2016 Full-Year Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Homes Have Never Been So Important

Homes have never been so important ANNUAL REPORT AND ACCOUNTS 2020 STRATEGIC REPORT Our purpose 1 Grainger at a glance 2 Chairman’s statement 4 Chief Executive’s statement 5 Investment case 10 Market drivers 12 Our business model 14 Key performance indicators 16 Financial review 19 Stories 25 People, resources and relationships 34 Section 172 statement 37 Our commitment to sustainability 38 Risk management 44 Principal risks and uncertainties 47 Viability statement 51 GOVERNANCE Chairman’s introduction to governance 52 Leadership and purpose 54 Division of responsibility 64 Composition, succession and evaluation 66 Audit, risk and control 69 Remuneration 74 Directors’ report 93 FINANCIAL STATEMENTS Independent auditor’s report 97 Consolidated income statement 104 Consolidated statement of comprehensive income 105 Consolidated statement of financial position 106 Consolidated statement of changes in equity 107 Consolidated statement of cash flows 108 Notes to the financial statements 109 Parent company statement of financial position 151 Parent company statement of changes in equity 152 Notes to the parent company financial statements 153 EPRA performance measures (unaudited) 160 Five year record 164 OTHER INFORMATION Shareholders’ information 166 Glossary of terms 167 Advisers 168 Our purpose is to provide high-quality rental homes and great REPORT STRATEGIC customer service. This has never been more important than during the unprecedented Covid-19 lockdown. Our homes have never been more fully utilised, and our market leading operating platform has never been more appreciated. It has enabled our residents to focus on the things that really matter during this period. Although doing some things a little differently, our Covid-19 response strategy ensured we focused on three key areas: innovate, communicate and improve. -

Retail Capital Markets Key 2020 Transaction Highlights

Retail Capital Markets Key 2020 Transaction Highlights Contact us Tom Edson +44 7766 657 478 [email protected] St Peter’s Retail Park | Burton Upon Trent Lululemon | 127, 129 & 131 High Street, Guildford Anthropologie | 55-56 High Street, Winchester Client: Colliers Global Investors | Price: £5.5m Client: Private Investor | Price: £3m Client: AXA IM | Price: £2.5m Becky Hance +44 7894 509 566 [email protected] Pierre Kunkler +44 7508 124751 [email protected] Morrisons | Lawey Drive, Telford Tesco | Ponders Lane, Enfield Abbey Retail Park | Newtownabbey, Belfast Client: LaSalle IM | Price: £14.25m Client: Realty Income | Price: £67m Client: Hammerson | Price: £33m Georgie Griffiths +44 7860 180 330 [email protected] To learn more about our services and what we can do for you please visit colliers.com Asda | Torquay 7-9 Bond Street | Leeds Homebase | Walthamstow Client: Aberdeen Standard | Price: £16m Client: DTZ Investors | Price: £1.4m Client: Inland Homes plc | Price: £28m All information, analysis and recommendations made for clients by Colliers are made in good faith and represent Colliers professional judgement on the basis of information obtained from the client and elsewhere during the course of the assignment. However, since the achievement of recommendations, forecasts and valuations depends on factors outside Colliers' control, no statement made by Colliers may be deemed in any circumstances to be a representation, undertaking or warranty, and Colliers cannot accept any liability should such statements prove to be inaccurate or based on incorrect premises. In particular, and without limiting the generality of the foregoing, any projections, financial and otherwise, in this report are intended only to illustrate particular points of argument and do not constitute forecasts of actual performance. -

2021 Half-Year Results 5 August 2021

2021 half-year results 5 August 2021 1 The Oracle, Reading Agenda Overview Financial results Strategy update Q&A 2 Overview Progress against FY20 priorities Balance sheet Strategy Operational Strengthened capital structure Update on portfolio & organisational reviews Rent collection improving(1) £403m of disposals, including French presented today: FY20 now at 90% minority stakes Simplify organisation by more efficient HY 21 at 71% Issue of €700m 1.75% sustainability- structures and platform linked bond Footfall c.80% pre-Covid levels Redeemed €500m 2022 bond & 53% New leadership: of 2023 €500m bond CFO with experience in transformation Leasing volumes improving (+£5.4m on H1 £297m of private placement notes & technology 20, £+1.4m on H1 19)(2) repaid Expertise in repositioning of assets and Right categories and structures £415m RCF maturing 2022 refinanced development to £200m of facilities maturing 2026 Strong pipeline Net debt reduced from £2.2bn to £1.9bn No significant unsecured maturities until 2025 1 Rent collection was FY20 89%, HY 21 68% as at 9 July 2021 3 2 Flagships only Half-year results Westquay, Southampton 2021 half-year financial results H1 headline results 30 June 2021 30 June 2020 Change Income statement Adjusted net rental income (£m)(1) (2) 87.2 94.4 (8%) LFL NRI (£m) 67.70 67.60 0.1% Premium outlets earnings (£m)(3) (2.0) (7.4) 73% Adjusted earnings (£m) 20.1 17.7 14% IFRS loss (£m)(4) (375.5) (1,088.4) 65% 30 June 2021 31 Dec 2020 Change Balance sheet Managed portfolio value (£m)(1) 3,596 4,414 (19%) Value Retail net asset value (£m) 1,130 1,154 (2%) Net debt (£m)(1) (1,879) (2,234) 16% Value Retail value (£m) 1,902 1,924 (1%) Value Retail net debt (£m) (690) (689) 0% EPRA NTAPS (p) 69 82 (16%) 1 Figures on a proportionally consolidated basis excluding Value Retail. -

Where Morehappens

Where more happens Annual Report 2015 HAMMERSON PLC ANNUAL REPORT 2015 We are Hammerson At Hammerson, we create destinations that excite shoppers, attract and support retailers, reward investors and serve communities; destinations where more happens. CONTENTS STRATEGIC REPORT FINANCIAL STATEMENTS Highlights 01 Directors’ responsibilities 113 Our business at a glance 02 Independent Auditor’s report 114 Our business model 04 Primary financial statements 118 Our business model in action 06 Notes to the accounts 124 In conversation with David Atkins, Company primary statements 158 Chief Executive 08 Notes to the Company accounts 160 Our market 14 OTHER INFORMATION Key performance indicators 18 Business review 22 Additional disclosures 166 Sustainability review 43 Ten-year financial summary 173 Our people 49 Summary of Directors’ remuneration policy 174 Financial review 53 Shareholder information 178 Principal risks and uncertainties 62 Glossary 181 CORPORATE GOVERNANCE Index 183 REPORT Chairman’s letter 68 In conversation with the Board 70 Your Board’s year 74 Nomination Committee report 78 Visit our website www.hammerson.com Audit Committee report 80 for more information about us and our Directors’ Remuneration report 84 business Compliance with the UK Follow us on twitter Corporate Governance Code 102 @hammersonplc Directors’ biographies 108 Directors’ report 110 Watch us on youtube Search hammerson Cover image: Taurus Geodessica installation Follow us on LinkedIn by Joshua Harker at Bullring September 2015 Search hammerson HAMMERSON PLC -

LONDON SPONSORSHIP 2020 “An Opportunity to Promote Your Brand to London’S Property and Construction Movers and Shakers”

LONDON SPONSORSHIP 2020 “An Opportunity to Promote your brand to London’s Property and Construction Movers and Shakers” • Connect and Engage – with an audience of c.450 senior Industry players and decision makers • • Comprehensive Sponsor Package – including a table of 10 and a position on the Chairman’s Table • • Brand Association – with high-profile Private & Public sector leaders and Industry influencers • • Be part of key Industry debates! Supporters Data Partner Design Partner PR & Comms for 2020 Partner “Contecting the Movers and Shakers in UK Property” great speakers... great events... great networking... Breakfast Sponsorships 2020 An opportunity to associate your brand with the UK’s number one Property and Construction Networking Forum, and communicate to an audience of key players in the Marketplace. Background 2020 is Movers & Shakers’ 25th Anniversary! Movers & Shakers is an exclusive membership organisation; structured to deliver the BEST NETWORKING OPPORTUNITES IN THE MARKETPLACE! Members must be able to deliver reciprocal business and with restricted numbers in each sector, we can ensure a balanced mix of interests; to underpin the exclusivity of the organisation. OUR AIM IS TO HELP YOU TO MAKE THE RIGHT CONNECTIONS; TO NETWORK AT THE HIGHEST LEVEL, TO GENERATE BUSINESS OPPORTUNITIES AND TO WIN WORK - with over 300 member companies, from leading organisations across the Industry. To gain shared knowledge and understanding from our first-class speakers and members. To deliver debate on our four pillars: SUSTAINABILITY | INCLUSIVITY | SOCIAL VALUES | TECHNOLOGY Events Programme Movers & Shakers runs events in London and across the UK (Birmingham, Bristol, Edinburgh, Manchester). The mainstay of the business is the programmes of breakfast events; which, in London are held at The Royal Lancaster Hotel. -

Report & Accounts 2018

Report & Accounts 2018 Report & Accounts Derwent London plc Report & Accounts 2018 01 DERWENT LONDON CONTENTS Who we are We are the largest London-focused real estate investment trust (REIT), owning a 5.4 million sq ft portfolio of mainly commercial real estate in 13 ‘villages’ across central London. Our purpose Our purpose is to help improve and upgrade the stock of office space in central London, providing above average long-term returns to our shareholders while bringing social and economic benefits to all our stakeholders. By setting an open and progressive corporate culture and promoting values that include building lasting relationships, our design-led ethos has created a brand of well-designed, flexible and efficient buildings at affordable rents. These not only help our occupiers attract talent but also revitalise neighbourhoods and benefit local communities. Our approach contributes to workforce well-being and will help to maintain London’s place as a leading global business hub. What we do The majority of our portfolio is income producing. STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS We aim for a balance between properties with potential to add further value through regeneration and those 2018 summary ......................................................................................... 04 Introduction from the Chairman ........................................................... 84 Statement of Directors’ responsibilities ........................................... 138 which have already been improved but where our asset -

Hammerson Plc Annual Report 2012 Report Annual

Hammerson plc plc Hammerson Annual Report 2012 Hammerson plc Annual Report 2012 Who we are We create HIGH-QUALITY retail property Our vision is to be the best owner-manager and developer of retail property within Europe. We focus on winning locations: prime regional shopping centres, convenient retail parks and premium designer outlet villages. Hammerson retail locations (see pages 8 to 17 for more details) EXPERIENCE CONVENIENCE LUXURY UK shopping centres UK retail parks Value Retail 1 1 1 Brent Cross, London NW4 Abbey Retail Park, Belfast Bicester Village, Oxford 2 2 2 Centrale, Croydon Central Retail Park, Falkirk La Vallée Village, Paris 3 3 3 Queensgate, Peterborough Dallow Road, Luton Kildare Village, Dublin 4 4 Bullring, Birmingham Battery Retail Park, Birmingham 5 5 Not shown Highcross, Leicester Cleveland Retail Park, Middlesbrough 6 6 Silverburn, Glasgow Drakehouse Retail Park, Sheffield Maasmechelen Village, Brussels 7 7 Wertheim Village, Frankfurt Cabot Circus, Bristol Brent South Shopping Park, London 8 8 The Oracle, Reading Cyfarthfa Retail Park, Merthyr Tydfil Ingolstadt Village, Munich 9 9 Fidenza Village, Milan Union Square, Aberdeen Elliott’s Field, Rugby 10 10 Las Rozas Village, Madrid WestQuay, Southampton Fife Central Retail Park, Kirkcaldy 11 11 La Roca Village, Barcelona Monument Mall, Newcastle Parc Tawe Retail Park, Swansea 12 12 Victoria Quarter, Leeds Westwood & Westwood Gateway, Thanet 13 Manor Walks, Cramlington France shopping centres 14 Ravenhead Retail Park, St Helens 13 Grand Maine, Angers 15 Wrekin Retail -

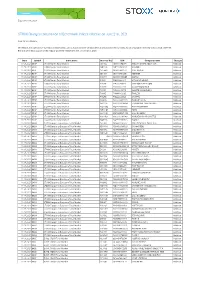

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. -

Market Roundup Company Focus: Bellway 23 March 2018

23 March 2018 Market Roundup Chart 1: UK Consumer Inflation (CPIH %) UK shares suffered heavy losses this week, taking the FTSE 100 index 6 below the 7,000 level for the first time since 2016. 5 On Monday, the blue-chip benchmark dropped 1.6%, with Micro Focus International plunging an eye-watering 47% after cutting its revenue 4 forecast and announcing the exit of its chief executive. But real estate 3 companies were in demand after shopping centre owner Hammerson 2 said it had rebuffed a takeover attempt by French rival Kleppiere. 1 Banks led the gainers on Tuesday, with RBS raising hopes that dividends could restart as early as mid-year if a US investigation into 0 mortgage mis-selling is resolved. Housebuilders also rose after solid results from Bellway, whose shares finished 3.5% higher. CPIH Annual Rate… Markets were nervous on Wednesday ahead of the US Federal Reserve’s decision on interest rates. B&Q-owner Kingfisher dropped Source: ONS Data at 23/3/2018 10.7% after issuing a cautious outlook. And a profit warning sent Moss Chart 2: UK Employment Growth (annual change; thousands) Bros down 23% to a six-year low. The FTSE 100 was off 0.3%. Thursday saw the FTSE 100 fall 1.2% on trade war worries. US share Men working full-time indexes were down more than 2%. Banks were big fallers, with Lloyds Banking Group off 1.6% and both Men working part-time Barclays and HSBC losing more than 2%. But Reckitt Benckiser jumped 4.8% after it pulled out of bidding for Pfizer’s consumer health Women working full-time unit. -

The Hard Sell Recent Years Has Been Downwards

TIPS IDEAS FARM the general trajectory of the share price over subsequent build-up in shorts underpinned The hard sell recent years has been downwards. This our confidence in the sell case and encour- emphasises the importance of taking the kind aged us to restate the call. Shorts peaked ALGY HALL of external prompts we monitor in the Ideas at 12.5 per cent in May last year, by which ome stock ideas just keep on giving. While Farm as a reason to undertake further research time the shares were already down to 774p. Sthis is a principle often associated with rather than a call to blindly follow suit. Negative bets fell to 5 per cent a year ago, but buy-and-hold investments, the same can But on this occasion, we think the have been riding high again for much of the apply to popular shorts (bets that a share prospects for Sainsbury may be more akin to past 12 months. The shares hit a 66p low in price will fall). Indeed, over recent weeks, two of the other serial short favourites when March and currently trade at 95p. four of the top five stocks in our most-shorted- they’ve previously experienced short surges: Shorts aside, our view of both Cineworld shares table are names that have flirted with Cineworld and Metro Bank. and Metro Bank when we moved to sell boiled top spots on the list in the past. In the case of cinema chain Cineworld, down to the fact they looked vulnerable to the Of the top five,Cineword (CINE), Metro it was a combination of sharply rising short dreaded combination of an ongoing decline Bank (MTRO), J Sainsbury (SBRY) and interest and broker downgrades that attracted in profit coupled with an overstretched bal- Premier Oil (PMO) all have historical form as our attention to the shares in September ance sheet.