(Penn Ave Arts District) Garfield / Friendship

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Garfield Green Zone Phase II

garfield green zone project phase II Bloomfield Garfield Corporation Prepared By: Western Pennsylvania Conservancy evolve environment::architecture Summer 2016 bloomfield garfield corporation richard swartz 5149 penn avenue, pittsburgh, pa 15224 aggie brose www.bloomfield-garfield.org western pennsylvania conservancy gavin deming 800 waterfront drive, pittsburgh, pa 15222 michael knoop www.waterlandlife.org evolve environment::architecture christine mondor 5300 penn avenue, pittsburgh, pa 15206 elijah hughes www.evolveea.com daniel klein Cover and final spread photo based on Landsat image acquired via Google Earth. B GarfieldGreen Zone CONTENTS 02 Background 04 Phase I Recap 07 Tree Analysis and recommendations 11 Green Zone Goals 14 Integrate + Connect 27 Preserve + Play 41 Restore + Rebuild Green Zone Phase II C D GarfieldGreen Zone Green Zone Phase II 1 BACKGROUND The Garfield Green Zone Project is intended to test the proposition that intentionally protected and improved green areas in Garfield offer a positive strategy for anchoring future revitalization of the hillside community. The purpose of this project is to work with the Garfield community to determine how a “Green Zone” might support other community aspirations. The three phases of work include: 1. Assessment of existing conditions and information needed for a successful clean up of the area (Phase I); 2. Identification of options for potential reuse of the area including views, paths and other visible improvements (Phase II); and, finally, 3. Development of a vision and strategy package to help guide specific green infrastructure improvements. Bloomfield Garfield Corporation (BGC) and the Western Pennsylvania Conservancy (WPC) worked with community members to complete the first phase of the Green Zone project in spring 2015. -

Page 6 - to FIVE PRESSING QUESTIONS FESTIVAL REACTIVATE PENN AVE

Vol. 46, No. 5 NON-PROFIT U.S. POSTAGE MAY PAID PITTSBURGH, PA 2021 Permit No. 2403 $SXEOLFDWLRQRIWKH%ORRPILHOG*DUILHOG&RUSRUDWLRQRPILHOG*DUILHOG&RUSRUDWLRQ Serving Bloomfield, Friendship, Garfield, East Liberty, and Lawrenceville since 1975 *DUÀHOGKRXVLQJ GHYHORSPHQWVXIIHUV setback at URA %\-RH5HXEHQBulletin contributor Garfield - Last month, Module Design, Inc. was prepared to enter into negotiations with the Urban Redevelopment Authority (URA) to purchase nine city-owned lots in the 5100 block of Rosetta Street. Then, the URA’s Board of Directors could not muster a vote to green light the negoti- ations; a motion that was on the table to do just this died for lack of a second. It was a bit of an awkward moment for the agency, considering that Module is col- laborating on the project with the Pitts- burgh Housing Development Corporation (PHDC), a subsidiary of the URA. Most observers thought the vote would be a mere formality. But board members Ed Gainey, a state representative for the city’s East End, and Lindsay Thompson, an aide ABOVE : Jeff Wilson takes a break from his daily routine - vaccinating people on a walk-in basis - outside Wilson’s Pharmacy (4101 Penn See 0RGXOH| page 2 Ave.) in Lawrenceville. The pharmacist’s vax tally now tops 12,000 arms and counting. Read more on page 4. Photo by John Colombo. Wilson’s Pharmacy offers free vaccinations By Andrew McKeon The Bulletin Lawrenceville - Wilson’s Pharmacy (4101 ical professionals, we had people driving Penn Ave.) has been around long enough down here from Erie, PA.” to survive a crisis or two. Founded 81 According to estimates, the pharmacy has, years ago, the pharmacy is now a neigh- as of press time, vaccinated more than borhood mainstay with a new mission to 12,000 individuals. -

Affordable Housing Plan for Fineview & Perry Hilltop

A FIVE-YEAR AFFORDABLE HOUSING PLAN FOR FINEVIEW & PERRY HILLTOP PERRY W H IE IL V L E T O N I P P F P O E T R L R L I www . our future hilltop . org Y H H Y I L R L R T E O P PE P R R Y F W I E I N V W E H PREPARED BY: IE IL V L E T Studio for Spatial Practice O N I P P F Valentina Vavasis Consulting P O E T R L R L I Ariam Ford Consulting www . our future hilltop . org Y H H Y I L R L R T E O P P PER R F W I E I N Y V W E H IE IL V L E T O N I P P F P O E T R L R L I www . our future hilltop . org Y H H Y I L R L R T E O P P F W I E I N V E FIVE-YEAR AFFORDABLE HOUSING PLAN ACKNOWLEDGMENTS PREPARED BY Special Thanks to: Studio for Spatial Practice Valentina Vavasis Consulting Fineview Citizens Council Housing Working Group Board Of Directors Members Ariam Ford Consulting Christine Whispell, President Fred Smith, Co-Chair Terra Ferderber, Vice President Sally Stadelman, Co-Chair FOR Jeremy Tischuk, Treasurer Robin Alexander, former Chair Fineview Citizens Council Greg Manley, Secretary Betty Davis Perry Hilltop Citizens Council Chris Caldwell Diondre Johnson Diondre Johnson Lance McFadden WITH SUPPORT FROM Robyn Pisor Doyle Mel McWilliams The Buhl Foundation Cheryl Gainey Eliska Tischuk ONE Northside Tiffany Simpson Christine Whispell Eliska Tischuk Lenita Wiley Perry Hilltop Citizens Council Fineview and Perry Hilltop Board Of Directors Citizens Council Staff Dwayne Barker, President Joanna Deming, Executive Director Reggie Good, Vice President Lukas Bagshaw, Community Gwen Marcus, Treasurer Outreach Coordinator Janet Gunter, Secretary Carla Arnold, AmeriCorps VISTA Engagement Specialist Pauline Criswell Betty Davis Gia Haley Lance McFadden Sally Stadelman Antjuan Washinghton Rev. -

City of Pittsburgh Neighborhood Profiles Census 2010 Summary File 1 (Sf1) Data

CITY OF PITTSBURGH NEIGHBORHOOD PROFILES CENSUS 2010 SUMMARY FILE 1 (SF1) DATA PROGRAM IN URBAN AND REGIONAL ANALYSIS UNIVERSITY CENTER FOR SOCIAL AND URBAN RESEARCH UNIVERSITY OF PITTSBURGH JULY 2011 www.ucsur.pitt.edu About the University Center for Social and Urban Research (UCSUR) The University Center for Social and Urban Research (UCSUR) was established in 1972 to serve as a resource for researchers and educators interested in the basic and applied social and behavioral sciences. As a hub for interdisciplinary research and collaboration, UCSUR promotes a research agenda focused on the social, economic and health issues most relevant to our society. UCSUR maintains a permanent research infrastructure available to faculty and the community with the capacity to: (1) conduct all types of survey research, including complex web surveys; (2) carry out regional econometric modeling; (3) analyze qualitative data using state‐of‐the‐art computer methods, including web‐based studies; (4) obtain, format, and analyze spatial data; (5) acquire, manage, and analyze large secondary and administrative data sets including Census data; and (6) design and carry out descriptive, evaluation, and intervention studies. UCSUR plays a critical role in the development of new research projects through consultation with faculty investigators. The long‐term goals of UCSUR fall into three broad domains: (1) provide state‐of‐the‐art research and support services for investigators interested in interdisciplinary research in the behavioral, social, and clinical sciences; (2) develop nationally recognized research programs within the Center in a few selected areas; and (3) support the teaching mission of the University through graduate student, post‐ doctoral, and junior faculty mentoring, teaching courses on research methods in the social sciences, and providing research internships to undergraduate and graduate students. -

We, Though Many, Are One Body in Christ” Romans 12:5

February 9, 2020 † Fifth Sunday of Ordinary Time “We, though many, are one body in Christ” Romans 12:5 CATHOLIC FAITH COMMUNITY OF BLOOMFIELD, GARFIELD, AND LAWRENCEVILLE Our Lady of the Angels Parish Office: 225 37th Street, Lawrenceville, 15201 . 412-682-0929 St. Augustine Church, 234 37th Street, Lawrenceville, 15201 Saint Maria Goretti Parish Office: 4712 Liberty Avenue, Bloomfield, 15224 . 412-682-2354 Immaculate Conception Mission, 321 Edmond Street, Bloomfield, 15224 St. Joseph Mission, 4700 Liberty Avenue, Bloomfield, 15224 Administration Bro. John D. Harvey, O.F.M. Cap., Administrator Rev. Mr. Richard Fitzpatrick, Deacon [email protected] [email protected] Rev. Dam Nguyen, Senior Parochial Vicar Chrissy Jankowski, Music Minister [email protected] [email protected] Bro. Jonathan Ulrick, O.F.M. Cap., Parochial Vicar Don Fontana, Director of Faith Formation [email protected] [email protected] Sunday Mass Schedule Weekday Mass Schedule Saturday Vigil 4:00 p.m. OLA Monday ~ Friday 6:30 a.m. SMG—ICM 5:30 p.m. SMG—ICM (Convent Chapel) Thursday 8:30 a.m. SMG—ICM Sunday 8:00 a.m. SMG—ICM (During School Year) 9:30 a.m. OLA 9:30 a.m. SMG—ICM Monday ~ Saturday 11:30 a.m. SMG—SJM 11:30 a.m. SMG—ICM Monday ~ Thursday 6:30 p.m. OLA Confessions (Parish House Chapel) Saturday Noon ~ 1:00 p.m. OLA First Friday 6:30 p.m. OLA Noon SMG—SJM (Parish House Chapel) Diocesan Church-Related Abuse Hotline: 1-888-808-1235 Hospital Chaplains in Residence Children’s Hospital Fr. -

5149 Penn Avenue, Pittsburgh, PA 15224 | Phone (412) 441-6950

Community Development Office | 5149 Penn Avenue, Pittsburgh, PA 15224 | Phone (412) 441-6950 www.bloomfield-garfield.org IMPORTANT: Local Help is Available during the Covid-19 Social Distancing Initiative BUDDY PROGRAM- A “Buddy” program to match Lawrenceville, Bloomfield & Garfield volunteers with seniors and others at high risk for phone calls / check-ins, grocery/prescription runs, meal deliveries, etc. To sign up for a buddy or be a buddy go to https://tinyurl.com/CovidBuddy To sign up for a buddy’s help call: Bloomfield Garfield Corporation: 412-426-5329, Lawrenceville United: 412-802-7220, or Bloomfield Development Corporation: (412) 681-8800 GARFIELD NEIGHBORS IN NEED FUND- A fund to help individuals & families facing a hardship. Typical grants average $0-$500. Bloomfield Garfield Corporation: 412-426-5329 or email [email protected] MEALS DELIVERED-A volunteer service delivering packaged meals to those in need in Garfield. Garfield Jubilee: 412-849-6689 HEALTH INFORMATION- What we know: ○ The new Coronavirus, or COVID-19*, was identified in December 2019 ○ It produces flu-like symptoms--fever, cough, shortness of breath, but is more contagious. ○ In about 15% of cases, it can lead to severe respiratory illness, such as pneumonia ○ There is no vaccine and no antiviral treatment at this time. ○ The virus is fatal in about 2% of reported cases--more than the seasonal flu. ○ If you are experiencing symptoms or believe you may be at risk for COVID-19, please call your doctor’s office or 24/7 Nurse line first before going to be seen by a Doctor. ○ You can also contact one of the following sources with questions: ■ Allegheny County Health Department at (412) 687-2243 ■ PA State Department of Health at 1-877-724-3258. -

Moved to Lawrenceville, and a Survey of Those Having Moved Away

Executive Summary This study was conducted to provide community leaders with an understanding of the factors driving recent change in Pittsburgh’s Lawrenceville neighborhood. Two surveys were conducted: a survey of those who have recently moved to Lawrenceville, and a survey of those having moved away. The mail surveys were conducted by the University Center for Social and Urban Research (UCSUR) at the University of Pittsburgh in the summer of 2011. New resident survey About 60 percent of new residents moved from a different address in the City of Pittsburgh, with an additional 20 percent coming from a Pittsburgh suburb. The most- common origin communities included Lawrenceville and other nearby neighborhoods in the East End. New Lawrenceville residents also looked for housing in Bloomfield, Shadyside, Friendship, Squirrel Hill, the South Side, and Highland Park. The most-popular reasons for moving to Lawrenceville included the cost of living, convenience to work, school, friends, or family, and a walkable business district. Many new residents become exposed to the neighborhood through community events or neighborhood institutions. Upper Lawrenceville was viewed differently by survey respondents in comparison to Lower and Central Lawrenceville. Just under half of new residents included Upper Lawrenceville in their housing search. o Those who excluded Upper Lawrenceville expressed concerns over safety, blight, and the more-distant and isolated location o Those that included Upper Lawrenceville in their search did so due to its affordability and a perception of the neighborhood as up-and-coming. Former resident survey Nearly half of the former residents responding to the survey moved to a Pittsburgh suburb and one-third stayed in the City. -

Bloomfield/Garfield Allegheny County

Fresh Paint Days Bloomfield/Garfield Allegheny County Bloomfield and Garfield are neighborhoods located in the East End section VOLUNTEERS of Pittsburgh. The Bloomfield-Garfield Corporation (BGC) was created in Bloomfield/Garfield Corporation 2000 to improve the social, economic, and physical fabric of the communities of Bloomfield and Garfield. The BGC was a recipient of the Green and Screen Fresh Paint Days grant from Keep Pennsylvania Beautiful which enabled the Goodwill Industries community based organization and local residents to physically and economically revitalize the Bloomfield and Garfield neighborhoods. Penn Ave Arts Initiative Two neighborhood buildings were selected to have façades painted for the Pittsburgh Cares Fresh Paint Days project. Kraynicks Bike Shop has been on Penn Avenue DONORS & SPONSORS for thirty years and is the go to place for all things relating to bicycles in the greater Pittsburgh area. Garfield Jubilee Richard Rappaport Art Studio is home to local artist Richard Rappaport. Gerald Kraynicks He is long time resident of Garfield and has been a mentor to many Pittsburgh Cares/Aashe Pittsburgh artists. The Garfield Jubilee help to put the finishing touches on the project by donating windows for the studio. The Bloomfield/Garfield Corporation is working hard to revitalize these Event Date: October 2011 neighborhoods and the Fresh Paint Days program was a huge step in Township: City of Pittsburgh completing that goal. # Volunteers: 50 # Volunteer Hours: 350 “We greatly appreciate this grant and the opportunity that it provides . The neighborhood enrichment is immeasurable. Thank you so much for letting us be a part of it.” Jason Sauer Bloomfield Garfield Corporation This project was funded by: Richard King Mellon Foundation . -

Learn & Earn Providers 2018

Learn & Earn Providers 2018 Arts/Entertainment/Recreation Business/Finance/Insurance Marketing/Advertising/ /Entrepreneurship Graphic Design Culinary Arts/Hospitality Government Park Management/Public Works Education Health Care/Human Services STEM Community/Human Service Labor/Trades Provider Location(s) Career Tracks Auberle Uptown, Schenley Heights, Herron Hill, Manchester, Garfield, Bloomfield, Wilkinsburg, Forrest Hills, Auberle.org McKeesport, Duquesne, Glassport, Munhall, Mon Valley Bloomfield Garfield Corporation Garfield and throughout Pittsburgh Bloomfield-Garfield.org Braddock/Wilkinsburg Youth Project Braddock and Wilkinsburg BraddockYouth.org Center That Cares Hill District and Garfield CenterThatCares.org Community Empowerment Association Homewood, East Liberty, and Oakland CEAPittsburgh.org Focus on Renewal McKees Rocks and Stowe Township FORStoRox.org Garfield Jubilee Association Garfield, East Liberty, Homewood, Hill District, Oakland, and North Side GarfieldJubilee.org Robinson, Arlington, Banksville, Brookline, Carnegie, Southside, Downtown, Oakland, Uptown, Hill District, Goodwill SWPA Northside, West End, Sto-Rox, McKees Rocks, Polish Hill, Lawrenceville, East Liberty, Lincoln-Lemington, Wilkinsburg, Homewood, Verona, GoodwillSWPA.org Braddock, Duquesne, Homestead, Munhall, Rankin, McKeesport, North Versailles, Whitehall, Penn Hills, Monroeville Holy Family Academy Downtown, North Side, Hill District, Southside, Emsworth HFA-pgh.org Homewood Children's Village Homewood, East Liberty, Oakland HCVpgh.org Provider Location(s) -

PCRG's Comment Letter on the Fed Reserve APNR On

A+ Schools February 11, 2020 ACTION-Housing, Inc. Allegheny City Central Association Governor Lael Brainerd Allegheny Land Trust Amani Christian CDC Board of Governors of the Federal Reserve System th Bona Fide Bellevue 20 Street and Constitution Avenue NW Bloomfield Development Corp. Bloomfield-Garfield Corp. Washington, D.C. 20551 Brookline Area Community Council Design Center Pittsburgh RE: Community Reinvestment Act Regulations, Docket ID FRB 2020-21227 East Allegheny Community Council East Hills Consensus Group East Liberty Development, Inc. Dear Governor Brainerd, Economic Development South Etna Economic Development Corp Fineview Citizens Council Thank you for the opportunity to comment on the Advance Notice of Friendship Community Group Proposed Rulemaking (ANPR) regarding the Community Reinvestment Act Garfield Jubilee Association Grounded Pittsburgh (CRA). As the executive director of the Pittsburgh Community Reinvestment Habitat for Humanity of Group (PCRG), my job is to uphold our organization’s mission to address the Greater Pittsburgh Hazelwood Initiative, Inc. legacy of redlining and lack of investment in Pittsburgh’s low- to moderate- Highland Park CDC income (LMI) communities. PCRG is a coalition of nearly 60 community Hill District CDC Hill District Consensus Group development and service organizations representing 125 communities across Hill House EDC Western Pennsylvania, each with its own story about how CRA has motivated Hilltop Alliance Housing Alliance of Pennsylvania large and small banks alike to provide loans and investments from affordable Larimer Consensus Group housing and community development. Lawrenceville Corp. Lawrenceville United Manchester Citizens Corp. As an organization, our mission is to work with our members and stakeholders McKees-Rocks CDC Mexican War Streets Society to ensure equitable access to capital, land, and mobility across the Greater Millvale Borough Development Pittsburgh Region. -

Pittsburgh Legal Journal • 7

Wednesday, October 21, 2015 Pittsburgh Legal Journal • 7 Lot 14.20xavg53.58x13.54 Rr No 37. Blunt Michael J - 1100080g00207b Chatsworth Bet Private Wy & Mobile 82. Bulls Robert Lee, Bulls Roberta, Mathilda St 2 Sty Brk Hse 408 00. 5130 Dresden Way, Pt 52 Lot Partial Claim . .$22,337.55 Wilson Lucille & Scott Shirley M - LEGAL ADS 15.16x55 Dresden Way 2 Sty Brk Hse Partial Claim . .$9,426.65 65. Murrell Louis Jr - 1150055j00171a 1210007c00019 00. 1217 W North Ave, R 5130 Dresden Way 12. Cephas Thomas E & Cephas Cynthia 00. 4411 Chatsworth St, R B Coyle Plan & E O H McKnight Plan Pt 10 Lot Treasurer’s Sale A - 1100050e00017 00. 416 N Mathilda Partial Claim . .$1,409.75 Pt 14 Lot 20x55 Chatsworth St 13.97x140 North Ave 2 Sty Brk Hse 1217 St, 60 Lot 23.12xavg105.83x22 Rr 38. Fritz Albert T Jr & Carroll Dorothy F Partial Claim . .$15,303.20 1/2 Brk Gar SALE BY THE TREASURER OF THE CITY - 1100081b00070 00. 5538 Camelia St, Mathilda St Cor Brown Way 3 Sty Brk 66. Est Of Norvin L Bolton & Bolton AND SCHOOL DISTRICT OF PITTSBURGH Hse 416 1 Sty Brk Gar Camelia Place Plan 53-54 Lot 40x100 In Partial Claim . .$13,289.49 OF REAL ESTATE TO SATISFY UNPAID Dorothy M - 1150057c00006 00. 206 All Camelia Place 2 Sty Fra Hse 5538 83. Morgan Dave & Pollaro Jeanna - CLAIMS FOR CITY, SCHOOL AND Partial Claim . .$28,438.54 Mansion St, Mansion Hse Plan 120 Lot 1210022b00281 00. 1236 California Ave, ALLEGHENY COUNTY TAXES TO BE HELD 13. -

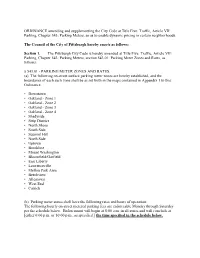

Traffic, Article VII: Parking, Chapter 543: Parking Meters, So As to Enable Dynamic Pricing in Certain Neighborhoods

ORDINANCE amending and supplementing the City Code at Title Five: Traffic, Article VII: Parking, Chapter 543: Parking Meters, so as to enable dynamic pricing in certain neighborhoods. The Council of the City of Pittsburgh hereby enacts as follows: Section 1. The Pittsburgh City Code is hereby amended at Title Five: Traffic, Article VII: Parking, Chapter 543: Parking Meters, section 543.01: Parking Meter Zones and Rates, as follows: § 543.01 - PARKING METER ZONES AND RATES. (a) The following on-street surface parking meter zones are hereby established, and the boundaries of each such zone shall be as set forth in the maps contained in Appendix 1 to this Ordinance: • Downtown • Oakland - Zone 1 • Oakland - Zone 2 • Oakland - Zone 3 • Oakland - Zone 4 • Shadyside • Strip District • North Shore • South Side • Squirrel Hill • North Side • Uptown • Brookline • Mount Washington • Bloomfield/Garfield • East Liberty • Lawrenceville • Mellon Park Area • Beechview • Allentown • West End • Carrick (b) Parking meter zones shall have the following rates and hours of operation: The following hourly on-street metered parking fees are enforceable Monday through Saturday per the schedule below. Enforcement will begin at 8:00 a.m. in all zones and will conclude at [either 6:00 p.m. or 10:00 p.m., as specified.] the time specified in the schedule below. Location [1/1/2013] [1/1/2014] [1/1/2015] Enforced 1/1/2014 1/1/2015 1/1/2016 8 a.m. until: Downtown 3.00 [3.00] [3.00] [6:00 p.m.] Dynamic Dynamic Dynamic Hours Pricing Pricing Oakland-Zone 4 2.00 [2.00] [2.00] 6:00 p.m.