A Glance at the Tax Implications of the Shenzhen – Hong Kong Stock Connect

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

This Circular Is Important and Requires Your Immediate Attention

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Fuyao Glass Industry Group Co., Ltd., you should at once hand this circular, together with the accompanying proxy form and the reply slip, to the purchaser(s) or transferee(s) or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser(s) or transferee(s). Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. This circular is for information purpose only and does not constitute an invitation or offer to acquire, purchase or subscribe for any securities of the Company. (A joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 3606) PROPOSED ISSUANCE OF ADDITIONAL H SHARES UNDER SPECIFIC MANDATE AND PROPOSED AMENDMENTS TO THE ARTICLES OF ASSOCIATION AND CERTAIN CORPORATE GOVERNANCE POLICIES Placing Agent The 2021 second extraordinary general meeting (the “EGM”) of Fuyao Glass Industry Group Co., Ltd. will be held in the conference room of the Company located at Fuyao Industrial Zone, Rongqiao Economic & Technological Development Zone, Fuqing City, Fujian Province, the PRC at 2:00 p.m. -

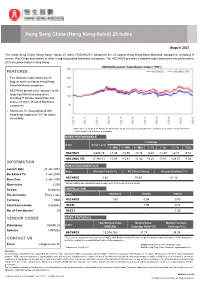

Hang Seng China (Hong Kong-Listed) 25 Index

Hang Seng China (Hong Kong-listed) 25 Index August 2021 The Hang Seng China (Hong Kong- listed) 25 Index ("HSCHK25") comprises the 25 largest Hong Kong-listed Mainland companies, including H shares, Red Chips and shares of other Hong Kong-listed Mainland companies. The HSCHK25 provides a tradable index that tracks the performance of China plays listed in Hong Kong. FEATURES ■ This thematic index tracks the 25 biggest and most liquid Hong Kong- listed Mainland companies ■ HSCHK25 provides an exposure to the large-cap Mainland companies, including H Shares, Red Chips and shares of other HK-listed Mainland companies ■ Stocks are freefloat-adjusted with weightings capped at 10% for higher investibility Data has been rebased at 100.00. All information for an index prior to its launch date is back-tested, back-tested performance reflects hypothetical historical performance. INDEX PERFORMANCE % Change Index Index Level 1 - Mth 3 - Mth 6 - Mth 1 - Yr 3 - Yr 5 - Yr YTD HSCHK25 8,630.19 +1.49 -13.50 -14.18 -0.67 -11.29 +6.71 -9.51 HSCHK25 TRI 17,191.11 +1.80 -11.81 -11.82 +2.47 -0.70 +28.57 -7.02 INFORMATION INDEX FUNDAMENTALS Launch Date 20 Jan 2003 Index Dividend Yield (%) PE Ratio (Times) Annual Volatility*(%) Backdated To 3 Jan 2000 HSCHK25 3.32 10.02 21.12 Base Date 3 Jan 2000 Base Index 2,000 *Annual Volatility was calculated based on daily return for the past 12-month period. Review Quarterly CORRELATION Dissemination Every 2 sec Index HSCHK25 HSCEI HSCCI Currency HKD HSCHK25 1.00 0.98 0.73 Total Return Index Available HSCEI - 1.00 0.73 No. -

Chinese Equities – the Guide March 2021

Chinese equities – the guide March 2021 For professional investors only. In Switzerland for Qualified Investors. In Australia for wholesale clients only. Not for use by retail investors or advisers. Introduction Investors who venture into the Chinese stock universe face an alphabet soup of seemingly random letters. There are A-shares, H-shares and S-chips to name just a few (see Chart 1). These letters represent various attempts to develop the equity market in a country where people traded the first shares as long ago as the 1860s. But something resembling a modern stock market, the Shenzhen Stock Exchange, didn’t start operations until 1 December 1990.1 Shenzhen beat Shanghai as the first exchange of the modern era by some three weeks.2 The Hong Kong Stock Exchange, a forerunner to the city’s current bourse, began operations in 1914 but developed under British colonial rule.3 Investors view Hong Kong as a separate and distinct market. Chart 1: Alphabet soup of Chinese equities Shares Listing Currency Country of Country Examples Index inclusion Comments Can Chinese incorporation where investors buy? company does most business A-share Shanghai + Renminbi China China Shanghai CSI 300 or MSCI Some have dual Y Shenzhen International China A Onshore. listing in H-share Airport Co. MSCI EM since market June 2018 B-share Shanghai + US dollar + China China N/A None Interest has Y Shenzhen Hong Kong collapsed since dollar H-shares H-share Hong Kong Hong Kong China China PetroChina, China MSCI China All Often dual listing Y dollar Construction -

Global Offering E

(a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock code : 2120 RESPECTING LIFE HUMBLE SERVICE GLOBAL OFFERING Joint Sponsors (in alphabetical order) Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers IMPORTANT IMPORTANT: If you are in any doubt about any of the contents of this Prospectus, you should obtain independent professional advice. Wenzhou Kangning Hospital Co., Ltd. 溫州康寧醫院股份有限公司 (a joint stock limited company incorporated in the People’s Republic of China with limited liability) GLOBAL OFFERING Number of Offer Shares under the Global Offering : 17,600,000 H Shares (subject to adjustment and the Over-allotment Option) Number of Hong Kong Offer Shares : 1,760,000 H Shares (subject to adjustment) Number of International Offer Shares : 15,840,000 H Shares (subject to adjustment and the Over-allotment Option) Maximum Offer Price : HK$38.7 per H Share, plus brokerage of 1%, SFC transaction levy of 0.0027%, and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars and subject to refund on final pricing) Nominal value : RMB1.00 per H Share Stock code : 2120 Joint Sponsors (in alphabetical order) Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. -

SH-HK Connect: New Regime, Unprecedented Opportunity

September 11, 2014 China Strategy SH-HK Connect: New regime, unprecedented opportunity Portfolio Strategy Research The ‘new’ investment case for China for global/A-share investors SH-HK Stock Connect: Redefining the Chinese equity market Kinger Lau, CFA +852-2978-1224 [email protected] The Connect scheme brings China A to the global arena and potentially Goldman Sachs (Asia) L.L.C. unleashes significant portfolio flows from China to HK. We provide a framework for the new market landscape for global and A-share investors. Timothy Moe, CFA +852-2978-1328 [email protected] Goldman Sachs (Asia) L.L.C. Global investors: China A is too important to ignore nd rd Ben Bei 1. The scheme creates a single ‘China’ market which ranks as the 2 /3 +852-2978-1220 [email protected] largest globally by cap/turnover, and adds 855 US$1bn companies to the Goldman Sachs (Asia) L.L.C. investable universe. 2. China A will likely be included in global benchmarks Chenjie Liu, Ph.D soon, based on Korea’s and Taiwan’s experience. 3. Global investors may +86(10)6627-3324 [email protected] be able to trade China growth more efficiently in China A. Key micro Beijing Gao Hua Securities Company Limited overlays for stock picking may revolve around scarcity value, GDP proxy, , and . high/stable yields, QFII ownership proper management incentive A-share investors: Diversification, undervalued growth in HK The scheme allows Chinese households to diversify their inefficient asset allocation: 72% in property, 6% in equities. Their investment behavior and demand for diversification suggest they may focus on: (1) mid-cap growth stocks, including select dual-listed H on possible re-rating; (2) HK blue chips with global footprint; and (3) household brands not available in A. -

The Mofo Guide to Hong Kong Ipos a COMPLEX SUBJECT MADE SIMPLE

THE MOFO GUIDE TO HONG KONG IPOS A COMPLEX SUBJECT MADE SIMPLE. A WEALTH OF EXPERIENCE. INNOVATIVE IDEAS. PRACTICAL SOLUTIONS. This IS MOFO. LearN MOre at www.MOFO.COM. FOrewORD The transition from private to public ownership is a major step in the lifecycle of a company, involving a complex and often challenging process of dealing with regulators, investors and professional parties, while continuing to run the company’s business. As one of the world’s preeminent international financial centers, Hong Kong has become a destination of choice for many companies seeking to make this transition through an initial public offering (“IPO”) and listing on the Hong Kong Stock Exchange. The MoFo Guide to Hong Kong IPOs (“Guide”) aims to help companies and their advisers successfully navigate this transition by providing a comprehensive overview of the IPO process in Hong Kong, with an emphasis on listings on the Main Board of the Hong Kong Stock Exchange. The Guide covers the IPO process from the preliminary planning stages and pre-IPO considerations all the way up to, and including, a listed company’s post-IPO obligations. The Guide also discusses listing issues pertinent to companies in specific industries, such as mineral and natural resources companies, as well as issues that arise when conducting an international offering to investors in other jurisdictions, such as the United States. Practical tips are included throughout the Guide based on our experience advising on Hong Kong IPOs over the years. While we have tried to make the Guide as informative as possible, please kindly note that it is only an overview of the major legal, regulatory and practical issues involved in the Hong Kong IPO process as of November 5, 2012 and therefore should not be relied upon as legal advice in any jurisdiction. -

Listing PRC Companies in Hong Kong Using VIE Structures

Listing PRC Companies in Hong Kong Using VIE Structures October 2014 www.charltonslaw.com 0 Index Page Executive summary 2 Contents 。 Hong Kong Stock Exchange (HKEx)’s background information 4 。 Introduction to listing of PRC companies on HKEx 15 。 VIE structure 21 。 Key requirement of Main Board listing on HKEx 30 。 Requirements for a listing – Hong Kong vs U.S. 39 About Charltons 46 Disclaimer 47 1 Executive summary Hong Kong market is the 6th largest stock market in the world Hong Kong ranked 3rd worldwide in terms of IPO funds raised (only after NYSE and Nasdaq) in 2013 VIE structures can be listed on The Hong Kong Stock Exchange (HKEx) subject to complying with requirements of listing decision ○ certain businesses maybe subject to PRC’s foreign investment restriction if they belong to certain industry sectors (Restricted Industries) ○ Restricted industries include compulsory education, news agencies and internet-related services Key Hong Kong listing requirements: ○ three financial criteria: (1) the profit test ; (2) the market capitalisation/revenue test; or (3) the market capitalisation/revenue/ cashflow test ○ A 3-year track record period requirement is usually applied to a listing applicant * HKEx may also accept a shorter trading record period and/or may vary or waive the financial standards requirements on certain circumstances ○ Maintain at all times a minimum public float of 25% of the Company’s total issued share capital 2 Executive summary Key U.S. listing requirements ○ minimum quantitative requirements, which -

SH-HK Stock Connect Information Book for Investor

0 The information contained in this document is for general informational purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any securities or to provide any investment advice or service of any kind. This document is not directed at, and is not intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Hong Kong Exchanges and Clearing Limited (“HKEX”), The Stock Exchange of Hong Kong Limited (“SEHK”), Hong Kong Securities Clearing Company Limited, Shenzhen Stock Exchange (“SZSE”), Shanghai Stock Exchange (“SSE”) and China Securities Depository and Clearing Corporation Limited (together, the “Entities”, each an “Entity”), or any of their affiliates, or any of their affiliates, or any of the companies that they operate, to any registration requirement within such jurisdiction or country. No section or clause in this document may be regarded as creating any obligation on the part of any of the Entities. Rights and obligations with regard to the trading, clearing and settlement of any securities transactions effected on the SZSE, SSE and SEHK, including through Shanghai Connect or Shenzhen Connect (together “Shanghai and Shenzhen Connect”), shall depend solely on the applicable rules of the relevant exchanges and clearing houses, as well as the applicable laws, rules and regulations of Mainland China and Hong Kong. Although the information contained in this document is obtained or compiled from sources believed to be reliable, none of the Entities guarantee the accuracy, validity, timeliness or completeness of the information or data for any particular purpose, and the Entities and the companies that they operate shall not accept any responsibility for, or be liable for, errors, omissions or other inaccuracies in the information or for the consequences thereof. -

449910 H Share Eng.Indb

Directors, Supervisors and Senior Management Members Basic Information Incumbent Directors, Supervisors and Senior Management Members Name Year of birth Gender Position Term of offi ce LI Lihui 1952 Male Vice Chairman and President From August 2004 to the date of the Annual General Meeting in 2013 LI Zaohang 1955 Male Executive Director and From August 2004 to the date of the Annual General Meeting in 2013 Executive Vice President WANG Yongli 1964 Male Executive Director and From February 2012 to the date of the Annual General Meeting in 2015 Executive Vice President SUN Zhijun 1955 Female Non-executive Director From October 2010 to the date of the Annual General Meeting in 2013 LIU Lina 1955 Female Non-executive Director From October 2010 to the date of the Annual General Meeting in 2013 JIANG Yansong 1963 Female Non-executive Director From October 2010 to the date of the Annual General Meeting in 2013 ZHANG Xiangdong 1957 Male Non-executive Director From July 2011 to the date of the Annual General Meeting in 2014 ZHANG Qi 1972 Male Non-executive Director From July 2011 to the date of the Annual General Meeting in 2014 Anthony Francis NEOH 1946 Male Independent Director From August 2004 to the date of the Annual General Meeting in 2013 HUANG Shizhong 1962 Male Independent Director From August 2007 to the date of the Annual General Meeting in 2013 HUANG Danhan 1949 Female Independent Director From November 2007 to the date of the Annual General Meeting in 2013 CHOW Man Yiu, Paul 1946 Male Independent Director From October 2010 to the date -

Annual Meeting

TaxB 23 October 2012 Tax Bulletin 2012 Annual Meeting The Inland Revenue Department and The Hong Kong Institute of Certified Public Accountants 2012 ANNUAL MEETING BETWEEN THE INLAND REVENUE DEPARTMENT AND THE HONG KONG INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS Preamble As part of the Institute’s regular dialogue with the government to facilitate tax compliance, improve procedural arrangements and to clarify areas of interpretation, representatives of the Institute met the Commissioner of Inland Revenue (“CIR”) and members of his staff in February 2012. As in the past, the agenda took on board items received from a circulation to members of the Institute prior to the meeting. The minutes of the meeting, prepared by the Inland Revenue Department (“IRD”) are reproduced in full in this Tax Bulletin and should be of assistance in members’ future dealings with the IRD. Part A contains items raised by the Institute and Part B, items raised by IRD. List of Discussion Items PART A - MATTERS RAISED BY THE INSTITUTE A1. Profits Tax Issues A(1a) Source of profits when unlisted shares subsequently become listed or vice versa A1(b) Source of interest income derived from second-hand loans A1(c) Determination of location of provision of credit in loan transactions without cash movement A1(d) Source of royalty income A1(e) Meaning of "use in Hong Kong" for the purpose of sections 15(1)(a) & (b) A1(f) Expenditure on building refurbishment 1 A1(g) Transfer pricing methodology A1(h) Transfer pricing adjustments between group companies A2. Salaries Tax Issues A(2a) Location of employment – residence of employer A2(b) Factor(s) determining the source of directors' fees A2(c) Taxation of directors' fees where the individual has to on-pay the fees to his employer A2(d) Practice in relation to section 8(1A)(b) read in conjunction with section 8(1B) A3. -

Appendix Iii — Taxation and Foreign Exchange

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. APPENDIX III — TAXATION AND FOREIGN EXCHANGE TAXATION The following is a summary of certain PRC and Hong Kong tax consequences to investors purchased under the [REDACTED] and held as capital assets. This summary does not purport to address all material tax consequences of the ownership of H Shares, and does not take into account the specific circumstances of any particular investor, some of which may be subject to special provisions. This summary is based on the tax laws of the PRC and Hong Kong in effect as of the Latest Practicable Date, all of which are subject to change (or changes in interpretation), possibly with retroactive effect. This section in this [REDACTED] does not address any aspect of Hong Kong or the PRC taxation other than income tax, capital tax, stamp duty, business tax and estate duty. Prospective investors are urged to consult their tax advisers regarding the PRC, Hong Kong and other tax consequences of owning and disposing of H Shares. PRC Taxation The following is a discussion of certain PRC tax provisions relating to the ownership and disposal of H Shares purchased in connection with the [REDACTED] and held by the investors as capital assets. This summary does not purport to address all material tax consequences of the ownership of H Shares and does not take into account the specific circumstances of any particular investors. This -

An Overview of A+H Shares and AH Discounts and Premiums

An Overview of A+H Shares and AH Discounts and Premiums A+H shares refer specifically to Chinese companies which are listed in the A-share market and the Hong Kong stock market at the same time. A+H shares are in the nature of ‘same shares, same rights’, but their price performances vary from market to market. The A+H company which got listed first in time is CHINA VANKE CO, which was listed in Shenzhen Stock Exchange back in 1991; the A+H company which got listed first in time in the Hong Kong stock market is TSINGTAO BREW, which was listed in Hong Kong Exchange and Shanghai Stock Exchange successively in 1993; the most recently listed A+H company is CHINA INTERNATIONAL CAPITAL CORP LTD, which was listed in Shanghai Stock Exchange in November 2020. According to the latest data from Wind (as of 20 Nov 2020), at present there are 129 A+H companies listed in both Mainland China and Hong Kong, and their aggregate market value is RMB 22.6 trillion, accounting for approximately 30% of the total market value of A-shares and also about 30% of the total market value of Hong Kong stocks. Except for a small number of ST shares and shares in the STAR Board, A+H shares are included in the Stock Connect. In terms of industry distribution, the largest number of A+H companies are from the financial sector (accounting for as many as 62.6%), followed by the industrial sector and the energy sector. Sector No. of Total market value Share in terms of companies (RMB billion) market value Materials 13 1,143.3 5.1% Real estate 3 403.9 1.8% Industrials 35 1,899.2 8.4% Utilities 7 352.6 1.6% Financials 33 14,152.8 62.6% Consumer discretionary 8 1,014.0 4.5% Energy 9 1,866.6 8.3% Consumer staples 3 137.5 0.6% Information technology 5 674.1 3.0% Medical and healthcare 13 971.5 4.3% Total 129 22,615.5 100% Source: Wind, as of 20 Nov 2020 The discounts and premiums of A+H shares form a topic which has attracted much 1 attention.