Management for Cell & Gene Therapy BIOMANWORLD.COM BMWS20 3 ATTENDEES A2 Biotherapeutics Sr. Director, Tech Ops Bristol Myers Squibb Sr. Director Acadia Director QA Bristol Myers Squibb Sr. Research Associate Acceleron Pharma Inc VP, Quality Bristol Myers Squibb Director, Cell Culture Eng. CoE (Cell Therapy) Acepodia & Sana Biotechnology Chairman & Founding Board Director Bristol Myers Squibb Director of Manufacturing Adaptimmune Chief Patient Supply Officer Bristol Myers Squibb Engineer ADMA Biologics VP of Quality BMS - Cell Therapy Tech Ops Sr. -

Representative Legal Matters Randall B

Representative Legal Matters Randall B. Sunberg • H. Lundbeck A/S in its collaboration with Rgenta Therapeutics to discover small molecules targeting RNA regulation and splicing of disease-causing genes. • Takeda in its strategic collaboration with KSQ Therapeutics to identify optimal T cell and NK cell gene targets screened using KSQ’s CRISPRomics technology and to develop and commercialize novel cell and non-cell immuno-oncology therapies. • H. Lundbeck A/S in the licensing to Denovo Biopharma of global rights to idalopirdine (an oral 5-HT6 antagonist) for Alzheimer's Disease, schizophrenia and other indications, subject to options for Lundbeck to re-acquire such rights with the parties sharing China rights. • NBE Therapeutics in its collaboration with Exelixis to discover and develop antibody-drug conjugates for oncology applications. • Takeda in the sale to Neuraxpharm of global rights to the prescription brand Buccolam® (indicated for the emergency treatment of epileptic children with prolonged acute convulsive seizures). • BeiGene in its collaboration with Assembly Biosciences to develop and commercialize in China, Hong Kong, Macau and Taiwan Assembly’s portfolio of three clinical-stage core inhibitor candidates for the treatment of patients with chronic hepatitis B virus (HBV) infection. • GSK Consumer Healthcare in its collaboration with Mammoth Biosciences to develop a rapid, handheld CRISPR-based test to detect novel coronavirus infections. • H. Lundbeck A/S in the acquisition of Alder BioPharmaceuticals, Inc, a company committed -

New Drug Approvals 201

New Drug Approvals 201 New Drug Approvals Upneeq (oxymetazoline hydrochloride) treatment of rheumatoid arthritis (RA), juvenile Ophthalmic Solution idiopathic arthritis (JIA), psoriatic arthritis (PsA), Company: Osmotica Pharmaceuticals plc ankylosing spondylitis (AS), Crohn’s disease (CD), Date of Approval: July 8, 2020 ulcerative colitis (UC), and plaque psoriasis (Ps). Treatment for: Blepharoptosis Byfavo (remimazolam) Injection Upneeq (oxymetazoline hydrochloride ophthalmic Company: Cosmo Pharmaceuticals NV solution, 0.1%) is a novel, once-daily ophthalmic Date of Approval: July 2, 2020 formulation of the direct-acting α-adrenergic receptor Treatment for: Sedation agonist oxymetazoline, indicated for the treatment of Byfavo (remimazolam) is an ultra-short-acting, acquired blepharoptosis (droopy eyelid). intravenous benzodiazepine sedative/anesthetic for Inqovi (decitabine and cedazuridine) Tablets the induction and maintenance of procedural sedation Company: Astex Pharmaceuticals, Taiho Oncology, in adults. and Otsuka Pharmaceutical Rukobia (fostemsavir) Extended-Release Tablets Date of Approval: July 7, 2020 Company: ViiV Healthcare Treatment for: Myelodysplastic Syndrome Date of Approval: July 2, 2020 Inqovi (decitabine and cedazuridine) is a nucleoside Treatment for: HIV Infection metabolic inhibitor and cytidine deaminase inhibitor Rukobia (fostemsavir) is a first-in-class, human combination indicated for the treatment of adults with immunodeficiency virus type 1 (HIV-1) gp120- intermediate and high-risk myelodysplastic directed attachment inhibitor indicated for use in syndromes (MDS) including chronic combination with other antiretroviral(s) for the myelomonocytic leukemia (CMML). treatment of HIV-1 infection in heavily treatment- Qwo (collagenase clostridium histolyticum-aaes) experienced adults with multidrug-resistant HIV-1 for Injection infection. Company: Endo International plc Dojolvi (triheptanoin) Oral Liquid Date of Approval: July 6, 2020 Treatment for: Cellulite Company: Ultragenyx Pharmaceutical Inc. -

Results Presentation Fiscal 2018 First Quarter

Result Presentation Fiscal 2018 First Quarter Kyowa Hakko Kirin Co., Ltd. © Kyowa Hakko Kirin Co., Ltd. Agenda Results Summary & Financial Review Motohiko Kawaguchi Executive Officer, Director of Accounting Department R&D Review Mitsuo Satoh, Ph.D Executive Officer, Vice President Head of R&D Division Business Topics Wataru Murata Executive Officer, Director of Corporate Strategy & Planning Department Q&A © Kyowa Hakko Kirin Co., Ltd. 2 Forward‐looking statements This document contains certain forward‐looking statements relating to such items as the company’s (including its domestic and overseas subsidiaries) forecasts, targets and plans. These forward‐looking statements are based upon information available to the company at the present time and upon reasonable assumptions made by the company in making its forecasts, but the actual results in practice may differ substantially due to uncertain factors. These uncertain factors include, but are not limited to, potential risks of the business activities in the pharmaceutical industry in Japan and overseas, intellectual property risks, risk of side effects, regulatory risks, product defect risks, risks of changes to the prices for raw materials, risks of changes to market prices, as well as risks of changes to foreign exchange rates and financial markets. This document is used only for the purpose of providing the information to investors. Though it may contain the information concerning pharmaceutical products (including products under development), it is not for the purpose of promotion, -

ULTRAGENYX PHARMACEUTICAL INC. (Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☒ Filed by a party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material under §240.14a-12 ULTRAGENYX PHARMACEUTICAL INC. (Name of Registrant as Specified In Its Charter) N/A (Name of Person(s) Filing Proxy Statement, if Other Than The Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: Table of Contents 60 Leveroni Court Novato, California 94949 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held on June 26, 2020 at 8:00 a.m.