A STUDY on THRIFT and LENDING PERFORMANCE of WOMEN SELF HELP GROUPS in ATHOOR BLOCK, DINDIGUL Dr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 4.1.9 Ground Water Resources Dindugal District

CHAPTER 4.1.9 GROUND WATER RESOURCES DINDUGAL DISTRICT 1 INDEX CHAPTER PAGE NO. INTRODUCTION 3 DINDUGAL DISTRICT – ADMINISTRATIVE SETUP 3 1. HYDROGEOLOGY 3-7 2. GROUND WATER REGIME MONITORING 8-15 3. DYNAMIC GROUND WATER RESOURCES 15-24 4. GROUND WATER QUALITY ISSUES 24-25 5. GROUND WATER ISSUES AND CHALLENGES 25-26 6. GROUND WATER MANAGEMENT AND REGULATION 26-32 7. TOOLS AND METHODS 32-33 8. PERFORMANCE INDICATORS 33-36 9. REFORMS UNDERTAKEN/ BEING UNDERTAKEN / PROPOSED IF ANY 10. ROAD MAPS OF ACTIVITIES/TASKS PROPOSED FOR BETTER GOVERNANCE WITH TIMELINES AND AGENCIES RESPONSIBLE FOR EACH ACTIVITY 2 GROUND WATER REPORT OF DINDUGAL DISTRICT INRODUCTION : In Tamil Nadu, the surface water resources are fully utilized by various stake holders. The demand of water is increasing day by day. So, groundwater resources play a vital role for additional demand by farmers and Industries and domestic usage leads to rapid development of groundwater. About 63% of available groundwater resources are now being used. However, the development is not uniform all over the State, and in certain districts of Tamil Nadu, intensive groundwater development had led to declining water levels, increasing trend of Over Exploited and Critical Firkas, saline water intrusion, etc. ADMINISTRATIVE SET UP The total geographical area of the Dindigul distict is6, 26,664 hectares, which is about 4.82 percent of the total geographical area of Tamil Nadu state.Thedistrict, is well connected by roads and railway lines with other towns within and outside Tamil Nadu.This district comprising 359 villages has been divided into 7 Taluks, 14 Blocks and 40 Firkas. -

Groundwater Quality Assessment in Dindigul District, Tamil Nadu Using GIS

Nature Environment and Pollution Technology ISSN: 0972-6268 Vol. 13 No. 1 pp. 49-56 2014 An International Quarterly Scientific Journal Original Research Paper Groundwater Quality Assessment in Dindigul District, Tamil Nadu Using GIS J. Colins Johnny and M. C. Sashikkumar* Department of Civil Engineering, Anna University, Tirunelveli Region, Tirunelveli, T.N., India *Department of Civil Engineering, University VOC College of Engineering, Anna University, Thoothukudi Campus, Tuticorin, T. N., India ABSTRACT Nat. Env. & Poll. Tech. Website: www.neptjournal.com Groundwater is a significant source of water in many parts of India, especially in semiarid and arid regions. Received: 10-6-2013 About 50% of the total irrigated area is dependent on groundwater. Groundwater is the major source of Accepted: 13-8-2013 drinking water in both urban and rural areas. Also, it is an important source of water for the agricultural and the industrial sectors. Groundwater quality is as important as the quantity. Poor quality of water adversely Key Words: affects the plant growth and human health. Hence, the demarcation of groundwater quality is of vital importance Groundwater to augment groundwater resources. The present study attempts to prepare the spatial variation map of the Spatial variation various groundwater quality parameters for Dindigul district, Tamil Nadu using Geographical Information Water quality System (GIS). GIS has been applied to visualize the spatial distribution of groundwater quality in the study Geographical information area. The major water quality parameters such as pH, total dissolved solids, total hardness, calcium, system (GIS) magnesium, fluoride, chloride and sulphates etc. were analysed. The final integrated map shows three Dindigul district priority classes such as high, moderate and poor groundwater quality zones of the study area and provides a guideline for the suitability of groundwater for drinking purposes. -

Vulnerable Areas (Taluk Wise) in Dindigul District ABSTRACT

Vulnerable Areas (Taluk wise) in Dindigul District ABSTRACT Sl. Very High High Moderate Low Taluk Total No. vulnerability vulnerability vulnerability vulnerability 1. Dindigul West 0 0 1 16 17 2. Dindigul East 0 2 0 7 9 3. Nilakottai 0 0 2 5 7 4. Natham 0 0 0 3 3 5. Athoor 0 1 0 0 1 6. Palani 0 3 0 3 6 7. Oddanchatram 0 1 0 13 14 8. Vedasandur 0 2 0 6 8 9. Kodaikanal 0 2 0 0 2 Total 0 11 3 53 67 1.Dindigul West Taluk Name & Type of local body Sl. ( Village Panchayat/Town Name of the location Reasons for Vulnerability No Panchayat/Municipality and corporation I. Very High Vulnerability NIL II. High Vulnerability NIL III. Moderate Vulnerability 1. Athuppatty, Thadicombu Town Way side village of River and H/o.Thadicombu, Due heavy flood in the past Panchayat Dindigul west Taluk Year (1977) IV. Low Vulnerability Lakshmananpatty, 1. Due to heavy flood in the H/o. Agaram, Agaram Town Panchayat past Year (1977) Dindigul West Taluk 2. Kiriampatty Colony, H/o. Agaram Agaram Town Panchayat Way side village of a river Dindigul West Taluk 3. Purusanathy Undarpatty, Thadicombu Town Way side village of River and H/o. Thadicombu Due heavy flood in the past Panchayat Dindigul West Taluk Year (1977) 4. Varattaru Andiyagoundanur, Thadicombu Town Way side village of River and Due heavy flood in the past H/o. Thadicombu Panchayat Year (1977) Dindigul West Taluk 5. Muthanampatty, Kuttathupatty Pt.,/ Due heavy flood in the past H/o. Kuttathupatty Village Panchayat Year Dindigul West Taluk 6. -

District Statistical Handbook 2018-19

DISTRICT STATISTICAL HANDBOOK 2018-19 DINDIGUL DISTRICT DEPUTY DIRECTOR OF STATISTICS DISTRICT STATISTICS OFFICE DINDIGUL Our Sincere thanks to Thiru.Atul Anand, I.A.S. Commissioner Department of Economics and Statistics Chennai Tmt. M.Vijayalakshmi, I.A.S District Collector, Dindigul With the Guidance of Thiru.K.Jayasankar M.A., Regional Joint Director of Statistics (FAC) Madurai Team of Official Thiru.N.Karuppaiah M.Sc., B.Ed., M.C.A., Deputy Director of Statistics, Dindigul Thiru.D.Shunmuganaathan M.Sc, PBDCSA., Divisional Assistant Director of Statistics, Kodaikanal Tmt. N.Girija, MA. Statistical Officer (Admn.), Dindigul Thiru.S.R.Arulkamatchi, MA. Statistical Officer (Scheme), Dindigul. Tmt. P.Padmapooshanam, M.Sc,B.Ed. Statistical Officer (Computer), Dindigul Selvi.V.Nagalakshmi, M.Sc,B.Ed,M.Phil. Assistant Statistical Investigator (HQ), Dindigul DISTRICT STATISTICAL HAND BOOK 2018-19 PREFACE Stimulated by the chief aim of presenting an authentic and overall picture of the socio-economic variables of Dindigul District. The District Statistical Handbook for the year 2018-19 has been prepared by the Department of Economics and Statistics. Being a fruitful resource document. It will meet the multiple and vast data needs of the Government and stakeholders in the context of planning, decision making and formulation of developmental policies. The wide range of valid information in the book covers the key indicators of demography, agricultural and non-agricultural sectors of the District economy. The worthy data with adequacy and accuracy provided in the Hand Book would be immensely vital in monitoring the district functions and devising need based developmental strategies. It is truly significant to observe that comparative and time series data have been provided in the appropriate tables in view of rendering an aerial view to the discerning stakeholding readers. -

Mapping of Fluoride Endemic Areas and Assessment of Fluoride Exposure

SCIENCE OF THE TOTAL ENVIRONMENT 407 (2009) 1579– 1587 available at www.sciencedirect.com www.elsevier.com/locate/scitotenv Mapping of fluoride endemic areas and assessment of fluoride exposure Gopalan Viswanathana,⁎, A. Jaswantha,1, S. Gopalakrishnanb,2, S. Siva ilangoc,3 aSrikrupa Institute of Pharmaceutical Sciences, Velkatta, Kondapak (mdl), Siddiped (Rd), Medak — 502277, Andhra Pradesh, India bManonmaniam Sundaranar University, Abishekapatti, Tirunelveli 627 012, India cDepartment of Chemistry, Thiyagaraja engineering College, Madurai, Tamil Nadu, India ARTICLE DATA ABSTRACT Article history: The prevalence of fluorosis is mainly due to the consumption of more fluoride through Received 28 June 2008 drinking water. It is necessary to find out the fluoride endemic areas to adopt remedial Received in revised form measures to the people on the risk of fluorosis. The objectives of this study are to estimate the 3 October 2008 fluoride exposure through drinking water from people of different age group and to elucidate Accepted 9 October 2008 the fluoride endemic areas through mapping. Assessment of fluoride exposure was achieved Available online 28 November 2008 through the estimation fluoride level in drinking water using fluoride ion selective electrode method. Google earth and isopleth technique were used for mapping of fluoride endemic Keywords: areas. From the study it was observed that Nilakottai block of Dindigul district in Tamil Nadu Fluorosis is highly fluoride endemic. About 88% of the villages in this block have fluoride level more Water pollution than the prescribed permissible limit in drinking water. Exposure of fluoride among different Fluoride intake age groups was calculated in this block, which comprises 32 villages. -

FORM 7-A. LIST of CONTESTING CANDIDATES (See Rule 10(1) Of

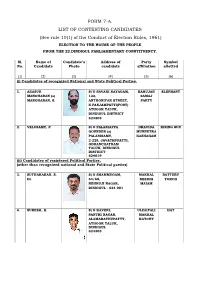

FORM 7-A. LIST OF CONTESTING CANDIDATES (See rule 10(1) of the Conduct of Election Rules, 1961) ELECTION TO THE HOUSE OF THE PEOPLE FROM THE 22.DINDIGUL PARLIAMENTARY CONSTITUENCY. Sl. Name of Candidate ’s Address of Part y Symbol No. Candidate Photo candidate affiliation allotted (1) (2) (3) (4) (5) (6) (i) Candidates of recognized National and State Political Parties. 1. ARASUR S/O SAVARI NAYAGAM, BAHUJAN ELEPHANT MANOHARAN (a) 122, SAMAJ MANOHARAN, S. ANTHONIYAR STREET, PARTY N.PANJAMPATTI(POST) ATHOOR TALUK, DINDIGUL DISTRICT 624303 2. VELUSAMY, P. S/O PALANIAPPA DRAVIDA RISING SUN GOUNDER (a) MUNNETRA PALANISAMY, KAZHAGAM 2-229, JAVATHUPATTI, ODDANCHATRAM TALUK, DINDIGUL DISTRICT 624619 (ii) Candida tes of registered Political Parties, (other than recognized national and State Political parties) 3. SUTHAKARAN, S. S/O SHAMMUGAM, MAKKAL BATTERY Dr. 64/65, NEEDHI TORCH NEHRUJI NAGAR, MAIAM DINDIGUL . 624 001 4. SURESH, K. S/O KAVERI, ULZAIPALI HAT SANTHI NAGAR, MAKKAL ALAMARATHUPATTY, KATCHY ATHOOR TALUK, DINDIGUL 624303 (1) (2) (3) (4) (5) (6) 5. MANSOORALI S/O ABDUL SALAM, NAAM TAMILAR GANNA KISAN KHAN, A. 12/11, THIRUKUMARA KATCHI PURAM 4 TH STREET, ARUMBAKKAM, CHENNAI-600106 6. JOTHIMUTHU, K. S/O KARUPPANA PATTALI MANGO GOUNDER, MAKKAL E1, MANOJ ILLAM, KATCHI ARUNA THEATER BACKSIDE, NALLA GOUNDER NAGAR, ODDANCHATRAM TOWN, DINDIGUL (iii) Other Candidates 7. ARUN KUMAR, A. S/O AYYAKALAI, INDEPENDENT CALCULATOR WEST STREET, PILLAIYARNATHAM, PITHALAIPATTI (POST), DINDIGUL -624002 8. ANBUROSE, D. S/O DEVASAHAYAM, INDEPENDENT AUTO DOOR NO. 123, RICKSHAW SUKKANMEDU, EAST AROCKIA MATHA STREET, NAGAL NAGAR(POST), DINDIGUL-624003 9. ANANTHRAJ, T. S/O THIRUMOORTHY, INDEPENDENT COMPUTER 3-4E, KALLIMANTHAYAM, ODDANCHATRAM, DINDIGUL DISTRICT 624616. -

List of Blocks of Tamil Nadu District Code District Name Block Code

List of Blocks of Tamil Nadu District Code District Name Block Code Block Name 1 Kanchipuram 1 Kanchipuram 2 Walajabad 3 Uthiramerur 4 Sriperumbudur 5 Kundrathur 6 Thiruporur 7 Kattankolathur 8 Thirukalukundram 9 Thomas Malai 10 Acharapakkam 11 Madurantakam 12 Lathur 13 Chithamur 2 Tiruvallur 1 Villivakkam 2 Puzhal 3 Minjur 4 Sholavaram 5 Gummidipoondi 6 Tiruvalangadu 7 Tiruttani 8 Pallipet 9 R.K.Pet 10 Tiruvallur 11 Poondi 12 Kadambathur 13 Ellapuram 14 Poonamallee 3 Cuddalore 1 Cuddalore 2 Annagramam 3 Panruti 4 Kurinjipadi 5 Kattumannar Koil 6 Kumaratchi 7 Keerapalayam 8 Melbhuvanagiri 9 Parangipettai 10 Vridhachalam 11 Kammapuram 12 Nallur 13 Mangalur 4 Villupuram 1 Tirukoilur 2 Mugaiyur 3 T.V. Nallur 4 Tirunavalur 5 Ulundurpet 6 Kanai 7 Koliyanur 8 Kandamangalam 9 Vikkiravandi 10 Olakkur 11 Mailam 12 Merkanam Page 1 of 8 List of Blocks of Tamil Nadu District Code District Name Block Code Block Name 13 Vanur 14 Gingee 15 Vallam 16 Melmalayanur 17 Kallakurichi 18 Chinnasalem 19 Rishivandiyam 20 Sankarapuram 21 Thiyagadurgam 22 Kalrayan Hills 5 Vellore 1 Vellore 2 Kaniyambadi 3 Anaicut 4 Madhanur 5 Katpadi 6 K.V. Kuppam 7 Gudiyatham 8 Pernambet 9 Walajah 10 Sholinghur 11 Arakonam 12 Nemili 13 Kaveripakkam 14 Arcot 15 Thimiri 16 Thirupathur 17 Jolarpet 18 Kandhili 19 Natrampalli 20 Alangayam 6 Tiruvannamalai 1 Tiruvannamalai 2 Kilpennathur 3 Thurinjapuram 4 Polur 5 Kalasapakkam 6 Chetpet 7 Chengam 8 Pudupalayam 9 Thandrampet 10 Jawadumalai 11 Cheyyar 12 Anakkavoor 13 Vembakkam 14 Vandavasi 15 Thellar 16 Peranamallur 17 Arni 18 West Arni 7 Salem 1 Salem 2 Veerapandy 3 Panamarathupatti 4 Ayothiyapattinam Page 2 of 8 List of Blocks of Tamil Nadu District Code District Name Block Code Block Name 5 Valapady 6 Yercaud 7 P.N.Palayam 8 Attur 9 Gangavalli 10 Thalaivasal 11 Kolathur 12 Nangavalli 13 Mecheri 14 Omalur 15 Tharamangalam 16 Kadayampatti 17 Sankari 18 Idappady 19 Konganapuram 20 Mac. -

DEPARTMENT of GEOLOGY and MINING DINDIGUL DISTRICT Contents S.No Chapter Page No

DEPARTMENT OF GEOLOGY AND MINING DINDIGUL DISTRICT Contents S.No Chapter Page No. 1.0 Introduction 1 2.0 Overview of Mining Activity in the District; 4 3.0 General profile of the district 6 4.0 Geology of the district; 9 5.0 Drainage of irrigation pattern 13 6.0 Land utilisation pattern in the district; Forest, Agricultural, 14 Horticultural, Mining etc 7.0 Surface water and ground water scenario of the district 19 8.0 Rainfall of the district and climate condition 20 9.0 Details of the mining lease in the district as per following 22 format 10.0 Details of Royalty / Revenue received in the last three years 46 (2015-16 to 2017-18) 11.0 Details of Production of Minor Mineral in last three Years 47 12.0 Mineral map of the district 48 13.0 List of letter of intent (LOI) holder in the district along with its 49 validity 14.0 Total mineral reserve available in the district. 72 15.0 Quality / Grade of mineral available in the district 73 16.0 Use of mineral 73 17.0 Demand and supply of the mineral in the lase three years 74 18.0 Mining leases marked on the map of the district 75 19.0 Details of the area where there is a cluster of mining leases viz., 77 number of mining leases, location (latitude & longitude) 20.0 Details of eco-sensitive area 77 21.0 Impact on the environment due to mining activity 79 22.0 Remedial measure to mitigate the impact of mining on the 81 environment 23.0 Reclamation of mined out area (best practice already 83 implemented in the district, requirement as per rules and regulations, proposed reclamation plan 24.0 Risk assessment & disaster management plan 83 25.0 Details of occupational health issue in the district (last five – 85 year data of number of patients of silicosis & tuberculosis is also needs to be submitted) 26.0 Plantation and green belt development in respect of leases 85 already granted in the district 27.0 Any other information 85 List of Figure Chapter Page S.No No. -

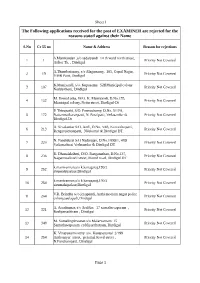

The Following Applications Received for the Post of EXAMINER Are Rejected for the Reasons Stated Against Their Name

Sheet1 The Following applications received for the post of EXAMINER are rejected for the reasons stated against their Name S.No Cr 55 no Name & Address Reason for rejections S.Manikandan ,s/o sadaiyandi 10 th ward north street, 1 1 Priority Not Covered Atthor Tk. , Dindigul A.Thandonisamy, s/o Alagarsamy, 163, Gopal Nagar, 2 19 Priority Not Covered YMR Patti, Dindigul K.Muniyandi, s/o. Kupusamy. 52BMunicipal colony 3 107 Priority Not Covered Neddu theru, Dindigul M. HemaLatha, W/O. K. Muniyandi, D.No.155, 4 132 Priority Not Covered Municipal colony, Nettu street, Dindigul-Dt P. Thirupathi, S/O. Ponnuchamy, D.No. 5/18A, 5 172 Nattanmaikaranpatti, N. Paraipatti, Vedasandur tk Priority Not Covered Dindigul-Dt A. Sivakumar S/O. Andi, D.No. 3/48, Kunoothupatti, 6 213 Priority Not Covered Renganaickanpatti, Nilakottai tk Dindigul DT N. Pandidurai S/O Nadarajan, D.No.109B/1, 48B 7 220 Priority Not Covered Vadamadurai Vedasandur tk Dindigul DT R. Dhanalakshmi, D/O. Ranganathan, D.No.137, 8 236 Priority Not Covered Nagammalkovil street, Round road, Dindigul DT k.manivannan,s/o k.kanagaraj,190/2 9 252 Priority Not Covered sirumalaipalaur,Dindigul k.manivannan,s/o k.kanagaraj,190/2 10 254 Priority Not Covered sirumalaipalaur,Dindigul V.R. Brindha w/o jeyapandi, Aathi moolam nagar police 11 264 Priority Not Covered colony,seelapadi,Dindigul A. Arunkumar, s/o Aruldas 17 samathuvapuram , 12 321 Priority Not Covered Rediyarsathiram , Dindigul M. Somalingshwaran s/o Malarvarnam 15 13 348 Priority Not Covered Samathuvapuram reddiyarchatram, Dindigul K. Vinayakamoorthy s/o. Kanaperumal 2/199 14 354 Anthoniyar street, perumal Kovil street , Priority Not Covered N.Panchampatti, Dindigul Page 1 Sheet1 M. -

District Survey Report Dindigul District, Tamil Nadu

DISTRICT SURVEY REPORT DINDIGUL DISTRICT, TAMIL NADU JULY, 2017 GEOLOGICAL SURVEY OF INDIA GOVERNMENT OF TAMIL NADU SU: TAMIL NADU & PUDUCHERRY DEPARTMENT OF GEOLOGY AND MINING, DINDIGUL DISTRICT SURVEY REPORT-DINDIGUL DISTRICT SURVEY REPORT DINDIGUL DISTRICT, TAMIL NADU ………………………………………………………………………………….... CONTENTS Sl. No. CHAPTERS Page No. 1 Introduction 1 2 Overview of mining activity in the district 2 3 List of mining leases in the district 3 4 Details of royalty or revenue received in last three years - Details of production of sand or Bajri or minor minerals in last three - 5 years 6 Process of deposition of river sediments in the district 38 7 General profile of the district 42 8 Land utilization pattern in the district 45 9 Physiography of the district 46 10 Rainfall month wise 48 11 Geology and mineral wealth 49 Conclusion and Recommendation 66 Sl. No. LIST OF FIGURES Page No. Fig.1.1 Dindigul District map 1 Fig.6.3.1. Schematic picture of meandering and deposition of sediments 40 Fig.6.3.2. River map of Dindigul 41 Fig.6.3.3. Ground water level of Dindigul from 1991 - 2016 41 Fig.8.1. Land Use & Utilisation map of Dindigul 46 Fig. 9.1. Geomorphology and Geohydrology map of Dindigul 47 Fig. 11.1. Geology of Tamil Nadu 49 Fig. 11.2. Geology of Dindigul district 51 Sl. No. LIST OF PHOTOGRAPHS Page No. 1 Charnockite quarry at Kothapulli, Dindigul (West) Taluk 54 2 Charnockite quarry at Thummalapatti, Palani Taluk 55 3 Layerred Charnockite quarry at Thimmananallur, Dindigul (East) 55 4 Limestone quarry at Alambadi, Vedasandur taluk 56 5 Limestone quarry at Panniyamalai, Natham taluk 56 6 Quartz & Feldspar quarry at Mulaiyur, Natham taluk 58 7 Quartz & Feldspar quarry at Kuttam, Vedasandur taluk 58 i DISTRICT SURVEY REPORT-DINDIGUL 8 Granite quarry at Eriyodu, Vedasandur taluk 59 9 Gravel excavation at Ellapatti, Oddanchatram taluk 60 10 Brick earth excavation at Tasiripatti, Oddanchatram taluk 61 Sl. -

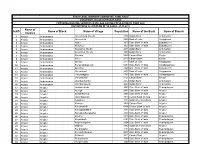

S.NO Name of District Name of Block Name of Village Population Name

STATE LEVEL BANKERS' COMMITTEE, TAMIL NADU CONVENOR: INDIAN OVERSEAS BANK PROVIDING BANKING SERVICES IN VILLAGE HAVING POPULATION OF OVER 2000 DISTRICTWISE ALLOCATION OF VILLAGES -01.11.2011 Name of S.NO Name of Block Name of Village Population Name of the Bank Name of Branch District 1 Ariyalur Andiamadam Anikudichan (South) 2730 Indian Bank Andimadam 2 Ariyalur Andiamadam Athukurichi 5540 Bank of India Alagapuram 3 Ariyalur Andiamadam Ayyur 3619 State Bank of India Edayakurichi 4 Ariyalur Andiamadam Kodukkur 3023 State Bank of India Edayakurichi 5 Ariyalur Andiamadam Koovathur (North) 2491 Indian Bank Andimadam 6 Ariyalur Andiamadam Koovathur (South) 3909 Indian Bank Andimadam 7 Ariyalur Andiamadam Marudur 5520 Canara Bank Elaiyur 8 Ariyalur Andiamadam Melur 2318 Canara Bank Elaiyur 9 Ariyalur Andiamadam Olaiyur 2717 Bank of India Alagapuram 10 Ariyalur Andiamadam Periakrishnapuram 5053 State Bank of India Varadarajanpet 11 Ariyalur Andiamadam Silumbur 2660 State Bank of India Edayakurichi 12 Ariyalur Andiamadam Siluvaicheri 2277 Bank of India Alagapuram 13 Ariyalur Andiamadam Thirukalappur 4785 State Bank of India Varadarajanpet 14 Ariyalur Andiamadam Variyankaval 4125 Canara Bank Elaiyur 15 Ariyalur Andiamadam Vilandai (North) 2012 Indian Bank Andimadam 16 Ariyalur Andiamadam Vilandai (South) 9663 Indian Bank Andimadam 17 Ariyalur Ariyalur Andipattakadu 3083 State Bank of India Reddipalayam 18 Ariyalur Ariyalur Arungal 2868 State Bank of India Ariyalur 19 Ariyalur Ariyalur Edayathankudi 2008 State Bank of India Ariyalur 20 Ariyalur -

Dindigul District

SARVA SHIKSHA ABHIYAN DISTRICT ELEMENTARY EDUCATION PLAN ANNUAL WORK PLAN & BUDGET 2003-2004 NIEPA DC D12161 DiNDIGUL DISTRICT TAMILNADU luatitu** ot' M4ne4tcir.t?.?' ?taQ»<i*4 *ud A doaiuiittitm. L7-B, *»i A vjfobindia M ar|, New i.v ihi-lJ.< 016 -tN iTl/, ooc. No .-- .....^ India Map Page I ot 1 MAP OF INDIA http://www.teatalk.com/indiaAndiamap.htm 7/1/2002 URAM (4567) (465Z) KARUR DINDIGUL (Tamilnadu) To Udclumalai|3petta( To Kalpattichauram COIMBATOR fmUCHCHmAPPALU Map not to Scalc OisariciBouvaflry Rivtf NalNmi Highway MaiorRoad Road t i l t R a « ^ Track 0 OiskktHeadquarter • TaM(HB«df|uirter O TcMd * Tourttf Pi»c« lopyflght (c) Con’parc Infobasc Pvl Ltd 2001-02 INDEX Chapter-I Plan Overview SI. Content Page N o. N o .. 1.1 Introduction 1 1.2 Planning Process 1 1.3 General ProGIe 3 1.4 Educational ProGle 5 1.4.1 Access 9 1.4.2 Enrolment - GER & Net Enrolment Ratio 10 1.4.3 CR , RR , DR - Primary level 13 1.4.4 CR , RR , DR - Upper Primary level 15 1.4.5 CR , RR , DR - Primary , Upper Primary 17 1.4.6 Transition Rate 19 1.4.7 Teacher Pupil Ratio 20 1.5 Early Childhood Care and Education 21 1.6 Out of School Children 22 1.7 Special focus Group 23 1.8 VECs , CRCs , BRCs 24 1.9 Infrastructure 25 1.10 District Project Office 27 Chapter-II Progress Review SI. Content Page No. No. 2.1 Introduction 28 2.2 Progress in Access 28 2.3 Progress in Enrolment 29 2.4 Progre.ss in Completion 30 2.5 Transition Rate for Primaiy 31 2.6 Attendance Rate for Upper Primary 32 2.7 Transition Rate for Primary 33 2.8 Pupils’ Achievement 34 2.9 Mainstreaming