2016 990 PF Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Handbook for Courage and Encourage Chaplains

Handbook for Courage and EnCourage Chaplains Fortieth Anniversary Edition Trumbull, Connecticut 2020 Published with ecclesiastical permission Nihil obstat: Rev. Brian P. Gannon, STD Censor librorum Imprimatur: Most Rev. Frank J. Caggiano Bishop of Bridgeport 1 May 2020 The nihil obstat and imprimatur are official declarations that a book or pamphlet is free of doctrinal or moral error. No implication is contained therein that those who have granted the declarations agree with the content, opinions or statements expressed. Ministry to Persons with a Homosexual Inclination: Guidelines for Pastoral Care © 2006 United States Conference of Catholic Bishops, Washington, D.C., 20017. All rights reserved. Handbook for Courage and EnCourage Chaplains Fortieth Anniversary Edition © 2020 Courage International, Inc. All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, elec- tronic or mechanical, including photocopying, recording or by any information storage and retrieval system with- out permission in writing from the Copyright Holder. Permission is hereby granted for Courage and EnCourage chaplains to reproduce short excerpts for the use of members of their chapters during chapter meetings. To obtain copies of this Handbook, or to obtain permission for reprinting, excerpts or translations, contact the Copyright Holder at: Courage International, Inc. 6450 Main Street Trumbull, CT 06611 USA +1 (203) 803-1564 [email protected] In Loving Memory of Father John F. Harvey, O.S.F.S. (1918 — 2010) -

Parish Bulletin Board

January 7, 2018 W E L C O M E The Epiphany of the Lord The Mission of our parish is to serve our neighbors with Jesus, to pray in faith with Jesus, and to teach as His Church with Jesus, so “that all may have more abundant life.” (John 10:10). The Word of God, the Sacraments, and the Catechism of the Catholic Church are the instruments and standards of this work of evangelization and faith formation. Our Lady of Mount Carmel Pastoral Team 23–25 Newtown Avenue, Astoria, NY 11102 718.278.1834 • Fax 718.278.0998 Pastor [email protected] Msgr. Sean G. Ogle, V.F. Ext. 22 [email protected] Saturday (Upper Church) Follow me on twitter @theogleoffice 5:00pm (Vigil Mass) Parochial Vicars Father Peter Nguyen Ext. 20 Sunday (Upper Church) Father Wlad Kubrak Ext. 19 English Masses: 8:00am, 10:00am, 11:15am, 5:00pm* Pastor Emeritus (7:00pm during the Summer months from Memorial Day Father Ed Brady Ext. 18 weekend to Labor Day weekend, inclusive) In Residence Misa en Español: 12:30pm Father John Harrington K.H.S., Ext. 28 Sunday (Lower Church) Father Joseph Pham Ext. 15 9:00am (Italian) Deacon 10:30am (Czech–Slovak) Ruben Mendez 3:00pm (Vietnamese) Pastoral Worker Chin Nguyen Ext. 23 Monday–Friday (Lower Church) Coordinator of Religious Education 8:00am and 12:00pm Nelly Gutierrez Ext. 14 Saturday: 8:00am [email protected] Parish Office Hours/ Horario de la Oficina Parish Outreach Coordinator Weekdays: 9:30am-12:00 Noon and 1:00pm-8:30pm Denise Dollard 718.721.9020 Saturday: 9:00am-12:00 Noon Parish Secretary/Bookkeeper CHAPEL OF ST. -

Unity Transcriptions by Karen Kaffenberger Copyediting and Layout by Deep River Media, LLC

Proceedings of the New York Encounter 2018 An “Impossible” Unity An “Impossible” Transcriptions by Karen Kaffenberger Copyediting and layout by Deep River Media, LLC Human Adventure Books An "Impossible" Unity Proceedings of New York Encounter 2018 Crossroads Cultural Center This edition © 2018 Human Adventure Books An “Impossible” Unity We naturally yearn for unity and long to be part of a real community: life blossoms when it is shared. And yet, we live in an age of fragmentation. At the social level, we suffer profound divisions among peoples and religions, and our country is ever more polarized along ideological lines, corroding our unity. At the personal level, we are often estranged from our communities, family members, and friends. When we discover that someone doesn’t think the way we do, we feel an embarrassing distance, if not open hostility, that casts a shadow on the relationship. As a result, either we become angry or we avoid controversial issues altogether, and retreat into safe territories with like-minded people. But the disunity we see around us often begins within ourselves. We are bombarded by images of what we are “supposed” to be, but they generally do not correspond to who we really are. In fact, our truest self seems to escape us. The full scope of our humanity, with all its vast and profound needs and desires, may suddenly emerge, elicited by memories, thoughts or events, but usually quickly fades, without lasting joy or real change. And unless our relationships are rooted in the common experience of such humanity, we don’t even have real dialogue; we just chat, gossip, text or argue. -

Envisioning Futures for the Catholic Church Hellemans, Staf; Jonkers, Peter

Tilburg University Envisioning Futures for the Catholic Church Hellemans, Staf; Jonkers, Peter Publication date: 2018 Document Version Publisher's PDF, also known as Version of record Link to publication in Tilburg University Research Portal Citation for published version (APA): Hellemans, S., & Jonkers, P. (2018). Envisioning Futures for the Catholic Church. Council for Research in Values and Philosophy. General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Download date: 27. sep. 2021 Cultural Heritage and Contemporary Change Series VIII, Christian Philosophical Studies 23 Envisioning Futures for the Catholic Church Edited by Staf Hellemans & Peter Jonkers The Council for Research in Values and Philosophy Copyright © 2018 by The Council for Research in Values and Philosophy Gibbons Hall B-20 620 Michigan Avenue, NE Washington, D.C. 20064 All rights reserved Printed in the United States of America Library of Congress Cataloging-in-Publication Names: Hellemans, Staf, editor. -

The Role of Mary in the New Ecclesial Communities in the Twentieth and Twenty-First Centuries

Marian Library Studies Volume 31 Mary in the Consecrated Life Article 23 2013 The Role of Mary in the New Ecclesial Communities in the Twentieth and Twenty-First Centuries Danielle Peters University of Dayton Follow this and additional works at: https://ecommons.udayton.edu/ml_studies Part of the Catholic Studies Commons Recommended Citation Peters, Danielle (2013) "The Role of Mary in the New Ecclesial Communities in the Twentieth and Twenty- First Centuries," Marian Library Studies: Vol. 31, Article 23. Available at: https://ecommons.udayton.edu/ml_studies/vol31/iss1/23 This Article is brought to you for free and open access by the Marian Library Publications at eCommons. It has been accepted for inclusion in Marian Library Studies by an authorized editor of eCommons. For more information, please contact [email protected], [email protected]. FROM MONOGRAM TO MISSION A SPECIALDEVOTION Communities Entrusted With A Special Marian Devotion Devotion to the Heart of Mary Holy Card Bouass6-Lebel Paris, 1 850 Tm Ror,n or Mmv rN TrrE Nnv Eccr,EsrAL Comuuurtrns oF TrrR TVrrvrmru mm TVnr.srr-FrRsr Cnlwunrns Introduction Ten popes,t Vatican Il, the renewal of the laws of canonical discipline, a drastic change in the pastoral sphere of the Church as well as the confrontation with radical social, political, and ecumenical changes in contemporary society are but a few details of the colorful and multifaceted portrayal of the Church in the 20th and at the dawn of the 21st century. The social and cultural hap- penings which have rapidly come about in modem society have also had a no- ticeable toll on the consecrated life in the church. -

New York Encounter 2019 Proceedings

TO START FROM START TO Proceedings of the New York Encounter 2019 1 2019 TO START FROM This booklet contains transcripts, not reviewed by the speakers, of talks given at New York Encounter 2019 Crossroads Cultural Center HumanHAB Adventure Books TO START FROM We are at the end of an epoch and we feel the need to rediscover our identity and somehow start again. But, having abandoned traditions, challenged norms, and rejected authorities, we are left with nothing but ourselves to make sense of it all. With no blueprint, the present is full of unease and the future appears enigmatic. We are uncertain of the meaning of our lives, and so often feel confused, alone and isolated. Our collective days are filled by the pressures of success and conformity, along with the fear of being left behind. Failure seems irredeemable, mercy impossible. So, we often look for scapegoats or ways to escape. But tribal belonging or artificial realities are poor substitutes for the certainties we have lost. At the same time, this very unease reveals something in us. Something that feels the lack, aches for meaning, and recognizes the truth, like a tuning fork vibrating for its single, unmistakable note. Something that makes us long to be looked at, listened to, understood, forgiven, valued just because we exist. Something that perceives a promise even within these challenging times and urges us to respond, to say “Here I am!”, to seek justice, to build anew. An innermost, irreducible, decisive core marked by a stubborn expectation. “Has anyone ever promised us anything? Then WHY do we expect something?” — Cesare Pavese 7 Cover image: Henri Matisse, Icarus, 1946 2 CONTENTS A Blossom in the Desert Naomi and Ken Genuard, Miriam Huettner, Riro Manuscalco .......... -

Raskob Foundation for Catholic Activities, Inc. Grants Approved

Raskob Foundation for Catholic Activities, Inc. Grants Approved Report - 2014 National Grants: United States KNOM Radio Mission, Inc. $25,000 Nome, AK To purchase digital radio production equipment to replace aging, out-of-date analog radio equipment as part of the Digital Studios capital campaign to enlarge the radio facility. Holy Family Cristo Rey Catholic High School $6,000 Birmingham, AL To purchase Latin, Algebra, Pre-Calculus and Geometry books. Pope John Paul II Catholic High School $10,000 Huntsville, AL To purchase iPads as part of the school's Technology Update Project. Society of St. Edmund $25,000 Selma, AL Toward program expenses of the Bosco Nutritional Center, a soup kitchen serving the poor, 365 days a year. St. Joseph the Worker (Job Service) $10,000 Phoenix, AZ Toward operating expenses of the Mobile Success Unit - a recreational vehicle designed to reach the homeless, low-income and other disadvantaged individuals with job development supplies and resources in an effort to help them become self-sufficient through quality employment. Diocese of Tucson $22,500 Tucson, AZ Toward expenses for priests to attend a 3-day Pastoral Leadership Program: "Developing Servant Leaders for the Diocese of Tucson". Salpointe Catholic High School $20,000 Tucson, AZ Toward a capital campaign to construct a new Student Center, including chapel, cafeteria, library/tech center, and counseling center. San Miguel of Tucson Corporation $5,000 Tucson, AZ Toward expenses of the Campus Ministry program in order to enhance annual retreats for students. Raskob Foundation for Catholic Activities, Inc. Grants Approved Report - 2014 St. Bernard School $6,000 Bellflower, CA To purchase math and science textbooks as well as online learning tools for 5th-8th grade. -

December 15, 2000 Vol

Inside Archbishop Buechlein . 4, 5 Editorial. 4 From the Archives . 8 Question Corner . 15 TheCCriterionriterion Sunday & Daily Readings. 15 Serving the Church in Central and Southern Indiana Since 1960 www.archindy.org December 15, 2000 Vol. XXXX, No. 11 50¢ President Clinton delays federal execution in Terre Haute Opponents vow to continue federal penitentiary in Terre Haute on The archbishop said he prayed with shuttle bus service in anticipation of Dec. 12, but Clinton announced Dec. 7 it Garza, who is Catholic, and asked God to crowds both opposing and supporting the seeking moratorium would be delayed. bless Garza with peace of mind, heart and execution. Commenting on the president’s deci- soul. Karen Burkhart, a member of From Staff and CNS reports sion, Indianapolis Archbishop Daniel M. Archbishop Buechlein, who is a member St. Susanna Parish in Plainfield, an Buechlein told The Criterion,the of the U.S. bishops’ Committee on Pro-Life Indiana Catholic who organizes events WASHINGTON—Opponents of the Indianapolis archdiocesan newspaper, he Activities, said he has seen through his vis- protesting capital punishment, told death penalty say they plan to keep press- was pleased that Garza’s execution had at its with Garza and the other inmates that Catholic News Service Dec. 11 that ing President Clinton to commute death least been delayed. conversion can occur. That fits in with the activists would continue writing to the sentences or declare a moratorium in the Archbishop Buechlein met with Garza pope’s message, he said, that prisoners president, encouraging him to declare a wake of his decision to delay for six twice at the U.S. -

'We Are the Pro-Life Generation'

HAWAII OBITUARY WORLD MANAOLANA Stewardship of time, Zambia-born Father Cletus Church entering ‘new era’ Meg Hunter-Kilmer is a talent, treasure called the Mooya was a parish priest under Pope Francis, top wandering missionary. practical path to holiness in Hawaii for seven years papal adviser says This week she’s on Oahu. Page 3 Page 5 Page 14 Page 20 HawaiiVOLUME 77, NUMBER 3 CatholicFRIDAY, JANUARY 31, 2014 Herald$1 ‘We are the pro-life generation’ Millennials at the Washington March for Life say their age group knows the cost of abortion Page 9 At state Capitol, signs, speeches, music, march observe Roe v. Wade anniversary Page 9 HCH photo | Patrick Downes 2 HAWAII HAWAII CATHOLIC HERALD • JANUARY 31, 2014 Hawaii Praying Catholic for unity Leaders from Hawaii Herald Newspaper of the Diocese of Honolulu Christian churches gath- Founded in 1936 ered with Bishop Larry Published every other Friday Silva, bottom left photo, PUBLISHER for a Taize Prayer service Bishop Larry Silva Jan. 24 at the Newman (808) 585-3356 Center/Holy Spirit Parish [email protected] in Manoa. Hundreds of EDITOR faithful from different Patrick Downes (808) 585-3317 Christian denominations [email protected] joined them for an hour REPORTER/PHOTOGRAPHER of meditative chants, peti- Darlene J.M. Dela Cruz tions, Scripture reading (808) 585-3320 and reverencing of the [email protected] cross. Bishop Silva hosted ADVERTISING the Taize Prayer event Shaina Caporoz in lieu of the ecumeni- (808) 585-3328 [email protected] cal evening gathering CIRCULATION traditionally scheduled Donna Aquino during the annual Week of (808) 585-3321 Prayer for Christian Unity [email protected] in January. -

Summer 2019 the FIRST FORTY-FIVE

From: Vol. 1, No. 1—Fall | Winter 1974 To: Vol. 45, Nos. 1 & 2—Spring | Summer 2019 THE FIRST FORTY-FIVE YEARS 1 2 1974, Vol. I, No. 1 – Fall / Winter Articles: * A Note on G. K.C. (Reginald Jebb) * An Everlasting Man (Maurice B. Reckitt) * Chesterton and the Man in the Forest (Leo A. Hetzler) * Chesterton on the Centenary of His Birth (Elena Guseva) * Chesterton as an Edwardian Novelist (John Batchelor) * To Gilbert K. Chesterton, a poem (Lewis Filewood) News & Comments: * Letter from Secretary of the Chesterton Society (1. Reviewing centenary year; 2. Announcing meeting of Chesterton Society) * Letter from Secretary of the H.G. Wells Society (Wants to exchange journals with the Chesterton Society) * Note about books: G.K. Chesterton: A Centenary Appraisal by John Sullivan; G. K. Chesterton by Lawrence J. Clipper; G. K. Chesterton: Critical Judgments by D.J. Conlon, and The Medievalism of Chesterton by P.J. Mroczkowski * Spode House Review announcement: publishing of the Chesterton Centenary Conference proceedings * Notes on Articles: “Some Notes on Chesterton” (CSL: The Bulletin of the New York C.S. Lewis Society, May 1974); “Chesterton on Dickens: The Legend and the Reality,” (Dickens Study Newsletter, June 1974); “Chesterton’s Colour Imagery in The Man Who Was Thursday” (Columbia University Pastel Essays Series, September 1974); “Chesterton, Viejo Amigo” (Incunable No. 297, September 1974-spanish); “Gilbert Keith Chesterton: A Fond Tribute” (Thought, XXVI, July 1974, Delhi, India) * Note on: Chesterton Centenary Conference at Notre Dame College of Education in Glasgow, by the Scottish Catholic Historical Association, September 1974 * Note on: Chesterton Conference at Gonzaga University, Spokane, WA, October 1974 * Letter from: John Fenlon Donnely, President of Donnely Mirrors on the Conference at Notre Dame College, Glasgow * Note on Adrian Cunningham (U. -

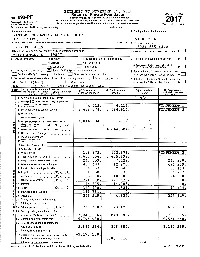

2017 990 PF Form

l EXTENDED TO NOVEMBER 15, 2018 I Return of Private Foundation 0MB No. 1545-0052 Form 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation Department of the Treasury ~ Do not enter social security numbers on this form as it may be made public. 2017 I Internal Revenue service ~ Go to www.irs.gov/Form990PF for instructions and the latest information. Uoen to l-'ubl1c lnsoection For calendar year 2017 or tax year beginning , and ending I Name of foundation A Employer identification number . RASKOB FOUNDATION FOR CATHOLIC ACTIVITIES INC. 51-0070060 Number and street {or P.O. box number if mail is not delivered to street address) I Room/suite B Telephone number P.O. BOX 4019 (302} 655-4440 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here ........ D WILMINGTON DE 19807 G Check all that apply: D Initial return D Initial return of a former public charity D 1. Foreign organizations, check here ..... o D Final return D Amended return 2. Foreign organizations meeting the 85% test, ........ D D Address change D Name change check here and attach computation . _. __ _ _ _ _ .,..... H Check type of organization: [x] Section 501(c)(3) exempt private foundation E If private foundation status was terminated D Section 4947(a)(1) nonexempt charitable trust D Other taxable private foundation under section 507(b)(1}(A), check here ..... o I Fair market value of all assets at end of year J Accounting method: D Cash [x] Accrual F If the foundation is in a 60-month termination (from Part II, col. -

Sp V,Nv,GD UT ' 11 Othi R Incong EN, -62 641

EXTENDED TO NOVEMBER 15, 2019 Return of Private Foundation 0MB No 1545 0052 Form 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation Deparlment the Treasury 1111- 01 Do not enter social security numbers on this form as ,t may be made pubhc 2018 Internal Revenue Serv,ce , 1111- Go to www ors gov/Form990PF for ,nstructoons and the latest mformat,on uoen o t'Uo11c nsoec ion 'For calendar year 2018 or tax year beginning . and ending Name of foundation A Employer 1dent1hcallon number RASKOB FOUNDATION FOR CATHOLIC -ACTIVITIES INC. 51-0070060 Number and street (or P O box number 1f mall 1s not dehvered to street address) I Room/su,te B Telephone number P.O. BOX 4019 ( 3 0 2) 655-4440 City or town, state or province, country, and ZIP or foreign postal code C If exemption apphcation 1s pending, check here ~D WILMINGTON DE 19807 G Check all that apply. D ln1t1al return D Initial return of a former public charity D 1 Foreign organizations, check here ~D D Final return D Amended return 2 Foreign organizations meeting the 85% test, D Address change D Name chanae check here and attach computat1on ~D H Check type of organization. [xJ Section 501(c)(3) exempt private foundation E If private foundation status was terminated D Section 4947(a}(1) nonexempt charitable trust D Other taxable orivate foundation 0~ under section 507(b)(1)(A), check here ~D I Fair market value of all assets at end of year J Accounting method D Cash [xJ Accrual F If the foundation 1s in a 60-month terminat1onD (from Part It, col.