China SOE Credits – One for Every Palate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Three Red Lines” Policy

Real Estate Developers with High Leverage to See Inventory Quality Tested Under Broader “Three Red Lines” Policy October 28, 2020 In our view, the widening of regulations aimed at controlling real estate developers’ interest- ANALYSTS bearing debt would further reduce the industry’s overall credit risk in the long term. However, the nearer term may see less headroom for highly leveraged developers to finance in the capital Xiaoliang Liu, CFA market, pushing them to sell off inventory to ease liquidity pressure. Beijing +86-10-6516-6040 The People’s Bank of China said in September that measures aimed at monitoring the funding [email protected] and financial management of key real estate developers will steadily be expanded. Media reports suggest that the new regulations would see a cap of 15% on annual growth of interest-bearing Jin Wang debt for all property developers. Developers will be assessed against three indicators, which are Beijing called “red lines”: whether asset liability ratios (excluding advance) exceeded 70%; whether net +86-10-6516-6034 gearing ratio exceeded 100%; whether cash to short-term debt ratios went below 1.0. Developers [email protected] which breached all three red lines won’t be allowed to increase their debt. If only one or two of the red lines are breached, such developers would have their interest-bearing debt growth capped at 5% and 10% respectively. The first half of the year saw debt grow rapidly among developers. In a sample of 87 real estate developers that we are monitoring, more than 40% saw their interest-bearing debt grow at a faster rate than 15% year over year as of the end of June (see the chart below). -

Global Offering

(Incorporated in the Cayman Islands with limited liability) Stock Code: Global Offering Joint Sponsors, Joint Global Coordinators, Joint Bookrunners and Joint Leadad ManagersManagers (in alphabetical order) Other Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager Other Joint Bookrunners and Joint Lead Managers (in alphabetical order) Project A_PPTUS cover(Eng) Cover size: 210 x 280mm / Open size: 445.3 x 280mm / Spine width: 25.3mm IMPORTANT If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice. (Incorporated in the Cayman Islands with limited liability) GLOBAL OFFERING Number of Offer Shares under : 550,000,000 Shares (subject to the Over- the Global Offering allotment Option) Number of Hong Kong Offer Shares : 27,500,000 Shares (subject to reallocation) Number of International Offer Shares : 522,500,000 Shares (including 55,000,000 Reserved Shares under the Preferential Offering) (subject to reallocation and the Over-allotment Option) Maximum Offer Price : HK$22.30 per Share plus brokerage of 1.0%, SFC transaction levy of 0.0027% and the Hong Kong Stock Exchange trading fee of 0.005% (payable in full on application, subject to refund) Nominal value : US$0.00001 per Share Stock code : 1209 Joint Sponsors, Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers (in alphabetical order) Other Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager Other Joint Bookrunners and Joint Lead Managers (in alphabetical order) Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. -

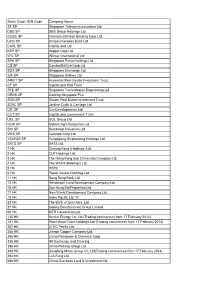

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

China Vanke (A-1)

9-314-104 REV: MAY 9, 2014 L Y N N S . P A I N E JOHN MACOMBER K E I T H C H I - H O W O N G China Vanke (A-1) For me, long term is five to ten years. For Wang Shi it’s way out there—beyond imagination. Twenty years ago when Vanke was still a very small company, he already had a very grand vision that I thought was impossible to achieve. Twelve years ago when I became the general manager, we were only a two billion RMB company. He was thinking what Vanke might look like if it's a 100 billion company. I couldn’t have imagined that we’d achieve that goal in less than 10 years. — Yu Liang, President, China Vanke China Vanke president Yu Liang surveyed the densely developed expanse of land below as his plane touched down in the southern city of Shenzhen in November 2011. Yu was eager to get back to the company’s headquarters in the suburbs of Shenzhen after several days on the road meeting with subsidiary heads, construction partners, and government officials across China. Under the leadership of its founder Wang Shi, China Vanke Co. Ltd. (Vanke) had grown from a small trading firm to China’s largest homebuilder, successfully navigating the tumultuous mix of volatile markets and ever-changing government policies that characterized China’s real estate market. For 2011, Vanke expected to sell some 10.7 million square meters of floor area, or more than 120,000 homes valued at over 120 billion RMB (about US $20 billion).1 Nonetheless, the year had been a slow one for the industry, as the central government introduced successive waves of austerity measures to bring down skyrocketing prices. -

Schedule of Investments (Unaudited) Blackrock Advantage Emerging Markets Fund January 31, 2021 (Percentages Shown Are Based on Net Assets)

Schedule of Investments (unaudited) BlackRock Advantage Emerging Markets Fund January 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Security Shares Value Common Stocks China (continued) China Life Insurance Co. Ltd., Class H .................. 221,000 $ 469,352 Argentina — 0.0% China Longyuan Power Group Corp. Ltd., Class H ....... 52,000 76,119 (a) 313 $ 60,096 Globant SA .......................................... China Mengniu Dairy Co. Ltd.(a) ......................... 15,000 89,204 Brazil — 4.9% China Merchants Bank Co. Ltd., Class H ................ 36,000 275,683 Ambev SA ............................................. 236,473 653,052 China Overseas Land & Investment Ltd.................. 66,500 151,059 Ambev SA, ADR ....................................... 94,305 263,111 China Pacific Insurance Group Co. Ltd., Class H......... 22,000 90,613 B2W Cia Digital(a) ...................................... 20,949 315,188 China Railway Group Ltd., Class A ...................... 168,800 138,225 B3 SA - Brasil Bolsa Balcao............................. 33,643 367,703 China Resources Gas Group Ltd. ....................... 30,000 149,433 Banco do Brasil SA..................................... 15,200 94,066 China Resources Land Ltd. ............................. 34,000 134,543 BRF SA(a).............................................. 22,103 85,723 China Resources Pharmaceutical Group Ltd.(b) .......... 119,500 62,753 BRF SA, ADR(a) ........................................ 54,210 213,045 China Vanke Co. Ltd., Class A .......................... 67,300 289,157 Cia de Saneamento de Minas Gerais-COPASA .......... 52,947 150,091 China Vanke Co. Ltd., Class H .......................... 47,600 170,306 Duratex SA ............................................ 19,771 71,801 CITIC Ltd............................................... 239,000 186,055 Embraer SA(a).......................................... 56,573 90,887 Contemporary Amperex Technology Co. Ltd., Class A .... 1,700 92,204 Gerdau SA, ADR ...................................... -

China Resources Land Target Price: HKD33.00 Price: HKD28.60 a Counter-Cyclical Developer Market Cap: USD25,208M Bloomberg Ticker: 1109 HK

Results Review Hong Kong 1H18 results announced on 21 Aug 2018 were above expectations 22 August 2018 Property | Real Estate Buy (Maintained) China Resources Land Target Price: HKD33.00 Price: HKD28.60 A Counter-Cyclical Developer Market Cap: USD25,208m Bloomberg Ticker: 1109 HK Maintain BUY with new HKD33.00 TP from HKD31.50, and 16% upside – Share Data based on the same 25% discount to end-FY18F ENAV of HKD44.00, from Avg Daily Turnover (HKD/USD) 326m/41.5m HKD42.00. We continue to like CRL’s sector-leading GPM, strong rental 52-wk Price low/high (HKD) 21.5 - 32.4 income growth and sector-low weighted average financing cost. It should help it to weather any threat from credit or policy tightening ahead. Also, Free Float (%) 39 abundant saleable resources offer high visibility for strong sales Shares outstanding (m) 6,931 performance, which we believe will allow CRL to finish 18.6% ahead of Estimated Return 16% FY18F sales target, equivalent to 42.7% YoY growth. Shareholders (%) Interim results beat. 1H18 recurring net profit came in stronger than our China Resources Holdings 61.2 expectations by 8.3% at CNY7.3bn, +151.8% YoY, thanks to further expansion in GPM of property develop business to 48.1% from 35% in 1H17. Net gearing rose to 52%, from 35.9% in 2H18 following more aggressive land replenishments in 1H18. China Resources Land’s announced an interim Share Performance (%) dividend of CNY0.11/share, up 30% YoY. YTD 1m 3m 6m 12m Sector-leading GPM with multiple years of visibility. -

Consolidated Statement of Investments (Unaudited), September 30, 2020

TEMPLETON DRAGON FUND, INC. Consolidated Statement of Investments (unaudited), September 30, 2020 a Country Shares a Value a Common Stocks 98.6% Air Freight & Logistics 1.3% aSF Holding Co. Ltd., A .................................. China 884,700 $10,644,988 Auto Components 0.7% Minth Group Ltd. ...................................... China 1,422,000 6,209,547 Banks 3.5% aChina Construction Bank Corp., A ......................... China 3,875,500 3,516,871 aChina Merchants Bank Co. Ltd., A ......................... China 1,935,246 10,301,832 China Merchants Bank Co. Ltd., H ......................... China 3,270,500 15,519,982 29,338,685 Beverages 2.6% China Resources Beer Holdings Co. Ltd. .................... China 1,082,000 6,645,564 aKweichow Moutai Co. Ltd., A ............................. China 46,445 11,456,278 aLuzhou Laojiao Co. Ltd., A ............................... China 202,956 4,310,078 22,411,920 Biotechnology 4.6% bBeiGene Ltd. ......................................... China 502,100 11,073,976 aHualan Biological Engineering, Inc., A ...................... China 538,188 4,530,141 bI-Mab, ADR .......................................... China 18,922 889,902 b,c,dInnoCare Pharma Ltd., 144A, Reg S ....................... China 2,028,400 2,657,048 b,dInnovent Biologics, Inc., 144A, Reg S ...................... China 2,133,900 15,913,012 aJinyu Bio-Technology Co. Ltd., A .......................... China 988,700 3,946,610 39,010,689 Capital Markets 0.5% aEast Money Information Co. Ltd., A ........................ China 1,268,800 4,515,968 Chemicals 1.6% aJiangsu Yangnong Chemical Co. Ltd., A .................... China 277,900 3,598,703 aShenzhen Capchem Technology Co. Ltd., A.................. China 1,218,410 10,309,913 13,908,616 Commercial Services & Supplies 2.4% dA-Living Services Co. -

Bilag 3. Negativlister I Relation Til Producenter Af Fossile Brændstoffer M.V. Københavns Kommunes Finansielle Strategi Og Risikopolitik

Bilag 3. Negativlister i relation til producenter af fossile brændstoffer m.v. Københavns Kommunes finansielle strategi og risikopolitik D. 8. juni 2016 Læsevejledning til negativlisten: Moderselskab / øverste ejer vises med fed skrift til venstre. Med almindelig tekst, indrykket, er de underliggende selskaber, der udsteder aktier og erhvervsobligationer. Det er de underliggende, udstedende selskaber, der er omfattet af negativlisten Moderselskab / øverste ejer – udstedende selskab Acergy SA SUBSEA 7 Inc Subsea 7 SA Adani Enterprises Ltd Adani Enterprises Ltd Adani Power Ltd Adani Power Ltd Adaro Energy Tbk PT Adaro Energy Tbk PT Adaro Indonesia PT Alam Tri Abadi PT Advantage Oil & Gas Ltd Advantage Oil & Gas Ltd Afren PLC Afren PLC Africa Oil Corp Africa Oil Corp AGL Energy Ltd AGL Electricity VIC Pty Ltd AGL Energy Ltd AGL Sales Pty Ltd Victorian Energy Pty Ltd Aker Solutions ASA Akastor ASA Aker Solutions Holding ASA Aker Solutions ASA Alliant Energy Corp Alliant Energy Corp Alliant Energy Resources LLC Interstate Power & Light Co Wisconsin Power & Light Co Alpha Natural Resources Inc Alex Energy Inc Alliance Coal Corp Alpha Appalachia Holdings Inc Alpha Appalachia Services Inc Alpha Natural Resource Inc/Old Alpha Natural Resources Inc Alpha Natural Resources LLC Alpha Natural Resources LLC / Alpha Natural Resources Capital Corp Alpha NR Holding Inc Aracoma Coal Co Inc AT Massey Coal Co Inc Bandmill Coal Corp Bandytown Coal Co Belfry Coal Corp Belle Coal Co Inc Ben Creek Coal Co Big Bear Mining Co Big Laurel Mining Corp Black King Mine -

Stock Code/ ISIN Code Company Name ST SP Singapore

Stock Code/ ISIN Code Company Name ST SP Singapore Telecommunications Ltd DBS SP DBS Group Holdings Ltd OCBC SP Oversea-Chinese Banking Corp Ltd UOB SP United Overseas Bank Ltd CAPL SP CapitaLand Ltd KEP SP Keppel Corp Ltd WIL SP Wilmar International Ltd SPH SP Singapore Press Holdings Ltd CD SP ComfortDelGro Corp Ltd SGX SP Singapore Exchange Ltd SIA SP Singapore Airlines Ltd AREIT SP Ascendas Real Estate Investment Trust CT SP CapitaLand Mall Trust STE SP Singapore Technologies Engineering Ltd GENS SP Genting Singapore PLC SUN SP Suntec Real Estate Investment Trust JCNC SP Jardine Cycle & Carriage Ltd CIT SP City Developments Ltd CCT SP CapitaLand Commercial Trust UOL SP UOL Group Ltd GGR SP Golden Agri-Resources Ltd SCI SP Sembcorp Industries Ltd VMS SP Ventrure Corp Ltd YZJSGD SP Yangzijiang Shipbuilding Holdings Ltd SATS SP SATS Ltd 1 HK Cheung Kong (Holdings) Ltd. 2 HK CLP Holdings Ltd. 3 HK The Hong Kong and China Gas Company Ltd. 4 HK The Wharf (Holdings) Ltd. 5 HK HSBC 6 HK Power Assets Holdinsg Ltd 11 HK Hang Seng Bank Ltd. 12 HK Henderson Land Development Company Ltd. 16 HK Sun Hung Kai Properties Ltd. 17 HK New World Development Company Ltd. 19 HK Swire Pacific Ltd. 'A' 23 HK The Bank of East Asia, Ltd. 27 HK Galaxy Entertainment Group Limited 66 HK MTR Corporation Ltd. 135 HK Kunlun Energy Co. Ltd (Trading commences from 17 February 2014) 151 HK Want Want China Holdings Ltd (Trading commences from 17 February 2014) 267 HK CITIC Pacific Ltd. -

Anatomy of the Hostile Takeover of China Vanke Co

Disturbing the Peace: Anatomy of the Hostile Takeover of China Vanke Co. Taurai Muvunza∗ Terrill Frantzy Abstract Wang Shi, a business mogul who created his empire of wealth from scratch, relished in his fame and basked in the glory of his affluent business. Nothing lasts forever! After mastering the turbulent business of real estate development in his country and there- fore enjoying a rising and robust stock price, China Vanke Co. Ltd (âĂIJVankeâĂİ) founder and Chairman of the Board of Directors, Wang Shi was suddenly presented with a scathing notice from the Hong Kong Stock Exchange: rival Baoneng Group (âĂIJBaonengâĂİ) filed the regulatory documentation indicating that it had nicode- mously acquired 5% of his company and was looking to buy more. Vanke case became brutal and sparked national controversy over corporate governance and the role of Chi- nese government in capital markets. Keywords: Vanke; Baoneng; corporate governance; hostile takeover; China arXiv:2003.06019v2 [q-fin.GN] 9 Jul 2020 ∗Tsinghua-Berkeley Shenzhen Institute. Tsinghua Shenzhen International Graduate School. Shenzhen, 518055, China. Email: [email protected]. The author wishes to thank an ’anonymous’ employee from Vanke for providing helpful comments yProfessor of eBusiness and Cybersecurity, Harrisburg University of Science and Technology, Pennsylva- nia; U.S. Email: [email protected]. 1 1 Introduction tion of yearly sales are driven by this cate- gory through providing U8 decoration sys- Baoneng is a fierce rival that does busi- tem, BIM based quality control and refab- ness in a way Wang calls âĂIJvulgarâĂİ; in ricated housing. Secondly, Vanke markets no way would he allow his company and its itself as an integrated urban property ser- stellar reputation and glory be plundered by vice provider which includes shopping malls, an ensuing majority ownership and thus con- integrated complex development, Vanke Ed- trol over Vanke by BaonengâĂŹs predatory ucation, Vanke Resort, and long term leasing founder and 46 year old CEO Yao Zhenhua. -

(Holdings) Co., Ltd. (“CR” Or “China Resources Group”) Is a Diversified Holding Company Registered in Hong Kong

Brief Introduction to CR April 16th & 17th, 2018 Shenzhen, China CR Profile China Resources (Holdings) Co., Ltd. (“CR” or “China Resources Group”) is a diversified holding company registered in Hong Kong. In 1938, CR was first established as “Liow & Co.” in Hong Kong . 7 Vital 16 grade-one Industries profit centers In 1983, CR was restructured into China Resources (Holdings) Co., Ltd. 6 listed companies in HK In 2003, CR became one of the key state-owned enterprises. 1,948 >450,000 business employees entities In 2017, CR is one of the Fortune Global 500 enterprises, ranking 86. Website: http://en.crc.com.cn/ CR Business in Various Industries Consumer Goods Finance Power Cement Pharmaceuticals Gas Real Estate Other Business Consumer Goods CR BEER As the largest beer manufacturer, seller, and distributor in China, CR Beer is mainly involved in beer brewing, product sales, and brand promotion, and has developed a series of mainstream, mid-market and high-end beers. CR Ng Fung CR Ng Fung is an outstanding assorted food products enterprise, combining research and development, production, processing, wholesale, retail, logistics and international trading under the same company. CR Beverage CR C'estbon Beverages is one of the leading beverage enterprises in China, with C'estbon purified water being its key business. C'estbon purified water is considered a famous Chinese trademark and the most competitive brand in the market. To find more, please visit: http://en.crc.com.cn/whatwedo/consumerproducts/ Finance CR Capital China Resources Capital Management Limited (“CR Capital”), originally known as Harvest Capital Management, was renamed in August, 2016.