Demand Estimation in the Presence of an Unobservable Product

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mckeesport Candy Co. CANDY CIGARETTES & CIGARS

412-678-8851 [email protected] FAX: 412-673-4406 McKeesport Candy Co. Visit CandyFavorites.com to view products. *** Please note that website prices reflect suggested retail *** CHANGEMAKERS EFRUTTI GUMMI CHANGEMAKER 7272 ANGEL MINTS 110 4090 GUMMI BRACELET 40 7248 CANDY CIGARETTES 24 42134 BAKERY SHOPPE - SHARE SIZE 12 7171 CARAMEL CREAMS 170 7177 GUMMI BURGER 60 7347 CELLA CHERRY- INDIVIDUALLY WRAPPED 72 3752 GUMMI CUPCAKES 60 7173 CHARLSTON CHEW - VANILLA 96 42133 EFRUTTI GUMMI CHEESECAKES 30 4277 CHICKO STICK 36 40078 GUMMI DONUTS - SHARE SIZE 12 COWTALES 7262 GUMMI HOT DOG 60 5067 COWTALES - CARAMEL APPLE 36 4105 GUMMI PIZZA 48 5304 COWTALES - CHOCOLATE BROWNIE 36 40079 GUMMI RAINBOW UNICORN - SHARE SIZE 12 7270 COWTALES - STRAWBERRY SMOOTHIE 36 63151 GUMMI SEA CREATURES 60 7263 COWTALES - VANILLA 36 7266 GUMMI SOUR GECKO 40 7269 FUN DIP 48 EFRUTTI GUMMI BAGS - LARGE 7275 ICE CUBES 100 43030 GUMMIUNIVERSE SHELF TRAY 12 46001 JOLLY RANCHER FILLED POPS 100 6943 GUMMI LUNCH BAG SHELF TRAY 12 7286 JUNIOR MINTS - BOXES 72 42111 GUMMI LUNCH BAG SOUR TRAY 12 5443 MALLO CUPS - FUN SIZE 60 42008 GUMMI MOVIE BAG SHELF TRAY 12 4848 PRETZEL RODS 450 43203 GUMMI TREASURE HUNT SHELF TRAY 12 7313 PUMPKIN SEEDS - INDIAN 36 25¢ PRE-PRICED BOXES 5040 RAZZLES CHANGEMAKERS 240 3395 BERRY CHEWY LEMONHEADS 24 4423 RAIN-BLO GUM - MINI PACKS 48 4018 BOSTON BAKED BEANS 24 7215 REESE PEANUT BUTTER CUPS - MINI 105 7912 APPLEHEADS 24 7156 SATELLITE WAFERS 240 7913 CHERRYHEADS 24 5089 SATELLITE WAFERS - SOUR 240 5154 CHEWY LEMONHEADS 24 7318 SIXLETS -

Effort to Reduce Carbon Footprint | Press Releases

PRESS RELEASE Wm. Wrigley Jr. Company Launches Effort to Reduce Carbon Footprint Enabled by Infosys Technologies World’s Largest Manufacturer of Chewing Gum Seeks to Transform Logistics Operations in Western Europe London, UK - November 20, 2008: In a move to extend its social responsibility leadership, the world’s leading manufacturer of chewing gum Wm. Wrigley Jr. Company is reducing the carbon footprint it creates in its logistics operations, Infosys Technologies announced today. Infosys is enabling Wrigley to transform its logistics operations by providing solutions and services in a pilot to determine how much carbon emissions are produced and subsequently may be reduced across the company’s truck-based shipping operations in Western Europe. “Managing our impact on the environment is an integral part of Wrigley corporate philosophy,” said Ian Robertson, head of supply chain sustainability at Wm. Wrigley Jr. Company. “We’re committed to making improvements across all operations but need an integrated enterprise system to measure progress. Infosys provided that solution and services to empower that process.” Early in the pilot, Infosys identified logistics operations in which Wrigley may reduce its carbon footprint by as much as 20 percent, and provided process consulting around operational adoption. The analysis will continue to evaluate Wrigley’s complex distribution network across six countries in Western Europe – spanning more than 44 million kilometers a year in shipments between suppliers, the company and its own customers and includes its distribution centers – for CO2 emissions emitted according to the UK’s Defra (Department for Environment, Food and Rural Affairs) standards. Infosys is using its patent-pending Logistics Optimization solution and carbon management tools to deliver the carbon footprint analysis to Wrigley as a managed information service. -

Market Achievements History Product

Wrigley ENG 15.03.2007 12:56 Page 170 Market a confectionery product.These products deliver a Since its founding in 1891,Wrigley has established range of benefits including dental protection itself as a leader in the confectionery industry. It is (Orbit), fresh breath (Winterfresh), enhancing best known for chewing gum and is the world’s memory and improving concentration (Airwaves), largest manufacturer of these products, some of relief of stress, helping in smoking cessation and which are among the best known and loved brands snack avoidance. in the world.Today,Wrigley's brands are woven into Wrigley is one of the pioneers in developing the fabric of everyday life around the world and are the dental benefits of chewing sugarfree gum - sold in over 150 countries.The original brands chewing a sugar-free gum like Orbit reduces the Wrigley’s Spearmint, Doublemint and Juicy Fruit incidence of tooth decay by 40%. Its work and have been joined by the hugely successful brands support in the area of oral healthcare has resulted Orbit,Winterfresh, Airwaves and Hubba Bubba. in dental professionals recommending sugarfree gum Chewing gum consumption in Croatia exceeds to their patients. the amount of 34 million USD and holds 34.8% of the total confectionery market (Nielsen, MAT chewing AM06). In comparison with the past year, the gum companies in the market has witnessed a 3.2% growth, and today, United States, but the industry Wrigley's Orbit is in Croatia a synonym for top was relatively undeveloped. Mr.Wrigley decided that quality chewing gum, holding the leading brand chewing gum was the product with the potential he position in the confectionery category (chocolates had been looking for, so he began marketing it excluded).This product holds 57.4% of the total under his own name. -

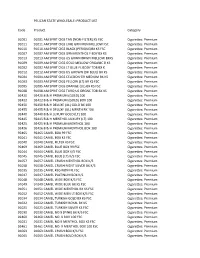

(NON-FILTER) KS FSC Cigarettes: Premiu

PELICAN STATE WHOLESALE: PRODUCT LIST Code Product Category 91001 91001 AM SPRIT CIGS TAN (NON‐FILTER) KS FSC Cigarettes: Premium 91011 91011 AM SPRIT CIGS LIME GRN MEN MELLOW FSC Cigarettes: Premium 91010 91010 AM SPRIT CIGS BLACK (PERIQUE)BX KS FSC Cigarettes: Premium 91007 91007 AM SPRIT CIGS GRN MENTHOL F BDY BX KS Cigarettes: Premium 91013 91013 AM SPRIT CIGS US GRWN BRWN MELLOW BXKS Cigarettes: Premium 91009 91009 AM SPRIT CIGS GOLD MELLOW ORGANIC B KS Cigarettes: Premium 91002 91002 AM SPRIT CIGS LT BLUE FL BODY TOB BX K Cigarettes: Premium 91012 91012 AM SPRIT CIGS US GROWN (DK BLUE) BX KS Cigarettes: Premium 91004 91004 AM SPRIT CIGS CELEDON GR MEDIUM BX KS Cigarettes: Premium 91003 91003 AM SPRIT CIGS YELLOW (LT) BX KS FSC Cigarettes: Premium 91005 91005 AM SPRIT CIGS ORANGE (UL) BX KS FSC Cigarettes: Premium 91008 91008 AM SPRIT CIGS TURQ US ORGNC TOB BX KS Cigarettes: Premium 92420 92420 B & H PREMIUM (GOLD) 100 Cigarettes: Premium 92422 92422 B & H PREMIUM (GOLD) BOX 100 Cigarettes: Premium 92450 92450 B & H DELUXE (UL) GOLD BX 100 Cigarettes: Premium 92455 92455 B & H DELUXE (UL) MENTH BX 100 Cigarettes: Premium 92440 92440 B & H LUXURY GOLD (LT) 100 Cigarettes: Premium 92445 92445 B & H MENTHOL LUXURY (LT) 100 Cigarettes: Premium 92425 92425 B & H PREMIUM MENTHOL 100 Cigarettes: Premium 92426 92426 B & H PREMIUM MENTHOL BOX 100 Cigarettes: Premium 92465 92465 CAMEL BOX 99 FSC Cigarettes: Premium 91041 91041 CAMEL BOX KS FSC Cigarettes: Premium 91040 91040 CAMEL FILTER KS FSC Cigarettes: Premium 92469 92469 CAMEL BLUE BOX -

Kosher Nosh Guide Summer 2020

k Kosher Nosh Guide Summer 2020 For the latest information check www.isitkosher.uk CONTENTS 5 USING THE PRODUCT LISTINGS 5 EXPLANATION OF KASHRUT SYMBOLS 5 PROBLEMATIC E NUMBERS 6 BISCUITS 6 BREAD 7 CHOCOLATE & SWEET SPREADS 7 CONFECTIONERY 18 CRACKERS, RICE & CORN CAKES 18 CRISPS & SNACKS 20 DESSERTS 21 ENERGY & PROTEIN SNACKS 22 ENERGY DRINKS 23 FRUIT SNACKS 24 HOT CHOCOLATE & MALTED DRINKS 24 ICE CREAM CONES & WAFERS 25 ICE CREAMS, LOLLIES & SORBET 29 MILK SHAKES & MIXES 30 NUTS & SEEDS 31 PEANUT BUTTER & MARMITE 31 POPCORN 31 SNACK BARS 34 SOFT DRINKS 42 SUGAR FREE CONFECTIONERY 43 SYRUPS & TOPPINGS 43 YOGHURT DRINKS 44 YOGHURTS & DAIRY DESSERTS The information in this guide is only applicable to products made for the UK market. All details are correct at the time of going to press but are subject to change. For the latest information check www.isitkosher.uk. Sign up for email alerts and updates on www.kosher.org.uk or join Facebook KLBD Kosher Direct. No assumptions should be made about the kosher status of products not listed, even if others in the range are approved or certified. It is preferable, whenever possible, to buy products made under Rabbinical supervision. WARNING: The designation ‘Parev’ does not guarantee that a product is suitable for those with dairy or lactose intolerance. WARNING: The ‘Nut Free’ symbol is displayed next to a product based on information from manufacturers. The KLBD takes no responsibility for this designation. You are advised to check the allergen information on each product. k GUESS WHAT'S IN YOUR FOOD k USING THE PRODUCT LISTINGS Hi Noshers! PRODUCTS WHICH ARE KLBD CERTIFIED Even in these difficult times, and perhaps now more than ever, Like many kashrut authorities around the world, the KLBD uses the American we need our Nosh! kosher logo system. -

Wrigley Some Research Online to Help

The 7 Steps - April 1. CONTEXT Mindmap anything you know about the topic, including vocabulary. Do Wrigley some research online to help. Listening Questions 1 1. In what year was Wrigley founded? 2. QUESTIONS . 2. What was the first product William Wrigley Jr. sold? . Read the listening questions to 3. Why did he decide to focus on selling gum? check your . understanding. 4. When was the Doublemint flavor introduced? Look up any new vocabulary. 5. Who bought Wrigley in 2008? . 3. LISTEN Listening Questions 2 1. Which MLB team did the Wrigley family own and when did they sell it? Listen and answer . the questions 2. How old is Fenway Park? using full sentences. Circle . the number of times and % you 3. What does Koshien Stadium share in common with Wrigley Field? understood. 4. When was the first official night game played at Wrigley Field? . 5. How long did the Chicago Cubs go between World Series championships? Listening 1 1 2 3 4 5 . % % % % % Discussion Questions 1. What snacks did you eat when you were younger? Is gum a popular snack in Japan? Listening 2 1 2 3 4 5 2. How do you feel about huge companies investing in sporting teams? How does it benefit them? % % % % % 4. CHECK ANSWERS TRANSCRIPT 1 When it comes to chewing gum, the Wrigley name is one of the most famous. The Wm. Wrigley Read through the Jr. Company, or Wrigley for short, was founded by William Wrigley Jr. in 1891 and is transcript and headquartered in Chicago, Illinois. underline the When William Wrigley Jr. -

Campbell Wholesale Company, Inc. Order Book 6849 E

Campbell Wholesale Company, Inc. Order Book 6849 E. 13th 1104 W. Broadway Tulsa, Oklahoma 74112 Muskogee, Oklahoma 74401 1(800) 722-2359 1(888) 516-2997 (918) 836-8774 (918) 682-6608 Fax: (918) 832-5689 Fax: (918) 686-8182 Customer No.: ________________________________________________ Customer Name: _____________________________________________ Date: _________________________________________________________ Written By: ___________________________________________________ ITEM NO. QTY. DESCRIPTION ITEM NO. QTY. DESCRIPTION _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ _______________________________________ -

Port, Sherry, Sp~R~T5, Vermouth Ete Wines and Coolers Cakes, Buns and Pastr~Es Miscellaneous Pasta, Rice and Gra~Ns Preserves An

51241 ADULT DIETARY SURVEY BRAND CODE LIST Round 4: July 1987 Page Brands for Food Group Alcohol~c dr~nks Bl07 Beer. lager and c~der B 116 Port, sherry, sp~r~t5, vermouth ete B 113 Wines and coolers B94 Beverages B15 B~Bcuits B8 Bread and rolls B12 Breakfast cereals B29 cakes, buns and pastr~es B39 Cheese B46 Cheese d~shes B86 Confect~onery B46 Egg d~shes B47 Fat.s B61 F~sh and f~sh products B76 Fru~t B32 Meat and neat products B34 Milk and cream B126 Miscellaneous B79 Nuts Bl o.m brands B4 Pasta, rice and gra~ns B83 Preserves and sweet sauces B31 Pudd,ngs and fru~t p~es B120 Sauces. p~ckles and savoury spreads B98 Soft dr~nks. fru~t and vegetable Ju~ces B125 Soups B81 Sugars and artif~c~al sweeteners B65 vegetables B 106 Water B42 Yoghurt and ~ce cream 1 The follow~ng ~tems do not have brand names and should be coded 9999 ~n the 'brand cod~ng column' ~. Items wh~ch are sold loose, not pre-packed. Fresh pasta, sold loose unwrapped bread and rolls; unbranded bread and rolls Fresh cakes, buns and pastr~es, NOT pre-packed Fresh fru~t p1es and pudd1ngs, NOT pre-packed Cheese, NOT pre-packed Fresh egg dishes, and fresh cheese d1shes (ie not frozen), NOT pre-packed; includes fresh ~tems purchased from del~catessen counter Fresh meat and meat products, NOT pre-packed; ~ncludes fresh items purchased from del~catessen counter Fresh f1sh and f~sh products, NOT pre-packed Fish cakes, f1sh fingers and frozen fish SOLD LOOSE Nuts, sold loose, NOT pre-packed 1~. -

New Products and Promotions

Fusion Gourmet USA NEW PRODUCTS Dolcetto Wafer Rolls, made from all natural ingredients, AND PROMOTIONS are light and crispy on the out- side with a creamy filling. Fla- vors include Tiramisu, Choco- late and Cappuccino. They come packaged in a 14.1 oz vintage-style tin and are available in shippers. Tel: +1 (310) 532 8938 www.fusiongourmet.com Impact Confections, Inc. USA Wm. Wrigley Jr. Co. USA Warheads Double Drops is a supersour candy liq- uid with two flavors in a two-chamber, dual- dropper bottle. Enjoy one flavor at a time or both. Flavor combos include green apple/ watermelon, blue raspberry/green apple and watermelon/blue raspberry. Available in a Orbit White Wintermint is a new fla- 24-count display with an srp of 99¢. vor of the teeth-whitening, stain- Warheads Juniors removing Orbit gum. Extreme Sour hard Eclipse Cinnamon Inferno and candy is a miniature Midnight Cool are two new fla- version of the original Extreme vors of Eclipse breath-freshening Sour candy in a sleek dis- gum. penser, with an assortment of five Altoids Mango Sours are a new sour flavors for mix-and-match flavor sensation and control fruit flavor Altoids hard candy. of sour intensity. Flavors include apple, black cherry, Extra Cool Watermelon is a blue raspberry, lemon and watermelon. Ships in an 18- new flavor addition to Extra count display with an srp of 99¢. gum. Tel: +1 (719) 268 6100 www.impactconfections.com Doublemint Twins Mints, an extension of the Dou- Van Damme Confectionery, Inc. USA blemint brand, come Van Damme has introduced All in two flavors, Winter- Natural Marshmallow Cubes, a mix creme and Mintcreme. -

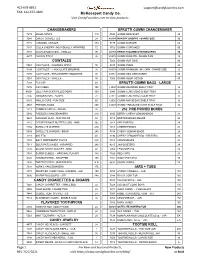

Master Candy List

412-678-8851 [email protected] FAX: 412-673-4406 McKeesport Candy Co. Visit CandyFavorites.com to view products. CHANGEMAKERS EFRUTTI GUMMI CHANGEMAKER 7272 ANGEL MINTS 110 4090 GUMMI BRACELET 40 7248 CANDY CIGARETTES 24 42134 BAKERY SHOPPE - SHARE SIZE 12 7171 CARAMEL CREAMS 170 7177 GUMMI BURGER 60 7347 CELLA CHERRY- INDIVIDUALLY WRAPPED 72 3752 GUMMI CUPCAKES 60 7173 CHARLSTON CHEW - VANILLA 96 42133 EFRUTTI GUMMI CHEESECAKES 30 4277 CHICKO STICK 36 40078 GUMMI DONUTS - SHARE SIZE 12 COWTALES 7262 GUMMI HOT DOG 60 5067 COWTALES - CARAMEL APPLE 36 4105 GUMMI PIZZA 48 5304 COWTALES - CHOCOLATE BROWNIE 36 40079 GUMMI RAINBOW UNICORN - SHARE SIZE 12 7270 COWTALES - STRAWBERRY SMOOTHIE 36 63151 GUMMI SEA CREATURES 60 7263 COWTALES - VANILLA 36 7266 GUMMI SOUR GECKO 40 7269 FUN DIP 48 EFRUTTI GUMMI BAGS - LARGE 7275 ICE CUBES 100 43030 GUMMIUNIVERSE SHELF TRAY 12 46001 JOLLY RANCHER FILLED POPS 100 6943 GUMMI LUNCH BAG SHELF TRAY 12 7286 JUNIOR MINTS - BOXES 72 42111 GUMMI LUNCH BAG SOUR TRAY 12 5443 MALLO CUPS - FUN SIZE 60 42008 GUMMI MOVIE BAG SHELF TRAY 12 4848 PRETZEL RODS 450 43203 GUMMI TREASURE HUNT SHELF TRAY 12 7313 PUMPKIN SEEDS - INDIAN 36 25¢ PRE-PRICED BOXES 5040 RAZZLES CHANGEMAKERS 240 3395 BERRY CHEWY LEMONHEADS 24 4423 RAIN-BLO GUM - MINI PACKS 48 4018 BOSTON BAKED BEANS 24 7215 REESE PEANUT BUTTER CUPS - MINI 105 7912 APPLEHEADS 24 7156 SATELLITE WAFERS 240 7913 CHERRYHEADS 24 5089 SATELLITE WAFERS - SOUR 240 5154 CHEWY LEMONHEADS 24 7318 SIXLETS 48 3396 CHEWY LEMONHEADS - REDRIFIC 24 7154 SOFT PEPPERMINT PUFFS -

Wm Wrigley Jr. Company Equity Valuation and Analysis

Wm Wrigley Jr. Company Equity Valuation and Analysis Valued November 1, 2007 Dr. MEM Analysts Alan Inman [email protected] Jonathan Haralson [email protected] Mark Leonard [email protected] Pete Nash [email protected] Shane Nowak [email protected] 1 Table of Contents Executive Summary 5 Business & Industry Analysis 10 Company Overview 10 Industry Overview 11 Five Forces Model 13 Competitive Force One – Rivalry Among Existing Firms 13 Competitive Force Two – Threat of New Entrants 18 Competitive Force Three – Threat of Substitute Products 20 Competitive Force Four – Bargaining Power of Buyers 21 Competitive Force Five – Bargaining Power of Suppliers 23 Value Chain Analysis 24 Firm Competitive Analysis 27 Accounting Analysis 30 Key Accounting Policies 30 Potential Accounting Flexibility 35 Actual Accounting Strategy 37 Quality of Disclosure 39 Sales Manipulation Diagnostics 41 2 Expense Manipulation Diagnostics 46 Potential Red Flags 53 Undo Accounting Distortions 54 Financial Analysis 55 Liquidity Ratio Analysis 55 Profitability Analysis 64 Capital Structure Analysis 71 IGR and SGR Analysis 76 Financial Statement Forecasting 78 Income Statement Analysis 78 Forecasted Income Statement 80 Common Size Income Statement 80 Balance Sheet Analysis 81 Forecasted Balance Sheet 84 Common Size Balance Sheet 86 Forecasted Statement of Retained Earnings 87 Statement of Cash Flows Analysis 88 Forecasted Statement of Cash Flows 89 Common Size Statement of Cash Flows 90 Cost of Equity 91 Regression Analysis 92 Cost of Debt 93 Weighted Average -

European Court of Justice, 23 October 2003, Doublemint

www.ippt.eu IPPT20031023, ECJ, Doublemint European Court of Justice, 23 October 2003, Dou- judgment, that ‘that term cannot be characterised as ex- blemint clusively descriptive’. It thus took the view that Article 7(1)(c) of Regulation No 40/94 had to be interpreted as precluding the registration of trade marks which are ‘exclusively descriptive’ of the goods or services in re- spect of which registration is sought, or of their charac- teristics. In so doing, the Court of First Instance applied a test based on whether the mark is ‘exclusively de- scrip-tive’, which is not the test laid down by Article 7(1)(c) of Regulation No 40/94. It thereby failed to as- certain whether the word at issue was capable of being used by other economic op-erators to designate a char- TRADEMARK LAW acteristic of their goods and services. Public interest Source: curia.europa.eu • Descriptive signs or indications relating to the characteristics of goods or services in respect of which registration is sought may be freely used by European Court of Justice, 23 October 2003 all (V. Skouris, P. Jann, C.W.A. Timmermans, C. Gul- By prohibiting the registration as Community trade mann, J.N. Cunha Rodrigues and A. Rosas, D.A.O. marks of such signs and indications, Article 7(1)(c) of Edward, A. La Pergola, J.-P. Puissochet, R. Schintgen, Regulation No 40/94 pursues an aim which is in the F. Macken, N. Colneric and S. von Bahr) public interest, namely that descriptive signs or indica- JUDGMENT OF THE COURT tions relating to the characteristics of goods or services 23 October 2003 (1) in respect of which registration is sought may be freely (Appeal - Community trade mark - Regulation (EC) No used by all.